Island Reversal Pattern .

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

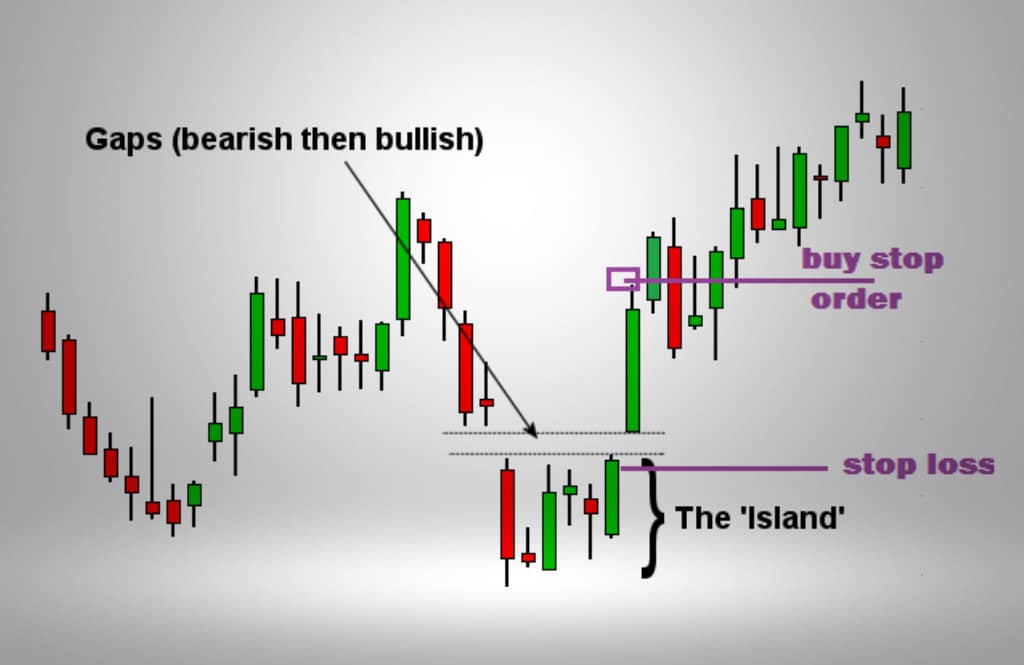

"Island Reversal Pattern" ek takneekी analysis pattern hai jo vartaman trend mein sambhavit palayan ka sanket ho sakta hai. Ye kuch anya patterns ke mukable adhik prachin nahin hai, lekin isse samajhna mahatvapooran hai. Ye pattern aam taur par ek trend ke palayan ke dauraan hota hai aur price action ke dono taraf ek gap se ghira hota hai, jisse ki ek chhote se candle group ko alag kar diya jaata hai. Yahan is pattern ka kaam tarike se samjhaaya gaya hai:1. **Prarambhik Trend:** Pattern ek lambe samay tak ke uptrend ya downtrend ke baad banta hai.2. **Island Banawat:** Pattern prarambhik trend ke aakhiri candle aur agle candle ke beech mein ek gap ke saath shuru hota hai. Is gap se price action ka ek alag "island" banta hai.3. **Alag Candles:** Gap ke ek taraf, pichle trend ko darshaane wale kai candles hote hain. Gap ke doosre taraf, ek sambhavit palayan trend ko darshaane wale kai candles hote hain.4. **Pushti Gap:** Pattern ko poora karne ke liye, palayan gap ke viparit disha mein ek aur gap hota hai jo isolation gap ko bandh deta hai aur sambhavit palayan ki pushti karta hai.Island Reversal Pattern ki mahatvapooran price action ke alag hone mein hoti hai, jisse ki bazaar bhavna mein ek achanak parivartan ho raha hai. Island ke dono taraf ke gap ek asamvedansheel tatha majboot parivartan ko vyakt karte hain. Is avikshit parivartan se pahle ke trend ki gati kamzor hoti hai aur sambhavit palayan ka sanket ho sakta hai.Island Reversal Pattern ke do mukhya prakar hote hain:1. **Bullish Island Reversal:** Ye pattern ek downtrend ke ant mein aata hai. Island ek niche ki taraf ka gap ke saath shuru hota hai, uske baad kuch candles aati hain aur phir ek upar ki taraf ka gap aata hai, jisse ki beech ke candles alag ho jaate hain. Isse yah sanket milta hai ki bechni ki dabav kamzor ho gayi hai aur kharidne ki ruchi badh rahi hai, sambhavit uptrend ki or sanket ho sakta hai.2. **Bearish Island Reversal:** Ye pattern ek uptrend ke ant mein aata hai. Island ek upar ki taraf ka gap ke saath shuru hota hai, uske baad kuch candles aati hain aur phir ek niche ki taraf ka gap aata hai. Isse yah sanket milta hai ki kharidne ki gati kamzor ho gayi hai aur bechni ki ruchi badh rahi hai, sambhavit downtrend ki or sanket ho sakta hai.Dhyaan rahe ki jab bhi Island Reversal Pattern ko sambhavit palayan ka sanket dene ke liye istemaal kiya jaata hai, to vyaparik nirnay lene se pahle ise doosre takneekी suchnaankit aur analysis upkaranon se pushti karna mahatvapooran hai. Asatya sanket ho sakte hain, isliye vyapari aksar pattern ki mahatvapooran ko pushti karne ke liye aur jankari ka upayog karte hain. -

#3 Collapse

Island Reversal Pattern: Island Inversion candle design ek specialized investigation strategy hai jo khas taur standard securities exchange aur monetary business sectors mein istemal hoti hai. Yeh ek prakar ka cost design hai jo graph examination ke zariye tajwezat dene mein madad karti hai. Is design mein candles ka jadoo shuda istemal hota hai jo taqreeban aik chotay samay mein ghuzar jata hai.Sab se pehli stage mein, market mein aik makhsoos pattern hota hai, yaani ke cost chadh raha ho ya gira ho. Agar cost upar ki taraf ja raha hai to ye upturn hota hai, jabke cost specialty ja raha ho to ye downtrend hota hai.Dusra stage island development ka hota hai. Is stage mein cost mein achanak ek hole hota hai, yaani ke ek noise ke close cost aur agle racket ke open cost mein farq hota hai. Is hole ke baad, kuch candles ki development hoti hai jo ek mukhtalif exchanging range mein hote hain aur alag aalamaton ko dikhate hain.Teesra aur aakhri stage island fruition ka hota hai. Is stage mein cost wapis hole ke qareeb aata hai aur wohi hole fill ho jata hai. Agar ye stage kisi inverse course mein hota hai, to yeh inversion signal hai aur dealers ko yeh ishara milta hai ke pattern badal sakta hai. Downtrend ke baad achanak ek hole aata hai aur phir kuch bullish candles ki development hoti hai, jin ka close cost hole ke qareeb hota hai, to yeh bullish island inversion design hai. Yeh bullish sign hai aur future mein cost badhane ki sambhavna hoti hai.Agar upturn ke baad achanak ek hole aata hai aur phir kuch negative candles ki arrangement hoti hai, jin ka close cost hole ke qareeb hota hai, to yeh negative island inversion design hai. Yeh negative sign hai aur future mein cost giraane ki sambhavna hoti hai.Island inversion design ek strong specialized investigation apparatus hai jo merchants aur financial backers ko cost patterns aur inversions ke uncovered mein maloomat faraham karta hai. Is design ki sahi samajh se un logon ko faida hota hai jo market mein exchanging aur speculations karte hain. Lekin, is design ko tanqeedi nazar se dekhna bhi zaroori hai, kyun ke kabhi yeh misleading signs bhi de sakta hai. Chart Pattern Types: Design ka istemal merchants potential inversions ko samajhne aur exchanging choices lene mein karte hain. Agar market mein island inversion design dikhta hai, to brokers ko ye sign milta hai ke pattern inversion sharpen wala hai aur woh apni exchanging techniques us ke mutabiq change kar sakte hain.Is design ko affirm karne ke liye dealers doosre specialized pointers aur examination instruments ka bhi istemal karte hain. Iske saath, exchanging choices lene se pehle economic situations aur gambles with ka bhi tajziya karna zaroori hota hai.Island Inversion Example ek strong inversion design hai jo brokers ko potential pattern changes aur inversions ko recognize karne mein madad deta hai. Is design ki understanding se merchants ko market ke opinion aur inversions ke baray mein maloomat milti hai. Lekin, is design ka affirm karne ke liye doosre specialized investigation apparatuses aur pointers ka istemal zaroori hota hai.

Downtrend ke baad achanak ek hole aata hai aur phir kuch bullish candles ki development hoti hai, jin ka close cost hole ke qareeb hota hai, to yeh bullish island inversion design hai. Yeh bullish sign hai aur future mein cost badhane ki sambhavna hoti hai.Agar upturn ke baad achanak ek hole aata hai aur phir kuch negative candles ki arrangement hoti hai, jin ka close cost hole ke qareeb hota hai, to yeh negative island inversion design hai. Yeh negative sign hai aur future mein cost giraane ki sambhavna hoti hai.Island inversion design ek strong specialized investigation apparatus hai jo merchants aur financial backers ko cost patterns aur inversions ke uncovered mein maloomat faraham karta hai. Is design ki sahi samajh se un logon ko faida hota hai jo market mein exchanging aur speculations karte hain. Lekin, is design ko tanqeedi nazar se dekhna bhi zaroori hai, kyun ke kabhi yeh misleading signs bhi de sakta hai. Chart Pattern Types: Design ka istemal merchants potential inversions ko samajhne aur exchanging choices lene mein karte hain. Agar market mein island inversion design dikhta hai, to brokers ko ye sign milta hai ke pattern inversion sharpen wala hai aur woh apni exchanging techniques us ke mutabiq change kar sakte hain.Is design ko affirm karne ke liye dealers doosre specialized pointers aur examination instruments ka bhi istemal karte hain. Iske saath, exchanging choices lene se pehle economic situations aur gambles with ka bhi tajziya karna zaroori hota hai.Island Inversion Example ek strong inversion design hai jo brokers ko potential pattern changes aur inversions ko recognize karne mein madad deta hai. Is design ki understanding se merchants ko market ke opinion aur inversions ke baray mein maloomat milti hai. Lekin, is design ka affirm karne ke liye doosre specialized investigation apparatuses aur pointers ka istemal zaroori hota hai.  Design commonly do ya zyada candles ke succession mein dikhai deta hai. Is design mein neeche di gayi cheezen hoti hain:Pehli flame ek noticeable bullish (green) ya negative (red) light hoti hai jo existing pattern ko affirm karti hai.candle ke baad ek hole aata hai, yani cost ka aik abrupt leap hota hai, jis se ek 'island' make hota hai. Yeh hole pehli light se particular hota hai.Gap ke baad doosri flame aati hai, jo regularly inverse heading mein hoti hai. Agar pehli light bullish thi, to doosri candle negative hoti hai aur agar pehli flame negative thi, to doosri candle bullish hoti hai.Is design mein 'island' make hota hai, jo cost development mein ek disconnected locale banata hai jahan cost hole se separate hota hai.Island Inversion Example bullish ya negative pattern ke inversion ko demonstrate karta hai. Punch pehli flame ke baad hole make hota hai aur doosri candle inverse heading mein aati hai, to ye ek sign hai ke pattern change sharpen wala hai.Gap, yani unexpected cost hop, market feeling mein extraordinary change ko address karta hai aur dealers ke beech vulnerability paida karta hai. Doosri light ka presence pehli candle ke pattern ko invert karta hai aur ye ek potential inversion ke signal ho sakta hai. Pattern Trading And Formation: Graph Example ki asalat aur precision ko samajhne ke liye, brokers ko verifiable information aur past models standard bhi ghor karna chahiye. Is design ki understanding aur uska sahi istemal karne se brokers pattern inversions ko pehchan sakte hain aur apni exchanging methodologies ko mazeed behtar banate hain.Island Inversion Diagram Example ek strong specialized device hai jo merchants ko market ki mukhtalif stages mein madad deta hai. Lekin, iska istemal karne se pehle, dealers ko iske subtleties aur market ki halat ko samajhna zaroori hai taake woh sahi faislay kar sakein.Island Inversion Outline Example ek qisam ka specialized graph design hai jo kisi bhi market mein pattern ki tafseelat faraham karta hai. Ye design aksar bullish ya negative pattern ki soorat mein zahir hota hai aur brokers ko potential pattern inversion ka pata chalata hai

Design commonly do ya zyada candles ke succession mein dikhai deta hai. Is design mein neeche di gayi cheezen hoti hain:Pehli flame ek noticeable bullish (green) ya negative (red) light hoti hai jo existing pattern ko affirm karti hai.candle ke baad ek hole aata hai, yani cost ka aik abrupt leap hota hai, jis se ek 'island' make hota hai. Yeh hole pehli light se particular hota hai.Gap ke baad doosri flame aati hai, jo regularly inverse heading mein hoti hai. Agar pehli light bullish thi, to doosri candle negative hoti hai aur agar pehli flame negative thi, to doosri candle bullish hoti hai.Is design mein 'island' make hota hai, jo cost development mein ek disconnected locale banata hai jahan cost hole se separate hota hai.Island Inversion Example bullish ya negative pattern ke inversion ko demonstrate karta hai. Punch pehli flame ke baad hole make hota hai aur doosri candle inverse heading mein aati hai, to ye ek sign hai ke pattern change sharpen wala hai.Gap, yani unexpected cost hop, market feeling mein extraordinary change ko address karta hai aur dealers ke beech vulnerability paida karta hai. Doosri light ka presence pehli candle ke pattern ko invert karta hai aur ye ek potential inversion ke signal ho sakta hai. Pattern Trading And Formation: Graph Example ki asalat aur precision ko samajhne ke liye, brokers ko verifiable information aur past models standard bhi ghor karna chahiye. Is design ki understanding aur uska sahi istemal karne se brokers pattern inversions ko pehchan sakte hain aur apni exchanging methodologies ko mazeed behtar banate hain.Island Inversion Diagram Example ek strong specialized device hai jo merchants ko market ki mukhtalif stages mein madad deta hai. Lekin, iska istemal karne se pehle, dealers ko iske subtleties aur market ki halat ko samajhna zaroori hai taake woh sahi faislay kar sakein.Island Inversion Outline Example ek qisam ka specialized graph design hai jo kisi bhi market mein pattern ki tafseelat faraham karta hai. Ye design aksar bullish ya negative pattern ki soorat mein zahir hota hai aur brokers ko potential pattern inversion ka pata chalata hai Outline Example mein aam taur standard youngster stages hoti hain: pehli stage mein, market major areas of strength for ek follow kar raha hota hai. Dusra stage mein, abrupt hole market mein nazar aata hai jahan costs ek tarah se "island" bana lete hain, yani ke unka development hole se aaghaz hota hai aur hole se khatam hota hai. Teesri stage mein, yeh hole band hota hai aur naya pattern shuru hota hai, jo aksar pehle grain pattern ke khilaf hota hai Island Inversion Graph Example ki tashkhees karne ke liye, merchants hole aur uske aas paas ke cost levels standard tawajjo dena zaroori samjhte hain. Agar aap negative pattern mein hain aur out of nowhere ek hole up hota hai, jisse ek bullish island design banta hai, to yeh ek bullish inversion signal ho sakta hai. Waise hello, agar aap bullish pattern mein hain aur unexpectedly ek hole down hota hai, jisse ek negative island design banta hai, to yeh negative inversion signal samjha ja sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:00 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим