Forex Trading Terminology : Homing Pigeon Candlestick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

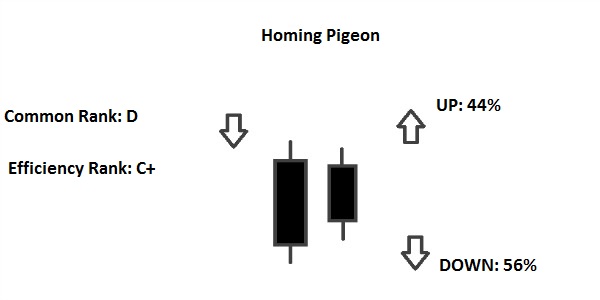

Assalamu Alaikum Dosto!Homing Pigeon PatternHoming pigeon pattern two days candles par mushtamil aik bullish trend reversal pattern hai, jo k prices k bottom par ya bearish trend k akhtetam par banta hai. Pattern ki pehli aur dosri candle same bearish candles hoti hai jis main dosri candle pehli candle k andar open aur close hoti hai. Homing pigeon pattern ki dosri candle ki formation same "Bullish Harami Pattern" aur "Bullish Harami Cross Pattern" jaisi hai lekin aik to iss candle ka color black hoti hai, jo k "Bullish Harami Pattern" k candle main white hoti, dosra ye candle small real body ki hoti hai, jo k "Bullish Harami Cross Pattern" ki candle doji candle hoti hai, jiss ka open aur close same hota hai. Homing pigeon pattern aik bullish trend reversal pattern hai, jo k prices k bottom par ya bearish trend main banta hai. Ye pattern bearish k kamzori ki nishan dahi karta karta hai. Dosree candle aik aik small real body wali bearish candle hoti hai jo uptrend ka ikhtetaam karti hai, jiss k baad prices bullish trend reversal ka sabab banti hai.Candles FormationHoming pigeon pattern two days candles par mushtamil ek bullish trend reversal pattern hai, aur downtrend k baad main bhi bannta hai to us k leye candles ki darrjazel format honi chaheye ;- First Candle: Homing pigeon pattern main pehle din ki candle aik long real body wali black/red hotee hai, jo prices k downtrend ki turrjumani kartti hai. Ye candle normal size aur bearish trend k mutabiq banti hai.

- Second Candle: Homing pigeon pattern main dosre din ki candle bhi same black ya red candle banti hai, jo k prices k bearish trend ka ikhtetaam karti hai, dosre din ki candle pehle din ki candle k real body k andar open aur close hoti hai.

ExplainationHoming pigeon pattern "Bullish Harami Pattern" aur "Bullish Harami Cross Pattern" se melta julta pattern hai, jo same bearish trend ko bullish trend me reverse kia jata hai. Homing pigeon pattern two days candles par mushtamil pattern hai, jis me pehlee aik long real body wali bearish candle hote hai, jis k baad dosree aik long real body wali small bearish candle banti hai. Pattern ki pehli candle prices k downtrend ki nishan-dahi kartti hai, ye candle size aur formation me normal long real body wali bearish candle hotti hai. Lekin dosre din ki candle aik small real body wali bearish candle hotee hai, jo k open aur close pehli candle k real body main hoti hai. Pattern ki dono candle bearish hone k bawajood bhi bullish trend reversal pattern ka kaam karta hai.TradingHoming pigeon pattern bhi dosre bullish trend reversal patterns ki tarah buy k signals deta hai. Pattern par trading ka tareeqay kar bhi "Bullish Harami Pattern" jaisa hai, jiss par market main buy ki entry ki jati hai. Pattern par trading se pehle prices ka baghawar study karlen k ya to ye downtrend me honni chaheye aur ya ye high level pe hon. Pattern ki pehlee candle normal long real body wali hotti hai, jis ko dosre din ki small bearish candle follow kartti hai. Homing pigeon pattern me dosre din ki candle ki formation bohut zarrori hai, jo k pehli candle k under honi chaheye, yanni candle ki open aur close dono pehli candle k open aur close se kam honi chaheye. Homing pigeon pattern k leye trend confirmation trade entry se pehle zarrori hai, jab bhi pattern k baad teesre din ki candle bearish ya white candle banne gi to ye market main me buy se entry karne ka time hoga. Stop Loss pattern k sab se lowest price ya bearish candle k bottom se aik ya do pips below resistance point par lagayen. -

#3 Collapse

"Homing Pigeon" is not a commonly recognized candlestick pattern in the field of forex trading. It's possible that you might be referring to a different pattern or term. However, based on your description, it seems like you might be combining two separate candlestick patterns: the "Homing Pigeon" and the "Doji" candlestick pattern. Doji Candlestick Pattern: A Doji is a candlestick pattern that occurs when the opening and closing prices of an asset are very close to each other, resulting in a very small or nonexistent body. It often looks like a plus sign (+) or a cross. The Doji pattern suggests indecision in the market, as neither buyers nor sellers were able to gain the upper hand during the trading period. Homing Pigeon Candlestick Pattern: The "Homing Pigeon" is not a widely recognized candlestick pattern in forex trading as of my last knowledge update in September 2021. It's possible that this term has emerged or gained popularity after that time. If it's a legitimate pattern, I would recommend checking with more up-to-date sources or educational materials on forex trading. Keep in mind that accurate pattern recognition and understanding are crucial when trading forex or any financial instrument. If you are interested in learning about candlestick patterns and other technical analysis tools for trading, it's important to refer to reputable sources and educational materials to ensure you're making informed decisions. -

#4 Collapse

**Forex Trading Terminology:** Forex trading ek global financial market hai jahan currencies ko khareedne aur bechne ka kaam hota hai. Is market mein kuch aise mukhtalif terminologies hain jo traders ko market understanding aur successful trading ke liye zaroori hoti hain. In terminologies ko samajhna aur istemal karna forex trading mein mahatvapurna hai. **Tafseel:** 1. **Currency Pairs (Currency Jod):** Forex market mein currencies pairs ke roop mein trade hoti hain. Har currency pair mein do currencies hoti hain – ek base currency aur ek quote currency. Maslan, EUR/USD mein Euro base currency hai aur USD quote currency hai. 2. **Bid aur Ask Price:** Bid price woh price hota hai jis par traders currency pair ko sell kar sakte hain aur Ask price woh price hai jis par traders currency pair ko khareed sakte hain. 3. **Spread:** Spread currency pair ke bid aur ask price ke beech ki difference hoti hai. Spread brokers ke through liya gaya fee hota hai. 4. **Pip:** Pip ek unit hai jisse price movements ko measure kiya jata hai. Most currency pairs mein ek pip 0.0001 ki value hoti hai. 5. **Leverage:** Leverage ek tool hota hai jo traders ko small investment se larger position control karne ki ijaazat deta hai. Yeh profits ko amplify karne mein madad deta hai, lekin risk bhi barhata hai. **Forex Trading Terminology Ke Iqsam:** 1. **Major Pairs:** Major pairs woh currency pairs hote hain jo dunia ke sabse strong economies se jude hotay hain, jaise EUR/USD, GBP/USD, USD/JPY. 2. **Minor Pairs (Cross Pairs):** Minor pairs mein major currencies shamil hote hain, lekin US Dollar nahi hota, jaise EUR/GBP, GBP/JPY. 3. **Exotic Pairs:** Exotic pairs mein ek major currency aur ek emerging or small economy ki currency shamil hoti hai, jaise USD/SGD, EUR/TRY. **Forex Trading Terminology Ke Fawaid:** 1. **Understanding the Market:** Forex trading terminology ko samajh kar traders market ki movements aur conditions ko better samajhte hain. 2. **Effective Communication:** Forex trading mein traders ko brokers aur other traders ke sath effective communication ke liye terminology ka istemal karna hota hai. 3. **Informed Decisions:** Terminology ko samajhne se traders informed decisions lete hain aur unka risk management improve hota hai. **Forex Trading Terminology Ke Nuqsanat:** 1. **Complexity:** Beginners ko initially forex trading terminology ka samajhna mushkil ho sakta hai. 2. **Misinterpretation:** Galat terminology ka istemal ya galat samajhne se trading decisions galat ho sakte hain. 3. **Overwhelming:** Forex trading terminology ka zayada istemal traders ko overwhelming kar sakta hai, especially beginners ke liye. **Ikhtitaam:** Forex trading terminology forex market mein successful trading ke liye zaroori hai. Is terminology ko samajh kar traders market movements ko better analyze karte hain aur informed decisions lete hain. Lekin terminology ka zayada istemal overwhelming ho sakta hai, is liye beginners ko step by step samajhna chahiye. Overall, forex trading terminology traders ki market understanding aur communication skills ko enhance karne mein madadgar hoti hai, lekin sahi samajh aur practice ke sath. -

#5 Collapse

Homing Pigeon Chart Pattern: Forex exchanging phrasing forex market mein effective exchanging ke liye zaroori hai. Is phrasing ko samajh kar merchants market developments ko better break down karte hain aur informed choices lete hain. Lekin wording ka zayada istemal overpowering ho sakta hai, is liye novices ko bit by bit samajhna chahiye. In general, forex exchanging phrasing brokers ki market understanding aur relational abilities ko upgrade karne mein madadgar hoti hai, lekin sahi samajh aur practice ke sath.Galat wording ka istemal ya galat samajhne se exchanging choices galat ho sakte hain.Forex exchanging phrasing ka zayada istemal merchants ko overpowering kar sakta hai, particularly amateurs ke liye ha Homing pigeon design bhi dosre bullish pattern inversion designs ki tarah purchase k signs deta hai. Design standard exchanging ka tareeqay kar bhi "Bullish Harami Example" jaisa hai, jiss standard market principal purchase ki passage ki jati hai. Design standard exchanging se pehle costs ka baghawar study karlen k ya to ye downtrend me honni chaheye aur ya ye significant level pe hon. Design ki pehlee light typical long genuine body wali hotti hai, jis ko dosre noise ki little negative flame follow kartti hai. Homing pigeon design me dosre noise ki candle ki development bohut zarrori hai, jo k pehli flame k under honi chaheye, yanni candle ki open aur close dono pehli candle k open aur close se kam honi chaheye. Homing pigeon design k leye pattern affirmation exchange passage se pehle zarrori hai, punch bhi design k baad teesre noise ki light negative ya white candle banne gi to ye market primary me purchase se passage karne ka time hoga. Stop Misfortune design k sab se most reduced cost ya negative flame k base se aik ya do pips underneath opposition point standard lagayen. Chart Pattern Types: Homing pigeon design "Bullish Harami Example" aur "Bullish Harami Cross Example" se melta julta design hai, jo same negative pattern ko bullish pattern me invert kia jata hai. Homing pigeon design two days candles standard mushtamil design hai, jis me pehlee aik long genuine body wali negative light hote hai, jis k baad dosree aik long genuine body wali little negative candle banti hai. Design ki pehli light costs k downtrend ki nishan-dahi kartti hai, ye flame size aur arrangement me typical long genuine body wali negative candle hotti hai. Lekin dosre clamor ki light aik little genuine body wali negative candle hotee hai, jo k open aur close pehli candle k genuine body principal hoti hai. Design ki dono flame negative sharpen k bawajood bhi bullish pattern inversion design ka kaam karta hai.

Homing pigeon design bhi dosre bullish pattern inversion designs ki tarah purchase k signs deta hai. Design standard exchanging ka tareeqay kar bhi "Bullish Harami Example" jaisa hai, jiss standard market principal purchase ki passage ki jati hai. Design standard exchanging se pehle costs ka baghawar study karlen k ya to ye downtrend me honni chaheye aur ya ye significant level pe hon. Design ki pehlee light typical long genuine body wali hotti hai, jis ko dosre noise ki little negative flame follow kartti hai. Homing pigeon design me dosre noise ki candle ki development bohut zarrori hai, jo k pehli flame k under honi chaheye, yanni candle ki open aur close dono pehli candle k open aur close se kam honi chaheye. Homing pigeon design k leye pattern affirmation exchange passage se pehle zarrori hai, punch bhi design k baad teesre noise ki light negative ya white candle banne gi to ye market primary me purchase se passage karne ka time hoga. Stop Misfortune design k sab se most reduced cost ya negative flame k base se aik ya do pips underneath opposition point standard lagayen. Chart Pattern Types: Homing pigeon design "Bullish Harami Example" aur "Bullish Harami Cross Example" se melta julta design hai, jo same negative pattern ko bullish pattern me invert kia jata hai. Homing pigeon design two days candles standard mushtamil design hai, jis me pehlee aik long genuine body wali negative light hote hai, jis k baad dosree aik long genuine body wali little negative candle banti hai. Design ki pehli light costs k downtrend ki nishan-dahi kartti hai, ye flame size aur arrangement me typical long genuine body wali negative candle hotti hai. Lekin dosre clamor ki light aik little genuine body wali negative candle hotee hai, jo k open aur close pehli candle k genuine body principal hoti hai. Design ki dono flame negative sharpen k bawajood bhi bullish pattern inversion design ka kaam karta hai. Homing pigeon design two days candles standard mushtamil ek bullish pattern inversion design hai, aur downtrend k baad primary bhi bannta hai to us k leye candles ki darrjazel design honi chaheye Homing pigeon design principal pehle commotion ki candle aik long genuine body wali dark/red hotee hai, jo costs k downtrend ki turrjumani kartti hai. Ye light typical size aur negative pattern k mutabiq banti hai.Homing pigeon design primary dosre commotion ki flame bhi same dark ya red candle banti hai, jo k costs k negative pattern ka ikhtetaam karti hai, dosre racket ki candle pehle clamor ki candle k genuine body k andar open aur close hoti hai.Homing pigeon design two days candles standard mushtamil aik bullish pattern inversion design hai, jo k costs k base standard ya negative pattern k akhtetam standard banta hai. Design ki pehli aur dosri candle same negative candles hoti hai jis primary dosri flame pehli light k andar open aur close hoti hai. Trading View: Design ki dosri light ki arrangement same "Bullish Harami Example" aur "Bullish Harami Cross Example" jaisi hai lekin aik to iss candle ka variety dark hoti hai, jo k "Bullish Harami Example" k flame primary white hoti, dosra ye candle little genuine body ki hoti hai, jo k "Bullish Harami Cross Example" ki candle doji candle hoti hai, jiss ka open aur close same hota hai.Homing pigeon design aik bullish pattern inversion design hai, jo k costs k base standard ya negative pattern fundamental banta hai. Ye design negative k kamzori ki nishan dahi karta hai. Dosree flame aik little genuine body wali negative light hoti hai jo upturn ka ikhtetaam karti hai, jiss k baad costs bullish pattern inversion ka sabab banti hai.

Candle design aik bullish pattern inversion design hai, jo cost diagram standard do candles se mel kar banta hai. Design principal shamil dono candles negative hoti hai, issi waja se design k leye costs ka pehle se low region ya negative pattern primary hona zarori hai. Two days candles ki precision single day design se behtar hota hai, q k iss principal aik light thori bohut affirmation bhi deti hai. Punch bhi market principal dealers costs ko aik khas level tak nechay push karte hen, to yahan standard pattern inversion k imkanat ziada hote hen, ye pattern affirmation aksar kuch design se affirm ho jati hai, jiss fundamental homing pigeon design bhi shamil hai. candle design costs k base primary banne ki waja se aik bullish sign genrate karta hai, jiss standard market fundamental purchase ki passage ki ja sakti hai. Design pat exchange enter karne se design ki dosri light aik affirmation candle ki zarorat parti hai, jo k genuine body fundamental aik bullish flame honi chaheye, aur dosri negative candle k top standard close bhi honi chaheye. Design ki affirmation CCI, RSI, MACD pointer aur stochastic oscillator se bhi ki ja sakti hai, jiss ki esteem oversold zone principal honi chaheye. Design k baad negative flame se design invalid tasawar kia jayega. Design ka Stop Misfortune sab se lower ya pehli flame k close cost se two pips beneath set karen.

Candle design aik bullish pattern inversion design hai, jo cost diagram standard do candles se mel kar banta hai. Design principal shamil dono candles negative hoti hai, issi waja se design k leye costs ka pehle se low region ya negative pattern primary hona zarori hai. Two days candles ki precision single day design se behtar hota hai, q k iss principal aik light thori bohut affirmation bhi deti hai. Punch bhi market principal dealers costs ko aik khas level tak nechay push karte hen, to yahan standard pattern inversion k imkanat ziada hote hen, ye pattern affirmation aksar kuch design se affirm ho jati hai, jiss fundamental homing pigeon design bhi shamil hai. candle design costs k base primary banne ki waja se aik bullish sign genrate karta hai, jiss standard market fundamental purchase ki passage ki ja sakti hai. Design pat exchange enter karne se design ki dosri light aik affirmation candle ki zarorat parti hai, jo k genuine body fundamental aik bullish flame honi chaheye, aur dosri negative candle k top standard close bhi honi chaheye. Design ki affirmation CCI, RSI, MACD pointer aur stochastic oscillator se bhi ki ja sakti hai, jiss ki esteem oversold zone principal honi chaheye. Design k baad negative flame se design invalid tasawar kia jayega. Design ka Stop Misfortune sab se lower ya pehli flame k close cost se two pips beneath set karen.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:17 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим