Double Top Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

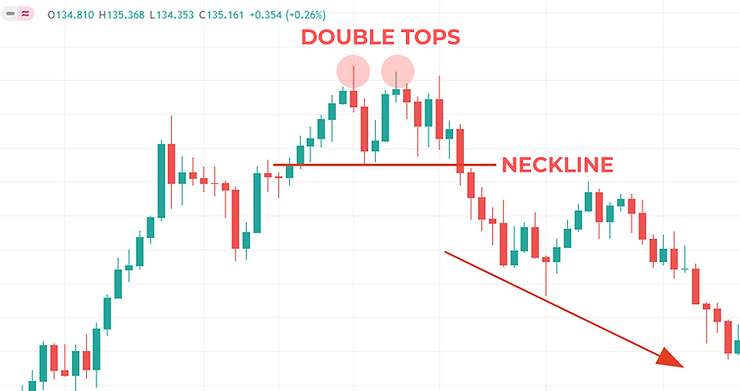

Formation aur Structure Double top pattern ek lambi bullish trend ke baad ubharte hue khareedne ki dabawat ki mumkin exhaustion ko dikhata hai. Iski pehchaan do mukhtalif price peaks se hoti hai jo qareebi barabar level tak pohanchte hain, ek waqtan-fa-waqtan guzarne wali ghata se jude hote hain jise trough kehte hain. Is pattern ko aksar kisi khas time frame mein, jaise daily ya hourly intervals mein plot karke price chart par zahir kiya jata hai. Ye peaks aam taur par ek trendline se jura hua hota hai, jo traders ke liye ek visual cue ka kaam karta hai. Pehla peak mojooda uptrend ka natija hai, jab khareedne wale market ko mukhalif hain aur prices ko relaively ziada buland level tak pohanchate hain. Is pehle peak se jab price wapas atata hai, kuch traders apne faiday kaatne lagte hain, jabke naye khareedne ke orders mein kami aur purane buyers mein kami ki wajah se price par neeche ki taraf dabawat aati hai. Is retracement se trough ka formation hota hai, jisme bulls aur bears dono taraf se koi wazi fayda nahi hota. Trough se ooper uthne mein mazeed izafa, dusre peak ke formation tak pohanchta hai. Lekin iss waqt tak, ooper ki taraf ki momentum kam hojati hai. Pehle market ko uncha level par le jane wale khareedne ki dabawat kamzor hone lagti hai aur price pehle peak ke level ko paar karne mein mushkil mehsoos karti hai. Iss naye unche level ko sthapit karne mein nakami, market sentiment mein ulta palat jane ki nishani hai. Psychological Underpinnings

Double top pattern ek lambi bullish trend ke baad ubharte hue khareedne ki dabawat ki mumkin exhaustion ko dikhata hai. Iski pehchaan do mukhtalif price peaks se hoti hai jo qareebi barabar level tak pohanchte hain, ek waqtan-fa-waqtan guzarne wali ghata se jude hote hain jise trough kehte hain. Is pattern ko aksar kisi khas time frame mein, jaise daily ya hourly intervals mein plot karke price chart par zahir kiya jata hai. Ye peaks aam taur par ek trendline se jura hua hota hai, jo traders ke liye ek visual cue ka kaam karta hai. Pehla peak mojooda uptrend ka natija hai, jab khareedne wale market ko mukhalif hain aur prices ko relaively ziada buland level tak pohanchate hain. Is pehle peak se jab price wapas atata hai, kuch traders apne faiday kaatne lagte hain, jabke naye khareedne ke orders mein kami aur purane buyers mein kami ki wajah se price par neeche ki taraf dabawat aati hai. Is retracement se trough ka formation hota hai, jisme bulls aur bears dono taraf se koi wazi fayda nahi hota. Trough se ooper uthne mein mazeed izafa, dusre peak ke formation tak pohanchta hai. Lekin iss waqt tak, ooper ki taraf ki momentum kam hojati hai. Pehle market ko uncha level par le jane wale khareedne ki dabawat kamzor hone lagti hai aur price pehle peak ke level ko paar karne mein mushkil mehsoos karti hai. Iss naye unche level ko sthapit karne mein nakami, market sentiment mein ulta palat jane ki nishani hai. Psychological Underpinnings  Double top pattern ke peeche ki psychology samajhna iski ahmiyat ko tashkeel dena ke liye mukhsoos hai. Pehle peak ke doran, woh traders jo uptrend mein hain, market ke rukh ki taraf pur sukoon hote hain. Jab price wapas aata hai, kuch traders apne faiday kaat lete hain, jabke doosre traders ziada khareedne ke positions lenay mein rukawat ka samna karte hain kyunke woh fikar rakhte hain ke market overbought halat mein aa gaya hai. Is hesitation ki wajah se trough ka formation hota hai. Jab price dobara barhne lagta hai, woh traders jo pehle uptrend mein shamil nahi ho sake, woh long positions lenay ka moqa hasil karne mein tawajjo dete hain, umeed karte hain ke bullish movement jari rahegi. Lekin unki utsukta ko waqt ke sath hakikat miljati hai ke market ki unchaayi wazan hone lagi hai. Price ka pehle peak ko paar na karne ki nakami, ek mumkin trend reversal ki taraf shift hone ka ishara hai. Confirmation and Trading Strategies

Double top pattern ke peeche ki psychology samajhna iski ahmiyat ko tashkeel dena ke liye mukhsoos hai. Pehle peak ke doran, woh traders jo uptrend mein hain, market ke rukh ki taraf pur sukoon hote hain. Jab price wapas aata hai, kuch traders apne faiday kaat lete hain, jabke doosre traders ziada khareedne ke positions lenay mein rukawat ka samna karte hain kyunke woh fikar rakhte hain ke market overbought halat mein aa gaya hai. Is hesitation ki wajah se trough ka formation hota hai. Jab price dobara barhne lagta hai, woh traders jo pehle uptrend mein shamil nahi ho sake, woh long positions lenay ka moqa hasil karne mein tawajjo dete hain, umeed karte hain ke bullish movement jari rahegi. Lekin unki utsukta ko waqt ke sath hakikat miljati hai ke market ki unchaayi wazan hone lagi hai. Price ka pehle peak ko paar na karne ki nakami, ek mumkin trend reversal ki taraf shift hone ka ishara hai. Confirmation and Trading Strategies  Double top pattern ko kamyabi se trade karne ki chabi iske reversal ki tasdeeq mein hai. Jabke pattern khud pehle signal faraham karta hai, traders am taur par mazeed isharaon ka intezar karte hain qabal-e-amal hone se pehle. Aik mamooli tareeqa hai ke price ko trough ke support level se guzarne ka intezar karen. Iss guzish ko tasdeeq maana jata hai ke bears ne maqooli faida hasil kar liya hai aur ye ek potential downtrend ki taraf ishara hai. Apni tafsili tashkhees mein accuracy barhane ke liye, traders aksar double top pattern ke sath technical indicators ka istemal karte hain. Jaise ke Moving Average Convergence Divergence (MACD) ya Relative Strength Index (RSI) woh indicators hain jo reversal signal ki taqat ko dikhate hain. Price aur in indicators ke darmiyan bearish divergence, ishara ke taqat ko barha sakti hai ke ek nazdeek hone wala downtrend hai. Kai trading strategies us waqt istemal ki ja sakti hain jab aik tasdeeq shuda double top pattern se mulaqat hoti hai. Aik tareeqa yeh hai ke jab price trough ke support level ko paar karte waqt neeche girta hai, tab short position enter karen. Risk ko control karne ke liye stop-loss order doosre peak ke thoda ooper lagaya ja sakta hai. Iske elawa, traders pehle ke support levels par profit targets set kar sakte hain ya potential downward moves ko capture karne ke liye trailing stops ka istemal kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Double top pattern ko kamyabi se trade karne ki chabi iske reversal ki tasdeeq mein hai. Jabke pattern khud pehle signal faraham karta hai, traders am taur par mazeed isharaon ka intezar karte hain qabal-e-amal hone se pehle. Aik mamooli tareeqa hai ke price ko trough ke support level se guzarne ka intezar karen. Iss guzish ko tasdeeq maana jata hai ke bears ne maqooli faida hasil kar liya hai aur ye ek potential downtrend ki taraf ishara hai. Apni tafsili tashkhees mein accuracy barhane ke liye, traders aksar double top pattern ke sath technical indicators ka istemal karte hain. Jaise ke Moving Average Convergence Divergence (MACD) ya Relative Strength Index (RSI) woh indicators hain jo reversal signal ki taqat ko dikhate hain. Price aur in indicators ke darmiyan bearish divergence, ishara ke taqat ko barha sakti hai ke ek nazdeek hone wala downtrend hai. Kai trading strategies us waqt istemal ki ja sakti hain jab aik tasdeeq shuda double top pattern se mulaqat hoti hai. Aik tareeqa yeh hai ke jab price trough ke support level ko paar karte waqt neeche girta hai, tab short position enter karen. Risk ko control karne ke liye stop-loss order doosre peak ke thoda ooper lagaya ja sakta hai. Iske elawa, traders pehle ke support levels par profit targets set kar sakte hain ya potential downward moves ko capture karne ke liye trailing stops ka istemal kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:55 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим