Bearish 3 line strike pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam alaikum dear members!- umeed karta hun aap sb khairiat se hn gy or apki trading bahut achii ja rahi ho ge.

- dear members aj ki post main hum three line strike candle stick pattern ko detail se study karen gy or dekhen gy k esko kesy trade kia jay.

- Bullish Three line strike

- Bearish Three line Strike

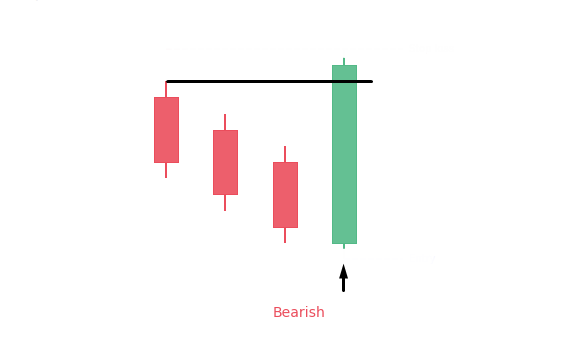

- Dear members ye pattern bearish trend k end main banta ha or es k bad market ka trend reverse ho k bullish ho jati ha.

- bearish trend main strong support py 3 bearish candles aisy banti hain k hr candle dosri candle k low k nechy close hoti ha or 3rd candle k bad aik Bari bullish candle banti ha jo k in 3 k ki height k equal hoti ha.

- estraha ye pattern complete hota ha or es k bad market ka trend reverse hota ha.

- Dear members es pattern main trade karny k lye pattern k complete hony ka wait karen or es k bad hum 4th bullish candle ki closing k bad buy ki trade le skty hain. Or es main hmara stop loss bullish candle k low k equal ho ga.

- es main hmara profit target next strong resistance tk ho ga.

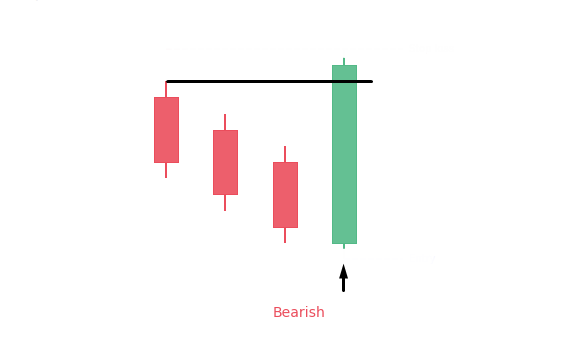

- Dear members ye pattern bullish trend k end main banta ha or strong resistance level py banta ha es main 3 bullish candles estrha banti hain k hr candle dosri candle k high k opr close hoti ha or es k bad aik bari bearish candle banti ha jo k in 3 candles ki height k equal hoti ha or es k bad ye pattern complete hota ha or market ka trend reverse hota ha.

- Dear members es pattern main trade leny k lye pattern k complete hony ka wait karen or es k bad lmbi bearish candle 4th candle k close hony py hum sell ki entry le skty hain or hmara stop loss es lambi bearish candle k high k equal hota ha.

- es main hmara profit target next strong support tk ho ga

-

#3 Collapse

Bearish 3 line Strike pattern ek technical analysis ka tool hai jo forex trading mein istemal hota hai taakey market mein mukhtalif reversals ya bechne ki signals ko pehchana ja sake. Ye ek chart pattern hai jo teen musalsal lower highs se bana hota hai, har ek ke baad ek lower low ata hai. Ye pattern bearish qarar diya jata hai kyunki ye ishara karta hai ke qeemat mein kamzori hai aur ye mumkin hai ke ye ek neeche ki taraf ja sakta hai. 3 line Strike pattern ko Mauli Pattern ya Three Rivers Pattern bhi kaha jata hai, aur ise amuman candlestick charts mein dekha jata hai.

Characteristics of the Bearish 3 line Strike Pattern:

Three consecutive lower highs: Is pattern ki pehli khasoosiyat hai ke is mein teen musalsal lower highs hoti hain. Har uncha teep pehle se kam hona chahiye, jo ke mumkin hai ke mumkin reversal ko darust karti hai.

Lower lows: Har lower high ke baad, ek lower low hona chahiye, jo dikhata hai ke qeemat ki harkat neeche jaari hai. Ye tasdeeq karta hai ke market quwwat haar rahi hai aur mumkin hai ke ek neeche ki taraf trend ban sake.

Long wicks or shadows: Is pattern ko banane wale candles mein lambi ungliyan ya shadows honi chahiye, jo dikhata hai ke us time frame mein bechne ki dabao bohot zyada tha. Ye dikhata hai ke bechne wale the jo ke uncha qeemat pe bechna chahte the, lekin unka koi asar nahi hua.

High volume: Is pattern ki formation ke doran volume zyada hona chahiye, jo dikhata hai ke us time frame mein bechnay ki bohot zyada gati thi. Ye signal ko credible banata hai aur ye badha deta hai ke market neeche jaari rahegi.

Formation of the Bearish 3 line Strike Pattern:

Is pattern ki banao mein teen musalsal candles shamil hoti hain jin mein lower highs aur lower lows hote hain:- Candle 1: Pehli candle ka uncha point (H) $1.6000 pe hota hai, neeche ka point (L) $1.5950 pe, aur bandish (C) $1.6000 pe hota hai. Ye candle hamare pattern ka pehla lower high banata hai.

- Candle 2: Dusri candle ka oopar se shuru hota hai (O) $1.6000 pe, lekin ye pehli candle ke uncha point (H) se upar nahi jata. Balki, iska bandish (C) usse neeche, $1.5950 pe hota hai, dusra lower high banata hai $1.5950 pe. Is candle ka neeche ka point (L) $1.5925 pe hota hai, hamare pattern ke doosre characteristic ko tasdeeq karte huye.

- Candle 3: Teesri candle ka ek aur lower high hota hai $1.5925 pe aur ek aur lower low $1.5875 pe hota hai, hamare pattern ke teesre characteristic ko tasdeeq karte huye. Is candle ka ooper wala hissa lambi ungli ya shadow ke sath hota hai, jo dikhata hai ke us time frame mein bechne ki dabao bohot zyada tha.

Significance of the Bearish 3 line Strike Pattern:

Bearish 3 line Strike pattern is liye ahmiyat ka hamil hai kyunki ye dikhata hai ke qeemat ki harkat quwwat haar rahi hai aur ye market mein ek neeche ki taraf trend bana sakta hai. Ye dikhata hai ke us time frame mein bechne wale kharidne wale se zyada hain, ishara karte huye ke mustaqbil mein aur bhi bechne ki dabao ho sakti hai. Traders is signal ko istemal karke short positions khol sakte hain ya phir intezar kar sakte hain ke trade karne se pehle tasdeeq ho. Lekin yaad rahe ke ye signal tanha istemal nahi karna chahiye, balki isay market ke trends aur doosre technical indicators jaise ke moving averages aur RSI ya MACD jaise oscillators ke saath ek taqatwar tajzia ka hissa banaya jana chahiye. Yahan kuch tips hain is signal ko forex trading mein istemal karne ke liye:

Confirmation: Is signal par amal karne se pehle, traders ko iski tasdeeq ke liye doosre technical indicators jaise ke moving averages ya RSI ya MACD jaise oscillators ko dekha jana chahiye taake ye dekha ja sake ke ye unke signal ke directional trend ke saath milta hai ya nahi. Ye kamyaabi ke imkanat ko barha dega aur volatile markets mein false signals ya whipsaws ke jokhim ko kam karega.

Market analysis: Traders ko market ke bunyadi factors jaise ke maaliyat se mutalliq data releases, central bank meetings, aur geo-political events ko tajzia karna chahiye, taake wo is tarah ke technical indicators ke istemal se pehle ye dekh sake ke wo unke chune gaye currency pairs ya crosses ke liye market trends aur future price movements ke mutabiq hain ya nahi.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Bearish 3 line strike pattern

Bearish 3 Line Strike Pattern (Urdu: بیئرش ٣ لائن اسٹرائیک پیٹرن)

Tazkirah: Bearish 3 Line Strike ek candlestick pattern hai jo ke market analysis mein istemal hota hai. Yeh pattern bullish trend ke baad aane wale possible bearish reversal ko darust karta hai.

Dekhne Mein Kaisa Hota Hai:- Peela Candlestick (Bullish): Pehla candlestick ek bullish trend ko represent karta hai, jiska matlab hai ke price upar ki taraf ja raha hai.

- Doosra, Teesra, Chotha Candlestick (Bearish): Ye teen consecutive bearish candlesticks hote hain jo pehle bullish candlestick ko cover karte hain. In teen candlesticks mein se koi bhi pehle wale candlestick ke upper side se overlap nahi karta.

Kya Darust Karta Hai:- Jab Bearish 3 Line Strike pattern dikhta hai, toh yeh indicate karta hai ke pehle bullish trend ke baad ab bearish trend start ho sakta hai.

- Ye pattern bullish momentum ki kamzori ko darust karta hai aur bearish reversal ki possibility ko highlight karta hai.

Trading Strategy:- Agar Bearish 3 Line Strike pattern confirm hota hai, toh traders is signal ko consider karke apne trading strategies ko adjust kar sakte hain.

- Is pattern ke baad, selling positions enter karna ek common approach ho sakta hai.

Thawabit-e-Dimaagh:- Bearish 3 Line Strike ek indicator hai, aur isay dusre technical analysis tools ke saath mila kar istemal karna behtar hota hai.

- Trading decisions mein risk management ka khayal rakhna zaroori hai.

Bearish 3 Line Strike pattern ek powerful reversal signal hai, lekin hamesha yaad rahe ke market conditions ko samajhne ke liye aur confirmations ke liye doosre technical indicators ka bhi istemal karna zaroori hai.

-

#5 Collapse

Bearish 3 Line Strike Pattern:

Cryptocurrency trading has gained immense popularity in recent years, attracting both seasoned investors and newcomers. One crucial aspect of successful trading is the ability to recognize and interpret various candlestick patterns. One such pattern that traders often use to identify potential bearish trends is the "Bearish 3 Line Strike."

Bearish 3 Line Strike is a candlestick pattern that typically signals a reversal of an uptrend. In Roman Urdu, it can be referred to as "Ghatey Hue 3 Line Strike." The pattern consists of four consecutive candlesticks: three ascending green (bullish) candles followed by a long red (bearish) candle that engulfs the previous three. This formation suggests a strong shift in market sentiment from bullish to bearish.

Traders who spot the Bearish 3 Line Strike pattern may interpret it as a signal to consider selling or shorting their positions. The pattern indicates that despite the initial bullish momentum, a sudden surge in selling pressure has overwhelmed the market, leading to a potential downturn. It is essential to note that successful trading requires a combination of technical analysis and other indicators, and the Bearish 3 Line Strike should be used in conjunction with other tools for a comprehensive analysis.

In conclusion, understanding candlestick patterns like the Bearish 3 Line Strike is crucial for cryptocurrency traders looking to make informed decisions in the dynamic market. While this pattern can provide valuable insights into potential bearish reversals, traders should always exercise caution and consider multiple factors before making trading decisions. Continuous learning and staying updated on market trends are key components of a successful trading strategy in the ever-evolving world of cryptocurrency.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

Introduction of the crptocurrency trading .

Me Umeid karta ho a sab khareyat say ho gay aj me ap koCryptocurrency trading has gained immense popularity in recent years, attracting both seasoned investors and newcomers. One crucial aspect of successful trading is the ability to recognize and interpret various candlestick patterns. One such pattern that traders often use to identify potential bearish trends is the "Bearish 3 Line Strike."

Bearish 3 Line Strike is a candlestick pattern.

that typically signals a reversal of an uptrend. In Roman Urdu, it can be referred to as "Ghatey Hue 3 Line Strike." The pattern consists of four consecutive candlesticks: three ascending green (bullish) candles followed by a long red (bearish) candle that engulfs the previous three. This formation suggests a strong shift in market sentiment from bullish to bearish.

Traders who spot the Bearish 3 Line Strike pattern.

May interpret it as a signal to consider selling or shorting their positions. The pattern indicates that despite the initial bullish momentum, a sudden surge in selling pressure has overwhelmed the market, leading to a potential downturn. It is essential to note that successful trading requires a combination of technical analysis and other indicators, and the Bearish 3 Line Strike should be used in conjunction with other tools for a comprehensive analysis.

In conclusion, understanding candlestick patterns.

like the Bearish 3 Line Strike is crucial for cryptocurrency traders looking to make informed decisions in the dynamic market. While this pattern can provide valuable insights into potential bearish reversals, traders should always exercise caution and consider multiple factors before making trading decisions. Continuous learning and staying updated on market trends are key components of a successful trading strategy in the ever-evolving world of cryptocurrency.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:35 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим