MACD Indicator In Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

MACD Indicator In ForexMACD Indicator ka matlab hota hai Moving Average Convergence Divergence. Yeh ek bohot hi ahem technical analysis tool hai jo forex trading mein istemal hota hai. Yeh indicator traders ko market ki trend aur momentum ko samajhne mein madad deta hai. MACD indicator moving averages par mabni hota hai aur yeh traders ko buy ya sell signals provide karta hai jab market mein trend mein changes hota hai. MACD Indicator Ka Calculation MACD indicator ka basic concept hai ke wo do alag alag moving averages ko use karta hai jo price chart par plot kiye jate hain. Yeh moving averages usually 12-period aur 26-period ke liye calculate ki jati hain. Yani ke last 12 ya 26 candlesticks ki closing prices ka average liya jata hai. In moving averages ko fast moving average aur slow moving average bhi kehte hain. MACD Ka Formula MACD Line = 12-period EMA - 26-period EMA EMA yani Exponential Moving Average hoti hai jo ke standard simple moving average se thora alag hoti hai. EMA recent prices ko zyada weight deti hai, is liye iska use MACD mein kia jata hai. Jab MACD line fast moving average (12-period EMA) slow moving average (26-period EMA) se upar chali jati hai, toh yeh ek bullish (upward) signal hai aur traders ko lagta hai ke market mein buying ka momentum barh raha hai. Signal Line MACD Histogram Lekin MACD line khud mein trading signals provide nahi karta. Iske liye Signal Line ki zaroorat hoti hai. Signal line MACD line ki 9-period EMA hoti hai. MACD line jab signal line ko upar se cross karti hai, toh yeh ek buy signal generate karta hai. Jab MACD line signal line ko neeche se cross karti hai, toh yeh ek sell signal indicate karta hai. [COLOR=var(--tw-prose-bold)][/COLOR] Lekin ek aur important point hai jise MACD analysis mein dekha jata hai, wo hai MACD Histogram. Histogram MACD line aur signal line ke beech ki difference ko darshata hai. Jab MACD line signal line ko upar se cross karti hai, toh histogram positive territory mein jata hai, indicating bullish momentum. Jab MACD line signal line ko neeche se cross karti hai, toh histogram negative territory mein jata hai, indicating bearish momentum.

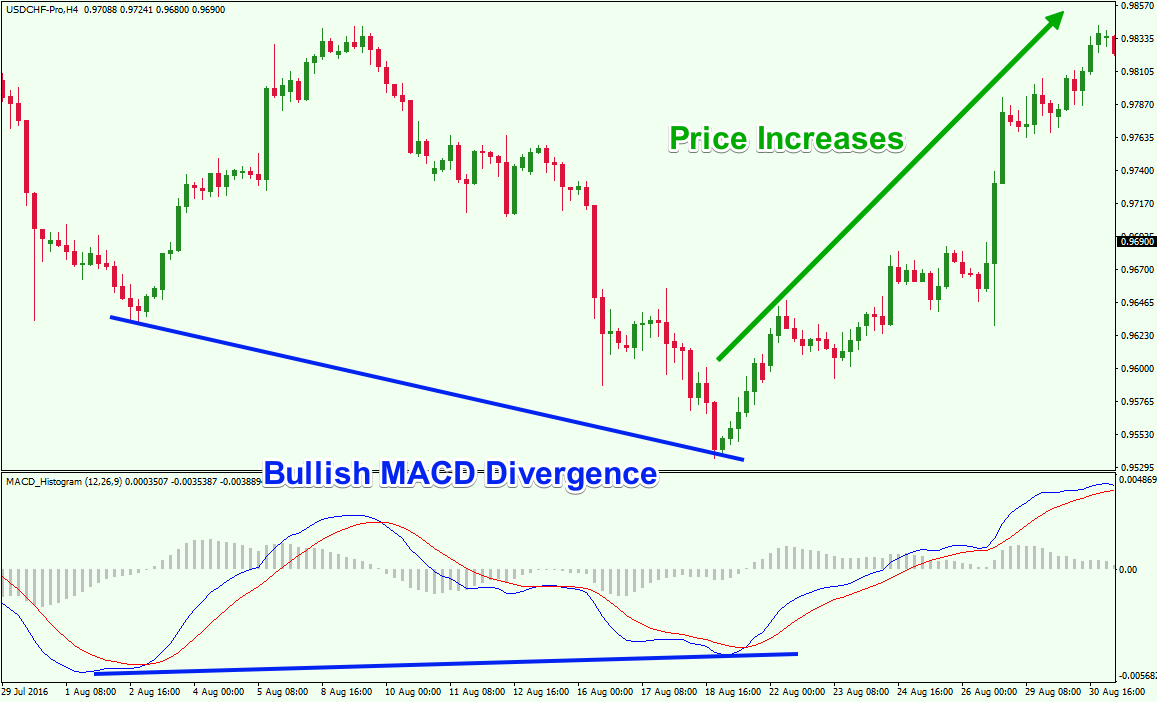

MACD Indicator Ka Calculation MACD indicator ka basic concept hai ke wo do alag alag moving averages ko use karta hai jo price chart par plot kiye jate hain. Yeh moving averages usually 12-period aur 26-period ke liye calculate ki jati hain. Yani ke last 12 ya 26 candlesticks ki closing prices ka average liya jata hai. In moving averages ko fast moving average aur slow moving average bhi kehte hain. MACD Ka Formula MACD Line = 12-period EMA - 26-period EMA EMA yani Exponential Moving Average hoti hai jo ke standard simple moving average se thora alag hoti hai. EMA recent prices ko zyada weight deti hai, is liye iska use MACD mein kia jata hai. Jab MACD line fast moving average (12-period EMA) slow moving average (26-period EMA) se upar chali jati hai, toh yeh ek bullish (upward) signal hai aur traders ko lagta hai ke market mein buying ka momentum barh raha hai. Signal Line MACD Histogram Lekin MACD line khud mein trading signals provide nahi karta. Iske liye Signal Line ki zaroorat hoti hai. Signal line MACD line ki 9-period EMA hoti hai. MACD line jab signal line ko upar se cross karti hai, toh yeh ek buy signal generate karta hai. Jab MACD line signal line ko neeche se cross karti hai, toh yeh ek sell signal indicate karta hai. [COLOR=var(--tw-prose-bold)][/COLOR] Lekin ek aur important point hai jise MACD analysis mein dekha jata hai, wo hai MACD Histogram. Histogram MACD line aur signal line ke beech ki difference ko darshata hai. Jab MACD line signal line ko upar se cross karti hai, toh histogram positive territory mein jata hai, indicating bullish momentum. Jab MACD line signal line ko neeche se cross karti hai, toh histogram negative territory mein jata hai, indicating bearish momentum.  MACD Uses In Different Timeframes MACD indicator ek versatile tool hai jo alag alag timeframes par istemal kiya ja sakta hai. Chota timeframe jaise ke 1-minute ya 5-minute charts par, MACD short-term trends aur momentum ko capture karta hai. Bade timeframe jaise ke daily ya weekly charts par, MACD long-term trends aur price movements ko identify karta hai. Lekin MACD ka istemal sirf iske crossovers aur histograms se seemit nahi hai. Traders aur analysts MACD ko divergence aur convergence analysis mein bhi istemal karte hain. Divergence tab hoti hai jab price chart aur MACD chart mein differences aate hain. Agar price chart new high banata hai lekin MACD chart mein new high nahi banata, toh yeh bearish divergence hai aur yeh price reversal ka indication ho sakta hai.

MACD Uses In Different Timeframes MACD indicator ek versatile tool hai jo alag alag timeframes par istemal kiya ja sakta hai. Chota timeframe jaise ke 1-minute ya 5-minute charts par, MACD short-term trends aur momentum ko capture karta hai. Bade timeframe jaise ke daily ya weekly charts par, MACD long-term trends aur price movements ko identify karta hai. Lekin MACD ka istemal sirf iske crossovers aur histograms se seemit nahi hai. Traders aur analysts MACD ko divergence aur convergence analysis mein bhi istemal karte hain. Divergence tab hoti hai jab price chart aur MACD chart mein differences aate hain. Agar price chart new high banata hai lekin MACD chart mein new high nahi banata, toh yeh bearish divergence hai aur yeh price reversal ka indication ho sakta hai.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

**Forex Mein MACD Indicator:** Bhai, MACD indicator forex trading mein ek bohot common aur useful tool hai. Iska matlab hota hai "Moving Average Convergence Divergence." Is indicator ka istemal price trends aur momentum ko samajhne mein hota hai.MACD indicator basically do moving averages - usually ek short-term aur ek long-term - ka difference dikhata hai. Jab yeh dono lines ek dusre ko cross karte hain, woh trading signals provide karte hain: 1. **Signal Line Cross:** Jab MACD line (short-term moving average) signal line (usually 9-day EMA) ko cross karti hai, toh yeh buy ya sell signals generate ho sakte hain. 2. **Zero Line Cross:** Agar MACD line zero line ko cross karti hai, toh woh trend change ka indication ho sakta hai. 3. **Divergence:** Jab price aur MACD line alag directions mein move karte hain, toh woh divergence signal ho sakta hai, indicating potential reversals.MACD indicator aapko trend aur momentum ki information deta hai, lekin yeh akele mein accurate signals provide nahi karta. Isko other indicators aur price action ke saath combine karna zaroori hota hai.Yaad rakho bhai, MACD indicator ki understanding aur istemal practice aur research se behtar hota hai. Market mein risk hota hai, isliye aap apni trades ko careful tareeqay se manage karna chahiye. Divergence: Jab price aur MACD line alag directions mein move karte hain, matlab agar price upar ja rahi hai aur MACD line neeche ja rahi hai ya ulta, toh yeh divergence signal ho sakta hai. Divergence potential trend reversals ko indicate kar sakti hai.MACD indicator aapko trend aur momentum ki information deta hai, lekin yeh signals akele mein accurate nahi hote. Isko other indicators aur price action ke saath combine karna zaroori hota hai.Yaad rakho bhai, MACD indicator ki understanding aur istemal practice aur research se behtar hota hai. Market mein risk hota hai, isliye aap apni trades ko careful tareeqay se manage karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:11 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим