Dark Cloud Cover Pattern Ka Chart Main Istamal

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Dosto jaisa ke trading chart main use hone wale har pattern ke aik ahmyat hay aur us ko identify karne ke skill ko he kamyabi ke zamanat samjha ja sakta hayCloudy cover pattern stick ko identify karna ek important skill hai forex trading mein. Cloudy cover pattern stick ko identify karne ke liye aap ye steps follow kar sakte hain: Candlestick Chart Analysis: Sabse pehle, aapko candlestick chart analysis mein mahir hona hoga. Candlestick charts mein har candlestick ek specific time period ki price movement ko represent karta hai. Dark Cloud Cover Formation: Cloudy cover pattern stick ka mukhya hissa "cloud" hota hai, jo ki Ichimoku Kinko Hyo indicator se aata hai. Cloud ek area hota hai jahan price movement hota hai. Cloud ka color bhi important hota hai, jaise ki green (bullish) aur red (bearish). Bullish Cloudy Cover Pattern Stick: Agar price candlestick ek bearish candlestick se neeche girta hai aur uske baad ek bullish candlestick cloud ke andar form karta hai, to yeh bullish cloudy cover pattern stick ho sakta hai. Isme price ki reversal ka possibility hota hai. Bearish Cloudy Cover Pattern Stick: Agar price candlestick ek bullish candlestick se upar uthkar girta hai aur uske baad ek bearish candlestick cloud ke andar form karta hai, to yeh bearish cloudy cover pattern stick ho sakta hai. Isme price ki reversal ka possibility hota hai. Confirmation Pattern ko confirm karne ke liye, aapko dusri technical indicators jaise ki moving averages, oscillators, aur trend lines ka bhi istemal karna chahiye. Practice and Experience: Cloudy cover pattern stick ko identify karne ke liye practice aur experience zaroori hai. Historical charts par backtesting karke pattern ko recognize karna sikh sakte hain. Yad rahe ki trading mein koi bhi pattern ya indicator 100% accurate nahi hota. Always risk management aur proper analysis par focus karna zaroori hai.Thank you for your attention -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

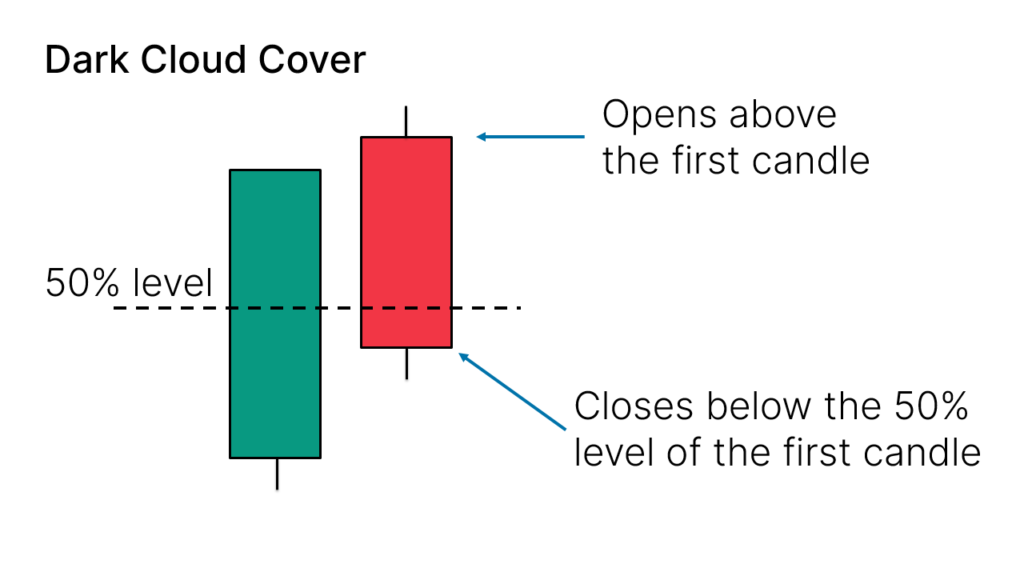

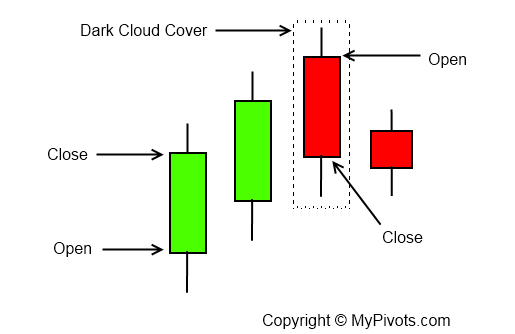

"Dark Cloud Cover" ek bearish reversal pattern hai jo candlestick chart analysis mein use hota hai. Yeh pattern uptrend ke baad dikhai deta hai aur price movement ke potential reversal ko indicate karta hai. Is pattern mein pehle ek strong bullish candle hota hai, jo ek uptrend ka hissa hai, aur uske baad ek bearish candle aata hai jo pehle candle ke upper half mein open hota hai aur uske close ke neeche close hota hai. Yeh pattern strong reversal signal dene ka indication deta hai. Chaliye, main aapko is pattern ko chart par find karne aur uska accurate signal find karne ka tariqa bataata hoon: Dark Cloud Cover Pattern Find Karne ka Tariqa: Trend Identification: Sabse pehle aapko trend ko identify karna hoga. Dark Cloud Cover pattern aksar uptrend ke baad dikhata hai, isliye aapko pehle trend ko confirm karna hoga. Candles Check Karein: Ab aapko candlesticks ko dekhna hoga. Dark Cloud Cover pattern mein aapko do consecutive candles dekhne hain. Pehla candle strong bullish hona chahiye aur dusra candle uske neeche open hona chahiye. Open aur Close Position: Dusra candle pehle candle ke upper half mein open hona chahiye aur uske close ke neeche close hona chahiye. Volume Check Karein: Yeh pattern confirm karne ke liye trading volume bhi check karein. Agar second candle ka volume significantly higher hai, toh yeh pattern ka confirmation hota hai. Accurate Signal Find Karne ka Tariqa: Confirmation: Dark Cloud Cover pattern ko confirm karne ke liye aapko kuch aur factors bhi dekhne honge, jaise ki nearby support and resistance levels, trend lines, aur technical indicators. Divergence: Agar kisi technical indicator mein (jaise ki RSI, MACD) divergence dikh raha hai, jahan price trend aur indicator trend alag hai, toh yeh bhi ek confirmation signal ho sakta hai. Multiple Time Frames: Doosre time frames par bhi dekhein ki kya woh bhi Dark Cloud Cover pattern show kar rahe hain. Agar multiple time frames par bhi yeh pattern dikh raha hai, toh uska signal strong ho sakta hai. Risk Management: Apne trade mein hamesha risk management ka khayal rakhein. Stop loss set karein aur trade size sahi tarah se manage karein. Dark Cloud Cover pattern ka accurate signal find karne ke liye aapko experience aur practice ki zaroorat hoti hai. Yeh ek piece of puzzle hota hai aur aapko dusre technical indicators aur analysis tools ke saath combine karke trading decisions leni chahiye. -

#4 Collapse

Dark cloud cover: Dark Cloud Cover" forex me ek candlestick pattern hai jo bearish reversal signal deta hai. Is pattern me do consecutive candles hote hain: pehli candle bullish (upward) trend ki hoti hai aur dusri candle usse neeche girti hai. Dusri candle ki opening price pehli candle ki closing price se ziada hoti hai, lekin uski closing price pehli candle ki body ke andar girti hai. Yeh ek indication hoti hai ke bullish trend khatam ho kar bearish trend shuru ho sakta hai.Dark Cloud Cover ek bearish reversal candlestick pattern hai jo ke price trend ko change karnay ka signal deta hai. Is pattern mein, pehlay din par ek bullish (upward) candle hoti hai, jo ke upar jati hai. Lekin dusre din, ek bearish (downward) candle hoti hai jiska open price pehlay din ki close price say ziada hota hai aur is candle ki body pehlay din ki body ko cover karti hai. Is tarah ka pattern market mein uptrend ke baad dikhayi deta hai aur yeh downward movement ki indication ho sakti hai. Isay samajhnay ke liye, price ki movement ka close observation zaroori hai. Dark Cloud Cover, ya DC, ek candlestick pattern hai jo forex trading mein use hota hai. Yeh pattern bearish reversal ka indication deta hai, matlab ke trend ki direction change hone ki possibility hoti hai. Is pattern mein do candlesticks hote hain. Pehla candlestick bullish (upward) trend mein hota hai, jabki dusra candlestick usi se neeche girta hai aur pehle candlestick ki kuch had tak cover karta hai. Is tarah ka pattern dekh kar traders ko yeh samjhne mein madad milti hai ke bullish trend khatam ho raha hai aur bearish trend shuru ho sakta hai. Explanation: Is pattern ki tashkeel aksar uptrend ke baad dekhi jati hai aur yeh price action analysis mein istemal hoti hai. Isko samajh kar traders apne trading decisions ko improve kar sakte hain.Dark Cloud Cover" forex pattern aik bearish reversal pattern hai jo candlestick charts par nazar aata hai. Is pattern mein do consecutive candles hoti hain: pehli candle bullish (upward) hoti hai aur dusri candle uski upper side mein open hoti hai, lekin overall price pehli candle ki body ko cover kar leti hai. Ye pattern market mein bullish trend ki possible khatraat ya trend change ki indication ho sakti hai. Dark Cloud Cover ek candlestick pattern hai jo ke forex trading mein use hota hai. Ye bearish reversal pattern hai jo price trend ko reverse karne ki possibility indicate karta hai. Is pattern mein do consecutive candlesticks hote hain. Pehla candlestick uptrend mein hota hai aur bullish (buyers ki dominance) hota hai. Dusra candlestick pehle candlestick ki body ke kareeb open hota hai, lekin phir uske neeche close ho jata hai. Iska matlab hota hai ke buyers ke baad sellers ka aana shuru ho gaya hai, jiski wajah se price mein girawat ho sakti hai. Dark Cloud Cover pattern ko confirm karne ke liye, traders ko candlestick ke close price se thoda below entry point set karna hota hai, aur stop loss pe pehle candlestick ki high level rakhi jaati hai. Ye pattern market trend change ka indication deta hai, lekin successful trading ke liye iske saath aur bhi analysis ki zarurat hoti hai. -

#5 Collapse

Dark Cloud Cover Chart Pattern: Forex me ek candle design hai jo negative inversion signal deta hai. Is design me do successive candles hote hain pehli flame bullish (up) pattern ki hoti hai aur dusri candle usse neeche girti hai. Dusri candle ki opening cost pehli candle ki shutting cost se ziada hoti hai, lekin uski shutting cost pehli candle ki body ke andar girti hai. Yeh ek sign hoti hai ke bullish pattern khatam ho kar negative pattern shuru ho sakta hai.Dark Overcast Cover ek negative inversion candle design hai jo ke cost pattern ko change karnay ka signal deta hai. Is design mein, pehlay racket standard ek bullish (up) candle hoti hai, jo ke upar jati hai. Lekin dusre clamor, ek negative (descending) light hoti hai jiska open cost pehlay noise ki close cost say ziada hota hai aur is candle ki body pehlay racket ki body ko cover karti hai. Is tarah ka design market mein upturn ke baad dikhayi deta hai aur yeh descending development ki sign ho sakti hai. Isay samajhnay ke liye, cost ki development ka close perception zaroori hai. Foreboding shadow Cover, ya DC, ek candle design hai jo forex exchanging mein use hota hai. Yeh design negative inversion ka sign deta hai, matlab ke pattern ki heading change sharpen ki probability hoti hai.Is design mein do candles hote hain. Pehla candle bullish (up) pattern mein hota hai, jabki dusra candle usi se neeche girta hai aur pehle candle ki kuch had tak cover karta hai. Is tarah ka design dekh kar brokers ko yeh samjhne mein madad milti hai ke bullish pattern khatam ho raha hai aur negative pattern shuru ho sakta hai Foreboding shadow Cover design ko affirm karne ke liye, dealers ko candle ke close cost se thoda beneath passage point set karna hota hai, aur stop misfortune pe pehle candle ki significant level rakhi jaati hai. Ye design market pattern change ka sign deta hai, lekin effective exchanging ke liye iske saath aur bhi investigation ki zarurat hoti hai. Chart Pattern Identification: Design ki tashkeel aksar upswing ke baad dekhi jati hai aur yeh cost activity examination mein istemal hoti hai. Isko samajh kar merchants apne exchanging choices ko improve kar sakte hain.Dark Overcast Cover" forex design aik negative inversion design hai jo candle graphs standard nazar aata hai. Is design mein do continuous candles hoti hain: pehli flame bullish (up) hoti hai aur dusri light uski upper side mein open hoti hai, lekin by and large cost pehli candle ki body ko cover kar leti hai. Ye design market mein bullish pattern ki conceivable khatraat ya pattern change ki sign ho sakti hai.Dark Overcast Cover ek candle design hai jo ke forex exchanging mein use hota hai. Ye negative inversion design hai jo cost pattern ko turn around karne ki probability demonstrate karta hai.Is design mein do successive candles hote hain. Pehla candle upswing mein hota hai aur bullish (purchasers ki strength) hota hai. Dusra candle pehle candle ki body ke kareeb open hota hai, lekin phir uske neeche close ho jata hai.

Foreboding shadow Cover, ya DC, ek candle design hai jo forex exchanging mein use hota hai. Yeh design negative inversion ka sign deta hai, matlab ke pattern ki heading change sharpen ki probability hoti hai.Is design mein do candles hote hain. Pehla candle bullish (up) pattern mein hota hai, jabki dusra candle usi se neeche girta hai aur pehle candle ki kuch had tak cover karta hai. Is tarah ka design dekh kar brokers ko yeh samjhne mein madad milti hai ke bullish pattern khatam ho raha hai aur negative pattern shuru ho sakta hai Foreboding shadow Cover design ko affirm karne ke liye, dealers ko candle ke close cost se thoda beneath passage point set karna hota hai, aur stop misfortune pe pehle candle ki significant level rakhi jaati hai. Ye design market pattern change ka sign deta hai, lekin effective exchanging ke liye iske saath aur bhi investigation ki zarurat hoti hai. Chart Pattern Identification: Design ki tashkeel aksar upswing ke baad dekhi jati hai aur yeh cost activity examination mein istemal hoti hai. Isko samajh kar merchants apne exchanging choices ko improve kar sakte hain.Dark Overcast Cover" forex design aik negative inversion design hai jo candle graphs standard nazar aata hai. Is design mein do continuous candles hoti hain: pehli flame bullish (up) hoti hai aur dusri light uski upper side mein open hoti hai, lekin by and large cost pehli candle ki body ko cover kar leti hai. Ye design market mein bullish pattern ki conceivable khatraat ya pattern change ki sign ho sakti hai.Dark Overcast Cover ek candle design hai jo ke forex exchanging mein use hota hai. Ye negative inversion design hai jo cost pattern ko turn around karne ki probability demonstrate karta hai.Is design mein do successive candles hote hain. Pehla candle upswing mein hota hai aur bullish (purchasers ki strength) hota hai. Dusra candle pehle candle ki body ke kareeb open hota hai, lekin phir uske neeche close ho jata hai. Time spans standard bhi dekhein ki kya woh bhi Foreboding shadow Cover design show kar rahe hain. Agar different time spans standard bhi yeh design dikh raha hai, toh uska signal solid ho sakta hai.Apne exchange mein hamesha risk the executives ka khayal rakhein. Stop misfortune set karein aur exchange size sahi tarah se oversee karein.Dark Overcast Cover design ka precise sign find karne ke liye aapko experience aur practice ki zaroorat hoti hai. Yeh ek piece of puzzle hota hai aur aapko dusre specialized pointers aur investigation apparatuses ke saath join karke exchanging choices leni chahiye.Dark Overcast Cover design ko affirm karne ke liye aapko kuch aur factors bhi dekhne honge, jaise ki close by help and obstruction levels, pattern lines, aur specialized indicators.Agar kisi specialized marker mein (jaise ki RSI, MACD) difference dikh raha hai, jahan cost pattern aur pointer pattern alag hai, toh yeh bhi ek affirmation signal ho sakta hai. Chart Pattern Trading And Formation: Design ko affirm karne ke liye, aapko dusri specialized markers jaise ki moving midpoints, oscillators, aur pattern lines ka bhi istemal karna chahiye.Dark Overcast Cover" ek negative inversion design hai jo candle diagram investigation mein use hota hai. Yeh design upswing ke baad dikhai deta hai aur cost development ke potential inversion ko demonstrate karta hai. Is design mein pehle ek solid bullish flame hota hai, jo ek upswing ka hissa hai, aur uske baad ek negative candle aata hai jo pehle candle ke upper half mein open hota hai aur uske close ke neeche close hota hai. Yeh design solid inversion signal dene ka sign deta hai. Chaliye, primary aapko is design ko graph standard find karne aur uska precise sign find karne ka tariqa bataata hon

Exchanging diagram fundamental use sharpen rib har design ke aik ahmyat feed aur us ko distinguish karne ke expertise ko he kamyabi ke zamanat samjha ja sakta hayCloudy cover design stick ko recognize karna ek significant ability hai forex exchanging mein. Overcast cover design stick ko distinguish karne ke liye aap ye steps follow kar sakte hain Sabse pehle, aapko candle outline examination mein mahir hona hoga. Candle graphs mein har candle ek explicit time span ki cost development ko address karta hai Overcast cover design stick ka hissa "cloud" hota hai,Hyo marker se aata hai. Cloud ek region hota hai jahan cost development hota hai. Cloud ka tone bhi significant hota hai, jaise ki green (bullish) aur red (negative) Agar cost candle ek negative candle se neeche girta hai aur uske baad ek bullish candle cloud ke andar structure karta hai, to yeh bullish overcast cover design stick ho sakta hai. Isme cost ki inversion ka probability hota hai.

Exchanging diagram fundamental use sharpen rib har design ke aik ahmyat feed aur us ko distinguish karne ke expertise ko he kamyabi ke zamanat samjha ja sakta hayCloudy cover design stick ko recognize karna ek significant ability hai forex exchanging mein. Overcast cover design stick ko distinguish karne ke liye aap ye steps follow kar sakte hain Sabse pehle, aapko candle outline examination mein mahir hona hoga. Candle graphs mein har candle ek explicit time span ki cost development ko address karta hai Overcast cover design stick ka hissa "cloud" hota hai,Hyo marker se aata hai. Cloud ek region hota hai jahan cost development hota hai. Cloud ka tone bhi significant hota hai, jaise ki green (bullish) aur red (negative) Agar cost candle ek negative candle se neeche girta hai aur uske baad ek bullish candle cloud ke andar structure karta hai, to yeh bullish overcast cover design stick ho sakta hai. Isme cost ki inversion ka probability hota hai.

- Mentions 0

-

سا0 like

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu-Alaikum! Dear members Me umeed karta hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : Dark Cloud Cover Pattern Ka Chart Main Istamal dark cloud cover aik bearish reversal candle stuck patteren hai jahan neechay candle ( aam tor par siyah ya surkh ) parai up candle ( aam tor par safaid ya sabz ) ke oopar khulti hai aur phir oopar candle ke wast point ke neechay band hojati hai . patteren ahem hai kyunkay yeh raftaar mein ulta se neechay ki taraf tabdeeli ko zahir karta hai. patteren aik oopar ki mom batii se banaya gaya hai jis ke baad neechay candle hai. tajir agli ( teesri ) mom batii par qeemat kam karne ke liye dekhte hain. usay tasdeeq kehte hain . Explanation: dark cloud cover aik candle stuck patteren hai jo qeemat mein izafay ke baad kami ki taraf momentum mein tabdeeli ko zahir karta hai . patteren aik bearish candle par mushtamil hai jo oopar khulti hai lekin phir parai blush candle ke wast point ke neechay band hojati hai . dono mom batian nisbatan barri honi chahiye, jo taajiron aur sarmaya karon ki mazboot shirkat ko zahir karti hain. jab patteren choti mom btyon ke sath hota hai to yeh aam tor par kam ahem hota hai . tajir aam tor par dekhte hain ke kya bearish candle ke baad anay wali candle bhi qeematon mein kami ko zahir karti hai. bearish candle ke baad qeemat mein mazeed kami ko tasdeeq kehte hain . gehray baadal ke ihata ko samjhna dark cloud cover patteren mein aik barri kaali mom batii shaamil hoti hai jo pehlay wali mom batii par" gehra baadal" banati hai. bearish engulfing patteren ki terhan, khredar khulay mein qeemat ko ouncha dhakel dete hain, lekin baichnay walay baad mein session mein qabza kar letay hain aur qeemat ko taizi se kam kar dete hain. khareed o farokht ki taraf yeh tabdeeli is baat ki nishandahi karti hai ke qeematon mein kami anay wali hai ziyada tar traders dark cloud cover patteren ko sirf is soorat mein mufeed samajte hain jab yeh oopar ke rujhan ya qeemat mein majmoi tor par izafay ke baad hota hai. jaisay jaisay qeematein barhti hain, patteren neechay ki taraf mumkina iqdaam ko nishaan zad karne ke liye ziyada ahem ho jata hai. agar qeemat ka amal kata sun-hwa hai to patteren kam ahem hai kyunkay patteren ke baad qeemat ke katay rehne ka imkaan hai . dark cloud cover patteren ko mazeed safaid aur siyah mom btyon ki khasusiyat di gayi hai jin ke haqeeqi jism lambay hain aur nisbatan mukhtasir ya ghair mojood saaye hain. yeh Awsaf batatay hain ke nichli harkat qeemat ki harkat ke lehaaz se intehai faisla kin aur ahem thi. traders patteren ke baad bearish candle ki shakal mein tasdeeq bhi talaash kar satke hain. dark cloud cover ke baad qeemat mein kami ki tawaqqa hai, lehaza agar aisa nahi hota hai to patteren nakaam ho sakta hai . bearish candle ke band ko lambi pozishnon se bahar niklny ke liye istemaal kya ja sakta hai. mutabadil tor par, agar qeemat musalsal girty rehti hai to tajir aglay din bahar nikal satke hain ( patteren ki tasdeeq ho gayi ). agar bearish candle ke band honay par ya aglay period mein short daakhil hota hai to, bearish candle ki oonchai ke oopar aik stap nuqsaan rakha ja sakta hai . dark cloud cover patteren ke liye munafe ka koi hadaf nahi hai. dark cloud cover par mabni mukhtasir tijarat se kab bahar niklana hai is ka taayun karne ke liye tajir deegar tareeqon ya candle stuck patteren ka istemaal karte hain . tajir takneeki tajzia ki deegar aqsam ke sath mil kar dark cloud cover patteren ka istemaal kar satke hain. misaal ke tor par, tajir 70 se ziyada rishta daar taaqat ka asharih ( rsi ) talaash kar satke hain, jo is baat ki tasdeeq faraham karta hai ke security ziyada kharidi gayi hai. aik tridr dark cloud cover patteren ke baad kaleedi support level se kharabi ki talaash bhi kar sakta hai is signal ke tor par ke neechay ka rujhan anay wala hai . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

**Dark Cloud Cover Pattern** forex aur stocks trading mein ek bearish reversal pattern hai jo price chart par dekhe jaane wale patterns mein se ek hai. Is pattern mein ek bullish trend ke baad ek bearish candlestick appear hota hai jo pehle bullish candlestick ke upar open hota hai aur uske body ko partially cover karta hai. **Explanation of Dark Cloud Cover Pattern**: Dark Cloud Cover pattern ek bearish reversal pattern hota hai jismein ek bullish trend ke baad ek bearish candlestick appear hota hai. Is pattern mein bearish candlestick pehle bullish candlestick ke upar open hota hai aur uske body ko partially cover karta hai, indicating potential reversal. **Types of Dark Cloud Cover Pattern**: Dark Cloud Cover pattern ka basic form hota hai aur variations normally nahi hote hain. Lekin traders specific market conditions aur trends ke hisab se entry aur exit rules customize kar sakte hain. **Characteristics of Dark Cloud Cover Pattern**: - Pehle candlestick bullish hota hai aur dusre candlestick bearish hota hai. - Dusre candlestick ka open price pehle candlestick ke close se upar hota hai. - Dusre candlestick ka close price pehle candlestick ke body ko partially cover karta hai. **Benefits (Fawaid) of Dark Cloud Cover Pattern**: - Dark Cloud Cover pattern traders ko potential bearish reversal points identify karne mein madad deta hai. - Price direction change ka strong indication hota hai jab dark cloud cover pattern form hota hai. - Is pattern se traders potential entry aur exit points find kar sakte hain. **Drawbacks (Nuqsan) of Dark Cloud Cover Pattern**: - Yeh pattern hamesha accurate nahi hota, kuch cases mein false signals bhi ho sakte hain. - Market conditions aur events ke impact se pattern ka interpretation challenging ho sakta hai. **Conclusion**: Dark Cloud Cover Pattern bearish reversal points ko identify karne mein madad deta hai. Lekin isey istemal karne se pehle, traders ko confirmatory signals aur dusre technical analysis tools ka bhi istemal karna chahiye. Market mein hone wali aur hone wale events ke madd-o-jazar se pehle, proper research aur analysis karna zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:56 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим