Triple Top Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

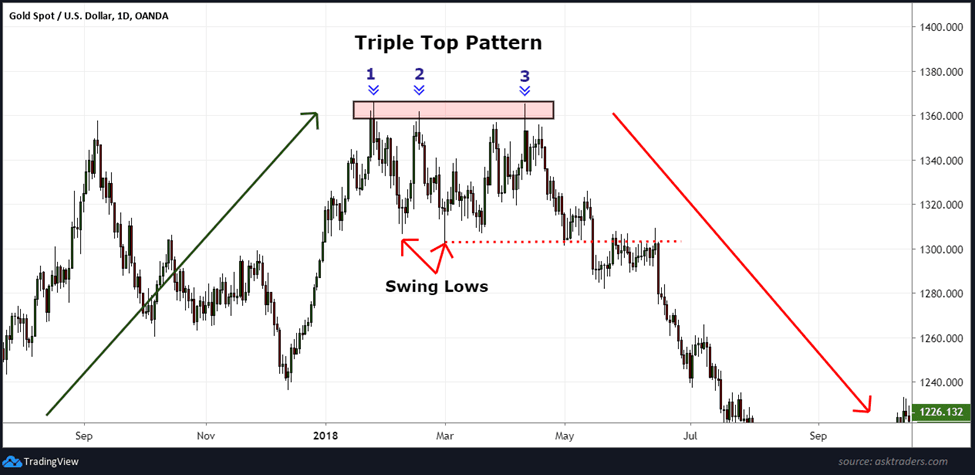

Recognizing the Triple Top PatternTriple top pattern aik reversal pattern hai jo ke uptrend ki akhri stages mein paaya jata hai. Is pattern mein price ek specific level pe teen baar pohanch kar rukta hai aur phir neechay mur kar trend change ho jata hai. Triple top pattern ki pehchan teen unwaanat (peaks) se hoti hai jo ke kareeb kareeb ek doosre ke barabar hote hain. In peaks ke darmiyan price ke zor ka kamzor hona shuru ho jata hai jis se trend badalne ka signal milta hai. Objectives of the Triple Top Pattern Triple top pattern ka asal maqsad yeh hota hai ke uptrend ki exhaustion yaani ke thakawat ka pata lagaya ja sake. Jab market ek consistent uptrend mein hota hai, to traders ko yeh sawal hota hai ke kya ab is trend ka khatma hone wala hai ya nahi. Triple top pattern isi situation mein madadgar sabit ho sakta hai. Teen baar price ek determined level pe pohanch kar ruk kar, yeh zahir karta hai ke buyers ke zor ka khatma ho raha hai aur sellers ka dabao barh raha hai.

Objectives of the Triple Top Pattern Triple top pattern ka asal maqsad yeh hota hai ke uptrend ki exhaustion yaani ke thakawat ka pata lagaya ja sake. Jab market ek consistent uptrend mein hota hai, to traders ko yeh sawal hota hai ke kya ab is trend ka khatma hone wala hai ya nahi. Triple top pattern isi situation mein madadgar sabit ho sakta hai. Teen baar price ek determined level pe pohanch kar ruk kar, yeh zahir karta hai ke buyers ke zor ka khatma ho raha hai aur sellers ka dabao barh raha hai.  Approach to Using the Triple Top Pattern Triple top pattern ki confirmation ke liye traders ko kuch cheezen dekhni hoti hain. Yahan kuch mukhtasar steps diye gaye hain jo ke is pattern ko samjhne aur istemal karne mein madadgar sabit ho sakte hain:

Approach to Using the Triple Top Pattern Triple top pattern ki confirmation ke liye traders ko kuch cheezen dekhni hoti hain. Yahan kuch mukhtasar steps diye gaye hain jo ke is pattern ko samjhne aur istemal karne mein madadgar sabit ho sakte hain:- Identify Peaks: Pehli cheez to yeh hai ke traders ko sahi tareeqay se teen peaks ko pehchan karne ki salahiyat honi chahiye. In peaks ka level aik jaisa hona chahiye aur kareebi tarikhon pe hone chahiye.

- Support Level: Triple top pattern ka sab se ahem hissa wo support level hota hai jahan price teen baar ruk kar neechay jata hai. Jab yeh level break hota hai, to trend change hone ka signal milta hai.

- Volume Analysis: Price movement ke saath saath trading volume ka bhi tafseel se mutala karna zaroori hai. Agar price peaks ke doran kam volume ke saath move kar raha hai, to yeh bearish divergence ka aalam ho sakta hai.

- Confirmation Signals: Triple top pattern ke tashkeel hone ke baad, traders ko aur bhi confirmation signals dekhne chahiye. Is mein RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur doosre technical indicators madadgar sabit ho sakte hain.

- Entry aur Stop-Loss: Jab triple top pattern confirm ho jaye, to traders ko entry aur stop-loss levels tay karna chahiye. Entry usually support level ke break ke neechay kiya jata hai aur stop-loss peaks ke top se thora oper rakha jata hai.

- Target Price: Target price ko tay karte waqt previous trends aur support/resistance levels ka bhi khayal rakhna zaroori hai. Yeh target price aksar pattern ki height se nikala jata hai.

Different Challenges Triple top pattern ka istemal karne ke bawajood, iske istemal mein kuch challenges bhi ho sakte hain. Market volatility, fakeouts (jali breakouts), aur galat signals ismein shamil hain. Isi liye traders ko apni analysis ko mukhtasar timeframes aur doosre technical tools ke saath verify karna chahiye. Is pattern ki pehchan aur samajhna traders ke liye zaroori hai takay wo market ki movement ko sahi tareeqay se predict kar sakein. Is pattern ki tafseel se samjhne ke baad hi traders ko entry, stop-loss, aur target price ka tay karna chahiye. Is ke istemal mein challenges bhi ho sakte hain, lekin sahi tajwezat aur analysis ke saath, traders is pattern se faida utha sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Different Challenges Triple top pattern ka istemal karne ke bawajood, iske istemal mein kuch challenges bhi ho sakte hain. Market volatility, fakeouts (jali breakouts), aur galat signals ismein shamil hain. Isi liye traders ko apni analysis ko mukhtasar timeframes aur doosre technical tools ke saath verify karna chahiye. Is pattern ki pehchan aur samajhna traders ke liye zaroori hai takay wo market ki movement ko sahi tareeqay se predict kar sakein. Is pattern ki tafseel se samjhne ke baad hi traders ko entry, stop-loss, aur target price ka tay karna chahiye. Is ke istemal mein challenges bhi ho sakte hain, lekin sahi tajwezat aur analysis ke saath, traders is pattern se faida utha sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Triple Top Pattern forex market mein yeh aik kesam ka chat pattern hota hey jo keh teen peak par moshtamel hota ey jaisa keh aap nechay dey gay chart par bhe daikh saktay hein ap ko forex market mein daily or weekly chart mein analysis karna chihay yeh pattern aik kesam ka bearish reversal chart pattern hota hey es pattern ke highs aik jaice hote hein jen ka turning point be resistance ko identify karta hey daily kay or 30 mint kay chart ko daikh kar analysis start kar saktay hein or jab aap end wale highs say central wale highs tak pohnch jatay hein to yeh bhe ho sakta hey keh trend khatam ho jay or forex trend mein aik strong kame kay trend ke omeed ke ja sakte hey Understanding Triple Top Pattern Triple Top Pattern forex market mein aik bearish reversal pattern hota hey jo keh aam tor par bar chart forex chart or candlestick chart par moshtamel hota hey support kay bad aik gap ka ad aik jaice highs hote hein baray reversal patter kay tor par aam tr par yeh pattern estamal keya jata hey baray reversal period kay bad aam tor par yeh forex market mein teen say 6 period tak bantay hein es bat ko bhe note karen keh bars par triple top reversal kay bad triple top candlestick pattern banta hey triple top pattern breakout mein bullish pattern hota hey yeh forex market mein triple top breakout say bohut he mokhtalef hotay hein sab say pehlay pattern kay individual parts ka jaiza layna ho ga jo keh aik upper resistance ko breakout karay hein Prior Trend forex market mein kese bhe reversal pattern kay sath reversal karnay kay ley aik majodah trend hona chihay triple top reversal honay say pehlay aik up trend ka tashkeel hona chihay three highs triple top pattern mein teen highs aik jaice hone chihay ache tarah fasla or wazah mor neshan zad hona chihay high belkul aik jaice nahi hone chihay laken maqol limit tak aik jaice hone chihay volume jaisay jaisay triple top eversa ho jata hey overall volume ke level aam tor par low ho jate hey volume kai dafa highs kay belkul qareeb mein barah jata hey tesaray high kay bad anay wale kame stock break par volume ke tosee mein ezafa karte hey or pattern strong bohut he zyada ho jata hey Support Break bohut say reversal pattern ke tarah triple top pattern os time tak reversal nahi hota hey jab tak support break na ho jay yeh es bat ke tashkeel ka sab say lower point hota hey or gap sab say low hota jata hey j keh es key support level ko neshan zad karta hey support say resistance support say resistance ke taraf indicate ho jata hey kai dafa new resistance level kay bad mein action ke rally kay sath imtehan hota hey Price ka target triple top pattern mein price ka target long bhe ho sakta hey highs ka target forex market mein price break say mapa ja sakta hey pattern jetna long hota hey price mein otna he gap zyada hota jata hey Triple Top reversal 6 ya os say zyada month ka bhe ho sakta hey or price ka target effective honay ka imkan kam ho jata hey Trade with Triple Top Pattern jab forex market mein assert ke price pattern ke support say nechay aa jay ge trde short position mein enter ho ge pattern forex trading sab say low recent swing mein he hota hey jab forex market mein price trend line say nechay aa jate hey to es pattern ko mokamal tor par samjha jata hey or price mein kamee ke omeed hote heyدیتے جائیںThanksحوصلہ افزائی کے لیے -

#4 Collapse

Definition: Triple Top pattern ek technical analysis concept hai jise traders forex market mein istemal karte hain. Is pattern mein, price chart par 3 peaks ya tops hote hain, jo kareeb-kareeb ek hi level par hote hain. Ye usually ek trend reversal indicator mana jata hai, matlab ke trend badalne ki possibility hoti hai. Is pattern ke phases: Upward Move (Urooj Shikanja): Price initially upar jaata hai, ek top banata hai, fir thoda neeche aata hai. Downward Move (Neeche Aane Ki Movement): Price neeche jaata hai aur ek bottom banata hai, jisse ek temporary reversal ka indication hota hai. Second Upward Move (Dusra Urooj Shikanja): Price dobara upar jaata hai aur pehle wale top se aage badhta hai. Second Downward Move (Dusra Neeche Aane Ki Movement): Price phir se neeche aata hai, lekin pehli bottom se neeche nahi jaata. Third Upward Move (Teesra Urooj Shikanja): Price teesri baar upar jaata hai, lekin pehle dono tops se neeche nahi jaata. Agar ye pattern poori tarah se confirm hota hai, toh traders isko ek potential reversal indicator samajhte hain aur sell positions ki taraf move karte hain, expecting ke price neeche jaayega. Lekin yaad rahe ke har pattern ki tarah, ye bhi 100% accurate nahi hota, isliye risk management ka bhi khayal rakhein. Triple Top pattern forex mein ek common reversal pattern hai jise traders price charts par dekhte hain. Is pattern mein ek security ya currency pair mein teen baar aik similar peak (top) ban jata hai. Ye peak usually ek resistance level ke qareeb hota hai, jahan se price pehle gir kar neeche aata hai. Ye pattern aksar price trend ki change ya bearish reversal ko suggest karta hai. Jab pehli aur doosri bar price peak banata hai, to traders cautious hojate hain. Lekin jab teesri bar bhi price wahi peak tak pohnchta hai aur wahan se neeche aata hai, to ye pattern confirm hota hai aur traders iska signal follow karte hain. Is pattern ki recognition mein price ke movement aur trading volume ka bhi dehan rakhna zaroori hota hai. Triple Top pattern ko samajhne ke liye historical price data aur chart analysis ki zaroorat hoti hai, taa ke is pattern ko sahi tareeqe se pehchan saken. Yad rahe ke forex trading risky hoti hai aur patterns ke bina bhi market mein movement hoti rehti hai, is liye trading se pehle detailed research aur risk management ka istemal karna chahiye. Triple top pattern: Triple Top pattern forex mein ek common reversal pattern hai. Is pattern mein price chart pe teen baray peaks (tops) nazar aatay hain, jo ek doosre se similar hote hain. Yeh peaks ek specific price level tak pohanch kar girte hain. Jab price teesri bar wohi level pe gir kar neechay jata hai jo pehle do baron mein bhi resistance ban chuka hai, to yeh ek indication ho sakta hai ke price ka trend ab downward direction mein change ho sakta hai. Is pattern ko samajhne ke liye, yeh important hai ke aapko support aur resistance levels, trendlines, aur price movement ki understanding ho. Triple Top pattern typically bullish trend ke baad dikhai deta hai aur price downward move shuru hota hai. Aapko confirmation ke liye price break below the neckline dekhna hota hai, jo usually second peak ke beech mein hota hai. Yaad rahe, keval pattern dekh kar trading nahi karni chahiye. Isko confirm karne ke liye aur additional analysis karne ke liye technical indicators aur fundamental analysis bhi use karni chahiye. Explanation: Triple Top pattern forex market mein ek common reversal pattern hai. Is pattern mein price chart par teen baar similar level par reach karta hai aur phir down trend shuru hota hai. Is pattern ko recognize karne ke liye, aapko teen peaks (tops) dekhne hote hain jo approximately same level par hote hain. Yeh ek indication hoti hai ke market uptrend se downtrend mein jaane ki possibility hai. Jab price teesri bar woh same level touch karta hai, jo pehle do bar touch hua tha, aur uske baad neeche ki taraf move karta hai, to yeh triple top pattern complete hota hai. Is point par traders ne sell karne ki possibilities ko consider karna shuru kar dete hain. Is pattern ke confirmation ke liye, aapko volume aur other technical indicators bhi dekhne chahiye. Agar aap sure nahi hain, toh expert advice lena bhi zaroori ho sakta hai, kyunke market mein false signals bhi ho sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Triple Top Chart Pattern: Triple Top example forex market mein ek normal inversion design hai. Is design mein cost diagram standard high schooler baar comparative level standard reach karta hai aur phir down pattern shuru hota hai.Is design ko perceive karne ke liye, aapko youngster tops (tops) dekhne hote hain jo roughly same level standard hote hain. Yeh ek sign hoti hai ke market upswing se downtrend mein jaane ki probability hai.Jab cost teesri bar woh same level touch karta hai, jo pehle do bar contact hua tha, aur uske baad neeche ki taraf move karta hai, to yeh triple top example complete hota hai. Is point standard brokers ne sell karne ki prospects ko consider karna shuru kar dete hain.Is design ke affirmation ke liye, aapko volume aur other specialized markers bhi dekhne chahiye. Agar aap sure nahi hain, toh master exhortation lena bhi zaroori ho sakta hai, kyunke market mein bogus signs bhi ho sakte hain. Design forex mein ek normal inversion design hai. Is design mein cost diagram pe high schooler baray tops (tops) nazar aatay hain, jo ek doosre se comparative hote hain. Yeh tops ek explicit cost level tak pohanch kar girte hain. Punch cost teesri bar wohi level pe gir kar neechay jata hai jo pehle do nobleman mein bhi obstruction boycott chuka hai, to yeh ek sign ho sakta hai ke cost ka pattern stomach muscle descending heading mein change ho sakta hai.Is design ko samajhne ke liye, yeh significant hai ke aapko support aur opposition levels, trendlines, aur cost development ki grasping ho. Triple Top example commonly bullish pattern ke baad dikhai deta hai aur cost descending move shuru hota hai. Aapko affirmation ke liye cost break underneath the neck area dekhna hota hai, jo normally second pinnacle ke beech mein hota hai.pattern dekh kar exchanging nahi karni chahiye. Isko affirm karne ke liye aur extra investigation karne ke liye specialized pointers aur central examination bhi use karni chahiye. Chart Pattern Types: Agar ye design poori tarah se affirm hota hai, toh brokers isko ek potential inversion marker samajhte hain aur sell positions ki taraf move karte hain, expecting ke cost neeche jaayega. Lekin yaad rahe ke har design ki tarah, ye bhi 100 percent precise nahi hota, isliye risk the executives ka bhi khayal rakhein.Triple Top example forex mein ek normal inversion design hai jise brokers cost outlines standard dekhte hain. Is design mein ek security ya cash pair mein youngster baar aik comparable pinnacle (top) boycott jata hai. Ye top normally ek obstruction level ke qareeb hota hai, jahan se cost pehle gir kar neeche aata hai.Second Descending Move (Dusra Neeche Aane Ki Development): Cost phir se neeche aata hai, lekin pehli base se neeche nahi jaata.Third Up Move (Teesra Urooj Shikanja): Cost teesri baar upar jaata hai, lekin pehle dono tops se neeche nahi jaata.

Design forex mein ek normal inversion design hai. Is design mein cost diagram pe high schooler baray tops (tops) nazar aatay hain, jo ek doosre se comparative hote hain. Yeh tops ek explicit cost level tak pohanch kar girte hain. Punch cost teesri bar wohi level pe gir kar neechay jata hai jo pehle do nobleman mein bhi obstruction boycott chuka hai, to yeh ek sign ho sakta hai ke cost ka pattern stomach muscle descending heading mein change ho sakta hai.Is design ko samajhne ke liye, yeh significant hai ke aapko support aur opposition levels, trendlines, aur cost development ki grasping ho. Triple Top example commonly bullish pattern ke baad dikhai deta hai aur cost descending move shuru hota hai. Aapko affirmation ke liye cost break underneath the neck area dekhna hota hai, jo normally second pinnacle ke beech mein hota hai.pattern dekh kar exchanging nahi karni chahiye. Isko affirm karne ke liye aur extra investigation karne ke liye specialized pointers aur central examination bhi use karni chahiye. Chart Pattern Types: Agar ye design poori tarah se affirm hota hai, toh brokers isko ek potential inversion marker samajhte hain aur sell positions ki taraf move karte hain, expecting ke cost neeche jaayega. Lekin yaad rahe ke har design ki tarah, ye bhi 100 percent precise nahi hota, isliye risk the executives ka bhi khayal rakhein.Triple Top example forex mein ek normal inversion design hai jise brokers cost outlines standard dekhte hain. Is design mein ek security ya cash pair mein youngster baar aik comparable pinnacle (top) boycott jata hai. Ye top normally ek obstruction level ke qareeb hota hai, jahan se cost pehle gir kar neeche aata hai.Second Descending Move (Dusra Neeche Aane Ki Development): Cost phir se neeche aata hai, lekin pehli base se neeche nahi jaata.Third Up Move (Teesra Urooj Shikanja): Cost teesri baar upar jaata hai, lekin pehle dono tops se neeche nahi jaata.  Triple Top example ek specialized examination idea hai jise dealers forex market mein istemal karte hain. Is design mein, cost graph standard 3 pinnacles ya tops hote hain, jo kareeb ek hey level standard hote hain. Ye generally ek pattern inversion marker mana jata hai, matlab ke pattern badalne ki plausibility hoti hai.Upward Move Cost at first upar jaata hai, ek top banata hai, fir thoda neeche aata hai.Downward Move (Neeche Aane Ki Development): Cost neeche jaata hai aur ek base banata hai, jisse ek impermanent inversion ka sign hota hai.Second Up Move Cost dobara upar jaata hai aur pehle grain top se aage badhta hai.turning point be obstruction ko recognize karta hello everyday kay or 30 mint kay outline ko daikh kar investigation start kar saktay hein aap end rib highs say focal grain highs tak pohnch jatay hein t yeh bhe ho sakta hello keh pattern khatam ho jay Trading And Formation: Design ka istemal karne ke bawajood, iske istemal mein kuch challenges bhi ho sakte hain. Market instability, fakeouts (jali breakouts), aur galat signals ismein shamil hain. Isi liye brokers ko apni investigation ko mukhtasar time spans aur doosre specialized apparatuses ke saath check karna chahiye. Is design ki pehchan aur samajhna brokers ke liye zaroori hai takay wo market ki development ko sahi tareeqay se foresee kar sakein. Is design ki tafseel se samjhne ke baad hello dealers ko passage, stop-misfortune, aur target cost ka tay karna chahiye. Is ke istemal mein challenges bhi ho sakte hain, lekin sahi tajwezat aur examination ke saath, dealers is design se faida utha sakte hain.Triple top example aik inversion design hai jo ke upturn ki akhri stages mein paaya jata hai. Is design mein cost ek explicit level pe youngster baar pohanch kar rukta hai aur phir neechay mur kar pattern change ho jata hai. Triple top example ki pehchan adolescent unwaanat (tops) se hoti hai jo ke kareeb ek doosre ke barabar hote hain. In tops ke darmiyan cost ke zor ka kamzor hona shuru ho jata hai jis se pattern badalne ka signal milta hai.

Triple Top example ek specialized examination idea hai jise dealers forex market mein istemal karte hain. Is design mein, cost graph standard 3 pinnacles ya tops hote hain, jo kareeb ek hey level standard hote hain. Ye generally ek pattern inversion marker mana jata hai, matlab ke pattern badalne ki plausibility hoti hai.Upward Move Cost at first upar jaata hai, ek top banata hai, fir thoda neeche aata hai.Downward Move (Neeche Aane Ki Development): Cost neeche jaata hai aur ek base banata hai, jisse ek impermanent inversion ka sign hota hai.Second Up Move Cost dobara upar jaata hai aur pehle grain top se aage badhta hai.turning point be obstruction ko recognize karta hello everyday kay or 30 mint kay outline ko daikh kar investigation start kar saktay hein aap end rib highs say focal grain highs tak pohnch jatay hein t yeh bhe ho sakta hello keh pattern khatam ho jay Trading And Formation: Design ka istemal karne ke bawajood, iske istemal mein kuch challenges bhi ho sakte hain. Market instability, fakeouts (jali breakouts), aur galat signals ismein shamil hain. Isi liye brokers ko apni investigation ko mukhtasar time spans aur doosre specialized apparatuses ke saath check karna chahiye. Is design ki pehchan aur samajhna brokers ke liye zaroori hai takay wo market ki development ko sahi tareeqay se foresee kar sakein. Is design ki tafseel se samjhne ke baad hello dealers ko passage, stop-misfortune, aur target cost ka tay karna chahiye. Is ke istemal mein challenges bhi ho sakte hain, lekin sahi tajwezat aur examination ke saath, dealers is design se faida utha sakte hain.Triple top example aik inversion design hai jo ke upturn ki akhri stages mein paaya jata hai. Is design mein cost ek explicit level pe youngster baar pohanch kar rukta hai aur phir neechay mur kar pattern change ho jata hai. Triple top example ki pehchan adolescent unwaanat (tops) se hoti hai jo ke kareeb ek doosre ke barabar hote hain. In tops ke darmiyan cost ke zor ka kamzor hona shuru ho jata hai jis se pattern badalne ka signal milta hai.  Merchants ko sahi tareeqay se high schooler tops ko pehchan karne ki salahiyat honi chahiye. In tops ka level aik jaisa hona chahiye aur kareebi tarikhon pe sharpen chahiye.Triple top example ka sab se ahem hissa wo support level hota hai jahan cost high schooler baar ruk kar neechay jata hai. Poke yeh level break hota hai, to drift change sharpen ka signal milta ha Cost development ke saath exchanging volume ka bhi tafseel se mutala karna zaroori hai. Agar cost tops ke doran kam volume ke saath move kar raha hai, to yeh negative dissimilarity ka aalam ho sakta hai.Triple top example ke tashkeel sharpen ke baad, merchants ko aur bhi affirmation signals dekhne chahiye. Is mein RSI (Relative Strength Record), MACD (Moving Normal Combination Disparity), aur doosre specialized pointers madadgar sabit ho sakte hain. Punch triple top example affirm ho jaye, to brokers ko passage aur stop-misfortune levels tay karna chahiye. Passage normally support level ke break ke neechay kiya jata hai aur stop-misfortune tops ke top se thora oper rakha jata hai.Target cost ko tay karte waqt past patterns aur support/opposition levels ka bhi khayal rakhna zaroori hai. Yeh target cost aksar design ki level se nikala jata hai.

Merchants ko sahi tareeqay se high schooler tops ko pehchan karne ki salahiyat honi chahiye. In tops ka level aik jaisa hona chahiye aur kareebi tarikhon pe sharpen chahiye.Triple top example ka sab se ahem hissa wo support level hota hai jahan cost high schooler baar ruk kar neechay jata hai. Poke yeh level break hota hai, to drift change sharpen ka signal milta ha Cost development ke saath exchanging volume ka bhi tafseel se mutala karna zaroori hai. Agar cost tops ke doran kam volume ke saath move kar raha hai, to yeh negative dissimilarity ka aalam ho sakta hai.Triple top example ke tashkeel sharpen ke baad, merchants ko aur bhi affirmation signals dekhne chahiye. Is mein RSI (Relative Strength Record), MACD (Moving Normal Combination Disparity), aur doosre specialized pointers madadgar sabit ho sakte hain. Punch triple top example affirm ho jaye, to brokers ko passage aur stop-misfortune levels tay karna chahiye. Passage normally support level ke break ke neechay kiya jata hai aur stop-misfortune tops ke top se thora oper rakha jata hai.Target cost ko tay karte waqt past patterns aur support/opposition levels ka bhi khayal rakhna zaroori hai. Yeh target cost aksar design ki level se nikala jata hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:41 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим