Trailing Stop In Forex

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trailing Stop In Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

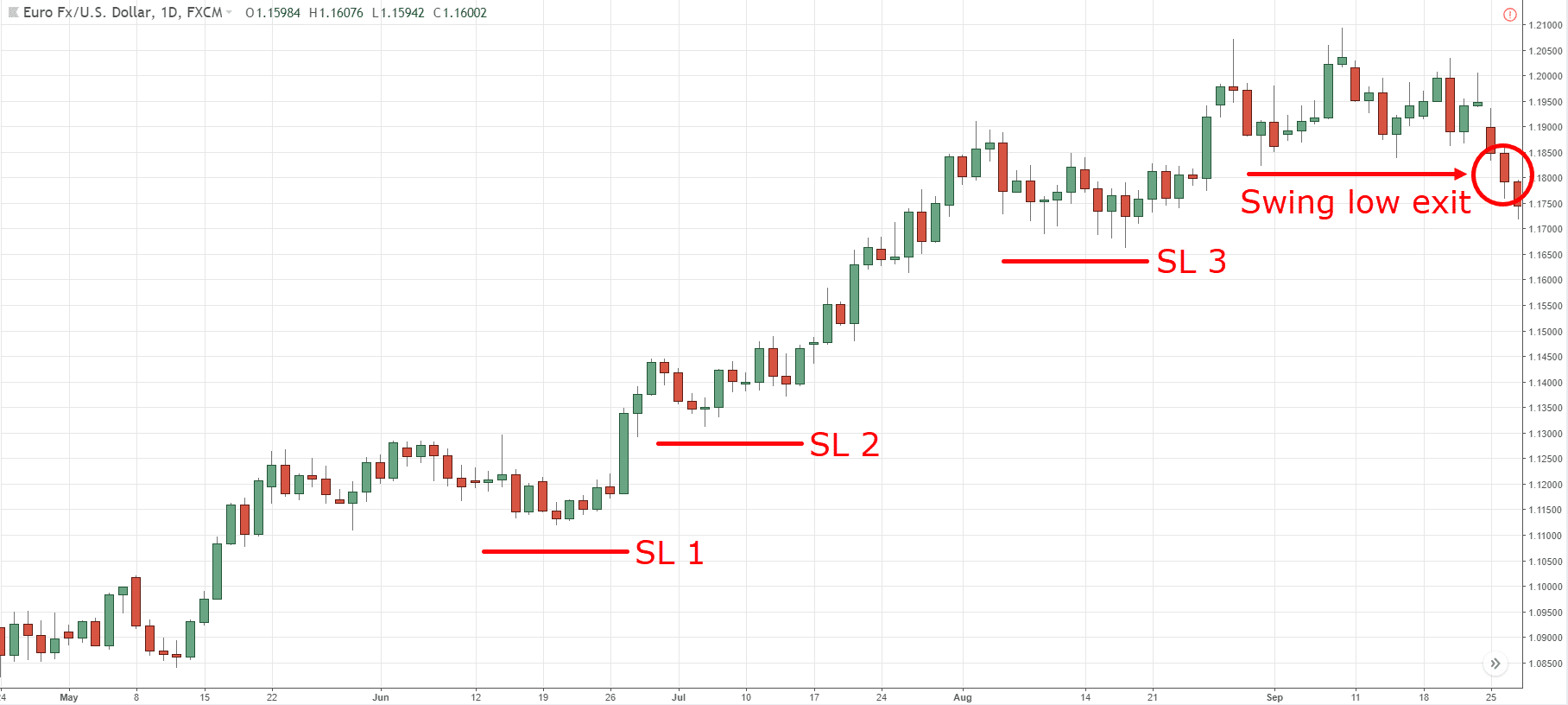

Understanding Trailing Stops Trailing stop aik advanced order type hai jo tijarat mein istemal hota hai ta ke bazaar ke dauran jo behtareen tareeqe se tijarat karne walay ko asmanjas aur maal ka ziada nuqsaan hone se bachane ki ijazat de, jaise jaise bazaar mein unke liye munasib raftar mein tabdeel hoti hai. Aik trailing stop ka asal maqsad munafa jama karna hai jabkay tijarat jari rakhne ke liye stop-loss level ko market price ke sath sath tabdeel karna bhi shamil hai. Aam taur par ek static stop-loss order jo aik mukarrar qeemat pe rehta hai jab aik dafa set ho jata hai, woh qeemat pe rehta hai. Components of a Trailing Stop

Components of a Trailing Stop- Trailing Distance or Trailing Amount: Is parameter se tay hota hai ke trailing stop bazaar ke dauran market price ke kitni qareeb rehta hai. Isay pip increments mein ya qeemat ke harkat ke percentage ke tor par mukarrar kiya ja sakta hai.

- Lock-In Point: Jab market price tijarat karne wale ke haq mein chalne lagti hai, to trailing stop tabdeel hona shuru hota hai. Trailing stop level market price ke mutabiq tayyar hota hai, is tarah ke sath ke woh hamesha market price ke peechay aik mukarrar faslay pe rehta hai.

- Protection and Profit Locking: Jab market price tijarat karne wale ke pasandeeda raaste mein aage badhti hai, to trailing stop level bhi aik tijarat mein jata hai (agar aik lambi position hai) jabke tijarat ka maqsad jari rehta hai ke market ke palatne ke baad bhi jama shuda munafa ko lock kia ja sake.

Benefits of Trailing Stops Trailing stops tijarat karne wale ke liye kai faiday hasil karne mein madadgar sabit hote hain jo munafa barhane aur apne maal ki hifazat karne ki koshish mein hain:

Benefits of Trailing Stops Trailing stops tijarat karne wale ke liye kai faiday hasil karne mein madadgar sabit hote hain jo munafa barhane aur apne maal ki hifazat karne ki koshish mein hain:- Capitalizing on Trends: Trailing stops tijarat karne wale ko tajaweezat par chalne aur mustawez munafa hasil karne ki ejazat dete hain jabkay is dauran tijarat chalane ka option hasil rehta hai agar rawayat ulat jaye.

- Limiting Emotional Decision-Making: Jazbat tijarat karne walon ke faislon ko mutasir kar sakte hain, jo behtareen faislon ko hasil karne mein madadgar hotay hain. Trailing stops kisi manual tabdeel ki zaroorat ko khatam karte hain, tijarat karne walon ke faislon ke jazbati pehlo ko kam karte hain.

- Flexible Risk Management: Tijarat karne wale trailing stops ko apni risk management strategy ka hissa bana sakte hain. Jab tijarat unke pasandeeda raaste mein chalti hai, to trailing stops market ke haq mein tayyar hojata hai, is tarah se ke agar market akasratan palat jaye, to tijarat karne wala munafa jama karke nikal sakta hai.

- Automation: Trailing stops stop-loss orders ko tabdeel karne ka process khud kar deta hai, jo khaas kar tez raftar wale bazaaron mein intehai faida mand sabit hota hai. Is se tijarat karne wale ko apne waqt aur tawajja ko dusre analysis aur faislon ke liye azaadi milti hai.

Implementing Trailing Stops Trailing stops ko tafseel se tayyar karne ke liye mukhtalif factors ka dehan dena zaroori hai:

Implementing Trailing Stops Trailing stops ko tafseel se tayyar karne ke liye mukhtalif factors ka dehan dena zaroori hai:- Market Volatility: Market bulandiyon ki surat mein aksar qeemat mein tezi ki miqdaar zyada hoti hai, jis se achi tarah se tayyar trailing distance ke taur par tayyar nahi hota hai. Isi tarah low volatility markets mein trailing distance ko zyada qareeb tayyar karna zaroori ho sakta hai munasib munafa jama karne ke liye.

- Timeframe and Strategy: Timeframe aur tijarat karne ki strategy trailing stops ke mustaqbil par asar andaz hoti hai. Chotay timeframes tajaweezat ko qareeb trailing distance ki zaroorat ho sakti hai jabkay zyada lambi muddat ke strategies zyada qareeb trailing distances se faida utha sakti hain taa ke qeemat mein harkat ke liye jagah ho.

- Support Aur Resistance Levels: Tijarat karne wale ko ahem support aur resistance levels ka tawajjo dena chahiye, kyunke woh qeemat ulatne ki surat mein rawayat ya support zone ke baad tijarat ko chhorne ka shikar ho sakte hain. Agar trailing stop bohat qareeb tayyar kia jaye toh support ya resistance zone ke baad bhi qeemat ko palatne ka silsila shuru ho sakta hai.

- Trailing Distance Calculation: Tijarat karne wale trailing distance ko mukarrar pip values, qeemat ki harkat ke percentage ya takneeki indicators ke mutabiq tayyar kar sakte hain. Har tareeqa apni khasiyat aur nuqsanat ke sath aata hai, isliye maqsood takabbur aur munafa ki mumkinat ke beech ka tawazun tashkil karne ki zaroorat hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Trailing Stop Loss

Forex trading, bohot se tools hain jo humein potential profits maximize karne aur possible losses minimize karne mein madad karte hain, is liye yeh zaroori hai ke hum inhe theek tarah se use karna seekhen aur inhein achi tarah samjhen. Is article mein, hum aik aise tool ko explore karenge, jise Trailing Stop kaha jata hai.

Kya aapne kabhi apne aap se poocha hai, “Trading stop loss order kya hai?” Agar haan, to aap sahi jagah par hain. Classic stop loss ki tarah, trailing stop bhi aik order hai jis ka objective yeh hai ke market reversal ke waqt trade ko close kar diya jaye. Yeh aik essential tool hai risk management ke liye, trailing stop limit ki tarah. Lekin, stop loss aur trailing stop mein kya farq hai?

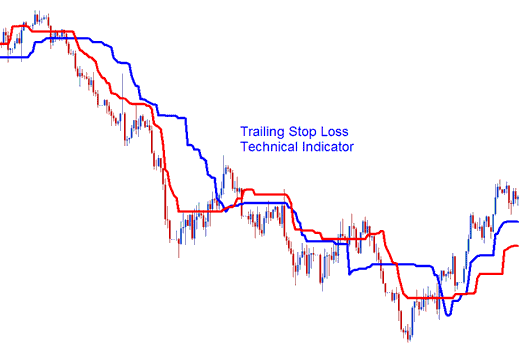

Trailing stop aik dynamic stop loss hai! Trailing stop asset price ke rise ko long positions mein aur fall ko short positions mein follow karta hai, aik predefined distance par. Yeh update hota rehta hai jab humari position market mein evolve hoti hai.

Kaise? Agar asset ka price aage badhta hai, trailing stop loss automatically asset ke direction ko follow karega. Ulta, agar price trend change karta hai, position close ho jayegi, is tarah se profit percentage ko ensure karta hai.

➤ Is order ka main objective yeh hai ke humari operations mein profits ko protect kiya jaye: agar market turn around ho jaye to zero par na jaye.

Yeh tool bohot useful hai jab hum apni positions par aware nahi ho sakte, kyunki yeh automatically kaam karta hai. Of course, yeh sirf tab kaam karta hai jab hamari open platform active aur operational ho.

How to use the trailing stop loss?

Jaisa ke hum pehle bhi point out kar chuke hain, trailing stop prices ke movement ko real time mein follow karta hai aur jab market trend change karta hai to ruk jata hai. Operation kuch is tarah hota hai:- Ek long position mein, trailing stop market ke sath rise karega aur jab price girega to ruk jayega. Position automatically close ho jayegi jab price set level par pohonch jayega.

- Ek short position mein, trailing stop price ke downward movement ko follow karega aur jab price rise karega to freeze ho jayega. Position automatically close ho jayegi jab price set level par pohonch jayega.

- Trailing stop loss sirf tab activate hota hai jab yeh price se hit hota hai. Us waqt operation with benefits close ho jayegi.

Trailing Stop Examples

Chalain dekhte hain ke trailing stop ko Forex mein use karne ka aik example dekh kar kaise kaam karta hai.- Purchase order

Let's say hum aik buy order open karte hain at 1.11300 aur apna trailing stop 30 pips below that price set karte hain (1.11000).- ➨ Agar market humare favor mein jata hai aur EURUSD rise karta hai, for example, 1.11700 tak, humara stop price ko 1.11400 tak accompany karega.

- ➨ Agar, us waqt, market turn around karta hai aur EURUSD fall karta hai, trailing stop ruk jata hai aur activate hoga us last value par, jab price 1.11400 pohonch jata hai. Is se humein 10 pips ka profit secure karne ka moka milta hai (order 1.11300 par open hua tha aur 1.11400 par close hua).

- Sell order

Ab hum sell order ka aik example lete hain same pair ke sath. Hum order open karte hain at 1.11800 aur trailing stop ko 30 pips par set karte hain, is case mein 1.12100 par.- ➨ Agar price humare favor mein move karta hai, trailing stop hamesha aik distance of 30 pips chhodte hue accompany karega.

- ➨ Ulta, agar EURUSD rise karta hai, humari position ke against, yeh last level par activate ho jayega jab market humare favor mein tha.

Differences between stop loss and trailing stop

Humein stop loss order ko trailing stop order ke sath confuse nahi karna chahiye kyunki unka function alag hai.

Jab hum yeh keh sakte hain ke trailing stop aik type ka stop loss order hai, yeh clear hona chahiye ke trailing stop potential profits ko ensure karne ke liye use hota hai jab market humare favor mein jata hai, jabke stop loss losses ko limit karne ke liye use hota hai agar market humare against position mein hota hai.

Main farq jo stop loss aur trailing stop mein hai wo yeh hai ke trailing stop price ke sath move karta hai jab bhi yeh humare favor mein jata hai aur freeze ho jata hai jab humare against jata hai.

Dusri taraf, stop loss hamesha fixed rehta hai us level par jo humne establish kiya hai, regardless of asset ke movement, aur jab price us level tak pohonch jata hai tab trigger hota hai. Trailing stop kabhi bhi stop loss se kam nahi hona chahiye.

Advantages of the trailing stop- ✅ Secure benefits and reduce risk

Classic stop loss ki tarah, trailing stop aapke capital ko protect karta hai by considerably reducing risk of losses during trading sessions. Yeh is liye ke yeh ab bhi aik stop loss hai.

Isliye, yeh aapki position ke liye aik seat belt ka kaam karta hai. Agar sudden market reversal hota hai, yeh aapko quickly losses close karne ka moka deta hai, aksar faster than agar aap manually position close karte.

Aur sirf itna nahi, yeh humein apne profits ko consolidate karne ka moka bhi deta hai agar market humare favor mein move karta hai. - ✅ It is dynamic

Trailing stop spontaneously aur real time mein aapki position ke sath evolve hota hai. Isliye, yeh aik acha risk management tool hai during volatility peaks, jo aapko rapid market movements ka faida uthane mein madad karta hai while protecting your position from a trend reversal in the market.

Yeh especially scalpers ke liye useful hai. - ✅ Save time

Trailing stop ki wajah se, humein constantly screen ke saamne rehne ki zaroorat nahi hoti to manually stop loss ko adjust karna jab market move karta hai, trailing stop yeh automatically karta hai.

In addition, yeh traders ko jo multiple assets mein positions hold karte hain, time save karne mein madad karta hai kyunki unhe har position ko manually manage nahi karna padta.

Jab markets volatility ya liquidity spikes experience karte hain, time bohot important hota hai aur manual management of positions time consuming ho sakta hai. Isliye, trailing stop aapko seconds fraction mein woh kaam karne deta hai jo manually karne mein 10, 20, 30 seconds ya zyada lag sakte hain. - ✅ Suitable for all styles of trading

Scalpers ko sudden volatility spikes se protect karne ke ilawa, trailing stop unhein aik stop loss dene mein madad karta hai jo real time mein unki position ke sath adapt karega, jo manually karna mushkil ho sakta hai.

Intraday traders aur swing traders ke liye, trailing stop unhein new charts study karne aur new opportunities dekhne mein madad karta hai, ye jante hue ke unki open positions ka risk under control hai. Isliye, yeh tool aapko zyada confidence dene mein madad karta hai, kyunki yeh directly trader ke psychology ko affect karta hai.

Disadvantages of trailing stop- ❌ Permanent connection to trading servers

Correctly function karne ke liye aur market prices ki evolution ko constantly update karne ke liye, trailing stop require karta hai ke trading platform broker ke servers se connected ho.

Iska kya matlab hai? Aapko apna computer on rakhna hoga aur trading platform open at all times ya phir VPS (virtual private server) use karna hoga taake trailing stop theek se kaam kar sake jab tak aapki open positions hoon.

Actually, trailing stop aik expert advisor hai. Yani, yeh exactly standard trading robot ki tarah kaam karta hai jo servers ke sath constant connection ki zaroorat hoti hai.

Jab hum platform ko off kar dete hain, trailing stop move karna band kar deta hai aur last set point par fixed reh jata hai. - ❌ Not suitable for highly volatile or range markets

Trailing stop trends ya reversals ke liye great hai, lekin yeh tricky ho sakta hai range markets ya highly volatile assets mein. Iska risk hota hai ke position prematurely close ho jaye with little profit despite price ke baad mein humare favor mein move karne ke bawajood.

Do strategies hain jo aap follow kar sakte hain:- ➣ Trailing stop loss ke distance ko increase karen, taake short-term corrections ko withstand kar sakein without order systematically close hone ke (lekin is se risk bhi increase hota hai).

- ➣ Trailing stop ko deactivate karen jab aap detect karen ke market range mein hai ya high volatility ka moment hai, aur instead classic stop loss use karen jab tak market trend mein wapas nahi aata.

How to set a trailing stop order in MT4

MetaTrader 4 mein trailing stop place karna kaafi simple hai, jaisa ke aap neechay dekhain ge. Hamare paas teen tareeqe hain yeh karne ke:- ⃣ Mini Terminal of MetaTrader Supreme Edition

Yeh sabse fastest aur easiest way hai MT4 trailing stop place karne ka. Jab hum Mini Terminal window open karte hain toh humein kuch options fill karne ko dikhte hain. Unmein se aik T/S ya trailing stop hai, jo tool hum is case mein use karne wale hain.

Parameters ko exactly set karne ke liye, hum apne keyboard par Ctrl press karenge aur, Ctrl hold karte hue, left click karenge. Ek new dialog box appear hoga teen options ke sath:- Fixed risk in EUR.

- % of equity

- % of balance

Jab hum 'Set T/S' button press karenge, platform automatically trailing stop calculate karega aur hum isey Mini Terminal mein dekh sakte hain. - ⃣ Tools included in the platform

Hamari MetaTrader platform mein, agar hum 'New order' tab par click karte hain, aik window appear hoti hai bohot se parameters ko fill karne ke liye, lekin trailing stop unmein appear nahi hota.

Isko access karne ke liye, aapko pehle ek operation open karna hoga. Phir, humein mouse ko us operation ke upar place karna hai jo platform ke bottom mein hai aur right click karna hai.

Jo window display hoti hai, usmein hum 'Trailing Stop' par jate hain, aur aik choti menu of possibilities appear hoti hai. Humein sirf points choose karne hain jo hum fix karna chahte hain. - ⃣ Smart Lines - Mini Terminal

Aik aur bohot practical way trailing stop place karne ka MT4 mein yeh hai ke lines jo hum charts par draw karte hain. Inke zariye hum sirf trailing stop loss set nahi kar sakte balkay trailing take profit bhi, jo kaafi useful hota hai.

Chalain dekhte hain kaise.

Maan lijiye hum aik uptrend line draw karte hain EURUSD chart par. Trailing stop loss ya trailing take profit place karne ke liye, hum Alt key press karte hain jab left mouse button click karte hain.

Aik dialog window appear hoti hai. Humein sirf isey apni preferences ke mutabiq configure karna hai.

Yad rakhein ke, in trailing stops types mein se kuch ke liye, aapko MetaTrader Supreme Edition platform download karna hoga.

Trailing stop trading strategies

Yeh imperative hai ke traders samjhein ke trading mein zero risk nahi hota, is liye good risk management key hai agar hum long term mein successful hona chahte hain. Yeh case hai kisi bhi situation mein, chahe aap trailing stop ko Forex mein kaise use karna seekh rahe hain, ya kisi aur trading instrument mein. Jab hum stop loss place karte hain, jab hum trailing stop establish karte hain toh humein kuch aspects clear hone chahiye:- Maximum loss jo hum har position mein accept karne ko tayar hain

- Asset ki volatility jo humne choose kiya hai

- Trailing stop meri strategy ke liye better suited hai ya nahi?

- Mere paas kya funds hain?

Bohot se beginning traders in sawalon ke baare mein nahi sochte. Wo trailing stop aur stop loss dono ko 'by eye' set kar dete hain. Important cheez jab inhe place karte hain toh yeh hai ke hum instrument ko dekhte hue, time horizon ko aur agar hum operation ko aware reh sakte hain ya nahi, consider karen. Jaise maine upar highlight kiya, yeh aspect vital hai kyunki trailing stop sirf tab kaam karta hai jab humari active platform ho.

Where should you set your trailing stop loss (how far)?

Is article ke point par, aap already yeh jawab jaante hain ke trailing stop loss kya hai? Aap yeh bhi jaante hain ke trailing stop loss kaise use karte hain. Lekin ab key question yeh hai...Kitna door rakha jaye?

Placing the trailing stop with the ATR indicator

Kuch traders kabhi kabhi technical indicators use karte hain trailing stop loss set karne ke liye. Ek commonly used indicator is case mein Average True Range (ATR) hota hai, aik indicator jo asset ki volatility reflect karta hai. Is tarah se, moments ya instruments of greater volatility mein, trailing stop price se door move karega, jabke agar volatility reduced ho jaye, stop price ke qareeb move karega.- ➨ Agar aap scalping kar rahe hain, aap directly number of pips use kar sakte hain jo ATR indicate karta hai. Aapka trailing stop kaafi tight hoga aur aap brief volatility peaks ka faida utha sakte hain, lekin yeh risk hota hai ke operation close ho jaye agar too much retracement hota hai.

- ➨ Agar aap day trades ya swing trading kar rahe hain, yeh worth ho sakta hai ke aap ATR ke indicated number of pips ko multiplier of 2 apply karein. Kyun? Kyunki aap bigger moves market mein capture karna chaah rahe hain, aapko thoda larger pullbacks withstand karne chahiye.

ATR ka value 2 se multiply karna aik standard hai jo bohot se traders apply karte hain, lekin aap apne tests karne ke liye free hain jo multiplier aapko best suit karta ho select karne ke liye.

-

#4 Collapse

Open sidebar

Trailing Stop In Forex

A trailing stop in Forex trading is a type of stop-loss order that moves with the market price. It is designed to lock in profits as the market moves in a favorable direction, while also protecting against losses if the market reverses.

Here's how it works:- Initial Setup: You set a trailing stop order at a certain distance from the current market price. This distance is typically set in pips.

- Price Movement: As the market price moves in your favor (up for long positions, down for short positions), the trailing stop moves with it, maintaining the set distance from the current price.

- Locking in Profits: If the market price reverses direction and hits the trailing stop level, the order is executed, closing your position and locking in your profits up to that point.

- Protection Against Losses: If the market reverses before moving enough to trigger the trailing stop, the stop-loss order will execute to minimize your loss.

- You enter a long position at 1.1000 with a trailing stop of 20 pips.

- The price moves up to 1.1020. Your trailing stop is now at 1.1000.

- The price continues to rise to 1.1050. Your trailing stop moves to 1.1030.

- If the price then drops to 1.1030, your position is closed, locking in a profit of 30 pips.

- Automatic Adjustment: The trailing stop adjusts automatically as the market moves, requiring less manual intervention.

- Profit Maximization: It allows you to lock in profits while giving your trade room to run.

- Risk Management: Provides a disciplined approach to managing risk and protecting against significant losses.

- Volatility: In highly volatile markets, a trailing stop set too close to the current price might trigger prematurely.

- Broker Limitations: Some brokers might have limitations or additional fees for using trailing stops.

Certainly! Let's delve deeper into trailing stops in Forex trading, covering additional aspects such as types of trailing stops, strategies for setting them, and potential pitfalls.

Types of Trailing Stops- Fixed Trailing Stop:

- Moves at a fixed distance from the market price.

- For example, if you set a trailing stop of 20 pips, it will always trail the market by 20 pips regardless of how much the market moves.

- Percentage-Based Trailing Stop:

- Moves based on a percentage of the current market price.

- For instance, if you set a trailing stop at 2%, it will move by 2% of the current price as the market price changes.

- Volatility-Based Trailing Stop:

- Adjusts based on market volatility.

- Uses indicators like the Average True Range (ATR) to set the distance, expanding during high volatility and contracting during low volatility.

- Indicator-Based Trailing Stop:

- Uses technical indicators such as moving averages or the Parabolic SAR to determine the trailing stop level.

- For example, you might set the trailing stop to move in line with a short-term moving average.

- ATR (Average True Range) Trailing Stop:

- Use the ATR indicator to determine the average volatility over a specified period.

- Set the trailing stop at a multiple of the ATR value to accommodate normal market fluctuations.

- Chart-Based Trailing Stop:

- Set trailing stops based on significant support or resistance levels on the chart.

- Adjust the trailing stop as new support/resistance levels are formed.

- Time-Based Trailing Stop:

- Adjust the trailing stop at regular intervals, such as daily or weekly, based on market conditions.

- Useful for swing traders or longer-term positions.

- Profit Target Trailing Stop:

- Combine a trailing stop with a profit target.

- Once the profit target is hit, the trailing stop activates to lock in gains while allowing for further upside.

- Whipsawing:

- In volatile markets, the price might frequently hit the trailing stop, resulting in premature exits.

- To mitigate this, set a trailing stop distance that accommodates typical price swings without being too tight.

- Over-Optimization:

- Over-optimizing the trailing stop distance based on historical data might lead to poor performance in live trading.

- Regularly review and adjust your trailing stop strategy based on current market conditions.

- Broker Limitations:

- Ensure your broker supports trailing stops and understand their policies, as some brokers might have restrictions or additional fees.

- Psychological Impact:

- Relying solely on trailing stops might cause traders to become complacent.

- Maintain a proactive approach to managing trades and use trailing stops as part of a broader risk management strategy.

- Backtesting:

- Before implementing a trailing stop strategy, backtest it using historical data to assess its effectiveness.

- Pay attention to different market conditions (trending vs. ranging) to ensure robustness.

- Monitor Market Conditions:

- Continuously monitor market conditions and adjust your trailing stop strategy as needed.

- Be flexible and ready to adapt to changes in volatility and market trends.

- Combine with Other Tools:

- Use trailing stops in conjunction with other risk management tools, such as position sizing and diversification.

- Consider using multiple trailing stops at different levels to secure partial profits while letting the rest of the position run.

Trailing stops are a powerful tool in Forex trading, offering a dynamic way to manage risk and lock in profits. By understanding the different types of trailing stops, strategies for setting them, and potential pitfalls, traders can effectively incorporate trailing stops into their trading plans. Continuous learning, monitoring, and adaptation are key to optimizing the use of trailing stops and achieving long-term trading success.

Sure, let's explore some more advanced concepts and considerations when using trailing stops in Forex trading, including setting optimal trailing stop distances, combining trailing stops with other trading strategies, and using automated trading systems.

Advanced Concepts and Considerations

Optimal Trailing Stop Distance

Setting the right trailing stop distance is crucial. Too tight, and the stop may trigger prematurely; too loose, and it may not effectively protect profits. Here are some methods to determine an optimal distance:- Historical Volatility Analysis:

- Analyze historical price data to understand typical price movements and volatility.

- Calculate the average price range over various time frames (e.g., daily, weekly) to set an appropriate trailing stop distance.

- ATR-Based Method:

- The Average True Range (ATR) is a popular indicator for measuring volatility.

- Set the trailing stop at a multiple of the ATR (e.g., 1.5x or 2x ATR) to account for market noise while providing enough room for the trade to develop.

- Dynamic Adjustment:

- Use a dynamic approach where the trailing stop distance adjusts based on current market conditions.

- For example, if the market becomes more volatile, widen the trailing stop; if it becomes less volatile, tighten it.

- Trend Following:

- Trailing stops are particularly effective in trend-following strategies, where the goal is to capture large market moves.

- Use technical indicators like moving averages or the Parabolic SAR to identify trends and set trailing stops accordingly.

- Breakout Strategies:

- Combine trailing stops with breakout strategies to maximize profits from significant price movements.

- After a breakout is confirmed, set a trailing stop to follow the new trend while protecting against reversals.

- Mean Reversion:

- In mean reversion strategies, where the price is expected to revert to its average, trailing stops can help manage risk.

- Set trailing stops to protect against adverse price movements while giving the trade time to revert to the mean.

- Algorithmic Trading:

- Develop algorithmic trading systems that incorporate trailing stops as part of their risk management.

- Use programming languages like Python or trading platforms like MetaTrader to automate trailing stop adjustments based on predefined criteria.

- Expert Advisors (EAs):

- In platforms like MetaTrader, create or use existing Expert Advisors (EAs) that include trailing stop functionality.

- EAs can continuously monitor the market and adjust trailing stops automatically based on your strategy.

- Backtesting and Optimization:

- Thoroughly backtest automated systems to ensure they perform well under different market conditions.

- Optimize trailing stop parameters using historical data to find the best settings for your trading strategy.

- Regular Review and Adjustment:

- Regularly review and adjust your trailing stop settings based on current market conditions and performance.

- Be proactive in adapting to changes in volatility, trend strength, and market sentiment.

- Partial Position Close:

- Consider using a strategy where you close part of your position at a predetermined profit level while letting the remainder trail with a stop.

- This approach secures some profit while allowing the rest of the position to benefit from further market moves.

- Risk Management:

- Combine trailing stops with other risk management tools, such as fixed stop-loss orders, position sizing, and portfolio diversification.

- Ensure that trailing stops are part of a comprehensive risk management plan that aligns with your overall trading strategy.

- Avoid Overcomplication:

- While advanced techniques can enhance trading performance, avoid overcomplicating your trailing stop strategy.

- Keep your approach straightforward and easy to execute, focusing on consistency and discipline.

Imagine you're trading the EUR/USD pair, and you've identified a strong uptrend using technical analysis. You decide to enter a long position at 1.1000 with a trailing stop based on the ATR indicator. Here's how you might implement this:- ATR Calculation:

- Calculate the ATR for the EUR/USD pair over the past 14 days, which is 20 pips.

- Set Trailing Stop:

- Set the trailing stop at 1.5 times the ATR, which equals 30 pips.

- Your trailing stop is initially placed at 1.0970 (1.1000 - 30 pips).

- Market Movement:

- The price moves up to 1.1030, and your trailing stop adjusts to 1.1000.

- The price continues to rise to 1.1080, and your trailing stop moves to 1.1050.

- Price Reversal:

- The price then reverses and drops to 1.1050, triggering your trailing stop.

- Your position is closed, locking in a profit of 50 pips.

Trailing stops are an essential tool in Forex trading, offering a flexible and dynamic way to manage risk and maximize profits. By understanding the different types of trailing stops, setting optimal distances, combining them with other strategies, and using automated systems, traders can enhance their trading performance. Continuous learning, regular review, and disciplined execution are key to effectively utilizing trailing stops in your trading strategy.

-

#5 Collapse

### Trailing Stop Forex Trading Mein: Ek Comprehensive Guide

Forex trading mein risk management ek crucial element hai jo successful trading strategy ka hissa hota hai. Trailing Stop ek aisa tool hai jo traders ko market ke favourable movements ko capture karne aur losses ko minimize karne mein madad karta hai. Yahaan Trailing Stop ke concept, benefits, aur practical application par detailed discussion kiya gaya hai:

**1. Trailing Stop Kya Hai?**

Trailing Stop ek dynamic stop-loss order hai jo market price ke sath adjust hota hai. Jab price aapke favor mein move karti hai, trailing stop bhi apne level ko adjust karta hai, lekin jab price reverse hoti hai, trailing stop apni position par rehta hai. Yeh tool aapko profit ko lock karne aur market ke fluctuations se protection provide karne mein madad karta hai.

**2. Trailing Stop Ki Functionality:**

- **Fixed Distance Trailing Stop:** Isme aap ek fixed distance ya pips set karte hain jo trailing stop price aur current market price ke beech maintain hota hai. Agar price aapke favor mein move karti hai, trailing stop bhi is fixed distance ke saath adjust hota hai.

- **Percentage-Based Trailing Stop:** Isme aap ek specific percentage set karte hain jo market price aur trailing stop ke beech ka gap define karta hai. Jab price aapke favor mein move karti hai, trailing stop bhi percentage ke hisaab se adjust hota hai.

**3. Benefits of Trailing Stop:**

- **Profit Locking:** Trailing Stop aapko market ke favorable movements ko capture karne mein madad karta hai aur aapke profits ko lock karta hai. Jab price aapke favor mein move karti hai, trailing stop apne level ko adjust karta hai, jo potential gains ko secure karta hai.

- **Risk Management:** Yeh tool losses ko minimize karne mein bhi madad karta hai. Agar price reverse hoti hai, trailing stop aapke predefined level par activate hota hai, jo aapko excessive losses se bachata hai.

- **Emotional Control:** Trailing Stop emotional trading decisions ko reduce karta hai. Yeh automatic adjustments ki wajah se aapko market ke fluctuations ke according trading decisions lene ki zaroorat nahi hoti.

**4. Practical Application:**

- **Setup Trailing Stop:** Apni trading platform par trailing stop order ko setup karne ke liye, aapko desired distance ya percentage set karni hoti hai. Yeh distance ya percentage aapki trading strategy aur market conditions ke hisaab se vary kar sakti hai.

- **Monitor Market Conditions:** Trailing Stop ko effectively use karne ke liye, market conditions aur price movements ko monitor karna zaroori hai. Yeh tool dynamic adjustments karta hai, lekin aapko market trends aur volatility ko samajhna bhi important hai.

- **Combine with Other Tools:** Trailing Stop ko dusre technical indicators aur analysis tools ke saath combine karke, aap apni trading strategy ko enhance kar sakte hain. Yeh combination aapko better entry aur exit points identify karne mein madad karta hai.

Trailing Stop forex trading mein ek valuable tool hai jo aapko profits ko secure karne aur risks ko manage karne mein madad karta hai. Is tool ko samajh kar aur effectively use karke, aap apni trading performance ko improve kar sakte hain aur market fluctuations ke against better protection aur profitability achieve kar sakte hain.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Trailing Stop Forex Trading Mein Kya Hai?**

Trailing stop ek trading tool hai jo forex market mein risk management aur profit booking ke liye use hota hai. Yeh tool traders ko market ke favorable movements ke sath profit ko lock karne aur losses ko minimize karne mein madad karta hai. Yahan kuch key points hain jo trailing stop ko explain karte hain:

1. **Trailing Stop Ka Concept**:

- **Definition**: Trailing stop ek dynamic stop-loss order hai jo market price ke sath adjust hota hai. Jab price market ke favorable direction mein move karti hai, to trailing stop bhi apni position ko adjust karta hai, lekin jab price reverse hoti hai, to trailing stop order execute hota hai.

- **Purpose**: Iska maqsad yeh hota hai ke traders ko profit ko protect karna aur losses ko control karna. Yeh tool automatically profit-taking aur stop-loss levels ko manage karta hai.

2. **How It Works**:

- **Distance Setting**: Trailing stop ke liye ek fixed distance ya percentage set kiya jata hai jo market price se trailing stop order ko maintain karta hai. Yeh distance market volatility aur trader ke risk tolerance par depend karta hai.

- **Adjustments**: Jab price market ke favorable direction mein move karti hai, to trailing stop bhi apne distance ko maintain karte hue adjust hota hai. Agar price market ke unfavorable direction mein move karti hai aur trailing stop price ko reach karti hai, to position automatically close ho jati hai.

3. **Benefits**:

- **Profit Locking**: Trailing stop traders ko market ke favorable movements ke sath profit ko lock karne ki suvidha deta hai. Yeh tool profit booking ke liye useful hai aur trader ko market ke upward trends ko capture karne mein madad karta hai.

- **Risk Management**: Trailing stop losses ko minimize karne mein madad karta hai. Yeh automatic stop-loss orders ko adjust karta hai aur risk ko control karte hue potential losses ko limit karta hai.

- **Automated Execution**: Trailing stop orders automatically execute hote hain, jo traders ko market movements ke sath manually adjust karne ki zaroorat ko eliminate karta hai. Yeh manual intervention ko reduce karta hai aur trading process ko streamline karta hai.

4. **Types of Trailing Stops**:

- **Fixed Trailing Stop**: Isme ek fixed distance ya amount set kiya jata hai jo market price se trailing stop ko maintain karta hai. Yeh method simple aur straightforward hai.

- **Percentage Trailing Stop**: Isme trailing stop ek fixed percentage ke distance par set kiya jata hai. Yeh percentage market price ke sath adjust hota hai aur percentage based stop-loss ko manage karta hai.

5. **Limitations**:

- **Slippage**: Market volatility ke dauran, trailing stop order ko slippage ka samna karna pad sakta hai. Yeh orders execution ke waqt market price se thoda different price par execute ho sakte hain.

- **Over-Reliance**: Trailing stop ke use se traders market conditions aur trends ko overlook kar sakte hain. Yeh automated tool hote huye bhi manual analysis aur market understanding zaroori hoti hai.

- **False Signals**: Agar market me frequent price fluctuations hote hain, to trailing stop false signals generate kar sakta hai. Yeh frequent stop-outs aur premature exits ka sabab ban sakta hai.

Trailing stop forex trading mein ek valuable tool hai jo profit protection aur risk management ko enhance karta hai. Yeh tool traders ko market movements ke sath adjust karne aur losses ko control karne mein madad karta hai, lekin iske effective use ke liye market conditions aur manual analysis ki zaroorat hoti hai.

-

#7 Collapse

Forex Mein Trailing Stop Kya Hai?

Forex trading mein trailing stop ek khas tareeqa hai jo traders ko apne munafa ko barhane aur nuksan ko kam karne mein madad karta hai. Is artical mein, hum trailing stop ke mukhtalif pehluon ko tafseel se samjhenge. Forex trading ek bahut hi complex aur dynamic field hai. Is mein har waqt market ke trends aur price movements dekhte rehna padta hai. Trailing stop ek aisa tool hai jo traders ko ye sab kuch karne mein madad karta hai.

Trailing Stop Ki Tareef

Trailing stop ek automatic order hai jo market ki harakat ke mutabiq adjust hota hai. Yeh initial stop loss ko har naye high ya low ke saath adjust karta hai. Yeh ek dynamic tool hai jo market ke moves ke sath change hota rehta hai. Jab market aapke favor mein move karti hai, trailing stop bhi usi direction mein move karta hai, lekin jab market opposite direction mein jati hai to yeh fixed rahata hai. Yeh traders ko apne munafa ko secure karne aur nuksan ko minimize karne mein madad karta hai.

Trailing Stop Ka Maqsad

Trailing stop ka maqsad traders ko apne munafa ko lock karna aur nuksan se bachna hai. Jab market unke haq mein chalti hai, trailing stop unke munafa ko protect karta hai. Agar market unke khilaf jati hai, trailing stop unke losses ko limit karta hai. Yeh traders ko ek predefined level of risk maintain karne mein madad karta hai. Yeh unhe zyada discipline ke sath trade karne aur emotional decisions se bachne mein madadgar sabit hota hai.

Trailing Stop Kaise Kaam Karta Hai?

Trailing stop initial stop loss ko har market move ke saath adjust karta hai. Agar market aapki trade ke haq mein chalti hai, trailing stop aapke favor mein move karta rehta hai. Yeh ek fixed distance par rehta hai jo aap set karte hain. Jaise hi market aapki trade ke favor mein move karti hai, yeh distance maintain karte hue move karta rehta hai. Agar market reverse hoti hai, trailing stop apne place par fixed rahata hai aur aapki trade ko protect karta hai.

Trailing Stop Ka Faida

Trailing stop ka sabse bara faida yeh hai ke yeh traders ko market ko closely monitor karne ki zarurat nahi hoti. Yeh automatically adjust hota rehta hai. Yeh aapko apne munafa ko maximize karne aur nuksan ko minimize karne mein madadgar hota hai. Isse aap ek baar trade set karne ke baad relax ho sakte hain, kyunki aapko pata hota hai ke aapka trailing stop aapki trade ko manage kar raha hai.

Initial Stop Loss Aur Trailing Stop Mein Farq

Initial stop loss fix hota hai jabke trailing stop market ke sath move karta hai. Trailing stop zyada flexible aur market ke sath adjust hone wala hota hai. Initial stop loss ek predefined level par set hota hai, jabke trailing stop market ke har new high ya low ke sath adjust hota rehta hai. Yeh aapko zyada dynamic aur responsive trading karne mein madad karta hai.

Trailing Stop Ka Calculation

Trailing stop ko calculate karne ke liye, trader ko apni risk tolerance aur market volatility ko dekhna hota hai. Market ki volatility ke hisaab se trailing stop ka distance set kiya jata hai. Agar market zyada volatile hai, to trailing stop ko thoda zyada distance par set karna chahiye. Agar market kam volatile hai, to trailing stop ko kam distance par set kar sakte hain. Yeh calculation traders ki individual strategy aur risk tolerance par depend karti hai.

Trailing Stop Ki Strategy

Achi strategy yeh hai ke aap market ki volatility ko samjhen aur uske mutabiq apna trailing stop set karein. Yeh zaroori hai ke aap market ke current conditions ko analyze karte hue apna trailing stop adjust karein. Yeh bhi zaroori hai ke aap apni individual risk tolerance ko samjhein aur uske mutabiq apna trailing stop set karein. Yeh aapko disciplined aur systematic trading karne mein madadgar hoga.

Manual Trailing Stop

Manual trailing stop mein trader khud adjust karta hai, jab woh samjhta hai ke market unke haq mein move kar rahi hai. Yeh method zyada active involvement aur close monitoring ki zarurat hoti hai. Traders jo zyada hands-on approach prefer karte hain, woh manual trailing stop ko use karte hain. Ismein trader apne analysis aur market conditions ke mutabiq apne stop loss ko adjust karta rehta hai.

Automatic Trailing Stop

Automatic trailing stop broker ke platform ke through set hota hai aur market ke move ke sath automatic adjust hota hai. Yeh ek automated process hai jo traders ko zyada time aur effort bachat hai. Yeh traders ko relaxed aur stress-free trading ka experience provide karta hai. Automated trailing stop set karne ke baad, trader ko market ko closely monitor karne ki zarurat nahi hoti, kyunki yeh automatic adjust hota rehta hai.

Trailing Stop Ki Ahmiyat

Trailing stop forex trading mein ek zaroori tool hai jo traders ko apne munafa ko protect karne mein madad karta hai. Yeh aapko disciplined aur systematic trading karne mein madadgar hota hai. Yeh aapko emotional decisions se bachne aur apne risk management strategy ko implement karne mein madad karta hai. Yeh aapko apne munafa ko maximize karne aur nuksan ko minimize karne mein madadgar hota hai.

Trailing Stop Aur Risk Management

Trailing stop risk management ka ek hissa hai jo aapko zyada risk lene se bachata hai aur apne munafa ko secure karta hai. Yeh aapki overall risk management strategy ka ek important component hai. Yeh aapko ek predefined level of risk maintain karne mein madad karta hai. Yeh aapko apni trades ko systematic aur disciplined tareeke se manage karne mein madadgar hota hai.

Trailing Stop Aur Market Volatility

Agar market volatile hai, trailing stop zyada aggressive hona chahiye, jabke low volatility market mein yeh zyada relax ho sakta hai. Market volatility ko samajhna aur uske mutabiq apne trailing stop ko adjust karna zaroori hai. Yeh aapko market ke current conditions ke hisaab se apni trades ko manage karne mein madad karta hai. Yeh aapko apne risk aur reward ko balance karne mein madadgar hota hai.

Trailing Stop Ka Time Frame

Trailing stop kisi bhi time frame par kaam kar sakta hai, lekin long-term traders isko zyada use karte hain. Short-term traders bhi isko use kar sakte hain, lekin long-term traders ke liye yeh zyada beneficial hota hai. Yeh aapki trading strategy aur time frame ke mutabiq adjust hota hai. Yeh aapko apne trades ko systematic aur disciplined tareeke se manage karne mein madad karta hai.

Trailing Stop Aur Trend Following

Trailing stop trend following strategy ke liye ideal hai kyun ke yeh market ke trend ke sath adjust hota rehta hai. Yeh aapko market ke trends ke sath apne trades ko adjust karne mein madad karta hai. Trend following strategy mein trailing stop aapko zyada munafa kamaane aur nuksan ko minimize karne mein madadgar hota hai. Yeh aapko disciplined aur systematic trading karne mein madad karta hai.

Trailing Stop Aur Range Bound Markets

Range bound markets mein trailing stop kam effective hota hai kyun ke market zyada move nahi karti. Range bound markets mein market ek specific range ke andar move karti hai, isliye trailing stop zyada beneficial nahi hota. Is condition mein, traders ko apne stop loss ko manual adjust karna hota hai. Yeh unhe market ke current conditions ke mutabiq apne trades ko manage karne mein madad karta hai.

Trailing Stop Ka Downside

Trailing stop ka downside yeh hai ke agar market suddenly reverse hoti hai to aapka trailing stop hit ho sakta hai aur aapko nuksan ho sakta hai. Yeh aapko market ke sudden reversals se fully protect nahi kar sakta. Iska matlab yeh hai ke aapko apne trailing stop ko wisely set karna hota hai. Yeh zaroori hai ke aap market ke current conditions ko samajh kar apna trailing stop adjust karein.

Trailing Stop Ko Set Karne Ki Tips- Market volatility ko dekhein: Market volatility ke hisaab se apna trailing stop set karein.

- Apni risk tolerance ko samjhen: Apne risk tolerance ke mutabiq apna trailing stop set karein.

- Apne strategy ke mutabiq trailing stop set karein: Apni trading strategy ko madde nazar rakhte hue apna trailing stop adjust karein.

Conclusion

Trailing stop forex trading mein ek valuable tool hai jo aapko apne munafa ko protect karne aur nuksan ko kam karne mein madad karta hai. Iska sahi istemal aapko zyada munafa kamaane mein madadgar sabit ho sakta hai. Yeh aapko disciplined aur -

#8 Collapse

### Trailing Stop in Forex

Forex trading mein risk management ka bohot bara role hota hai. Is liye traders apne losses ko kam karne ke liye mukhtalif tools aur techniques use karte hain. Un mein se ek ahem tool **Trailing Stop** hai. Aaj hum janenge ke trailing stop kya hai aur kis tarah se yeh traders ke liye faidemand sabit ho sakta hai.

#### Trailing Stop Kya Hai?

Trailing stop ek dynamic stop loss order hai jo market price ke sath sath move karta hai. Yeh aik aise order ko set karne ka tareeqa hai jo aapki trade ko profit zone mein lock kar leta hai jab market aapke favor mein move karti hai. Trailing stop, price ke against move nahi karta, lekin jab market aapke favor mein jati hai toh yeh us movement ko follow karta hai.

#### Trailing Stop Kaise Kaam Karta Hai?

Jab aap trailing stop set karte hain, toh aap ek specific distance ya percentage select karte hain jisse aapka stop loss price ke sath adjust hota rehta hai. Misaal ke taur par, agar aap 50 pips ka trailing stop set karte hain aur market aapke favor mein 100 pips move karti hai, toh aapka trailing stop bhi 50 pips peeche move kar jayega. Lekin agar market price ulta hota hai, toh trailing stop wahi ruk jata hai jahan tak wo adjust ho chuka hota hai.

#### Trailing Stop Ke Faide

1. **Profit Protection**: Trailing stop aapko profit lock karne ki sahulat deta hai jab market aapke favor mein move kar rahi hoti hai. Yeh losses ko kam karne aur profits ko maximize karne mein madadgar hai.

2. **Emotional Control**: Trading ke doran emotional decisions se bachne mein madad karta hai. Jab trailing stop set hota hai, toh aapko manually trade close karne ki zarurat nahi hoti, jo ke emotional mistakes se bachata hai.

3. **Market Monitoring**: Trailing stop ki wajah se aapko har waqt market ko monitor karne ki zarurat nahi hoti. Yeh aapke set parameters ke mutabiq automatically adjust hota rehta hai.

4. **Flexibility**: Yeh tool aapko flexibility deta hai ke aap market trends ko follow kar sakein aur apne trades ko waqt ke sath sath adjust kar sakein.

#### Trailing Stop Use Karne Ki Tips

- **Right Distance Select Karein**: Market ki volatility ko mad-e-nazar rakhte hue apna trailing stop ka distance set karein. Agar distance bohot chota hoga toh market ki choti-choti fluctuations aapki trade ko prematurely close kar sakti hain.

- **Market Conditions Ko Samjhein**: Trailing stop ko sahi tareeqe se use karne ke liye market conditions ko samajhna bohot zaroori hai. Jab market bohot volatile ho toh trailing stop ko zyada aggressively set karna behtar hota hai.

- **Testing Aur Practice**: Real money se pehle demo accounts par trailing stop ko test karein taake aap is tool ka behtareen istemal samajh sakein.

#### Conclusion

Trailing stop forex trading mein ek ahem risk management tool hai jo aapki trades ko profits lock karne aur losses ko minimize karne mein madadgar sabit hota hai. Is tool ka sahi istemal aapki trading strategy ko behtar bana sakta hai aur aapko disciplined trader banne mein madad de sakta hai. Is liye trailing stop ko samjhein aur apne trading system mein shamil karein. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trailing Stop In Forex

Trailing stop ek trading tool hai jo forex market mein profit ko lock karne aur losses ko minimize karne ke liye use hota hai. Yeh dynamic stop loss order hai jo market ke movement ke sath adjust hota hai aur trader ko profitable positions ko protect karne mein madad karta hai. Is article mein hum trailing stop ke concept, benefits, aur implementation ke baare mein discuss karenge.

Trailing Stop Kya Hai?

Trailing stop ek stop loss order hai jo price movement ke sath automatically adjust hota hai. Jab market price aapke favor mein move karti hai, trailing stop bhi apne level ko adjust karta hai, lekin agar price reverse hoti hai toh trailing stop apni position ko hold karti hai aur trade ko close karti hai. Yeh method profits ko lock karne aur potential losses ko minimize karne mein madad karta hai.

Trailing Stop Ka Tareeqa

1. Fixed Amount Trailing Stop:

- Fixed Distance:

Fixed amount trailing stop ek predetermined distance ke sath set kiya jata hai, jaise ke 50 pips. Jab price move hoti hai aur 50 pips ke distance ko cross karti hai, trailing stop bhi adjust hota hai.

- Adjustment:

Agar price move hoti hai, trailing stop automatically update hota hai aur aapke trade ko profit protect karta hai. Lekin, agar price reverse hoti hai aur trailing stop ko hit karti hai, toh trade close ho jati hai.

2. Percentage-Based Trailing Stop:

- Percentage Distance:

Percentage-based trailing stop market price ke percentage ke sath adjust hota hai. Jaise ke agar aap 2% trailing stop set karte hain aur price 2% ke sath move karti hai, toh trailing stop bhi adjust hota hai.

- Dynamic Adjustment:

Yeh trailing stop dynamic adjustment ko ensure karta hai aur market ke volatility ke sath align hota hai.

Trailing Stop Ka Use Aur Benefits

1. Profit Locking:

- Automatic Adjustment:

Trailing stop automatically profit ko lock karta hai jab market price favorable direction mein move karti hai. Yeh manual adjustments ki zaroorat ko khatam karta hai.

- Risk Management:

Yeh tool aapke profits ko protect karta hai aur market ke unfavorable movements se aapko bachata hai.

2. Reduced Emotional Trading:

- Emotion-Free Trading:

Trailing stop emotional trading ko reduce karta hai. Traders ko manual exit points determine karne ki zaroorat nahi hoti, jo decision-making ko streamline karta hai.

- Objective Strategy:

Yeh strategy objective aur systematic trading ko facilitate karti hai, jo trading decisions ko more disciplined banata hai.

3. Flexibility:

- Adaptability:

Trailing stop flexible aur adaptable hota hai, jo market ke different conditions aur volatility ke sath align hota hai. Yeh various trading strategies ke sath use kiya ja sakta hai.

- Custom Settings:

Traders trailing stop ko apne risk tolerance aur trading strategy ke hisaab se customize kar sakte hain. Yeh tool different trading styles ke liye suitable hota hai.

Trailing Stop Ka Implementation

1. Setting Trailing Stop:

- Platform Settings:

Most trading platforms trailing stop order ko set karne ki facility provide karte hain. Aap trailing stop ko order entry ke waqt set kar sakte hain ya existing trades ke liye modify kar sakte hain.

- Distance Selection:

Aapko trailing stop ke distance ko carefully select karna chahiye. Too tight trailing stop quickly exit kar sakta hai aur too loose trailing stop profits ko lock nahi karta.

2.Monitoring and Adjustments:

- Real-Time Monitoring:

Trailing stop ko real-time monitor karna zaroori hai, especially volatile market conditions mein. Yeh ensure karta hai ke trailing stop correctly adjust ho raha hai.

- Regular Review:

Trading strategy aur market conditions ke hisaab se trailing stop settings ko review aur adjust karna chahiye. Yeh effective risk management aur profit protection ko ensure karta hai.

Trailing Stop Ka Challenges

1. Volatility Risks:

- Market Noise:

High volatility aur market noise trailing stop ko affect kar sakte hain. Yeh sudden price movements trailing stop ko quickly trigger kar sakte hain, jo profits ko prematurely lock kar sakta hai.

- Slippage:

Trailing stop ke execution mein slippage ka risk bhi hota hai. Yeh situation tab hoti hai jab market price rapidly move karti hai aur trailing stop desired level par execute nahi hota.

2. Complexity:

- Understanding Requirements:

Trailing stop ko effectively use karne ke liye proper understanding aur practice ki zaroorat hoti hai. Beginners ko trailing stop ke concept aur implementation ko samajhne mein thodi difficulty ho sakti hai.

- Strategy Integration:

Trailing stop ko existing trading strategy aur risk management practices ke sath integrate karna zaroori hota hai. Yeh ensure karta hai ke trailing stop effectively work kar raha hai.

Conclusion

Trailing stop forex trading mein ek valuable tool hai jo profits ko lock karne aur losses ko minimize karne mein madad karta hai. Yeh automatic adjustment aur dynamic risk management ko offer karta hai, jo trading decisions ko more disciplined aur objective banata hai. Proper setting, real-time monitoring, aur regular review se trailing stop ko effectively implement kiya ja sakta hai. Trailing stop ke benefits aur challenges ko samajhkar traders apne trading strategies ko optimize kar sakte hain aur successful trading outcomes achieve kar sakte hain. -

#10 Collapse

Trailing Stop in Forex: Ek Tafreehati Guide

1. Ta'aruf

Forex trading, yaani foreign exchange trading, duniya ki sab se badi aur liquid market hai. Is mein traders currencies ke pair ka trading karte hain. Is maqasid ke liye, ek effective risk management strategy ka istemal zaroori hai, jismein trailing stop ek aham tool hai.

2. Trailing Stop Kya Hai?

Trailing stop ek aisa order hai jo trader ko apne profits ko secure karne mein madad deta hai jab market aapke haq mein jata hai. Yeh ek dynamic stop loss hai jo price ki movement ke sath sath adjust hota hai. Agar market aapke favor mein chalta hai, to trailing stop bhi aage badhta hai, lekin jab price aapki position ke khilaf chalti hai, to yeh ek fixed point par ruk jata hai.

3. Trailing Stop Kaise Kaam Karta Hai?

Trailing stop ka kaam kaise hota hai, isay samajhne ke liye, pehle aapko iske fundamental concepts ko samajhna hoga. Jab aap trailing stop set karte hain, to aap ek specific point ya percentage define karte hain, jo price ke sath sath move karega. Jab market price is point ko cross karta hai, to aapki position automatically close ho jati hai.

4. Trailing Stop Ka Faaida

Trailing stop ka sab se bada faida yeh hai ke yeh aapko profit lock karne ki flexibility deta hai. Iski madad se aap apne profits ko maximize kar sakte hain jab market favorable conditions mein ho, aur saath hi aap apne losses ko minimize bhi kar sakte hain.

5. Risk Management Aur Trailing Stop

Risk management trading ka ek anjaam hai. Trailing stop aapko apne risk ko manage karne mein madad karta hai. Yeh strategy especially un traders ke liye faida mand hai jo volatile markets mein kaam karte hain, jahan price ki movements tezi se hoti hain.

6. Trailing Stop Set Karne Ka Tareeqa

Trailing stop set karne ka tareeqa asan hai. Aapko apne trading platform par trailing stop option ko dhoondna hoga. Aap wahan par price point ya percentage daal kar apne trailing stop ko set kar sakte hain. Har platform par yeh feature thoda alag ho sakta hai, isliye use karne se pehle tutorial ya user guide dekh lena chahiye.

7. Trailing Stop Ki Qismain

Trailing stop ki do qismain hain: fixed trailing stop aur percentage trailing stop. Fixed trailing stop ek specified price point par set hota hai, jabke percentage trailing stop price ki ek percentage par based hota hai. Aapki trading strategy aur market conditions ke hisaab se in dono ka istemal kiya ja sakta hai.

8. Kab Trailing Stop Ka Istemal Karna Chahiye?

Trailing stop ka istemal tab karna chahiye jab aap market ki upward trend ko samajhte hain. Yeh aapko profits lock karne ki ek strategy deta hai, jab market aapke favor mein move kare. Lekin agar aapko lagta hai ke market kisi uncertain situation mein hai, to trailing stop ka istemal na karna behtar hai.

9. Trailing Stop Ke Nuqsanat

Trailing stop ke faida ke sath sath kuch nuqsanat bhi hain. Kabhi kabhi market ki tezi se movements ki wajah se aapka trailing stop trigger ho sakta hai, jabki aapko lagta hai ke market phir se aapki taraf ayega. Is wajah se kabhi kabhi aap ke profits bhi kam ho sakte hain.

10. Emotional Discipline Aur Trailing Stop

Trading mein emotional discipline bahut zaroori hai. Trailing stop aapko yeh discipline dene mein madad karta hai kyunke yeh aapko apne emotions se door rakhkar ek logical approach follow karne ka mauka deta hai. Aapko apne profit aur loss ko behtar tarike se manage karne ki salahiyat milti hai.

11. Trailing Stop Aur Technical Analysis

Technical analysis ka istemal karte waqt trailing stop aapki madad kar sakta hai. Jab aap price patterns aur indicators ka istemal karte hain, to trailing stop ko un patterns ke sath link karke aap behtar trading decisions le sakte hain. Yeh strategy aapko market ki volatility se bachne mein bhi madadgar sabit hoti hai.

12. Trailing Stop Ka Istemal Karne Ke Tips

Agar aap trailing stop ka istemal kar rahe hain, to kuch tips yaad rakhna behtar hai:- Choti positions mein trailing stop ka istemal karna.

- Market conditions ko samajhna aur uske mutabiq trailing stop ko adjust karna.

- Regularly apne trailing stop levels ko review karna.

Trailing stop ek ahem tool hai jo Forex trading mein risk management aur profit locking ke liye istemal hota hai. Isay istemal karte waqt aapko market ki volatility aur conditions ka khayal rakhna zaroori hai. Yeh aapko emotional discipline dene ke sath sath ek behtar trading strategy develop karne mein madad karta hai.

14. Akhri Baat

Aakhir mein, trailing stop Forex traders ke liye ek valuable tool hai. Isay sahi tareeqe se istemal karke, aap apne trading experience ko behtar bana sakte hain. Hamesha yaad rakhein ke trading mein knowledge aur strategy ka hona zaroori hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Trailing Stop in Forex: Ek Tafreehati Guide

Trailing Stop Kya Hai?

Trailing stop ek aisa tool hai jo traders ko market ki movement ke saath apne stop loss ko adjust karne ki ijazat deta hai. Ye stop loss ek certain percentage ya points se trailing hota hai, jo aapko potential profits ko protect karne aur losses ko minimize karne mein madad karta hai. Iska maqsad yeh hai ke aap market ki favorable movements ka faida utha sakein jab tak ke market aapke khilaf na ho jaye.

Trailing Stop Kaise Kaam Karta Hai?

Jab aap trailing stop set karte hain, aap ek initial stop loss point set karte hain. Jab market aapki position ke haq mein move karta hai, trailing stop aapke stop loss point ko aage barhata hai. Misal ke taur par, agar aapne trailing stop ko 20 points par set kiya hai aur market aapki position ke haq mein 50 points move hota hai, toh aapka stop loss 30 points par set ho jata hai.

Agar market phir se aapki position ke khilaf move kare, toh trailing stop aapki position ko protect karega. Ye aapko opportunity deta hai ke aap profit kama sakein jab market favorable rahe, lekin aapko bhi risk ko control karne ka mauqa deta hai.

Trailing Stop Ke Faide- Profit Protection: Trailing stop aapko market ke favorable movements ka faida uthane ki ijazat deta hai jab tak ke market aapke khilaf na ho.

- Emotional Decision Making Ko Kam Karta Hai: Trailing stops ko set karke, aapko emotional decisions lene ki zarurat nahi hoti jab market fluctuations aate hain.

- Flexible Trading Strategy: Ye strategy traders ko flexible trading approach adopt karne mein madad karti hai, jahan wo apni trading strategies ko market ki movement ke saath adjust kar sakte hain.

Trailing Stop Kaise Set Karein?

Trailing stop set karna asaan hai. Aap apne trading platform par trailing stop option select karte hain. Aapko yeh decide karna hota hai ke aapko kis percentage ya points ka trailing stop chahiye. Misal ke taur par, agar aap 15 points ka trailing stop set karte hain, toh jab market aapke haq mein 15 points move karega, aapka stop loss usse adjust ho jayega.

Aakhir Mein

Trailing stop Forex trading mein ek ahem tool hai jo aapko potential profits ko maximize karne aur losses ko minimize karne mein madad karta hai. Iska istemal karte waqt, aapko apne trading strategy aur market conditions ko samajhna zaruri hai. Isse aap smarter decisions le sakte hain aur apni trading performance ko enhance kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:20 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим