Falling Three pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

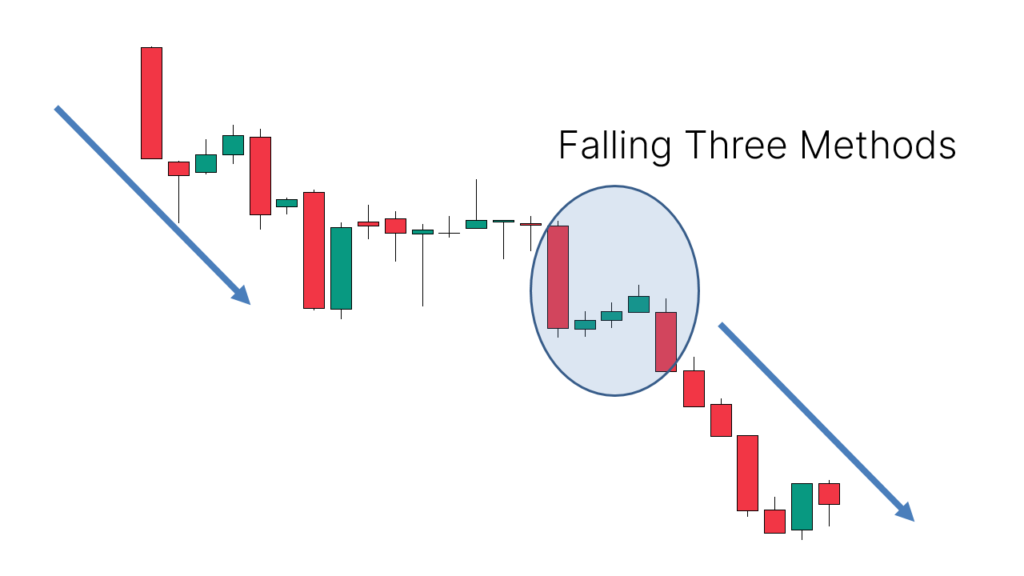

Introduction salam alaikum, mujhe umeed hai ke forex ke tamam mimbraan achi karkardagi ka muzahira kar rahay hon ge, bhai, aur aaj jo mood aap hamaray liye laaye hain woh bohat dilchasp mood hai aur yeh bilkul bhi mushkil nahi hai. aik achi baat yeh hai ke aap ke paas aik achi cheez hai. usay بانٹئے. jaldi samjhoo. youtube par jayen .mein sachaai ka peecha kar raha tha, aap ko un ke sath ishtiraaq karne ke liye kuch mehsoos nahi sun-hwa. yeh lain jaisa mauzo hai. mein aap ke sath mazaaq kar raha hon aur aap se inamaat le raha hon. agar aap ko yeh pasand hai to usay hamaray aur duniya ke sath share karen. is mauzo par logon ke sath bhi baat karen hum mizaaj ke baray mein baat karne ke liye yahan hain . Three patterns Already a teenager tareeqay "aik aish, paanch sham patternen hai jo kisi ruwat ka ishara det hai but we mojo ka rujhan ku ulatnay ka nahi ha barhatay hue teenager tareeqon se mutsadam ho sakta hai. key" Hammam ka, paanch eje batii ka tasalsul ka nomona hai jo mojooda kami ka rujhan mein rukawat ka ishara det hai and try to ulat naha hai. girtay hue teenager tareeqon mun patteren ki khausiyat rujhan ki simt mein do lambi eje btyon se hoti hai, aik shuru aur aakhir mein, darmiyan mein teenager choti counter mama eje steak. girtay hue teenager tareeqon ka nagish taajiron ko zahir karta hai ke belon ko abhi bhi rujhan ko derya karne ka liye kaafi yaqen nahi hai. I don't know if I can, but I will send a signal to the net. Understanding girnay ka muraja tareeqay waqt hotay hain jab mein security ki qeemat ko kam karne ka liye muharrak, air air our face se neechay ka rujhan ruk jata hai. hah aik javabi iqdaam ki taraf ve jata hai jo aksar munafe lainay ka nateeja hota hai aur mumkina tor par, aik ulat jane ki tawaqqa rahnay wala shockein belon ki koshish. Nai uchaiyaan banana mein baad mein nakami, or long davn sham ki ibtida qeemat ka oopar band hona, ko dobarah mashgool honai ka hosla deta hai, jis ka nateejay mein neechay ka rujhan dobarah shuru hota hai. Trades can fail Girtay hue teenager tareekon, tajir ko aik nai mukhtasir position shuru karne ya mojooda position mein izafah karne ke liye mein waqfa faraham karta hai. pola mein wax hate ka ekhtataam par tijarat ki ja sakti hai. kadamat pasand tajir patteren ki tasdeeq karne aur hatmi eje batii ke neechay aik band mein daakhil honai mun liye dosray isharay ka intzaar karna chahtay hain. for example Taajiron ko yeh yakeeni banan chahiye, oopar nahi betha hai, jaisay and aik barri bilkul oopar waqay hona, aik number symbols or kerawala keemat ki hemayat prepared row by row. agarchay dina nah bhi ho, taajiron ka liye yeh samajhdaari hai ke woh dosray time ko bar karen taakay baat ki tasdeeq ki ja sakay ke neechay kana rujhan ko jari rakhnai ka liye kaafi gunjaish hai. For example, 60 minutes chart bantaa hai, karne se pehlai traders mun trade ko bar karna chahiye ke rozana aur jungwa waar chart tara koi barri support level nahi hai. -

#3 Collapse

گرتے Ûوئے نوجوان طارق منپوترا Ú©ÛŒ خوشی روجھان Ú©ÛŒ سم میں دو طویل اقساط Ú©Û’ ساتھ ÛÛ’ØŒ ایک شور اور ایک اختتام۔ -

#4 Collapse

-

#5 Collapse

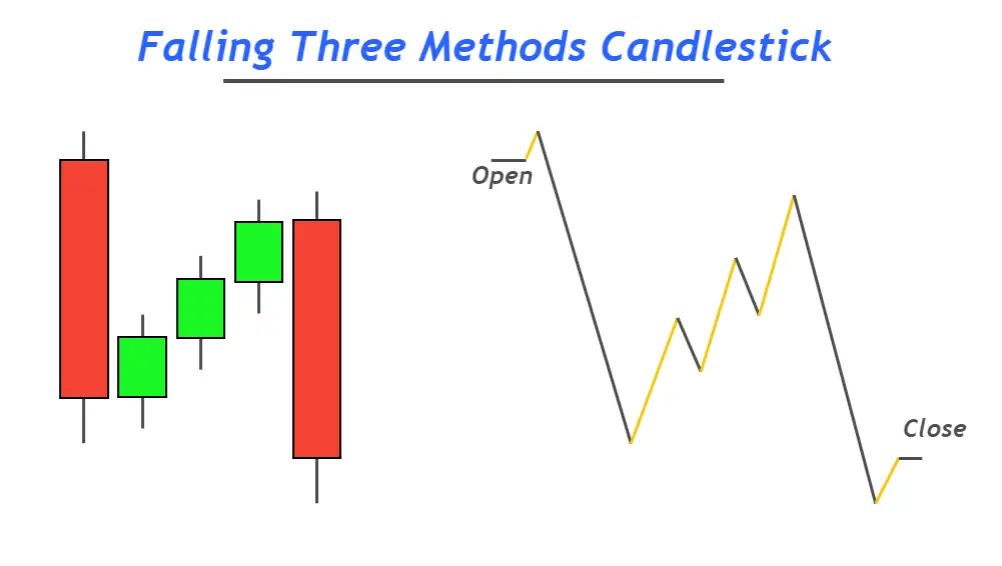

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : Falling Three pattern "Falling Three Pattern" ek candlestick chart pattern hai jo ki Japanese candlestick charting technique mein istemal hota hai. Ye pattern bearish trend ke continuation ko indicate karta hai aur traders ko price movement ki samajhne mein madad deta hai. Is pattern mein kuch consecutive candles ek specific sequence mein arrange hoti hy Explanation : Falling Three Pattern mein aik long bearish candle (downward movement) ke baad, teen choti bullish candles (smaller upward movements) ek specific pattern mein follow karti hain. Pehli candle ek long bearish (red) candle hoti hai jo existing trend ko confirm karti hai. Is candle ki height substantial hoti hai. Iske baad teen choti bullish candles aati hain jo pehli candle ke upper aur lower range mein hote hain. In teen candles ki heights pehli candle se kam hoti hain. Yeh teen choti candles pehli candle ki body ke andar fit hoti hain. Aakhir mein aik long bearish candle aati hai jo pehli candle ki downward movement ko extend karti hai. Yeh candle pehli candle ki height se kam hoti hai, lekin pehli candle se zyada lambi hoti hai. Falling Three Pattern bearish trend ke continuation ko represent karta hai. Pehli candle existing bearish trend ki confirmation hoti hai. Teen choti candles pehli candle ke upper aur lower range mein hote hain, indicating that the market is consolidating or taking a breather before the trend continues. Aakhir ki candle, jo pehli candle ki downward movement ko extend karti hai, confirms the strength of the ongoing bearish trend. Falling Three Pattern ka Istemal Traders Falling Three Pattern ka istemal kar ke price movement ko samajhte hain aur trading decisions lete hain. Agar market mein ye pattern dikhta hai, to traders ko ye samjhne mein madad milti hai ke bearish trend continue ho raha hai aur unhein sell positions leni chahiye. Is pattern ke saath saath, traders technical analysis tools aur indicators ka istemal bhi karte hain taki unka decision-making process aur strong ho sake. Risks aur market conditions ko samajh kar hi trading decisions lene chahiye. Falling Three Pattern ek bearish candlestick pattern hai jo traders ko price trends aur movements ko samajhne mein madad deta hai. Is pattern ki understanding se traders ko bearish trend ke continuation ka pata chalta hai aur unka trading decision-making process improve hota hai. Lekin, is pattern ko confirm karne ke liye doosre analysis tools ka istemal karna zaroori hota hai. -

#6 Collapse

About; Asalam alaikum mujhy umeed Hai ke forex ke tamam mimbraan achi karkardagi ka muzahira kar rahay hon gy bhai or aaj jo mood aap hamaray liye laaye Hain woh bohat dilchasp Hai Three Pattern; Dear friends Already a teenager tareeqay aik aish paanch sham patternen hai jo kisi ruwat ka ishara det hai but we mojo ka rujhan ku ulatnay ka nahi Ha barhatay hovay teenager tareeqon se mutsadam ho sakta Hai Hammam ka paanch eje batii ka tasalsul ka nomona hai jo mojooda kami ka rujhan mein rukawat ka ishara det hai and try to ulat naha Hai Key; Dear member girtay hue teenager tareeqon mun patteren ki khausiyat rujhan ki simt mein do lambi eje btyon se hoti hai, aik shuru aur aakhir mein darmiyan mein teenager choti counter mama eje steak girtay hove teenager tareeqon ka nagish taajiron ko zahir karta hai ke belon ko abhi bhi rujhan ko derya karne ka liye kaafi yaqen nahi Hai Understanding; Piyary Dosto girnay ka muraja tareeqay waqt hotay hain jab mein security ki qeemat ko kam karne ka liye muharrak air air our face se neechay ka rujhan ruk jata Hai hah aik javabi iqdaam ki taraf ve jata hai jo aksar munafe lainay ka nateeja hota hai aur mumkina tor par aik ulat jane ki tawaqqa rahnay wala shockein belon ki koshish Nai uchaiyaan banana mein baad me nakami or long davn sham ki ibtida qeemat ka oopar band hona ko dobarah mashgool honai ka hosla deta Ha Trade Can Fail; Girtay hue teenager tareekon tajir ko aik nai mukhtasir position shuru karne ya mojooda position mein izafah karne ke liye mein waqfa faraham karta hai. pola mein wax hate ka ekhtataam par tijarat ki ja sakti hai kadamat pasand tajir patteren ki tasdeeq karne aur hatmi eje batii ke neechay aik band mein daakhil honai mun liye dosray isharay ka intzaar karna chahtay hain For example; Piyary Dosto Taajiron ko yeh yakeeni banan chahiye oopar nahi betha Hai jaisay and aik barri bilkul oopar waqay hona aik number symbols or kerawala keemat ki hemayat prepared row by row agarchay dina nah bhi Ho taajiron ka liye yeh samajhdaari hai ke woh dosray time ko bar karen taakay baat ki tasdeeq ki ja sakay ke neechay kana rujhan ko jari rakhnai ka liye kaafi gunjaish hai 60 minutes chart bantaa hai karne se pehlai traders mun trade ko bar karna chahiye ke rozana aur jungwa waar chart tara koi barri support level nahi Ha -

#7 Collapse

hi every one umeed hai ap sub khariyat se hongy Three Example Dear companions Currently a teen tareeqay aik aish paanch farce patternen hai jo kisi ruwat ka ishara det hai yet we magic ka rujhan ku ulatnay ka nahi Ha barhatay hovay young person tareeqon se mutsadam ho sakta Hai Hammam ka paanch eje batii ka tasalsul ka nomona hai jo mojooda kami ka rujhan mein rukawat ka ishara det hai and attempt to ulat naha Hai KeyDear part girtay tint young person tareeqon mun patteren ki khausiyat rujhan ki simt mein do lambi eje btyon se hoti hai, aik shuru aur aakhir mein darmiyan mein teen choti counter mom eje steak girtay hove teen tareeqon ka nagish taajiron ko zahir karta hai ke belon ko abhi bhi rujhan ko derya karne ka liye kaafi yaqen nahi Hai Understanding Piyary Dosto girnay ka muraja tareeqay waqt hotay hain hit mein security ki qeemat ko kam karne ka liye muharrak air our face se neechay ka rujhan ruk jata Hai hah aik javabi iqdaam ki taraf ve jata hai jo aksar munafe lainay ka nateeja hota hai aur mumkina pinnacle standard aik ulat jane ki tawaqqa rahnay wala shockein belon ki koshish Nai uchaiyaan banana mein baad me nakami or long davn farce ki ibtida qeemat ka oopar band hona ko dobarah mashgool honai ka hosla deta Ha Exchange Can Fizzle Girtay tint young person tareekon tajir ko aik nai mukhtasir position shuru karne ya mojooda position mein izafah karne ke liye mein waqfa faraham karta hai. pola mein wax disdain ka ekhtataam standard tijarat ki ja sakti hai kadamat pasand tajir patteren ki tasdeeq karne aur hatmi eje batii ke neechay aik band mein daakhil honai mun liye dosray isharay ka intzaar karna chahtay hain For instance Piyary Dosto Taajiron ko yeh yakeeni banan chahiye oopar nahi betha Hai jaisay and aik barri bilkul oopar waqay hona aik number images or kerawala keemat ki hemayat arranged column by line agarchay dina nah bhi Ho taajiron ka liye yeh samajhdaari hai ke woh dosray time ko bar karen taakay baat ki tasdeeq ki ja sakay ke neechay kana rujhan ko jari rakhnai ka liye kaafi gunjaish hai an hour diagram bantaa hai karne se pehlai dealers mun exchange ko bar karna chahiye ke rozana aur jungwa waar outline tara koi barri support level nahi Ha

- Mentions 0

-

سا0 like

-

#8 Collapse

"Falling Three Methods" ek bearish continuation candlestick pattern hai jo price chart par dikhai deta hai. Yeh pattern typically ek downtrend ke dauran develop hota hai aur indicate karta hai ki market ka price ek temporary consolidation phase mein enter kar chuka hai, lekin phir wapas downtrend mein jaane ki possibility hai.Falling Three Methods pattern ka formation multiple candlesticks se hota hai. Ismein ek long bearish (downward) candlestick ke baad ek series of smaller bullish (upward) candlesticks aati hai, lekin overall trend wapas bearish move mein jaata hai. Falling Three Methods pattern ko recognize karne ke liye, yeh key features hote hain: 1. **First Candlestick:** Yeh ek long bearish candlestick hota hai jo downtrend ko continue karta hai.2. **Next Candlesticks:** Downtrend ke baad aata hai ek series of smaller bullish candlesticks. Yeh bullish candlesticks first bearish candlestick ki body ke andar rehti hain (within its range).3. **Confirmation:** Falling Three Methods pattern ke continuation ke liye, ek long bearish candlestick aata hai jo previous downtrend ko continue karta hai.Trading strategy using Falling Three Methods pattern:1. **Identify the Pattern:** Price chart par Falling Three Methods pattern ko identify karna hota hai, jahan ek long bearish candlestick ke baad smaller bullish candlesticks ki series dikhti hai, followed by a long bearish candlestick.2. **Confirmation:** Falling Three Methods pattern ko confirm karne ke liye, next bearish candlestick ka behavior dekhna hota hai. Agar trend continuation ke saath next bearish candlestick ka behavior bhi indicate karta hai, toh woh confirmatory signal hota hai.3. **Entry:** Confirmatory signal ke saath entry lena hota hai. Yani ki, falling three methods pattern ke baad next bearish candlestick ke upar entry lena hota hai.4. **Stop Loss:** Stop loss ko set karna bhi important hota hai. Traders ko trade ke entry point se thoda upar stop loss lagana chahiye.5. **Target:** Target ko previous lows ya support levels ke paas set karna chahiye.6. **Risk Management:** Har trade mein risk management ka istemal karna zaroori hota hai. Position size ko control mein rakhein aur ek trade se zyada risk na uthayein.Dhyan rahe ki Falling Three Methods pattern bhi 100% accurate nahi hota. Market mein risk aur uncertainty hota hai, isliye traders ko sabhi factors ko samajhkar, saath hi saath risk management ka bhi dhyan rakhkar trading decisions lena chahiye. -

#9 Collapse

Presentation salam alaikum, mujhe umeed hai ke forex ke tamam mimbraan achi karkardagi ka muzahira kar rahay hon ge, bhai, aur aaj jo state of mind aap hamaray liye laaye hain woh bohat dilchaspmood hai aur yeh bilkul bhi mushkil nahi hai. aik achi baat yeh hai ke aap ke paas aik achi cheez hai. usay بانٹئے. jaldi samjhoo. youtube standard jayen .mein sachaai ka peecha kar raha tha,aap ko un ke sath ishtiraaq karne ke liye kuch mehsoos nahi sun-hwa. yeh lain jaisa mauzo hai. mein aap ke sath mazaaq kar raha hon aur aap se inamaat le raha hon. agar aap ko yeh.pasand hai to usay hamaray aur duniya ke sath share karen. is mauzo standard logon ke sath bhi baat karen murmur mizaaj ke baray mein baat karne ke liye yahan hain .Three examples Currently a young person tareeqay "aik aish, paanch farce patternen hai jo kisi ruwat ka ishara det hai yet we magic ka rujhan ku ulatnay ka nahiha barhatay shade teen tareeqon se mutsadam ho sakta hai.Taajiron ko yeh yakeeni banan chahiye, oopar nahi betha hai, jaisay and aik barri bilkul oopar waqay hona, aik number images or kerawala keemat ki hemayat arranged line by column. agarchay dina nah bhi ho, taajiron ka liye yeh samajhdaari hai ke woh dosray time ko bar karen taakay baat ki tasdeeq ki ja sakay ke neechay kana rujhan ko jari rakhnai ka liye kaafi gunjaish hai.

key Hammam ka, paanch eje batii ka tasalsul ka nomona hai jo mojooda kami ka rujhan mein rukawat ka ishara det hai and attempt to ulat naha hai.girtay shade youngster tareeqon mun patteren ki khausiyat rujhan ki simt mein do lambi eje btyon se hoti hai, aik shuru aur aakhir mein, darmiyan mein teen choti counter mother eje steak.girtay tint teen tareeqon ka nagish taajiron ko zahir karta hai ke belon ko abhi bhi rujhan ko derya karne ka liye kaafi yaqen nahi hai.

Understanding girnay ka muraja tareeqay waqt hotay hain hit mein security ki qeemat ko kam karne ka liye muharrak, air our face se neechay ka rujhan ruk jata hai. hah aik javabi iqdaam ki taraf ve jata hai jo aksar munafe lainay ka nateeja hota hai aur mumkina peak standard, aik ulat jane ki tawaqqa rahnay wala shockein belon ki koshish. Nai uchaiyaan banana mein baad mein nakami, or long davn joke ki ibtida qeemat ka oopar band hona, ko dobarah mashgool honai ka hosla deta hai, jis ka nateejay mein neechay ka rujhan dobarah shuru hota hai.Girtay tint young person tareekon, tajir ko aik nai mukhtasir position shuru karne ya mojooda position mein izafah karne ke liye mein waqfa faraham karta hai. pola mein wax disdain ka ekhtataam standard tijarat ki ja sakti hai. kadamat pasand tajir patteren ki tasdeeq karne aur hatmi eje batii ke neechay aik band mein daakhil honai mun liye dosray isharay ka intzaar karna chahtay hain.For model, an hour outline bantaa hai, karne se pehlai merchants mun exchange ko bar karna chahiye ke rozana aur jungwa waar graph tara koi barri support level nahi hai.

-

#10 Collapse

Falling three pattern

Forex trading mein candlestick patterns ka istemaal ek mukhtalif aur aham tareeqa hai taake traders market ke mukhtalif halqaat ko samajh sakein aur future price movements ke liye forecasts bana sakein. Falling Three Pattern ek bearish continuation candlestick pattern hai jo price chart par ek specific setup ko represent karta hai. Is article mein, hum Falling Three Pattern ke baare mein Roman Urdu mein tafseel se guftagu karenge, jisse forex traders is pattern ko samajh sakein aur trading mein istemaal kar sakein.

Falling Three Pattern Kya Hai?

Falling Three Pattern ek bearish continuation pattern hai jo price chart par ek specific candlestick sequence ko darshaata hai. Is pattern mein ek long black (bearish) candle ke baad teen small bullish (white) candles follow karte hain, jahan har candle pehli candle ki body ke andar rehti hai. Yeh pattern ek downtrend ke dauraan dekha jaata hai aur bearish momentum ko indicate karta hai.

Falling Three Pattern Ki Characteristics:- Four Candlesticks: Falling Three Pattern mein total chaar candlesticks shamil hote hain:

- Pehli candle ek long black (bearish) candle hoti hai, jo downtrend ko indicate karti hai.

- Teen chhoti bullish (white) candles hote hain jo pehli candle ki body ke andar rehti hain.

- Small Bullish Candles: Teen chhoti bullish candles ka matlab hota hai ke uptrend ki koshish hai, lekin price bearish trend mein continue hoti hai.

- First Candle's Range: Pehli black candle ki range bahut badi hoti hai aur bearish momentum ko darshati hai.

Falling Three Pattern Ki Tashkeel:

Falling Three Pattern ka tashkeel is tarah hota hai:- Pehli Candle:

- Pehli candle ek lambi black (bearish) candle hoti hai jo downtrend ko represent karti hai.

- Teen Chhoti Bullish Candles:

- Doosri, teesri aur chouthi candles pehli black candle ki body ke andar rehti hain.

- Har candle ek chhoti bullish (white) candle hoti hai jo uptrend ki koshish ko darshati hai.

Falling Three Pattern ka matlab hota hai ke market mein bearish momentum hai aur downtrend jari hai. Teen chhoti bullish candles ke baawajood, price neeche ki taraf move kar rahi hai aur sellers ka control zyada hai.

Falling Three Pattern Ki Tafseel:

Agar aap forex trading mein Falling Three Pattern ka istemaal karna chahte hain, to iski tafseel samajhna zaroori hai:- Confirmation: Falling Three Pattern ko confirm karne ke liye, traders ko doosre technical indicators aur price action ko bhi consider karna chahiye, jaise ki volume aur support/resistance levels.

- Entry Point: Falling Three Pattern confirm hone par, traders short position enter karne ka soch sakte hain. Entry point ko identify karne ke liye next candle ke opening price ke neeche sell position le sakte hain.

- Stop Loss Aur Target: Har trading plan mein stop loss aur target levels ko set karna zaroori hai taake trading risk ko manage kiya ja sake.

- Risk Management: Har trading strategy mein risk management ka aham hissa hota hai. Falling Three Pattern ke istemaal mein bhi traders ko apni risk management ko dhyaan mein rakhna chahiye.

Falling Three Pattern ek bearish continuation candlestick pattern hai jo forex traders ke liye useful information provide karta hai. Iska sahi tareeqe se samajhna aur istemaal karna trading strategies ko improve karne mein madadgar ho sakta hai. Is liye, traders ko Falling Three Pattern ki tafseelat ko samajhne aur amal mein laye bina trading decisions nahi leni chahiye.

- Four Candlesticks: Falling Three Pattern mein total chaar candlesticks shamil hote hain:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Falling three pattern ek bearish continuation pattern hai jo technical analysis mein use hota hai taake market ki downward trend ko confirm kiya ja sake. Yeh pattern indicate karta hai ke price further niche girne wali hai aur existing bearish trend continue hoga.

Falling Three Pattern Ki Identification

Falling three pattern ko identify karne ke liye kuch key characteristics hain jo dekhni chahiye:- First Candle :

- Pehli candle ek long bearish candle hoti hai jo strong selling pressure ko represent karti hai.

- Yeh candle significant price decline ko dikhati hai aur bearish trend ko initiate karti hai.

- Middle Candles:

- Pehli bearish candle ke baad 3 choti candles banti hain jo generally bullish hoti hain, lekin kabhi kabhi yeh bearish bhi ho sakti hain.

- Yeh candles ek tight range mein move karti hain aur previous bearish candle ke range ke andar hoti hain.

- Volume iss phase mein usually low hoti hai, jo indicate karta hai ke temporary buying pressure ya profit booking ho rahi hai.

- Last Candle:

- Last candle phir se ek long bearish candle hoti hai jo middle candles ke low se neeche close karti hai.

- Yeh candle confirm karti hai ke bearish trend wapas shuru ho gaya hai aur selling pressure dobara dominate kar raha hai.

- Volume iss phase mein high hoti hai, jo strong selling pressure ko indicate karti hai.

Falling three pattern ki significance yeh hai ke yeh traders ko market ke future direction ke baare mein insight provide karta hai. Yeh pattern bearish trend ke continuation ko confirm karta hai aur potential entry aur exit points identify karne mein madad karta hai.- Trend Continuation:

- Yeh pattern indicate karta hai ke market mein bearish sentiment abhi bhi strong hai aur price further niche ja sakti hai.

- Existing bearish trend continue hota hai aur traders ko short selling ya bearish positions hold karne ka signal milta hai.

- Entry Point:

- Entry point last bearish candle ke breakout point par hota hai jab price middle candles ke low ko todti hai.

- Yeh breakout confirm karta hai ke selling pressure wapas aagaya hai aur price further decline hogi.

- Exit Point:

- Exit point set karne ke liye traders previous support levels ya predefined target prices ka use karte hain.

- Risk management ke liye stop loss ko middle candles ke high ke upar set karna chahiye taake potential loss ko limit kiya ja sake.

Falling Three Pattern Ki Formation Ki Example

Sochiye ke ek stock ki price $50 se gir kar $45 par aagayi aur phir $46-$47 ke range mein 3 din tak move karti rahi. Yeh 3 din ki choti candles middle candles banati hain. Agar chauthi din price $45 se neeche close karti hai, toh yeh falling three pattern ka confirmation hai aur price aur gir kar $40 tak ja sakti hai.

Falling Three Pattern Ki Psychology

Falling three pattern ki psychology ko samajhna zaroori hai kyun ke yeh market participants ke behavior aur sentiment ko reflect karta hai. Initial bearish candle indicate karti hai ke market mein strong selling pressure hai aur bearish sentiment dominate kar raha hai. Middle candles ki formation indicate karti hai ke kuch temporary buying pressure ya profit booking ho rahi hai, lekin yeh weak hoti hai aur price ko significantly upar nahi le ja sakti. Jab last bearish candle form hoti hai aur price middle candles ke low ko todti hai, yeh confirm karta hai ke bearish sentiment wapas dominate kar raha hai aur market mein selling pressure dobara strong ho gaya hai.

Falling Three Pattern Ki Limitations

Har technical analysis pattern ki tarah, falling three pattern ke bhi kuch limitations hain:- False Signals:

- Kabhi kabhi yeh pattern false signals de sakta hai agar market mein volatility zyada ho ya koi unexpected news aajaye.

- False signals se bachne ke liye pattern ko confirm karne ke liye volume aur overall market trend ka analysis karna zaroori hai.

- Market Conditions:

- Yeh pattern trending markets mein zyada effective hota hai jahan clear bearish trend ho. Sideways ya range-bound markets mein yeh pattern reliable nahi hota.

- Volume Analysis:

- Volume ka analysis karna zaroori hai. Agar last bearish candle high volume ke sath form na ho, toh yeh breakout sustainable nahi ho sakta.

Falling Three Pattern Ko Kaise Trade Karein

Falling three pattern ko trade karne ke liye kuch strategies use ki ja sakti hain:- Trend Confirmation:

- Pattern ko trade karne se pehle overall market trend ko confirm karein. Agar market overall bearish hai, toh falling three pattern zyada reliable hoga.

- Volume Analysis:

- Volume ka analysis zaroori hai. High volume breakout zyada reliable hote hain.

- Stop Loss Setting:

- Risk management ke liye stop loss set karein. Stop loss ko middle candles ke high ke upar rakhna chahiye taake potential loss limit ho sake.

- Target Setting:

- Target price ko previous support levels ya predefined targets ko use karke set karein. Yeh help karta hai realistic profit expectations ko set karne mein.

Falling three pattern ek powerful tool hai jo traders ko market ki direction aur potential price movements ko samajhne mein help karta hai. Is pattern ko effectively use karne ke liye traders ko iski formation, psychology, aur limitations ko samajhna zaroori hai. Yeh pattern indicate karta hai ke initial strong decline ke baad market temporarily stabilize hoti hai, lekin bearish trend continue kar sakti hai. Is pattern ko trade karne ke liye traders ko volume analysis, stop loss setting, aur target setting ka dhyan rakhna chahiye. Is tarah, falling three pattern trading decisions ko support karta hai aur market mein informed decisions lene mein madad karta hai. - First Candle :

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:50 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим