What is Harami CandleStick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Assalamu alaikum ummid Karti hun ke Forex member se khairiyat se honge bhai aur bahanon main aapke liye bahut hi khas topic Lai hun is topic ka naam hai what is harami candle stick pattern to puchte Hain Ki harami candlest person Kya Hai to Aaj ham iske bare Mein kuchh aapko maloomat Denge jisko janne ke bad aap Khel Mein bahut jyada izaafa hoga aur aapko bahut jyada profit hasil hoga to jaise ki yah topic Maine dhundh kar aap logon ke sath share kiya tha ki main aap logon ke sath share Karun aur aap ise fayda kar se Kya aapko bhi chahie ki aap isko aage share Karen Taki dusre log bhi se kuchh fayda kar sake to ham is topic ke bare mein batchit karte hain shukriya Is topic ko jitne jyada aap samjhenge utna jyada aapke liye fayda band hoga ismein se koi bhi mushkil wali baat nahin hai jo ki aapko samajh Mein Na aaye maine bahut hi aasan lafzon Mein aap logon ke sath share Kiya Hai Taki aap pahli Najar mein dekhne se hi is topic ko samajh jaen aur isase kuchh fayda hasil kar saken aapko bhi chahie ki jawab koi naya topic dekhen jo ki Forex ke platform Mein uska jyada se jyada kam ho aur vah jyada fayda deta ho to aapko bhi chahie ki aap hamare sath share Karen Taki ham bhi usse kuchh fayda hasil kar saken What is the Harami candlestick pattern? Dear participants, Hota Ha MTLB, Banta Ha Kadé, Brazen Bull Ho Ho Jata Ha or Bazar Kamten Warna Shlo Ho Jati Hai most important, I will be glad if you come. Patten k buy dirty clothes at a basic price. Halami Ek Aham Sham Nagsi Hi Jiska name "Halami" means "aggressive" or "angry" hotha in Arabic. Identify patterns and price movements for investors. An illegal candlestick pattern is a short-term trend reversal when a continuous candle is formed. Ek Dusare Sham Ku Gof (Khan Kana) Karuta Bala. Ismen pahere sham ki ramuka harami trend tree defta hai, you show the opposite indicator, karate pada kawung, kal saket hai. The "barn owl" view is "bullish", but you are suggesting the opposite, because there is a risk-averse investor. -

#3 Collapse

Aslamoalekum kesay hein ap sab members mein umed karti hon ap sab kheryt say hon gay or apki posting achi ja rhii hogi. Aj ka jo topic zer e behas hy uska name harami candlestick pattern hy. Isy dekhty hein ky yh kia hy or hmen kia malomat faraham karta hai. Harami Candlestick pattern Harami Candlestick Pattern forex trading mein ek am sa istemal honay wala reversal pattern hai, jahan ek chhota candle ek baraa candle ke andar hota hai. Yehahi neshandahi karta hai ke trend mein mumkina tabdeli ho sakta hai. Is pattern ka use trend reversal ki pehchaan karne mein hota hai.harami Candlestick Pattern sy forex trading mein is liye important hota hai kyun ke yeh ek reversal signal deta hai. Jab trend mein ek Harami pattern appear hota hai, matlab chhota candle bada candle ke andar fit hota hai, toh yeh tajweez karta hai ke trend mein tabdeeli ho sakta hai. Traders is pattern ka istemal trend ki direction ka andaza karne mein he karte hain, jisse unko potential profits mil sakte hain. Lekin yeh important hai ke aap doosre technical indicators aur market ki trah situation ko bhi gour karein jab aap trading decisions lein. Forex trading mein Harami Candlestick Pattern ka istemal karne se pehle kuch limitations ya challenges hote hain. Harami pattern jesy bohat su galat feslay b peda kar sakta hai, matlab ke trend reversal nahi hota jab pattern appear hota hai. Isliye, sirf is pattern par rely na karein, balki doosre sahii indicators aur tajziya bhi istemal karein. Harami pattern ka size chhota ho sakta hai, jisse ki trend reversal ke chances kam ho jaate hain. Bade timeframes par is pattern ka use karna zyada reliable ho sakta hai. Harami pattern ki confirmation ke liye doosre candlestick patterns ya indicators ki zaroorat hoti hai. Bas ek bullish Harami pattern dekh kar trade na karein, balkay tasdeeq ke liye intezar karein. Agar Harami pattern trend kay bilkul mukhalif simat main ho, toh yeh kam reliable ho sakta hai. Isliye market ki context aur trend ko bhi samajh karna zaroori hai.Trading decisions lene se pehle hamesha risk management ko yaad bhe rakhein. importance Harami pattern ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami pattern ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.Harami Candlestick Pattern ka istemal karne se pehle iske limitations ko samajhna zaroori hai. Yeh ek tool hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex trading mein Harami Candlestick Pattern ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke trend reversal nahi hota jab pattern appear hota hai. Agar aap sirf is pattern par rely karte hain to aap ghalat trading decisions le sakte hain. Harami pattern chhota hone ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar par karne se zyada fayda ho sakta hai.Harami pattern ki tasdeeq ke liye doosre isharay aur patterns ki zaroorat hoti hai. Bina confirmation ke trade karna risky ho sakta hai. Agar Harami pattern trend ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur trend ko zahir karna zaroori hay.Harami pattern ka istemal karte waqt risk management ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami pattern ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai. Ilam aur practice ke is pattern par rely karna nuqsan deh ho sakta hai aakhir mein, yad rahe ke Harami Candlestick Pattern ek tool hai aur iska istemal karte waqt ehtyat aur doosre awmil ko bhi madde nazar rakhte hue trading decisions lena chahiye. -

#4 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : What is Harami CandleStick Pattern "Harami Candlestick Pattern" ek popular Japanese candlestick charting technique ka hissa hai jo traders ko price trends aur reversals ki samajhne mein madad deta hai. Is pattern mein do consecutive candles ki sequence hoti hai jo aik specific tareeqay se arrange hoti hain. Harami pattern bullish aur bearish reversals dono ko indicate kar sakta hai, lekin iske tafsili mafhoom ko samjhne ke liye chaliye is pattern ko roman Urdu mein detail se samjhte hain. Explanation: Harami pattern mein do candles shamil hoti hain jinmein se pehli candle large aur dominant hoti hai, jabke dusri candle pehli candle ki body mein fit hoti hai. Is pattern mein neeche di gayi cheezen hoti hain Pehli candle large body wali hoti hai aur existing trend ko indicate karti hai. Agar pehli candle bullish hai, to body green (bullish) color ki hoti hai aur agar bearish hai, to body red (bearish) color ki hoti hai. Dusri candle pehli candle ki body mein fit hoti hai, lekin typically opposite direction mein hoti hai. Agar pehli candle bullish thi, to dusri candle bearish hoti hai aur agar pehli candle bearish thi, to dusri candle bullish hoti hai. Harami pattern bullish aur bearish reversals dono ko indicate kar sakta hai, lekin iska matlab aur direction doosri candle ki positioning par depend karta hai. Agar pehli candle bearish hai aur dusri candle uski body mein fit ho kar bullish hai, to ye bullish trend ke reversal ka sign ho sakta hai. Jab pehli candle bullish hai aur dusri candle uski body mein fit ho kar bearish hai, to ye bearish trend ke reversal ka sign ho sakta hai. Harami pattern ka istemal traders trend reversals ko samajhne aur trading decisions lene mein karte hain. Agar market mein harami pattern dikhayi deta hai, to traders ko ye indication milti hai ke trend reversal ka chance hai aur woh apne trading strategies us ke mutabiq adjust kar sakte hain. Traders is pattern ko confirm karne ke liye doosre technical indicators aur analysis tools ka bhi istemal karte hain. Iske saath saath, market conditions aur risk management ko bhi samajh kar trading decisions lene chahiye. Harami Candlestick Pattern ek powerful candlestick pattern hai jo traders ko price trends aur reversals ko identify karne mein madad deta hai. Is pattern ka istemal kar ke traders apni trading strategies ko improve kar sakte hain aur potential trend changes ko pehchan sakte hain. Lekin, is pattern ko samajhne ke liye doosre technical analysis tools aur indicators ka istemal zaroori hota hai. -

#5 Collapse

Harami Candle Chart Pattern: Traders or Merchants is design ko affirm karne ke liye doosre specialized markers aur examination apparatuses ka bhi istemal karte hain. Iske saath, economic situations aur risk the board ko bhi samajh kar exchanging choices lene chahiye.Harami Candle Example ek strong candle design hai jo dealers ko cost patterns aur inversions ko recognize karne mein madad deta hai. Is design ka istemal kar ke brokers apni exchanging procedures ko improve kar sakte hain aur potential pattern changes ko pehchan sakte hain. Lekin, is design ko samajhne ke liye doosre specialized investigation apparatuses aur pointers ka istemal zaroori hota hai.arami design ka istemal merchants pattern inversions ko samajhne aur exchanging choices lene mein karte hain. Agar market mein harami design dikhayi deta hai, to brokers ko ye sign milti hai ke pattern inversion ka chance hai aur woh apne exchanging procedures us ke mutabiq change kar sakte hain.:max_bytes(150000):strip_icc()/dotdash_Final_Bullish_Harami_2020-8e7ee8e18daf483288e4962f3ebc8be2.jpg) Harami pattern design mein do candles shamil hoti hain jinmein se pehli light huge aur prevailing hoti hai, jabke dusri flame pehli candle ki body mein fit hoti hai. Is design mein neeche di gayi cheezen hoti hain Pehli light huge body wali hoti hai aur existing pattern ko demonstrate karti hai. Agar pehli light bullish hai, to body green (bullish) variety ki hoti hai aur agar negative hai, to body red (negative) variety ki hoti hai.Dusri candle pehli candle ki body mein fit hoti hai, lekin regularly inverse bearing mein hoti hai. Agar pehli candle bullish thi, to dusri light negative hoti hai aur agar pehli candle negative thi, to dusri flame bullish hoti hai.Harami design bullish aur negative inversions dono ko demonstrate kar sakta hai, lekin iska matlab aur course doosri candle ki situating standard depend karta hai. Agar pehli light negative hai aur dusri flame uski body mein fit ho kar bullish hai, to ye bullish pattern ke inversion ka sign ho sakta hai. Punch pehli flame bullish hai aur dusri light uski body mein fit ho kar negative hai, to ye negative pattern ke inversion ka sign ho sakta hai. Chart Pattern Formation: Candle Example" ek famous Japanese candle outlining method ka hissa hai jo brokers ko cost patterns aur inversions ki samajhne mein madad deta hai. Is design mein do back to back candles ki succession hoti hai jo aik explicit tareeqay se organize hoti hain. Harami design bullish aur negative inversions dono ko demonstrate kar sakta hai, lekin iske tafsili mafhoom ko samjhne ke liye chaliye is design ko roman Urdu mein detail se samjhte hain.Harami design ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami design ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.Harami Candle Example ka istemal karne se pehle iske constraints ko samajhna zaroori hai. Yeh ek device hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex exchanging mein Harami Candle Example ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke pattern inversion nahi hota hit design seem hota hai. Agar aap sirf is design standard depend karte hain to aap ghalat exchanging choices le sakte hain.

Harami pattern design mein do candles shamil hoti hain jinmein se pehli light huge aur prevailing hoti hai, jabke dusri flame pehli candle ki body mein fit hoti hai. Is design mein neeche di gayi cheezen hoti hain Pehli light huge body wali hoti hai aur existing pattern ko demonstrate karti hai. Agar pehli light bullish hai, to body green (bullish) variety ki hoti hai aur agar negative hai, to body red (negative) variety ki hoti hai.Dusri candle pehli candle ki body mein fit hoti hai, lekin regularly inverse bearing mein hoti hai. Agar pehli candle bullish thi, to dusri light negative hoti hai aur agar pehli candle negative thi, to dusri flame bullish hoti hai.Harami design bullish aur negative inversions dono ko demonstrate kar sakta hai, lekin iska matlab aur course doosri candle ki situating standard depend karta hai. Agar pehli light negative hai aur dusri flame uski body mein fit ho kar bullish hai, to ye bullish pattern ke inversion ka sign ho sakta hai. Punch pehli flame bullish hai aur dusri light uski body mein fit ho kar negative hai, to ye negative pattern ke inversion ka sign ho sakta hai. Chart Pattern Formation: Candle Example" ek famous Japanese candle outlining method ka hissa hai jo brokers ko cost patterns aur inversions ki samajhne mein madad deta hai. Is design mein do back to back candles ki succession hoti hai jo aik explicit tareeqay se organize hoti hain. Harami design bullish aur negative inversions dono ko demonstrate kar sakta hai, lekin iske tafsili mafhoom ko samjhne ke liye chaliye is design ko roman Urdu mein detail se samjhte hain.Harami design ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami design ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.Harami Candle Example ka istemal karne se pehle iske constraints ko samajhna zaroori hai. Yeh ek device hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex exchanging mein Harami Candle Example ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke pattern inversion nahi hota hit design seem hota hai. Agar aap sirf is design standard depend karte hain to aap ghalat exchanging choices le sakte hain.  Harami Chart design chhota sharpen ki wajah se, iska kam ho sakta hai. Iska istemal standard karne se zyada fayda ho sakta hai.Harami design ki tasdeeq ke liye doosre isharay aur designs ki zaroorat hoti hai. Bina affirmation ke exchange karna unsafe ho sakta hai. Agar Harami design pattern ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur pattern ko zahir karna zaroori hay.Harami design ka istemal karte waqt risk the executives ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami design ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai. Ilam aur practice ke is design standard depend karna nuqsan deh ho sakta hai aakhir mein, yad rahe ke Harami Candle Example ek apparatus hai aur iska istemal karte waqt ehtyat aur doosre awmil ko bhi madde nazar rakhte tint exchanging choices lena chahiye. Chart Pattern Trading View: Design jesy bohat su galat feslay ho sakta hai, matlab ke pattern inversion nahi hota poke design seem hota hai. Isliye, sirf is design standard depend na karein, balki doosre sahii markers aur tajziya bhi istemal karein. Harami design ka size chhota ho sakta hai, jisse ki pattern inversion ke chances kam ho jaate hain. Bade time spans standard is design ka use karna zyada solid ho sakta hai. Harami design ki affirmation ke liye doosre candle designs ya pointers ki zaroorat hoti hai. Bas ek bullish Harami design dekh kar exchange na karein, balkay tasdeeq ke liye intezar karein. Agar Harami design pattern kay bilkul mukhalif simat principal ho, toh yeh kam dependable ho sakta hai. Isliye market ki setting aur pattern ko bhi samajh karna zaroori hai.Trading choices lene se pehle hamesha risk the executives ko yaad bhe rakhein.

Harami Chart design chhota sharpen ki wajah se, iska kam ho sakta hai. Iska istemal standard karne se zyada fayda ho sakta hai.Harami design ki tasdeeq ke liye doosre isharay aur designs ki zaroorat hoti hai. Bina affirmation ke exchange karna unsafe ho sakta hai. Agar Harami design pattern ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur pattern ko zahir karna zaroori hay.Harami design ka istemal karte waqt risk the executives ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami design ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai. Ilam aur practice ke is design standard depend karna nuqsan deh ho sakta hai aakhir mein, yad rahe ke Harami Candle Example ek apparatus hai aur iska istemal karte waqt ehtyat aur doosre awmil ko bhi madde nazar rakhte tint exchanging choices lena chahiye. Chart Pattern Trading View: Design jesy bohat su galat feslay ho sakta hai, matlab ke pattern inversion nahi hota poke design seem hota hai. Isliye, sirf is design standard depend na karein, balki doosre sahii markers aur tajziya bhi istemal karein. Harami design ka size chhota ho sakta hai, jisse ki pattern inversion ke chances kam ho jaate hain. Bade time spans standard is design ka use karna zyada solid ho sakta hai. Harami design ki affirmation ke liye doosre candle designs ya pointers ki zaroorat hoti hai. Bas ek bullish Harami design dekh kar exchange na karein, balkay tasdeeq ke liye intezar karein. Agar Harami design pattern kay bilkul mukhalif simat principal ho, toh yeh kam dependable ho sakta hai. Isliye market ki setting aur pattern ko bhi samajh karna zaroori hai.Trading choices lene se pehle hamesha risk the executives ko yaad bhe rakhein.  Candle Example forex exchanging mein ek am sa istemal honay wala inversion design hai, jahan ek chhota flame ek baraa light ke andar hota hai. Yehahi neshandahi karta hai ke pattern mein mumkina tabdeli ho sakta hai. Is design ka use pattern inversion ki pehchaan karne mein hota hai.harami Candle Example sy forex exchanging mein is liye significant hota hai kyun ke yeh ek inversion signal deta hai. Punch pattern mein ek Harami design seem hota hai, matlab chhota flame bada candle ke andar fit hota hai, toh yeh tajweez karta hai ke pattern mein tabdeeli ho sakta hai. Dealers is design ka istemal pattern ki bearing ka andaza karne mein he karte hain, jisse unko potential benefits mil sakte hain. Lekin yeh significant hai ke aap doosre specialized pointers aur market ki trah circumstance ko bhi gour karein hit aap exchanging choices lein. Forex exchanging mein Harami Candle Example ka istemal karne se pehle kuch limits ya challenges hote hain.

Candle Example forex exchanging mein ek am sa istemal honay wala inversion design hai, jahan ek chhota flame ek baraa light ke andar hota hai. Yehahi neshandahi karta hai ke pattern mein mumkina tabdeli ho sakta hai. Is design ka use pattern inversion ki pehchaan karne mein hota hai.harami Candle Example sy forex exchanging mein is liye significant hota hai kyun ke yeh ek inversion signal deta hai. Punch pattern mein ek Harami design seem hota hai, matlab chhota flame bada candle ke andar fit hota hai, toh yeh tajweez karta hai ke pattern mein tabdeeli ho sakta hai. Dealers is design ka istemal pattern ki bearing ka andaza karne mein he karte hain, jisse unko potential benefits mil sakte hain. Lekin yeh significant hai ke aap doosre specialized pointers aur market ki trah circumstance ko bhi gour karein hit aap exchanging choices lein. Forex exchanging mein Harami Candle Example ka istemal karne se pehle kuch limits ya challenges hote hain.

-

#6 Collapse

Introduction aapke liye bahut hello khas subject matter Lai hun is subject matter ka naam hai what is harami candle stick pattern to puchte Hain Ki harami candlest individual Kya Hai to Aaj ham iske bare Mein kuchh aapko maloomat Denge jisko janne ke bad aap Khel Mein bahut jyada izaafa hoga aur aapko bahut jyada income hasil hoga to jaise ki yah subject matter Maine dhundh kar aap logon ke sath share kiya tha ki main aap logon ke sath percentage Karun aur aap ise fayda kar se Kya aapko bhi chahie ki aap isko aage percentage Karen Taki dusre log bhi se kuchh fayda kar sake to ham is topic ke bare mein batchit karte hain.Is topic ko jitne jyada aap samjhenge utna jyada aapke liye fayda band hoga ismein se koi bhi mushkil wali baat nahin hai jo ki aapko samajh Mein Na aaye maine bahut hello aasan lafzon Mein aap logon ke sath percentage Kiya Hai Taki aap pahli Najar mein dekhne se hi is topic ko samajh jaen aur isase kuchh fayda hasil kar saken aapko bhi chahie ki jawab koi naya subject matter dekhen jo ki the Forex market ke platform Mein uska jyada se jyada kam ho aur vah jyada fayda deta ho to aapko bhi chahie ki aap hamare sath percentage Karen Taki ham bhi united states kuchh fayda hasil kar saken.candlestick pattern Dear participants, Hota Ha MTLB, Banta Ha Kadé, Brazen Bull Ho Ho Jata Ha or Bazar Kamten Warna Shlo Ho Jati Hai most vital, I may be satisfied if you come. Patten okay buy grimy garments at a fundamental charge. Halami Ek Aham Sham Nagsi Hi Jiska name "Halami" manner "aggressive" or "indignant" hotha in Arabic.Identify styles and fee moves for buyers. An illegal candlestick sample is a quick-time period fashion reversal whilst a non-stop candle is shaped. Ek Dusare Sham Ku Gof (Khan Kana) Karuta Bala. Ismen pahere sham ki ramuka harami fashion tree defta hai, you display the opposite indicator, karate pada kawung, kal saket hai. The "barn owl" view is "bullish", however you're suggesting the opposite, due to the fact there may be a threat-averse investor. Significance Harami pattern ka use karke bhi stoploss aur target stages set karna zaroori hai.Harami pattern ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur exercise ki zaroorat hoti ha.Harami Candlestick Pattern ka istemal karne se pehle iske barriers ko samajhna zaroori hai. Yeh ek tool hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.The Forex market trading mein Harami Candlestick Pattern ka istemal karne ke nuqsanat ye ho sakte hain. Matlab ke trend reversal nahi hota jab sample appear hota hai. Agar aap sirf is sample par depend karte hain to aap ghalat trading choices le sakte hain. Harami sample chhota hone ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar par karne se zyada fayda ho sakta hai.Harami pattern ki tasdeeq ke liye doosre isharay aur styles ki zaroorat hoti hai. Bina confirmation ke exchange karna volatile ho sakta hai. Agar Harami sample fashion ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur trend ko zahir karna zaroori hay.Harami sample ka istemal karte waqt threat management ko karna nuqsan deh ho sakta hai. Aur goal tiers set nahi karne se aapko nuqsan uthana parr sakta hai.

-

#7 Collapse

Candlestick Pattern forex trading mein ek am sa istemal honay wala reversal pattern hai, jahan ek chhota candle ek baraa candle ke andar hota hai. Yehahi neshandahi karta hai ke trend mein mumkina tabdeli ho sakta hai. Is pattern ka use trend reversal ki pehchaan karne mein hota hai.harami Candlestick Pattern sy forex trading mein is liye important hota hai kyun ke yeh ek reversal signal deta hai. Jab trend mein ek Harami pattern appear hota hai, matlab chhota candle bada candle ke andar fit hota hai, toh yeh tajweez karta hai ke trend mein tabdeeli ho sakta hai. Traders is pattern ka istemal trend ki direction ka andaza karne mein he karte hain, jisse unko potential profits mil sakte hain. Lekin yeh important hai ke aap doosre technical indicators aur market ki trah situation ko bhi gour karein jab aap trading decisions lein. Forex trading mein Harami Candlestick Pattern ka istemal karne se pehle kuch limitations ya challenges hote hain. Harami pattern jesy bohat su galat feslay b peda kar sakta hai, matlab ke trend reversal nahi hota jab pattern appear hota hai. Isliye, sirf is pattern par rely na karein, balki doosre sahii indicators aur tajziya bhi istemal karein. Harami pattern ka size chhota ho sakta hai, jisse ki trend reversal ke chances kam ho jaate hain. Bade timeframes par is pattern ka use karna zyada reliable ho sakta hai. Harami pattern ki confirmation ke liye doosre candlestick patterns ya indicators ki zaroorat hoti hai. Bas ek bullish Harami pattern dekh kar trade na karein, balkay tasdeeq ke liye intezar karein.Topic : What is Harami CandleStick Pattern "Harami Candlestick Pattern" ek popular Japanese candlestick charting technique ka hissa hai jo traders ko price trends aur reversals ki samajhne mein madad deta hai. Is pattern mein do consecutive candles ki sequence hoti hai jo aik specific tareeqay se arrange hoti hain. Harami pattern bullish aur bearish reversals dono ko indicate kar sakta hai, lekin iske tafsili mafhoom ko samjhne ke liye chaliye is pattern ko roman Urdu mein detail se samjhte hain.patterns aur inversions ki samajhne mein madad deta hai. Is design mein do back to back candles ki succession hoti hai jo aik explicit tareeqay se organize hoti hain. Harami design bullish aur negative inversions dono ko demonstrate kar sakta hai, lekin iske tafsili mafhoom ko samjhne ke liye chaliye is design ko roman Urdu mein detail se samjhte hain.Harami design ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami design ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.Harami Candle Example ka istemal karne se pehle iske constraints ko samajhna zaroori hai. Yeh ek device hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex exchanging mein Harami Candle Example ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke pattern inversion nahi hota hit design seem hota hai. Agar aap sirf is design standard depend karte hain to aap ghalat exchanging choices le sakte hain.

pattern inversion nahi hota poke design seem hota hai. Isliye, sirf is design standard depend na karein, balki doosre sahii markers aur tajziya bhi istemal karein. Harami design ka size chhota ho sakta hai, jisse ki pattern inversion ke chances kam ho jaate hain. Bade time spans standard is design ka use karna zyada solid ho sakta hai. Harami design ki affirmation ke liye doosre candle designs ya pointers ki zaroorat hoti hai. Bas ek bullish Harami design dekh kar exchange na karein, balkay tasdeeq ke liye intezar karein. Agar Harami design pattern kay bilkul mukhalif simat principal ho, toh yeh kam dependable ho sakta hai. Isliye market ki setting aur pattern ko bhi samajh karna zaroori hai.Trading choices lene se pehle hamesha risk the executives ko yaad bhe rakhein.

pattern inversion nahi hota poke design seem hota hai. Isliye, sirf is design standard depend na karein, balki doosre sahii markers aur tajziya bhi istemal karein. Harami design ka size chhota ho sakta hai, jisse ki pattern inversion ke chances kam ho jaate hain. Bade time spans standard is design ka use karna zyada solid ho sakta hai. Harami design ki affirmation ke liye doosre candle designs ya pointers ki zaroorat hoti hai. Bas ek bullish Harami design dekh kar exchange na karein, balkay tasdeeq ke liye intezar karein. Agar Harami design pattern kay bilkul mukhalif simat principal ho, toh yeh kam dependable ho sakta hai. Isliye market ki setting aur pattern ko bhi samajh karna zaroori hai.Trading choices lene se pehle hamesha risk the executives ko yaad bhe rakhein.  Candlestick Pattern ka istemal karne se pehle iske barriers ko samajhna zaroori hai. Yeh ek tool hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.The Forex market trading mein Harami Candlestick Pattern ka istemal karne ke nuqsanat ye ho sakte hain. Matlab ke trend reversal nahi hota jab sample appear hota hai. Agar aap sirf is sample par depend karte hain to aap ghalat trading choices le sakte hain. Harami sample chhota hone ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar par karne se zyada fayda ho sakta hai.Harami pattern ki tasdeeq ke liye doosre isharay aur styles ki zaroorat hoti hai. Bina confirmation ke exchange karna volatile ho sakta hai. Agar Harami sample fashion ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur trend ko zahir karna zaroori hay.Harami sample ka istemal karte waqt threat management ko karna nuqsan deh ho sakta haiinversions ko recognize karne mein madad deta hai. Is design ka istemal kar ke brokers apni exchanging procedures ko improve kar sakte hain aur potential pattern changes ko pehchan sakte hain. Lekin, is design ko samajhne ke liye doosre specialized investigation apparatuses aur pointers ka istemal zaroori hota hai.arami design ka istemal merchants pattern inversions ko samajhne aur exchanging choices lene mein karte hain. Agar market mein harami design dikhayi deta hai, to brokers ko ye sign milti hai ke pattern inversion ka chance hai aur woh apne exchanging procedures us ke mutabiq change kar sakte hain.

Candlestick Pattern ka istemal karne se pehle iske barriers ko samajhna zaroori hai. Yeh ek tool hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.The Forex market trading mein Harami Candlestick Pattern ka istemal karne ke nuqsanat ye ho sakte hain. Matlab ke trend reversal nahi hota jab sample appear hota hai. Agar aap sirf is sample par depend karte hain to aap ghalat trading choices le sakte hain. Harami sample chhota hone ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar par karne se zyada fayda ho sakta hai.Harami pattern ki tasdeeq ke liye doosre isharay aur styles ki zaroorat hoti hai. Bina confirmation ke exchange karna volatile ho sakta hai. Agar Harami sample fashion ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur trend ko zahir karna zaroori hay.Harami sample ka istemal karte waqt threat management ko karna nuqsan deh ho sakta haiinversions ko recognize karne mein madad deta hai. Is design ka istemal kar ke brokers apni exchanging procedures ko improve kar sakte hain aur potential pattern changes ko pehchan sakte hain. Lekin, is design ko samajhne ke liye doosre specialized investigation apparatuses aur pointers ka istemal zaroori hota hai.arami design ka istemal merchants pattern inversions ko samajhne aur exchanging choices lene mein karte hain. Agar market mein harami design dikhayi deta hai, to brokers ko ye sign milti hai ke pattern inversion ka chance hai aur woh apne exchanging procedures us ke mutabiq change kar sakte hain. :max_bytes(150000):strip_icc()/dotdash_Final_Bullish_Harami_2020-8e7ee8e18daf483288e4962f3ebc8be2.jpg)

-

#8 Collapse

heloo every one Harami Candle Example forex exchanging mein ek am sa istemal honay wala inversion design hai, jahan ek chhota candle ek baraa light ke andar hota hai. Yehahi neshandahi karta hai ke pattern mein mumkina tabdeli ho sakta hai. Is design ka use pattern inversion ki pehchaan karne mein hota hai.harami Candle Example sy forex exchanging mein is liye significant hota hai kyun ke yeh ek inversion signal deta hai. Hit pattern mein ek Harami design seem hota hai, matlab chhota light bada candle ke andar fit hota hai, toh yeh tajweez karta hai ke pattern mein tabdeeli ho sakta hai. Brokers is design ka istemal pattern ki bearing ka andaza karne mein he karte hain, jisse unko potential benefits mil sakte hain. Lekin yeh significant hai ke aap doosre specialized pointers aur market ki trah circumstance ko bhi gour karein poke aap exchanging choices lein. Forex exchanging mein Harami Candle Example ka istemal karne se pehle kuch restrictions ya challenges hote hain. Harami design jesy bohat su galat feslay b peda kar sakta hai, matlab ke pattern inversion nahi hota hit design seem hota hai. Isliye, sirf is design standard depend na karein, balki doosre sahii pointers aur tajziya bhi istemal karein. Harami design ka size chhota ho sakta hai, jisse ki pattern inversion ke chances kam ho jaate hain. Bade time periods standard is design ka use karna zyada dependable ho sakta hai. Harami design ki affirmation ke liye doosre candle designs ya markers ki zaroorat hoti hai. Bas ek bullish Harami design dekh kar exchange na karein, balkay tasdeeq ke liye intezar karein. Agar Harami design pattern kay bilkul mukhalif simat primary ho, toh yeh kam dependable ho sakta hai. Isliye market ki setting aur pattern ko bhi samajh karna zaroori hai.Trading choices lene se pehle hamesha risk the board ko yaad bhe rakhein. significance Harami design ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami design ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.Harami Candle Example ka istemal karne se pehle iske constraints ko samajhna zaroori hai. Yeh ek device hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex exchanging mein Harami Candle Example ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke pattern inversion nahi hota hit design seem hota hai. Agar aap sirf is design standard depend karte hain to aap ghalat exchanging choices le sakte hain. Harami design chhota sharpen ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar standard karne se zyada fayda ho sakta hai.Harami design ki tasdeeq ke liye doosre isharay aur designs ki zaroorat hoti hai. Bina affirmation ke exchange karna dangerous ho sakta hai. Agar Harami design pattern ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur pattern ko zahir karna zaroori hay.Harami design ka istemal karte waqt risk the executives ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami design ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai. Ilam aur practice ke is design standard depend karna nuqsan deh ho sakta hai aakhir mein, yad rahe ke Harami Candle Example ek device hai aur iska istemal karte waqt ehtyat aur doosre awmil ko bhi madde nazar rakhte shade exchanging choices lena chahiye.

significance Harami design ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami design ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.Harami Candle Example ka istemal karne se pehle iske constraints ko samajhna zaroori hai. Yeh ek device hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex exchanging mein Harami Candle Example ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke pattern inversion nahi hota hit design seem hota hai. Agar aap sirf is design standard depend karte hain to aap ghalat exchanging choices le sakte hain. Harami design chhota sharpen ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar standard karne se zyada fayda ho sakta hai.Harami design ki tasdeeq ke liye doosre isharay aur designs ki zaroorat hoti hai. Bina affirmation ke exchange karna dangerous ho sakta hai. Agar Harami design pattern ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur pattern ko zahir karna zaroori hay.Harami design ka istemal karte waqt risk the executives ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami design ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai. Ilam aur practice ke is design standard depend karna nuqsan deh ho sakta hai aakhir mein, yad rahe ke Harami Candle Example ek device hai aur iska istemal karte waqt ehtyat aur doosre awmil ko bhi madde nazar rakhte shade exchanging choices lena chahiye.

-

#9 Collapse

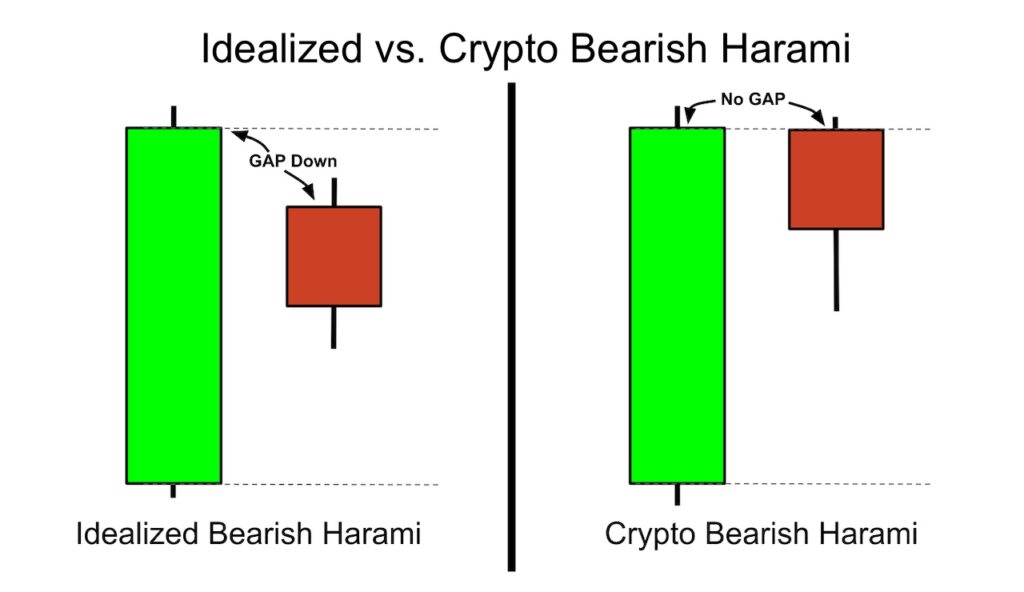

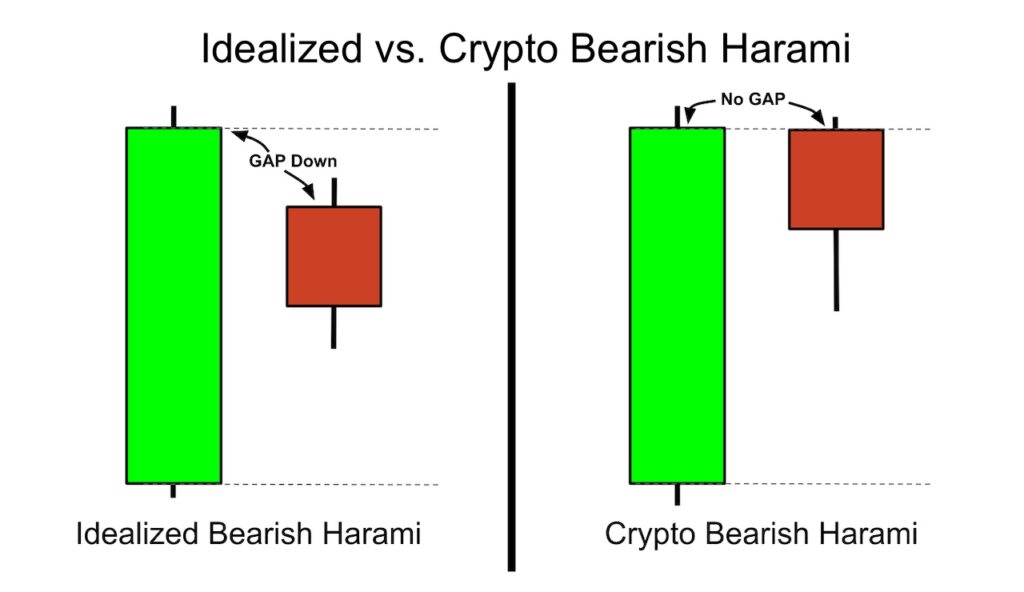

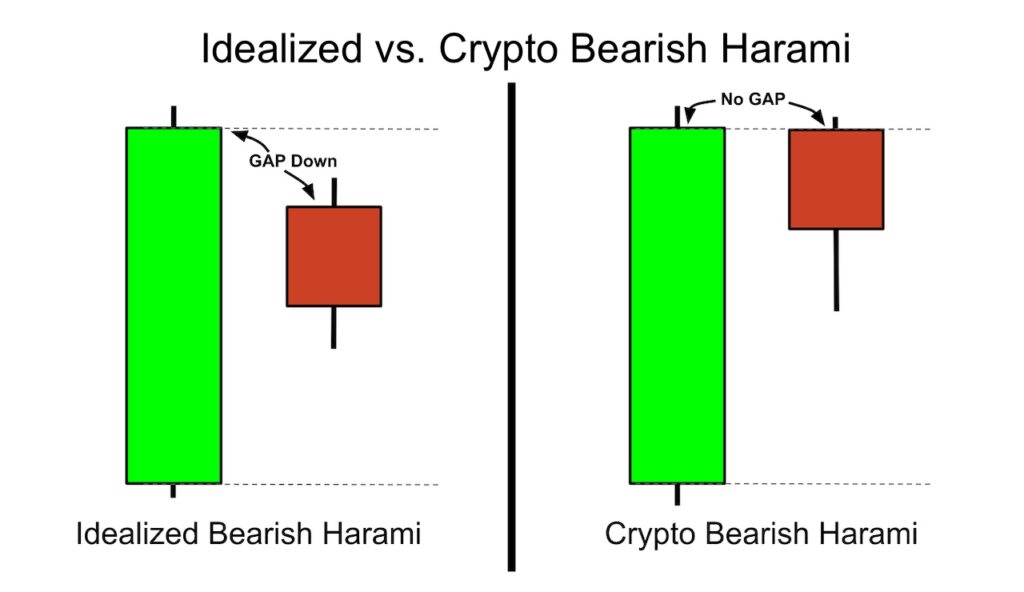

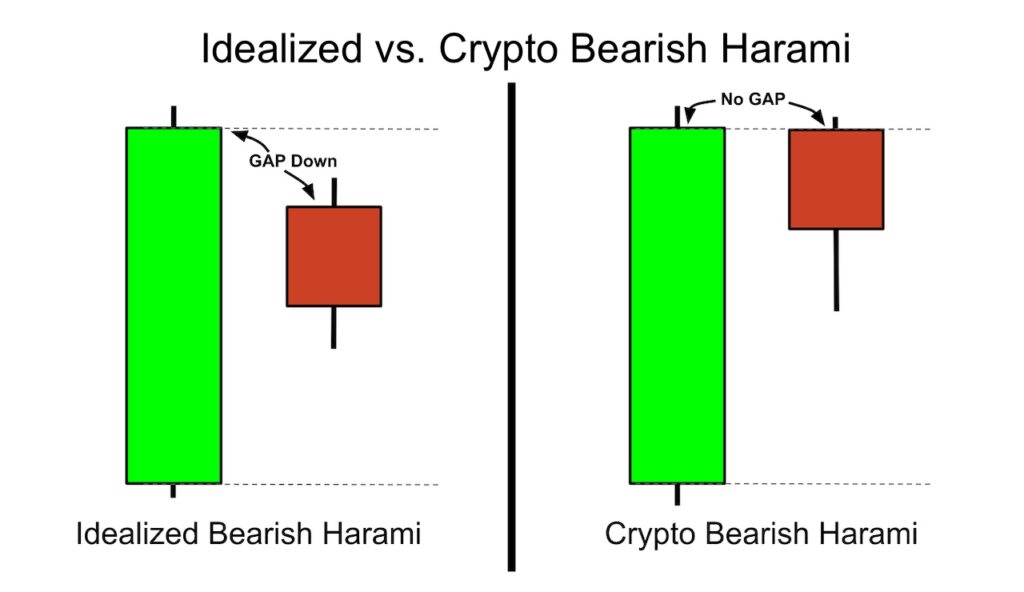

Harami Candlestick Pattern ek technical analysis ka concept hai jo keemati maal ki markets mein istemal hota hai, khaaskar candlestick charts ki tashrih mein. "Harami" ka lafz Japani zabaan se liya gaya hai jo "hamila" ya "umeedwar" ko tashbeeh dene ke liye istemal hota hai, jo chart par is pattern ki shakl ko tawajjo deti hai. Harami pattern do mombattiyan se bana hota hai: Pehli mombatti bari mombatti hoti hai jo mojud trend ko zahir karti hai. Is mombatti mein bullish (upward) ya bearish (downward) trend ho sakta hai, mojud trend ke mutabiq.Dusri mombatti choti hoti hai aur pehli mombatti ke range mein puri tarah samahit hoti hai. Isay aam taur par "andar ki" mombatti kaha jata hai.Yahan do qisam ke Harami patterns hain: Bullish Harami: Pehli mombatti bearish (downward) mombatti hoti hai. Dusri mombatti choti hoti hai aur iska bullish (upward) trend hota hai jo pehli mombatti ke range mein puri tarah samahit hota hai.Bearish Harami: Pehli mombatti bullish (upward) mombatti hoti hai. Dusri mombatti choti hoti hai aur iska bearish (downward) trend hota hai jo pehli mombatti ke range mein puri tarah samahit hota hai.Harami pattern ko ek mogheeb u-turn ka signal samjha jata hai, jo kehta hai ke mojud trend apni raftar khota ja raha hai aur aik u-turn hone ki koshish ho sakti hai. Lekin ahem hai ke Harami pattern akele mein hamesha kamyabi wala u-turn nahi dene wala, kyun ke is ki asar ko mojud market ki halat, volume aur dusre technical indicators bhi mutasir kar sakte hain.Karobar karne walay aksar Harami pattern ko savdhani se istemal karke trading decisions lene se pehle mazeed qeemti information aur technical signals ki tafseel se tafteesh karte hain.Jaise ke kisi bhi technical analysis tool ko, Harami pattern ko bhi doosre indicators aur tafseelati tajwezat ke saath istemal karne ka mashwara diya jata hai takay trading decisions mein kamiyabi ke imkanat barh jayen. -

#10 Collapse

Presentation Assalamu alaikum ummid Karti hun ke Forex part se khairiyat se honge bhai aur bahanon primary aapke liye bahut hello khas subject Lai hun is point ka naam hai what is harami candle example to puchte Hain Ki harami candlest individual Kya Hai to Aaj ham iske exposed Mein kuchh aapko maloomat Denge jisko janne ke awful aap Khel Mein bahut jyada izaafa hoga aur aapko bahut jyada benefit hasil hoga to jaise ki yah theme Maine dhundh kar aap logon ke sath share kiya tha ki fundamental aap logon ke sath share Karun aur aap ise fayda kar se Kya aapko bhi chahie ki aap isko aage share Karen Taki dusre log bhi se kuchh fayda kar purpose to ham is point ke uncovered mein batchit karte hain shukriya Is subject ko jitne jyada aap samjhenge utna jyada aapke liye fayda band hoga ismein se koi bhi mushkil wali baat nahin hai jo ki aapko samajh Mein Na aaye maine bahut hello aasan lafzon Mein aap logon ke sath share Kiya Hai Taki aap pahli Najar mein dekhne se greetings is point ko samajh jaen aur isase kuchh fayda hasil kar saken aapko bhi chahie ki jawab koi naya theme dekhen jo ki Forex ke stage Mein uska jyada se jyada kam ho aur vah jyada fayda deta ho to aapko bhi chahie ki aap hamare sath share Karen Taki ham bhi usse kuchh fayda hasil kar saken What is the Harami candle design? Dear members, Hota Ha MTLB, Banta Ha Kadé, Audacious Bull Ho Jata Ha or Bazar Kamten Warna Shlo Ho Jati Hai generally significant, I will be happy on the off chance that you come. Patten k purchase messy garments at a fundamental cost. Halami Ek Aham Joke Nagsi Greetings Jiska name "Halami" signifies "forceful" or "furious" hotha in Arabic.

Is subject ko jitne jyada aap samjhenge utna jyada aapke liye fayda band hoga ismein se koi bhi mushkil wali baat nahin hai jo ki aapko samajh Mein Na aaye maine bahut hello aasan lafzon Mein aap logon ke sath share Kiya Hai Taki aap pahli Najar mein dekhne se greetings is point ko samajh jaen aur isase kuchh fayda hasil kar saken aapko bhi chahie ki jawab koi naya theme dekhen jo ki Forex ke stage Mein uska jyada se jyada kam ho aur vah jyada fayda deta ho to aapko bhi chahie ki aap hamare sath share Karen Taki ham bhi usse kuchh fayda hasil kar saken What is the Harami candle design? Dear members, Hota Ha MTLB, Banta Ha Kadé, Audacious Bull Ho Jata Ha or Bazar Kamten Warna Shlo Ho Jati Hai generally significant, I will be happy on the off chance that you come. Patten k purchase messy garments at a fundamental cost. Halami Ek Aham Joke Nagsi Greetings Jiska name "Halami" signifies "forceful" or "furious" hotha in Arabic. :max_bytes(150000):strip_icc()/dotdash_Final_Bullish_Harami_2020-8e7ee8e18daf483288e4962f3ebc8be2.jpg) Recognize examples and cost developments for financial backers. An unlawful candle design is a transient pattern inversion when a consistent light is framed. Ek Dusare Joke Ku Gof (Khan Kana) Karuta Bala. Ismen pahere joke ki ramuka harami pattern tree defta hai, you show the contrary marker, karate pada kawung, kal saket hai. The "outbuilding owl" view is "bullish", however you are proposing the inverse, since there is a gamble unwilling financial backer. significance Harami design ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami design ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.

Recognize examples and cost developments for financial backers. An unlawful candle design is a transient pattern inversion when a consistent light is framed. Ek Dusare Joke Ku Gof (Khan Kana) Karuta Bala. Ismen pahere joke ki ramuka harami pattern tree defta hai, you show the contrary marker, karate pada kawung, kal saket hai. The "outbuilding owl" view is "bullish", however you are proposing the inverse, since there is a gamble unwilling financial backer. significance Harami design ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami design ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.  Harami Candle Example ka istemal karne se pehle iske impediments ko samajhna zaroori hai. Yeh ek apparatus hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex exchanging mein Harami Candle Example ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke pattern inversion nahi hota poke design seem hota hai. Agar aap sirf is design standard depend karte hain to aap ghalat exchanging choices le sakte hain. Harami design chhota sharpen ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar standard karne se zyada fayda ho sakta hai.Harami design ki tasdeeq ke liye doosre isharay aur designs ki zaroorat hoti hai. Bina affirmation ke exchange karna dangerous ho sakta hai. Agar Harami design pattern ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur pattern ko zahir karna zaroori hay.Harami design ka istemal karte waqt risk the board ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami design ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai. Ilam aur practice ke is design standard depend karna nuqsan deh ho sakta hai aakhir mein, yad rahe ke Harami Candle Example ek instrument hai aur iska istemal karte waqt ehtyat aur doosre awmil ko bhi madde nazar rakhte tone exchanging choices lena chahiye.

Harami Candle Example ka istemal karne se pehle iske impediments ko samajhna zaroori hai. Yeh ek apparatus hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex exchanging mein Harami Candle Example ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke pattern inversion nahi hota poke design seem hota hai. Agar aap sirf is design standard depend karte hain to aap ghalat exchanging choices le sakte hain. Harami design chhota sharpen ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar standard karne se zyada fayda ho sakta hai.Harami design ki tasdeeq ke liye doosre isharay aur designs ki zaroorat hoti hai. Bina affirmation ke exchange karna dangerous ho sakta hai. Agar Harami design pattern ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur pattern ko zahir karna zaroori hay.Harami design ka istemal karte waqt risk the board ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami design ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai. Ilam aur practice ke is design standard depend karna nuqsan deh ho sakta hai aakhir mein, yad rahe ke Harami Candle Example ek instrument hai aur iska istemal karte waqt ehtyat aur doosre awmil ko bhi madde nazar rakhte tone exchanging choices lena chahiye.

-

#11 Collapse

Introduction Of Harami Candlestick; Assalamu alaikum umid Karta hun ke Forex member se khairiyat se honge bhai aur bahanon main aapke liye bahut hi khas topic Lai hun is topic ka naam hai what is harami candle stick pattern to puchte Hain Ki harami candlest person Kya Hai to Aaj ham iske bare Mein kuchh aapko maloomat Denge jisko janne ke bad aap Khel Mein bahut jyada izaafa hoga aur aapko bahut jyada profit hasil hoga to jaise ki yah topic Maine dhundh kar aap logon ke sath share kiya tha ki main aap logon ke sath share Karun aur aap ise fayda kar se Kya aapko bhi chahie ki aap isko aage share Karen Taki dusre log bhi se kuchh fayda kar saky Discussion of Harami Candlestick; Dear friends Is topic ko jitne jyada aap samjhenge utna jyada aapke liye fayda band hoga ismein se koi bhi mushkil wali baat nahin hai jo ki aapko samajh Mein Na aaye maine bahut hi aasan lafzon Mein aap logon ke sath share Kiya Hai Taki aap pahli Najar mein dekhne se hi is topic ko samajh jaen aur isase kuchh fayda hasil kar saken aapko bhi chahie ki jawab koi naya topic dekhen jo ki Forex ke platform Mein uska jyada se jyada kam ho aur vah jyada fayda deta ho to aapko bhi Chahiye ki aap hamare sath share Karen Taki ham bhi usse kuchh fayda hasil kar saky Explanation; Dear members Hota Ha mtlb Banta Ha kady to rBrazen Bull Ho Ho Jata Ha or Bazar Kamten Warna Shlo Ho Jati Hai most important I will be glad if you come Patten k buy dirty clothes at a basic price Halami Ek Aham Sham Nagsi Hi Jiska nameHalami means aggressive or angry hota Hai Identify Harami Candlestick pattern; Piyary Dosto Identify patterns and price movements for investors An illegal candlestick pattern is a short term trend reversal when a continuous candle is formed Ek Dusare Sham Ku Gof (Khan Kana) Karuta Bala Ismen pahere sham ki ramuka harami trend tree defta Hai you show the opposite indicator karate pada kawung kal saket hai The barn owl view is bullish but you are suggesting the opposite because there is a risk averse investor -

#12 Collapse

Dear members forex trading marketing Mei HARAMI CANDLESTICK PATTERN ek am sa istemal honay wala reversal pattern hai, jahan ek chhota candle ek baraa candle ke andar hota hai. Yehahi neshandahi karta hai ke trend mein mumkina tabdeli ho sakta hai. Is pattern ka use trend reversal ki pehchaan karne mein hota hai.harami Candlestick Pattern sy forex trading mein is liye important hota hai kyun ke yeh ek reversal signal deta hai. Jab trend mein ek Harami pattern appear hota hai, matlab chhota candle bada candle ke andar fit hota hai, toh yeh tajweez karta hai ke trend mein tabdeeli ho sakta hai. Traders is pattern ka istemal trend ki direction ka andaza karne mein he karte hain, jisse unko potential profits mil sakte hain. Lekin yeh important hai ke aap doosre technical indicators aur market ki trah situation ko bhi gour karein jab aap trading decisions lein. Forex trading mein Harami Candlestick Pattern ka istemal karne se pehle kuch limitations ya challenges hote hain. Harami pattern jesy bohat su galat feslay b peda kar sakta hai, matlab ke trend reversal nahi hota jab pattern appear hota hai. Isliye, sirf is pattern par rely na karein, balki doosre sahii indicators aur tajziya bhi istemal karein. Harami pattern ka size chhota ho sakta hai, jisse ki trend reversal ke chances kam ho jaate hain. Bade timeframes par is pattern ka use karna zyada reliable ho sakta hai. Harami pattern ki confirmation ke liye doosre candlestick patterns ya indicators ki zaroorat hoti hai. Bas ek bullish Harami pattern dekh kar trade na karein, balkay tasdeeq ke liye intezar karein. Agar Harami pattern trend kay bilkul mukhalif simat main ho, toh yeh kam reliable hota Hai. Dear members forex trading marketing Mei HARAMI CANDLESTICK PATTERN chart price bhot ziyada hoti hey our eski bhot ziyada type Hei jo estmal kiya howa hota Hai price bhi change karty hen our HARAMI CANDLESTICK pattern ka use karke bhi stoploss aur target levels set karna zaroori hai.Harami pattern ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.Harami Candlestick Pattern ka istemal karne se pehle iske limitations ko samajhna zaroori hai. Yeh ek tool hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex trading mein Harami Candlestick Pattern ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke trend reversal nahi hota jab pattern appear hota hai. Agar aap sirf is pattern par rely karte hain to aap ghalat trading decisions le sakte hain. Harami pattern chhota hone ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar par karne se zyada fayda ho sakta hai.Harami pattern ki tasdeeq ke liye doosre isharay aur patterns ki zaroorat hoti hai. Bina confirmation ke trade karna risky ho sakta hai. Agar Harami pattern trend ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur trend ko zahir karna zaroori hay.Harami pattern ka istemal karte waqt risk management ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami pattern ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai. Ilam aur practice ke is pattern par rely karna nuqsan deh ho sakta hai aakhir mein, yad rahe ke Harami Candlestick Pattern ek tool hai aur iska istemal karte waqt ehtyat aur doosre awmil ko bhi madde nazar rakhte hue trading decisions Lena chahta hein our profite bhi sahii tareky sy samjhy jaty hen our successful in the forex trading marketing Mei hoty hein.Shukriya for this post.

-

#13 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "What is harami candlestick pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Harami candlestick pattern Harami Mumtaz Candlestick Pattern Forex Trading Mein Mumtaz Taqqazon ka Safar Mumtaz Taqqazon ka Nara, forex tijarat ke kisi bhi karobar mein mustand auzaron mein se ek hai. Ye qeemat ki manazir ki tasviren faraham karte hain jo keematon ke hawale se bazar ke jazbat aur mumkin mustaqbil ke qeemat tajarbat mein qeemati wazahatain faraham karte hain. Aik aisa nizam hai "Harami" mumtaz taqze ka, jo tijarat karne wale traders ke liye ehmiyat rakhta hai jo tajarbat mein muawin ya manzil ke muqablay mein pehlu ya jari rehne ki talash mein hain. Is mazameen mein, hum Harami taqze ka maqsad, is ka kis tarah paida hota hai, is ke ikhtilafaat aur forex tijarat ke tajarbat ke liye is ke asrat par ghor karenge. Mumtaz Taqzon ke Hawale se Samajhna: Mumtaz Taqze qadeem dour mein Japan se ubharay aur jadeed mali bazar mein takneekiy tajarbat ka mustand hissa ban gaye hain. Har mumtaz taqaza chaar ahem asbaab se mushtamil hota hai: shuruqat ki keemat, band ki keemat, bulandi ki keemat aur pasti ki keemat. Ye asbaab mazbooti aur baal ki surat mein paish kiye jate hain. Harami Mumtaz Taqze Kya Hai? Harami mumtaz taqaza aik do-mumtaz taqze ka sazish hai jo ek bazar ki tarafrawi rukhsat ke doran paida hota hai, tajarbat ki manzil ya jari rehne ki talash mein ek mumkin badalnay ya muqablay ki taraf ishara karta hai. Lafz "Harami" bache ki maan ke Japani lafz se liya gaya hai, kyunki taqaza jism se kuch milti-julti saabit hota hai. Harami mumtaz taqaza do mumtaz taqazon se mushtamil hai: 1. Pehla Mumtaz Taqaza: Ye aik barhwa taqaza hai jo hawale se manzil ki jareeh safar ka izhar karta hai. Misal ke taur par, aik ooper ki tarafrawi ke doran, pehla mumtaz taqaza bullish (sabz ya safed) hoga, is se maloom hota hai ke kharidar qabza mein hain. 2. Dusra Mumtaz Taqaza: Ye mumtaz taqaza pehlay mumtaz taqaze ke badan mein ghoshafta hota hai aur isay poori tarah mein lipta hota hai. Ye pehlay mumtaz taqaze ke baraks rang ka hota hai aur manzil ki taraf muqabla mein mukhalif rang ki taraf badalne ki mumkinat ki alamat hoti hai. Harami Taqze Ki Tashkeel: Harami taqze ko pehchana tashkeel hasil karne ke liye, doosra mumtaz taqaza pehlay mumtaz taqaze ki hadd mein shamil hona chahiye. Iska matlab hai ke doosre mumtaz taqaze ki oonchai aur pasti pehlay mumtaz taqaze ki oonchai aur pasti ke andar honi chahiye. Is ke ilawa, dono mumtaz taqazon ke rang bhi ahem kirdar ada karte hain. Agar pehla mumtaz taqaza bullish ho aur doosra bearish ho, to isay "Bearish Harami" kehte hain. Ulta, agar pehla mumtaz taqaza bearish ho aur doosra bullish ho, to ise "Bullish Harami" kehte hain. Harami Taqze Ki Tashreeh: Harami taqaza jab ek dora ko khatam hone par paida hota hai, to ye manzil ki taraf muqabla ya jari rehne ka ishara samajha jata hai. Is se maloom hota hai ke safar ki rafiq dor ki lehar khatam ho rahi hai aur badalnay ka imkan hai. Traders Harami taqaza ko kharidar aur farokht karne wale mein ikhtilaf ke taur par samajhte hain. Pehla mumtaz taqaza ishara karta hai ke aik taraf (kharidar ya farokht karne wale) qabza mein hain, jabke doosra mumtaz taqaza ishara karta hai ke mukhalif taraf ko taqat hasil ho rahi hai. Harami Taqazon Ke Mukhtalif Iqsaam: 1. Bearish Harami Cross:Ye iqsaam jab paida hoti hai, jab doosra mumtaz taqaza aik Doji hota hai, jis ka matlab hai ke us ke shuruqat aur band keemat bohat qareeb ya mawafiq hoti hain. Ye mazeed tashweesh aur badalnay ki mumkinat ko ishara karta hai. 2. Bullish Harami Cross: Is halat mein, doosra mumtaz taqaza aik Doji hota hai, jis ka matlab hai ke ishara ke dora ke baad kharidar mein taqat hasil ho rahi hai. Harami Taqazon Ke Tijarati Strategies: 1. Badalnay Ki Strategy: Traders jo jari rehne wale safar par mutabiq trade karne ki koshish kar rahe hain, wo Harami taqaza pehchankar ishara ke baad jari rehne wale safar ke khilaf trade mein dakhil ho sakte hain. Is strategy ko doosre takneekiy indicators ya qeemat ki amli karaamaat ki tasdeeq se mustanad karne ki zaroorat hoti hai. 2. Jari Rehne Ki Strategy: Jabke Harami taqaza aksar badalnay ki taraf rawani ke sath paish kiya jata hai, is se maloom hota hai ke jari reh. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Harami candlestick pattern Kya Hai. is topic ka naam hai what is harami candle stick pattern to puchte Hain Ki harami candlest person Kya Hai to Aaj ham iske bare Mein kuchh aapko maloomat Denge jisko janne ke bad aap Khel Mein bahut jyada izaafa hoga aur aapko bahut jyada profit hasil hoga to jaise ki yah topic Maine dhundh kar aap logon ke sath share kiya tha ki main aap logon ke sath share Karun aur aap ise fayda kar se Kya aapko bhi chahie ki aap isko aage share Karen Taki dusre log bhi se kuchh fayda kar sake to ham is topic ke bare mein batchit karte hain shukriya.Is topic ko jitne jyada aap samjhenge utna jyada aapke liye fayda band hoga ismein se koi bhi mushkil wali baat nahin hai jo ki aapko samajh Mein Na aaye maine bahut hi aasan lafzon Mein aap logon ke sath share Kiya Hai Taki aap pahli Najar mein dekhne se hi is topic ko samajh jaen aur isase kuchh fayda hasil kar saken aapko bhi chahie ki jawab koi naya topic dekhen jo ki Forex ke platform Mein uska jyada se jyada kam ho aur vah jyada fayda deta ho to aapko bhi chahie ki aap hamare sath share Karen Taki ham bhi usse kuchh fayda hasil kar saken. Explanation. Yehahi neshandahi karta hai ke pattern mein mumkina tabdeli ho sakta hai. Is design ka use pattern inversion ki pehchaan karne mein hota hai.harami Candle Example sy forex exchanging mein is liye significant hota hai kyun ke yeh ek inversion signal deta hai. Hit pattern mein ek Harami design seem hota hai, matlab chhota light bada candle ke andar fit hota hai, toh yeh tajweez karta hai ke pattern mein tabdeeli ho sakta hai. Brokers is design ka istemal pattern ki bearing ka andaza karne mein he karte hain, jisse unko potential benefits mil sakte hain. Lekin yeh significant hai ke aap doosre specialized pointers aur market ki trah circumstance ko bhi gour karein poke aap exchanging choices lein. Forex exchanging mein Harami Candle Example ka istemal karne se pehle kuch restrictions ya challenges hote hain. Harami design jesy bohat su galat feslay b peda kar sakta hai, matlab ke pattern inversion nahi hota hit design seem hota hai. Isliye, sirf is design standard depend na karein, balki doosre sahii pointers aur tajziya bhi istemal karein. Harami design ka size chhota ho sakta hai, jisse ki pattern inversion ke chances kam ho jaate hain. Bade time periods standard is design ka use karna zyada dependable ho sakta hai. Harami design ki affirmation ke liye doosre candle designs ya markers ki zaroorat hoti hai. Bas ek bullish Harami design dekh kar exchange na karein, balkay tasdeeq ke liye intezar karein. Harami candlestick pattern ke ahmiyat. hai.Harami pattern ko sahi tareeke se shnakht karna aur uski seekhna bhe waqat aur practice ki zaroorat hoti ha.Harami Candlestick Pattern ka istemal karne se pehle iske limitations ko samajhna zaroori hai. Yeh ek tool hai, lekin iska istemal ehtyat sy aur doosre awamil ko gor karke karna chahiye.Forex trading mein Harami Candlestick Pattern ka istemal karne ke nuqsanat ye ho sakte hain. matlab ke trend reversal nahi hota jab pattern appear hota hai. Agar aap sirf is pattern par rely karte hain to aap ghalat trading decisions le sakte hain. Harami pattern chhota hone ki wajah se, iska kam ho sakta hai. Iska istemal bade waqar par karne se zyada fayda ho sakta hai.Harami pattern ki tasdeeq ke liye doosre isharay aur patterns ki zaroorat hoti hai. Bina confirmation ke trade karna risky ho sakta hai. Agar Harami pattern trend ke ho, to uska istemal kam ho sakta hai. Market ki harkaat aur trend ko zahir karna zaroori hay.Harami pattern ka istemal karte waqt risk management ko karna nuqsan deh ho sakta hai. aur target levels set nahi karne se aapko nuqsan uthana parr sakta hai. Harami pattern ko sahi tareeke se samajhna aur istemal karna practice ki zaroorat rakhta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:16 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим