Timeframe In Forex

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Timeframe In Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Understanding TimeframesForex trading mein timeframes ka bara maqsad hai trading strategies, risk management aur munafa darusti par asar daalna. Ye timeframes sirf seconds se lekar saalon tak ho sakte hain, har ek apni tafreeqati insight dete hain market ke rawaiye par. Traders ko mukhtalif timeframes mein se chunna hota hai, jaise ke scalping (seconds se minutes), day trading (minutes se hours), swing trading (hours se days), position trading (days se weeks), aur long-term investing (months se years). Scalping Timeframes (Seconds to Minutes) Scalping mein choti price movements se faida hasil karna hota hai sirf seconds ya minutes mein. Is mein tez faislon aur execution ki zaroorat hoti hai, tick charts ya one-minute charts istemal hote hain. Jabke ye jaldi munafa deta hai, ye tabeeli nazar rakhta hai aur market dynamics ka achi samajh zaroori hoti hai. Day Trading Timeframes (Minutes to Hours) Day trading chand minutes se hours ke ander short-term price movements par tawajjo deti hai, 15-minute se lekar 1-hour charts ka istemal hota hai. Is se raat ko hone wale risks se bacha jata hai aur ye logon ke liye munafa mand hai jo scalping se thora lamba trade chahte hain. Day traders technical patterns aur short-term trends par tawajjo dete hain. Swing Trading Timeframes (Hours to Days) Swing trading mein positions ko dino ya hafton tak hold kia jata hai, hourly aur daily charts istemal hote hain. Traders ko maqsad hota hai darmiyani size ke price movements ko capture karna aur wo technical aur fundamental analysis par bharosa rakhte hain. Ye approach day trading se ziada flexibility deta hai aur is ko part-time traders ke liye istemal karna behtar hota hai. Position Trading Timeframes (Days to Weeks) Position trading mein positions ko hafton se maheenon tak hold kia jata hai, daily aur weekly charts ka istemal hota hai. Ye short timeframes se kam stressful hota hai aur is mein lambay time period wale traders ke liye behtareen hai. Fundamental analysis aur macroeconomic trends position trading ke decisions par asar andaz hote hain. Long-Term Investing Timeframes (Months to Years) Long-term investing mein positions ko maheenon se saalon tak hold karna hota hai, fundamental analysis aur macro trends par tawajjo hoti hai. Investors monthly aur yearly charts istemal karte hain aur wo choti timeframes se kam pareshan rehte hain. Ye sabr karne wale logon ke liye munafa mand hota hai jo lambay time period mein ziada faida hasil karna chahte hain.

Swing Trading Timeframes (Hours to Days) Swing trading mein positions ko dino ya hafton tak hold kia jata hai, hourly aur daily charts istemal hote hain. Traders ko maqsad hota hai darmiyani size ke price movements ko capture karna aur wo technical aur fundamental analysis par bharosa rakhte hain. Ye approach day trading se ziada flexibility deta hai aur is ko part-time traders ke liye istemal karna behtar hota hai. Position Trading Timeframes (Days to Weeks) Position trading mein positions ko hafton se maheenon tak hold kia jata hai, daily aur weekly charts ka istemal hota hai. Ye short timeframes se kam stressful hota hai aur is mein lambay time period wale traders ke liye behtareen hai. Fundamental analysis aur macroeconomic trends position trading ke decisions par asar andaz hote hain. Long-Term Investing Timeframes (Months to Years) Long-term investing mein positions ko maheenon se saalon tak hold karna hota hai, fundamental analysis aur macro trends par tawajjo hoti hai. Investors monthly aur yearly charts istemal karte hain aur wo choti timeframes se kam pareshan rehte hain. Ye sabr karne wale logon ke liye munafa mand hota hai jo lambay time period mein ziada faida hasil karna chahte hain.  Choosing the Optimal Timeframe Sahi timeframe chunna har trader ki apni quwwatein, pasandidgiyan aur maqasid par munhasir hota hai. Scalping jaldi munafa deta hai magar is mein mustaqil tawajjo aur mazboot infrastructure ki zaroorat hoti hai. Day trading short-term trends se faida hasil karta hai aur is mein kam pareshani hoti hai. Swing trading flexibility aur kam stress deta hai. Position trading busy traders ke liye munasib hai jo kam pareshani aur lambay holding periods chahte hain. Long-term investing sabar aur lambay arsay tak ka nazar rakhta hai. Behtareen timeframe har trader ke liye mukhtalif hota hai. Scalping aur day trading mehnat aur dedikeshan ki zaroorat hoti hai magar tez munafa hasil ho sakta hai. Swing trading flexibility aur kam pareshani deta hai. Position trading kam holding periods aur kam pareshani ka mishwar hai. Long-term investing sabr aur lambay arsay tak ka focus hai. Jo bhi timeframe chuna jaye, kaamyabi ka raaz achi tarah tayyar ki gayi strategy, mufeed research, mufeed risk management aur mustaqil taleem mein hai. Har timeframe apni faiday aur nuqsanat rakhta hai, lekin kaamyabi ka raaz chuna gaya tareeqe ko apni quwwatein aur maqasid ke mutabiq sazaayish karna hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Choosing the Optimal Timeframe Sahi timeframe chunna har trader ki apni quwwatein, pasandidgiyan aur maqasid par munhasir hota hai. Scalping jaldi munafa deta hai magar is mein mustaqil tawajjo aur mazboot infrastructure ki zaroorat hoti hai. Day trading short-term trends se faida hasil karta hai aur is mein kam pareshani hoti hai. Swing trading flexibility aur kam stress deta hai. Position trading busy traders ke liye munasib hai jo kam pareshani aur lambay holding periods chahte hain. Long-term investing sabar aur lambay arsay tak ka nazar rakhta hai. Behtareen timeframe har trader ke liye mukhtalif hota hai. Scalping aur day trading mehnat aur dedikeshan ki zaroorat hoti hai magar tez munafa hasil ho sakta hai. Swing trading flexibility aur kam pareshani deta hai. Position trading kam holding periods aur kam pareshani ka mishwar hai. Long-term investing sabr aur lambay arsay tak ka focus hai. Jo bhi timeframe chuna jaye, kaamyabi ka raaz achi tarah tayyar ki gayi strategy, mufeed research, mufeed risk management aur mustaqil taleem mein hai. Har timeframe apni faiday aur nuqsanat rakhta hai, lekin kaamyabi ka raaz chuna gaya tareeqe ko apni quwwatein aur maqasid ke mutabiq sazaayish karna hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Forex Chart TimeframesForex market mein "timeframe" trading ke liye aik ahem parameter hai. Timeframe, ya "muddat" ko waqt ki muddat ke tor par define kya jata hai jis mein aap trading charts ko analyze karte hain. Forex market mein, traders kai muddaton (timeframes) ki zaroorat hoti hai, jin mein kuch common timeframes 1 minute, 5 minutes, 15 minutes, 30 minutes, 1 hour, 4 hours, 1 day, 1 week aur 1 month hain. Timeframe ka chunav aapke trading strategy par nirbhar karta hai. Har timeframe mein apni khasiyat hoti hai aur in timeframes ko chunane se, traders ko market ki harkaton ko behtar tariqe se samajhne aur price trends ko predict karne mein madad milti hai.- 1 Minute Timeframe: 1 minute timeframe mein traders ko market ki short-term price movements ki jankari milti hai. Ye timeframe scalping strategy ke liye suitable hota hai, jismein traders ko short-term trades mein jaldi profit earn karna hota hai. 1 minute timeframe par trading karte waqt, traders ko market ki short-term trends aur harkaton ko samajhne ke liye technical analysis aur price action ki zaroorat hoti hai. Is timeframe par trading karte waqt traders ko jaldi trade decisions lena hota hai, jisse unhein market ki movements par react karna aata hai.

- 5 Minute Timeframe: 5 minute timeframe traders ko market ki short-term trends aur harkaton ki jankari deta hai, jo scalping strategy ke liye suitable hota hai. Is timeframe par trading karte waqt, traders ko market ki short-term trends aur harkaton ko samajhne ke liye technical analysis aur price action ki zaroorat hoti hai. 5 minute timeframe par trading karne waale traders ko stop loss aur take profit levels ko set karne ke liye market volatility aur market ki liquidity par nazar rakhni hoti hai. Is timeframe par trading karte waqt, traders ko market ki short-term movements ke sath sath apni trades ko manage karna hota hai.

- 15 Minute Timeframe: 15 minute timeframe traders ko market ki short-term trends aur harkaton ke bare mein jankari deti hai, jo short-term trading strategy ke liye suitable hota hai. Is timeframe par trading karne waale traders ko technical analysis aur price action ke sath sath economic data aur geopolitical events par bhi nazar rakhni hoti hai. 15 minute timeframe par trading karte waqt, traders ko market ki short-term trends aur harkaton ko samajhne ke liye mausam ke nuskhon ke sath sath market ki liquidity aur volatility par bhi nazar rakhni hoti hai. Is timeframe par trading karne waale traders ko market ki short-term trends ke sath sath apni trades ko manage karna hota hai.

- 30 Minute Timeframe: 30 minute timeframe traders ko market ki short-term trends aur harkaton ke bare mein jankari deta hai. Is timeframe par trading karne waale traders ko technical analysis aur price action ke sath sath economic data aur geopolitical events par bhi nazar rakhni hoti hai. 30 minute timeframe par trading karte waqt, traders ko market ki short-term trends aur harkaton ko samajhne ke liye mausam ke nuskhon ke sath sath market ki liquidity aur volatility par bhi nazar rakhni hoti hai. Is timeframe par trading karne waale traders ko market ki short-term trends ke sath sath apni trades ko manage karna hota hai.

- Hourly Timeframe: Hourly timeframe traders ko market ki short-term trends aur harkaton ke bare mein jankari deta hai, jo short-term trading strategy ke liye suitable hota hai. Is timeframe par trading karne waale traders ko technical analysis aur price action ke sath sath economic data aur geopolitical events par bhi nazar rakhni hoti hai. Hourly timeframe par trading karte waqt, traders ko market ki short-term trends aur harkaton ko samajhne ke liye mausam ke nuskhon ke sath sath market ki liquidity aur volatility par bhi nazar rakhni hoti hai. Is timeframe par trading karne waale traders ko market ki short-term trends ke sath sath apni trades ko manage karna hota hai.

- 4 Hours Timeframe: 4 hours timeframe traders ko market ki short-term trends aur harkaton ke bare mein jankari deta hai. Is timeframe par trading karne waale traders ko technical analysis aur price action ke sath sath economic data aur geopolitical events par bhi nazar rakhni hoti hai. 4 hours timeframe par trading karte waqt, traders ko market ki short-term trends aur harkaton ko samajhne ke liye mausam ke nuskhon ke sath sath market ki liquidity aur volatility par bhi nazar rakhni hoti hai. Is timeframe par trading karne waale traders ko market ki short-term trends ke sath sath apni trades ko manage karna hota hai.

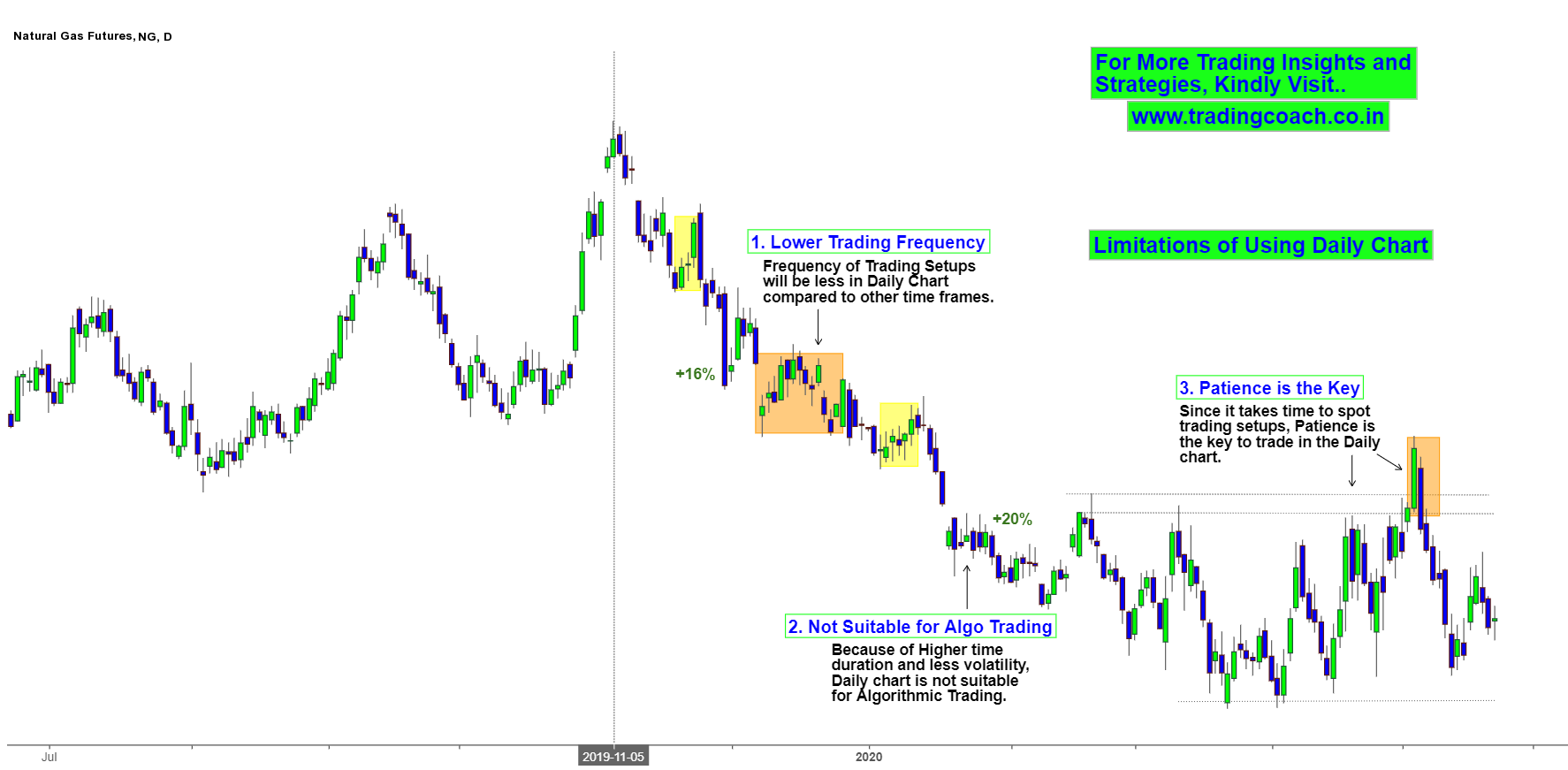

- Daily Timeframe: Daily timeframe traders ko market ki long-term trends aur harkaton ke bare mein jankari deta hai, jo long-term trading strategy ke liye suitable hota hai. Is timeframe par trading karne waale traders ko fundamental analysis aur technical analysis ke sath sath market ki news aur economic events par bhi nazar rakhni hoti hai. Dail timeframe par trading karte waqt, traders ko market ki long-term trends aur harkaton ko samajhne ke liye economic data ke sath sath market ki liquidity aur volatility par bhi nazar rakhni hoti hai. Is timeframe par trading karne waale traders ko market ki long-term trends ke sath sath apni trades ko manage karna hota hai.

- Weekly Timeframe: Weekly timeframe traders ko market ki long-term trends aur harkaton ke bare mein jankari deta hai, jo long-term trading strategy ke liye suitable hota hai. Is timeframe par trading karne waale traders ko fundamental analysis aur technical analysis ke sath sath market ki news aur economic events par bhi nazar rakhni hoti hai. Weekly timeframe par trading karte waqt, traders ko market ki long-term trends aur harkaton ko samajhne ke liye economic data ke sath sath market ki liquidity aur volatility par bhi nazar rakhni hoti hai. Is timeframe par trading karne waale traders ko market ki long-term trends ke sath sath apni trades ko manage karna hota hai.

- Monthly Timeframe: Monthly timeframe par trading karne wale traders ko long term price trends aur market ki harkaton ke bare mein jankari deti hai. Is timeframe ke chart par traders ko price movements ko analyze karne ke liye market ki technical analysis ke sath sath fundamentals ki bhi zaroorat hoti hai. Monthly timeframe par trading karte waqt, traders ko global economic events aur other macroeconomic factors par nazar rakhna hota hai. Position traders ko 1 month timeframe par trading karne se pehle, market ki muddaton ko samajhne ke liye kafi research karni hoti hai.

-

#4 Collapse

;;;Forex Market mein "Timeframe";;;

Forex market mein "timeframe" ka mtlb hota hai trading charts par diye gaye data ka specific time duration. Traders apne trading strategies ko analyze karne aur trading decisions lene ke liye different timeframes ka istemal karte hain. Har timeframe ki apni importance hoti hai aur traders apne trading goals, risk tolerance, aur trading style ke hisab se alag timeframes ka istemal karte hain.

;;;Forex Market mein "Timeframe" Common Timeframe;;;

Yahan kuch common timeframes hain jo Forex trading mein istemal hote hain:- Minute Charts: Isme har candlestick ya bar 1 minute ka time period represent karta hai. Ye short-term traders ke liye useful ho sakta hai.

- Hourly Charts: Isme har candlestick ya bar 1 ghante ka time period represent karta hai. Ye medium-term traders ke liye useful ho sakta hai.

- Daily Charts: Isme har candlestick ya bar 1 din ka time period represent karta hai. Ye long-term investors ke liye useful ho sakta hai.

- Weekly Charts: Isme har candlestick ya bar 1 week ka time period represent karta hai. Ye long-term trends ko analyze karne ke liye useful ho sakta hai.

- Monthly Charts: Isme har candlestick ya bar 1 mahina ka time period represent karta hai. Ye bahut bade trends ko analyze karne ke liye useful ho sakta hai.

;;;Forex Market mein "Timeframe" Ke Fawaed;;;

Short-Term Timeframes (Chhote Timeframes):- Day Trading (Din Bhar Ki Trading): Minute ya hourly charts ka istemal din bhar ke trading opportunities ko pakadne mein hota hai.

- Quick Profits (Tezi se Munafa): Short-term timeframes par trading karke traders jaldi munafa kamane ki koshish karte hain.

- Swing Trading (Swing Trading): Hourly ya daily charts se trading, jisme traders trends ko pakadne ki koshish karte hain.

- Positional Trading (Maqami Trading): Medium-term timeframes ko istemal karke traders lambi muddat ke trends mein invest karte hain.

- Investment Decisions (Sarmaya Kari Faislay): Weekly ya monthly charts se lambi muddat ke trends aur sarmaya kari ke faislay liye istemal hota hai.

- Macro Analysis (Makro Tahlil): Lambi muddat ke timeframes par trading karke traders puri arthik, siyasi, aur samajhi tahlil karte hain.

-

#5 Collapse

جی ہاں سر اپ نے بہت اچھی معلومات دی ہے ٹائم فریم سے ہی ہم ٹریڈنگ کر سکتے ہیں اس سے ہی ہم کوڈ پتہ چلتا ہے کہ ہم کو پتہ چلتا ہے کہ ہم نے کتنے ٹائم کے لیے ٹریڈ لگانی ہے اور کب تک ٹریڈ کو ہولڈ رکھنا ہے اگر ہم نے سیم ڈے میں ٹریڈ بند کرنی ہے تو ہم کو چھوٹا ٹائم فریم استعمال کرنا ہوگا جیسے پانچ منٹ 15 منٹ اور 30 منٹ ہے اور اگر ہم نے ایک ویک یا ایک دو دن کے لیے ٹریڈ لگانی ہے تو ہم کو ایک گھنٹہ چار گھنٹے اور ایک ویک کا ٹائم فریم استعمال کرنا ہوگا اگر ہم نے بہت لمبے ٹائم کے لیے ٹریڈ کو ہولڈ کرنا ہے جیسے کہ ایک منتھ دو منتھ یا ایک سال اس کے لیے ہم کو ایک منتھ کا ٹائم فریم استعمال کرنا ہوگا جب ہم نے ٹریڈنگ سٹارٹ کرنی ہے تو ہم کو پہلے ہی پتہ ہونا چاہیے کہ ہم کتنے ٹائم کے لیے ٹریڈ کو ہولڈ کرنا چاہتے ہیں اگر کوئی نیوز انے والی ہو تو ہم کو اس سے پہلے پہلے اپنی ساری ٹریڈ کو کلوز کر دینا چاہیے کیونکہ نیوز سے کچھ بھی ہو سکتا ہے اکاؤنٹ واش بھی ہو سکتا ہے اس ٹائم اگر ہماری ٹریڈ لگی ہوں گی تو ہم کو اپنے اکاؤنٹ کو سیو کرنے کے لیے ساری ٹریٹ کو بندکیونکہ نیوز سے ٹریڈنگ پر کافی اثر پڑتا ہے اس لیے نیوز سے پہلے ٹریڈ کلوز ہو جانی چاہیے پھر نیوز کو دیکھنے کے بعد نیوز کے مطابق ہم دوبارہ ٹریڈ لگا سکتے ہیں ایک اچھا ٹریڈ سیم ڈے میں ٹریڈنگ کلوز کر دیتا ہے اگر لاس میں جائے تو زیادہ لاس کا انتظار نہیں کرنا چاہیے بس تھوڑا سا لاس لے کر ٹریڈ کو بند کر دینا چاہیے کر دینا چاہیےRemoved by Moderator -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Timeframe In Forex

Forex mein Waqt Darust Karnay Ka Ahem Hissa Hai

Forex, ya Foreign Exchange, ek aisa bazaar hai jahan mulk ki mudraon ka kharid o farokht hota hai. Is bazaar mein traders duniya bhar ke mukhtalif currencies ke darmiyan mubadala karte hain. Har ek currency pair ka apna apna time frame hota hai, jise samajhna aur istemal karna traders ke liye zaroori hai. Is article mein, hum Forex mein istemal hone wale mukhtalif time frames par baat karenge aur ye samjheinge ke har time frame ka apna apna mahatva kya hai.

1. Scalping (5-Minute aur 15-Minute Charts):

Scalping ek trading strategy hai jisme traders chhoti muddat ke liye trade karte hain, aksar 5-minute ya 15-minute charts ka istemal karte hain. Is time frame par focus kar ke traders jald se jald chand pips hasil karne ki koshish karte hain. Scalping mein risk ziada hota hai, is liye ismein traders ko market ko tez raftar se samajhna aur tezi se faislay karne ki zarurat hoti hai.

2. Day Trading (1-Hour aur 4-Hour Charts):

Day trading mein traders din bhar ke liye apne trades hold nahi karte hain, aur unka maqsad hai din ke andar mukhtalif mouqon ka faida uthana. 1-hour aur 4-hour charts day trading ke liye acha time frame hai. Is time frame par trading karne wale traders ko market trends ko samajhna aur uske mutabiq faislay karna hota hai.

3. Swing Trading (Daily aur Weekly Charts):

Swing trading mein traders thoda lamba waqt hold karte hain, aksar kuch din ya hafton ke liye. Is strategy mein daily aur weekly charts ka istemal hota hai. Traders ko market ke long-term trends ko samajhna hota hai, taake unhe behtar faida ho. Swing trading mein risk control bhi ahem hota hai, kyunki trades ko lamba waqt hold kiya jata hai.

4. Position Trading (Monthly Charts):

Position trading ek long-term strategy hai jisme traders apne positions ko mahine bhar ya is se bhi zyada waqt tak hold karte hain. Is strategy mein traders monthly charts ka istemal karte hain. Position trading mein market ke macro trends ko samajhna aur economic indicators ko monitor karna zaroori hota hai.

Forex market mein har time frame ka apna apna mahatva hai aur har ek trader apne maqasid aur trading style ke mutabiq apna time frame chunta hai. Kuch log tezi se trades karna pasand karte hain, jabke doosre lambi muddat ke liye apne positions hold karna pasand karte hain. Is liye, traders ko apne maqasid ko aur market conditions ko madde nazar rakhte hue apna time frame chunna chahiye.

Iske ilawa, har time frame par trading karte waqt risk management ka khayal rakhna bhi zaroori hai. Har ek time frame par trading ke liye apne risk tolerance aur trading plan ko dhyan mein rakhna traders ko nuqsaan se bacha sakta hai.

Akhri lafz mein, Forex mein waqt darust karna mushkil ho sakta hai, lekin ismein maharat hasil kar ke traders apne maqasid hasil kar sakte hain. Har time frame ki understanding aur uske mutabiq trading karna, ek trader ke liye kaamyaabi ki kunji ho sakti hai.

-

#7 Collapse

Timeframe In Forex

Forex mein Waqt Darust Karnay Ka Ahem Hissa Hai

Forex, ya Foreign Exchange, ek aisa bazaar hai jahan mulk ki mudraon ka kharid o farokht hota hai. Is bazaar mein traders duniya bhar ke mukhtalif currencies ke darmiyan mubadala karte hain. Har ek currency pair ka apna apna time frame hota hai, jise samajhna aur istemal karna traders ke liye zaroori hai. Is article mein, hum Forex mein istemal hone wale mukhtalif time frames par baat karenge aur ye samjheinge ke har time frame ka apna apna mahatva kya hai.

1. Scalping (5-Minute aur 15-Minute Charts):

Scalping ek trading strategy hai jisme traders chhoti muddat ke liye trade karte hain, aksar 5-minute ya 15-minute charts ka istemal karte hain. Is time frame par focus kar ke traders jald se jald chand pips hasil karne ki koshish karte hain. Scalping mein risk ziada hota hai, is liye ismein traders ko market ko tez raftar se samajhna aur tezi se faislay karne ki zarurat hoti hai.

2. Day Trading (1-Hour aur 4-Hour Charts):

Day trading mein traders din bhar ke liye apne trades hold nahi karte hain, aur unka maqsad hai din ke andar mukhtalif mouqon ka faida uthana. 1-hour aur 4-hour charts day trading ke liye acha time frame hai. Is time frame par trading karne wale traders ko market trends ko samajhna aur uske mutabiq faislay karna hota hai.

3. Swing Trading (Daily aur Weekly Charts):

Swing trading mein traders thoda lamba waqt hold karte hain, aksar kuch din ya hafton ke liye. Is strategy mein daily aur weekly charts ka istemal hota hai. Traders ko market ke long-term trends ko samajhna hota hai, taake unhe behtar faida ho. Swing trading mein risk control bhi ahem hota hai, kyunki trades ko lamba waqt hold kiya jata hai.

4. Position Trading (Monthly Charts):

Position trading ek long-term strategy hai jisme traders apne positions ko mahine bhar ya is se bhi zyada waqt tak hold karte hain. Is strategy mein traders monthly charts ka istemal karte hain. Position trading mein market ke macro trends ko samajhna aur economic indicators ko monitor karna zaroori hota hai.

Forex market mein har time frame ka apna apna mahatva hai aur har ek trader apne maqasid aur trading style ke mutabiq apna time frame chunta hai. Kuch log tezi se trades karna pasand karte hain, jabke doosre lambi muddat ke liye apne positions hold karna pasand karte hain. Is liye, traders ko apne maqasid ko aur market conditions ko madde nazar rakhte hue apna time frame chunna chahiye.

Iske ilawa, har time frame par trading karte waqt risk management ka khayal rakhna bhi zaroori hai. Har ek time frame par trading ke liye apne risk tolerance aur trading plan ko dhyan mein rakhna traders ko nuqsaan se bacha sakta hai.

Akhri lafz mein, Forex mein waqt darust karna mushkil ho sakta hai, lekin ismein maharat hasil kar ke traders apne maqasid hasil kar sakte hain. Har time frame ki understanding aur uske mutabiq trading karna, ek trader ke liye kaamyaabi ki kunji ho sakti hai.

-

#8 Collapse

---

**Forex Trading: Waqt Ka Intezar**

Forex trading, ya foreign exchange trading, ek aisa shobha hai jahan aap mulk ki mudraon ka kharid o farokht karte hain. Yeh ek mahirana duniya hai jismein aapko har kadam par samajhdaari aur planning ki zarurat hoti hai. Ek aham factor jo yahan par aata hai, woh hai "time frame" ya trading waqt ka faisla.

**Trading Waqt Ka Ehmiyat**

Forex market 24 ghante kaam karta hai, lekin har waqt ki apni ehmiyat hoti hai. Trading mein waqt ka sahi istemaal karna, ek safaltapoorvak trader ke liye behad zaroori hai. Har trader apne liye sahi waqt frame ko chunna chahta hai, jisse uske trading strategies par asar ho.

**Different Time Frames**

Forex market mein, kai tarah ke time frames hote hain, jaise ke short-term, medium-term, aur long-term. Short-term time frames, jaise ke 1-minute ya 5-minute charts, traders ko market ki choti bewakoofiyan dekhnay mein madad karte hain. Medium-term time frames, jaise ke 1-hour ya 4-hour charts, trendon ko samajhne mein madad karte hain. Long-term time frames, jaise ke daily ya weekly charts, market ke bade trends ko samajhne mein madad karte hain.

**Intraday Trading: Choti Mudraon Mein Chhota Waqt**

Intraday trading, yaani ke din bhar ka trading, short-term time frames par adharit hoti hai. Isme traders din bhar ke chhote movements ka faida uthate hain. Yeh trading style jyada risky hoti hai, lekin experienced traders isme mahir hokar achhi kamaai kar sakte hain.

**Swing Trading: Ghanteon Ya Dinon Ka Intezar**

Swing trading, jo ke medium-term time frames par mabni hoti hai, traders ko market ke trends ka faida uthane ka mouka deti hai. Isme aapko kuch ghante ya dinon tak hold karna padta hai, lekin isme risk intraday trading se kam hota hai.

**Position Trading: Lambi Soch, Lamba Waqt**

Position trading, ya long-term trading, long-term time frames par adharit hoti hai. Isme traders ko mahinon ya saalon tak hold karna padta hai. Yeh trading style zyada sukooni hoti hai aur market ke bade trends ka faida uthane mein madad karti hai.

**Time Frame Ka Chayan Kaise Karein?**

Trading waqt ka faisla karne se pehle, aapko apne trading goals aur risk tolerance ko madde nazar rakhte hue apne liye sahi time frame ka chayan karna chahiye. Agar aap quick profits kamana chahte hain toh short-term time frames jaise ke 1-minute ya 5-minute charts ka istemaal karein. Agar aapko market ke bade trends ka faida uthana hai toh long-term time frames jaise ke daily ya weekly charts ka chayan karein.

**Ikhtiyaar Aur Planning**

Har trader ko apni trading strategy ke mutabiq sahi time frame ka ikhtiyaar karna chahiye. Planning aur discipline ke sath trading waqt ko manage karna, safalta ke raaste mein ek zaroori kadam hai.

**Ikhtitami Alfaz**

Forex trading mein waqt ka intezar ek mahirana faisla hai. Trading waqt frame ko sahi taur par chunna, aapki trading ki safalta mein aham role ada karta hai. Har trader ko apni goals aur risk tolerance ke mutabiq sahi time frame ka ikhtiyaar karna chahiye aur fir uspar amal karte hue apne trading career ko taraqqi deni chahiye.

---

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex mein "timeframe" wo muddat hoti hai jisme aap market ki analysis karte hain. Yeh muddat aapko batati hai ke aap kis arsey mein market ko dekh rahe hain. Different timeframes traders ko alag insights deti hain aur unki trading strategies ko influence karti hain.

Kuch common timeframes hain:

1. M1 (1 Minute): Har candlestick 1 minute ka movement represent karti hai. Bohat choti time horizon, jisme market ka bahut zyada fluctuation hota hai.

2. M5 (5 Minutes): Har candlestick 5 minutes ka movement show karti hai. Yeh bhi chota timeframe hai, jisme short-term fluctuations dekhe ja sakte hain.

3. H1 (1 Hour): Har candlestick 1 ghante ka movement show karti hai. Yeh aam taur par day traders ke liye relevant hota hai.

4. D1 (1 Day): Har candlestick 1 din ka movement represent karti hai. Long-term trends ko analyze karne ke liye use hota hai.

5. W1 (1 Week): Har candlestick 1 haftay ka movement show karti hai. Is timeframe mein market ke trends ko achi tarah se analyze kiya ja sakta hai.

6. MN (1 Month): Har candlestick 1 mahine ka movement represent karti hai. Long-term investors is timeframe ko use karte hain.

Har timeframe apne apne fayde aur challenges lekar aata hai. Short-term traders chhote timeframes par focus karte hain, jabki long-term investors bade timeframes par dhyan dete hain. Traders apni trading strategies ke mutabiq sahi timeframe choose karte hain.

-

#10 Collapse

Timeframe In Forex

Forex mein Samay Ka Khaaka:

Forex, ya foreign exchange market, ek global tijarat bazaar hai jahan currencies ko khareedna aur bechna hota hai. Yeh bazaar 24 ghante, 5 dinon mein kaam karta hai, aur iska mool udeshya currencies ke badlav ko mahsus karna aur munafa kamana hai. Forex market ka har ek din, har ek ghanta, aur har ek minute apne khaas maayne aur kirdaar ke saath hota hai. Isme samay kaafi ahem hota hai, aur traders ke liye yeh zaroori hai ki woh iske timeframes ko samajh sakein.- Monthly Timeframe (Mahine Ka Khaaka): Forex mein mahine ka khaaka, ya monthly timeframe, lambe muddat ke trendon ko samajhne mein madad karta hai. Yeh ek mahine ke muddat ko darust karta hai, aur isme har ek candlestick ek mahine ki performance ko darust karti hai. Monthly timeframe ka istemal lambe muddat ke investors ke liye faida-mand hota hai jo araam se badlavon ko dekhna chahte hain.

- Weekly Timeframe (Haftay Ka Khaaka): Haftay ka khaaka, ya weekly timeframe, traders ko ek haftay ke trendon ko samajhne mein madad karta hai. Isme har candlestick ek haftay ki darusti ko darust karti hai. Yeh timeframe traders ko mahine bhar ke badlavon ka ek acha overview deta hai, aur isme trading decisions ke liye kafi sahayak hota hai.

- Daily Timeframe (Roz Ka Khaaka): Roz ka khaaka, ya daily timeframe, ek din ke trendon ko darust karta hai. Har candlestick ek din ki trading activity ko represent karti hai. Yeh timeframe active traders ke liye mahatvapurna hai, kyun ki isme chhoti-muddat ke badlavon ko acche se dekha ja sakta hai. Isme trading signals ka pata lagana asaan hota hai.

- 4-Hour Timeframe (4 Ghanton Ka Khaaka): 4 ghanton ka khaaka, ya 4-hour timeframe, chhoti muddat ke trendon ko darust karta hai. Har candlestick 4 ghante ki trading activity ko darust karta hai. Yeh timeframe day traders ke liye kafi mahatvapurna hota hai, kyun ki isme chhoti-muddat ke badlavon ka dhyan rakhna asaan hota hai.

- 1-Hour Timeframe (1 Ghante Ka Khaaka): 1 ghante ka khaaka, ya 1-hour timeframe, ek ghante ke trendon ko darust karta hai. Har candlestick ek ghante ki trading activity ko darust karta hai. Isme bhi day traders kaafi active hote hain aur is timeframe mein trading signals ka pata lagana asaan hota hai.

- 15-Minute Timeframe (15 Minute Ka Khaaka):

-

#11 Collapse

Timeframe In Forex

1. Ta'aruf (Introduction)

Forex, yaani Foreign Exchange, ek international currency exchange market hai jahan dunya bhar ke mulk ki currencies trade hoti hain. Is market mein traders currencies ko buy aur sell karte hain taa ke wo profit kamayen.

2. Waqt aur Forex

Forex market 24 ghante, 5 dinon mein kaam karta hai. Iska mtlb hai ke traders har waqt currencies ko trade kar sakte hain, chahe din ho ya raat. Lekin, is 24 ghante ke waqt ko alag-alag sessions mein divide kiya gaya hai.

a. Asian Session (Asiya Session)

Ye session Asia ke kuch important financial centers jaise Tokyo aur Singapore mein hota hai. Is session mein yen, yuan aur doosri Asian currencies trade hoti hain.

b. European Session (Yoropean Session)

Yeh session London, Frankfurt, aur Paris mein hota hai. Is waqt Euro, Pound, aur doosri European currencies ka active trading hota hai.

c. North American Session (Shumali Amrican Session)

Ye session New York mein hota hai. Is session mein Dollar ka trading hota hai.

3. Market Opening Times (Market Ki Khulaiyan)

Har session ki opening time aur closing time hoti hai, jise traders ko madad milti hai trading plan banane mein. Yeh waqt market volatility ko influence karta hai.

a. Opening Time

Jab ek session shuru hota hai, to market mein activity tezi se badhti hai. Traders naye information ke mutabiq apne positions adjust karte hain.

b. Closing Time

Jab ek session khatam hota hai, to market mein volatility kam ho jati hai. Yeh waqt traders ke liye important hota hai kyun ke is waqt unko apne positions ko manage karne ka mauka milta hai.

4. Economic Events (Maeeshati Waqiyat)

Forex market mein economic events ka bhi bara asar hota hai. Jab koi important economic report ya news release hoti hai, to market mein tezi se movement hoti hai. Traders ko chahiye ke is tarah ke events ka asar samajhna zaroori hai.

5. Weekend Gaps (Haftay ke Darmiyan Ka Fasla)

Forex market haftay ke akhri din (Jumma) ko New York session ke bad kuch waqt ke liye band ho jata hai. Is waqt ko weekend gap kehte hain, aur isse market opening par asar hota hai.

Aakhri Alfaaz (Conclusion)

Forex market mein waqt ka sahi istemal karna traders ke liye zaroori hai. Sahi waqt par trading karna aur market ke waqt ke according apne positions ko manage karna asan nahi hota, lekin isse traders ko behtar results milte hain.

- CL

- Mentions 0

-

سا0 like

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Timeframe In Forex

Forex mein Timeframe ka matlab hota hai trading charts par dikhaye gaye waqt ke frame ya time periods. Ye timeframes traders ko market ki movement aur trends ko analyze karne mein madad dete hain. Forex trading mein mukhtalif timeframes istemal kiye jate hain, jaise ke minute charts, hourly charts, daily charts, weekly charts, aur monthly charts.

Timeframe Ka Ahmiyat

Timeframe ka intekhab karna trading strategy ke liye bohot ahmiyat rakhta hai. Har timeframe ki apni khasiyat hoti hai aur har ek timeframe par trading ki strategy mukhtalif hoti hai. Choti timeframes jese ke 1-minute ya 5-minute charts zyada tezi se move karte hain aur scalping ke liye zyada mufeed hote hain. Baray timeframes jese ke daily ya weekly charts long-term trends ko analyze karne ke liye istemal kiye jate hain.

Mukhtalif Timeframes

Minute Charts

Minute charts mein har candlestick ya bar ek minute ka hota hai. Ye charts bohot tezi se move karte hain aur short-term traders ke liye zyada mufeed hote hain.

Hourly Charts

Hourly charts mein har candlestick ya bar ek ghante ka hota hai. Ye charts trading sessions ke dauran market ki movement ko analyze karne ke liye istemal kiye jate hain

Daily Charts

Daily charts mein har candlestick ya bar ek din ka hota hai. Ye charts long-term trends ko samajhne aur positions hold karne ke liye istemal kiye jate hain.

Weekly Charts

Weekly charts mein har candlestick ya bar ek haftay ka hota hai. Ye charts badi scale ki trends ko samajhne aur long-term investments ke liye istemal kiye jate hain.

Monthly Charts

Monthly charts mein har candlestick ya bar ek mahine ka hota hai. Ye charts bohot lambi muddat ke trends ko samajhne ke liye istemal kiye jate hain.

Timeframe Ka Intekhab

Timeframe ka intekhab trading style aur trading objectives par mabni hota hai. Agar kisi trader ka maqsad short-term profits kamana ho to wo chote timeframes jese ke minute ya hourly charts istemal karega. Jabke agar long-term investment ya trend analysis karna ho to wo bade timeframes jese ke daily, weekly ya monthly charts istemal karega.

Timeframe Aur Technical Analysis

Har timeframe par technical analysis ka tajziya alag hota hai. Chote timeframes par price action aur indicators ki choti periods ki settings istemal ki jati hain, jabke bade timeframes par long-term trends aur major support aur resistance levels ko identify karne ke liye lambi periods ki settings istemal hoti hain.

Timeframe Par Amal

Timeframe par amal karte waqt trader ko mukhtalif timeframes ka tajziya karna chahiye aur unke mutabiq trading ki strategy ko customize karna chahiye. Iske ilawa, ek hi samay par mukhtalif timeframes ki tajziya se market ki asal halat ka behtar andaza lagaya ja sakta hai.

-

#13 Collapse

?Timeframe In Forex

Forex trading ki tez tareen duniya mein, waqtframes ko samajhna aur effectively manage karna, traders ke liye zaroori hai jo foreign exchange market ke complexities ko samajhna chahte hain. Forex mein timeframe wo waqt duration hai jis par price data ek chart par plot hota hai, aur traders market trends ko analyze karne, informed decisions lene, aur trades execute karne ke liye various timeframes ka istemal karte hain. Timeframe ka chunao trader ki strategy, risk tolerance, aur overall trading objectives par depend karta hai.

Sab se aam forex timeframes ko chhote-term, medium-term, aur long-term mein broadly categorize kiya ja sakta hai. Chhote-term timeframes, jaise 1-minute, 5-minute, aur 15-minute charts, price movements ko chhote arse mein detail se dikhate hain. Ye charts day traders ke beech lokpriya hain jo chhote-term price fluctuations ka faida uthana chahte hain. Day trading mein tezi se decisions lena aur execute karna hota hai, isliye chhote-term timeframes is trading style ke liye mahatva purna hain.

Medium-term timeframes, jaise 1-hour, 4-hour, aur daily charts, ek santulit drishti pradan karte hain, jisme price movements ko thoda lamba samay lekar dikhaya jata hai. In timeframes ka istemal swing traders karte hain jo trends ko pehchanna aur medium-term market fluctuations ka faida uthane ke liye. Swing trading mein positions ko kuch dinon ya weeks tak hold karna hota hai, jisse traders bade price swings ko bina constant monitoring ke capture kar sake.

Lambi-term timeframes, jaise weekly aur monthly charts, market trends par ek vyapak drishti pradan karte hain aur ise position traders aur long-term investors pasand karte hain. Position trading mein positions ko weeks, months, ya kabhi-kabhi years ke liye hold kiya jata hai, fundamental analysis aur macroeconomic trends par adharit hokar. Lambi-term timeframes chhote-term market noise se kam prabhavit hote hain, isliye ye un logo ke liye upyukt hain jo currency values par prabhavit karne vale fundamental factors ka faida uthana chahte hain.

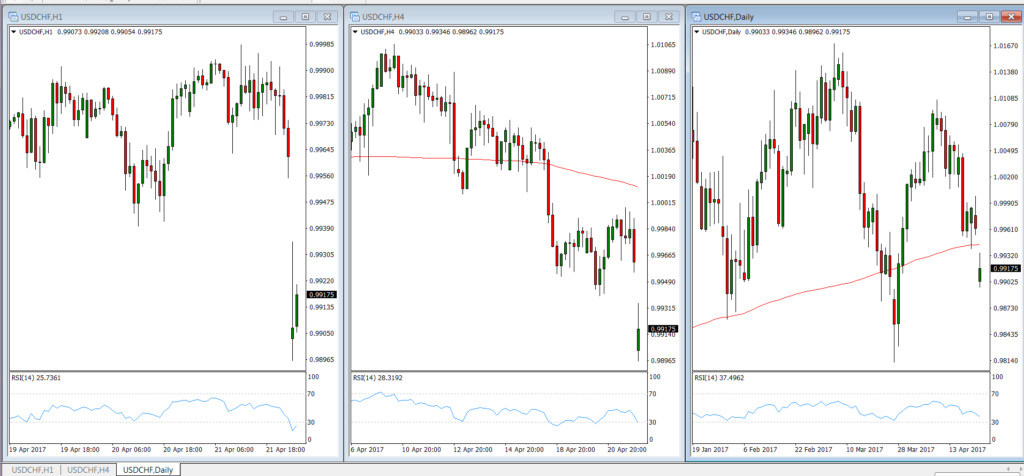

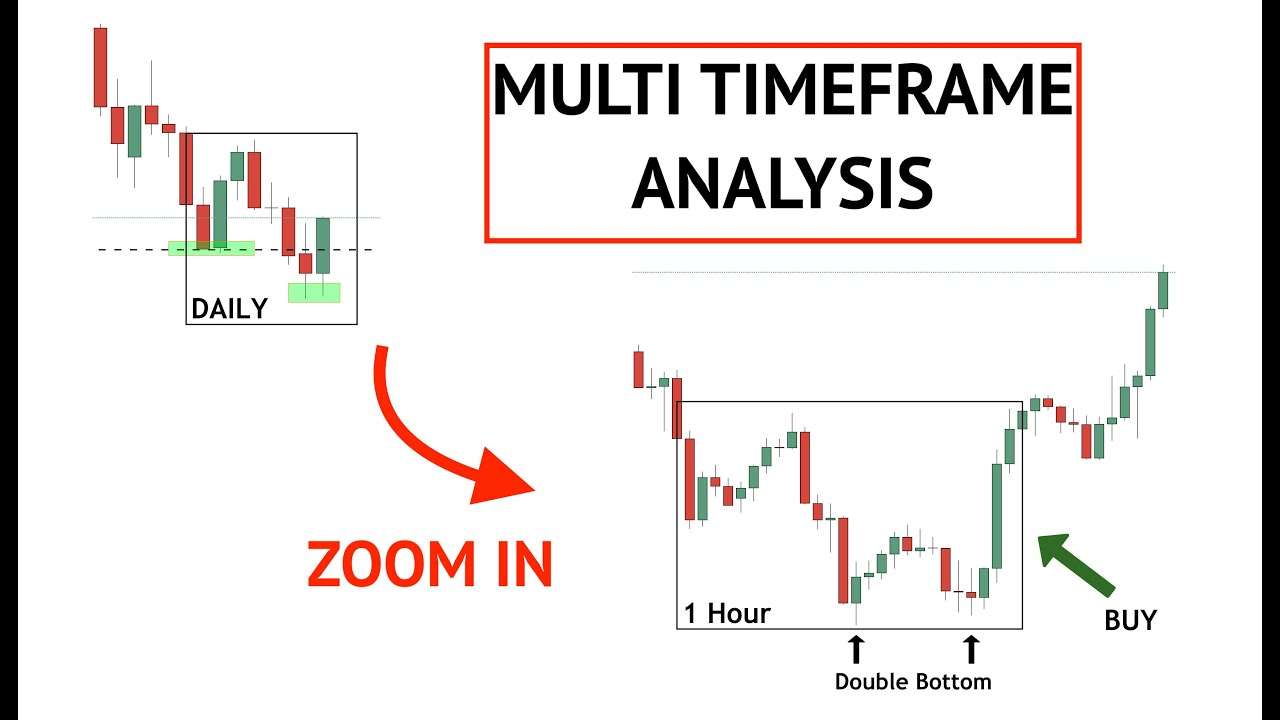

Traders aksar market ko samajhne ke liye alag-alag timeframes ka samuh istemal karte hain. Is approach ko multiple timeframe analysis kehte hain, jisme traders short-term trades ko longer timeframes par dekhar unke overall trend ke sath milate hain. For example, ek trader entry aur exit points ke liye 1-hour chart ka istemal kar sakta hai jabki prevailing trend direction ko confirm karne ke liye ek daily chart ka istemal kare.

Har timeframe ka apna ek advantage aur limitation hota hai, aur traders ko unke trading style aur objectives ke sath mel-jol rakhne wale timeframes ko chunna chahiye. Chhote-term traders tezi se hone wale price movements ke thrill par depend karte hain, jabki long-term investors ko extended periods ke market fluctuations ko sahne ke liye patience chahiye hota hai.

Iske alawa, timeframe ka chunao closely trading strategy se juda hua hota hai. Scalping, ek high-frequency trading strategy, quick trades aur chhote profits ke liye extremely short-term timeframes ka istemal karta hai. Ulta, trend-following strategies me lambi timeframes ko use karne ka dhyan hota hai taki sustained market trends ko capture kiya ja sake.

News events aur economic releases ka different timeframes par hone wale asar ko samajhna bhi forex traders ke liye mahatva purna hai. Chhote-term traders ko news announcements ke turant baad hone wale market reactions par adhik dhyan dena padta hai, jabki long-term investors ko broader economic landscape ko prathamikta deni chahiye.

Risk management bhi timeframe par adharit ek mahatva purna pehlu hai. Chhote-term traders volatile markets mein risk ko manage karne ke liye tighter stop-loss orders ka istemal kar sakte hain, jabki long-term investors bade price fluctuations ko dhyan mein rakhte hue wider stop-loss levels ka istemal kar sakte hain.

Ant mein, forex trading mein timeframes ko master karna ek dynamic skill hai jo market conditions aur individual trading preferences ke sath evolve hoti hai. Traders ko apni strategies, risk tolerance, aur overall objectives ke sath mel khate huye timeframes ko dhyan se chunna chahiye taki unke chances of success ko forex ke complex aur hamesha badalte duniya mein badhaya ja sake.

- CL

- Mentions 0

-

سا2 likes

-

#14 Collapse

Timeframe Forex Mein

Timeframe Forex Mein (وقت کا فریم)

Mukhtasar Tafseelat:

Timeframe forex trading mein waqt ki tajziya ke liye istemal hota hai. Yeh traders ko market ki activity ko dekhne aur analyze karne mein madad deta hai.

Kya Hai Timeframe?

Timeframe ek period hai jisme traders market ki activity ko dekhte hain. Yeh period minutes, ghante, ya dinon mein ho sakta hai aur traders apne trading strategies ke mutabiq timeframe choose karte hain.

Kaise Istemal Kiya Jaye:- Timeframe Choose Karna: Har trader apni trading strategy ke mutabiq ek timeframe choose karta hai. Kuch traders chhotay timeframes jese 5-minute ya 15-minute ko prefer karte hain jabke doosre lambay timeframes jese 1 ghante ya dinon ko choose karte hain.

- Price Action Ka Tajziya: Chhotay timeframes par zyada price volatility hoti hai, jabke lambay timeframes par market ki activity stable hoti hai. Traders apne timeframes ke mutabiq price action ka tajziya karte hain.

Mafhum (Interpretation):

Timeframe choose karne ke baad, traders us timeframe ke andar price patterns aur market trends ko analyze karte hain. Yeh unko trading decisions ke liye madad deta hai.

Tips:- Apni trading strategy ke mutabiq timeframe choose karein.

- Doosre technical indicators ke saath saath timeframe ka istemal karein taake sahi trading decisions liya ja sakein

- Timeframe ko select karein: Apni trading strategy ke mutabiq timeframe ko chunna mahatvapurna hai. Choti timeframe jaise ki 5-minute ya 15-minute charts ko istemal karna scalping ke liye uchit ho sakta hai, jabki bade timeframe jaise ki 1-hour ya daily charts ko trend analysis ke liye behtar mana jaata hai. Aapki trading strategy aur aapke risk tolerance ke anusaar timeframe ko chunna avashyak hai.

- Multiple Timeframe Analysis (MTFA): Ek single timeframe ke alawa, doosre timeframe ka bhi istemal karein. Isse aapko ek adhik sahi aur puri tarah se tulanatmak jhalak milti hai. Misal ke taur par, agar aap daily chart par trend identify kar rahe hain, toh aap hourly ya 4-hour charts par entry aur exit points ko confirm karne ke liye dekh sakte hain.

- Technical Indicators: Apne trading strategy ke anusaar technical indicators ka sahi istemal karein. Jyadatar traders moving averages, RSI, MACD, aur Bollinger Bands jaise prasiddh indicators ka istemal karte hain. In indicators ko timeframe ke saath milakar istemal karein taaki aapko sahi entry aur exit points ka pata chale.

- Backtesting: Apni strategy ko backtest karna mat bhoolen. Backtesting ke dwara aap apni strategy ko historical data par test kar sakte hain aur uski prefficiency ko dekh sakte hain. Yeh aapko sahi timeframe aur indicators ka chayan karne mein madad karega.

- Risk Management: Hamesha risk management ka dhyan rakhein. Stop-loss aur take-profit levels ko sahi taur par set karein aur apne trading capital ka sahi taur par prabandhan karein. Yeh aapko nuksan se bachane mein madad karega.

- Patience aur Discipline: Trading mein patience aur discipline bahut mahatvapurna hai. Apne plan ko follow karein aur impulsive decisions se bachein. Agar market conditions aapki strategy ke saath match nahi karti, toh trading na karna bhi ek sahi nirnay ho sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Timeframe In Forex

Forex market mein, "timeframe" woh muddat hoti hai jisme aap market ki analysis karte hain. Har trader apne trading strategy ke mutabiq mukhtalif timeframes ka istemal karta hai. Yahan, kuch common timeframes aur unki tafseel Roman Urdu mein di gayi hai:- Monthly (Mahinayi): Monthly timeframe mein har candlestick ya price bar ek mahine ki performance ko darust karti hai. Is timeframe par focus karke, traders lambi muddat ke trends aur market ke overall direction ko samajhne ki koshish karte hain.

- Weekly (Haftai): Weekly timeframe mein har candlestick ya price bar ek haftay ki performance ko represent karta hai. Is timeframe par focus karke, traders medium-term trends aur market ke major movements ko observe karte hain.

- Daily (Rozana): Daily timeframe mein har candlestick ya price bar ek din ki performance ko darust karti hai. Yeh timeframe commonly day traders aur short-term investors ke liye important hota hai. Daily charts par focus karke, traders short-term trends aur market ki daily fluctuations ko monitor karte hain.

- 4-Hour (4 Ghantay): 4-hour timeframe mein har candlestick ya price bar chaar ghantay ki performance ko show karta hai. Yeh timeframe traders ko market ki chhoti fluctuations aur intraday trends ko observe karne mein madad karta hai.

- 1-Hour (1 Ghanta): 1-hour timeframe mein har candlestick ya price bar ek ghantay ki performance ko represent karta hai. Is timeframe par focus karke traders intraday trading aur short-term trends ko analyze karte hain.

- 15-Minute (15 Minute): 15-minute timeframe mein har candlestick ya price bar pandrah minute ki performance ko darust karti hai. Yeh timeframe day traders ke liye common hota hai jo chhoti muddat mein trading karte hain.

- 5-Minute (5 Minute): 5-minute timeframe mein har candlestick ya price bar paanch minute ki performance ko show karta hai. Yeh timeframe bhi day traders ke liye important hota hai, jo market ke bahut chhotay movements par focus karte hain.

Har timeframe apne apne taur par ahmiyat rakhta hai aur traders apne trading style ke mutabiq inmein se ek ya multiple timeframes ka istemal karte hain. Timeframe ka chunav aapke trading goals, risk tolerance aur trading strategy par depend karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:59 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим