what is marubozu candlestick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Marubozu candlestick pattern Maruibozu Ek Samadhan Hai jismein Koi viks Nahin Hota Jiska Jism Lamba hota hai yah Ek mazbut price ke kaarvayi ka Ishara Dete Hain Kyunki kharidar ya niche wale session per Galba rakhte Hain Marubozu Ek Japani islah hoti hai iska matlab hai Ganja ya Garib se Kata hua yah Mandi hoti hai agar Khuli price Kareeb se upar hai ya Tezi Agar Khuli price band se niche Hai Jab aisa hota hai How tdentify the marubozu candlestick Ek Had Mein price ufki ahmiyat Aur mazamat Ke Andar Chalti Hai yah Ishara karti hai ki kharidar aur Bechne wale Ek sangeen Jung Mein hote hain aur na hi galba rakhte Hain isase yah bhi zahar Karte Hain ke tajron ne apni Chhoti Sar garmiyon ke sath Hath Jor liye hain Marubozu had ko todrsakte hain Jo is baat ki Nishan Dahi karte hain riftar barny Lagi Hoti Hai range ke alava marubozu pattern Ek rujan mein hote hain yah Iske start Vast ya Aakhir Mein Hote Hain Bearish marubozu candlestick Marubbozu candle stick is Baat Ke Nishan Dahi karti hai ki vah kab dastyab Hoti Hai bearish marubozu aamtaur per Ek red ya black mombatti hoti hai aur kam price per Band Ho Jaati Hai Aur iska Lamba Jism bhi frockt ke dabao Ke Nishan Dahi karta hai

How tdentify the marubozu candlestick Ek Had Mein price ufki ahmiyat Aur mazamat Ke Andar Chalti Hai yah Ishara karti hai ki kharidar aur Bechne wale Ek sangeen Jung Mein hote hain aur na hi galba rakhte Hain isase yah bhi zahar Karte Hain ke tajron ne apni Chhoti Sar garmiyon ke sath Hath Jor liye hain Marubozu had ko todrsakte hain Jo is baat ki Nishan Dahi karte hain riftar barny Lagi Hoti Hai range ke alava marubozu pattern Ek rujan mein hote hain yah Iske start Vast ya Aakhir Mein Hote Hain Bearish marubozu candlestick Marubbozu candle stick is Baat Ke Nishan Dahi karti hai ki vah kab dastyab Hoti Hai bearish marubozu aamtaur per Ek red ya black mombatti hoti hai aur kam price per Band Ho Jaati Hai Aur iska Lamba Jism bhi frockt ke dabao Ke Nishan Dahi karta hai Bullish marubbozu candlestick Bullish candle stick Bearish version ke baraks hoti hai yah Lambe tajro ki nazron Ko pakrati Hai jo kam Rask price point per kharidari ke liye mauka Talash karti hai

Marubozu candlestick tell you Marubozu ek strong Paigam Aage bhejta Hai market a direction mein chal rahi hoti hai agar aap mombatti ko tor Hain To aap yah dekh sakte hain ki asaha ki price pure session mein ek direction Mein Tijarat kar rahi hoti hai yah khushiyat Marubozu Khuli aur bandh mombattiyon per Lagu karte hain Iske bavjud ke donon taraf se Chhoti mombattiyan Lagi hoti hai Kyunki kharido firoft Mein dilchas Bhi Itni mazbut Hoti Hai Ke isane market ke dusre Hisse ko zher kar liya Hota Hai

Marubozu candlestick tell you Marubozu ek strong Paigam Aage bhejta Hai market a direction mein chal rahi hoti hai agar aap mombatti ko tor Hain To aap yah dekh sakte hain ki asaha ki price pure session mein ek direction Mein Tijarat kar rahi hoti hai yah khushiyat Marubozu Khuli aur bandh mombattiyon per Lagu karte hain Iske bavjud ke donon taraf se Chhoti mombattiyan Lagi hoti hai Kyunki kharido firoft Mein dilchas Bhi Itni mazbut Hoti Hai Ke isane market ke dusre Hisse ko zher kar liya Hota Hai

-

#3 Collapse

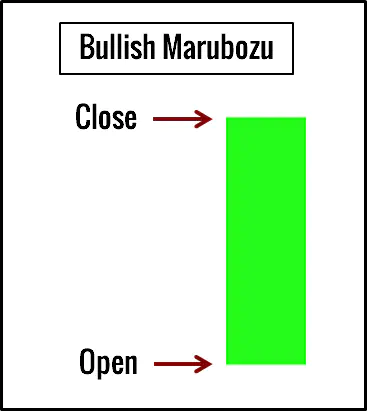

Marubozu candlestick pattern trading mein ek significant indicator hota hai jo traders ko market trends aur potential price movements ko understand karne mein madad karta hai. Ye pattern trading mein decision-making process ko simplify karne ke liye use hota hai aur aksar market mein strong momentum ko represent karta hai. Marubozu candlestick pattern ek aisi candlestick hoti hai jisme koi shadows (wicks) nahi hote. Yani, is candlestick ka high aur low points bilkul open aur close price ke barabar hote hain. Ye pattern do tarike ka hota hai: Bullish Marubozu aur Bearish Marubozu.- Bullish Marubozu:

- Ye tab form hoti hai jab open price day ka lowest point ho aur close price day ka highest point ho. Iska matlab hai ke poore trading session mein buyers ka control tha aur price continuously upar ki taraf move hoti rahi.

- Bearish Marubozu:

- Ye tab form hoti hai jab open price day ka highest point ho aur close price day ka lowest point ho. Iska matlab hai ke poore trading session mein sellers ka control tha aur price continuously neeche ki taraf move hoti rahi.

Marubozu Pattern Ka Importance

Marubozu candlestick pattern ka importance is baat mein hai ke ye market participants ke sentiments aur momentum ko clearly depict karta hai. Jab market mein ek Marubozu candlestick form hoti hai, to isse ye indication milta hai ke market mein strong buying ya selling pressure hai jo current trend ko reinforce karta hai.

Identification of Marubozu Candlestick Pattern

Marubozu candlestick pattern ko identify karna relatively simple hai kyunki is pattern mein koi shadows nahi hote. Isse easily spot kiya ja sakta hai:- Bullish Marubozu:

- White/green candlestick.

- No upper or lower shadows.

- Open price day ka lowest point aur close price day ka highest point hota hai.

- Bearish Marubozu:

- Black/red candlestick.

- No upper or lower shadows.

- Open price day ka highest point aur close price day ka lowest point hota hai.

Marubozu candlestick pattern ki interpretation karte waqt kuch key points ko consider karna chahiye:- Bullish Marubozu:

- Jab Bullish Marubozu form hoti hai, to ye indicate karti hai ke market mein strong buying pressure hai. Buyers poore session ke dauran price ko upar ki taraf push karte rahe. Ye pattern aksar uptrend ke continuation ya downtrend ke reversal ko indicate karta hai.

- Bearish Marubozu:

- Jab Bearish Marubozu form hoti hai, to ye indicate karti hai ke market mein strong selling pressure hai. Sellers poore session ke dauran price ko neeche ki taraf push karte rahe. Ye pattern aksar downtrend ke continuation ya uptrend ke reversal ko indicate karta hai.

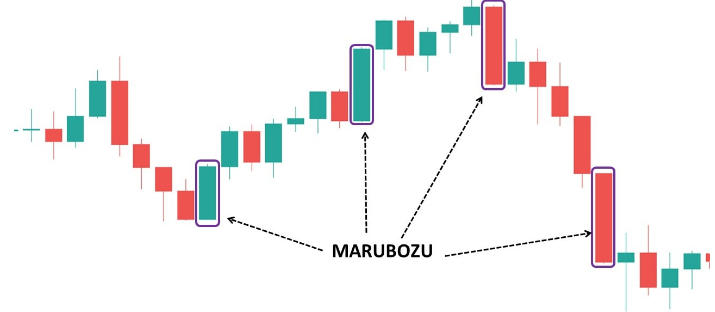

Marubozu candlestick pattern ki effectiveness increase ho sakti hai agar isse broader market context mein analyze kiya jaye. Kuch points jo consider karne chahiye:- Trend Analysis:

- Marubozu pattern ko existing trend ke context mein dekhna chahiye. Agar Bullish Marubozu uptrend mein form hoti hai, to ye trend continuation ko indicate karti hai. Similarly, Bearish Marubozu downtrend mein trend continuation ko indicate karti hai.

- Support and Resistance Levels:

- Marubozu pattern ke formation points ko support aur resistance levels ke nazar se dekhna chahiye. Agar Bullish Marubozu support level ke qareeb form hoti hai, to ye potential trend reversal ko indicate kar sakti hai. Similarly, Bearish Marubozu resistance level ke qareeb trend reversal ko indicate kar sakti hai.

- Volume Analysis:

- Volume analysis bhi important hai. High volume ke sath Marubozu pattern formation strong trend ko indicate karta hai jabke low volume ke sath Marubozu pattern false signal ya weak trend ko indicate kar sakta hai.

Marubozu candlestick pattern ko trading strategies mein implement karne ke kai tareeqe hain. Kuch common strategies yahan discuss ki gayi hain:- Trend Following Strategy:

- Marubozu pattern ko trend following strategy mein use kiya ja sakta hai. For example, agar ek Bullish Marubozu uptrend ke dauran form hoti hai, to trader is pattern ke baad buy position le sakta hai. Similarly, Bearish Marubozu downtrend ke dauran sell signal ko indicate kar sakti hai.

- Breakout Trading:

- Marubozu pattern ko breakout trading strategy mein bhi use kiya ja sakta hai. For example, agar price ek defined range ya level ko break karta hai aur Marubozu pattern form hoti hai, to ye strong breakout ko indicate karta hai. Trader is point par entry le sakta hai.

- Reversal Trading:

- Marubozu pattern ko reversal trading strategy mein bhi use kiya ja sakta hai. For example, agar ek Bullish Marubozu support level ke qareeb form hoti hai, to ye potential trend reversal ko indicate kar sakti hai. Similarly, Bearish Marubozu resistance level ke qareeb trend reversal ko indicate kar sakti hai.

Risk management trading mein bohot important hai, aur Marubozu candlestick pattern ke sath bhi effective risk management strategies implement karni chahiye:- Stop Loss Orders:

- Marubozu pattern ke sath trading karte waqt stop loss orders lagana zaroori hai. Bullish Marubozu ke case mein stop loss pattern ke low point par set karna chahiye, aur Bearish Marubozu ke case mein high point par.

- Position Sizing:

- Position sizing ko trade risk ke hisaab se adjust karna chahiye. Yeh ensure karta hai ke ek single trade failure overall capital par significant impact na dale.

- Diversification:

- Diversification se risk ko distribute karne mein madad milti hai. Multiple trades aur different markets mein positions le kar risk ko manage kiya ja sakta hai.

Marubozu Pattern ke Limitations

Jese ke har trading strategy aur pattern ke apne limitations hote hain, waise hi Marubozu candlestick pattern ke bhi kuch limitations hain:- False Signals:

- Marubozu pattern false signals generate kar sakta hai, especially low volume market conditions mein. Isliye, pattern ko confirm karne ke liye additional indicators aur analysis ka use karna chahiye.

- Market Noise:

- Market noise aur short-term price fluctuations Marubozu pattern ki effectiveness ko impact kar sakte hain. Isliye, pattern ko broader market context aur trends ke sath analyze karna chahiye.

- Reliance on Historical Data:

- Marubozu pattern historical price data par base karta hai, aur future price movements ko accurately predict karne mein limitations ho sakti hain. Isliye, pattern ko future projections ke liye sole indicator nahi banana chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Bullish Marubozu:

-

#4 Collapse

what is marubozu candlestick pattern

Marubozu Ka Matlab

Marubozu candlestick pattern forex trading mein ek bohot aham aur mashhoor pattern hai. Yeh pattern Japanese candlestick charting technique ka hissa hai, jo trading aur technical analysis mein bohot ziada use hota hai. Marubozu ka lafzi matlab "bald" ya "shaven" hai. Yeh is pattern ke smooth aur clear structure ko represent karta hai. Jab market mein strong trend hota hai aur koi fluctuation nahi hoti, to Marubozu candlestick banta hai. Isme candlestick ka body bilkul plain hota hai aur usme koi shadow ya wick nahi hoti, jo ke is baat ki nishani hoti hai ke market ne ek hi direction mein significant move kiya hai. Marubozu pattern ko samajhna aur pehchanana trading decision making mein bohot madadgar ho sakta hai.

Marubozu Ki Pehchan

Marubozu candlestick pattern ki pehchan yeh hai ke isme open aur close ke beech koi shadow nahi hoti. Yeh pattern pure bullish ya bearish nature ka hota hai, jahan opening aur closing prices extreme points pe hote hain. Bullish Marubozu mein opening price lowest point hota hai aur closing price highest point hota hai, jo ke market mein strong buying pressure ko dikhata hai. Bearish Marubozu mein opening price highest point hota hai aur closing price lowest point hota hai, jo ke market mein strong selling pressure ko dikhata hai. Marubozu pattern ke through hum market ki strength aur direction ko bohot easily assess kar sakte hain. Yeh pattern us waqt banta hai jab market mein koi bhi reversal ya hesitation nahi hoti aur price ek direction mein move karta hai.

Bullish Marubozu

Bullish Marubozu candlestick pattern tab banta hai jab opening price lowest point hota hai aur closing price highest point hota hai. Yeh indicate karta hai ke buyers ne poora control sambhal liya hai aur market mein strong bullish sentiment hai. Bullish Marubozu ka presence signify karta hai ke buyers confident hain aur prices ko aur bhi upar le jane ka irada rakhte hain. Bullish Marubozu usually uptrend ke continuation ka signal hota hai, lekin kuch situations mein yeh trend reversal ka bhi indication de sakta hai, khas tor pe jab yeh pattern support level pe banta hai. Traders is pattern ko identify karke buying opportunities ko explore kar sakte hain aur market ke trend ko follow kar sakte hain.

Bearish Marubozu

Bearish Marubozu candlestick pattern tab banta hai jab opening price highest point hota hai aur closing price lowest point hota hai. Yeh indicate karta hai ke sellers ne poora control sambhal liya hai aur market mein strong bearish sentiment hai. Bearish Marubozu ka presence signify karta hai ke sellers confident hain aur prices ko aur bhi niche le jane ka irada rakhte hain. Bearish Marubozu usually downtrend ke continuation ka signal hota hai, lekin kuch situations mein yeh trend reversal ka bhi indication de sakta hai, khas tor pe jab yeh pattern resistance level pe banta hai. Traders is pattern ko identify karke selling opportunities ko explore kar sakte hain aur market ke trend ko follow kar sakte hain.

Forex Trading Mein Marubozu Ki Ahmiyat

Forex trading mein Marubozu candlestick pattern ki bohot ahmiyat hai. Yeh pattern trading decisions lene mein bohot madadgar hota hai. Marubozu pattern market ki direction aur sentiment ko clear aur precise tarike se depict karta hai. Yeh pattern traders ko market ke trend ko identify karne aur sahi direction mein trade lene mein madad karta hai. Marubozu pattern ka study karna aur uski pehchan karna trading ke liye bohot beneficial hota hai. Yeh pattern trend continuation aur trend reversal ko pehchanne mein bhi madadgar hota hai, jo ke trading strategies ko enhance karne mein bohot useful hai.

Trend Continuation Signal

Marubozu candlestick pattern ko trend continuation signal ke tor pe use kiya jata hai. Agar Marubozu ek existing trend mein banta hai, to yeh signal hota hai ke trend continue rehne wala hai. Bullish trend mein bullish Marubozu ka banana indicate karta hai ke market uptrend ko continue kar raha hai aur prices aur bhi upar jayengi. Bearish trend mein bearish Marubozu ka banana indicate karta hai ke market downtrend ko continue kar raha hai aur prices aur bhi niche jayengi. Trend continuation signal ko identify karne se traders ko market ki direction ko assess karne aur apni trading strategy ko align karne mein madad milti hai.

Trend Reversal Signal

Kuch situations mein, Marubozu candlestick pattern trend reversal ka bhi indication de sakta hai. Yeh khas tor pe us waqt hota hai jab yeh pattern support ya resistance level ke qareeb banta hai. Support level pe bullish Marubozu ka banana indicate karta hai ke market ne bottom bana liya hai aur ab upar jaane ke chances hain. Resistance level pe bearish Marubozu ka banana indicate karta hai ke market ne top bana liya hai aur ab niche jaane ke chances hain. Trend reversal signal ko identify karne se traders ko potential turning points ko assess karne aur sahi entry aur exit points ko define karne mein madad milti hai.

Support Aur Resistance Levels

Support aur resistance levels forex trading mein bohot aham hote hain. Yeh levels woh points hote hain jahan price ke aage barhne ya girne ke chances kam hotay hain. Support level woh level hota hai jahan buying interest barh jata hai aur price niche girne se ruk jati hai. Resistance level woh level hota hai jahan selling interest barh jata hai aur price upar barhne se ruk jati hai. Marubozu candlestick pattern support aur resistance levels pe bohot significant hota hai. Support level pe bullish Marubozu ka banana indicate karta hai ke market mein strong buying interest hai aur price upar ja sakti hai. Resistance level pe bearish Marubozu ka banana indicate karta hai ke market mein strong selling interest hai aur price niche ja sakti hai.

Entry Aur Exit Points

Marubozu candlestick pattern traders ko entry aur exit points identify karne mein bohot madad karta hai. Bullish Marubozu ke baad buy karna ek aam strategy hai, kyunke yeh indicate karta hai ke market uptrend ko continue kar raha hai aur prices aur bhi upar ja sakti hain. Bearish Marubozu ke baad sell karna bhi ek aam strategy hai, kyunke yeh indicate karta hai ke market downtrend ko continue kar raha hai aur prices aur bhi niche ja sakti hain. Entry aur exit points ko sahi tarike se identify karne se traders apni trading strategy ko optimize kar sakte hain aur market ke movement ko effectively capture kar sakte hain.

Stop Loss Strategy

Marubozu candlestick pattern ke sath stop loss set karna zaroori hai taake risk manage ho sake. Stop loss ek predefined level hota hai jahan trader apni trade ko close kar deta hai taake loss ko minimize kiya ja sake. Bullish Marubozu ke case mein, stop loss usually candlestick ke lowest point pe set hota hai. Bearish Marubozu ke case mein, stop loss usually candlestick ke highest point pe set hota hai. Stop loss strategy ko implement karne se traders apni risk exposure ko control mein rakh sakte hain aur unexpected market movements se bach sakte hain.

Volume Ka Role

Volume bhi Marubozu candlestick pattern ki reliability ko check karne mein bohot madadgar hota hai. High volume ka matlab hai ke pattern zyada strong hai aur market participants ka strong interest hai. Low volume ka matlab hai ke pattern kam reliable hai aur market participants ka interest kam hai. Volume ko analyze karne se traders pattern ki strength ko assess kar sakte hain aur trading decisions ko improve kar sakte hain. High volume ke sath Marubozu pattern ka banana ek strong signal hota hai ke market mein strong trend hai aur yeh trend continue reh sakta hai.

Combining With Other Indicators

Marubozu candlestick pattern ko doosre technical indicators ke sath mila ke bhi use kiya ja sakta hai. Isse trading signals ki accuracy barh jati hai. Moving averages, RSI, MACD aur Bollinger Bands jaise indicators ko Marubozu pattern ke sath combine karne se traders ko zyada reliable trading signals milte hain. Yeh indicators market ki overall trend aur strength ko assess karne mein madadgar hote hain aur Marubozu pattern ke sath mil ke trading strategy ko enhance karte hain. Combining indicators se traders ko multiple confirmations milti hain jo ke trading decisions ko aur bhi strong banati hain.

Time Frames

Different time frames pe Marubozu candlestick pattern ki significance bhi different hoti hai. Higher time frames pe yeh pattern zyada reliable hota hai kyunke higher time frames pe price movements zyada stable aur reliable hote hain. Lower time frames pe Marubozu pattern ka reliability kam hota hai kyunke lower time frames pe price movements zyada volatile aur choppy hote hain. Time frames ko analyze karne se traders pattern ki significance ko assess kar sakte hain aur apni trading strategy ko us hisab se adjust kar sakte hain. Higher time frames pe Marubozu pattern ka banana ek strong signal hota hai ke market mein strong trend hai aur yeh trend continue reh sakta hai.

Common Mistakes

Marubozu candlestick pattern ko identify karte waqt kuch common mistakes bhi hoti hain. Inse bachne ke liye pattern ko achi tarah samajhna zaroori hai. Pehli mistake yeh hoti hai ke incomplete candlestick ko Marubozu samajh lena. Marubozu pattern mein koi shadow nahi hoti, isliye agar shadow ho to yeh Marubozu nahi hai. Doosri mistake yeh hoti hai ke low volume ke sath pattern ko reliable samajh lena. High volume ke sath Marubozu pattern zyada reliable hota hai. Teesri mistake yeh hoti hai ke pattern ko support aur resistance levels ke bagair analyze karna. Support aur resistance levels ke saath pattern ko analyze karna zaroori hai taake market ki strength aur direction ko sahi tarike se assess kiya ja sake.

Importance of Confirmation

Koi bhi trade lene se pehle confirmation lena zaroori hai. Sirf Marubozu candlestick pattern pe rely karna risky ho sakta hai. Confirmation lene ke liye different methods use kiye ja sakte hain, jaise ke doosre technical indicators, volume analysis, aur support aur resistance levels ka study. Confirmation lene se trading signals ki accuracy barh jati hai aur trading decisions zyada reliable ho jate hain. Marubozu pattern ke sath multiple confirmations lene se traders apni trading strategy ko optimize kar sakte hain aur market ke movements ko effectively capture kar sakte hain.

Psychological Aspect

Marubozu candlestick pattern trading mein psychological aspects ko bhi address karta hai. Yeh pattern market sentiment ko achi tarah reflect karta hai. Bullish Marubozu ka banana indicate karta hai ke buyers confident hain aur prices ko upar le jane ka irada rakhte hain. Bearish Marubozu ka banana indicate karta hai ke sellers confident hain aur prices ko niche le jane ka irada rakhte hain. Market sentiment ko analyze karne se traders ko market ki psychology ko samajhne aur trading decisions ko align karne mein madad milti hai. Marubozu pattern ke psychological aspect ko samajh ke traders apni trading performance ko improve kar sakte hain.

Real-Life Examples

Marubozu candlestick pattern ke real-life examples ko study karna bhi beneficial hota hai. Yeh aapko pattern ko live market mein dekhne ka moka deta hai. Real-life examples ko analyze karne se traders pattern ki practical application ko samajh sakte hain aur market ke different scenarios mein pattern ki significance ko assess kar sakte hain. Real-life examples ko study karne se traders ko pattern ki strengths aur weaknesses ko identify karne mein madad milti hai aur apni trading strategy ko enhance karne ka moka milta hai. Marubozu pattern ke real-life examples ko dekhne se traders ko market ki dynamics ko better understand karne ka moka milta hai.

Learning Resources

Marubozu candlestick pattern ke baray mein mazeed seekhne ke liye different resources available hain. Books, online courses, webinars, aur trading forums kuch aise resources hain jahan se traders Marubozu pattern ke baray mein detailed knowledge hasil kar sakte hain. Yeh resources traders ko pattern ki theoretical aur practical aspects ko samajhne mein madadgar hote hain. Learning resources ko utilize karne se traders apni trading knowledge ko expand kar sakte hain aur market ki dynamics ko better understand kar sakte hain. Marubozu pattern ke baray mein detailed study karne se traders apni trading performance ko improve kar sakte hain.

Conclusion

Marubozu candlestick pattern forex trading mein ek powerful tool hai. Isko samajh ke aur sahi tarah use karke aap apni trading performance ko improve kar sakte hain. Marubozu pattern market ki direction aur sentiment ko clear aur precise tarike se depict karta hai aur traders ko trading decisions lene mein bohot madad karta hai. Trend continuation aur trend reversal ko pehchanne mein Marubozu pattern bohot useful hota hai. Different technical indicators ke sath isko combine karne se trading signals ki accuracy barh jati hai. Marubozu pattern ko study karne aur real-life examples ko analyze karne se traders pattern ki practical application ko samajh sakte hain aur market ke different scenarios mein pattern ki significance ko assess kar sakte hain. -

#5 Collapse

Marubozu candlestick pattern ek important technical analysis tool hai jo traders ko market trends aur price movement ke bare mein information deta hai. Is pattern ka naam Japanese word "marubozu" se aya hai jo "close-cropped" ya "bald" ke meaning ko represent karta hai. Marubozu candlestick pattern ek strong signal provide karta hai regarding the direction of the market, as well as potential trend reversals.

Is article mein hum Marubozu candlestick pattern ke bare mein detailed information denge, including its characteristics, types, significance, aur trading strategies. Yeh pattern kis tarah se market analysis mein istemal hota hai aur kaise traders isse benefit le sakte hain, sab kuch yahan cover kiya jayega. Let's dive in and explore the world of Marubozu candlestick pattern.

1. Marubozu Candlestick Pattern: An Overview

Marubozu candlestick pattern ek single candlestick pattern hai jo market mein strong trend ke existence ko indicate karta hai. Yeh pattern price analysis ke liye useful hai aur traders ke liye potential trading opportunities create karta hai. Marubozu candlestick pattern mein kewal ek hi candlestick hota hai, jo ke bare mein hum neeche discuss karenge.

Is pattern mein, market close ke either near the high or near the low hota hai, indicating strong buying or selling pressure. Marubozu candlestick pattern ko analyze karke traders market ka trend determine kar sakte hain aur trading decisions le sakte hain.

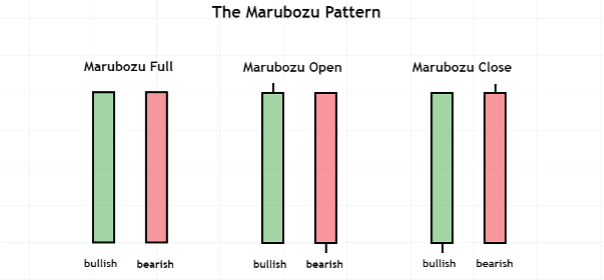

2. Characteristics of Marubozu Candlestick Pattern

Marubozu candlestick pattern ka primary characteristic hota hai its lack of wicks. Iska matlab hai ke market open ya close ke near hi price movement hota hai, indicating strong momentum in one direction. Marubozu candlestick pattern ke kuch key characteristics neeche diye gaye hain:

- Ek single candlestick: Marubozu pattern mein ek hi candlestick hota hai, indicating a strong trend.

- Lack of wicks: Marubozu candlestick mein wicks ya shadows nahi hote hain, representing consistent buying or selling pressure.

- Market close near the high or low: Agar Marubozu candlestick bullish hai, to market close near the high hoga, indicating strong buying pressure. Aur agar bearish hai, to market close near the low hoga, indicating strong selling pressure.

- Length of the candle: Marubozu candlestick ka length ko importance di jati hai. Longer the candle, stronger the trend.

3. Types of Marubozu Candlestick Patterns

Marubozu candlestick pattern ke do primary types hote hain:

- Bullish Marubozu: Bullish Marubozu pattern market mein strong buying pressure indicate karta hai. Is pattern mein open price near the low hota hai, aur close price near the high hota hai. Bullish Marubozu candlestick bullish trend ke continuation ya trend reversal ko represent karta hai.

- Bearish Marubozu: Bearish Marubozu pattern market mein strong selling pressure indicate karta hai. Is pattern mein open price near the high hota hai, aur close price near the low hota hai. Bearish Marubozu candlestick bearish trend ke continuation ya trend reversal ko represent karta hai.

4. Significance of Marubozu Candlestick Pattern

Marubozu candlestick pattern ka significance market analysis mein bohot jyada hota hai. Is pattern ke presence se traders ko market sentiment aur trend ke bare mein clarity milti hai. Marubozu candlestick pattern ke kuch key significance neeche diye gaye hain:

- Strong trend indication: Marubozu candlestick pattern market mein strong trend ke existence ko indicate karta hai. Agar Marubozu pattern bullish hai, to strong buying pressure indicate karta hai. Aur agar bearish hai, to strong selling pressure indicate karta hai.

- Potential trend reversal: Marubozu candlestick pattern aksar trend reversals ke indication ke liye use hota hai. Agar market mein trend change hone wala hai, to Marubozu pattern traders ko is change ke bare mein warning deta hai.

- Entry and exit points: Traders is pattern ka istemal karke trading opportunities identify kar sakte hain. Agar Marubozu bullish hai, to traders buying positions enter kar sakte hain. Aur agar bearish hai, to selling positions enter kar sakte hain.

- Confirmation with other indicators: Marubozu candlestick pattern ko dusre technical indicators ke sath combine karke traders more accurate predictions kar sakte hain. Isse market analysis improve hoti hai aur trading decisions more informed ho jate hain.

5. Trading Strategies with Marubozu Candlestick Pattern

Marubozu candlestick pattern ke sath traders different trading strategies use karte hain to take advantage of market opportunities. Kuch popular trading strategies neeche diye gaye hain:

- Trend following strategy: Agar Marubozu candlestick bullish hai, to traders long positions enter kar sakte hain to follow the bullish trend. Aur agar bearish hai, to short positions enter kar sakte hain to follow the bearish trend.

- Reversal trading strategy: Agar Marubozu candlestick bullish hai aur uptrend mein hai, to traders short positions enter kar sakte hain to catch the potential trend reversal. Aur agar bearish hai aur downtrend mein hai, to traders long positions enter kar sakte hain to catch the potential trend reversal.

- Stop loss and take profit strategy: Traders stop loss aur take profit levels set karte hain based on Marubozu candlestick pattern to manage risk aur protect their profits. Stop loss level ko set karna important hai to limit losses in case of adverse market movements.

6. How to Identify Marubozu Candlestick Pattern

Marubozu candlestick pattern ko identify karne ke liye traders ko candlestick charts analyze karna hota hai. Marubozu pattern recognition mein kuch key steps neeche diye gaye hain:

- Look for a single candlestick: Marubozu pattern mein ek hi candlestick hota hai, jo market mein strong trend ke existence ko indicate karta hai. Traders should look for a single candlestick with no wicks or shadows.

- Identify the open and close prices: Agar Marubozu pattern bullish hai, to open price near the low hoga, aur close price near the high hoga. Aur agar bearish hai, to open price near the high hoga, aur close price near the low hoga.

- Analyze the length of the candle: Marubozu candlestick ka length bhi important hota hai. Longer the candle, stronger the trend. Traders should pay attention to the length of the candle to assess the strength of the trend.

- Compare with other indicators: Marubozu candlestick pattern ko confirm karne ke liye traders should compare it with other technical indicators like moving averages, RSI, aur MACD. Isse more accurate market analysis ho sakti hai.

7. Conclusion

Summing up, Marubozu candlestick pattern ek powerful technical analysis tool hai jo traders ko market trends aur price movement ke bare mein information deta hai. Is pattern ka presence traders ko strong trend indication provide karta hai, aur trading decisions improve karta hai. Is article mein hum ne Marubozu candlestick pattern ke characteristics, types, significance, aur trading strategies ke bare mein detailed information di hai.

Traders ko Marubozu candlestick pattern ka istemal kar ke market analysis improve kar sakte hain aur trading opportunities identify kar sakte hain. Is pattern ko properly recognize karne ke liye traders ko candlestick charts analyze karna aana chahiye aur technical indicators ke sath combine karna chahiye. With the right knowledge aur skills, traders can use Marubozu candlestick pattern effectively to enhance their trading performance.

Hopefully, yeh article aapko Marubozu candlestick pattern ke importance aur implementation ke bare mein valuable information provide kiya hoga. Agar aapko koi sawal ya feedback hai, toh aap humse comment section mein share kar sakte hain. Happy trading! -

#6 Collapse

**What is Marubozu Candlestick Pattern?**

Marubozu candlestick pattern aik important aur commonly used pattern hai jo price action aur market sentiment ko reflect karta hai. Yeh pattern Japanese word "Marubozu" se liya gaya hai, jiska matlab hota hai "bald" ya "shaven." Is pattern mein candlestick ke upar ya neeche koi shadow nahi hoti, sirf ek solid body hoti hai. Marubozu pattern bullish ya bearish dono ho sakta hai aur yeh market ke strong trend ko indicate karta hai.

**Structure aur Identification**

Marubozu pattern ko identify karna asaan hai kyunki ismein sirf ek solid body hoti hai aur koi upper ya lower shadow nahi hoti. Is pattern ka structure kuch is tarah ka hota hai:

1. **Bullish Marubozu:** Bullish Marubozu pattern ek strong uptrend ko indicate karta hai. Ismein opening price lowest point hota hai aur closing price highest point hota hai. Yeh indicate karta hai ke buyers poore session mein dominant rahe.

2. **Bearish Marubozu:** Bearish Marubozu pattern ek strong downtrend ko indicate karta hai. Ismein opening price highest point hota hai aur closing price lowest point hota hai. Yeh indicate karta hai ke sellers poore session mein dominant rahe.

**Key Characteristics**

1. **No Shadows:** Marubozu pattern mein upper aur lower shadows nahi hoti. Iska matlab hai ke session ke dauran price sirf ek direction mein move karta hai.

2. **Full Body:** Candlestick ki body poori hoti hai jo market participants ki strong conviction ko show karti hai.

**Implications aur Trading Strategy**

Marubozu pattern ko dekhte hue traders ko market ke strong trend ko samajhna chahiye aur accordingly apni positions ko adjust karna chahiye. Yahan kuch strategies hain jo is pattern ke analysis ke baad use ki ja sakti hain:

1. **Trend Following:** Bullish Marubozu pattern ko dekhte hue long positions le sakte hain aur bearish Marubozu pattern ko dekhte hue short positions le sakte hain. Yeh trend following strategy market ke strong moves ka faida uthane mein madadgar hoti hai.

2. **Stop Loss:** Marubozu pattern ke time, stop loss ko use karna zaruri hai taake potential losses se bacha ja sake. Yeh stop loss pattern ki body ke opposite end pe place karna chahiye.

3. **Technical Indicators:** MACD, RSI jaise technical indicators ko use karke pattern ki confirmation ko aur bhi strengthen kiya ja sakta hai.

**Conclusion**

Marubozu candlestick pattern ek powerful indicator hai jo market ke strong trend ko indicate karta hai. Is pattern ko identify karne aur uski confirmation ke liye proper analysis aur technical indicators ka use karna zaruri hai. Yeh pattern traders ko market ke future movements ko predict karne mein madad karta hai aur unhe profitable trading decisions lene mein assist karta hai.

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

Marubozu candlestick pattern ek simple aur important candlestick pattern hai jo trend continuation ya reversal ke strong signals provide karta hai. Yeh pattern typically kisi bhi shadow (wick) ke baghair hota hai, ya shadows bohot choti hoti hain. Marubozu candlestick pattern ke do types hain: Bullish Marubozu aur Bearish Marubozu.

Types of Marubozu Candlestick Patterns- Bullish Marubozu:

- Description: Bullish Marubozu candlestick ek long green (white) body hoti hai jisme opening price lowest point aur closing price highest point hoti hai. Yeh indicate karta hai ke buyers ne poore session ke dauran control maintain kiya.

- Interpretation: Bullish Marubozu ek strong bullish signal hai jo indicate karta hai ke market mein upward momentum hai aur price aur zyada rise ho sakti hai.

- Bearish Marubozu:

- Description: Bearish Marubozu candlestick ek long red (black) body hoti hai jisme opening price highest point aur closing price lowest point hoti hai. Yeh indicate karta hai ke sellers ne poore session ke dauran control maintain kiya.

- Interpretation: Bearish Marubozu ek strong bearish signal hai jo indicate karta hai ke market mein downward momentum hai aur price aur zyada fall ho sakti hai.

- No Shadows: Marubozu candles ke upper aur lower shadows ya to bilkul nahi hote ya bohot chote hote hain.

- Strong Trend Indicator: Yeh pattern strong trend continuation ya reversal ka indication hota hai.

- Bullish Marubozu Trading:

- Entry Point: Bullish Marubozu dekhne ke baad next candle ke open par buy position enter karein.

- Stop Loss: Previous candle ke low par stop loss set karein.

- Take Profit: Previous resistance levels ya Fibonacci retracement levels ko target karein.

- Bearish Marubozu Trading:

- Entry Point: Bearish Marubozu dekhne ke baad next candle ke open par sell position enter karein.

- Stop Loss: Previous candle ke high par stop loss set karein.

- Take Profit: Previous support levels ya Fibonacci retracement levels ko target karein.

- Uptrend Continuation: Agar Bullish Marubozu uptrend ke dauran form ho, to yeh signal hota hai ke trend continue hoga.

- Downtrend Continuation: Agar Bearish Marubozu downtrend ke dauran form ho, to yeh signal hota hai ke trend continue hoga.

- Trend Reversal: Bullish Marubozu agar downtrend ke end par form ho, to yeh reversal ka indication de sakta hai. Similarly, Bearish Marubozu agar uptrend ke end par form ho, to yeh reversal ka indication de sakta hai.

Marubozu candlestick pattern ek powerful tool hai jo traders ko market trend aur momentum samajhne mein madad deta hai. Yeh pattern simple hai magar effective signals provide karta hai jo trading decisions ko enhance kar sakte hain. Aapko is pattern ko identify karna aur effectively use karna ana chahiye taake aap apni trading strategy ko improve kar sakein.

- Bullish Marubozu:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

### Marubozu Candlestick Pattern Ki Ahmiyat

Marubozu candlestick pattern, jo trading aur technical analysis mein bahut ma'roof hai, ek khas tarah ka candlestick hai jo market ki strong momentum ko darshata hai. Yeh pattern aksar kisi bhi time frame mein banta hai aur iski pehchan karna traders ke liye behad zaroori hota hai. Marubozu ka matlab hai "khaali," jo iske structure ko samjhaata hai—yani is pattern mein na koi upper shadow hoti hai aur na hi lower shadow.

Marubozu candlestick do tarah ki hoti hai: bullish aur bearish. Bullish marubozu woh hota hai jab candlestick ki body ka rang safed ya green hota hai, jo is baat ka izhar karta hai ke buyers ne poore din market par control hasil kiya. Is pattern ka formation tab hota hai jab opening price aur closing price ke darmiyan koi bhi rukawat nahi hoti, yani price sirf upar ki taraf hi chalti hai. Yeh signal karta hai ke market mein strong buying pressure hai aur agla trend bullish ho sakta hai.

Dusri taraf, bearish marubozu woh hota hai jab candlestick ki body ka rang kala ya red hota hai. Iska matlab yeh hai ke sellers ne market par pakar hasil ki hai. Is pattern mein bhi opening price se closing price tak koi shadow nahi hoti, jo yeh darshata hai ke poore din price neeche ki taraf hi chalti rahi. Yeh signal karta hai ke market mein strong selling pressure hai aur yeh bearish trend ki taraf ishara karta hai.

Marubozu candlestick pattern ki ahmiyat sirf market movements tak hi mehdood nahi hai; yeh risk management aur trading strategy mein bhi madadgar hota hai. Traders is pattern ko identify karke apne entry aur exit points ko behtar bana sakte hain. Agar bullish marubozu ke baad price upar jati hai, to traders entry lene ke liye tayar ho sakte hain. Wahi bearish marubozu ke baad, agar price neeche jati hai, to exit ya short position lene ka waqt ho sakta hai.

Marubozu candlestick pattern ki pehchan karne ke liye volume ka bhi khayal rakhna chahiye. Agar pattern ke saath volume zyada ho, to yeh signal ko aur bhi mazboot banata hai. Is tarah, marubozu pattern traders ko market ke bullish ya bearish trend ko samajhne mein madad karta hai, aur iski sahih pehchan unke trading decisions ko behtar banane mein kaamyaab hoti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:15 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим