Price Action Best Strategy In Forex

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Price Action Best Strategy In Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Forex market mein trading karne ke liye mukhtalif strategies aur tareeqay istemal kiye ja sakte hain. In mein se ek ahem aur muzoun tareeqa Price Action hai, jo kay traders ke darmiyan kaafi mashhoor hai. Price Action trading strategy ka matlab hai ke aap sirf price charts ki movement par tawajjo dete hain aur indicators ya oscillators ka istemal kam ya bilkul na karte hue trading karte hain. Is tareeqay mein aap market ke natural movement ko samajhne ki koshish karte hain aur is se trading decisions lete hain. Importance of Price Action Price Action trading strategy ka yehi fikr hai ke market ki harkat khud hi market ki asal halat ko darshaati hai. Is tareeqay mein, aap trend lines, support aur resistance levels, candlestick patterns, aur chart formations jese tools ka istemal karte hain. Is strategy mein aapko price ke movement ko tafseel se samajhne ki zarurat hoti hai, jo kay aapko market ke trend aur reversals ke bare mein behtar idrak deti hai. Advantages of the Price Action Strategy

Advantages of the Price Action Strategy - Simplicity: Price Action strategy ka istemal karne mein asal tarjuma se kam waqt aur mehnat lagti hai. Is mein complex indicators aur formulas ki zarurat nahi hoti, jo naye traders ke liye aksar mushkil hoti hai.

- Natural Approach: Price Action strategy market ke natural movement par mabni hai. Is tarah ke trading mein aap market ke asal behavior ko samajhte hain aur indicators ki taraf ki taraf anay wali noise ko kam karte hain.

- Versatile: Price Action trading strategy mukhtalif timeframes aur market conditions mein istemal ki ja sakti hai. Yeh strategy trending aur range-bound markets dono mein kam karti hai.

- Decision Making: Price Action strategy aapko trading decisions lene mein madad karti hai. Aap candlestick patterns aur chart formations ki madad se entry aur exit points tay kar sakte hain.

- Candlestick Patterns: Candlestick patterns, jese ke doji, engulfing, aur hammer, aapko price ke movement ki mukhtalif phases ko samajhne mein madad dete hain. In patterns ki madad se aap trend reversals aur continuations ko predict kar sakte hain.

- Support aur Resistance Levels: Support aur resistance levels aapko price ke movement ki limits aur turning points samajhne mein madad dete hain. Aap is tareeqay se entry aur exit points tay kar sakte hain.

- Trend Lines: Trend lines aapko market ke trend ko determine karne mein madad deti hain. Aap trend lines ki madad se trend ke direction aur strength ko samajh sakte hain.

- Chart Formations: Chart formations, jese ke head and shoulders, double tops aur bottoms, aapko price ke patterns aur market ke possible reversals ke bare mein information dete hain.

Implementing the Price Action Strategy

Implementing the Price Action Strategy - Learn the Basics: Price Action strategy ko istemal karte waqt, sab se pehle aapko is tareeqe ke basic concepts aur tools se mutala karna chahiye. Candlestick patterns aur chart formations ko samajhne ka waqt dein.

- Practice: Price Action strategy ko istemal karte waqt practice ka khaas khayal rakhein. Demo account par trading karke aap is strategy ko behtar tareeqay se samajh sakte hain.

- Risk Management: Jese ke har trading strategy mein, risk management Price Action strategy mein bhi ahem hai. Apne trades ko manage karte waqt stop-loss aur take-profit levels ka tayun karein.

- Patience and Discipline: Price Action strategy ke istemal mein sabr aur discipline rakhna zaroori hai. Markets volatile ho sakte hain, is liye impulsive decisions se bachne ke liye tawajjo aur tahamul se kaam len.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

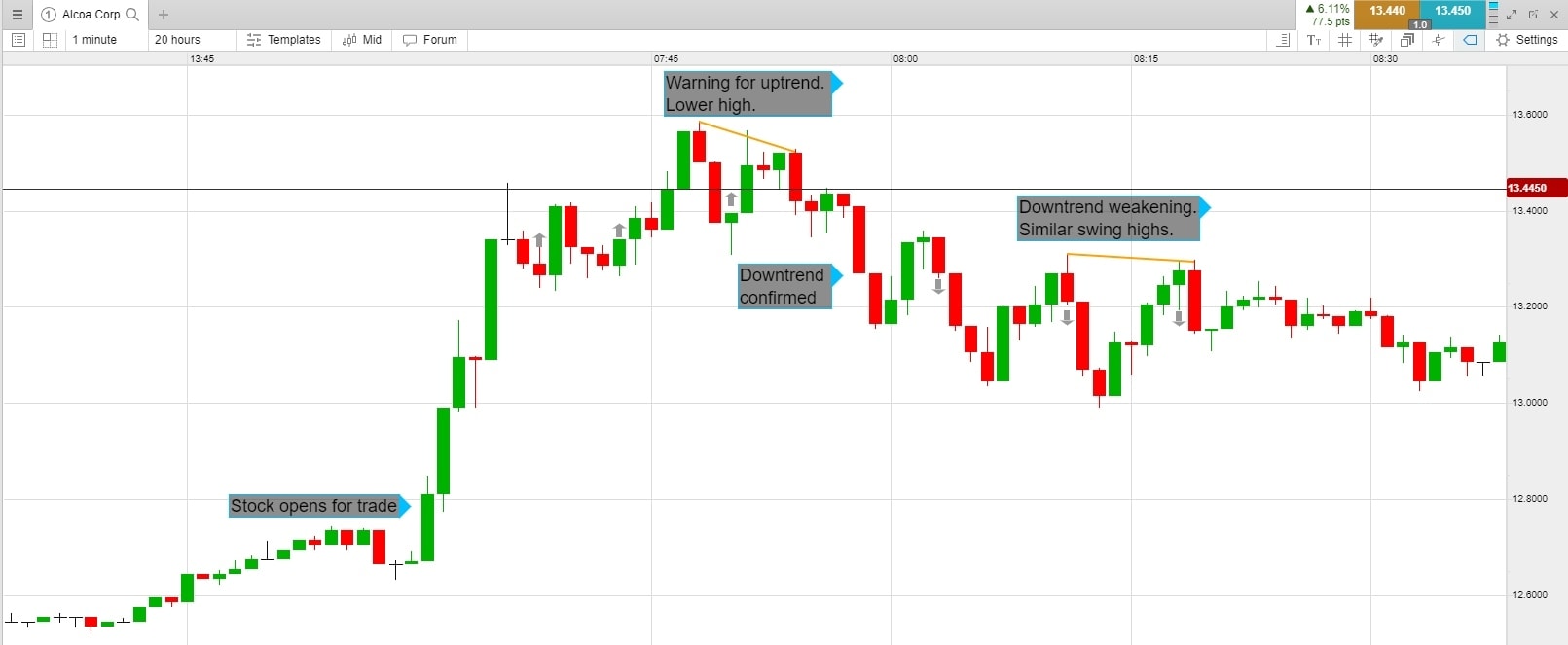

Introduction price action forex trading mein aik technical trading strategy hote hey technical trading strategy mein price ka study keya jata hey or price action stand kay akailay technique kay tor par estamal keya jata hey or yeh forex trade kay indicator kay sath mell kar estamal keya jata hey es pattern mein basic baten shazo nadar he pay jate hein tahum economics wakeyaat ko aik stable element kay tor par shamel keya jata hey price action mein length of trade price action forex trading kay mokhtalef period mein estamal keya jata hey analysis mein aik say zyada time frame kay estamal karnay ke taqat hote hey jo keh price action trading ko kabel e kadar banate hey Entry / Exit Points support ya resistance level ka tayon karnay kay bohut say tarekay hotay hein aam tor par entry exit kay tor par estamal kartay hein price action mein range hote hey trend day , scalping , swing or position trading strategy hote hey jes ka zail mein tafsel say khaka paish keya jay ga takeh es bat ko bhe zahair keya ja sakay keh trading kes qadar matnoo bhe ho sakte hey yeh mesales strategy par trade karnay ke different technique ka bhe estamal kerte heytakeh es bat zahair keya ja sakay keh trading strategy mokhtalef kesam ke technique ko bhe zahhair kar sakte hein es kay sath sath trader kay ley choice kay ley kai kesam ke trading bhe ho sakte hey Price action Trend analysis analysis ka pehla soba jes par trader ko towajah dayne chihay woh hey trend ke tshkhes karna hey keh koi kabel e adrak trend kahan par majod ho saktay hein ya phir es time jazbaat kahan par paida ho saktay hein price action kay introduce mein hum nay daikha tha keh forex market kay pair mein hum higher highs ya higher lows ko bhe daikh saktay hein or lower lows say lower kay trend ke identification hote hy or higher highs trend say higher trend ke identification hote hey mazeed tafsel zail kay chart mein daikh saktay heinدیتے جائیںThanksحوصلہ افزائی کے لیے -

#4 Collapse

"Mudood Action," ya Roman Urdu mein "Price Action," forex trading mein ek behtareen tareeqa hai jis se traders qeemat ki harqatain samajhte hain aur bina indicators aur oscillators ke qeemat ki tawanai ki tashrih karte hain. Yeh tareeqa traders ko charts par mojud qeemati data ko padhne aur samajhne mein madad deta hai, jisse ke informed trading decisions liye ja sakte hain. Is tareeqe mein traders un patterns, trends, aur reversals ki pehchan karte hain jo qeemat ki movement mein nazar ati hain. Price Action Ki Ahmiyat - Kyun Ke Price Action Behtareen Hai Price Action trading ka istemal karne ki khaas ahmiyat hai, kyun ke ismein traders directly qeemat ki movement aur market sentiment ko samajh sakte hain. Yeh tareeqa indicators aur oscillators ki zaroorat se bari had tak kam karta hai, aur traders ko bina kisi choti maloomat ke asal aur taqatwar trends ki tashrih karne ki salahiyat deta hai. Niche diye gaye points mein "Price Action" ke behtareen tareeqe ke baare mein janiye: Visual Aur Clear Tashrih "Price Action" charts traders ko visual aur clear tashrih dete hain. Traders asani se patterns aur trends ko samajh sakte hain jab woh chart par price movements ko dekhte hain. No Lagging Indicators "Price Action" tareeqe mein traders indicators aur oscillators ke bina kaam karte hain. Yeh tareeqa direct price movement ko analyze karta hai, is liye lagging indicators ke wajood se bachata hai. Patterns Ki Pehchan Price Action trading mein traders ko patterns ki pehchan karni hoti hai, jaise ke doji, pin bar, engulfing patterns, aur doosre candlestick patterns. In patterns ki madad se potential reversals aur trends ko pehchana ja sakta hai. Support Aur Resistance Price Action mein support aur resistance levels ki ahmiyat hoti hai. Traders in levels ko samajh kar entry aur exit points mukarrar karte hain. Candlestick Analysis Candlestick patterns ki tashrih kar ke traders market sentiment aur price movement ko samajhne mein madad hasil karte hain. Bullish aur bearish signals ki pehchan karne mein yeh kargar hoti hai. Price Fluctuations Ki Samjh "Price Action" traders ko qeemat ki fluctuations ki samajh mein madad deta hai. Yeh tareeqa traders ko pata lagane mein madad karta hai ke market kis taraf ja raha hai. Decision Making Mein Madad Price Action trading traders ko informed decision making mein madad deta hai. Traders direct qeemat ki movement par amal karte hue trading strategies tayyar karte hain. "Price Action" versatile tareeqa hai jo kayi tarah ki trading styles mein istemal ho sakta hai, jaise ke day trading, swing trading, aur positional trading. "Price Action," ya "Mudood Action," forex trading mein ek powerful aur effective tareeqa hai jo traders ko indicators aur oscillators ke baghair qeemat ki movement aur market trends ki samajhne mein madad deta hai. Lekin, is tareeqe ko istemal karte waqt bhi sahi risk management aur proper research ki zaroorat hoti hai. Traders ko mehnat aur farahmi ke saath amli maharat ko behtar banane chahiye aur "Price Action" tareeqa ka istemal karke inform kiye hue trading decisions par qaim rehna chahiye. (Note: Upar di gayi maloomat taleemi aur maaloomati maqasid ke liye di gayi hain aur isay mali ya trading advice ki hesiyat se nahi liya jana chahiye. Maliyat market mein khatrat hote hain aur logon ko trading decisions se pehle mali mashwaray hasil karne aur research karne ki zaroorat hoti hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

"Price action" ek trading methodology hai jisme traders market movements aur price charts ke base par trading decisions lete hain. Price action trading mein indicators ka kam minimal hota hai, aur traders price patterns, candlestick patterns, support-resistance levels, aur trend analysis ka istemal karte hain. Lekin, "best" strategy ka chayan karna challenging hota hai, kyun ki har trader ka risk tolerance, trading style, aur market understanding alag hota hai.Yahan kuch common price action strategies hain jo Forex traders istemal karte hain: Pin Bar Strategy: Pin bars ya "Pinocchio bars" bearish aur bullish reversals ke signals provide karte hain. Yeh candlestick pattern market sentiment ke change hone ka indication deta hai. Inside Bar Strategy: Inside bars ek range-bound market ya trend reversal ka indication ho sakte hain. Traders entry aur exit points identify karne mein inka istemal karte hain. Engulfing Pattern Strategy: Engulfing patterns bullish ya bearish reversal ke signals provide karte hain jab ek candlestick dusre candlestick ko completely engulf karta hai. Support-Resistance Strategy: Support aur resistance levels par focus karke traders price bounces aur breakouts ko samajhne aur trading opportunities ko dhundte hain. Trend Following Strategy: Trend following strategies mein traders trend direction aur momentum ko analyze karte hain aur us direction mein trade karte hain. Isme moving averages aur trend lines ka istemal hota hai. Price Patterns Strategy: Chart patterns jaise ki head and shoulders, double tops, double bottoms, aur triangles ka istemal price movements ko predict karne aur trading decisions lene mein hota hai. Multiple Timeframe Analysis : Traders different timeframes par price action ko analyze karke ek comprehensive understanding develop karte hain, aur fir trading decisions lete hain.Har trader ka approach alag hota hai, aur "best" strategy kisi specific situation ya market condition par depend karta hai. Aapko apne risk tolerance, trading goals, aur market understanding ke hisab se price action strategies ko explore karna chahiye. Starting mein, demo account par practice karke alag-alag strategies ko test karna bhi beneficial ho sakta hai. Additionally, ek acchi strategy kaam karne ke liye disciplined approach aur risk management bhi zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:33 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим