Bear flag candlestick pattern ki complete details

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

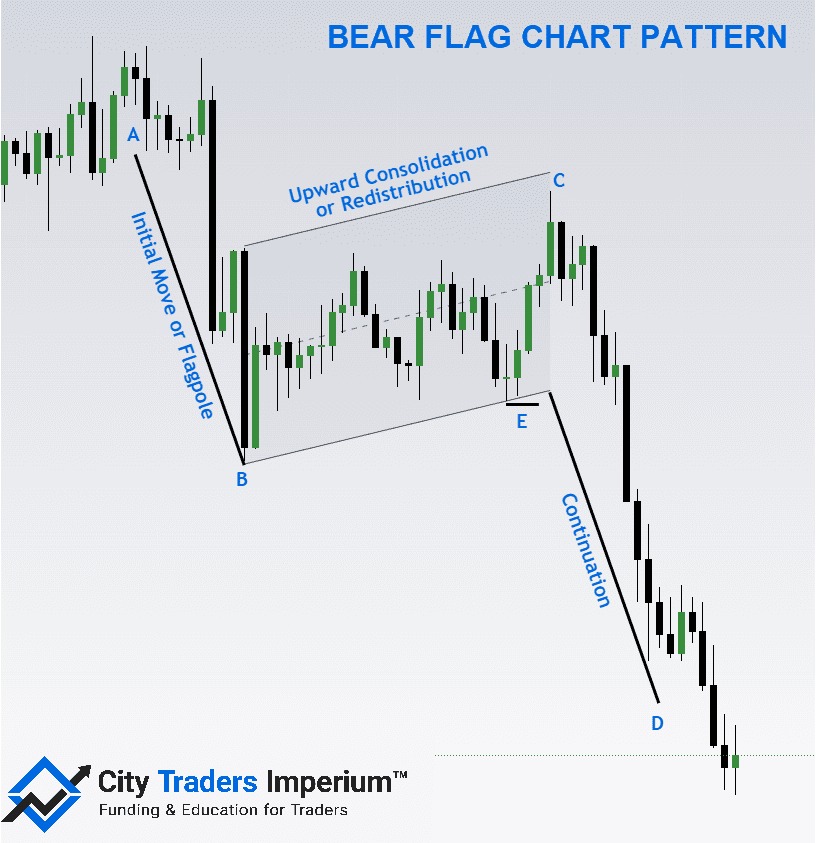

BEAR FLAG CANDLESTICK PATTERNIntroduction Bear flag candlestick pattern, jo ke trading mein istemal hota hai, ek technical analysis tool hai jo traders ko market ki movement ko samajhnay aur predict karne mein madad deta hai. Is pattern ki identification aur istemal se traders market ki possible downward movement ki direction aur strength ka andaza laga sakte hain. Details Bear flag pattern usually price chart par dekha ja sakta hai jab ek downtrend ya bearish trend mein market chal raha hota hai. Yeh pattern price action ki mukhtalif candlesticks se banta hai. Is pattern ko do hisson mein baanta ja sakta hai: ek sharp downward move, jo pole ke roop mein jaana jaata hai, aur phir iske baad ek consolidation phase, jo flag ke roop mein hota hai. Yeh flag price chart par parallel trend lines ke darmiyan form hota hai. Identification Is pattern ki pehchaan karne ke liye, neeche diye gaye steps follow kar sakte hain: Downtrend Ki Pehchaan (Pehla Hissa): Sabse pehle, dekhein ke market kisi downtrend mein hai ya nahi. Iske liye previous candlesticks ki direction aur price ki movement ko dekhein. Pole Ki Pehchaan: Agar market mein strong downward movement hota hai, to yeh pole ki tarah dikhega. Pole ki length aur intensity bhi important hai. Flag Ki Pehchaan: Pole ke baad price action observe karein. Agar price chart par ek consolidating phase ban raha hai aur price trend lines ke beech mein hai, to yeh flag ki tarah dikhega. Breakout Ki Pehchaan: Bear flag pattern complete hone ke baad, traders ko breakout ka wait karna hota hai. Breakout downward direction mein hota hai jab price trend lines se bahar nikalta hai. Guidelines for traders Bear flag pattern ki identification ke baad, traders iska istemal karke market mein trading decisions le sakte hain. Yeh pattern traders ko niche diye gaye tareeqon se madad deta hai: Short Selling (Sell Ki Strategy): Agar bear flag pattern sahi tarah se identify ho jaye, to yeh short selling opportunity indicate kar sakta hai. Traders sell order place karke profit earn kar sakte hain jab price breakout ke baad expected direction mein move karta hai. Stop Loss Aur Target Setting: Bear flag pattern se traders ko stop loss level aur target setting mein madad milti hai. Agar breakout ki direction sahi hai, to traders stop loss level ko tight rakh sakte hain aur target ko realistic set kar sakte hain. Confirmation Ke Liye Indicators Ka Istemal: Bear flag pattern ko confirm karne ke liye traders technical indicators ka istemal karte hain jaise ke RSI, MACD, aur volume indicators. In indicators ki madad se pattern ki authenticity aur expected movement ko confirm kiya ja sakta hai. Risk Management: Yeh pattern traders ko risk management mein madad deta hai. Agar breakout ki direction opposite hoti hai, to traders loss ko minimize karne ke liye jaldi se position close kar sakte hain. Summary Bear flag candlestick pattern traders ko market ki downward movement ki identification aur uski possible strength ka andaza dene mein madad deta hai. Is pattern ko sahi tarah se samajhne aur istemal karne ke liye practice aur technical analysis ki achi understanding zaroori hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Bearish Flag Chart Pattern

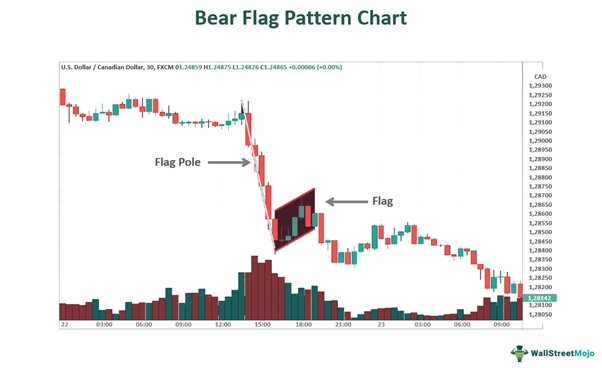

Bear Flag Pattern yeh sabit karta hai ke bearish downtrend ki maeeshat jaari rahegi, ek temporary price reversal ya pullback ke baad. Aksar, mahir traders apne invest karne ke maqasid pura karne ke liye trends ko pehchanne ki koshish karte hain. Bear Flag Pattern aam taur par candlestick chart par pehchana jata hai. Ismein Flag Pole hoti hai, jo pullback se pehle strong bearish move hota hai, aur Flag khud actual retracement ko darust karti hai.

Yeh ek trend extension hoti hai, is liye Bear Flag chart pattern trend continuation pattern ke tor par dekhi jati hai. Shuru mein, price pattern bearish trend mein ghira rehta hai jab tak ek naye support level nahi banta. Tab flag ek aisi form mein aati hai jo upward consolidation channel hoti hai. Kuch waqt ke baad, price flag ke support level ke neeche break hoti hai aur bearish trend jaari rahta hai. Yeh forex traders ko signal deta hai ke woh short positions open kar sakte hain taake woh price giravat se faida utha saken.

Pattern k Effects

Currency aur commodities aksar samjhe nahi jate hain ke kala bazaar mein trade karne ke liye mushkil siari hai. Iske asal form mein cryptocurrency forex ke bohot barabar hoti hai. Yani ke ye aik exchange ke medium hain, beshak legal tender nahi hain. Isliye, aksar woh continuation patterns jo traditional forex market mein kaam karte hain, unka use currency pairs trade ke liye kiya ja sakta hai.

Bear Flag ko ahmiyat dene ke liye aap technical indicators jaise ke moving averages ka sahara le sakte hain aur volume indicator pe nazar rakh sakte hain. Aksar, bearish volume flag pole ke banne ke doran barh jati hai, jab tak consolidation nahi hoti. Isse ye samjha jata hai ke bearish sentiment mazboot hai aur consolidation temporary ho sakti hai. Bear Flag pattern ko decades se stock market, foreign exchange aur commodity markets mein istemal kiya jata hai. Isliye crypto traders ne bhi bear pattern ko apnaya hai, jaise ke bull flag jo hum mazeed discuss karenge.

Pattern Identification

Bear Flag Pattern ke do asal hisse hote hain: pole aur flag. Uske alawa, volume indicator aur breakout par tawajjo dena bhi ahmiyat rakhta hai. Yeh dekhein ke chart par kya dekhna chahiye:

Sabse pehle, aapko flag pole tay karna hoga, jo strong bearish momentum se driven initial price decline ke sath milta hai. Is point par, price movement bohot steep ho sakta hai, jabke volume indicator ascend kar sakta hai.

Phir, bear flag form mein ek consolidation channel ki shakal mein dekha ja sakta hai jo price decline ke baad aata hai. Yeh woh waqt hota hai jab price movement pullback karne lagta hai aur channel upward dekhta hai.

Yahan do potential outcomes hain: ya to price movement upward rehti hai ya phir yeh channel ke neeche break hojata hai aur bearish trend chalta rahta hai. Agar pehla scenario hota hai to flag pattern nahi milta kyun ke downtrend reverse ho raha hai. Lekin agar doosra scenario hota hai, to flag ke support ke neeche break hone ke baad hum short positions open kar sakte hain.

Last mein, jab price consolidation channel (flag) ke neeche break karti hai, hum Sell orders place kar sakte hain. Aksar traders flag pole ka istemal profit target tay karne ke liye karte hain. Dusri baaton mein, flag channel ki unchai ke barabar profit target hota hai. Bear flag pattern ke aham hisse darja-zel hain:- Flag pole, jo pehle bearish move hai.

- Bear flag, jo consolidation channel upward dekhti hai.

- Breakout, jab price flag ke support ke neeche break karti hai; aur

- Price target aam taur par flag pole ki length ke barabar hota hai.

Bull & Bear Flag Explaination

Bull flag pattern bear flag pattern ka evil twin hota hai. Yeh bullish markets mein aati hai. Dono patterns ke structure mein barabar hoti hai. Bas ek badi farq hota hai jo trend direction ko lekar hota hai. Bull flag pattern uptrend mein aata hai. Isliye bull flag pole ascending line ko darust karta hai. Flag khud neeche dekhti hai aur yeh temporary correction ko darust karti hai. Jab price flag ke resistance line ke upar break hoti hai, traders ko long positions open karne mein interest hota hai. Stop-loss aur take profit ke rules practically wahi hote hain, bas ulte hue hote hain.

Bear aur bull flags ke beech ek aur farq hai jo volume ka hai. Jab bull flag pattern aata hai to volume pole ke doran barh kar phir consolidation ke doran kam hojata hai. Lekin bear flag pattern ke doran volume indicator ka behavior waisa nahi hota. Indicator pole ke doran bhi barhta hai lekin woh wahi level ko sustain karta hai, kam nahi hota.

Pattern Formation

Flag yeh dikhata hai ke ek mojud trend oversold (downtrend ke case mein) ya overbought (bullish trend ke case mein) level par pohanch gaya hai. Market ko araam ki zaroorat hoti hai. Isi tarah se, ek steep price movement ke baad, price thora waqt ke liye opposite direction mein move karegi. Pullback khatam hone ke baad, price mojud trend ki direction mein move karna jaari rakhti hai.

Behtar signal pane ke liye flag pattern ko kisi oscillator ke sath combine karna acha hota hai. For example, aap Relative Strength Index (RSI) ka istemal kar sakte hain. Bullish market mein, flag ke elements pole ke baad overbought level ke doran aksar nazar aate hain.

Trading

Dusre chart formations ke muqablay mein, bear flag pattern ke sath trading samajhne mein asaan hota hai. Aap bearish market se faida uthane ke liye flag chart pattern ki dynamics par bharosa karke bearish market se faida uthane ke liye ek strategy bana sakte hain. Yahan standard trading system ke ahem pehlu hain jo flag pattern par mabni hota hai:[*] Entry: Flag ek continuation pattern hoti hai, lekin iska matlab nahi ke aap short order flag ke support ke neeche break hone ke baad turant place kar den. Balki, aapko false signal se bachne ke liye downtrend ki confirmation ka intezar karna chahiye.

Traders aksar ek candle ko flag ke support line ke neeche close hone ka intezar karte hain aur phir agle candle ke doran short position khulti hai. Sabar aur discipline bohot ahem hain, khaaskar day traders ke liye, khaaskar volatile forex ki trading mein.[*] Stop-Loss Order: Agar price opposite direction mein move kar rahi hai, to aapko potential nuksan ko limit karne ke liye ek stop-loss order ka istemal karna chahiye. Traders aksar stop-loss order ko flag ke resistance line ke upar rakhna pasand karte hain.

For example, chaliye ke hum XAUUSD ko hourly chart par trade kar rahe hain. Agar flag ka lower line $1950 par hai aur upper line $1980 par hai, to aap $1980 ke upar stop-loss order place karne mein ruchi rakhein ge.

Take Profit: Upar bataya gaya hai ke conservative traders flag ke parallel trend lines ke darmiyan ki doori ka istemal profit target tay karne ke liye karte hain. Hamare example mein, dono lines ke darmiyan ka fark $80 hai, isliye hum is amount ko breakout entry point $1930 par shamil kar ke apna price target $1900 kar lete hain.

Zyada aggressive traders flag ke pole (flag khud ko shamil na kar ke) ka istemal kar sakte hain price target tay karne ke liye. Lekin price pehle wahan se support level mil sakta hai. Aik acha mashwara ye hai ke pehle ke strong support levels ko check karein. Agar woh mojud hain to phir woh is martaba bhi kaam kar sakte hain aur pattern ke prediction ko nakara nahi kar sakte.

Breakout k Baad Kya hota Hai?

Order place karne se pehle, aapko bear flag pattern ki evolution ko breakout point tak dekhna chahiye. Breakout tab hota hai jab price movement defined support ya resistance level ko paar kar leti hai. Flag ke retracement pole ke mukable mein zyada se zyada 50% nahi hona chahiye.

Ideally, pullback flag pole ke kam se kam 38% se kam hona chahiye. Agar breakout in shiraiton mein hota hai, to aapko short hone ke liye tayyar rehna chahiye. Jaisa ke upar bataya gaya hai, flag ke support ke neeche ek candle close hone ka intezar karein aur phir next candle ke doran short position open karein.

Flag patterns ke sath kam karne ke liye kamyabi hasil karne ke liye, aap hamesha volume ko guide ke taur par istemal karne ke liye decision banate waqt istemal kar sakte hain takay aap breakout ko confirm kar saken aur uske baad momentum ke bare mein soch saken.

Kya Bear Flag Pattern Fayeda-mand Hai?

Bear flag ek popular price action pattern hai, jaise double top aur head and shoulders ke sath. Lekin iska matlab nahi hai ke iski di gayi tamam signals 100% sahi honge, khaaskar jab aap cryptocurrencies trade karte hain. Nuksan ko kam karne ke liye price pattern ke rules ko nazar andaz karne ke risk management techniques ka istemal karein. Stop-loss ek basic aur powerful risk management tool hai jo aap istemal kar sakte hain. Ek aur achi technique hai 1% rule follow karna, jo yeh kehta hai ke aap ek trade par zyada se zyada 1% kharch nahi karna chahiye.

Bear Flag Pattern Benifits

Yeh bear flag pattern ke mukhya fayde hain:- Versatility: Bear flag pattern ko forex ke sath sath sabhi markets mein istemal kiya ja sakta hai. Bitcoin ya altcoins trade karte waqt, aap is pattern ko H15, H30, H1, H4, aur D1 jaise tamam time frames par pehchan sakte hain. Pattern ko day traders aur swing traders dono prefer karte hain.

- Clear entry and stop-loss rules: Bear flag pattern ke ek ahem fayde yeh hain ke traders ko bilkul wazeh hota hai ke kab short position open karna hai, kahan stop-loss rakhna hai, aur kis profit ko ummid kar sakte hain. Conservative traders ke liye do mukhya profit targets hote hain.

- Risk/reward ratio: traders bear ya bull flag trade karte waqt faida karne ke liye acha risk/reward ratio milta hai. Haan, koi bhi yeh nahi keh sakta ke chart formation har bar kaam karega, lekin ek trader ko ek lambe term ki strategy ke sath lagatar faida hasil karne ka khayal ho sakta hai.

Patterns Risks / Limitations

Jaise kisi bhi pattern ya technical analysis strategy ke sath, trader ko trading patterns ke istemal se judi risks ke bare mein jankari honi chahiye. Yeh hain formation ke mukhya nuksan:- Complexity: Pattern visually to clear aur simple lagta hai, lekin haqiqatan mein isse handle karna bohot mushkil hota hai. Yeh beginners ke liye challenge hai. Lekin agar aap demo account mein practice karte hain to aap patterns ko pehchanne mein mahir ho sakte hain aur rules ko implement kar sakte hain.

- Risk: Kabhi kabhi pullback socha se zyada lamba ho sakta hai. Agar flag pole 50% se zyada pole ka hota hai, to pattern pe bharosa nahi karna chahiye, kyun ke failure ka risk zyada hota hai. Lekin jab pattern ideal lagta hai, to price rules ko follow nahi kar sakta, khaaskar forex ki unpredictable aur volatile nature ke case mein. Kabhi kabhi price flag ke support ke neeche break hone ke baad seedha rebound kar sakta hai, jisse stop-loss trigger ho sakta hai. Lekin isse aapko mayoos nahi hona chahiye. Behtar signals pane ke liye aap technical analysis indicators ka istemal kar sakte hain aur volume ko dekh sakte hain.

Conclusion

Jab aap technical analysis ke sath trading karne ka sochte hain, to behtar result long time frames par mil sakte hain. For example, aap flag-related strategies ko H4 time frame aur usse badi time frames par implement kar sakte hain.

Nuksan aur potential loss kam karne ke liye, ek chatur forex trader demo account par pattern ke rules ko practice karega ya phir chote funds ke sath trading shuru karega. Isse aapko patterns pehchanne aur rules ko theek se implement karne mein madad milegi.

- Bitcoin

- Mentions 0

-

سا0 like

-

#4 Collapse

Forex Market Mein Bear Flag Candlestick Pattern:!:!:!:!

Bear flag candlestick pattern ek technical analysis pattern hai jo forex market mein bearish trend ke indication ke liye istemal hota hai. Ye pattern typically downtrend ke doran dekha jata hai aur bearish continuation pattern ke roop mein samjha jata hai.

Bear flag pattern mein usually ek sharp downward move (pole) ke baad price mein ek small consolidation phase hoti hai, jise flag kehte hain. Is consolidation phase mein price usually ek ascending channel mein move karta hai, jismein highs higher lows se close hote hain. Ye channel flag ki shape banata hai.

Forex Market Mein Bear Flag Candlestick Pattern Ke Steps:!:!:!:!

Bear flag pattern ko samajhne ke liye, yeh steps follow kiye ja sakte hain:- Initial Downtrend (Pole): Bear flag pattern ki shuruat ek sharp downward move se hoti hai, jo pole ke roop mein jaani jaati hai. Is downtrend mein price mein significant downward movement hoti hai.

- Consolidation Phase (Flag): Downtrend ke baad, price mein ek consolidation phase aata hai, jo flag ke roop mein dekha jata hai. Is phase mein price ek ascending channel mein move karta hai, jismein highs higher lows se close hote hain. Flag typically kuch sessions ya candles tak extend ho sakta hai.

- Breakout: Jab flag ke consolidation phase khatam ho jata hai, price mein breakout hota hai. Breakout usually downside hota hai, indicating the continuation of the bearish trend. Traders is breakout ka wait karte hain confirmatory signal ke roop mein.

- Volume: Volume bhi bear flag pattern ke analysis mein important hota hai. Typically, pole ke during high volume hota hai, indicating strong selling pressure. Flag ke consolidation phase mein volume usually decrease hota hai, indicating lack of interest or indecision among traders. Breakout ke samay fir se volume increase ho sakta hai, confirming the validity of the pattern.

- Target: Bear flag pattern ka target usually pole ki length se estimate kiya jata hai downward direction mein. Agar breakout ho gaya hai, toh traders usually expect karte hain ki price pole ki length ke barabar ya usse bhi zyada downward move kare.

Bear flag pattern ko identify karne aur interpret karne ke liye practice aur market analysis ki zarurat hoti hai. Is pattern ke saath sahi risk management aur entry/exit strategies ka bhi istemal kiya jana chahiye. -

#5 Collapse

Bear flag candlestick pattern ki complete details

Bear flag candlestick pattern ek technical analysis tool hai jo traders ko market mein potential price reversals ya continuations ke baare mein information provide karta hai. Ye pattern bearish trend ke beech mein ek temporary pause ya consolidation ko indicate karta hai, jise flag ke roop mein describe kiya jata hai, aur phir trend ke downward movement ka continuation hota hai. **Bear Flag Pattern Formation:** Bear flag pattern ek downward price trend ke dauraan form hota hai. Is pattern ko identify karne ke liye, traders ko do key components par dhyan dena hota hai: 1. **Pole (Flagpole):** Pehla component bear flag pattern ka pole hota hai. Yeh pole ek sharp downward price movement ko represent karta hai, jise flagpole kehte hain. Ye sharp decline price chart par vertical line ke roop mein dikhai deta hai. 2. **Flag:** Dusra component flag hota hai, jo ek horizontal price consolidation ko represent karta hai, jise pole ke baad form hota hai. Flag usually ek ascending or descending channel ke roop mein appear hota hai, jahan price ek range mein move karta hai aur volatility kam hoti hai. **Trading Bear Flag Pattern:** Bear flag pattern ko trade karne ke liye traders ko kuch key points ka dhyan rakhna chahiye: 1. **Identification:** Sabse pehle, traders ko bear flag pattern ko identify karna hota hai price chart par. Iske liye, traders ko pole aur flag ko dhyan se dekhna hota hai aur unki formation ko samajhna hota hai. 2. **Entry Point:** Entry point ko determine karne ke liye, traders ko wait karna hota hai jab price flag ke neeche breakout karta hai, indicating ki downward movement ka continuation ho sakta hai. Agar breakout confirmed hota hai, traders short positions enter kar sakte hain. 3. **Stop Loss aur Target:** Stop loss orders ko lagana important hai taaki traders apne positions ko protect kar sakein agar price unexpectedly reversal karta hai. Targets ko set karna bhi zaroori hai jisse traders apne profits ko lock kar sakein. **Conclusion:** Bear flag candlestick pattern bearish trend ke continuation ke indication ke roop mein traders ke liye valuable hai. Is pattern ko identify karne aur samajhne ke baad, traders apne trading strategies ko formulate kar sakte hain aur market movements ko anticipate kar sakte hain. Lekin, har trading decision ke liye proper risk management aur confirmation ke saath saath other technical indicators ka bhi istemal kiya jana chahiye. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

BEAR FLAG CANDLESTICK KI COMPLETE DETAIL DEFINITION

engulfing ya second candle bhi huge ho sakti hain Agar voh pattern ko trade karne ka opt Karte Hain to is se trader ko bahut zyada stop loss ho sakta hai trading se potential reward risk ka justify nahi kar sakta hai Potential reward establishing karna bhi engulfing pattern ke sath difficult ho sakta hai because candlestick price ka target provide nahi karti hai instead trader ko price ka target selecting karne ya profitable trade se kab get out hona hai iska determine karne ke liye other method use karne ki need Hogi Jaise indicator ya Trend ka analysis bullish engulfing pattern Ek powerful signal ho sakta hai especially Jab current trend ke sath combined ho kar however bullet proof nahi hai price ke down ward clean hone ke bad engulfing most useful ho sakte hain Kyunke pattern clearly Momentum Mein shift ko aap side show karta hai

WHAT IS A BULLISH ENGULFING PATTERN TELL YOU

bullish engulfing pattern ki formation ke liye stock ko Din one par closed hone ke mukabale mein Din two ko close price per open karna chahie Agar price down nahi hoti to white candle ke body ko engulf karne ka chance Nahin Milega previous De ki black candlestick ka Kyunki stock both day one ko open se kiye jaane se higher closed hote hain isliye Bullish engulfing pattern Mein white candle us day ki represents karti hai jismein bear ne morning ke time Stock ki price ko decisively controlled kiya tha Day ke end tak le lo

BULLISH ENGULGIN PATTERN VS. BEARISH ENGULFING PATTERN

bullish and bearish engulfing donon ke pattern one another ke opposites Hote Hain price ke Higher Move ke bad bearish Ka Shikar pattern Hota Hai and come lower price ki indicate karta hai Yahan first candle two candle Main Ek up candle hai second candle down ki ek large candle Hai Jiska Ek real body hai jo smaller up candle ko fully engulf kar leta hai

-

#7 Collapse

Bear Flag Candlestick Pattern kya hai?

Bear Flag Candlestick Pattern ek technical analysis chart pattern hai jo ek downtrend mein hota hai. Yah pattern ek short pause ko represent karta hai jiske baad bearish move ka continuation hota hai. Pattern ek flagpole aur flag ki tarah dikhai deta hai, isliye ise "Bear Flag" ka naam diya gaya hai. Traders is pattern ko potential short-selling opportunities ko identify karne ke liye use karte hain.

Bear Flag Pattern ki structure kya hai?

Bear Flag Pattern ki structure mein teen parts hoti hain:- Pole: Yah ek sharp downward price move hai jo downtrend ki shuruaat karta hai.

- Flag: Yah ek consolidation phase hai jo pole ke baad hota hai. Flag do parallel trend lines ke andar hota hai, jo upward sloping hoti hain.

- Breakout: Yah price action ka downward movement hai jo flag ki lower trend line ko breach karta hai.

Bear Flag Pattern ka kya matlab hai?

Bear Flag Pattern ka matlab hai ki downtrend continue hone ki sambhavna hai. Flag ka consolidation phase sellers ko regroup karne aur ek aur downward move ke liye energy gather karne ka mauka deta hai. Breakout is baat ki confirm karti hai ki sellers control mein hain aur price action ko aur niche le ja rahe hain.

Bear Flag Pattern ka kaise trade karein?

Bear Flag Pattern ko trade karne ke liye, yeh steps follow karein:- Ek downtrend mein bear flag pattern ki identify karein.

- Flag ki lower trend line ko breakout karne ka wait karein.

- Breakout ke baad short position enter karein.

- Stop loss ko flag ki upper trend line ke par rakhein.

- Profit target ko downtrend ki starting point ke par rakhein.

Bear Flag Pattern ki kya limitations hain?

Bear Flag Pattern ek reliable indicator hai, lekin iski kuch limitations bhi hain:- False signals: Flag ki lower trend line ka breakout hamesha downward trend ka continuation nahi hota hai. Kuch cases mein, price action trend line ko breach kar sakta hai aur phir upward move kar sakta hai.

- Volume: Breakout ke saath strong volume hone chahiye. Agar volume low hai, to breakout false signal ho sakta hai.

Bear Flag Pattern ka example:

Is chart mein, hum ek bear flag pattern dekh sakte hain. Price action ek sharp downward move ke saath downtrend shuru karta hai. Iske baad, price action consolidate hota hai aur do parallel trend lines ke andar ek flag banata hai. Flag ki lower trend line ko breakout karne ke baad, price action downtrend ko continue karta hai.

Conclusion

Bear Flag Candlestick Pattern ek useful technical analysis tool hai jo traders ko potential short-selling opportunities ko identify karne mein madad kar sakta hai. Halanki, yah yad rakhna important hai ki koi bhi pattern perfect nahi hai, aur bear flag patterns bhi false signals de sakte hain. Isliye, is pattern ko trade karne se pehle, traders ko confirmation ke liye volume aur other indicators ka use karna chahiye.

- CL

- Mentions 0

-

سا0 like

-

#8 Collapse

Bear flag candlestick pattern ki complete details

Forex trading ek bohot popular tareeqa hai paisa kamane ka, lekin isay samajhna aur achi tarah se istemal karna aam tor par challenging hota hai. Candlestick patterns jaise ke bear flag, traders ko market trends aur price movements samajhne mein madad karte hain. Is article mein, hum bear flag candlestick pattern ke bare mein gehri maloomat denge, tafseelat ke saath jo forex trading ke liye ahem hai.

Introduction to Candlestick Patterns

Candlestick patterns price charts ke graphical representations hote hain jo traders ko market dynamics aur potential trends ke bare mein samajhne mein madad karte hain. Har candlestick chart ek specific time period (jaise ke 1 din, 1 ghanta ya 1 minute) ko represent karta hai. Candlesticks do parts mein hotay hain: body (moom) aur shadows (chhaye). Candlestick patterns market sentiment aur price movement ko represent karte hain.

Bear Flag: Kya Hai?

Bear flag ek price pattern hai jo typically downward trend ke baad hota hai aur ek temporary pause ya consolidation ko represent karta hai, phir se downward movement shuru hota hai. Is pattern mein, price downward trend ke dauran neeche ki taraf jaata hai, phir ek flat ya shallow upward trend hoti hai jo flag ki shakal ko banati hai, aur phir price phir se neeche jaane ka expectation hota hai.

Bear Flag Ki Components

Bear flag ko samajhne ke liye kuch basic components hain:- Pehla Leg (Downward Trend): Bear flag start hota hai ek strong downward trend se jahan price neeche jaata hai.

- Flagpole (Upright Leg): Yeh pehla leg ke baad hoti hai, jismein price ko flat ya minor upward movement dikhai deta hai. Yeh movement bear flag ki pole ki shakal banati hai.

- Consolidation (Flag): Flagpole ke baad ek horizontal ya shallow upward movement hoti hai, jo flag ki shakal banati hai.

- Breakout (Continuation): Generally, bear flag ke baad price phir se downward trend follow karta hai, jaisa ke pehla leg.

Bear flag ko identify karne ke liye traders in points ka dhyaan rakhte hain:- Volume: Flagpole aur consolidation phase ke dauran volume ka observation karna important hai. Agar volume flagpole ke dauran high hai aur consolidation phase mein low hai, toh bearish continuation ka signal mil sakta hai.

- Pattern Structure: Flagpole vertical aur sharp hoti hai jabki consolidation phase mein price horizontal ya slightly upward chal rahi hoti hai.

- Price Targets: Bear flag ke breakout point se neeche ka price target estimate kiya jaa sakta hai, jo flagpole ki length se measure kiya ja sakta hai.

Forex traders bear flag pattern ko price action ke analysis mein istemal karte hain. Agar ek bear flag pattern identify hota hai, toh traders neeche ki taraf ki aur trading ki strategy bana sakte hain. Is pattern ki samajh se, traders ko entry aur exit points ke liye better insights milte hain. Zaroori hai ke traders flag ke breakout se pehle aur breakout ke baad confirmatory signals ka wait karein.

Conclusion

Bear flag candlestick pattern ek useful tool hai forex trading mein, lekin isay samajhna aur theek tareeqe se interpret karna zaroori hai. Traders ko price movements aur market sentiment ko samajhne ke liye candlestick patterns ka istemal karna chahiye, lekin har pattern ki tarah, bear flag pattern ko bhi accurately identify aur validate karna zaroori hai trading decisions ke liye.

Forex trading mein successful hona pattern recognition, technical analysis, aur risk management par depend karta hai. Is liye, traders ko candlestick patterns aur unke implications ko achi tarah se samajhna chahiye taa ke woh informed trading decisions le sakein. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Bear Flag Candlestick Pattern Ki Complete Details

Forex trading mein technical analysis ke liye candlestick patterns ka istemal market trends aur price movements ko samajhne ke liye hota hai. Bear Flag candlestick pattern ek significant bearish continuation pattern hai jo market ke downtrend ko sustain karne aur future price movements ko predict karne mein madad karta hai. Is post mein, hum Bear Flag pattern ki definition, formation, aur trading strategies ko detail mein discuss karenge.

**1. Bear Flag Pattern Ki Definition:**

- **Pattern Overview:** Bear Flag pattern ek bearish continuation pattern hai jo ek existing downtrend ke dauran banta hai. Is pattern ka shape flag ke jaisa hota hai, jahan ek strong downtrend ke baad ek consolidation phase aata hai. Consolidation phase ke baad price phir se niche ki taraf move karti hai.

- **Formation:** Bear Flag pattern do main phases mein divide hota hai: flagpole aur flag. Flagpole ek strong downward move hota hai, jabke flag consolidation phase hota hai jo generally horizontal ya upward sloping range mein hota hai.

**2. Bear Flag Pattern Ki Formation:**

- **Flagpole:** Pehla phase ek strong downward movement ko represent karta hai. Yeh phase market ke bearish sentiment ko indicate karta hai aur pattern ke initial decline ko form karta hai.

- **Flag:** Flag phase ke dauran price consolidation aur slight upward movement dikhati hai. Yeh consolidation phase market ko bearish trend ke continuation ke liye prepare karta hai. Flag ka shape rectangular ya slightly upward sloping hota hai.

- **Breakout:** Bear Flag pattern ka breakout tab hota hai jab price flag ke lower boundary ko break karti hai aur downtrend continue hota hai. Yeh breakout bearish signal hota hai aur trading opportunities ko indicate karta hai.

**3. Trading Strategy Using Bear Flag Pattern:**

- **Entry Point:** Ideal entry point tab hota hai jab price flag ke lower boundary ko break karti hai aur bearish movement ko continue karti hai. Traders sell positions open kar sakte hain jab breakout confirm ho jata hai.

- **Stop-Loss Placement:** Risk management ke liye, stop-loss orders ko flag ke upper boundary ke thoda upar place kiya jata hai. Yeh unexpected market reversals se protection provide karta hai aur potential losses ko limit karta hai.

- **Target Setting:** Profit targets ko flagpole ki length ke mutabiq calculate kiya jata hai. Flagpole ki length ko pattern ke breakout point se minus karke profit target set kiya jata hai. Targets ko realistic aur achievable levels par place karna chahiye jo market ke overall trend aur price action se match karte hain.

**4. Additional Confirmation Tools:**

- **Technical Indicators:** Bear Flag pattern ke signals ko additional technical indicators jaise RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence) se confirm karna chahiye. RSI ka overbought condition aur MACD ka bearish crossover pattern ke bearish trend ko validate karte hain.

- **Volume Analysis:** Volume bhi important hai pattern ke validity ko confirm karne ke liye. High volume during the breakout confirms the strength of the bearish move, jabke low volume market ke indecision ko indicate karta hai.

**5. Limitations of Bear Flag Pattern:**

- **False Breakouts:** Bear Flag pattern kabhi-kabhi false breakouts bhi generate kar sakta hai, especially volatile markets mein. Isliye, pattern ko other technical tools aur indicators ke sath combine karke use karna chahiye.

- **Subjectivity:** Pattern ki identification aur interpretation subjective hoti hai aur traders ke different perspectives ke upar depend karti hai. Accurate analysis ke liye experience aur practice zaroori hai.

**Conclusion:** Bear Flag candlestick pattern forex trading mein bearish continuation signals ko identify karne ka ek effective tool hai. Accurate pattern identification, proper risk management, aur combined analysis se traders is pattern ko successful trading strategies mein implement kar sakte hain. Market trends aur price movements ko samajhne ke liye Bear Flag pattern ka istemal trading decisions ko enhance kar sakta hai aur long-term trading success ko ensure kar sakta hai.

-

#10 Collapse

**Bear Flag Candlestick Pattern Ki Complete Details**

1. **Bear Flag Candlestick Pattern Kya Hai:**

- Bear Flag ek bearish continuation pattern hai jo price ke downtrend ke baad develop hota hai.

- Yeh pattern price ke temporary consolidation aur phir se decline ko indicate karta hai.

2. **Pattern Ki Structure:**

- **Flagpole:** Pattern ka pehla hissa 'flagpole' kehlata hai. Yeh sharp decline hoti hai jo price ke downtrend ko indicate karti hai.

- **Flag:** Flagpole ke baad, price ek consolidation phase me enter hoti hai jahan ek rectangular ya parallel channel banata hai. Yeh flag part hota hai aur price usually sideways ya slight upward movement dikhaata hai.

- **Breakout:** Flag ke consolidation phase ke baad, price flag ki lower boundary ko break karti hai aur phir se decline hoti hai. Yeh breakout pattern ki confirmation hoti hai.

3. **Pattern Ka Formation:**

- Bear Flag pattern tab develop hota hai jab ek strong bearish trend ke baad price consolidation phase me enter hoti hai.

- Consolidation phase me, price ek range me move karti hai jo flag ka shape create karti hai.

- Pattern ke completion ke liye, price consolidation phase ke end me lower boundary ko break kar ke continue downward move karti hai.

4. **Pattern Ki Characteristics:**

- **Bearish:** Yeh pattern bearish market sentiment ko reflect karta hai aur price ke decline ko continue karne ka signal hota hai.

- **Volume:** Volume usually flagpole ke dauran high hota hai aur flag ke consolidation phase me low hota hai. Breakout ke waqt volume increase hota hai, jo pattern ki strength ko confirm karta hai.

5. **Trading Strategy:**

- **Entry Point:** Bear Flag pattern ki confirmation ke liye, trader ko flag ke lower boundary break hone ka wait karna chahiye. Breakout ke baad, entry point ke taur par consider kiya jata hai.

- **Stop Loss:** Stop loss ko flagpole ke high ya consolidation phase ke upper boundary ke upar place kiya jata hai, taake sudden reversals se bachaa ja sake.

- **Target:** Target price ko flagpole ki height ke equal distance par set kiya jata hai, jo expected price decline ko estimate karta hai.

6. **Pattern Ki Limitations:**

- **False Signals:** Bear Flag pattern kabhi kabhi false breakouts de sakta hai, jisse traders ko misleading signals mil sakte hain.

- **Confirmation:** Pattern ki accurate prediction ke liye breakout aur volume increase ka confirmation zaroori hota hai.

7. **Example Aur Application:**

- Bear Flag pattern ko real-world charts par dekh kar traders market ke bearish trends aur potential entry points ko identify kar sakte hain.

- Is pattern ko other technical indicators aur analysis tools ke sath combine karke trade ki accuracy ko improve kiya ja sakta hai.

Bear Flag candlestick pattern ek useful tool hai jo traders ko bearish trends aur market movements ko samajhne me madad karta hai, lekin iski accurate prediction ke liye proper confirmation aur analysis zaroori hoti hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

### Bear Flag Candlestick Pattern Ki Complete Details

Bear flag candlestick pattern ek aham technical analysis tool hai jo traders ko market ke potential downward movement ka signal deta hai. Yeh pattern bearish trend ke dauran banta hai aur market ke chhote temporary rallies ko indicate karta hai jo long-term bearish trend ko continue karne ke liye hota hai. Is pattern ko samajhne se traders ko market ki direction aur momentum ka idea lagta hai, jo unki trading strategy ko behtar banane mein madadgar hota hai.

**Pattern Ka Banawat:**

Bear flag pattern do main parts par mushamil hota hai: **flagpole** aur **flag**. Flagpole ek sharp decline ka part hai jo market ke bearish trend ko represent karta hai. Iske baad, ek flag formation banta hai jo ek short-term upward movement ya consolidation phase ko show karta hai. Flag usually rectangular shape mein hota hai aur flagpole ke angle se thoda flat ya slight upward slope par hota hai. Yeh flag formation consolidation ya minor rally ka indication hota hai jo ke downtrend ke continuation ke liye hota hai.

**Pattern Ka Formation:**

1. **Flagpole Formation:** Bear flag pattern ke formation ki shuruaat tab hoti hai jab market ek sharp downward move karti hai, jo flagpole kehlata hai. Yeh movement typically ek high volume ke sath hota hai jo bearish sentiment ko indicate karta hai. Flagpole ka length pattern ke strength ko measure karne mein madad karta hai.

2. **Flag Formation:** Flagpole ke baad, market ek temporary consolidation phase ya rally mein chali jati hai jo flag formation ke roop mein hoti hai. Is phase ke dauran, price ek parallel channel ke andar move karti hai jo market ke short-term upward movement ko dikhata hai. Flag ke is stage ke dauran trading volume usually kam hota hai, jo consolidation phase ko confirm karta hai.

3. **Breakout and Continuation:** Flag formation ke baad, jab market flag ke lower boundary ko break karti hai, toh yeh bearish signal hai. Breakout ke baad, price flagpole ke length ke barabar ya usse zyada gir sakti hai. Yeh price target ko estimate karne ka ek tareeqa hai. Is stage par high volume dekha jata hai jo market ke downward movement ki confirmation karta hai.

**Trading Strategy:**

Bear flag pattern ko use karte waqt traders ko kuch cheezon ka dhyan rakhna chahiye. Pehle, traders ko ensure karna chahiye ke flagpole ki length achi ho aur market ka downward movement strong ho. Flag ke consolidation phase ko dhyan se observe karna zaroori hai aur flag ke lower boundary ke breakout ko confirm karna chahiye. Stop-loss orders bhi set karne chahiye taake sudden market reversals se bacha ja sake.

**Limitations:**

Bear flag pattern ke kuch limitations bhi hain. Kabhi-kabhi pattern false breakouts ka shikaar hota hai, jahan price flag ke lower boundary ko break karti hai lekin fir se upar chali jati hai. Yeh situation traders ko confusion mein daal sakti hai aur isliye pattern ka confirmation aur additional technical indicators ka use zaroori hai.

In summary, bear flag candlestick pattern ek valuable tool hai jo traders ko bearish trend ke continuation ka signal deta hai. Pattern ki correct identification aur analysis se trading decisions ko behtar banaya ja sakta hai aur market ki downward movement ka faida uthane ke chances badh jaate hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:09 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим