Impulse wave pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Impulse wave pattern Ek impulse wave pattern maliyati Hasas ki price mein ek strong ek dam ka Ishara karta hai jo bases rujan ke mercazi direction ke sath no moafiq Hota Hai tasalsul ki laharen Upar ke rujan Mein Upar ki taraf Harkat ya niche ke rujannat mein niche ki taraf Harkat ka Hawala Deti Hai yah Islah alet wave theory ke perokaro ki taraf se kasrat se use Hoti Hai maliyati mandiyon Mein prices ke nakal aur Harkat ka tajiya aur pesh gui karne ka ek Tarika Hota Hai Understanding impulse wave elite wave theory Ke Silsile Mein impulse wave patterns ke bare mein dilchas baat yah hoti hai ki vah ek maksus Mudda Tak mahdud Nahin Hoti Ek Lahar Kai ghanton Kai Salon ya dahaiyon Tak Chalti Hai use kiye jaane wale time frame se kata Nazer tasolsul ki laharen Hamesha ek hi direction Mein hoti hai Jiska rujan yah Hota Hai lekin ek Bari degree per ine impuluse waves ko niche Di Gai example Mein Lahar 3 Lahar 5 ke Taur per Dekha Jata Hai Jaap ke majma hi Taur per 1.2.3.4 aur laharen Ek Bari degree per five laharon Ka Tasolsul banati hai

Understanding impulse wave elite wave theory Ke Silsile Mein impulse wave patterns ke bare mein dilchas baat yah hoti hai ki vah ek maksus Mudda Tak mahdud Nahin Hoti Ek Lahar Kai ghanton Kai Salon ya dahaiyon Tak Chalti Hai use kiye jaane wale time frame se kata Nazer tasolsul ki laharen Hamesha ek hi direction Mein hoti hai Jiska rujan yah Hota Hai lekin ek Bari degree per ine impuluse waves ko niche Di Gai example Mein Lahar 3 Lahar 5 ke Taur per Dekha Jata Hai Jaap ke majma hi Taur per 1.2.3.4 aur laharen Ek Bari degree per five laharon Ka Tasolsul banati hai  Interpretation and trading strategy Jab up trading ke dauran impulse wave pattern ke mushada karte hain to taajir Mulkna Taur per fayda uthate Hain pahle Nahar ki identity ke bad vah dusre Lahar ke islahi Ek kam perekadam bar ek strong Teesri Lahar per shart Lagate Hain Ek lambi Lahar hoti hai four Lahar ki Islah ke ikhtam per Ek Aur mauka Paida Hota Hai Jahan Ek taajir paanchvi Lahar ki peshkatmi ki tavakkon Karta Hai Ek Bar phr lambi position sambhalta Hai is hikmat Amali ki ek Kalid Khatre ki munasib ikhtam ko yakin hi banana hota hai Kyunki Elite wave theory per mabni Tijarat Sa peshkash hoti hai

Interpretation and trading strategy Jab up trading ke dauran impulse wave pattern ke mushada karte hain to taajir Mulkna Taur per fayda uthate Hain pahle Nahar ki identity ke bad vah dusre Lahar ke islahi Ek kam perekadam bar ek strong Teesri Lahar per shart Lagate Hain Ek lambi Lahar hoti hai four Lahar ki Islah ke ikhtam per Ek Aur mauka Paida Hota Hai Jahan Ek taajir paanchvi Lahar ki peshkatmi ki tavakkon Karta Hai Ek Bar phr lambi position sambhalta Hai is hikmat Amali ki ek Kalid Khatre ki munasib ikhtam ko yakin hi banana hota hai Kyunki Elite wave theory per mabni Tijarat Sa peshkash hoti hai -

#3 Collapse

Elite Wave Ki History:

Ralph Nelson Elliott (1871–1948) ek American accountant tha. jo apni umar ke 58 saal par retire ho gaye the. Unki lambi career me various accounting aur commercial professions me kaam kiya tha, lekin wo Central America me rehte hue ek bimari ki wajah se retire ho gaye. Unhone apni beemari ke dauran stock market ki movement analyze karne par dhyan diya. Elliott ki soch 1935 me soch mili jab unhone sahi tareeke se fainacial market ka bottom predict kiya. Tab se hazaron portfolio managers, traders aur private investors ne unki theory ka istemal kiya hai.

Elliott Wave International:

Elliott Wave International 1978 me banayi gayi, Elliott ke model ka istemal market analysis aur forecasting ke liye karti hai. Ye duniya ki sabse badi independent financial analysis aur market forecasting company hai.

Elliott Wave Ki Pehchan:

Elliott ne in wave patterns ko pehchanne, forecast karne aur unse fayda uthane ke liye kuch specific guidelines diye hai. Ye guidelines R.N. Elliott's Masterworks me record ki gayi hai, jo 1994 me publish hui. Isme books articles aur letters shaamil hai.

Elliott Wave Ka Basice Principle:

Elliott Wave Theory ke basic principles mainly do mukhya components par dhyan dete hai:

1. Momentum

Momentum ki baat karte hain. Security ke price mein hone wali tabdeeli ko momentum kehte hain, jo stock ki trend ki taqat ko darshaata hai.

Elliott Wave High Momentum:

Aik high momentum indicator, for example, yeh batata hai ke stock prices kitni tezi se upar ya neeche ja rahe hain. Jab momentum kam hojata hai, tab prices range mein move karne lagte hain.

Elliott Wave Two Types:

1. Impulse Waves 2. Corrective Waves

1. Impulse Waves

Jab market participants kisi fainacial market ke baare mein similar feelings rakhte hain toh uski price aik direction mein tezi se move karti hai jise impulsive waves kehte hain.

2. Corrective Waves

Lekin jab traders ke paas opposite viewpoints hote hain, tab prices tezi se upar ya neeche nahi jaati, aur corrective waves create hoti hain.

Price action Or Fractal:

Fractals aur Elliott wave analysis ke beech mein ek strong connection hai. Fractals, wave patterns ko describe karne ke liye istemal kiye jate hain, jahan waves chote aur chote sub-waves mein tukde ho jate hain. For example agar ak real-life fractal hai. Woh apne aap ko kai scales par repeat karta hai, matlab ki ek scale par jo pattern hai woh bade scales mein bhi waise hi dikhta hai. Yehi baat Elliott wave theory ke liye bhi sahi hai. Agar tu kisi impulsive wave ke andar se zoom out karega, toh tujhe pata chalega ki waha recurrent patterns hai jo analysts market movements forecast karne ke liye istemal kar sakte hain.

Elliott Wave ki Pehchan:

Elliott wave analysis ke peeche ek theory hai jisme market driving force ki assumption hai: Herd Mentality. Yeh theory kehta hai ki financial assets ke prices predictable patterns mein move karte hain, jo herd mentality par based hoti hai.

Elliot Wave Herd mentality:

Is theory ke hisaab se market mein herd mentality dominate karti hai jahan bade investor groups dusre logon ke soch aur action par asar dalte hain. Is tarah pricing trends prevalent psychology ke through shape hote hain. Investor sentiment waqt ke saath repeat hoti hai, jiski wajah se fractal patterns ya waves create hote hain. Analysts aur traders in waves ko study karke behtar entry aur exit opportunities discover kar sakte hain. -

#4 Collapse

1. Muqadma (Introduction):

Impulse Wave Pattern ek technical analysis concept hai jo Elliot Wave Theory ke andar aata hai. Elliot Wave Theory market trends ko analyze karne ka aik tareeqa hai, jismein market movement ko aik set of waves ya patterns ke zariye describe kiya jata hai. Impulse wave pattern market mein hone wale strong trends ko represent karta hai aur traders ko future price movements ke liye guide karta hai.

2. Elliot Wave Theory Ki Buniyad (Foundation of Elliot Wave Theory):

2.1 Elliot Waves Ki Tareef:

Elliot Waves market ke natural cycles ko describe karte hain jinmein 5 impulsive waves aur 3 corrective waves shamil hote hain. Impulse wave pattern Elliot Waves ke teht aata hai, jise traders market trends ko predict karne ke liye istemal karte hain.

2.2 Impulsive Waves Aur Corrective Waves:- Impulsive Waves: Ye waves trend ke direction mein move karte hain aur 1, 2, 3, 4, 5 numbers se represent kiye jate hain. Inme se 1st, 3rd, aur 5th waves upward direction mein move karte hain, jabke 2nd aur 4th waves correction ya consolidation ke liye hoti hain.

- Corrective Waves: Ye waves impulsive waves ke opposite direction mein move karte hain aur a, b, c se represent kiye jate hain. Inme se a aur c waves impulsive waves ke opposite direction mein move karte hain, jabke b wave correction ke liye hoti hai.

3.1 5-Wave Structure:

Impulse wave pattern ko pehchanne ka pehla tareeqa ye hai ke traders market chart par 5-wave structure dhoondhein. Ye structure impulsive waves ko represent karta hai, jismein 1st, 3rd, aur 5th waves upward direction mein move karte hain, jabke 2nd aur 4th waves correction ya consolidation ke liye hoti hain.

3.2 Fibonacci Retracement Levels:

Traders Impulse Wave Pattern ko identify karne ke liye Fibonacci retracement levels ka istemal bhi karte hain. Agar 2nd ya 4th wave Fibonacci retracement level ke qareeb aati hai, to ye ek confirmation sign ho sakta hai ke market mein impulse wave pattern hai.

4. Impulse Wave Pattern Ke Faiday (Benefits of Impulse Wave Pattern):

4.1 Trend Prediction:

Impulse Wave Pattern ka istemal karke traders ko market ke trends ko predict karne mein madad milti hai. Jab 5-wave structure dikhai deta hai, to traders samajh jate hain ke market mein strong trend hai.

4.2 Entry and Exit Points:

Ye pattern traders ko entry aur exit points tay karne mein bhi madad deta hai. Jab market impulsive waves mein hota hai, to traders apne positions ko adjust kar sakte hain.

4.3 Risk Management:

Impulse Wave Pattern ka istemal risk management mein bhi hota hai. Agar trader ye samajh leta hai ke market mein 5-wave structure hai, to wo apni trading strategy ko iske mutabiq adjust karke apne risk ko minimize kar sakta hai.

5. Impulse Wave Pattern Ke Tijarati Istemal (Commercial Use of Impulse Wave Pattern):

5.1 Forex Trading:

Forex market mein Impulse Wave Pattern ka istemal common hai. Traders is pattern ki madad se currency pairs ke price movements ko analyze karte hain aur future trends ke liye predictions banate hain.

5.2 Stock Market:

Stock market mein bhi Impulse Wave Pattern ka istemal hota hai. Traders aur investors is pattern ki madad se stocks ke future movements ko predict karte hain.

5.3 Commodities Market:

Commodities market mein bhi Impulse Wave Pattern ka istemal hota hai. Traders is pattern ki madad se gold, silver, oil, aur doosre commodities ke price movements ko analyze karte hain.

6. Nuqsaanat (Drawbacks):

6.1 Subjectivity:

Ek major nuqsaan ye hai ke Impulse Wave Pattern ka interpretation trader par depend karta hai. Alag traders alag tareeqon se is pattern ko samajhte hain, is liye ismein kuch had tak subjectivity hoti hai.

6.2 False Signals:

Kuch cases mein, market mein 5-wave structure dikhai de sakti hai lekin actual mein wo kisi strong trend ki jagah consolidation phase ho. Is wajah se false signals ka khatra rehta hai.

7. Pakistan Mein Impulse Wave Pattern Ka Istemal (Use of Impulse Wave Pattern in Pakistan):

Pakistan mein bhi traders aur investors technical analysis ke tareeqon ka istemal karte hain, aur Impulse Wave Pattern ka bhi istemal hota hai. Specially, forex trading aur stock market mein ye pattern traders ki tijarat ko guide karne mein istemal hota hai.

8. Ikhtetami Raaye (Final Opinion):

Impulse Wave Pattern ek powerful tool hai jise traders market trends ko samajhne aur predict karne ke liye istemal karte hain. Lekin, iski complexity aur subjective nature ko madde nazar rakhte hue, traders ko chahiye ke is pattern ko samajhne ke liye sahi training aur practice hasil karein. Iske saath sahi risk management aur doosre technical analysis tools ke istemal se traders behtar results achieve kar sakte hain.

-

#5 Collapse

IMPULSE WAVE PATTERN DEFINITION

Ek impulse wave pattern financial asset ki price mein ek strong move ka indication hai impulse ki wave Upar ki trend Mein Upar ki taraf movement ya down trend mein move ka Hawala de sakti hai yah term elliott wave theory ki taraf se istemal ki Jaati Hai elliott wave theory Ke Silsile mein impulse wave pattern ke bare mein interested Baat Yeh Hai Ki Woh Ek makhsoos term tak Limited Nahin Hai Ek wave several hours several year tak chal sakti hai istemal kiye jaane wale time frame se impulse wave Hamesha ek hi direction Mein Chalti Hai Jiska Trends Hota Hai

TRADING STRATEGIES AND IMPULSE WAVE THEORY PATTERN

in impulse wave ko niche Di gai example Mein wave 1 and Wave 3 ke Taur per dikhaya gaya hai impulse ki wave five sub wave per mushtamil hoti hai Jo next sabse large degree ke Trends ke Taur per ISI diraction mein common motive hai aur Market Mein Talash karna sabse Aasan hai Iske ke three rules Hain jo is ki formation ki define Karte Hain elliott ne apni theory equity market Mein price ki large movement ki potantial futures ki direction ke bare mein insights provide karne ke liye design Kiya

COMMON MISTAKE WHEN IDENTIFYING IMPULSE WAVE

impulsve wave theory ke andar work karna Mushkil ho sakta hai isliye aap apni work per common mistake bhi nahin Karni chahie theory ko opportunities ki maloomat karne ke liye others technical analysis ke tarikon ke sath Milkar istemal Kiya jata hai wave ka theory market ki price ki direction maloomat karne ki koshish karta hai Jahan traders Kisi tasalsal ke andar Sab wave ki Fales identify Karte Hain Yeh Koi sakht rules Nahin Hai traders market ka analysis karne ki ahmiyat ko nazar andaaz kar sakte hain Trends support and resistance levels technical analysis Jaise factors par focus karne mein nakam ho sakte hain aur iska determine moving average Se Kiya jata hai

-

#6 Collapse

Impulse wave pattern ek technical analysis concept hai jo ke Elliott Wave Theory ka hissa hai. Elliott Wave Theory market trends, price movements, aur investor psychology ko analyze karne ke liye istemal hoti hai. Impulse wave pattern me, market ke primary trend ko represent karta hai. Yeh pattern bullish ya bearish trend ke andar develop hota hai aur investors ko market ke future movements ka idea deta hai.

Impulse wave pattern ko samajhne ke liye, pehle Elliott Wave Theory ko samajhna zaroori hai. Elliott Wave Theory ke mutabiq, market ke price movements ko 5 impulse waves aur 3 corrective waves mein divide kiya jata hai. Impulse waves trend ke direction mein move karte hain jabke corrective waves counter-trend moves hote hain.

Impulse wave pattern key characteristics- Directionality: Impulse wave pattern ek direction mein move karta hai, ya to bullish ya bearish . Yeh primary trend ko reflect karta hai.

- Five-Wave Structure: Impulse wave pattern mein paanch waves hote hain jo ke ek consistent direction mein move karte hain. Yeh waves labeling ke through identify kiye jate hain: 1, 2, 3, 4, aur 5.

- Wave Relationships: Har wave ka specific relationship hota hai dusre waves ke saath. Jaise ke wave 3 kabhi wave 1 se bada hota hai, wave 4 kabhi wave 2 se overlapping nahi hota, aur wave 5 kabhi bhi wave 3 se bada ya barabar nahi hota.

- Volume and Momentum: Impulse wave pattern ke sath volume aur momentum bhi increase hota hai. Is se yeh pata chalta hai ke trend strong hai aur price movements me genuine interest hai.

Fibonacci Relationships: Impulse wave pattern mein Fibonacci ratios aur relationships bhi frequently observed hote hain. Yeh Fibonacci retracement levels aur extensions ke through identify kiye jate hain.

Impulse wave pattern ka istemal kar ke investors market ke future movements ka forecast karte hain. Yeh pattern price charts par observe kiya jata hai aur uski help se investors entry aur exit points determine karte hain.

Impulse wave pattern techniques- Wave Counting: Impulse wave pattern ko identify karne ke liye, investors ko price charts par waves ko count karna hota hai. Har wave ko accurately label karna important hai taake sahi analysis ho sake.

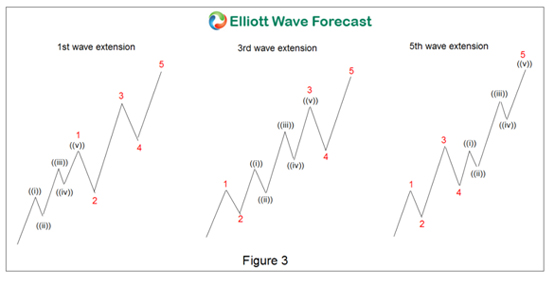

- Wave Extensions: Impulse wave pattern mein, kuch cases mein wave 3 lamba hota hai aur wave 5 extended hota hai. Is tarah ke extensions ko identify karna aur unka impact analyze karna zaroori hai.

- Volume Analysis: Impulse wave pattern ke sath volume analysis karna bhi important hai. Volume ke saath trend ke sath movement ko confirm kiya jata hai.

- Fibonacci Retracement and Extensions: Fibonacci retracement aur extensions levels ko use kar ke, investors price targets aur retracement levels ko determine karte hain.

- Wave Relationships: Har wave ke saath dusre waves ke relationships ko samajhna important hai. Yeh help karta hai sahi entry aur exit points ko identify karne mein.

Impulse wave pattern ki understanding ke liye, practical examples aur real-time market analysis bhi important hai. Is ke ilawa, historical price data aur backtesting bhi investors ko impulse wave pattern ko samajhne mein madad karta hai. -

#7 Collapse

Yes dear, forex main use honay walay mukhtalif patterns aur charts main say Impulse waves pattern ek key concept hai jo Elliott Wave Theory mein hota hay, yeh market trends aur price movements ko analyze karne ke liye istemal hota hai, is kay main points yeh hain,

1. Impulse Waves Ki explanation:

Impulse waves market mein strong trending movements ko represent karte hain. Yeh bullish ya bearish trends ke strong phases ko darust karte hain,

2. Impulse Waves Ka Structure:

Impulse waves structure mein three waves se milta hai, three trend waves (1, 3, aur 5) aur 2 corrective waves (2 aur 4),

3. Recognition process of impulse waves:

Impulse waves ko identify karne ke liye traders ko price movement aur wave counts par focus karna hota hai. Is me strong trending movements ka dhyan rakhna zaroori hai,

4. Impulse Waves Aur Trend Continuation:

Impulse waves trend continuation ko indicate karte hain, jise traders ko market direction ka pata lagane mein madad milti hai,

5. Impulse Waves Trading Strategies:

Impulse waves ka istemal trading strategies banane mein hota hai. Wave counts aur Fibonacci retracement levels ke istemal se traders ko entry aur exit points tay karne mein madad milti hai,

6. Impulse Waves Ka Importance:

Impulse waves ka sahi se istemal karke traders market trends ko anticipate kar sakte hain aur potential profitable opportunities ko identify kar sakte hain,

7. Limitations of Impulse Waves:

Impulse waves ke sath kuch limitations bhi hain, jaise ki false signals aur choppy markets mein accuracy ka kam hona,

8. Conclusion:

Impulse waves pattern Elliott Wave Theory ke tahat ek important concept hai jo traders ko market trends ko samajhne mein madad karta hai. Saath hi, iske sahi se istemal se traders apne trading strategies ko improve kar sakte hain aur profitable trading decisions le sakte hain, -

#8 Collapse

Impulse Wave Pattern

Impulse wave candlestick pattern ek technical analysis tool hai jo traders ko market trends ko samajhne mein madad karta hai. Ye pattern market mein ek directional move ko darust karne ki koshish karta hai. Isko samajhne ke liye, sabse pehle candlestick patterns aur Elliott Wave Theory ke basic concepts ko samajhna zaroori hai.

Candlestick patterns market sentiment ko reflect karte hain. Ek candlestick chart par, har candle ek specific time period ko represent karta hai, jaise ek din, ek ghanta ya ek minute. Har candle ko do hisson mein baant jaata hai: body aur wicks (ya shadows). Body candle ke opening aur closing prices ko represent karta hai, jabki wicks uski high aur low prices ko darust karta hai. Candlestick patterns ki madad se traders market ke potential reversals ya continuations ko identify kar sakte hain.

Elliott Wave Theory market ke long-term trends ko analyze karne ka ek tarika hai. Is theory ke mutabiq, market moves ko waves mein divide kiya ja sakta hai, jismein 5 impulse waves aur 3 corrective waves hote hain. Impulse waves trend ki direction mein move karte hain, jabki corrective waves uske against move karte hain. Har impulse wave ko phir se 5 smaller waves mein divide kiya ja sakta hai.

Impulse wave candlestick pattern Elliott Wave Theory par mabni hai aur iska maqsad market mein impulse waves ko identify karna hai. Ye pattern usually 5 candlesticks se bana hota hai, jinmein har candlestick ek specific role ada karta hai.

1. Wave 1 (Impulse Start):

Ye pehli candle hai jo trend ke shuru hone ki indication deta hai. Ismein usually uptrend ya downtrend ka initial movement hota hai. Agar trend upward hai, to is candle ka closing price typically higher hota hai aur agar trend downward hai, to closing price lower hota hai.

2. Wave 2 (Correction):

Ye candle Wave 1 ke baad aata hai aur ek corrective phase ko darust karta hai. Ismein price typically Wave 1 ki direction mein thodi si reversal hoti hai, lekin overall trend mein phir se continuation hoti hai. Ismein price usually Wave 1 ke low se upar rehti hai.

3. Wave 3 (Strongest Impulse):

Wave 3 usually sabse lamba aur strongest hota hai. Ye trend ke direction mein bahut zyada move karta hai aur market mein maximum participation hoti hai. Agar uptrend hai, to ismein price high banata hai aur agar downtrend hai, to price low banata hai.

4. Wave 4 (Correction):

Wave 3 ke baad aata hai aur ek corrective phase ko darust karta hai. Ismein price usually Wave 3 ke high se neeche rehti hai, lekin overall trend mein phir se continuation hoti hai.

5. Wave 5 (Final Move):

Ye candle pattern ka last candle hota hai. Agar uptrend hai, to ismein price typically Wave 3 ke high se thodi si upar rehti hai aur agar downtrend hai, to price Wave 3 ke low se thodi si neeche rehti hai. Ye candle trend ke exhaustion ko indicate karta hai aur traders ko exit point provide karta hai.

Explanation

Impulse wave candlestick pattern ki samajh se traders market ke potential reversals ya continuations ko identify kar sakte hain. Agar ye pattern sahi tareeqe se identify kiya jaye, to traders ko market mein hone wale potential moves ka pata chal sakta hai aur wo apni trading strategies ko improve kar sakte hain. Lekin hamesha yaad rahe ke kisi bhi pattern ko sirf ek tool ke taur par istemal kiya jaye aur dusri confirmatory signals aur risk management ke saath istemal kiya jaye.

- CL

- Mentions 0

-

سا0 like

-

#9 Collapse

Impulse Wave Pattern

Impulse Wave Pattern ek concept hai jo Elliott Wave Theory ke tahat aata hai. Elliott Wave Theory market trends ko analyze karne ke liye istemal hoti hai, aur iska maqsad market mein hone wale up aur down trends ko predict karna hai.

Impulse Wave Pattern Ki Khasoosiyat:- Uptrend Mein Hota Hai:

- Impulse Wave Pattern typically uptrend mein paaya jata hai, jiska matlab hai ke ye market mein prices ke upar ki taraf ja raha hai.

- Directional Movement:

- Ye pattern market mein ek strong directional movement ko darust karta hai, jisme prices ek consistent direction mein move karte hain.

- Five Waves:

- Impulse Wave ek specific sequence mein hota hai jise "Five-Wave Pattern" kehte hain. Ismein three up-waves (1, 3, 5) aur two down-waves (2, 4) shamil hote hain.

- Wave 3 Sabse Badi Hoti Hai:

- Impulse Wave ke andar, Wave 3 sabse badi hoti hai aur often sabse strong bhi hoti hai. Ye wave market mein maximum price movement ko darust karta hai.

- Wave 4 Kabhi Kabhi Sideways Hota Hai:

- Wave 4 impulse wave ke andar kabhi sideways movement bhi kar sakta hai, jise corrective phase kehte hain.

- Wave 5 Se Pehele Ek Correction Wave:

- Impulse Wave ke pehle hoti hai ek correction wave (Wave 2), aur iske baad sequence mein Wave 4 ke baad Wave 5 hoti hai.

- Trend Identification:

- Impulse Wave Pattern ka istemal trend ko identify karne mein hota hai. Jab ye pattern uptrend mein paaya jata hai, to traders ko maloom hota hai ke market mein strong buying interest hai.

- Entry Points:

- Impulse Wave ke saath trade karte waqt traders entry points ko identify karne mein madad lete hain. Usually, traders Wave 2 ke baad ya Wave 4 ke baad entry karte hain.

- Stop-Loss Placement:

- Har trade mein stop-loss orders ka istemal karna zaroori hai, taake losses ko control mein rakh saken.

- Profit Targets:

- Impulse Wave ke sath trading karte waqt traders profit targets ko set karte hain, jo ke Wave 3 ke completion ke baad hota hai.

Impulse Wave Pattern, jab sahi taur par samjha jata hai, traders ko market trends ko anticipate karne mein madad karta hai. Lekin, jaise ke har technical analysis tool ke sath hota hai, isay bhi caution ke sath aur confirmatory signals ke sath istemal karna chahiye.

- Uptrend Mein Hota Hai:

-

#10 Collapse

Impulsive Wave Pattern: Forex Trading Mein Aik Naya Rasta

Introduction: Forex trading mein impulsive wave pattern ek aham concept hai jo traders ko market movements ko samajhne aur munafa kamane mein madad deta hai. Yeh pattern market analysis ka ek zaroori hissa hai jo traders ke liye bohot ahem hota hai.

Impulsive Waves ki Tareef: Impulsive waves, ya impulse waves, forex trading mein un movements ko refer karte hain jo price chart mein tezi se upar ya neeche ki taraf jaati hain. Ye waves market mein taaqatwar trends ko darust karte hain.

Impulsive Waves ki Pehchan: Impulsive waves ko pehchanna aur samajhna zaroori hai taake traders sahi waqt par munafa kamayen. In waves ki pehchan chart analysis aur technical indicators ki madad se ki ja sakti hai.

Impulsive Waves ka Istemal: Traders impulsive waves ka istemal karke market ke strong trends ko pehchante hain aur un par trading karte hain. Ye waves unko market ke mukhtalif phases mein guide karte hain.

Impulsive Waves ka Nuqsan: Impulsive waves ki samajh aur istemal mein ghalati traders ko nuqsaan mein daal sakti hai. Agar ghaflat se ya sahi waqt par action na liya gaya, to traders ko nuqsaan ho sakta hai.

Tajurba aur Ilm: Impulsive wave pattern ko samajhne aur istemal karne ke liye, traders ko tajurba aur ilm ki zaroorat hoti hai. Is ke saath sahi time par entry aur exit ke faislay bhi bohot zaroori hote hain.

Zaroorat-e-Zimmedari: Impulsive wave pattern ka istemal karne se pehle, traders ko zimmedari aur shafqat se kaam lena chahiye. Sahi tajurba aur analysis ke baghair, is pattern ka istemal karna mushkil ho sakta hai.

Forex trading mein impulsive wave pattern ek ahem concept hai jo traders ke liye market ko samajhne mein madad deta hai. Lekin, iska istemal karne se pehle, traders ko zaroorat hai tajurba aur ilm ki, taake wo sahi faislay kar sakein aur munafa kamayen.

-

#11 Collapse

Impulse wave pattern

Impulse Wave Pattern ek concept hai jo Elliott Wave Theory ke teht aata hai. Elliott Wave Theory ek technical analysis tool hai jo market trends ko analyze karne ke liye istemal hoti hai, aur iska maqsad market mein hone wale up aur down trends ko predict karna hai.

Impulse Wave Pattern Ki Khasoosiyat:- Uptrend Mein Hota Hai:

- Impulse Wave Pattern typically uptrend mein paaya jata hai, jiska matlab hai ke ye market mein prices ke upar ki taraf ja raha hai.

- Directional Movement:

- Ye pattern market mein ek strong directional movement ko darust karta hai, jisme prices ek consistent direction mein move karte hain.

- Five Waves:

- Impulse Wave ek specific sequence mein hota hai jise "Five-Wave Pattern" kehte hain. Ismein three up-waves (1, 3, 5) aur two down-waves (2, 4) shamil hote hain.

- Wave 3 Sabse Badi Hoti Hai:

- Impulse Wave ke andar, Wave 3 sabse badi hoti hai aur often sabse strong bhi hoti hai. Ye wave market mein maximum price movement ko darust karta hai.

- Wave 4 Kabhi Kabhi Sideways Hota Hai:

- Wave 4 impulse wave ke andar kabhi sideways movement bhi kar sakta hai, jise corrective phase kehte hain.

- Wave 5 Se Pehele Ek Correction Wave:

- Impulse Wave ke pehle hoti hai ek correction wave (Wave 2), aur iske baad sequence mein Wave 4 ke baad Wave 5 hoti hai.

- Trend Identification:

- Impulse Wave Pattern ka istemal trend ko identify karne mein hota hai. Jab ye pattern uptrend mein paaya jata hai, to traders ko maloom hota hai ke market mein strong buying interest hai.

- Entry Points:

- Impulse Wave ke saath trade karte waqt traders entry points ko identify karne mein madad lete hain. Usually, traders Wave 2 ke baad ya Wave 4 ke baad entry karte hain.

- Stop-Loss Placement:

- Har trade mein stop-loss orders ka istemal karna zaroori hai, taake losses ko control mein rakha ja sake.

- Profit Targets:

- Impulse Wave ke sath trading karte waqt traders profit targets ko set karte hain, jo ke Wave 3 ke completion ke baad hota hai.

Impulse Wave Pattern, jab sahi taur par samjha jata hai, traders ko market trends ko anticipate karne mein madad karta hai. Lekin, jaise ke har technical indicator ya pattern ke sath hota hai, isay bhi caution ke sath aur doosre confirmatory signals ke sath dekha jana chahiye.

- Uptrend Mein Hota Hai:

-

#12 Collapse

Impulse wave pattern

Impulse Wave Pattern Elliott Wave Theory ke framework mein aata hai aur market trends ko analyze karne ke liye istemal hota hai. Elliott Wave Theory ek technical analysis tool hai jo price movements ko waves mein categorize karta hai, aur Impulse Wave Pattern is theory ka ek key component hai.

Impulse Wave Pattern Ki Khasoosiyat:- Directional Movement:

- Impulse Wave ek directional movement ko darust karta hai, jisme price ek consistent trend mein move karta hai.

- Five-Wave Structure:

- Impulse Wave ek specific sequence mein hota hai, jo paanch waves se milta hai. Ye waves hote hain:

- Wave 1 (Impulse Wave): Pehli up-move wave, usually small.

- Wave 2 (Corrective Wave): Pehle wave ke opposite direction mein move karta hai.

- Wave 3 (Strong Impulse Wave): Sabse badi aur powerful upward move.

- Wave 4 (Corrective Wave): Wave 3 ke opposite direction mein move karta hai.

- Wave 5 (Impulse Wave): Aakhiri up-move wave.

- Impulse Wave ek specific sequence mein hota hai, jo paanch waves se milta hai. Ye waves hote hain:

- Wave 3 Sabse Badi Hoti Hai:

- Wave 3 typically sabse badi aur powerful hoti hai, aur isme maximum price movement hota hai.

- Wave 4 Sideways Move:

- Wave 4 mein market sideways ya corrective move karta hai.

- Wave 5 Mein Aakhiri Move:

- Wave 5 mein market aakhiri up-move karta hai, indicating the completion of the impulse wave.

- Trend Identification:

- Impulse Wave Pattern ka istemal trend ko identify karne mein hota hai. Jab ye pattern downtrend ke baad dikhai deta hai, to ye bullish reversal ko indicate karta hai, aur uptrend ke baad dikhai deta hai to ye bearish reversal ko indicate karta hai.

- Entry Points:

- Impulse Wave Pattern ke sath trade karte waqt traders entry points ko identify karne mein madad lete hain, especially Wave 2 ya Wave 4 ke baad.

- Stop-Loss Placement:

- Har trade mein stop-loss orders ka istemal karna zaroori hai taake losses ko control mein rakha ja sake.

- Profit Targets:

- Traders Impulse Wave ke sath trading karte waqt profit targets ko set karte hain, jo Wave 3 ke completion ke baad hota hai.

Impulse Wave Pattern, jab sahi taur par samjha jata hai, traders ko market trends ko anticipate karne mein madad karta hai. Lekin, jaise ke har technical indicator ya pattern ke sath hota hai, isay bhi caution ke sath aur confirmatory signals ke sath dekha jana chahiye.

- Directional Movement:

-

#13 Collapse

Assalam O Alikum Dear friends I hope you will be happy and fine Today I want to tell you that about IMPULSE WAVE CANDLE STICK PATTERN

INTRODUCTION OF IMPULSE WAVE:

Impulse Wave Pattern ek technical analysis concept hai jo Elliot Wave Theory ke andar aata hai. Elliot Wave Theory market trends ko analyze karne ka aik tareeqa hai, jismein market movement ko aik set of waves ya patterns ke zariye describe kiya jata hai. Impulse wave pattern market mein hone wale strong trends ko represent karta hai aur traders ko future price movements ke liye guide karta hai.

EXPLAINATION OF IMPULSE WAVE:

Impulsive Waves: Ye waves trend ke direction mein move karte hain aur 1, 2, 3, 4, 5 numbers se represent kiye jate hain. Inme se 1st, 3rd, aur 5th waves upward direction mein move karte hain, jabke 2nd aur 4th waves correction ya consolidation ke liye hoti hain. Corrective Waves: Ye waves impulsive waves ke opposite direction mein move karte hain aur a, b, c se represent kiye jate hain. Inme se a aur c waves impulsive waves ke opposite direction mein move karte hain

IDENTIFICATION:

Impulse wave pattern ko pehchanne ka pehla tareeqa ye hai ke traders market chart par 5-wave structure dhoondhein. Ye structure impulsive waves ko represent karta hai, jismein 1st, 3rd, aur 5th waves upward direction mein move karte hain, jabke 2nd aur 4th waves correction ya consolidation ke liye hoti hain.

FIBONACCI RETRACEMENT LEVEL:

Traders Impulse Wave Pattern ko identify karne ke liye Fibonacci retracement levels ka istemal bhi karte hain. Agar 2nd ya 4th wave Fibonacci retracement level ke qareeb aati hai, to ye ek confirmation sign ho sakta hai ke market mein impulse wave pattern hy

ENTRY POINT:

Ye pattern traders ko entry aur exit points tay karne mein bhi madad deta hai. Jab market impulsive waves mein hota hai, to traders apne positions ko adjust kar sakte hain

RISK MANAGEMENT:

Impulse Wave Pattern ka istemal risk management mein bhi hota hai. Agar trader ye samajh leta hai ke market mein 5-wave structure hai, to wo apni trading strategy ko iske mutabiq adjust karke apne risk ko minimize kar sakta hai.mpulse Wave Pattern ek powerful tool hai jise traders market trends ko samajhne aur predict karne ke liye istemal karte hain. Lekin, iski complexity aur subjective nature ko madde nazar rakhte hue, traders ko chahiye ke is pattern ko samajhne ke liye sahi training aur practice hasil karein. Iske saath sahi risk management aur doosre technical analysis tools ke istemal se traders behtar results achieve kar sakte hain.

COMMON MISTAKE WHEN IDENTIFYING IMPULSE WAVE

impulsve wave theory ke andar work karna Mushkil ho sakta hai isliye aap apni work per common mistake bhi nahin Karni chahie theory ko opportunities ki maloomat karne ke liye others technical analysis ke tarikon ke sath Milkar istemal Kiya jata hai wave ka theory market ki price ki direction maloomat karne ki koshish karta hai Jahan traders Kisi tasalsal ke andar Sab wave ki Fales identify Karte Hain Yeh Koi sakht rules Nahin Hai traders market ka analysis karne ki ahmiyat ko nazar andaaz kar sakte hain Trends support and resistance levels technical analysis Jaise factors par focus karne mein nakam ho sakte hain aur iska determine moving

CONCLUSION:

mpulse Wave Pattern ek powerful tool hai jise traders market trends ko samajhne aur predict karne ke liye istemal karte hain. Lekin, iski complexity aur subjective nature ko madde nazar rakhte hue, traders ko chahiye ke is pattern ko samajhne ke liye sahi training aur practice hasil karein. Iske saath sahi risk management aur doosre technical analysis tools ke istemal se traders behtar results achieve kar sakte hain.

Impulse wave candlestick pattern ki samajh se traders market ke potential reversals ya continuations ko identify kar sakte hain. Agar ye pattern sahi tareeqe se identify kiya jaye, to traders ko market mein hone wale potential moves ka pata chal sakta hai aur wo apni trading strategies ko improve kar sakte hain. Lekin hamesha yaad rahe ke kisi bhi pattern ko sirf ek tool ke taur par istemal kiya jaye aur dusri confirmatory signals aur risk management ke saath istemal kiya jaye.

-

#14 Collapse

**Impulse Wave Pattern Kya Hai?**

Technical analysis mein, impulse wave pattern ek ahem concept hai jo market trends aur price movements ko samajhne ke liye use hota hai. Yeh pattern Elliott Wave Theory ka ek important hissa hai aur traders ko market ke strong moves ko identify karne mein madad karta hai. Aaiye, impulse wave pattern ko detail mein samajhte hain aur dekhte hain ke isse trading mein kaise faida utha sakte hain.

**Impulse Wave Pattern Kya Hai?**

Impulse wave pattern market ke primary trend ko represent karta hai aur typically 5 waves ke sequence mein develop hota hai. Yeh pattern bullish aur bearish trends dono mein dikhai de sakta hai. Impulse wave pattern ko identify karne ke liye kuch key components hote hain:

1. **Five Waves Structure:** Impulse wave pattern ek five-wave structure ke roop mein hota hai. Yeh five waves ko generally do phases mein divide kiya jata hai: three impulse waves (waves 1, 3, aur 5) aur do corrective waves (waves 2 aur 4). Impulse waves primary trend ko follow karti hain, jabke corrective waves price correction ko represent karti hain.

2. **Wave 1:** Wave 1 market ke trend ki shuruaat ko represent karta hai aur yeh usually chhoti aur initial move hoti hai. Is wave ke dauran price thodi si increase ya decrease karti hai, jo trend reversal ka indication hota hai.

3. **Wave 2:** Wave 2 ek corrective wave hoti hai jo Wave 1 ke upward move ko partially reverse karti hai. Yeh wave market ko ek temporary pullback ya consolidation phase dikhati hai.

4. **Wave 3:** Wave 3 impulse wave ka sabse strong aur longest wave hoti hai. Yeh wave market ke primary trend ko strongly follow karti hai aur price me significant movement dikhati hai.

5. **Wave 4:** Wave 4 ek aur corrective wave hoti hai jo Wave 3 ke move ko partially reverse karti hai. Yeh wave market ko consolidation aur temporary pullback dikhati hai.

6. **Wave 5:** Wave 5 market ke trend ka final wave hoti hai. Yeh wave usually market ke primary trend ko complete karti hai aur price me final upward ya downward move dikhati hai.

**Pattern Ko Recognize Karne Ke Tareeqe:**

1. **Identify Trend:** Impulse wave pattern tabhi valid hota hai jab yeh clear trend ke dauran develop hota hai. Trend ke primary direction ko identify karna zaroori hai.

2. **Wave Structure:** Waves 1, 3, aur 5 ko impulse waves aur waves 2 aur 4 ko corrective waves ke roop mein recognize karna hota hai. Har wave ki specific length aur structure ko analyze karke pattern ki accuracy ko verify karna chahiye.

3. **Volume Analysis:** Volume analysis bhi impulse wave pattern ke validity ko confirm karne mein madad karta hai. High volume ke sath impulse waves ki formation zyada reliable hoti hai.

**Trading Strategy:**

- **Entry Point:** Impulse wave pattern ke dauran, Wave 1 aur Wave 5 ke points par trading opportunities ko identify kiya jata hai. Buy orders ko Wave 1 ke dauran aur Wave 3 ke high par place karna effective hota hai.

- **Stop Loss Aur Targets:** Stop loss ko corrective waves ke levels ke niche set karna chahiye, aur profit targets ko Wave 3 ke length ke hisaab se calculate kiya jata hai.

Impulse wave pattern ko samajh kar aur iske structure aur trends ko accurately analyze karke, traders market trends ko effectively predict kar sakte hain aur profitable trading opportunities ko identify kar sakte hain. Yeh pattern aapko market ke strong moves ko capitalize karne aur apne trading strategy ko optimize karne mein madad karega.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

### Impulse Wave Pattern

Forex trading aur technical analysis mein impulse wave pattern ek ahem concept hai jo market ke trend movements ko samajhne mein madad karta hai. Ye pattern Elliot Wave Theory ka ek hissa hai jo market movements ko waves ke zariye analyze karta hai. Is post mein hum impulse wave pattern ko detail se samjhenge aur iski trading strategies ko explore karenge.

Impulse wave pattern market ke trend ki strong movements ko dikhata hai. Yeh pattern typically five waves par mabni hota hai: teen bullish waves aur do corrective waves. Is pattern ko samajhna aur sahi waqt par identify karna traders ko market ke major trends ko exploit karne mein madad kar sakta hai.

Impulse wave pattern ke teen bullish waves ko generally 'motive waves' kehte hain. Inka sequence usually 1, 3, aur 5 hota hai, jahan wave 1 aur wave 3 trend ki strong movement ko dikhate hain aur wave 5 trend ke end tak continue karti hai. Do corrective waves jo ke wave 2 aur wave 4 hain, trend ke chhote temporary corrections ko reflect karte hain. Ye corrective waves market ke noise aur fluctuations ko represent karti hain jo trend ke continuation ke dauran hoti hain.

Impulse wave pattern ke kuch important characteristics hain jo traders ko is pattern ko identify karne aur interpret karne mein madad karte hain. Pehla characteristic yeh hai ke wave 3 kabhi bhi sabse chhoti nahi hoti. Ye wave 1 aur wave 5 se bada hota hai. Doosra characteristic yeh hai ke wave 4 wave 1 ke range ke andar rehna chahiye, yani wave 4 wave 1 ko overlap nahi karti. Tisra characteristic yeh hai ke wave 5 wave 3 ke high se upar close hoti hai, jo ke pattern ki final move ko dikhata hai.

Impulse wave pattern ko identify karne ke liye traders ko kuch tools aur techniques ka istemal karna padta hai. Elliott Wave Theory ki guidelines aur Fibonacci retracement levels is pattern ko analyze karne mein madadgar sabit hoti hain. Fibonacci retracement levels, jo ke market ke retracement points ko dikhate hain, traders ko wave 2 aur wave 4 ke potential levels ko identify karne mein help karte hain. Is tarah se traders ko entry aur exit points ko sahi se determine karne mein asani hoti hai.

Impulse wave pattern ka analysis karte waqt, trading strategy ko bhi samajhna zaroori hai. Jab traders impulse wave pattern ko identify kar lete hain, to unhe trend ke continuation aur reversal points ko samajhna padta hai. Ye strategy market ke major trends ko follow karne aur profit generate karne mein madad karti hai. Market ke strong movements aur trends ko exploit karne ke liye traders ko impulse waves ke characteristics ko achhe se samajhna aur apply karna chahiye.

Ek effective trading strategy ke liye, impulse wave pattern ke combination ko dusre technical indicators ke sath bhi use kiya ja sakta hai. For example, moving averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) jaise indicators trend ki strength aur momentum ko confirm karne mein madad karte hain. Is combination se traders ko zyada accurate trading signals milte hain aur trading decisions ko enhance kar sakte hain.

In conclusion, impulse wave pattern ek crucial tool hai jo Forex traders ko market ke trends ko analyze aur exploit karne mein madad karta hai. Is pattern ki understanding aur proper application traders ko market ki fluctuations aur trends ko samajhne mein madad deti hai, jo ke unki trading success ke liye important hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:57 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим