Pivot points In Forex

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pivot points In Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

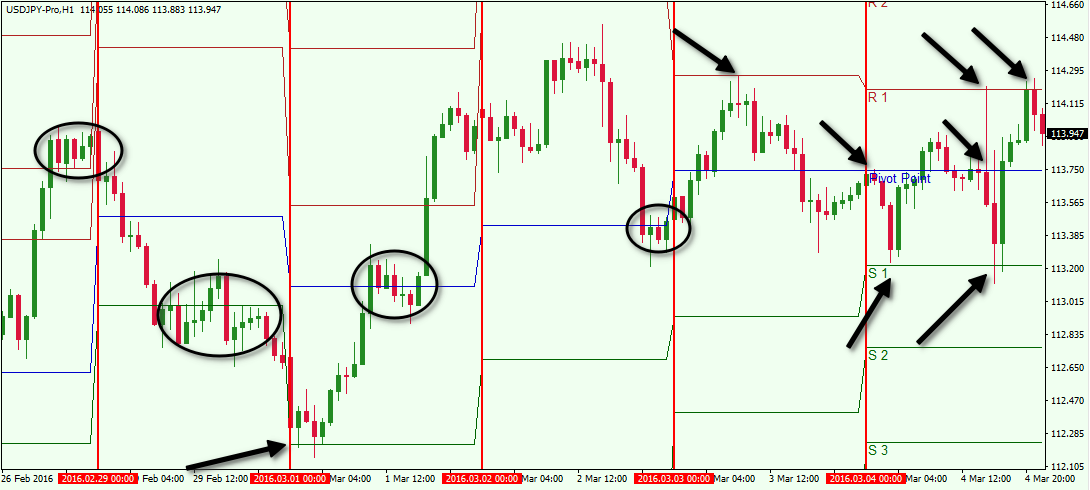

Pivot points In ForexPivot point forex mein aik ahem tajarba shuda tool hai jo tijarat karnay walon ko apni maqbooliyat ki samajh aur jinsi tawanai ko barhane mein madad deta hai. Yeh ek technical analysis ka hissa hai jisay tijarat karnay walay traders aur investors istemal karte hain taakay woh future price movements ka andaaza lagasakain. Pivot points price chart per aik set formula ke teht tayyar kiye jatay hain jo tijarat karnay walon ko market ke current trend aur previous day ki high, low aur close prices ka andaza deta hai. Calculation Methods Pivot point calculate karne ke liye aam taur per do tareeqay istemal kiye jatay hain: Standard Pivot Points aur Fibonacci Pivot Points. Dono tareeqay mein hi high, low aur close prices ka istemal hota hai. 1. Standard Pivot Points Standard pivot points ko calculate karne ke liye formulas istemal kiye jatay hain: Pivot Point (PP) = (High + Low + Close) / 3 Support and Resistance Levels: Support 1 (S1) = (2 * PP) - High Support 2 (S2) = PP - (High - Low) Support 3 (S3) = Low - 2 * (High - PP) Resistance 1 (R1) = (2 * PP) - Low Resistance 2 (R2) = PP + (High - Low) Resistance 3 (R3) = High + 2 * (PP - Low) 2. Fibonacci Pivot Points Fibonacci pivot points Fibonacci numbers aur Golden Ratio (1.618) ka istemal karke calculate kiye jatay hain. Inko standard pivot points se calculate karte waqt yeh levels mukhtalif ho jate hain. Pivot Point (PP) = (High + Low + Close) / 3 Support and Resistance Levels: Support 1 (S1) = PP - (High - Low) * 0.382 Support 2 (S2) = PP - (High - Low) * 0.618 Support 3 (S3) = PP - (High - Low) * 1.000 Resistance 1 (R1) = PP + (High - Low) * 0.382 Resistance 2 (R2) = PP + (High - Low) * 0.618 Resistance 3 (R3) = PP + (High - Low) * 1.000

Calculation Methods Pivot point calculate karne ke liye aam taur per do tareeqay istemal kiye jatay hain: Standard Pivot Points aur Fibonacci Pivot Points. Dono tareeqay mein hi high, low aur close prices ka istemal hota hai. 1. Standard Pivot Points Standard pivot points ko calculate karne ke liye formulas istemal kiye jatay hain: Pivot Point (PP) = (High + Low + Close) / 3 Support and Resistance Levels: Support 1 (S1) = (2 * PP) - High Support 2 (S2) = PP - (High - Low) Support 3 (S3) = Low - 2 * (High - PP) Resistance 1 (R1) = (2 * PP) - Low Resistance 2 (R2) = PP + (High - Low) Resistance 3 (R3) = High + 2 * (PP - Low) 2. Fibonacci Pivot Points Fibonacci pivot points Fibonacci numbers aur Golden Ratio (1.618) ka istemal karke calculate kiye jatay hain. Inko standard pivot points se calculate karte waqt yeh levels mukhtalif ho jate hain. Pivot Point (PP) = (High + Low + Close) / 3 Support and Resistance Levels: Support 1 (S1) = PP - (High - Low) * 0.382 Support 2 (S2) = PP - (High - Low) * 0.618 Support 3 (S3) = PP - (High - Low) * 1.000 Resistance 1 (R1) = PP + (High - Low) * 0.382 Resistance 2 (R2) = PP + (High - Low) * 0.618 Resistance 3 (R3) = PP + (High - Low) * 1.000  Identifying and Using Pivot Points Forex traders aur investors pivot points ka istemal karke market ka trend samajhtay hain aur potential entry aur exit points talaash kartay hain. Yeh tajawuzat aur satahain woh levels hain jin per traders ko price ka rukh aur mawad ke baray mein achi samajh milti hai. Pivot points ki tashkhees karnay se traders ko yeh maloom hota hai ke price kis qisam ka trend follow kar raha hai (upward, downward ya sideways) aur is trend ka kya matlab hai. Trend Identification Pivot points ka istemal karke traders trend ka tashkhees karte hain. Agar price pivot point se oopar hai, to yeh isharah ho sakta hai ke market bullish hai. Jab price pivot point se neechay hota hai, to yeh bearish trend ka isharah ho sakta hai. Support and Resistance Levels Pivot points traders ko support aur resistance levels provide karte hain. Support levels woh price points hotay hain jahan traders ko umeed hoti hai ke price girnay se rokay ga aur phir se buland hoga. Resistance levels woh price points hain jahan traders ko umeed hoti hai ke price girnay lagay ga. Yeh levels traders ko apni trade positions ki mukhalif tarafan daikhne mein madad detay hain. Entry and Exit Points Pivot points traders ko potential entry aur exit points talaash karne mein madad detay hain. Agar price kisi resistance level ke qareeb hota hai aur trend bearish hai, to yeh traders ke liye potential short entry point ho sakta hai. Vaise hi, agar price support level ke qareeb hota hai aur trend bullish hai, to yeh traders ke liye potential long entry point ho sakta hai.

Identifying and Using Pivot Points Forex traders aur investors pivot points ka istemal karke market ka trend samajhtay hain aur potential entry aur exit points talaash kartay hain. Yeh tajawuzat aur satahain woh levels hain jin per traders ko price ka rukh aur mawad ke baray mein achi samajh milti hai. Pivot points ki tashkhees karnay se traders ko yeh maloom hota hai ke price kis qisam ka trend follow kar raha hai (upward, downward ya sideways) aur is trend ka kya matlab hai. Trend Identification Pivot points ka istemal karke traders trend ka tashkhees karte hain. Agar price pivot point se oopar hai, to yeh isharah ho sakta hai ke market bullish hai. Jab price pivot point se neechay hota hai, to yeh bearish trend ka isharah ho sakta hai. Support and Resistance Levels Pivot points traders ko support aur resistance levels provide karte hain. Support levels woh price points hotay hain jahan traders ko umeed hoti hai ke price girnay se rokay ga aur phir se buland hoga. Resistance levels woh price points hain jahan traders ko umeed hoti hai ke price girnay lagay ga. Yeh levels traders ko apni trade positions ki mukhalif tarafan daikhne mein madad detay hain. Entry and Exit Points Pivot points traders ko potential entry aur exit points talaash karne mein madad detay hain. Agar price kisi resistance level ke qareeb hota hai aur trend bearish hai, to yeh traders ke liye potential short entry point ho sakta hai. Vaise hi, agar price support level ke qareeb hota hai aur trend bullish hai, to yeh traders ke liye potential long entry point ho sakta hai.  Limitations of Pivot Points Pivot points forex market mein aik tool hote hain aur unki sahi tashkhees zaroori hai. Lekin, inki tashkhees karna kisi bhi technical analysis tool ki tarah perfect nahi hota. Market mein qayamat kayi tajawuzat aur asraat mojood hotay hain jo pivot points ko asar andaz karte hain. Traders ko yaad rakhna chahiye ke pivot points sirf aik tool hain aur inki sahi tashkhees aur istemal ke liye practice aur experience ki zaroorat hoti hai. Market ke tamam factors ko samajhne aur doosri technical aur fundamental analysis tools ke saath pivot points ko istemal karke hi sahi faislay kiye ja saktay hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Limitations of Pivot Points Pivot points forex market mein aik tool hote hain aur unki sahi tashkhees zaroori hai. Lekin, inki tashkhees karna kisi bhi technical analysis tool ki tarah perfect nahi hota. Market mein qayamat kayi tajawuzat aur asraat mojood hotay hain jo pivot points ko asar andaz karte hain. Traders ko yaad rakhna chahiye ke pivot points sirf aik tool hain aur inki sahi tashkhees aur istemal ke liye practice aur experience ki zaroorat hoti hai. Market ke tamam factors ko samajhne aur doosri technical aur fundamental analysis tools ke saath pivot points ko istemal karke hi sahi faislay kiye ja saktay hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex mein "pivot points" technical analysis ka ek important concept hai. Pivot points, traders aur analysts ke dwara price movement aur market trends ka analysis karne ke liye istemal kiye jate hain. Ye ek set of support aur resistance levels hote hain jo ki specific time period ke price movements se nikale jate hain. Pivot points, mainly intraday traders ke liye popular hote hain. Pivot points calculate karne ke liye kuch formulas istemal kiye jate hain. Inmein se sabse common formula "Standard Pivot Points" ka hai, jise aksar traders istemal karte hain. Is formula ke mutabik, aapko previous day's high (H), low (L), aur closing price (C) ki values ki zaroorat hoti hai. Yeh formula aksar istemal hota hai:Pivot Point (PP) = (H + L + C) / 3 Support and Resistance Levels: Support Levels: S1 = (2 * PP) - H S2 = PP - (H - L) S3 = L - 2 * (H - PP) Resistance Levels: R1 = (2 * PP) - L R2 = PP + (H - L) R3 = H + 2 * (PP - L) Pivot points ke alawa, traders aksar Fibonacci retracement levels aur moving averages jaise aur tools ke saath pivot points ko combine karte hain taaki wo price trends aur potential entry/exit points ko samajh saken. Ye techniques price movement patterns aur market psychology ko samajhne mein madadgar ho sakte hain. Dhyan rahe ki market mein kai alag-alag variations aur methods hote hain pivot points calculate karne ke liye, jaise ki Camarilla pivot points, Woodie's pivot points, etc. Har trader apne trading style aur preferences ke hisab se alag method istemal karta hai. Lekin yaad rahe ki market volatile hoti hai aur price movements ke predictions mein hamesha risk hota hai. Pivot points ek tool hain, lekin khud ko educate karna, demo trading karna, aur risk management follow karna bhi zaroori hai agar aap trading mein safalta pana chahte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:05 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим