Crab and shark pattern?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

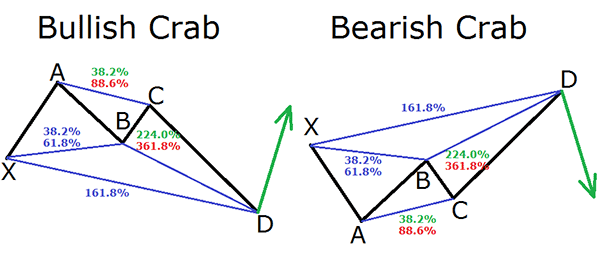

Assalam alaikum dear members! last posts main hum Harmonic patterns ka topic start kar chuky thy or us main se hun 1st 4 patterns ko pchli 2 posts main discus kar chuky hain.moving forward aj hum next 2 patterns ko es post main discus karen gy. CRAB PATTERN SHAKR PATTERN What is Crab Pattern? Dear members baki harmonic patterns ki tarha crab pattern k bhi 4 points hoty hain XABCD. or in 4 points ko mila k 4 movements jinko legs kaha tha jati ha wo banti han. X-A A-B B-C C-D Baki tmam harmonic patterns ki trha crab bullish or bearish dono form main hota ha. Bullish version main crab pattern estrha bnta ha k jb prices X se A ki trf tezi se girti hn to XA bnta ha kr us k bad AB leg bnti ha jo k 38% ya 61% retrace karti ha XA ko. Or es k BC ki projection hoti ha jo k 2.618 ya 3.14% retracement hoti ha or ye pattern completion ki nishani hoti ha or es k bad trend reverse hona hota ha or CD line banti ha jo k point X se bhi high hoti ha. how to trade crab pattern? Crab pattern main trade karny k lye apko pattern k complete hony ka wait krna chahye ya phir ap point C se trade le skty hain or profittargey point D ho ga or stop loss ap A K equal ya us se nechy rkh skty hain.Dear members shark pattern bhi crab pattern se milta julta pattern ha es main 5 legs matlb k 5 movements or 5 hi points hoty hn X , A , B & X. Shark pattern nechy diye gye fibbonaci rules ko follow kary ga otherwise ye shark pattern ni ho ga. * AB leg XA leg ki km se km 1.13% ya 1.618% retracement honi chahye. * BC leg OX leg ki 113% retracement honi chahye. * CD leg BC leg ki 50% retracement target hoti ha. What is Shark Pattern? Aksr traders es pattern mai point C se enter hoty hain or Point D 1 profit target mana jata ha. Baki tmam patterns ki trha es main bhi bullish or bearish type hoti ha jo ap picture main dekh skty hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Crab aur Shark Pattern Forex Forex trading mein, Crab aur shark pattern kaafi ahem hote hain. Ye patterns traders ko market ki movement ka pata lagane mein madad karte hain aur trading decisions lene mein help karte hain. Crab Pattern Crab pattern market mein trend reversal ki indication deta hai. Is pattern mein price chart mein ek crab ki tarah shape banta hai. Is pattern ki shuruwat mein price chart mein ek sharp move hota hai, phir price chart sideways movement karta hai aur phir ek aur sharp move hota hai. Is pattern mein traders ko second move ki direction ka pata lagana hota hai. Agar second move up ki taraf hai to traders long position le sakte hain. Agar second move down ki taraf hai to traders short position le sakte hain. Crab pattern ko confirm karne ke liye traders ko other indicators jaise ki RSI, MACD aur moving averages ka use karna hota hai. Shark Pattern Shark pattern bhi ek trend reversal pattern hai. Is pattern mein price chart mein ek shark ki tarah shape banta hai. Is pattern mein price chart mein ek sharp move hota hai, phir price chart sideways movement karta hai aur phir ek aur sharp move hota hai. Is pattern mein traders ko second move ki direction ka pata lagana hota hai. Agar second move up ki taraf hai to traders long position le sakte hain. Agar second move down ki taraf hai to traders short position le sakte hain. Shark pattern ko confirm karne ke liye traders ko other indicators jaise ki RSI, MACD aur moving averages ka use karna hota hai. Conclusion Crab aur shark pattern forex trading mein trend reversal ki indication dete hain. Traders in patterns ko confirm karne ke liye other indicators ka use karte hain. In patterns ko samajhna aur sahi tarike se use karna traders ke liye kaafi important hai. -

#4 Collapse

Trading mein technical analysis bohot zaroori hoti hai, aur technical analysis ke zariey different patterns ko identify karke profitable trades ki ja sakti hain. Harmonic patterns trading mein bohot popular hain, jismein Crab aur Shark patterns bhi shamil hain. Yeh patterns market ki price movements aur reversals ko predict karne mein madadgar hote hain.

Harmonic Patterns ka Introduction

Harmonic patterns market ki price movements ko mathematical ratios aur geometrical structures ke zariey identify karte hain. Yeh patterns Fibonacci retracement aur extension levels ka use karke price reversals ko identify karte hain. Harmonic patterns accurate aur reliable hote hain agar inko theek tarike se apply kiya jaye.

Crab Pattern

Crab pattern ek harmonic pattern hai jo price ka ek extreme reversal point predict karta hai. Yeh pattern typically strong trends mein banta hai aur trend reversal ki taraf indicate karta hai. Crab pattern ko identify karne ke liye specific Fibonacci ratios aur price swings ka analysis zaroori hota hai.

Crab Pattern ki Structure

Crab pattern ke chaar important points hote hain: X, A, B, C, aur D. Yeh points price swings ko represent karte hain aur specific Fibonacci ratios ko follow karte hain.- X to A Move: Yeh initial price move hota hai aur yeh kisi bhi direction mein ho sakta hai (upward ya downward).

- A to B Move: Yeh move X to A move ka retracement hota hai aur yeh typically 38.2% se 61.8% ke beech hota hai.

- B to C Move: Yeh move A to B move ka extension hota hai aur yeh typically 38.2% se 88.6% ke beech hota hai.

- C to D Move: Yeh move B to C move ka extension hota hai aur yeh Crab pattern ka final leg hota hai. Yeh move typically 161.8% se 224% ke beech hota hai X to A move ka.

Crab Pattern ko Identify Karna

Crab pattern ko identify karne ke liye aapko following steps follow karne chahiye:- Identify X to A Move: Pehle aapko strong price move ko identify karna hota hai jo X to A point hota hai.

- Identify A to B Retracement: Iske baad aapko X to A move ka retracement dekhna hota hai jo typically 38.2% se 61.8% ke beech hota hai.

- Identify B to C Move: Phir aapko A to B move ka extension dekhna hota hai jo 38.2% se 88.6% ke beech hota hai.

- Identify C to D Move: Last step mein aapko B to C move ka extension dekhna hota hai jo 161.8% se 224% ke beech hota hai X to A move ka.

Crab pattern ko trade karne ke liye aapko following steps follow karne chahiye:- Entry: D point pe entry leni chahiye jab price reversal signals milte hain.

- Stop Loss: Stop loss typically D point ke thoda neeche ya upar set karna chahiye, depending on the direction of the trade.

- Target: Target levels ko Fibonacci retracement levels ke hisaab se set karna chahiye. First target 38.2% retracement level hota hai aur second target 61.8% retracement level hota hai.

Shark pattern bhi ek harmonic pattern hai jo price reversals ko predict karta hai. Yeh pattern relatively new hai aur ise Scott Carney ne introduce kiya tha. Shark pattern price ka aggressive move aur reversal point identify karta hai.

Shark Pattern ki Structure

Shark pattern ke chaar important points hote hain: 0, X, A, aur B. Yeh points specific Fibonacci ratios ko follow karte hain.- 0 to X Move: Yeh initial price move hota hai aur yeh kisi bhi direction mein ho sakta hai.

- X to A Move: Yeh move 0 to X move ka retracement hota hai aur yeh typically 113% se 161.8% ke beech hota hai.

- A to B Move: Yeh move X to A move ka extension hota hai aur yeh typically 88.6% se 113% ke beech hota hai 0 to X move ka.

- B to C Move: Yeh Shark pattern ka final leg hota hai aur yeh move typically 113% se 161.8% ke beech hota hai X to A move ka.

Shark Pattern ko Identify Karna

Shark pattern ko identify karne ke liye aapko following steps follow karne chahiye:- Identify 0 to X Move: Pehle aapko strong price move ko identify karna hota hai jo 0 to X point hota hai.

- Identify X to A Retracement: Iske baad aapko 0 to X move ka retracement dekhna hota hai jo typically 113% se 161.8% ke beech hota hai.

- Identify A to B Move: Phir aapko X to A move ka extension dekhna hota hai jo 88.6% se 113% ke beech hota hai 0 to X move ka.

- Identify B to C Move: Last step mein aapko A to B move ka extension dekhna hota hai jo 113% se 161.8% ke beech hota hai X to A move ka.

Shark pattern ko trade karne ke liye aapko following steps follow karne chahiye:- Entry: C point pe entry leni chahiye jab price reversal signals milte hain.

- Stop Loss: Stop loss typically C point ke thoda neeche ya upar set karna chahiye, depending on the direction of the trade.

- Target: Target levels ko Fibonacci retracement levels ke hisaab se set karna chahiye. First target 38.2% retracement level hota hai aur second target 61.8% retracement level hota hai.

Crab aur Shark patterns mein kuch similarities aur differences hain jo inko alag banate hain:

Similarities- Harmonic Patterns: Dono hi harmonic patterns hain jo Fibonacci ratios ka use karke price reversals ko predict karte hain.

- Price Reversal: Dono patterns price reversal points ko identify karte hain aur traders ko profitable trades execute karne mein madad karte hain.

- Entry, Stop Loss, and Targets: Dono patterns similar approach follow karte hain for entry, stop loss, and target levels based on Fibonacci retracement levels.

- Structure: Dono patterns ka structure alag hota hai. Crab pattern mein chaar points (X, A, B, C, D) hote hain jabke Shark pattern mein bhi chaar points (0, X, A, B, C) hote hain, lekin inke formation aur Fibonacci ratios alag hote hain.

- Fibonacci Ratios: Dono patterns different Fibonacci ratios ko follow karte hain for their respective moves. Crab pattern typically 161.8% se 224% ka extension dekhta hai X to A move ka, jabke Shark pattern 113% se 161.8% ka extension dekhta hai X to A move ka.

Assume karte hain ke aap EUR/USD pair trade kar rahe hain.- Identify X to A Move: EUR/USD ne 1.1200 se 1.1400 tak upward move kiya (X to A move).

- Identify A to B Retracement: Iske baad EUR/USD ne 1.1400 se 1.1300 tak downward move kiya jo 50% retracement hai (A to B move).

- Identify B to C Move: Phir EUR/USD ne 1.1300 se 1.1350 tak upward move kiya jo 61.8% extension hai (B to C move).

- Identify C to D Move: Last mein EUR/USD ne 1.1350 se 1.1500 tak upward move kiya jo 161.8% extension hai X to A move ka (C to D move).

Crab pattern complete hone ke baad, aap 1.1500 pe sell entry le sakte hain jab price reversal signals milte hain, aur stop loss 1.1520 pe set kar sakte hain. First target 1.1400 aur second target 1.1300 pe set kar sakte hain.

Shark Pattern Example

Assume karte hain ke aap GBP/USD pair trade kar rahe hain.- Identify 0 to X Move: GBP/USD ne 1.3000 se 1.3200 tak upward move kiya (0 to X move).

- Identify X to A Retracement: Iske baad GBP/USD ne 1.3200 se 1.3100 tak downward move kiya jo 113% retracement hai (X to A move).

- Identify A to B Move: Phir GBP/USD ne 1.3100 se 1.3250 tak upward move kiya jo 88.6% extension hai (A to B move).

- Identify B to C Move: Last mein GBP/USD ne 1.3250 se 1.3150 tak downward move kiya jo 113% extension hai X to A move ka (B to C move).

Crab aur Shark patterns trading mein bohot useful harmonic patterns hain jo price reversals ko predict karte hain. Yeh patterns specific Fibonacci ratios aur price swings ko follow karte hain jo traders ko accurate entry aur exit points provide karte hain. Crab pattern extreme reversal points ko identify karta hai jabke Shark pattern aggressive price moves ko predict karta hai. Dono patterns ko effectively trade karne ke liye proper analysis aur discipline zaroori hai.

Yeh patterns trading mein consistent profits kamaane ke liye bohot madadgar hote hain agar inko theek tarike se identify aur trade kiya jaye. Continuous learning, practice, aur proper risk management se aap in patterns ko efficiently use kar sakte hain aur profitable trading decisions le sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

Crab aur Shark Patterns Kya Hain?

Crab aur Shark patterns harmonic patterns hain jo technical analysis mein use hoti hain taake potential price reversals ko identify kiya ja sake. Yeh patterns precise Fibonacci retracement aur extension levels par based hoti hain. Crab aur Shark patterns trading aur investing mein bohot important hain, specially forex, commodities, stocks, aur cryptocurrencies jaise markets mein.

Crab Pattern

Crab pattern ek harmonic pattern hai jo strong price reversals ko predict karne ke liye use hoti hai. Yeh pattern 5 points (X, A, B, C, D) par based hoti hai aur Fibonacci retracement aur extension levels ko follow karti hai.

Crab Pattern Ki Identification:

1. XA Leg:

Price X point se A point tak move karti hai.

2. AB Leg:

Price A point se reverse hoti hai aur X-A leg ka 38.2% ya 61.8% retracement karti hai, B point tak.

3. BC Leg:

Price B point se reverse hoti hai aur A-B leg ka 38.2% ya 88.6% retracement karti hai, C point tak.

4. CD Leg:

Price C point se reverse hoti hai aur A-B leg ka 161.8% ya 224.0% extension karti hai, D point tak.

5. PRZ (Potential Reversal Zone):

D point ek potential reversal zone hota hai jahan price strong reversal karti hai.

Trading Crab Pattern:

1. Entry Point:

Jab price D point par pohanchti hai, toh buy/sell position enter karein depending on pattern (bullish/bearish).

2. Stop-Loss:

Stop-loss D point ke thoda neeche/uper set karein taake risk ko manage kiya ja sake.

3. Take Profit:

Take profit levels ko previous support/resistance levels ya Fibonacci levels ke basis par set karein.

Shark Pattern

Shark pattern bhi ek harmonic pattern hai jo potential price reversals ko predict karne ke liye use hoti hai. Yeh pattern 5 points (O, X, A, B, C) par based hoti hai aur Fibonacci retracement aur extension levels ko follow karti hai.

Shark Pattern Ki Identification:

1. OX Leg:

Price O point se X point tak move karti hai.

2. XA Leg:

Price X point se reverse hoti hai aur O-X leg ka 113% ya 161.8% extension karti hai, A point tak.

3. AB Leg:

Price A point se reverse hoti hai aur X-A leg ka 113% ya 161.8% extension karti hai, B point tak.

4. BC Leg:

Price B point se reverse hoti hai aur A-B leg ka 88.6% ya 113% retracement karti hai, C point tak.

5. PRZ (Potential Reversal Zone):

C point ek potential reversal zone hota hai jahan price strong reversal karti hai.

Trading Shark Pattern:

1. Entry Point:

Jab price C point par pohanchti hai, toh buy/sell position enter karein depending on pattern (bullish/bearish).

2. Stop-Loss:

Stop-loss C point ke thoda neeche/uper set karein taake risk ko manage kiya ja sake.

3. Take Profit:

Take profit levels ko previous support/resistance levels ya Fibonacci levels ke basis par set karein.

Example of Crab aur Shark Patterns

Crab Pattern Example:

1. Identification:

Sochiye ke aap ek currency pair ka chart dekh rahe hain. Price X point se A point tak move karti hai. Phir A point se reverse hoti hai aur B point tak pohanchti hai. Phir B point se reverse hoti hai aur C point tak pohanchti hai. Phir C point se reverse hoti hai aur D point tak pohanchti hai, jo A-B leg ka 161.8% extension hai.

2. Trading Decision:

Aap D point par buy position enter karte hain aur stop-loss D point ke thoda neeche set karte hain.

3. Profit Booking:

Price upar move hoti hai aur aap previous resistance levels ke near take profit book karte hain.

Shark Pattern Example:

1. Identification:

Sochiye ke aap ek stock ka chart dekh rahe hain. Price O point se X point tak move karti hai. Phir X point se reverse hoti hai aur A point tak pohanchti hai. Phir A point se reverse hoti hai aur B point tak pohanchti hai. Phir B point se reverse hoti hai aur C point tak pohanchti hai, jo A-B leg ka 113% retracement hai.

2. Trading Decision:

Aap C point par sell position enter karte hain aur stop-loss C point ke thoda uper set karte hain.

3. Profit Booking:

Price neeche move hoti hai aur aap previous support levels ke near take profit book karte hain.

Conclusion

Crab aur Shark patterns harmonic patterns hain jo precise Fibonacci levels par based hoti hain aur potential price reversals ko predict karne mein madad karti hain. Proper identification, risk management, aur disciplined trading approach ke sath in patterns ko effectively use karke aap profitable trading results hasil kar sakte hain. Forex, equities, commodities, aur cryptocurrencies jaise different markets mein Crab aur Shark patterns ko incorporate karke aapki trading strategy ko enhance kiya ja sakta hai aur better trading outcomes hasil kiya ja sakta hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Crab aur Shark Patterns in Forex Trading: Roman Urdu Mein Tafseel**

Crab aur Shark patterns harmonic trading patterns ke aik part hain jo technical analysis mein use kiye jate hain. Yeh patterns price movements ko analyze karke potential market reversals aur continuations ki prediction karte hain. In patterns ko samajhna aur use karna traders ko trading decisions mein madad de sakta hai.

### 1. **Crab Pattern Kya Hai?**

Crab pattern ek harmonic pattern hai jo price movements ke specific sequence ko follow karta hai. Yeh pattern market ke potential reversal points ko identify karne ke liye use hota hai.

#### **Crab Pattern Ki Structure**

- **XA Leg:** Yeh pattern ka pehla leg hota hai jo price ke initial move ko represent karta hai. Yeh leg bullish ya bearish ho sakta hai.

- **AB Leg:** Is leg mein price XA leg ke initial move ke kuch portion ko retrace karti hai. Yeh retracement 61.8% ya 78.6% tak hota hai.

- **BC Leg:** Yeh leg price ka XA leg ke baad ka move hota hai aur ismein retracement 38.2% ya 50% hota hai.

- **CD Leg:** Yeh final leg hai jo pattern ka completion signal hota hai. Is leg ki extension 161.8% ya 224.0% tak hoti hai jo pattern ke completion ko indicate karti hai.

#### **Crab Pattern Ki Key Levels**

- **XA Leg:** Initial move.

- **AB Leg:** Retracement (61.8% ya 78.6%).

- **BC Leg:** Retracement (38.2% ya 50%).

- **CD Leg:** Extension (161.8% ya 224.0%).

#### **Trading Strategy Using Crab Pattern**

- **Entry Point:** Jab CD leg pattern ke completion level ko touch karta hai aur reversal signal milta hai.

- **Stop-Loss:** Recent low ya high ke paas stop-loss set karein.

- **Profit Target:** Profit targets ko XA leg ke high/low ya nearest support/resistance levels ke mutabiq set karein.

### 2. **Shark Pattern Kya Hai?**

Shark pattern bhi ek harmonic pattern hai jo market ke potential reversal points ko identify karne ke liye use hota hai. Yeh pattern price movements ke specific sequence ko follow karta hai aur market ke potential changes ko indicate karta hai.

#### **Shark Pattern Ki Structure**

- **XA Leg:** Yeh pattern ka initial move hota hai jo price ka ek significant movement ko represent karta hai.

- **AB Leg:** Is leg mein price XA leg ke kuch portion ko retrace karti hai. Yeh retracement 38.2% tak hota hai.

- **BC Leg:** Yeh leg price ke movement ko XA leg ke baad represent karta hai aur retracement 61.8% ya 78.6% hota hai.

- **CD Leg:** Yeh final leg hai jo pattern ke completion ko indicate karta hai aur iski extension 161.8% tak hoti hai.

#### **Shark Pattern Ki Key Levels**

- **XA Leg:** Initial move.

- **AB Leg:** Retracement (38.2%).

- **BC Leg:** Retracement (61.8% ya 78.6%).

- **CD Leg:** Extension (161.8%).

#### **Trading Strategy Using Shark Pattern**

- **Entry Point:** Jab CD leg pattern ke completion level ko touch karta hai aur reversal signal milta hai.

- **Stop-Loss:** Recent low ya high ke paas stop-loss set karein.

- **Profit Target:** Profit targets ko XA leg ke high/low ya nearest support/resistance levels ke mutabiq set karein.

### 3. **Crab Aur Shark Patterns Mein Differences**

#### **Structure Differences**

- **Crab Pattern:** Crab pattern mein CD leg ki extension 161.8% ya 224.0% hoti hai. Is pattern mein retracement levels thode different hote hain aur completion level higher hota hai.

- **Shark Pattern:** Shark pattern mein CD leg ki extension 161.8% hoti hai. Is pattern mein retracement levels aur completion level thode different hote hain.

#### **Trading Strategy Differences**

- **Crab Pattern:** Crab pattern ki trading strategy generally completion level ke baad reversal signal ko enter karne ke liye use hoti hai.

- **Shark Pattern:** Shark pattern ki trading strategy completion level ke baad reversal signal ko enter karne ke liye use hoti hai, lekin yeh pattern thoda different retracement aur extension levels ko follow karta hai.

### 4. **Pattern Recognition aur Trading**

#### **Pattern Recognition**

- **Chart Patterns:** In patterns ko identify karne ke liye charts ko carefully analyze karein. Price movements aur technical indicators ke sath patterns ko match karein.

- **Pattern Tools:** Charting software aur tools ko use karein jo harmonic patterns ko identify aur analyze karne mein madad karte hain.

#### **Trading Execution**

- **Confirmation:** Pattern ko confirm karne ke liye additional technical indicators aur price action analysis ko use karein.

- **Risk Management:** Proper risk management techniques ko apply karein, jaise stop-loss aur take-profit levels ko set karna.

### 5. **Limitations aur Considerations**

#### **False Signals**

- **False Patterns:** Harmonic patterns kabhi kabhi false signals generate karte hain. Yeh zaroori hai ke pattern ko confirm karne ke liye additional indicators aur analysis use kiya jaye.

#### **Complexity**

- **Pattern Complexity:** Harmonic patterns complex hoti hain aur inhe accurately identify aur trade karna challenging ho sakta hai. Practice aur experience zaroori hai.

### 6. **Conclusion**

Crab aur Shark patterns forex trading mein harmonic trading strategies ka ek important part hain. Yeh patterns price movements aur specific sequences ko analyze karke market ke potential reversal points ko identify karte hain. Trading in patterns ko samajhna aur use effectively karna traders ko better trading decisions lene aur market opportunities ko maximize karne mein madad karta hai. Proper identification, confirmation, aur risk management ke sath in patterns ko use karna zaroori hai. In patterns ko practice aur experience ke sath master kiya ja sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Crab Pattern kya hai?

Crab pattern ek harmonic pattern hai jo 5-point extension structure ka use karta hai. Is pattern mein, D point X point se aage badh jaata hai. Crab pattern ko Potential Reversal Zone (PRZ) mein 1.618 XA projection ka use karke pehchana ja sakta hai.

Crab pattern ke kuchh pramukh visheshtaen hain:- XA leg: Yeh pattern ka pahla segment hai, jo X point se Apoint tak jaata hai.

- AB leg: Yeh pattern k dusra segment hai, jo Apoint se B point tak jaata hai.

- BC leg: Yeh pattern ka teesra segment hai, jo B point se C point tak jaata hai.

- CD leg: Yeh pattern ka chautha segment hai, jo C point se D point tak jaata hai.

- XA extension: Yeh XA leg ka 1.618 projection hai, jo PRZ ka nirnay karta hai.

- BC extension: Yeh BC leg ka 2.618, 3.14, ya 3.618 projection hai.

Crab pattern ka use kaise karein:

Crab pattern ka use karne ke liye, aapko nimnalikhit charanon ka palan karna hoga:- Ek uptrend ya downtrend ki pahchan karein. Crab pattern uptrend aur downtrend donon mein valid ho sakta hai.

- XA leg ki pahchan karein. XA leg pattern ka pahla segment hai, jo X point se A point tak jaata hai.

- AB leg ki pahchan karein. AB leg pattern ka dusra segment hai, jo A point se B point tak jaata hai.

- BC leg ki pahchan karein. BC leg pattern ka teesra segment hai, jo B point se C point tak jaata hai.

- CD leg ki pahchan karein. CD leg pattern ka chautha segment hai, jo C point se D point tak jaata hai.

- XA extension ki pahchan karein. XA extension XA leg ka 1.618 projection hai, jo PRZ ka nirnay karta hai.

- BC extension ki pahchan karein. BC extension BC leg ka 2.618, 3.14, ya 3.618 projection hai.

- PRZ ki pahchan karein. PRZ XA extension aur BC extension ke bich ka kshetra hai.

- Trading signal ki pahchan karein. Crab pattern mein ek trading signal ke liye, kimat ko PRZ mein pahunchna chahie aur fir pattern ke viprit disha mein badhna chahie.

Shark Pattern kya hai?

Shark pattern ek harmonic pattern hai jo 5-point extension structure ka use karta hai. Is pattern mein, C point X point se aage badh jaata hai. Shark pattern ko Potential Reversal Zone (PRZ) mein 1.618 XA projection ka use karke pehchana ja sakta hai.

Shark pattern ke kuchh pramukh visheshtaen hain:- XA leg: Yeh pattern ka pahla segment hai, jo X point se Apoint tak jaata hai.

- AB leg: Yeh pattern ka dusra segment hai, jo apoint se Bpoint tak jaata hai.

- BC leg: Yeh pattern ka teesrasegmenthai, jo B point se C point tak jaata hai.

- CD leg: Yeh pattern ka chautha segment hai, jo C point se D point tak jaata hai.

- XA extension: Yeh XAlegXA ka 1.618projection hai, jo PRZ ka nirnay karta hai.

- BC extension: Yeh BC leg ka 2.236, 2.618, ya 3.36 projection hai.

Shark pattern ka use kaise karein:

Shark pattern ka use karne ke liye, aapko nimnalikhit charanon ka palan karna hoga:- Ek uptrend ya downtrend ki pahchan karein. Shark pattern uptrend aur downtrend donon mein valid ho sakta hai.

- XA leg ki pahchan karein. XA leg pattern ka pahla segment hai, jo X point se A point tak jaata hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:28 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим