Engulfing Candlestick Pattern in Forex..

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

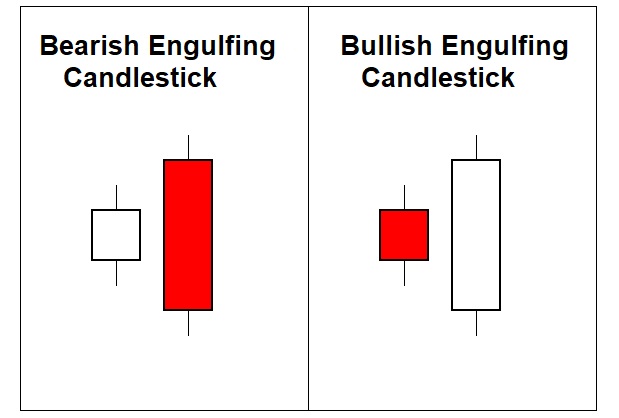

Definition: Engulfing Candlestick Pattern, jo kay Forex mein istemaal hota hai, ek aham price action pattern hai jo traders ko market ke possible reversals aur trend changes ki nishandahi karne mein madad karta hai. Is pattern mein do candlesticks (mombattiyan) involved hoti hain, aur yeh usually market ke uptrend ya downtrend mein dikhai deti hai. Engulfing Candlestick Pattern do qisam ke hote hain: Bullish Engulfing aur Bearish Engulfing. 1. Bullish Engulfing: Bullish Engulfing pattern uptrend mein nazar aata hai aur yeh trend change ya reversal ki nishandahi karta hai. - Pehli mombatti choti hoti hai aur down (neechay) ki taraf jati hai. - Dusri mombatti is se ziada lambi hoti hai aur up (upar) ki taraf jati hai. - Dusri mombatti pehli mombatti ko "engulf" karti hai, yani ke uski body pe puri tarah se chadhti hai. - Yeh pattern bullish sentiment ka izhar karta hai aur future mein price ki bulandiyon ki ummeed ko dikhata hai. 2. Bearish Engulfing : - Bearish Engulfing pattern downtrend mein dikhai deta hai aur trend change ya reversal ki indication deta hai. - Pehli mombatti lambi hoti hai aur up (upar) ki taraf jati hai. - Dusri mombatti is se ziada choti hoti hai aur down (neechay) ki taraf jati hai. - Dusri mombatti pehli mombatti ko "engulf" karti hai, yani ke uski body pe puri tarah se utarti hai. - Yeh pattern bearish sentiment ka izhar karta hai aur future mein price ki kami ki ummeed ko dikhata hai. Engulfing Candlestick Pattern: Engulfing Candlestick Pattern ka matlab hota hai ke market mein trend change ho sakta hai. Agar aap bullish engulfing pattern dekhte hain to yeh maane ja sakta hai ke bearish trend se bullish trend mein change hone ki sambhavna hai, jabke bearish engulfing pattern dekhne par bearish trend se bullish trend mein change hone ki sambhavna hoti hai. Is pattern ki tafsili tafseel aur sahi tajwez ke liye, aapko Forex education aur technical analysis mein mazeed deep study karna chahiye. -

#3 Collapse

**Engulfing Candlestick Pattern** forex aur stocks trading mein ek popular reversal pattern hai jo price chart par dekhe jaane wale patterns mein se ek hai. Is pattern mein ek candlestick dusre candlestick ko engulf (cover) karti hai. Engulfing pattern bullish aur bearish dono forms mein dekha ja sakta hai. **Explanation of Engulfing Candlestick Pattern**: Engulfing Candlestick pattern mein ek candlestick (engulfing candle) dusre candlestick (engulfed candle) ko cover karti hai, yani ke engulf karti hai. Yeh pattern ek reversal signal provide karta hai aur price direction change indicate karta hai. Engulfing pattern bullish aur bearish dono forms mein dekha ja sakta hai. **Types of Engulfing Candlestick Pattern**: 1. **Bullish Engulfing Pattern**: Is pattern mein pehle candlestick bearish hoti hai aur doosre candlestick mein uske range ko completely engulf (cover) kar leti hai. Yeh bullish reversal signal hota hai. 2. **Bearish Engulfing Pattern**: Is pattern mein pehle candlestick bullish hoti hai aur doosre candlestick mein uske range ko completely engulf (cover) kar leti hai. Yeh bearish reversal signal hota hai. **Characteristics of Engulfing Candlestick Pattern**: - Engulfing pattern mein pehle candlestick aur doosre candlestick ke range ka comparison hota hai. - Second candlestick pehle candlestick ke high aur low levels ko completely cover karta hai. **Benefits (Fawaid) of Engulfing Candlestick Pattern**: - Engulfing pattern traders ko potential reversal points identify karne mein madad deta hai. - Price direction change ka strong indication hota hai jab engulfing pattern appear hota hai. - Is pattern se traders potential entry aur exit points find kar sakte hain. **Drawbacks (Nuqsan) of Engulfing Candlestick Pattern**: - Yeh pattern hamesha accurate nahi hota, kuch cases mein false signals bhi ho sakte hain. - Market conditions aur events ke impact se pattern ka interpretation challenging ho sakta hai. **Conclusion**: Engulfing Candlestick Pattern reversal points ko identify karne mein madad deta hai. Lekin isey istemal karne se pehle, traders ko confirmatory signals aur dusre technical analysis tools ka bhi istemal karna chahiye. Market mein hone wali aur hone wale events ke madd-o-jazar se pehle, proper research aur analysis karna zaroori hai. -

#4 Collapse

Engulfing candlestick pattern ek prakar ka technical analysis tool hai jo forex aur dusre financial markets mein price movement ko predict karne ke liye istemal hota hai. Is pattern mein do consecutive candlesticks (kyunki ek candlestick ek time period ki price movement ko represent karta hai) hote hain, jo ki ek dusre ko "engulf" karte hain, yaani ek candlestick dusre candlestick ki range ko poori tarah se cover kar leta hai. Engulfing pattern do prakar ke hote hain: Bullish Engulfing Pattern: Isme pehli candlestick ek downtrend mein hoti hai (yaani price kam ho raha hai) aur dusri candlestick pehli ki range ko poori tarah se cover kar leti hai aur woh bhi upar ki taraf. Yeh ek potential trend reversal signal ho sakta hai, matlab ki price niche se upar ki taraf jaane ki sambhavna hoti hai. Bearish Engulfing Pattern: Isme pehli candlestick ek uptrend mein hoti hai (yaani price badh raha hai) aur dusri candlestick pehli ki range ko poori tarah se cover kar leti hai aur woh bhi niche ki taraf. Yeh bhi ek potential trend reversal signal ho sakta hai, matlab ki price upar se niche ki taraf jaane ki sambhavna hoti hai.Yeh patterns traders ko price movement ko samajhne aur future direction predict karne mein madad karte hain. Lekin, yeh patterns akela use karke trading karne se accuracy nahi milti. Traders usually in patterns ko dusre technical indicators aur market analysis ke saath combine karte hain. Iske alawa, trading mein involve hone se pehle aapko acchi tarah se research karna chahiye aur agar possible ho to ek financial advisor ya expert se salah leni chahiye, kyunki market mein trading risk se bhari hoti hai.

Isme pehli candlestick ek uptrend mein hoti hai (yaani price badh raha hai) aur dusri candlestick pehli ki range ko poori tarah se cover kar leti hai aur woh bhi niche ki taraf. Yeh bhi ek potential trend reversal signal ho sakta hai, matlab ki price upar se niche ki taraf jaane ki sambhavna hoti hai.Yeh patterns traders ko price movement ko samajhne aur future direction predict karne mein madad karte hain. Lekin, yeh patterns akela use karke trading karne se accuracy nahi milti. Traders usually in patterns ko dusre technical indicators aur market analysis ke saath combine karte hain. Iske alawa, trading mein involve hone se pehle aapko acchi tarah se research karna chahiye aur agar possible ho to ek financial advisor ya expert se salah leni chahiye, kyunki market mein trading risk se bhari hoti hai.

-

#5 Collapse

Engulfing candlestick pattern ek prakar ka technical analysis tool hai jo forex aur dusre financial markets mein price movement ko predict karne ke liye istemal hota hai. Is pattern mein do consecutive candlesticks (kyunki ek candlestick ek time period ki price movement ko represent karta hai) hote hain, jo ki ek dusre ko "engulf" karte hain, yaani ek candlestick dusre candlestick ki range ko poori tarah se cover kar leta hai. Engulfing pattern do prakar ke hote hain: Bullish Engulfing Pattern: Isme pehli candlestick ek downtrend mein hoti hai (yaani price kam ho raha hai) aur dusri candlestick pehli ki range ko poori tarah se cover kar leti hai aur woh bhi upar ki taraf. Yeh ek potential trend reversal signal ho sakta hai, matlab ki price niche se upar ki taraf jaane ki sambhavna hoti hai. Bearish Engulfing Pattern: Bullish Engulfing: Bullish Engulfing pattern uptrend mein nazar aata hai aur yeh trend change ya reversal ki nishandahi karta hai. - Pehli mombatti choti hoti hai aur down (neechay) ki taraf jati hai. - Dusri mombatti is se ziada lambi hoti hai aur up (upar) ki taraf jati hai. - Dusri mombatti pehli mombatti ko "engulf" karti hai, yani ke uski body pe puri tarah se chadhti hai. - Yeh pattern bullish sentiment ka izhar karta hai aur future mein price ki bulandiyon ki ummeed ko dikhata hai.2. Bearish Engulfing : - Bearish Engulfing pattern downtrend mein dikhai deta hai aur trend change ya reversal ki indication deta hai. - Pehli mombatti lambi hoti hai aur up (upar) ki taraf jati hai. - Dusri mombatti is se ziada choti hoti hai aur down (neechay) ki taraf jati hai. - Dusri mombatti pehli mombatti ko "engulf" karti hai, yani ke uski body pe puri tarah se utarti hai. - Yeh pattern bearish sentiment ka izhar karta hai aur future mein price ki kami ki ummeed ko dikhata hai.

Isme pehli candlestick ek uptrend mein hoti hai (yaani price badh raha hai) aur dusri candlestick pehli ki range ko poori tarah se cover kar leti hai aur woh bhi niche ki taraf. Yeh bhi ek potential trend reversal signal ho sakta hai, matlab ki price upar se niche ki taraf jaane ki sambhavna hoti hai.Yeh patterns traders ko price movement ko samajhne aur future direction predict karne mein madad karte hain. Lekin, yeh patterns akela use karke trading karne se accuracy nahi milti. Traders usually in patterns ko dusre technical indicators aur market analysis ke saath combine karte hain. Iske alawa, trading mein involve hone se pehle aapko acchi tarah se research karna chahiye aur agar possible ho to ek financial advisor ya expert se salah leni chahiye, kyunki market mein trading risk se bhari hoti hai.Types of Engulfing Candlestick Pattern**: 1. **Bullish Engulfing Pattern**: Is pattern mein pehle candlestick bearish hoti hai aur doosre candlestick mein uske range ko completely engulf (cover) kar leti hai. Yeh bullish reversal signal hota hai. 2. **Bearish Engulfing Pattern**: Is pattern mein pehle candlestick bullish hoti hai aur doosre candlestick mein uske range ko completely engulf (cover) kar leti hai. Yeh bearish reversal signal hota hai. **Characteristics of Engulfing Candlestick Pattern**: - Engulfing pattern mein pehle candlestick aur doosre candlestick ke range ka comparison hota hai. - Second candlestick pehle candlestick ke high aur low levels ko completely cover karta hai. **Benefits (Fawaid) of Engulfing Candlestick Pattern**: - Engulfing pattern traders ko potential reversal points identify karne mein madad deta hai. - Price direction change ka strong indication hota hai jab engulfing pattern appear hota hai. - Is pattern se traders potential entry aur exit points find kar sakte hain. **Drawbacks (Nuqsan) of Engulfing Candlestick Pattern**: - Yeh pattern hamesha accurate nahi hota, kuch cases mein false signals bhi ho sakte hain. - Market conditions aur events ke impact se pattern ka interpretation challenging ho sakta hai.

Isme pehli candlestick ek uptrend mein hoti hai (yaani price badh raha hai) aur dusri candlestick pehli ki range ko poori tarah se cover kar leti hai aur woh bhi niche ki taraf. Yeh bhi ek potential trend reversal signal ho sakta hai, matlab ki price upar se niche ki taraf jaane ki sambhavna hoti hai.Yeh patterns traders ko price movement ko samajhne aur future direction predict karne mein madad karte hain. Lekin, yeh patterns akela use karke trading karne se accuracy nahi milti. Traders usually in patterns ko dusre technical indicators aur market analysis ke saath combine karte hain. Iske alawa, trading mein involve hone se pehle aapko acchi tarah se research karna chahiye aur agar possible ho to ek financial advisor ya expert se salah leni chahiye, kyunki market mein trading risk se bhari hoti hai.Types of Engulfing Candlestick Pattern**: 1. **Bullish Engulfing Pattern**: Is pattern mein pehle candlestick bearish hoti hai aur doosre candlestick mein uske range ko completely engulf (cover) kar leti hai. Yeh bullish reversal signal hota hai. 2. **Bearish Engulfing Pattern**: Is pattern mein pehle candlestick bullish hoti hai aur doosre candlestick mein uske range ko completely engulf (cover) kar leti hai. Yeh bearish reversal signal hota hai. **Characteristics of Engulfing Candlestick Pattern**: - Engulfing pattern mein pehle candlestick aur doosre candlestick ke range ka comparison hota hai. - Second candlestick pehle candlestick ke high aur low levels ko completely cover karta hai. **Benefits (Fawaid) of Engulfing Candlestick Pattern**: - Engulfing pattern traders ko potential reversal points identify karne mein madad deta hai. - Price direction change ka strong indication hota hai jab engulfing pattern appear hota hai. - Is pattern se traders potential entry aur exit points find kar sakte hain. **Drawbacks (Nuqsan) of Engulfing Candlestick Pattern**: - Yeh pattern hamesha accurate nahi hota, kuch cases mein false signals bhi ho sakte hain. - Market conditions aur events ke impact se pattern ka interpretation challenging ho sakta hai. -

#6 Collapse

Immersing candle design ek prakar ka specialized investigation apparatus hai jo forex aur dusre monetary business sectors mein cost development ko anticipate karne ke liye istemal hota hai. Is design mein do continuous candles (kyunki ek candle ek time span ki cost development ko address karta hai) hote hain, jo ki ek dusre ko "immerse" karte hain, yaani ek candle dusre candle ki range ko poori tarah se cover kar leta hai.Engulfing design do prakar ke hote hain: Bullish Immersing Example: Isme pehli candle ek downtrend mein hoti hai (yaani cost kam ho raha hai) aur dusri candle pehli ki range ko poori tarah se cover kar leti hai aur woh bhi upar ki taraf. Yeh ek potential pattern inversion signal ho sakta hai, matlab ki cost specialty se upar ki taraf jaane ki sambhavna hoti hai.Isme pehli candle ek upturn mein hoti hai (yaani cost badh raha hai) aur dusri candle pehli ki range ko poori tarah se cover kar leti hai aur woh bhi specialty ki taraf. Yeh bhi ek potential pattern inversion signal ho sakta hai, matlab ki cost upar se specialty ki taraf jaane ki sambhavna hoti hai.Yeh designs dealers ko cost development ko samajhne aur future heading anticipate karne mein madad karte hain. Lekin, yeh designs akela use karke exchanging karne se exactness nahi milti. Dealers typically in designs ko dusre specialized pointers aur market examination ke saath consolidate karte hain.

Negative Engulfing Example: Isme pehli candle ek upswing mein hoti hai (yaani cost badh raha hai) aur dusri candle pehli ki range ko poori tarah se cover kar leti hai aur woh bhi specialty ki taraf. Yeh bhi ek potential pattern inversion signal ho sakta hai, matlab ki cost upar se specialty ki taraf jaane ki sambhavna hoti hai.

Negative Engulfing Example: Isme pehli candle ek upswing mein hoti hai (yaani cost badh raha hai) aur dusri candle pehli ki range ko poori tarah se cover kar leti hai aur woh bhi specialty ki taraf. Yeh bhi ek potential pattern inversion signal ho sakta hai, matlab ki cost upar se specialty ki taraf jaane ki sambhavna hoti hai. Yeh designs dealers ko cost development ko samajhne aur future bearing anticipate karne mein madad karte hain. Lekin, yeh designs akela use karke exchanging karne se exactness nahi milti. Brokers for the most part in designs ko dusre specialized pointers aur market examination ke saath join karte hain. Iske alawa, exchanging mein include sharpen se pehle aapko acchi tarah se research karna chahiye aur agar conceivable ho to ek monetary counselor ya master se salah leni chahiye, kyunki market mein exchanging risk se bhari hoti hai.

- Mentions 0

-

سا0 like

-

#7 Collapse

"Engulfing Candlestick Pattern" ek popular candlestick pattern hai jo technical analysis mein use hota hai. Yeh pattern bullish aur bearish reversal signals provide karta hai. Is pattern mein ek small candle (often referred to as the "inside" candle) followed by a larger candle (often referred to as the "outside" candle) hota hai, jo pehle candle ko completely "engulf" karta hai. Chaliye, is pattern ki tafseel aur best trade karne ka tarika dekhte hain: Bullish Engulfing Pattern: Bullish engulfing pattern uptrend ke baad dikhta hai aur bearish trend ki potential reversal indication deta hai. Yahan, small bearish candle ko ek larger bullish candle engulf karta hai. Bearish Engulfing Pattern: Bearish engulfing pattern downtrend ke baad dikhta hai aur bullish trend ki potential reversal indication deta hai. Yahan, small bullish candle ko ek larger bearish candle engulf karta hai. Best Trade Karne ka Tarika: Trend Identification: Sabse pehle aapko trend ko identify karna hoga. Engulfing pattern ka significance tab hota hai jab woh trend reversal ke potential ke sath trend ke opposite direction mein dikhta hai. Candlestick Analysis: Small candle ko carefully analyze karein. Agar woh dojis ya spinning top ki tarah weak hai, toh engulfing pattern ka reliability kam ho sakta hai. Confirmation: Engulfing pattern ko confirm karne ke liye aapko doosre technical indicators aur analysis tools bhi use karne chahiye. Moving averages, support and resistance levels, aur RSI jaise indicators ka istemal karke aap pattern ko confirm kar sakte hain. Entry Point: Agar bullish engulfing pattern hai aur reversal bullish direction mein hone wala hai, toh entry point often outside (larger) candle ke high point ke above set kiya jata hai. Agar bearish engulfing pattern hai aur reversal bearish direction mein hone wala hai, toh entry point outside candle ke low point ke below set kiya jata hai. Stop Loss: Aapko apne trade ke liye ek appropriate stop loss level set karna hoga, jisse ki aap excessive losses se bach sakte hain. Stop loss typically candlestick pattern ke opposite side (jis direction mein trend reversal ho raha hai) ke beyond set kiya jata hai. Target Setting: Target setting pattern ke size aur market conditions par depend karta hai. Aap previous swing highs aur lows, support and resistance levels, aur Fibonacci retracement levels ka istemal karke target levels set kar sakte hain. Risk Management: Hamesha risk management ka khayal rakhein. Apne trade size ko apne overall portfolio ke hisab se manage karein. Engulfing candlestick pattern ko samajhne aur sahi tarike se trade karne ke liye practice aur experience zaroori hai. Aap demo trading platforms par practice karke apne skills ko improve kar sakte hain, aur hamesha market trends ko samajhne ke liye constant learning par focus rakhein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Engulfing Candle Chart Pattern: Engulfing Candle Example" ek famous candle design hai jo specialized examination mein use hota hai. Yeh design bullish aur negative inversion signals give karta hai. Is design mein ek little light (frequently alluded to as "within" candle) trailed by a bigger candle (frequently alluded to as the "outside" candle) hota hai, jo pehle flame ko totally "inundate" karta hai. Chaliye, is design ki tafseel aur best exchange karne ka tarika dekhte hain Bullish inundating design upturn ke baad dikhta hai aur negative pattern ki potential inversion sign deta hai. Yahan, little negative light ko ek bigger bullish candle immerse karta hai. Negative immersing design downtrend ke baad dikhta hai aur bullish pattern ki potential inversion sign deta hai. Yahan, little bullish flame ko ek bigger negative light overwhelm karta hai. Sabse pehle aapko pattern ko distinguish karna hoga. Inundating design ka importance tab hota hai poke woh pattern inversion ke potential ke sath pattern ke inverse heading mein dikhta hai. Little light ko cautiously investigate karein. Agar woh dojis ya turning top ki tarah feeble hai, toh immersing design ka unwavering quality kam ho sakta hai.Engulfing design ko affirm karne ke liye aapko doosre specialized markers aur investigation devices bhi use karne chahiye. Moving midpoints, backing and opposition levels, aur RSI jaise markers ka istemal karke aap design ko affirm kar sakte hain.Agar bullish inundating design hai aur inversion bullish heading mein sharpen wala hai, toh passage point frequently outside (bigger) flame ke high point ke above set kiya jata hai. Agar negative immersing design hai aur inversion negative heading mein sharpen wala hai, toh section point outside flame ke depressed spot ke beneath set kiya jata hai. Chart Pattern Formation: Exchange ke liye ek suitable stop misfortune level set karna hoga, jisse ki aap unreasonable misfortunes se bach sakte hain. Stop misfortune ordinarily candle design ke inverse side (jis bearing mein pattern inversion ho raha hai) ke past set kiya jata hai. Target setting design ke size aur economic situations standard depend karta hai. Aap past swing highs aur lows, backing and obstruction levels, aur Fibonacci retracement levels ka istemal karke target levels set kar sakte hain.Hamesha risk the executives ka khayal rakhein. Apne exchange size ko apne generally portfolio ke hisab se oversee karein.Engulfing candle design ko samajhne aur sahi tarike se exchange karne ke liye practice aur experience zaroori hai. Aap demo exchanging stages standard practice karke apne abilities ko improve kar sakte hain, aur hamesha market patterns ko samajhne ke liye consistent learning standard center rakhein.

Sabse pehle aapko pattern ko distinguish karna hoga. Inundating design ka importance tab hota hai poke woh pattern inversion ke potential ke sath pattern ke inverse heading mein dikhta hai. Little light ko cautiously investigate karein. Agar woh dojis ya turning top ki tarah feeble hai, toh immersing design ka unwavering quality kam ho sakta hai.Engulfing design ko affirm karne ke liye aapko doosre specialized markers aur investigation devices bhi use karne chahiye. Moving midpoints, backing and opposition levels, aur RSI jaise markers ka istemal karke aap design ko affirm kar sakte hain.Agar bullish inundating design hai aur inversion bullish heading mein sharpen wala hai, toh passage point frequently outside (bigger) flame ke high point ke above set kiya jata hai. Agar negative immersing design hai aur inversion negative heading mein sharpen wala hai, toh section point outside flame ke depressed spot ke beneath set kiya jata hai. Chart Pattern Formation: Exchange ke liye ek suitable stop misfortune level set karna hoga, jisse ki aap unreasonable misfortunes se bach sakte hain. Stop misfortune ordinarily candle design ke inverse side (jis bearing mein pattern inversion ho raha hai) ke past set kiya jata hai. Target setting design ke size aur economic situations standard depend karta hai. Aap past swing highs aur lows, backing and obstruction levels, aur Fibonacci retracement levels ka istemal karke target levels set kar sakte hain.Hamesha risk the executives ka khayal rakhein. Apne exchange size ko apne generally portfolio ke hisab se oversee karein.Engulfing candle design ko samajhne aur sahi tarike se exchange karne ke liye practice aur experience zaroori hai. Aap demo exchanging stages standard practice karke apne abilities ko improve kar sakte hain, aur hamesha market patterns ko samajhne ke liye consistent learning standard center rakhein.  Plans sellers ko cost improvement ko samajhne aur future bearing expect karne mein madad karte hain. Lekin, yeh plans akela use karke trading karne se precision nahi milti. Agents generally in plans ko dusre specific pointers aur market assessment ke saath join karte hain. Iske alawa, trading mein incorporate hone se pehle aapko acchi tarah se research karna chahiye aur agar possible ho to ek money related advocate ya ace se salah leni chahiye, kyunki market mein trading risk se bhari hoti hai.Isme pehli candle ek rise mein hoti hai (yaani cost badh raha hai) aur dusri light pehli ki range ko poori tarah se cover kar leti hai aur woh bhi specialty ki taraf. Yeh bhi ek potential example reversal signal ho sakta hai, matlab ki cost upar se specialty ki taraf jaane ki hoti hai. Chart Pattern Trading View: Candle ek downtrend mein hoti hai (yaani cost kam ho raha hai) aur dusri light pehli ki range ko poori tarah se cover kar leti hai aur woh bhi upar ki taraf. Yeh ek potential example reversal signal ho sakta hai, matlab ki cost specialty se upar ki taraf jaane ki sambhavna hoti hai.Isme pehli light ek upswing mein hoti hai (yaani cost badh raha hai) aur dusri flame pehli ki range ko poori tarah se cover kar leti hai aur woh bhi specialty ki taraf. Yeh bhi ek potential example reversal signal ho sakta hai, matlab ki cost upar se specialty ki taraf jaane ki sambhavna hoti hai.Yeh plans vendors ko cost improvement ko samajhne aur future heading expect karne mein madad karte hain. Lekin, yeh plans akela use karke trading karne se precision nahi milti. Sellers ordinarily in plans ko dusre specific pointers aur market assessment ke saath combine karte hain.

Plans sellers ko cost improvement ko samajhne aur future bearing expect karne mein madad karte hain. Lekin, yeh plans akela use karke trading karne se precision nahi milti. Agents generally in plans ko dusre specific pointers aur market assessment ke saath join karte hain. Iske alawa, trading mein incorporate hone se pehle aapko acchi tarah se research karna chahiye aur agar possible ho to ek money related advocate ya ace se salah leni chahiye, kyunki market mein trading risk se bhari hoti hai.Isme pehli candle ek rise mein hoti hai (yaani cost badh raha hai) aur dusri light pehli ki range ko poori tarah se cover kar leti hai aur woh bhi specialty ki taraf. Yeh bhi ek potential example reversal signal ho sakta hai, matlab ki cost upar se specialty ki taraf jaane ki hoti hai. Chart Pattern Trading View: Candle ek downtrend mein hoti hai (yaani cost kam ho raha hai) aur dusri light pehli ki range ko poori tarah se cover kar leti hai aur woh bhi upar ki taraf. Yeh ek potential example reversal signal ho sakta hai, matlab ki cost specialty se upar ki taraf jaane ki sambhavna hoti hai.Isme pehli light ek upswing mein hoti hai (yaani cost badh raha hai) aur dusri flame pehli ki range ko poori tarah se cover kar leti hai aur woh bhi specialty ki taraf. Yeh bhi ek potential example reversal signal ho sakta hai, matlab ki cost upar se specialty ki taraf jaane ki sambhavna hoti hai.Yeh plans vendors ko cost improvement ko samajhne aur future heading expect karne mein madad karte hain. Lekin, yeh plans akela use karke trading karne se precision nahi milti. Sellers ordinarily in plans ko dusre specific pointers aur market assessment ke saath combine karte hain.  Inundating Candle Example, jo kay Forex mein istemaal hota hai, ek aham cost activity design hai jo dealers ko market ke potential inversions aur pattern changes ki nishandahi karne mein madad karta hai. Is design mein do candles (mombattiyan) involved hoti hain, aur yeh for the most part market ke upswing ya downtrend mein dikhai deti hai.Engulfing Candle Example ka matlab hota hai ke market mein pattern change ho sakta hai. Agar aap bullish immersing design dekhte hain to yeh maane ja sakta hai ke negative pattern se bullish pattern mein change sharpen ki sambhavna hai, jabke negative inundating design dekhne standard negative pattern se bullish pattern mein change sharpen ki sambhavna hoti hai. Is design ki tafsili tafseel aur sahi tajwez ke liye, aapko Forex training aur specialized examination mein mazeed profound review karna chahiye.

Inundating Candle Example, jo kay Forex mein istemaal hota hai, ek aham cost activity design hai jo dealers ko market ke potential inversions aur pattern changes ki nishandahi karne mein madad karta hai. Is design mein do candles (mombattiyan) involved hoti hain, aur yeh for the most part market ke upswing ya downtrend mein dikhai deti hai.Engulfing Candle Example ka matlab hota hai ke market mein pattern change ho sakta hai. Agar aap bullish immersing design dekhte hain to yeh maane ja sakta hai ke negative pattern se bullish pattern mein change sharpen ki sambhavna hai, jabke negative inundating design dekhne standard negative pattern se bullish pattern mein change sharpen ki sambhavna hoti hai. Is design ki tafsili tafseel aur sahi tajwez ke liye, aapko Forex training aur specialized examination mein mazeed profound review karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:21 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим