Consolidation In Forex Trading.

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Consolidation In Forex Trading. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

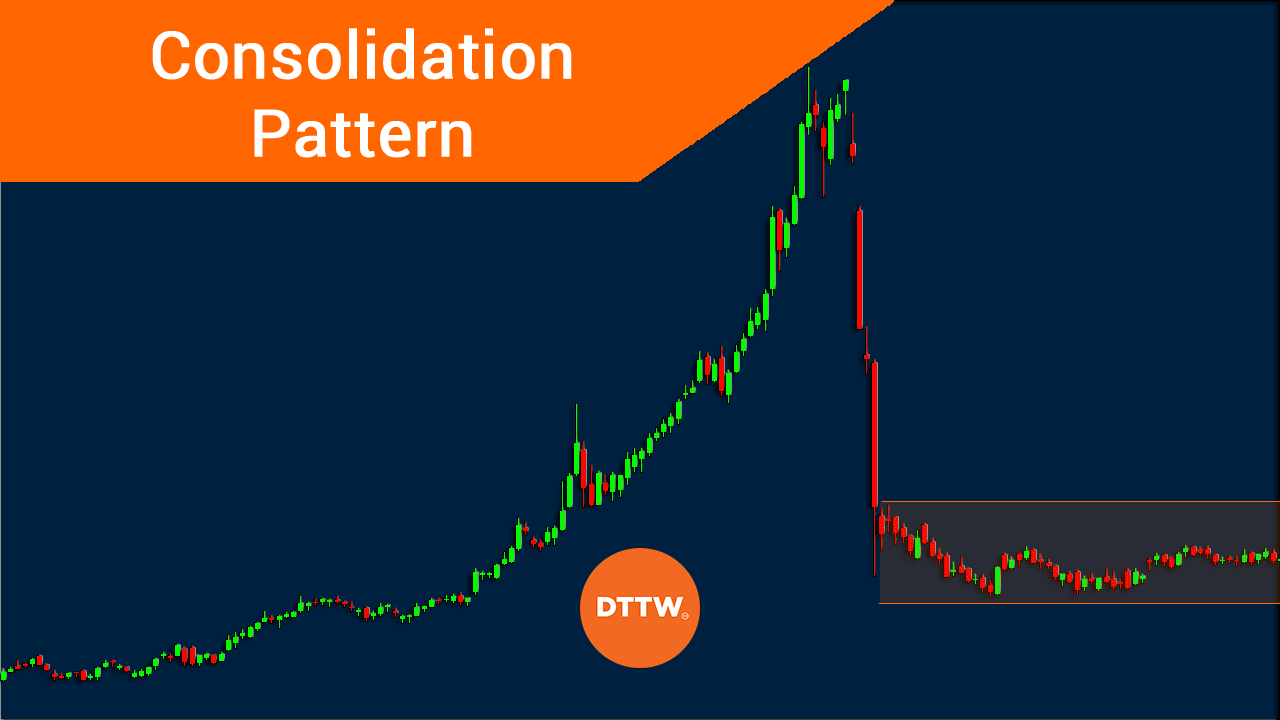

Consolidation Details. Forex trading mein consolidation ka matlab hota hai kisi currency pair ki price movement ki range ki kam hona. Iska matlab hai ki currency pair ki price movement kuch samay ke liye stable rehti hai aur kisi particular range ke andar hi rehti hai. Ye range ya price level horizontal lines ke form mein chart par dikhai dete hain. Consolidation Causes. Consolidation ka sabse bada cause hota hai market mein uncertainty. Iska matlab hai ki market mein koi clear trend nahi hai aur traders confused hote hain ki kya karein. Iske alawa market mein economic data ke release ke baad bhi consolidation dekha ja sakta hai. Kisi event ya news se traders ke paas clarity nahi hoti hai ki market kis direction mein move karega. Consolidation Benefits. Consolidation se traders ko kafi benefits mil sakte hain. Iske alawa traders apne risk ko bhi manage kar sakte hain. Kuch benefits niche diye gaye hain: Trading Range ki Limitation. Consolidation ki wajah se traders ko trading range ki limitation ka pata chalta hai. Isse traders ko pata chalta hai ki unhe kis level tak buy ya sell karna chahiye. Risk Management. Consolidation ki wajah se traders apne risk ko manage kar sakte hain. Agar traders ko pata chal jata hai ki market consolidation mein hai toh woh apni positions ko adjust kar sakte hain. Trading Strategy ki Development. Consolidation traders ke liye trading strategy ki development ka ek acha platform hai. Traders ko pata chalta hai ki kaise market mein movement ko read karna hai aur kis level par buy ya sell karna hai. Consolidation Forex trading mein ek common phenomenon hai. Traders ko iska pata hona chahiye aur isse benefits lene chahiye. Iske alawa traders ko apne risk ko bhi manage karna chahiye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex trading mein consolidation ek aham mudda hai jo traders ke liye maamul se zyada mushkilat utpann kar sakta hai.Consolidation, ya range-bound market, ek aisi halat hai jab market mein kisi specific trend ki kami hoti hai aur prices ek choti si range mein ghumte hain. Yani, currency pairs ki keemat mein kuch zyada tezi ya ghatari nahi hoti, aur market sideways move karti hai.

Consolidation Ki Pehchan:

Consolidation ko pehchanne ke liye traders ko market ke price charts par nazar rakhni hoti hai. Isme, price ek choti si area mein ghumti hai aur koi clear trend nahi hota. Candlestick patterns aur technical indicators ka istemal isme asaan hota hai.

Consolidation Ke Asarat:

Consolidation, traders ke liye ek double-edged sword ho sakta hai. Isme trading karna mushkil ho sakta hai, lekin sahi strategy ke saath, isse bhi faida uthaya ja sakta hai.

Consolidation Ke Strategies:- Range Trading: Consolidation ke doran, traders range trading ka istemal karte hain. Isme, wo currency pair ko buy karte hain jab price lower end of the range par hota hai aur use sell karte hain jab price upper end par hota hai.

- Breakout Trading: Kuch traders consolidation ke baad hone wale breakout par focus karte hain. Agar market ek range mein thi aur ek dum se kisi ek direction mein move hoti hai, toh ye breakout kehlayega. Traders is breakout ko capture karke profit kamane ki koshish karte hain.

- Volatility Strategies: Volatility consolidation ke doran kam hoti hai. Is waqt, kuch traders low volatility ke maayne lete hain aur kam risk wale trades execute karte hain.

Consolidation Mein Trading Ke Challenges:- False Breakouts: Consolidation ke doran false breakouts hone ke zyada chances hote hain, jisme traders ko bewaqoofi ka samna karna pad sakta hai.

- Low Volatility: Low volatility ki wajah se spreads bhi expand ho sakte hain, jisse trading cost badh jaati hai.

- Lack of Clear Trend: Trend ki kami hone ki wajah se, kuch traders ko market mein confusion ho sakta hai, aur wo galat decisions le sakte hain.

Consolidation Se Bachne Ki Strategies:- Wait and Watch: Kabhi-kabhi, behtar hota hai market ke clear trend ka wait karna aur consolidation ke dauran trading na karna.

- Tight Risk Management: Consolidation mein trading karte waqt, tight risk management ka hona bahut zaroori hai. Stop-loss orders ka istemal karke traders apne nuksan ko control mein rakh sakte hain.

- Focus on Other Pairs: Agar ek currency pair consolidation mein hai, toh traders dusre currency pairs par bhi focus kar sakte hain jinme trend clear ho.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Consolidation In Forex Trading.

Forex Trading Mein Consolidation

Consolidation, ya Thaharawat, ek aham mudda hai jo forex trading mein aksar pesh ata hai. Yeh maamoolan market mein rukawat ya stability ko darust karti hai. Niche diye gaye headings ke zariye is mudday ko samjha jaye:

1. Thaharawat Kya Hai?

Thaharawat, market mein trading ke doran aisi halat ko describe karta hai jab currency pairs ka price ek range mein thaharta hai aur kisi specific direction mein tezi se na badalta ho. Is doran, market participants apne trading strategies ko adjust karte hain.

2. Thaharawat Ki Wajah Kya Hoti Hai?

Thaharawat ki wajah alag-alag hosakti hai. Kuch mukhtalif factors isme shamil hote hain, jaise ke economic reports ka intezaar, geopolitical events, ya market mein uncertainty. Traders is waqt mein market ke future direction ko samajhne ki koshish karte hain.

3. Consolidation Kaise Pehchanein?

Consolidation ko pehchan'ne ke liye traders price charts aur technical analysis ka istemal karte hain. Yeh ek range-bound market ko darust karti hai jisme price horizontal lines ke darmiyan thahr raha hota hai. Bollinger Bands aur Support/Resistance levels bhi consolidation ke pata lagane mein madad karte hain.

4. Trading Strategies During Consolidation

Consolidation periods mein trading challenging hosakti hai, lekin kuch traders is doran bhi munafa kamane mein kamyab hojate hain. Range-bound strategies, jaise ke mean reversion ya breakout strategies, is waqt istemal hoti hain.

5. Consolidation Ka Kya Asar Hota Hai?

Thaharawat market participants ko future price movement ke baray mein uncertainty mein daal sakti hai. Traders ko chahiye ke is doran cautious rahein aur market trends ka dhyan rakhein, taake jab market phir se tezi se ghumaye, woh tayyar hojayein.

6. Risk Management Mein Ahmiyat

Jab market consolidation mein hota hai, risk management aur stop-loss orders ka istemal aur bhi zaroori hojata hai. Aise mein, traders apne positions ko monitor karte hain aur jaldi se apne trading plans ko adapt karte hain.

Yeh tha ek chhota sa overview consolidation ke hawale se. Forex market mein, is phenomenon ko samajhna aur sahi tajaweezat karna traders ke liye mukhtalif challenges lekar aata hai.

-

#5 Collapse

Introduction of the post.

I hope my frind Forex trading mein consolidation ka matlab hota hai kisi currency pair ki price movement ki range ki kam hona. Iska matlab hai ki currency pair ki price movement kuch samay ke liye stable rehti hai aur kisi particular range ke andar hi rehti hai. Ye range ya price level horizontal lines ke form mein chart par dikhai dete hay.

Consolidation Causes.

Consolidation ka sabse bada cause hota hai market mein uncertainty. Iska matlab hai ki market mein koi clear trend nahi hai aur traders confused hote hain ki kya karein. Iske alawa market mein economic data ke release ke baad bhi consolidation dekha ja sakta hai. Kisi event ya news se traders ke paas clarity nahi hoti hai ki market kis direction mein move karega.

Consolidation Benefits.

Consolidation se traders ko kafi benefits mil sakte hain. Iske alawa traders apne risk ko bhi manage kar sakte hain. Kuch benefits niche diye gaye hay.

Trading Range ki Limitation.

Consolidation ki wajah se traders ko trading range ki limitation ka pata chalta hai. Isse traders ko pata chalta hai ki unhe kis level tak buy ya sell karna chahiye.

Risk Management.

Consolidation ki wajah se traders apne risk ko manage kar sakte hain. Agar traders ko pata chal jata hai ki market consolidation mein hai toh woh apni positions ko adjust kar sakte hay.

Trading Strategy ki Development.

Consolidation traders ke liye trading strategy ki development ka ek acha platform hai. Traders ko pata chalta hai ki kaise market mein movement ko read karna hai aur kis level par buy ya sell karna hai. Consolidation Forex trading mein ek common phenomenon hai. Traders ko iska pata hona chahiye aur isse benefits lene chahiye. Iske alawa traders ko apne risk ko bhi manage karna chahiye hay. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Consolidation In Forex Trading.

Forex Trading Mein Consolidation

Forex trading mein "consolidation" ek aham mudda hai jo traders ke liye mahatva purna hota hai. Jab market mein consolidation hoti hai, yani ke price range mein stability dikhai deti hai, toh traders ko isse samajhne mein madad milti hai aur sahi trading decisions lene mein asani hoti hai.

Consolidation Kya Hai?

Consolidation ek market condition hai jab currency pairs ya kisi bhi financial instrument ki price mein stable phase hota hai. Iska arth hai ki market mein kisi bhi disha mein tezi ya mandi nahi ho rahi hoti aur prices ek specific range mein ghoomti hain.

Consolidation market mein uncertainty aur indecision ko darust karta hai. Traders ko is phase mein market ki behavior ko samajhne mein madad milti hai. Isme prices ek particular range mein ghoomti hain, jise horizontal support aur resistance levels se define kiya ja sakta hai.

Consolidation Ki Pehchan

Consolidation ko pehchanne ke liye traders ko kuch key indicators aur patterns ko dhyan mein rakhna chahiye:- Price Range: Consolidation ka sabse bada pehloo hai price range. Agar kisi currency pair ki price ek specific range mein ghoom rahi hai, toh yeh consolidation ka indication ho sakta hai.

- Volume Analysis: Consolidation ke dauran trading volume kam hota hai. Low volume ka matlab hai ki market mein kam interest hai aur traders indecision mein hain.

- Horizontal Support aur Resistance: Consolidation ke dauran prices horizontal support aur resistance levels ke beech mein ghoomti hain. Yeh levels traders ke liye crucial hote hain kyunki in par depend karke entry aur exit points decide kiye ja sakte hain.

- Chart Patterns: Kuch chart patterns bhi consolidation ko indicate karte hain, jaise ki rectangles, flags, aur pennants.

Consolidation Ke Fayde Aur Nuksan

Fayde:- Analysis Mein Madad: Consolidation traders ko market ke future direction ke bare mein idea dene mein madad karta hai. Is phase mein market ki stability hoti hai, jisse traders ko sahi tarah se analysis karne mein asani hoti hai.

- Low Risk Trading: Consolidation ke dauran risk kam hota hai kyunki market mein tezi ya mandi kam hoti hai. Isme traders ko low volatility ke dauran trading karne ka mauka milta hai.

- Range-bound Strategies: Consolidation phase mein range-bound trading strategies ka istemal kiya ja sakta hai. Traders support aur resistance levels ka istemal karke trade kar sakte hain.

Nuksan:- Lack of Trend: Consolidation phase mein market mein trend ki kami hoti hai, jisse long-term traders ko nuksan ho sakta hai kyunki unhe trend mein trading karne mein difficulty hoti hai.

- False Breakouts: Consolidation ke dauran false breakouts hone ke chances hote hain, jisse traders ko galat signals mil sakte hain.

- Low Volatility: Low volatility ke karan profit margins kam ho sakte hain, jisse traders ko kam moolya milta hai.

Consolidation Mein Trading Strategies- Range-bound Trading: Consolidation phase mein range-bound trading strategies ka istemal kiya ja sakta hai. Traders support aur resistance levels ke bich mein trade karte hain aur price range ke andar hi rahne ka try karte hain.

- Breakout Trading: Jab consolidation khatam hoti hai aur market mein breakout hota hai, tab traders breakout direction mein trade karte hain. Isme risk zaroor hota hai, lekin agar breakout sahi direction mein hota hai, toh reward bhi bada hota hai.

- Wait and Watch Approach: Kuch traders consolidation ke dauran wait and watch approach apnate hain. Unhe market ke clear direction milne ka wait hota hai aur tab woh entry points decide karte hain.

Conclusion

Consolidation forex trading mein ek common phenomenon hai, aur isse samajh kar trading decisions lene mein madad milti hai. Traders ko market ke behavior ko acche se samajhne ke liye consolidation ke key indicators aur patterns ka istemal karna chahiye. Saath hi, sahi trading strategies ka chayan karke traders ko is phase mein safalta prapt karne mein madad milegi.

-

#7 Collapse

Introduction.

Forex Trading mein consolidation, jab market mein prices ki range tight hoti hai, ko refer karta hai. Yeh waqt hota hai jab currency pairs mein prices sideways move karte hain.Forex Trading mein consolidation ka hona aam hai aur iska sahi taur par samajhna traders ke liye zaroori hai. Consolidation periods mein careful planning aur flexibility key hote hain trading success ke liye.

Reasons for Consolidation.

Consolidation hone ki wajah market mein uncertainty, economic events, ya traders ki cautiousness ho sakti hai. Is doran, market mein kisi specific direction ki kamzori hoti hai.Consolidation mein trading karna mushkil ho sakta hai kyunki clear trend na hone ki wajah se traders ko samajhna mushkil ho jata hai ke kis direction mein trade karna behtar hoga.

Trading Strategies.

Consolidation mein successful trading ke liye, range-bound strategies ka istemal kiya ja sakta hai. Yeh strategies support aur resistance levels par mabni hoti hain.Consolidation mein trading karte waqt risk management ka khayal rakhna zaroori hai. Stop-loss orders ka istemal karna aur position sizes ko control mein rakhna important hai.Consolidation ke baad market mein breakout hone ka possibility hota hai. Traders ko attentive rehna chahiye taake woh breakout ko identify karke usse faida utha sakein.

Impact of News Events and Technical Analysis.

Consolidation mein, unexpected economic ya geopolitical events ke asar se market mein volatility barh sakti hai. News events ka dhyan rakhna important hai.Consolidation mein technical analysis ka istemal karna bhi important hai. Support aur resistance levels, chart patterns aur indicators istemal karke market ka analysis karna zaroori hai consolidation periods mein traders ko market ke changing dynamics ka shaoor hona chahiye. Regular market analysis aur updates se traders apne strategies ko adjust kar sakte hain.

-

#8 Collapse

Consolidation in Forex Trading (Forex Trading Mein Consolidation)

Consolidation ya Range-bound Market:

Consolidation ek term hai jo market analysis mein istemal hoti hai, khaas karke forex trading mein. Isko Urdu mein "Muttahida Hona" ya "Range-bound Market" bhi kaha jata hai. Jab market mein prices ek specific range mein move karti hain aur clear trend na ho, toh use consolidation ya range-bound market kaha jata hai.

Kyun Hota Hai Consolidation:- Market Indecision: Jab market mein indecision hoti hai, yaani ke buyers aur sellers mein koi clear dominance nahi hoti, toh market consolidation mein chala jata hai.

- Economic Uncertainty: Agar kisi waqt global economic conditions mein uncertainty hoti hai, ya phir koi major economic event hone wala hai (jaise ke election ya economic data release), toh log market se hat kar wait karte hain.

- Profit Booking: Agar market mein pehle ek strong trend tha aur logon ne usmein positions li thi, toh jab woh log profit book karte hain, toh market consolidate ho sakta hai.

Consolidation Ki Pehchan Kaise Hoti Hai:- Horizontal Price Movement: Consolidation ka sabse aham pehchan wala feature hota hai ke prices ek horizontal range mein move karte hain.

- Lower Highs aur Higher Lows: Prices consolidate karte waqt lower highs aur higher lows bante hain, jo ek range ko indicate karte hain.

- Volume Kam Hota Hai: Consolidation mein trading volume kam hota hai kyunki market participants indecision mein hote hain.

Trading Strategies During Consolidation:- Range Trading: Traders consolidation mein range trading strategies istemal karte hain, jismein woh long positions letay hain jab price support level par hoti hai aur short positions letay hain jab price resistance level par hoti hai.

- Breakout Trading: Agar market mein kisi waqt consolidation ke baad breakout hota hai, toh traders woh breakout ka faida utha sakte hain. Breakout trading mein, positions li jati hain jab price range se bahar nikalti hai.

Hosla Afzaai (Caution):- Consolidation mein market choppy (zig-zag) ho sakti hai, aur isme fake breakouts bhi hote hain, is liye trading decisions lene se pehle mazboot risk management ka istemal karna zaroori hai.

- Market dynamics mein tabdeeli aur volatility ka bhi dhyan rakha jaye, kyunki consolidation kisi bhi waqt khatam ho sakti hai aur market mein new trend shuru ho sakta hai.

- Economic calendars aur market news ko regular basis par monitor karna bhi market conditions ko samajhne mein madadgar hota hai.

Consolidation, market mein hone wale trends ka ek temporary phase hai, aur traders ko chahiye ke is phase ko sahi taur par samajh kar trading strategies banayein.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Consolidation in Forex Trading (Forex Trading Mein Consolidation)

Consolidation (Tijarat Mein Jamaa Hona):

Consolidation ek market condition hai jahan price ek tight range mein move karta hai aur clear trend na ho. Is condition mein market mein price fluctuations kam hoti hain aur trading range narrow hota hai.

Kyun Consolidation Hoti Hai:- Market Indecision: Jab traders ko market ke future direction mein indecision hoti hai, toh consolidation ka scenario ban sakta hai.

- News Events: Kuch baar kisi significant news event ya economic indicator ke release hone se pehle, market consolidation phase mein chala jata hai.

- Liquidity Kam Hona: Agar market mein liquidity kam hai, toh price mein sharp movements kam hote hain aur consolidation hoti hai.

Consolidation Kaise Nazar Aati Hai:- Trading Range: Consolidation ka pehchaan karne ka tareeqa yeh hai ke trading range narrow hota hai. Highs aur lows ke darmiyan ki distance kam hoti hai.

- Horizontal Price Movement: Price horizontal direction mein move karta hai aur kisi specific trend ki taraf zyada nahi badhta.

Trading Strategy:- Range Trading: Consolidation periods mein range trading aam hoti hai. Traders range ke upper aur lower levels par buy aur sell orders place karte hain.

- Breakout Trading: Agar market consolidation ke baad breakout karta hai, toh traders breakout direction mein trading positions lete hain.

- Wait for Confirmation: Consolidation periods mein trading karne se pehle traders ko confirmatory tools aur indicators ka istemal karna chahiye.

Hosla Afzaai (Caution):- Consolidation mein market indecision ka scenario hota hai, is liye trading decisions lene se pehle mazboot risk management ka istemal karna zaroori hai.

- News events ya economic indicators ke release hone se pehle market consolidation mein chala jata hai, is liye traders ko economic calendar ka istemal karna chahiye.

- Market dynamics mein tabdeeli aur volatility ka bhi dhyan rakha jaye, kyunki consolidation periods market ke har waqt consistent nahi rehte.

Consolidation periods mein traders ko market trends aur overall market context ko samajhne mein madad karte hue trading decisions lena chahiye.

-

#10 Collapse

CONSOLIDATION IN FOREX TRADING DEFINITION

Technical analysis Mein consolidation se Murad trading levels ki ek acchi Tarah Se define pattern Ke Darmiyan Ek asset hai Jo use Waqt khatm Hota Hai Jab asset ki price trading pattern se Upar ya niche Jaati Hai financial accounting mein consolidation ko statements ke Taur per discribe Kiya jata hai consolidation ke periods Kisi bhi time ke Waqfe Ke Liye price ke chart Mein mil sakte hain technical traders price ke chart mein support and resistance levels Talash kar sakte hain phir buy ya sell ke decision karne ke liye on levels ka istemal kar sakte hain Ek Bar Jab price support and resistance key areas se Guzarti hai to volatility Bullih se barh jata hai

ACCOUNTING CONSOLIDATION

Aur yah periods days week month Tak continue Rah sakte hain aur ISI Tarah short term traders ko profit kamane ka mauka bhi Milta Hai dusri Taraf support level se niche break out Ishara Karta Hai Ke price Aur Bhi kam ho rahi hai aur traders Sel kar raha hai resistance levels price ke pattern ka sabse upar wala hissa hai Jab Ke support level nichla Sera hai consolidate financial statements banane ke liye asset ko market values ke sath adjusted Kiya jata hai Agar parent and NCI Khalis asset ki market value Se zyada pay Karte Hain

CONSOLIDATION SUPPORT vs RESISTANCE

Aapko binance tools taak bhi Rasi Hasil Hogi jo aapki trading history ko dekhna investors ka Nazam karna price ke chart dekhna aur zero fi ke sath investment ko Pahle Se Kahin zyada Aasan banate hain consolidation Kisi trading range mein Trends ki Kami ko wazeh karta hai ke price strong ho gayi hai Jab price support and resistance levels ki current lines se Tut Jaati Hai to consolidation close ho jata hai Trends channels parallel trends lines ka ek set Hota Hai break out tab Hota Hai Jab up trend aur Down trend ko Dekhne Mein help mile

-

#11 Collapse

Trend Line in Forex Trading:consolidation ek aham mudda hai jo traders ke liye maamul se zyada mushkilat utpann kar sakta hai.Consolidation, ya range-bound market, ek aisi halat hai jab market mein kisi specific trend ki kami hoti hai aur prices ek choti si range mein ghumte hain. Yani, currency pairs ki keemat mein kuch zyada tezi ya ghatari nahi hoti, market analysis mein istemal hoti hai, khaas karke forex trading mein. Isko Urdu mein "Muttahida Hona" ya "Range-bound Market" bhi kaha jata hai. Jab market mein prices ek specific range mein move karti hain aur clear trend na ho, toh use consolidation ya range-bound market kaha jata hai. aur market sideways move karti hai. market mein trading ke doran aisi halat ko describe karta hai jab currency pairs ka price ek range mein thaharta hai aur kisi specific direction mein tezi se na badalta ho. Is doran, market participants apne trading strategies ko adjust karte hainConsolidation Ke Strategies: traders range trading ka istemal karte hain. Isme, wo currency pair ko buy karte hain jab price lower end of the range par hota hai aur use sell karte hain jab price upper end par hota hai.Consolidation phase mein range-bound trading strategies ka istemal kiya ja sakta hai.Consolidation ko pehchan'ne ke liye traders price charts aur technical analysis ka istemal karte hain. Yeh ek range-bound market ko darust karti hai jisme price horizontal lines ke darmiyan thahr raha hota hai. Bollinger Bands aur Support/Resistance levels bhi consolidation ke pata lagane mein madad karte hain. Traders support aur resistance levels ka istemal karke trade kar sakte hain

Analysis: Consolidation ke dauran trading volume kam hota hai. Low volume ka matlab hai ki market mein kam interest hai aur traders indecision mein hain.Consolidation periods mein trading challenging hosakti hai, News events ka dhyan rakhna important hai.Consolidation mein technical analysis ka istemal karna bhi important hai. Support aur resistance levels, chart patterns aur indicators istemal karke market ka analysis karna zaroori hai consolidation periods mein traders ko market ke changing dynamics ka shaoor hona chahiye. lekin kuch traders is doran bhi munafa kamane mein kamyab hojate hain. Range-bound strategies, jaise ke mean reversion ya breakout strategies, is waqt istemal hoti hain.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Consolidation in Forex Trading

Introduction

Forex trading, ya foreign exchange trading, aik dunia bhar mein maqami aur beynulmulki mudatoo aur currency pairs ke darmiyan mubahisay ka aik shai hai. Is mein traders apnay paisay mubadala karte hain, aur market mein tabdeeliyon ki peshan gao mein munafa kamatay hain. Aaj hum "Consolidation in Forex Trading" par guftagu karenge, jo trading ke mahaul mein aik makhsoos halat ko darust karta hai.

Consolidation Kya Hai?

Consolidation, forex market mein ek aam halat hai jahan currency pairs ka qeemat barqarar rehti hai aur market mein kisi khaas trend ki kami hoti hai. Is doran, market mein trading volume kam hota hai aur prices ek makhsoos range mein rehti hain. Yeh waqt hota hai jab traders uncertainty aur indecision ka samna karte hain.

Consolidation Ke Karishmay

Tijarat Mein Rukawat:

Consolidation ke doran market mein rukawat hoti hai. Traders ko prices mein ziada izafa ya kami ka intezaar hota hai jab tak market trend banaye.

Trading Volume Mein Kami:

Consolidation ke doraan trading volume mein kami hoti hai, jis se market mein stability aati hai. Traders ko careful aur cautious rehna chahiye is doran.

Patterns Ki Paidaish:

Consolidation, trading patterns ka janam deti hai jese ke triangles, rectangles, aur flags. In patterns ko samajhna traders ke liye aham hai kyunki yeh future price movements ki prediction mein madad karte hain.

Consolidation Ke Asarat

Indecision:

Consolidation ka ek asar yeh hai ke market mein indecision barqarar rehta hai. Traders ko samajhna zaroori hai ke kis direction mein jaana behtar hoga.

Range-Bound Trading:

Is doran market range-bound hoti hai, jisme prices aik makhsoos range mein ghoomti hain. Range-bound trading mein, traders ko prices ko monitor karte rehna chahiye aur entry/exit points ko dhyan se chunna hoga.

Breakout Ke Mauqe:

Consolidation ke baad aksar breakout hota hai, jisme market ek naye trend ki taraf badal jaati hai. Traders ko yeh mouqa bariki se dekhna chahiye, kyun ke sahi waqt par entry karne se munafa kamaya ja sakta hai.

Consolidation Ka Khatma:

Consolidation ka khatma ek aham waqt hota hai jab market mein ek strong trend ban jata hai. Is waqt, traders ko apni strategies ko dobara tajwez karna chahiye aur market ke mutabiq amal karna chahiye.

Tajaweezat aur Hidayat:

Vigilance:

Traders ko market ko hoshyarana dekhnay ki zarurat hai. Consolidation ke doran, prices mein tezi se izafa ya kami ka intezaar karna nuqsaan ka sabab ho sakta hai.

Risk Management:

Har tijarat mein risk management ka khaas khayal rakhna chahiye. Consolidation mein bhi, zyada risk se bachne ke liye apni investment ko control mein rakhna zaroori hai.

Educated Decisions:

Traders ko educated decisions lena chahiye. Market trends, patterns, aur economic indicators ko samajhna traders ko behtar tijarat karne mein madadgar sabit ho sakta hai.

Conclusion:

Forex trading mein consolidation aik aham haqiqat hai jo traders ko tezi aur itminan ke darmiyan apni strategies ko tajwez karne par majboor karta hai. Consolidation ke doran, hoshyari aur tahqiqati tajaweezat se faida uthana traders ke liye zaroori hai. Isi tarah se, aik sahi tajaweez aur moqa pehchan kar forex market mein kamyabi hasil ki ja sakti hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

Forex Trading aur Consolidation

Forex trading ek volatile market hai jahan currencies ki values rozana badal jati hain. Consolidation ek important concept hai jo traders ke liye crucial hai.

Consolidation Kya Hai?

Consolidation, ek market phase hai jab currency pair ki price range mein koi significant movement nahi hoti. Yeh market mein sideways movement ko represent karta hai jab prices ek range mein atke rehte hain. Consolidation ke dauran, price bars horizontal lines ke darmiyan chalte hain.

Consolidation Ki Pehchan

Horizontal Price Bars

Consolidation ki pehchan horizontal price bars se hoti hai jahan prices ek range mein move karte hain.

Low Volatility

Consolidation ke doran market ki volatility kam hoti hai aur price mein minor fluctuations hoti hain.

Consistent Support aur Resistance Levels

Consolidation mein support aur resistance levels consistent hote hain aur price in levels ke darmiyan atak kar rehta hai.

Consolidation Ke Types

Tight Consolidation

Tight consolidation mein price range chhoti hoti hai aur price bars ek doosre ke qareeb rehte hain.

Wide Consolidation

Wide consolidation mein price range bari hoti hai aur price bars zyada space cover karte hain.

Consolidation Ke Fayde

Clear Trends Ka Pata Chal Jata Hai

Consolidation ke baad, market ka direction clear ho jata hai aur traders ko trend ka pata chal jata hai.

Trading Strategies Develop Hoti Hain

Consolidation ke doran traders apni trading strategies develop karte hain jaise breakout ya range trading.

Consolidation Ka Istemal Trading Mein

Breakout Trading

Breakout trading mein traders consolidation ke baad price movement ka wait karte hain aur phir jab price range se bahar nikalti hai, wo us direction mein trade karte hain.

Range Trading

Range trading mein traders price range ke andar hi trade karte hain aur jab price support ya resistance level tak pahunchta hai, wo opposite direction mein trade karte hain.

Consolidation Ke Nuqsanat

False Breakouts

Consolidation ke baad false breakouts ka khatra hota hai jahan price range se bahar nikal kar phir wapas usi range mein chala jata hai.

Low Volatility

Consolidation ke doran market ki volatility kam hoti hai, jis se traders ke liye trading opportunities kam ho jati hain.

Risk Management

Consolidation ke doran, risk management ka khayal rakhna bhi zaroori hai. Low volatility ki wajah se stop loss orders ko tight rakhna zaroori hai taake nuksan kam ho.

Consolidation Aur Trading Psychology

Consolidation trading psychology par bhi asar dalta hai. Traders ko patience aur discipline maintain karna hota hai jab market consolidation phase mein hota hai.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:11 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим