How to avoid false breakout?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Confirmation: Breakout ke signals ko dusre technical indicators ya patterns se pushtikaran karein. Yadi ek breakout ho raha hai, to dusre indicators bhi us disha mein jana chahiye. Isse aapko praman milta hai ki breakout sach mein hone wala hai.Volume Analysis: Breakout ke samay volume ka bhi mahatvapooran hota hai. Yadi breakout mein uchit volume nahi hai, to yeh sanket ho sakta hai ki yeh false breakout ho. Uchit volume ke sath breakout hone par praman badh jata hai. Wait for Confirmation: Breakout ke baad turant vyapar nahi karein. Thoda samay dekar dekhein ki price trend mein sthirata hai ya nahi. Yadi breakout asli hai, to price trend mein sudhar hone chahiye.Use Trendlines: Trendlines ka upayog breakout ke samay karke false breakout ko pahchanne mein madad karti hai. Agar breakout trendline ko cross nahi kar pata hai, to yeh false breakout ho sakta hai.Avoid During Low Volatility: Kam volatility ke samay breakout avoid karna chahiye kyunki aise samay mein false breakouts hone ke chances adhik hote hain. Volatility badhne par breakout ke signals adhik sthir hote hain.Use Support and Resistance: Breakout ke signal ko support aur resistance levels ke sath milakar dekhein. Agar breakout un levels ko cross nahi kar pata hai, to yeh false breakout ho sakta hai.Use Multiple Timeframes: Different timeframes ka upayog kar breakout ke signals ko confirm karne mein madad m -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

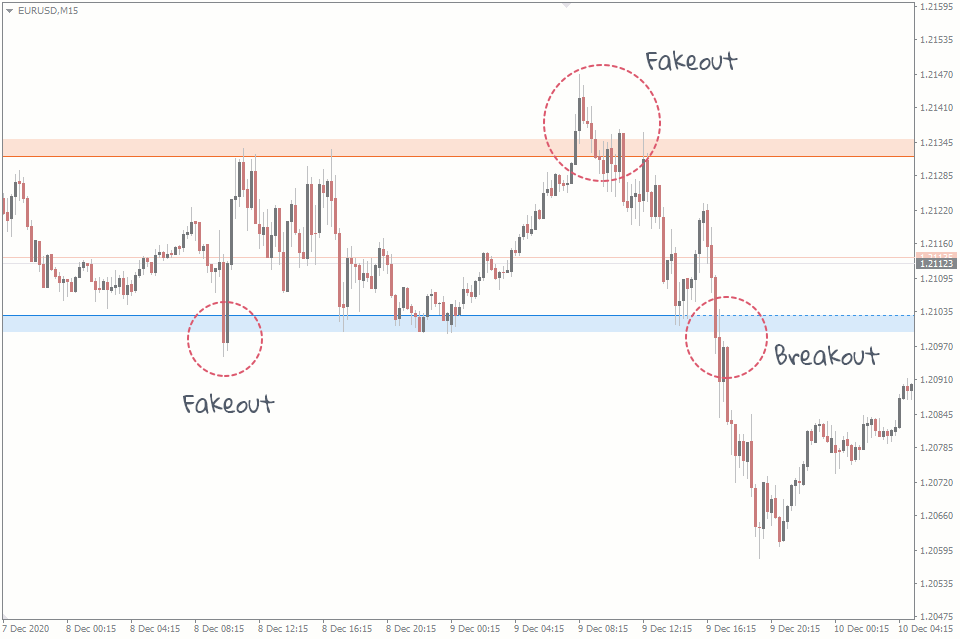

Trading ki duniya mein, false breakout ek aisi situation hai jahan price kisi important support ya resistance level ko break karti hai, lekin phir wapas us level ke andar chali jati hai. Yeh traders ke liye bohot hi nuqsan deh ho sakta hai, kyunki unki positions khulne ke baad price wapas chali jati hai, jisse wo losses ka samna karte hain. False breakout wo situation hai jab price kisi key level ko break karne ke baad wapas us level ke andar aa jati hai. Yeh price movements aksar short-term traders ko confuse karte hain aur unhe galat trading decisions lene par majboor karte hain. False breakouts do tarah ke hote hain:- Bullish False Breakout: Yeh tab hota hai jab price resistance level ko break karti hai, lekin phir wapas gir jati hai.

- Bearish False Breakout: Yeh tab hota hai jab price support level ko break karti hai, lekin phir wapas upar aa jati hai.

Market Psychology Ko Samajhna

False breakouts ko avoid karne ke liye market psychology ko samajhna bohot zaroori hai. Traders aur investors ka behavior market movements par asar dalta hai. Agar market mein zyada log bullish hain, to price resistance ko break karne ki koshish karegi, lekin agar sentiment mein shift aata hai, to price wapas gir sakti hai.

Market psychology ko samajhne ke liye kuch factors ko madde nazar rakhna chahiye:- News Events: Jab koi important news ya announcement hota hai, to price movements mein zyada volatility aati hai. Yeh volatility false breakouts ka sabab ban sakti hai.

- Traders Ka Behavior: Market mein jab zyada traders kisi specific direction ki taraf ja rahe hote hain, to yeh momentum create karta hai, lekin yeh momentum kabhi kabhi jaldi hi khatam ho sakta hai.

Technical analysis aur indicators ka istemal false breakouts se bache ke liye ek behtar tareeqa hai. Yahan kuch important tools aur techniques hain jo aap istemal kar sakte hain:- Volume Analysis: Volume ka analysis karna bohot zaroori hai. Jab price kisi level ko break karti hai, to volume bhi zyada hona chahiye. Agar price breakout ke waqt volume low hai, to yeh false breakout ka signal ho sakta hai.

- Moving Averages: Moving averages ka istemal karna bhi faydemand hai. Jab short-term moving average long-term moving average ko cross karta hai, to yeh strong signal hota hai. Lekin agar price us level ko break karti hai bina moving averages ke signal ke, to yeh false breakout ho sakta hai.

- Relative Strength Index (RSI): RSI indicator ka istemal karne se aap market ki overbought ya oversold conditions ko jaan sakte hain. Agar price resistance level ko break karti hai lekin RSI overbought region mein hai, to yeh false breakout ka indication ho sakta hai.

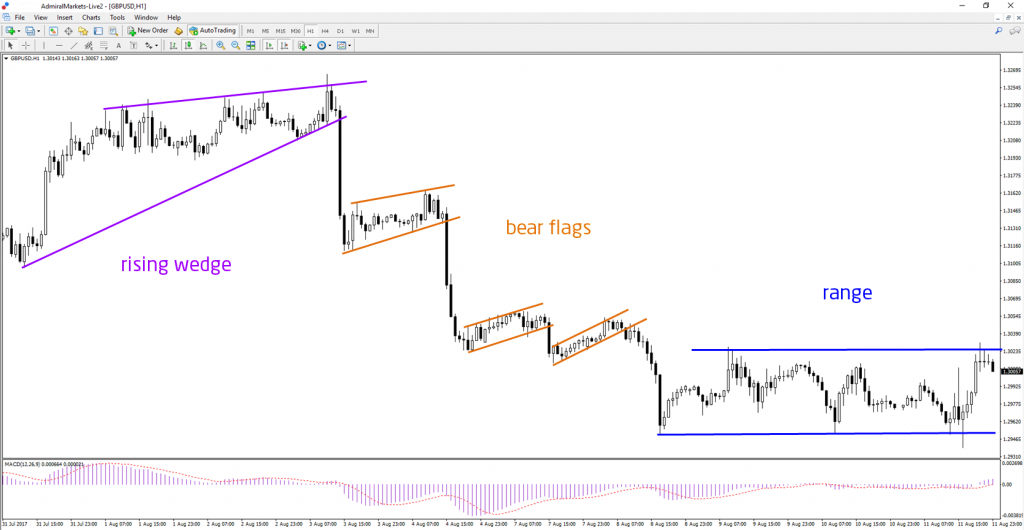

Multiple time frames analysis bhi false breakouts se bacha sakta hai. Jab aap higher time frame charts (jaise daily ya weekly charts) ko analyze karte hain, to aapko zyada accurate trend aur levels ki pehchaan hoti hai. Aksar lower time frames par dekhe gaye breakouts higher time frames par confirm nahi hote. Isliye, aapko hamesha higher time frames ko dekhna chahiye taake aapko zyada accurate signals mil sakein.

Support Aur Resistance Levels Ki Pehchaan

Support aur resistance levels ko identify karna false breakouts se bachne ke liye bohot zaroori hai. Aapko strong support aur resistance levels ki pehchaan karni hogi, jo price movements par asar dalte hain. Yeh levels aise honge jahan price aksar wapas jati hai. Agar price kisi strong resistance level ko break karti hai, lekin wapas us level par aakar ruk jati hai, to yeh false breakout ka indication ho sakta hai.

Risk Management Strategies

Risk management strategies ka istemal bhi false breakouts se bachne ke liye zaroori hai. Aapko apne stop loss levels ko aise set karna chahiye ke wo normal price fluctuations se nahi trigger ho. Yahan kuch strategies hain:- ATR Ka Istemal: Average True Range (ATR) ko use kar ke aap apne stop loss levels ko set kar sakte hain. ATR ki madad se aap price fluctuations ko samajh sakte hain, aur stop loss ko accordingly set kar sakte hain.

- Trailing Stops: Trailing stops ka istemal karne se aap apne profits ko protect kar sakte hain. Agar price aapke favor mein move karti hai, to trailing stop automatically adjust ho jata hai, isse aap false breakouts ke samne kuch protection le sakte hain.

News aur events ka market par asar hota hai, aur ye false breakouts ka sabab ban sakte hain. Jab bhi koi important news aane wali hoti hai, to aapko trading se thoda door rehna chahiye, ya phir aapko news ke baad market ka reaction dekhna chahiye. Aksar news events ke dauran market mein zyada volatility hoti hai, jo false breakouts ko janam de sakti hai.

Patience Aur Discipline

Trading mein patience aur discipline ka hona zaroori hai. Jab aapko lagta hai ke market kisi breakout ki taraf ja rahi hai, to aapko jaldi faisla nahi karna chahiye. Market ke price action ko observe karna, volume ko dekhna, aur indicators ko analyze karna chahiye. Agar sab kuch confirm ho jaye, tab hi trade mein enter karna chahiye.

Historical Data Ka Analysis

Historical data ka analysis karna bhi false breakouts se bachne ke liye faydemand hai. Aapko yeh dekhna chahiye ke past mein kisi particular level par price ka behavior kaisa raha hai. Agar price ne pehle bhi kisi level par false breakout diya hai, to aapko us level ke paas caution se kaam lena chahiye.

Psychological Barriers Ko Samajhna

Market mein psychological barriers bhi hoti hain jo false breakouts ko janam deti hain. Traders ka behavior, fear, aur greed price movements par asar dalte hain. Aksar traders important levels par zyada react karte hain, jo price ko false breakout ki taraf le jata hai. Isliye, aapko market psychology ko samajhna hoga taake aap in barriers se bach sakein.

Demo Trading

Demo trading karna bhi ek achi strategy hai taake aap market conditions ko samajh sakein aur false breakouts ka experience le sakein. Jab aap demo account par trading karte hain, to aap bina kisi risk ke strategies ko test kar sakte hain. Yeh aapko actual trading mein confidence de sakta hai.

False breakouts trading mein ek common challenge hain, lekin in se bacha ja sakta hai agar aap sahi strategies aur techniques ka istemal karte hain. Market psychology ko samajhna, technical analysis aur indicators ka istemal, multiple time frames ka analysis, strong support aur resistance levels ki pehchaan, risk management strategies, news aur events ka analysis, patience aur discipline, historical data ka analysis, psychological barriers ko samajhna, aur demo trading ye sab aapko false breakouts se bacha sakte hain. Trading ek art hai, aur isme experience ke saath aap behtar ho sakte hain. In sab tips ko istemal karke aap false breakouts ko pehchan sakte hain aur apne trading results ko behtar bana sakte hain.Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

words### False Breakout Se Kaise Bacha Jaye: Ek Guide

Forex trading mein false breakout ek aisi situation hai jab price ek key support ya resistance level ko break karne ki koshish karti hai, lekin phir wapas us level ke andar chali jaati hai. Ye situation traders ke liye kaafi frustrating hoti hai, kyunki ismein wo sahi signal par trade karte hain, lekin market unki expectations ke khilaf chali jaati hai. Is post mein hum false breakouts se bachne ke liye kuch effective strategies par roshni dalenge.

**1. Technical Analysis Ka Istemal:**

False breakouts se bachne ke liye technical analysis ka istemal karna zaroori hai. Traders ko key support aur resistance levels ko identify karna chahiye. Agar price kisi strong level ko break karne ki koshish kar rahi hai, to confirmatory indicators ka intezar karna behtar hai. Jaise, agar price resistance level ko break karti hai, to ek strong bullish candle ka intezar karein taake ye confirm ho sake ke breakout genuine hai.

**2. Volume Analysis:**

Volume analysis ko bhi consider karna chahiye. Agar breakout ke waqt volume low hai, to ye ek warning sign ho sakta hai ke ye breakout false ho sakta hai. High volume ke sath breakout hone par ye zyada credible hota hai. Traders ko volume indicators, jaise On-Balance Volume (OBV) ya Volume Oscillator, ka istemal karna chahiye taake wo breakout ki strength ko assess kar sakein.

**3. Time Frames Ka Khayal:**

Different time frames par analysis karna bhi zaroori hai. Agar aap short-term trades kar rahe hain, to higher time frames ko bhi check karein. Agar higher time frame par trend strong hai lekin lower time frame par breakout ho raha hai, to ye false breakout ka signal ho sakta hai. Isliye, multiple time frames par analysis karna ek achi practice hai.

**4. Stop-Loss Orders Ka Istemal:**

Risk management ke liye stop-loss orders ka istemal zaroori hai. Agar aapko lagta hai ke price breakout ke baad wapas pullback ho sakti hai, to stop-loss ko breakout level ke thoda upar ya neeche set karein. Isse aap apne losses ko limit kar sakte hain agar market aapki expectations ke khilaf chale.

**5. Pattern Recognition:**

Candlestick patterns ko pehchanna bhi kaafi helpful hota hai. Agar aapko reversal patterns, jaise shooting stars ya hammers, dikhai dete hain breakout ke baad, to ye signal ho sakta hai ke price wapas us level par aayegi. In patterns ko dekh kar traders apne trades ko adjust kar sakte hain.

**6. Market Sentiment:**

Market sentiment ko samajhna bhi zaroori hai. News events ya economic indicators ki wajah se bhi price movements mein volatility aa sakti hai. Isliye, economic calendar ko check karna aur news updates se waqif rehna aapko false breakouts se bacha sakta hai.

**Aakhir Mein:**

False breakouts se bachne ke liye traders ko disciplined aur informed rehna chahiye. Technical analysis, volume assessment, aur risk management techniques ka istemal karke aap apne chances ko behtar bana sakte hain. Sahi approach ke sath, aap market ki volatility ka faida utha sakte hain aur false breakouts se bach sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:59 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим