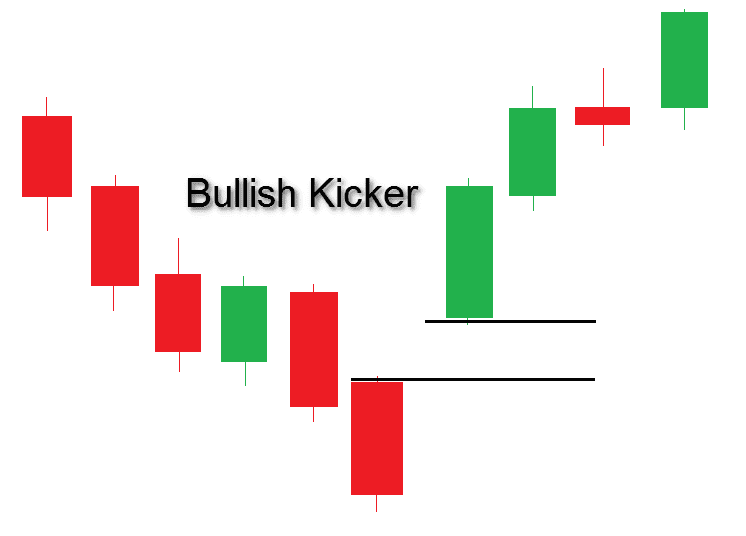

bullish kicker candle stick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

"Bullish Kicker" ek candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern price chart par uptrend ke reversal ya continuation ka signal dene ke liye istemal hota hai. Chaliye "Bullish Kicker" pattern ko roman English mein samjhein: **Pattern Description "Bullish Kicker" pattern ek two-candle pattern hai jisme pehla candle bearish (downward) hota hai, aur dusra candle usse immediately follow karta hai jisse wo bullish (upward) hota hai. Pehle candle ka range dusre candle ke range se bahar hota hai. Yani, bearish candle ke niche open hota hai aur bullish candle ke upar close hota hai. **Pattern Formation (Pattern Ke Banne Ka Tarika):** 1. **Bearish Candle (Pehla Candle):** Pehla candle downward (bearish) direction mein hota hai aur uska range bada hota hai. Iska matlab hai ki candle ki opening price uski closing price se upar hoti hai.2. **Bullish Candle (Dusra Candle):** Dusra candle upward (bullish) direction mein hota hai aur pehle candle ke upar open hota hai. Iska closing price pehle candle ki opening price se upar hota hai. **Pattern Interpretation (Pattern Ki Samjh):** "Bullish Kicker" pattern bullish reversal ya continuation signal dene ke liye istemal hota hai. Jab ye pattern uptrend ke baad appear hota hai, to ye indicate karta hai ki bullish momentum phir se shuru ho sakta hai. **Advantages (Fayde):** 1. **Strong Reversal Signal:** " Bullish Kicker" pattern ek strong bullish reversal signal provide karta hai. Iska appearance downtrend ke baad potential uptrend ke start ki indication deta hai. 2. **Quick Identification:** Ye pattern price chart par aasani se identify ho sakta hai, khaaskar jab pehle bearish candle ke baad bullish candle follow hota hai. 3. **Entry Points:** Traders ko pattern ke confirmation ke baad uptrend mein entry points milte hain, jisse wo price movement ka fayda utha sakte hain. **Disadvantages (Nuksan):** 1. **False Signals:** Kuch cases mein "Bullish Kicker" pattern false signals bhi generate kar sakta hai, isliye aur confirmatory indicators ke saath iska istemal karna important hai. 2. **Market Context:** Sirf is pattern par nirbhar karke trading decisions lena nahi recommended hai. Market ki broader condition aur trends ko bhi consider karna zaroori hai.Ant mein, "Bullish Kicker" ek powerful bullish reversal ya continuation pattern hai, lekin iska sahi tarah se identification aur confirmation zaroori hai. Technical analysis ka istemal karte waqt proper research aur market understanding honi chahiye taki sahi trading decisions liye ja sake. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish Kicker Chart Pattern: Bullish kicker aik do candle patteren hai jo aam peak standard numaya kami ke baad bantaa hai lekin yeh oopar ke rujhan ke baad bhi zahir ho sakta hai. Bullish Kicker candle patteren my Bullish kicker aik brri Bullish candle pr mushtamil hota hai jis ki qayadt oopar ki taraf aik opening aur negative light se hoti hai. Is ki mutabqat is waqt barh jati hai punch yeh ziyada khareeday cover ya ziada frokht hony walay ilaqon mein hota hai. Agar ap ko up plan ke awful taizi se kicker nazar aata hai to yeh is baat ki alamat ho sakti hai ke market mein stomach muscle bhi up plan ko jari rakhnay ke liye kaafi taaqat hai.Bullish kicker market mein ek achcha fire hai jisko Ham jitna acha follow karenge itna jyada Ham market mein isko work mein use karenge to hamen kamyabi milegi agar aapko light ka use Nahin aata hai to uske liye aapko demo account ka use karna chahie demo account mein Ham Inka punch use karte hain to hamari practis ho jaati hai aur iski vajah se Ham market se fayda bhi le sakte hain aapko pata hai ki market mein kam karne ke liye Kitna jyada hamen information increment hota hai information hamare pass jitna jyada Hoga mark market ko acchi Tarah time denge to kamyabi milegi additional work agar Ham market mein karenge Kicker development aik inversion design hai jo bunyadi rujhan ki simt mein aik candle se shuru hota hai, is ke baad rujhan ke bar aks aik hole hota hai .agar aap ka faisla band hai to tijarat ke ghalat pehlu standard pakdae jane ke baray mein baat karen .patteren stock ke baray mein sarmaya vehicle ke ravayye mein mazboot tabdeeli ki alamat hai. yeh aam peak standard organization ke baray mein ahem maloomat ke ajra ki wajah se hota hai qeematon mein mandi ke douran taizi kicker light stulick patteren tayyar hota hai. mein jaanta hon ke yeh mutazaad hai, lekin bunyadi rujhan ke mukhalif simt mein stock ke farq ko yaad rakhen - is liye taizi. dekhen ke farq ki do mother batian bal tarteeb mandi aur taizi hain. cal karne ka ahem nuqta yeh hai ke mother batian kabhi cross-over nahi hoti hain. patteren ki toseeq karte waqt yeh zaroori hai . Chart Pattern Formation: Bullish Kicker design negative pattern ke baad nazar aata hai, punch cost neechay jata hai.Is design mein do candles included hoti hain: pehli candle negative (descending) pattern ki hoti hai, jabke dusri candle bullish (up) pattern ki hoti hai.Pehli candle ki range generally ziyada hoti hai aur us ki shutting qeemat neechay hoti hai.Dusri candle ki range pehli candle ki range ke andar hoti hai aur us ki opening qeemat pehli candle ki shutting qeemat se upar hoti hai.Trend Inversion Indication:Bullish Kicker design negative pattern ke baad nazar aane standard pattern inversion ki sign ho sakti hai.Yani ke hit negative pattern ki baad bullish candle aati hai, to yeh dealers ko show karta hai ke market opinion badal gaya hai aur upturn ki shuruaat ho sakti hai.

Kicker development aik inversion design hai jo bunyadi rujhan ki simt mein aik candle se shuru hota hai, is ke baad rujhan ke bar aks aik hole hota hai .agar aap ka faisla band hai to tijarat ke ghalat pehlu standard pakdae jane ke baray mein baat karen .patteren stock ke baray mein sarmaya vehicle ke ravayye mein mazboot tabdeeli ki alamat hai. yeh aam peak standard organization ke baray mein ahem maloomat ke ajra ki wajah se hota hai qeematon mein mandi ke douran taizi kicker light stulick patteren tayyar hota hai. mein jaanta hon ke yeh mutazaad hai, lekin bunyadi rujhan ke mukhalif simt mein stock ke farq ko yaad rakhen - is liye taizi. dekhen ke farq ki do mother batian bal tarteeb mandi aur taizi hain. cal karne ka ahem nuqta yeh hai ke mother batian kabhi cross-over nahi hoti hain. patteren ki toseeq karte waqt yeh zaroori hai . Chart Pattern Formation: Bullish Kicker design negative pattern ke baad nazar aata hai, punch cost neechay jata hai.Is design mein do candles included hoti hain: pehli candle negative (descending) pattern ki hoti hai, jabke dusri candle bullish (up) pattern ki hoti hai.Pehli candle ki range generally ziyada hoti hai aur us ki shutting qeemat neechay hoti hai.Dusri candle ki range pehli candle ki range ke andar hoti hai aur us ki opening qeemat pehli candle ki shutting qeemat se upar hoti hai.Trend Inversion Indication:Bullish Kicker design negative pattern ke baad nazar aane standard pattern inversion ki sign ho sakti hai.Yani ke hit negative pattern ki baad bullish candle aati hai, to yeh dealers ko show karta hai ke market opinion badal gaya hai aur upturn ki shuruaat ho sakti hai.  Agar Bullish Kicker design nazar aaye aur pehli negative candle ke baad bullish candle dikhai de, to merchants upturn ki tayari kar sakte hain.Yeh design ki tasdeeq ke liye brokers typically stand by karte hain ke next candle corroborative sign de.Risk Management:Jab bhi aap exchanging karte hain, hamesha risk the executives ka khayal rakhna zaruri hai. Stop-misfortune orders ka istemal karna chahiye taa ke nuksan se bacha ja sake.Bullish Kicker design bhi 100 percent sahi nahi hota, is liye doosri specialized aur essential investigation ke saath consolidate karna bhi zaruri hai.Bullish Kicker candle design ko samajh kar brokers pattern inversion ki tashkhees karne mein madad hasil kar sakte hain. Lekin, jaise har exchanging technique mein hai, isko istemal karte waqt alert aur legitimate examination ka istemal karna zaruri hai. Trading And Types: Candle negative (red ya dark) hota hai jo cost ka descending development dikhata hai.Doosra Candle: Doosra candle bullish (green ya white) hota hai aur pehle ridge negative candle ke neeche open hota hai. Yani ke doosra candle pehle rib light ke range ke andar start hota hai.Bullish Kicker design ka development is tarah hota hai ke doosra candle pehle grain negative candle ko hole down ke saath cover karta hai, jisse solid bullish energy ka signal banta hai.Bullish Kicker Example ka MatlaBullish Kicker design ka arrangement recommend karta hai ke negative strain unexpectedly khatam ho gaya hai aur purchasers (bulls) ka control market serious areas of strength for mein gaya hai. Iska matlab ho sakta hai ke stomach muscle market mein upswing ya solid bullish development shuru sharpen wala hai.Traders is design ko affirm karne ke liye doosre specialized pointers aur investigation apparatuses ka istemal karte hain. Agar design ko sahi tarah se affirm kiya jaaye aur economic situations bhi s

Agar Bullish Kicker design nazar aaye aur pehli negative candle ke baad bullish candle dikhai de, to merchants upturn ki tayari kar sakte hain.Yeh design ki tasdeeq ke liye brokers typically stand by karte hain ke next candle corroborative sign de.Risk Management:Jab bhi aap exchanging karte hain, hamesha risk the executives ka khayal rakhna zaruri hai. Stop-misfortune orders ka istemal karna chahiye taa ke nuksan se bacha ja sake.Bullish Kicker design bhi 100 percent sahi nahi hota, is liye doosri specialized aur essential investigation ke saath consolidate karna bhi zaruri hai.Bullish Kicker candle design ko samajh kar brokers pattern inversion ki tashkhees karne mein madad hasil kar sakte hain. Lekin, jaise har exchanging technique mein hai, isko istemal karte waqt alert aur legitimate examination ka istemal karna zaruri hai. Trading And Types: Candle negative (red ya dark) hota hai jo cost ka descending development dikhata hai.Doosra Candle: Doosra candle bullish (green ya white) hota hai aur pehle ridge negative candle ke neeche open hota hai. Yani ke doosra candle pehle rib light ke range ke andar start hota hai.Bullish Kicker design ka development is tarah hota hai ke doosra candle pehle grain negative candle ko hole down ke saath cover karta hai, jisse solid bullish energy ka signal banta hai.Bullish Kicker Example ka MatlaBullish Kicker design ka arrangement recommend karta hai ke negative strain unexpectedly khatam ho gaya hai aur purchasers (bulls) ka control market serious areas of strength for mein gaya hai. Iska matlab ho sakta hai ke stomach muscle market mein upswing ya solid bullish development shuru sharpen wala hai.Traders is design ko affirm karne ke liye doosre specialized pointers aur investigation apparatuses ka istemal karte hain. Agar design ko sahi tarah se affirm kiya jaaye aur economic situations bhi s  Market mein pattern badalne ka signal hai aur isay dekh kar merchants ko khareedne (purchasing) ki achi mauqa mil sakti hai. Lekin, is design ko tasdeeq karne ke liye dusre specialized pointers aur market investigation ka istemal hota hai.Sarasar, Bullish Kicker Candle Example ek bullish inversion signal hai jo market mein tezi ya upturn ki shuruaat sharpen ki nishani hai. Iska sahi tafsiri karne ke liye dealers ko mazeed market ki tafseelat aur information ka mutala karna hota hai.sarhadon wala manfi signal hota hai jo stocks ke tajwezat ke jazbat ko badal dene ki salahiyat rakhta hai. Yeh ek mohim candle design hai jo brokers aur financial backers ke liye ahem hota hai. Is design mein do back to back candles (aik ke baad aik) shamil hote hain.Pehli candle mein aksar aam taur standard ek downtrend ya cost kam hoti hai. Lekin dusri candle mein, cost tabdeeli ke rang mein tezi se barhti hai aur pehli candle ki range ko puri kar leti hai, ya phir usse zyada cross kar leti hai. Iska matlab hai ke market mein ek jhatpat pattern change sharpen ki ha

Market mein pattern badalne ka signal hai aur isay dekh kar merchants ko khareedne (purchasing) ki achi mauqa mil sakti hai. Lekin, is design ko tasdeeq karne ke liye dusre specialized pointers aur market investigation ka istemal hota hai.Sarasar, Bullish Kicker Candle Example ek bullish inversion signal hai jo market mein tezi ya upturn ki shuruaat sharpen ki nishani hai. Iska sahi tafsiri karne ke liye dealers ko mazeed market ki tafseelat aur information ka mutala karna hota hai.sarhadon wala manfi signal hota hai jo stocks ke tajwezat ke jazbat ko badal dene ki salahiyat rakhta hai. Yeh ek mohim candle design hai jo brokers aur financial backers ke liye ahem hota hai. Is design mein do back to back candles (aik ke baad aik) shamil hote hain.Pehli candle mein aksar aam taur standard ek downtrend ya cost kam hoti hai. Lekin dusri candle mein, cost tabdeeli ke rang mein tezi se barhti hai aur pehli candle ki range ko puri kar leti hai, ya phir usse zyada cross kar leti hai. Iska matlab hai ke market mein ek jhatpat pattern change sharpen ki ha

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:22 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим