Forex Trading Without Indicators

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

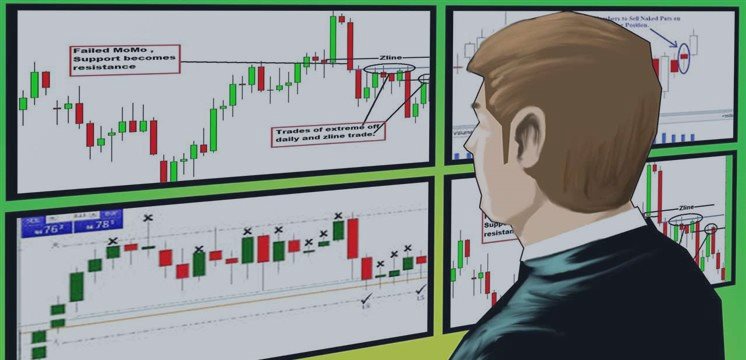

Indicator bina trading aik aisa amal hai jo keemat karwi karobar mein faislay karne mein markazi kirdar ada karta hai. Is trading kay tareeqay mein, trading ke faislay ke liye moving averages, oscillators aur trend lines jaise takneekati indicators ki bajaaye keemat karwi amal, market ka doura, aur dosri tafseeli suratain ka istemaal karte hain. Is tareeqay ko aksar price action trading kehte hain, jis mein traders ko market dynamics ka gehra samajh hasil hota hai aur unko raw price movements aur patterns ki bunyad par faislay karne ki salahiyat milti hai. Is tarike se, traders market ki asal halat ka acha samajh hasil kar sakte hain jo unko zyada durust aur waqt par trading karne mein madadgar sabit ho sakta hai.Indicator-Free TradingKamiyabi hasil karne wali indicator bina trading ke liye, aam taur par payi jane wali keemat patterns aur market structures ko pehchanana shuruat hoti hai. Double tops, head and shoulders, triangles, aur flags jaise patterns faida mand price movements aur market ki asalat mein madadgar hoti hain. In patterns ki ahmiyat aur unke asraat ko samajh kar traders market mein rukawat ya jari rehne wali keemat karwi harkaton ka andaza laga sakte hain. Principles of Indicator-Free Trading Support aur Resistance Support aur resistance levels is trading ke ahem hisson mein shamil hain. Ye levels woh jagahain hain jahan price ne aik zamane mein mutazad react kia hai, aksar zehni ya asaliyat ki wajahon ki bina par. Ye levels pehchankar, traders price ke mutazad react hone ki tawaqo kar sakte hain aur mazeed maloomat hasil karne mein madadgar ho sakte hain. Price Patterns and Structure Kamiyabi hasil karne wali indicator bina trading ke liye, aam taur par payi jane wali keemat patterns aur market structures ko pehchanana shuruat hoti hai. Double tops, head and shoulders, triangles, aur flags jaise patterns faida mand price movements aur market ki asalat mein madadgar hoti hain. In patterns ki ahmiyat aur unke asraat ko samajh kar traders market mein rukawat ya jari rehne wali keemat karwi harkaton ka andaza laga sakte hain. Candlestick Analysis Candlestick patterns khareed farokht ki dour mein khareedne wale aur farokht karne wale ke darmiyan hone wale jang ko daryaft karne mein madad deti hain. Doji, engulfing patterns, aur hammers jaise patterns market ki jazbat mein taqreeban inqilab hone ki mumkinat bata sakte hain. Candlesticks ki size, shakal, aur rang ki tahlil, price movements ki taqat ke bare mein qeemti maloomat faraham kar sakti hai. Trendlines aur Channels Jabke trendlines aam taur par takneekati indicators samjhe jate hain, woh am taur par indicator bina trading mein istemaal hote hain q k unka seedha talluq price movements se hota hai. Trendlines traders ko market ki overall direction aur potential breakout ya breakdown points ka pata lagane mein madad deti hain. Channels, parallel trendlines ko jorne se banae jate hain, price movements ki tayariyat ke bare mein mazeed maloomat faraham kar sakte hain.

Principles of Indicator-Free Trading Support aur Resistance Support aur resistance levels is trading ke ahem hisson mein shamil hain. Ye levels woh jagahain hain jahan price ne aik zamane mein mutazad react kia hai, aksar zehni ya asaliyat ki wajahon ki bina par. Ye levels pehchankar, traders price ke mutazad react hone ki tawaqo kar sakte hain aur mazeed maloomat hasil karne mein madadgar ho sakte hain. Price Patterns and Structure Kamiyabi hasil karne wali indicator bina trading ke liye, aam taur par payi jane wali keemat patterns aur market structures ko pehchanana shuruat hoti hai. Double tops, head and shoulders, triangles, aur flags jaise patterns faida mand price movements aur market ki asalat mein madadgar hoti hain. In patterns ki ahmiyat aur unke asraat ko samajh kar traders market mein rukawat ya jari rehne wali keemat karwi harkaton ka andaza laga sakte hain. Candlestick Analysis Candlestick patterns khareed farokht ki dour mein khareedne wale aur farokht karne wale ke darmiyan hone wale jang ko daryaft karne mein madad deti hain. Doji, engulfing patterns, aur hammers jaise patterns market ki jazbat mein taqreeban inqilab hone ki mumkinat bata sakte hain. Candlesticks ki size, shakal, aur rang ki tahlil, price movements ki taqat ke bare mein qeemti maloomat faraham kar sakti hai. Trendlines aur Channels Jabke trendlines aam taur par takneekati indicators samjhe jate hain, woh am taur par indicator bina trading mein istemaal hote hain q k unka seedha talluq price movements se hota hai. Trendlines traders ko market ki overall direction aur potential breakout ya breakdown points ka pata lagane mein madad deti hain. Channels, parallel trendlines ko jorne se banae jate hain, price movements ki tayariyat ke bare mein mazeed maloomat faraham kar sakte hain.  Advantages of Indicator-Free Trading

Advantages of Indicator-Free Trading- Real-Time Decision Making: Indicator bina trading traders ko waqt par hone wali price movements aur market structure par bharosa karne ke liye majboor karta hai. Is trading ke tareeqay se, traders tayyar halat ke mutabiq faislay kar sakte hain, takneekati indicators ke peeche rehne ki bajaye.

- Enhanced Understanding of Market Dynamics:Price action aur patterns ko gehri tafseeli tor par samajh kar traders market ki jazbat, supply aur demand dynamics, aur khabar ki asar ko gehri tafseel se samajhne mein kamyabi hasil karte hain. Ye maloomat behtareen tashkhees aur behtareen risk management tak pohanchne mein madad deti hain.

- Adaptability to Different Market Conditions: Indicator bina trading traders ko trading ke tabdeeli halat mein istidat hasil karne ki salahiyat deta hai. Chahe market trending ho, range mein ho, ya zyada volatility ho, traders halat ke manzar ko dekhte huye apne tareeqay ko tayyar kar sakte hain.

- Reduced Dependence on External Tools: Sirf price action par bharosa karne se mushkil takneekati indicators aur software ki zaroorat kam hoti hai, jis se trading ka amal asan ho jata hai aur traders ko information overload se bachata hai.

Challenges of Indicator-Free Trading

Challenges of Indicator-Free Trading- Subjectivity: Price action ko tashkeel dena kisi had tak subjectivity ki zaroorat rakhta hai. Traders alag alag tashkeel ya levels dekh sakte hain, jis se trading faislay mukhtalif ho sakte hain.

- Steeper Learning Curve: Indicator bina trading ko maharat hasil karne ke liye price patterns, candlestick formations, aur market structures ki gehri samajh ki zaroorat hoti hai. Ye naye traders ke liye mushkil seekhne ka rasta bana sakta hai.

- Emotional Discipline: Price action par bharosa rakhna traders ko market ki jazbat bhari manzar mein mubtila kar sakta hai. Jazbati discipline qayam rakhna tashkhees ke jhatke par amal karne se bachne ke liye ahem hai.

- Lack of Confirmation: Indicator bina trading mein takneekati indicators ki tasdeeq ki kami hoti hai, jo kabhi kabar mauqaat ko chhodne ya jhooti signals ko janam dene mein munsalik ho sakti hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Forex Trading Without Indicators

Forex trading yaani foreign exchange trading, ek aisa business hai jahan log currencies ko khareedte aur bechte hain. Ye ek global market hai jahan currencies ka daam rozana tabdeel hota hai. Forex trading ko samajhna mushkil ho sakta hai, lekin indicators ke bina bhi trading kiya ja sakta hai. Is article mein, hum dekhenge ke indicators ke baghair forex trading kaise ki ja sakti hai.

1. Forex Trading Kya Hai?

Forex trading, jise FX trading bhi kaha jata hai, ek aisa process hai jisme currencies ko exchange kiya jata hai. Is market mein currencies ka daam har pal tabdeel hota hai, jo traders ke liye mauqa hota hai profit kamane ka. Forex market duniya ka sabse bada financial market hai, aur ye 24 ghante khula rehta hai.

2. Indicators Kya Hain?

Indicators woh tools hain jo traders ko market ki movement samajhne mein madad karte hain. Ye charts aur graphs par base hotay hain aur price action ko analyze karte hain. Lekin, indicators ke bina bhi trading ki ja sakti hai agar aapko market ki samajh ho.

3. Price Action Trading

Price action trading ek aisi strategy hai jisme traders sirf price movement par focus karte hain. Is mein indicators ka istemal nahi hota, balki price ke historical data aur market ke trends ka ghor se dekha jata hai. Is method se traders ko market ki asli halat ka pata chalta hai.

4. Support aur Resistance Levels

Support aur resistance levels ko samajhna bhi indicators ke bina trading ka ek aham hissa hai. Support level wo point hota hai jahan price girne par ruk jata hai, jabke resistance level wo point hai jahan price barhne par ruk jata hai. Ye levels traders ko market ke behavior samajhne mein madad karte hain.

5. Candlestick Patterns

Candlestick patterns, price action trading ka ek crucial hissa hain. Ye patterns traders ko market ki psychological state samajhne mein madad dete hain. Jaise ki bullish engulfing pattern, bearish engulfing pattern, aur doji candles. In patterns ki madad se aap market ke trend ka andaza laga sakte hain.

6. Market Sentiment

Market sentiment, traders ki emotions aur opinions ko refer karta hai. Jab market ka majority bullish hota hai, to isay bullish sentiment kaha jata hai, aur jab bearish hota hai, to isay bearish sentiment kaha jata hai. Ye sentiment bhi price movement ko samajhne mein madadgar hota hai.

7. Economic News

Economic news jaise ke employment reports, inflation rates, aur central bank interest rates bhi currency prices par asar dalte hain. In news ko samajhna aur inke aas paas trading karna, traders ko market ke trends ko jaanne mein madad deta hai. Aksar news releases ke doran market mein volatility hoti hai, jo profit kamaane ka mauqa deti hai.

8. Time Frames

Different time frames par trading karna bhi ek strategy hai jo indicators ke bina use hoti hai. Aap short-term (like 1-minute or 5-minute charts) ya long-term (like daily or weekly charts) par trading kar sakte hain. Har time frame ka apna ek alag trend hota hai, aur inhe samajhna zaroori hai.

9. Risk Management

Risk management, kisi bhi trading strategy ka ek integral hissa hai. Aapko apni position sizes aur stop losses set karne chahiye taake aap apne capital ko protect kar saken. Indicators ke baghair bhi, sahi risk management techniques se aap apne losses ko minimize kar sakte hain.

10. Market Psychology

Market psychology ko samajhna bhi trading ke liye zaroori hai. Traders ka behaviour aur unki reactions market movements par asar dalte hain. Jab aapko market psychology ka pata hota hai, to aap behter decisions le sakte hain, chahe indicators na ho.

11. Trading Plan

Ek comprehensive trading plan banana bohat zaroori hai. Is plan mein aapko apne trading goals, strategies, aur risk management techniques ko shamil karna chahiye. Aapke trading plan ka focus price action, market sentiment, aur economic news par ho sakta hai, jo indicators ke bina bhi kaam karega.

12. Discipline aur Patience

Discipline aur patience, forex trading mein bohat zaroori hain. Indicators ke baghair trading karte waqt aapko zyada focus aur patience ki zaroorat hoti hai. Aapko apne trading rules par amal karna hoga aur impulsive decisions lene se bacha rehna hoga.

13. Practice and Backtesting

Indicators ke baghair trading karne ke liye practice karna zaroori hai. Aap demo accounts par practice karke apni strategies ko test kar sakte hain. Backtesting, aapko apne strategies ko past market data par test karne ki ijaazat deta hai, jisse aap apne approach ko refine kar sakte hain.

14. Conclusion

Forex trading ko indicators ke bina bhi kiya ja sakta hai. Price action, support and resistance levels, candlestick patterns, aur market sentiment jaise tools ka istemal karke, traders market ko samajh sakte hain aur sahi decisions le sakte hain. Har trader ko apne liye ek effective strategy develop karni chahiye, jo unke goals aur trading style ke mutabiq ho. Discipline, patience, aur practice se aap apne trading results ko behtar bana sakte hain aur forex market mein successful ban sakte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Forex Trading Without Indicators

Forex Trading Ki Pehchaan

Forex trading ek aisa business hai jahan aap duniya bhar ki currencies ki kharid aur farokht karte hain. Is mein kamiyabi hasil karne ke liye bahut se traders indicators ka istemal karte hain, lekin aisa zaroori nahi hai. Kayi traders aise hain jo indicators ke baghair bhi trading karte hain aur achi kamai karte hain. Aayiye, hum is approach ka jaiza lete hain.

Market ki Samajh

Indicators ki zaroorat nahi hai agar aapko market ki samajh hai. Aapko pata hona chahiye ke kis tarah market kaise kaam karta hai, trends kya hain aur economic news kaise prices ko asar daalti hain. Economic indicators, jaise ke GDP, employment figures, aur interest rates, trading decisions par asar daalte hain. Aap in news ka jaiza lekar market ke mood ka andaza laga sakte hain.

Price Action Analysis

Price action analysis ek technique hai jahan aap price ke movements ko dekh kar trading decisions lete hain. Is mein aap candlestick patterns, support and resistance levels, aur trend lines ka istemal karte hain. Price action aapko market ke behavior ka direct andaza deta hai. Aap dekh sakte hain ke prices kis tarah se react karte hain jab wo kisi particular level par aate hain. Ye technique bohot hi effective hai, khas taur par short-term traders ke liye.

Risk Management

Risk management bhi forex trading ka ek ahem hissa hai. Agar aap indicators ke baghair trading kar rahe hain, toh aapko risk ko behtar samajhna hoga. Stop-loss orders ka istemal karna aur position size ko manage karna zaroori hai. Aapko ye dekhna hoga ke aap kis risk ko lene ke liye tayar hain aur us hisaab se trades ka size tay karna hoga.

Discipline aur Patience

Discipline aur patience bhi forex trading ke liye bahut zaroori hain. Aapko apne emotions par control rakhna hoga aur market ki movements par react nahi karna chahiye. Aapko apne trading plan par amal karna hoga, chahe market aapke khilaf hi kyun na ja raha ho. Ye cheezen aapko behtar traders banane mein madad karengi.

Aakhir ka Lafz

Indicators ka istemal zaroori nahi hai, lekin trading ki duniya mein samajh, patience, aur discipline ki zaroorat hoti hai. Forex trading ek skill hai jo waqt ke sath improve hoti hai. Is liye, practice karein, seekhein aur apne aap par yaqeen rakhein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:13 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим