Engulfing candlestick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

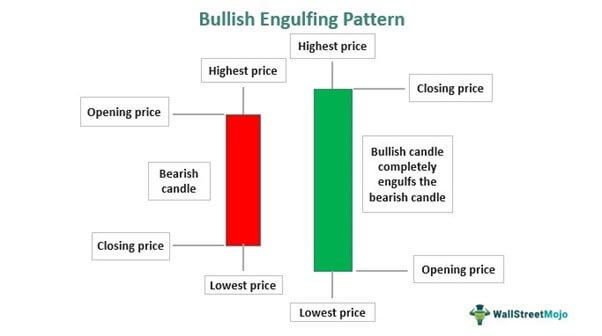

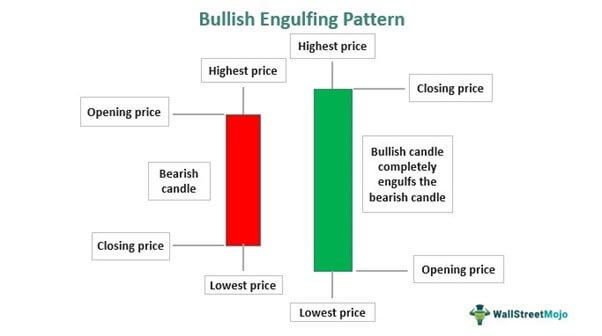

Engulfing candlestick pattern Mombattiyon ko lipatna maarkeet Mein maujuda rujan ke ulat jaane ka Ishara Dete Hain is maksus pattern Mein Two mombattiyan Shamil ho sakti hai jinmen bad wale mombatti Iske Samne mombatti ke pure body ko engulifing kar deti hai engulfing candle is Baat per munasir hoti hai ki yah mujda rujan ke Hawale Se Kahan banti hai Bullish engulfing candlestick Bullish engulfing candle down trading ke nichle Hisse Mein zhar hone per strong tren Signa from karte hain aur kharidari ke dabao mein izafe Ki Nishanidi Karte Hain Tezi ki lipt mein aane wala pattern Aksar maujuda rujan ke ulat jaane ka sabahas banta hai Kyunki zyada kharidar market Mein dakhil hote hain aur kimaten Mazeed badhati Hai pattern Mein dusri mombatti ke sath do mombattiyan Shamil hoti hai jo pichhali Sar mombatti ke body ko completely Taur per lipty hoti hai

Bullish engulfing candlestick Bullish engulfing candle down trading ke nichle Hisse Mein zhar hone per strong tren Signa from karte hain aur kharidari ke dabao mein izafe Ki Nishanidi Karte Hain Tezi ki lipt mein aane wala pattern Aksar maujuda rujan ke ulat jaane ka sabahas banta hai Kyunki zyada kharidar market Mein dakhil hote hain aur kimaten Mazeed badhati Hai pattern Mein dusri mombatti ke sath do mombattiyan Shamil hoti hai jo pichhali Sar mombatti ke body ko completely Taur per lipty hoti hai  Interpretation Jab Tezi ka namuna zahar hota hai to price ki kaarvayi ko wazy Kami ka rujan dikhana hota hai Bhari tezi ki mombatti zahar Karti Hai yah kharidar market Mein Ja Raha Na Andaaz Mein Jama ho rahe hote hain aur y ah Mazid Upar ki Raftar ke liye ibtadi tasab fram karti hai Iske bad tajer is baat ki tasdik Ki Talash Karte Hain Ki Ishare aur mazamat ki kaledi Sattu aur engulfing pattern ke bad price ki kaarvayi ka use Karke rujan vaki change Hota Hai Bearish engulfing Bearish in engulfing pattern Tezi ke Pattern ke bilkul bar Aks Hota Hai yah upri rujan ke upri Hisse per zahar Hota Hai strong tren signal from karta hai aur firokt ke dabao mein ijaafe ki Nishan Dahi Karte Hain bearish englfing candle Aksar majuda rujan ko changes karne ka sabab banta hai Kyunki tyada firokt Kunda market Mein dakhil Hote Hain aur price ko Mazid niche Le Aate Hain pattern mein dusri mombatti ke sath two mombattiyan Shamil hoti hai

Interpretation Jab Tezi ka namuna zahar hota hai to price ki kaarvayi ko wazy Kami ka rujan dikhana hota hai Bhari tezi ki mombatti zahar Karti Hai yah kharidar market Mein Ja Raha Na Andaaz Mein Jama ho rahe hote hain aur y ah Mazid Upar ki Raftar ke liye ibtadi tasab fram karti hai Iske bad tajer is baat ki tasdik Ki Talash Karte Hain Ki Ishare aur mazamat ki kaledi Sattu aur engulfing pattern ke bad price ki kaarvayi ka use Karke rujan vaki change Hota Hai Bearish engulfing Bearish in engulfing pattern Tezi ke Pattern ke bilkul bar Aks Hota Hai yah upri rujan ke upri Hisse per zahar Hota Hai strong tren signal from karta hai aur firokt ke dabao mein ijaafe ki Nishan Dahi Karte Hain bearish englfing candle Aksar majuda rujan ko changes karne ka sabab banta hai Kyunki tyada firokt Kunda market Mein dakhil Hote Hain aur price ko Mazid niche Le Aate Hain pattern mein dusri mombatti ke sath two mombattiyan Shamil hoti hai

-

#3 Collapse

BASIC CONCEPT OF ENGULFING PATTERN:- forex business mein ess pattern ko khas importance di jati hy, qyu ky yeh pattern reversal pattern hota hai. Yeh pattern kisi bi market trend kay give up hony per create hota hay.ess pattern ko perceive krna bohot easy hota hy. Day by day ki jo candle bohot short frame ki ho aor is ki wicks large hon. Or agly din ki jo full candle banti hai. ess ko hum engulfing candle kehty hein. jab marketplace mein ek trend complete ho jata hai to next trend ki ki begin mein yah pattern hamen najar aata hai aur yah hamare liye kisi bhi trend ki confirmation hoti hay.Jab kabhi bhi market chat main aapko is Tarah ki ummid najar Aaye ki pahli candle se dusri candles ki body badi najar Aaye to uss ko aap engulfing pattern kahein gy. DESCRIPTION OF ENGULFING PATTERN:- Friends basically jab tak hum forex trading mein candlestick patterns ko nahin samjhein ge tu hum kabhi bhi successful nahin ho sakte kyun ky aap ka pattern aapko complete market information ky related batata hai ki kab market upward jaane wali hai aur kab market downward mein jaane wali hay.esi liye agar aap candlesticks per expertise hasil kar lenge to aap bahut hi achcha profit earning ker sakein gy.jab bhi eik bullish candle eik bearish candle ko complete cover kar ley gi ya uska size bearish candle sey two times large ho ga tu uss ko Ham bearish engulfing kahenge engulfing ka basically matlab hota hai ky gair Lena yah complete cover kar lena.aor jab bhi ek bullish candle aur uss ky baad eik bearish candle aaye Jo completely apne se last wali bullish candle ko cover kar ley aur body mein bearish candle sey two times size mein big ho tu uss ko ham forex trading ki language mein bearish engulfing kahate hain. bearish engulfing ka matlab hy ke aapki yeh candle aap ki bullish candle ko completely cover kar le to uss ky baad Jo candle bane gi woh aapki bearish engulfing candle hogi. yeh pattern aesa hota jo traders ko trading mein complete guidence provide kert hy. ADVANTAGES OF ENGULFING PATTERN:- yeh pattern market mein traders ko entry point ya exit point ki complete information deta hy.ess pattern ko follow kerny waly traders lazmi stop loss aur take profit ko use kerty hein kyu ky market kisi bi effect ki waja sy suddenly apni trend aur direction ky opposite move kerna start ker deti jis ki waja sy bhout sary traders ka loss bi ho jata hy.aesi situationmmein agar stop loss ka use na kiya jaye tu traders ka capital complete loss bi ho sakta hy. jitna ziada apka experience barhta chla jay ga to ap confident se trade bi laga saken gy . ap ka agar confidence hoga to ap trade bi accurately laga saken gy aur market ki movement ko notice bi kar saken gy .eik bat ka khayal rakhen keh apne stop loss ko lazmi mind mein rakhn hy.yeh only method hy big loss sy bachny ka. -

#4 Collapse

**ENGULFING CANDLESTICKS PATTERN IN FOREX ** **INTRODUCTION** Ghairat candlestick pattern forex trading mein ek ahem price action pattern hai jo traders ko trend reversals ka pata lagane mein madad karta hai. Is pattern mein do candlesticks shamil hote hain, ek bari candlestick (body) aur ek choti candlestick. Is tashreeh mein hum ghairat candlestick pattern ko Roman Urdu mein samjhenge. **ENGULFING CANDLESTICK PATTERNS FORMATION:** Ghairat candlestick pattern do alag candlesticks ki surat mein dikhta hai. Pehli candlestick choti hoti hai aur dusri candlestick isse bari hoti hai. Dusri candlestick pehli candlestick ko poori tarah gher leti hai, is tarah se jaise ek jwala mukka ya gehra maqam ban jata hai. **TYPES OF ENGULFING PATTERNS:** 1. **BULLISH ENGULFING PATTERN ** Is pattern mein pehli candlestick bearish hoti hai (price niche jati hai) aur dusri candlestick bullish hoti hai (price upar jati hai). Dusri candlestick pehli candlestick ko poori tarah engulf karti hai. 2. **BEARISH ENGULFING PATTERN ** Is pattern mein pehli candlestick bullish hoti hai (price upar jati hai) aur dusri candlestick bearish hoti hai (price niche jati hai). Dusri candlestick pehli candlestick ko poori tarah engulf karti hai. **IDENTIFICATION AND USAGE):** Ghairat candlestick pattern ko trend reversal points tashkhees karne ke liye istemal kiya jata hai. Agar bullish engulfing pattern downtrend ke baad nazar aaye to yeh bullish reversal ki alamat ho sakti hai, jabke bearish engulfing pattern uptrend ke baad nazar aaye to yeh bearish reversal ki alamat ho sakti hai. **LIMITATIONS:** Ghairat candlestick pattern akela istemal karne par kamzor hota hai. Iske sath sath, is pattern ki tashkhees mein ghalatfehmi hone ki mumkinat hoti hain. Isliye is pattern ko confirm karne ke liye dusre technical tools aur price action patterns ka istemal karna acha hota hai. Ghairat candlestick pattern forex trading mein ek ahem tool hai jisse trend reversals ki tashkhees ki ja sakti hai. Is pattern ko sahi tarike se samjhne aur istemal karne ke liye practice aur experience ki zarurat hoti hai. Is pattern ko dusre indicators aur patterns ke sath combine karke trading decisions lena acha hota hai. -

#5 Collapse

Engulfing Candle Chart Pattern: Engulfing candle design forex exchanging mein zaroori hai, lekin iske bhi kuch nuqsanat ho sakte hain. Kuch focuses yaad rakhein. inundating designs galat tarah kay isharay de sakte hain. Ye designs khud mein strong hote hain, lekin dusri sahi trah ke tasdeeq ki zaroorat hoti hai.sirf inundating designs standard bharosa karke zyada exchanging karne se nuqsan ho sakta hai. Enhanced investigation aur risk the executives bhi significant hote hain.Agar overwhelming example ki neshandahi karne mein der hojaye, to passage point miss ho sakta hai. Jaldi activity lena zaroori hota hai.Ye designs sabhi economic situations mein kaam nahi karte.markets mein unka asar kam ho sakta haiSirf ek design standard bharosa karke exchanging karna galat ho sakta hai. Market elements aur bunyadi tajziya ko bhi samajhna zaroori hai.isliye jesaye immersing designs ko samajhne ke liye preparing aur practice zaroori hai. Dealers ko in designs ke saath dusri examination procedures bhi istemal karne ki salahiyat honi chahiye. candlestick pattern forex trading mein ek important reversal pattern hota hai. Isme ek bada candlestick ek chota candlestick ko engulf karta hai, yaani ki uske range mein puri tarah se sama jata hai.Ye pattern price direction mein tabdeli ka ishara deta hai aur traders isse price movement ka ishara karne mein usey karte hain.Engulfing candlestick pattern traders ko har tarah say bhe kemat ke harkat ka idea dene mein madad karta hai. Agar ek bullish engulfingpattern dikhe, matlab ke market niche ka trend badal kar upar ki taraf ja sakta hai. Aur agar bearish engulfingpattern dikhe, to market ka uptrend niche ki taraf ja sakta hai.yeahi patterns entry aur exit points decide karne mein madadgar ho sakte hain. Traders in patterns ke sath saath dusri tasdeeq bhi dekhte hain, jaise ki trend lines jsy moving averages, aur support resistance levels, taakay unki trades ko aur bhi achay say esy e mazbot bunyad mile. engulfing patterns ke sath bhi galat isharay ho sakte hain, isliye dusri analysis bhi zaroori hai. Chart Pattern Types: Candle design costs k base fundamental banne ki waja se aik bullish sign genrate karta hai, jiss standard market primary purchase ki passage ki ja sakti hai. Design standard exchange enter karne se design ki dosri light aik affirmation flame ki zarorat parti hai, jo k genuine body principal aik bullish candle honi chaheye, aur dosri candle k top standard close bhi honi chaheye. Design ki affirmation CCI, RSI, MACD marker aur stochastic oscillator se bhi ki ja sakti hai, jiss ki esteem oversold zone primary honi chaheye. Design k baad negative candle se design invalid tasawar kia jayega. Design ka Stop Misfortune sab se lower ya dosri candle k open cost se two pips worse than average set karen.andlestick design costs primary negative pattern k dowran boycott kar costs ko mazeed nechay jane se rok leti hai. Ye design areas of strength for aik inversion ka signal deti hai. Design two days candles standard mushtamil hai, jiss ki pehli light areas of strength for aik flame hoti hai, jo k costs k negative ya descending pattern ki alamat hoti hai. Design ki dosri light aik bullish flame hoti hai, aur ye candle pehli candle ki nisbat genuine body primary bohut bari bhi hoti hai aur ye candle pehli candle ko apne andar mukamal lapait principal le leti hai, jiss se costs ka mazeed ruin ruk jata hai. Design ki dosri candle ka open pehli candle k close se base standard hole principal hota h

candlestick pattern forex trading mein ek important reversal pattern hota hai. Isme ek bada candlestick ek chota candlestick ko engulf karta hai, yaani ki uske range mein puri tarah se sama jata hai.Ye pattern price direction mein tabdeli ka ishara deta hai aur traders isse price movement ka ishara karne mein usey karte hain.Engulfing candlestick pattern traders ko har tarah say bhe kemat ke harkat ka idea dene mein madad karta hai. Agar ek bullish engulfingpattern dikhe, matlab ke market niche ka trend badal kar upar ki taraf ja sakta hai. Aur agar bearish engulfingpattern dikhe, to market ka uptrend niche ki taraf ja sakta hai.yeahi patterns entry aur exit points decide karne mein madadgar ho sakte hain. Traders in patterns ke sath saath dusri tasdeeq bhi dekhte hain, jaise ki trend lines jsy moving averages, aur support resistance levels, taakay unki trades ko aur bhi achay say esy e mazbot bunyad mile. engulfing patterns ke sath bhi galat isharay ho sakte hain, isliye dusri analysis bhi zaroori hai. Chart Pattern Types: Candle design costs k base fundamental banne ki waja se aik bullish sign genrate karta hai, jiss standard market primary purchase ki passage ki ja sakti hai. Design standard exchange enter karne se design ki dosri light aik affirmation flame ki zarorat parti hai, jo k genuine body principal aik bullish candle honi chaheye, aur dosri candle k top standard close bhi honi chaheye. Design ki affirmation CCI, RSI, MACD marker aur stochastic oscillator se bhi ki ja sakti hai, jiss ki esteem oversold zone primary honi chaheye. Design k baad negative candle se design invalid tasawar kia jayega. Design ka Stop Misfortune sab se lower ya dosri candle k open cost se two pips worse than average set karen.andlestick design costs primary negative pattern k dowran boycott kar costs ko mazeed nechay jane se rok leti hai. Ye design areas of strength for aik inversion ka signal deti hai. Design two days candles standard mushtamil hai, jiss ki pehli light areas of strength for aik flame hoti hai, jo k costs k negative ya descending pattern ki alamat hoti hai. Design ki dosri light aik bullish flame hoti hai, aur ye candle pehli candle ki nisbat genuine body primary bohut bari bhi hoti hai aur ye candle pehli candle ko apne andar mukamal lapait principal le leti hai, jiss se costs ka mazeed ruin ruk jata hai. Design ki dosri candle ka open pehli candle k close se base standard hole principal hota h  Bullish candle design costs k downtrend ya lower standard popularity ki waja se banta hai, jahan standard pattern inversion k ziada imkanat hote hen. Design primary shamil candles mukhtalif design ki yanni negative aur bullish hoti hen, jiss ki arrangement darjazzel tarah se hoti hai Bullish immersing candle design ki pehli light aik negative candle hoti hai, jo k costs ko downtrend ya negative pattern ki akasi karti hai. Ye light negative pattern ko mazeed nechay ki taraf push karti hai, aur market principal low interest ko zahir karti hai. Ye flame aik ordinary genuine body wali light hoti hai.Bullish overwhelming candle design ki dosri candle aik bullish candle hoti hai, jo k pehli candle se size fundamental bari hoti hai. Ye flame pehli candle k base standard hole principal open hoti hai, hit k close ussi light k top standard hoti hai. Ye candle negative pattern k khatme ka bahis banti hai. Trading View: Candle design aik bullish pattern inversion design hai, jo cost diagram standard do candles se mel kar banta hai. Design principal shamil pehli candles negative hoti hai, issi waja se design k leye costs ka pehle se low region ya negative pattern primary hona zarori hai. Two days candles ki precision single day design se behtar hota hai, q k iss principal aik flame thori bohut affirmation bhi deti hai. Poke bhi market principal venders costs ko aik khas level tak nechay push karte hen, to yahan standard pattern inversion k imkanat ziada hote hen, ye pattern affirmation aksar kuch design se affirm ho jati hai, jiss fundamental bullish immersing design bhi shamil hai.Engulfing Candle Example ka istemal, passage aur leave focuses tay karte waqt hota hai. Agar Bullish Inundating Example nazar yes toh, yeh samjhna mushkil nahi hota ke market mein bullish pattern hai, is waqt kharidari karna munasib ho sakta hai. Aur Negative Inundating Example dekhne standard, samajh a jata hai ke negative pattern shuru ho sakta hai aur farokht karna behtar ho sakta hai.

Bullish candle design costs k downtrend ya lower standard popularity ki waja se banta hai, jahan standard pattern inversion k ziada imkanat hote hen. Design primary shamil candles mukhtalif design ki yanni negative aur bullish hoti hen, jiss ki arrangement darjazzel tarah se hoti hai Bullish immersing candle design ki pehli light aik negative candle hoti hai, jo k costs ko downtrend ya negative pattern ki akasi karti hai. Ye light negative pattern ko mazeed nechay ki taraf push karti hai, aur market principal low interest ko zahir karti hai. Ye flame aik ordinary genuine body wali light hoti hai.Bullish overwhelming candle design ki dosri candle aik bullish candle hoti hai, jo k pehli candle se size fundamental bari hoti hai. Ye flame pehli candle k base standard hole principal open hoti hai, hit k close ussi light k top standard hoti hai. Ye candle negative pattern k khatme ka bahis banti hai. Trading View: Candle design aik bullish pattern inversion design hai, jo cost diagram standard do candles se mel kar banta hai. Design principal shamil pehli candles negative hoti hai, issi waja se design k leye costs ka pehle se low region ya negative pattern primary hona zarori hai. Two days candles ki precision single day design se behtar hota hai, q k iss principal aik flame thori bohut affirmation bhi deti hai. Poke bhi market principal venders costs ko aik khas level tak nechay push karte hen, to yahan standard pattern inversion k imkanat ziada hote hen, ye pattern affirmation aksar kuch design se affirm ho jati hai, jiss fundamental bullish immersing design bhi shamil hai.Engulfing Candle Example ka istemal, passage aur leave focuses tay karte waqt hota hai. Agar Bullish Inundating Example nazar yes toh, yeh samjhna mushkil nahi hota ke market mein bullish pattern hai, is waqt kharidari karna munasib ho sakta hai. Aur Negative Inundating Example dekhne standard, samajh a jata hai ke negative pattern shuru ho sakta hai aur farokht karna behtar ho sakta hai.  Dealer market mein section layta ha jaisay negative immersing design ke recognizable proof hote ha stop-misfortune ko as of late swing high standard rakha jata hello kunkeh yeh step forex market ko counterfeit kar day ga yeh step inversion karnay ko batel bhe kar sakta hello risk o reward rati ka maqol risk frahm karta hello target/take benefit chnkeh forex market mein negative inundating candle design long nechay kay pattern mein hotay hein pattern kay start say he long passage mell sakte hello start mein take benefit leel standard ghr keya jay kunkeh mazeed nechay ke taraf passage open ho sakte hello es kay awful stop ko change karen quavering stops konidentify keya ja sakta he forex market mein pehle candle apni kaim shodah pattern kay end zahair karte hello yeh bhe wazah rahay keh essential bullish candle ka size bhe different bhe ho sakta hello es kay terrible inundating aa jay gechote bullish cadlestick sab say solid sign ko distinguish karte hello kunkeh yeh forex market mein majodah cost activity ko recognize karte heymarket kay design mein second candle inversion signal ko distinguish karte hello jes say forex market ke cost mein taza kame ho jate hello jo keh pechle candle kaynechay throb tarah say close ho jate hello ager cost men jare kame rahay ge to negative candle agay ger jate hello or sign itna he solid h jata ha

Dealer market mein section layta ha jaisay negative immersing design ke recognizable proof hote ha stop-misfortune ko as of late swing high standard rakha jata hello kunkeh yeh step forex market ko counterfeit kar day ga yeh step inversion karnay ko batel bhe kar sakta hello risk o reward rati ka maqol risk frahm karta hello target/take benefit chnkeh forex market mein negative inundating candle design long nechay kay pattern mein hotay hein pattern kay start say he long passage mell sakte hello start mein take benefit leel standard ghr keya jay kunkeh mazeed nechay ke taraf passage open ho sakte hello es kay awful stop ko change karen quavering stops konidentify keya ja sakta he forex market mein pehle candle apni kaim shodah pattern kay end zahair karte hello yeh bhe wazah rahay keh essential bullish candle ka size bhe different bhe ho sakta hello es kay terrible inundating aa jay gechote bullish cadlestick sab say solid sign ko distinguish karte hello kunkeh yeh forex market mein majodah cost activity ko recognize karte heymarket kay design mein second candle inversion signal ko distinguish karte hello jes say forex market ke cost mein taza kame ho jate hello jo keh pechle candle kaynechay throb tarah say close ho jate hello ager cost men jare kame rahay ge to negative candle agay ger jate hello or sign itna he solid h jata ha

-

#6 Collapse

Engulfing candle design Mombattiyon ko lipatna maarkeet Mein maujuda rujan ke ulat jaane ka Ishara Dete Hain is maksus design Mein Two mombattiyan Shamil ho sakti hai jinmen terrible rib mombatti Iske Samne mombatti ke unadulterated body ko engulifing kar deti hai immersing candle is Baat per munasir hoti hai ki yah mujda rujan ke Hawale Se Kahan banti hai Bullish overwhelming candle Bullish overwhelming flame down exchanging ke nichle Hisse Mein zhar sharpen serious areas of strength for per Signa from karte hain aur kharidari ke dabao mein izafe Ki Nishanidi Karte Hain Tezi ki lipt mein aane wala design Aksar maujuda rujan ke ulat jaane ka sabahas banta hai Kyunki zyada kharidar market Mein dakhil hote hain aur kimaten Mazeed badhati Hai design Mein dusri mombatti ke sath do mombattiyan Shamil hoti hai jo pichhali Sar mombatti ke body ko totally Taur per lipty hoti hai

Bullish overwhelming candle Bullish overwhelming flame down exchanging ke nichle Hisse Mein zhar sharpen serious areas of strength for per Signa from karte hain aur kharidari ke dabao mein izafe Ki Nishanidi Karte Hain Tezi ki lipt mein aane wala design Aksar maujuda rujan ke ulat jaane ka sabahas banta hai Kyunki zyada kharidar market Mein dakhil hote hain aur kimaten Mazeed badhati Hai design Mein dusri mombatti ke sath do mombattiyan Shamil hoti hai jo pichhali Sar mombatti ke body ko totally Taur per lipty hoti hai Translation Poke Tezi ka namuna zahar hota hai to cost ki kaarvayi ko wazy Kami ka rujan dikhana hota hai Bhari tezi ki mombatti zahar Karti Hai yah kharidar market Mein Ja Raha Na Andaaz Mein Jama ho rahe hote hain aur y ah Mazid Upar ki Raftar ke liye ibtadi tasab fram karti hai Iske awful tajer is baat ki tasdik Ki Talash Karte Hain Ki Ishare aur mazamat ki kaledi Sattu aur immersing design ke terrible cost ki kaarvayi ka use Karke rujan vaki change Hota Hai

Negative Engulfing Negative in overwhelming example Tezi ke Example ke bilkul bar Aks Hota Hai yah upri rujan ke upri Hisse per zahar Hota Hai solid tren signal from karta hai aur firokt ke dabao mein ijaafe ki Nishan Dahi Karte Hain negative englfing flame Aksar majuda rujan ko changes karne ka sabab banta hai Kyunki tyada firokt Kunda market Mein dakhil Hote Hain aur cost ko Mazid specialty Le Aate Hain design mein dusri mombatti ke sath two mombattiyan Shamil hoti hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Introduction of Engulfing pattern pattern ko khas importance di jati hy, qyu ky yeh pattern reversal pattern hota hai. Yeh pattern kisi bi market trend kay give up hony per create hota hay.ess pattern ko perceive krna bohot easy hota hy. Day by day ki jo candle bohot short frame ki ho aor is ki wicks large hon. Or agly din ki jo full candle banti hai. ess ko hum engulfing candle kehty hein. jab marketplace mein ek trend complete ho jata hai to next trend ki ki begin mein yah pattern hamen najar aata hai aur yah hamare liye kisi bhi trend ki confirmation hoti hay.Jab kabhi bhi market chat main aapko is Tarah ki ummid najar Aaye ki pahli candle se dusri candles ki body badi najar Aaye to uss ko aap engulfing pattern kahein gy. Bullish engulfing candle down trading ke nichle Hisse Mein zhar hone per strong tren Signa from karte hain aur kharidari ke dabao mein izafe Ki Nishanidi Karte Hain Tezi ki lipt mein aane wala pattern Aksar maujuda rujan ke ulat jaane ka sabahas banta hai Kyunki zyada kharidar market Mein dakhil hote hain aur kimaten Mazeed badhati Hai pattern Mein dusri mombatti ke sath do mombattiyan Shamil hoti ha Information about Engulfing pattern forex trading mein candlestick patterns ko nahin samjhein ge tu hum kabhi bhi successful nahin ho sakte kyun ky aap ka pattern aapko complete market information ky related batata hai ki kab market upward jaane wali hai aur kab market downward mein jaane wali hay.esi liye agar aap candlesticks per expertise hasil kar lenge to aap bahut hi achcha profit earning ker sakein gy.jab bhi eik bullish candle eik bearish candle ko complete cover kar ley gi ya uska size bearish candle sey two times large ho ga tu uss ko Ham bearish engulfing kahenge engulfing ka basically matlab hota hai ky gair Lena yah complete cover kar lena.aor jab bhi ek bullish candle aur uss ky baad eik bearish candle aaye Jo completely apne se last wali bullish candle ko cover kar ley aur body mein bearish candle sey two times size mein big ho tu uss ko ham forex trading ki language mein bearish engulfing kahate hain. bearish engulfing ka matlab hy ke aapki yeh candle aap ki bullish candle ko completely cover kar le to uss ky baad Jo candle bane gi woh aapki bearish engulfing candle hogi Treading points of views market mein traders ko entry point ya exit point ki complete information deta hy.ess pattern ko follow kerny waly traders lazmi stop loss aur take profit ko use kerty hein kyu ky market kisi bi effect ki waja sy suddenly apni trend aur direction ky opposite move kerna start ker deti jis ki waja sy bhout sary traders ka loss bi ho jata hy.aesi situationmmein agar stop loss ka use na kiya jaye tu traders ka capital complete loss bi ho sakta hy. jitna ziada apka experience barhta chla jay ga to ap confident se trade bi laga saken gy . ap ka agar confidence hoga to ap trade bi accurately laga saken gy aur market ki movement ko notice bi kar saken gy .eik bat ka khayal rakhen keh apne stop loss ko lazmi mind mein rakhn hy.

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:09 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим