MACD indicator kya ha or uska use kesy krty han.

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

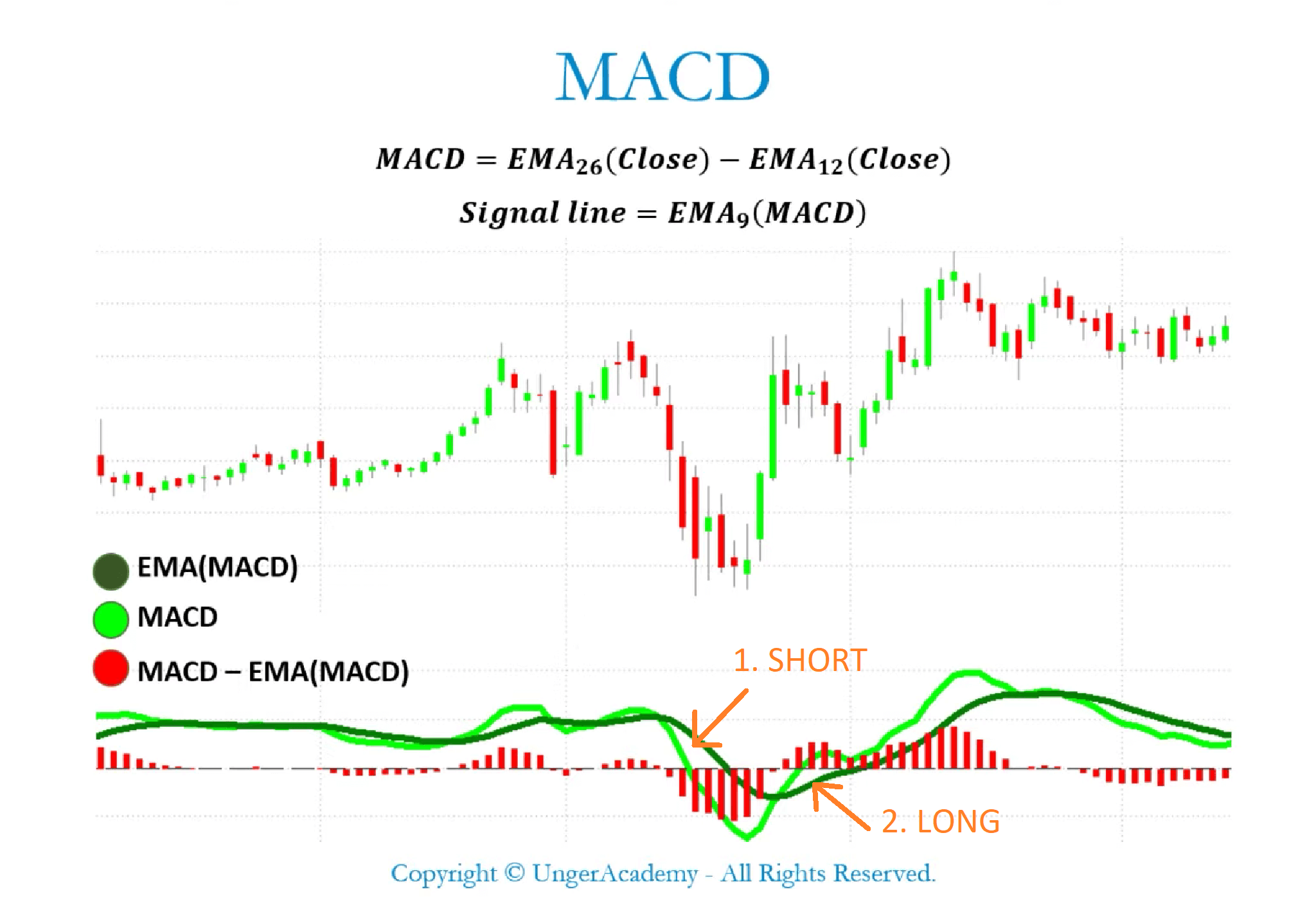

What IS MACD INDICATOR.INTRODUCTION: MACD (Moving Average Convergence Divergence) aik technical analysis indicator hai jo stocks, commodities, currencies aur 2sry financial instruments ki price trends ko analyze karne mein istemal hota hai. Ye indicator traders aur investors ky liye trend aur momentum ka pata lagane mein madad karta hai.FORMULA:Is indicator ka formula 2 EMA (Exponential Moving Average) lines kY beech ky difference par based Krta hai: MACD Line aur Signal Line. MACD Line ka formula: MACD Line = 12-period EMA - 26-period EMA Signal Line ka formula: Signal Line= 9-period EMA of MACD Line DETAILS: Iska matlab hota hai ky MACD Line pehle 12 trading periods (jaise daily, weekly, ya monthly) ki EMA ka average hota hai aur isme sy 26 trading periods ki EMA ka average subtract hota hai. Is tarah sy aik line banati hai jise MACD Line kehte hain. Is line ki values positive ya negative ho sakti hain. Phr is MACD Line ka 9 trading periods ki EMA calculate kiya jata hai, jise Signal Line kehte hain. Signal Line ko MACD Line ky saath compare karke buy aur sell signals generate kiye jate hain.Important Terms: Is indicator ki kuch important terms hain: 1: MACD Line: Price trends ko reflect karta hai. Agar MACD Line positive hai toh ye uptrend ko indicate karta hai, jabky agar negative hai toh downtrend ko indicate karta hai. 2: Signal Line: MACD Line ki values ka moving average hota hai. Jab MACD Line Signal Line ko upar sy cross karta hai, toh ye aik buy signal deta hai. Jab MACD Line Signal Line ko niche sy cross karta hai, toh ye aik sell signal deta hai. 3: Histogram: MACD Line aur Signal Line ky beech ki difference ko histogram ky roop mein represent kiya jata hai. Positive histogram uptrend aur negative histogram downtrend ko show karta hai.USES:- MACD ka istemal primarily trend direction aur momentum ko analyze krny ky liye hota hai. Traders is indicator ko price patterns aur other technical indicators ky saath combine karke trading decisions lete hain. MACD ky signals ka istemal karte waqt traders ko chahiye ky wo 2sry indicators aur price action ko bhi consider karein, kyunki ye kabhi-kabhi false signals generate kar sakta hai.

- Iska istemal short-term aur long-term trading mein kiya ja sakta hai. Short-term traders ko zyada frequent signals milte hain, jabky long-term investors ky liye ye trend changes ko detect karne mein madad karta hai.

CONCLUSION: To conclude, MACD aik popular technical analysis tool hai jo traders aur investors ko price trends aur momentum ky analyze karne mein madad karta hai. Iska formula simple hai aur iske signals trend direction ky liye useful hoty hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

MOVING AVERAGE CONVERGENCE DIVERGENCE(MACD) INDICATOR Moving average convergence divergence indicator Ek technical indicator Hai Jisko ham trend following Momentum indicator bhi Kahate Hain yah indicator exponential moving average security price moving average convergent divergent indicator ko ham exponential moving average ke26 periods EMA12 Ko minus Karke calculate kar sakte hain. BUY AND SELL SIGNAL Moving average convergence divergence indicator ko Ham Ek Line ki madad se calculate kar sakte hain moving average convergence indicator Ek Long term trading. per moshtamil Hota Hai agar exponential moving average convergence divergence line per nine days EMA Draw Karte Hain To yah Hamen signal line provide karti hai Jisko ham moving average convergence divergence indicator ke top per Lagate Hain Jo Hamen buy aur sell signal Deti Hai. Market Mein Jab MACD ki line security line ko OPER SE cross Karti Hain To trader apni trade ko BUY mein open Karte Hain lekin Jab MACD ki lines security line Ke Niche Se cross Karti Hain To PHEr trader apni trade ko SLL mein open Karte Hain moving average convergent divergent indicator ke liye Ham cross overs divergence aur Rapid rise aur Falls wale method istemal Karte Hain. CALCULATIONS MACD ko calculate karne ke liye hum long term EMA 26 periods ko short term EMA 12periods mein se minus kar dety hain.EMA hamein recent data points provide karta hai.EMA recent prices ke data ko simple moviving average SMA se zyada accurate data provide karta hai. EXPLANATION MACD market ki positive value ko show karta hai.jub market mein long term EMA aur short term EMA difference paida hota tu hamein price difference maloom ho jata hai jiski madad se hum market ki positivity aur negativity ko asani se maloom kar saktey hain aur easily market ke buy aur sell signal ko difference ki buniyad per maloom kar saktey hain.es chart ki madad se hum market ki positivity aur negativity ko ba asani dekh saktey hain.

CALCULATIONS MACD ko calculate karne ke liye hum long term EMA 26 periods ko short term EMA 12periods mein se minus kar dety hain.EMA hamein recent data points provide karta hai.EMA recent prices ke data ko simple moviving average SMA se zyada accurate data provide karta hai. EXPLANATION MACD market ki positive value ko show karta hai.jub market mein long term EMA aur short term EMA difference paida hota tu hamein price difference maloom ho jata hai jiski madad se hum market ki positivity aur negativity ko asani se maloom kar saktey hain aur easily market ke buy aur sell signal ko difference ki buniyad per maloom kar saktey hain.es chart ki madad se hum market ki positivity aur negativity ko ba asani dekh saktey hain.  MACD ko aksar okat histogram per dekhia jata hai jo graph aur MACD ke darmiyan aur signal line ke darmiyan taulok ko show karta hai.

MACD ko aksar okat histogram per dekhia jata hai jo graph aur MACD ke darmiyan aur signal line ke darmiyan taulok ko show karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:08 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим