Bearish Mat-Hold Candles..!!!

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

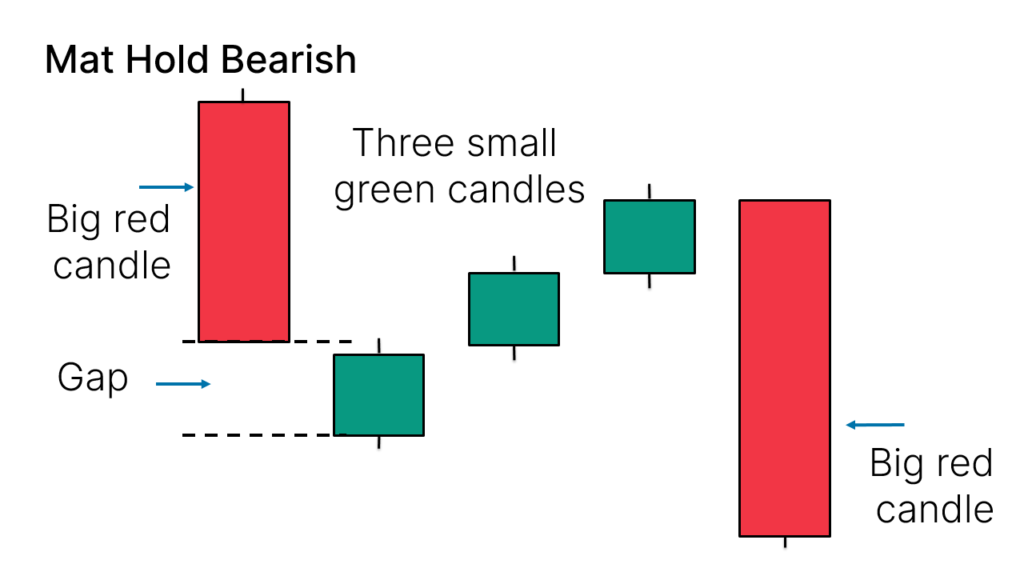

"Bearish Mat-Hold Candles" bhi candlestick patterns mein se ek hai, jo ki technical analysis mein use hota hai. Ye pattern downtrend ke dauran price ka continuation indication deta hai, matlab ke trend ka aage bhi continuation ho sakta hai.Bearish Mat-Hold Candles pattern mein, do consecutive bearish candles hote hain jinmein se pehli candle ka body chhota hota hai aur dusri candle ka body bada hota hai. Dusri candle pehli candle ki body ke andar open hoti hai aur uski close pehli candle ke body ke neeche hoti hai. Isse ek continuation pattern banta hai jo downtrend ko continue kar sakta hai.Is pattern ki interpretation kuch is tarah hoti hai: First Candle: Pehli candle bearish hoti hai aur iski body chhoti hoti hai. Yeh bearish trend ko confirm karta hai. Second Candle: Dusri candle bhi bearish hoti hai aur iski body pehli candle ke andar open hoti hai. Dusri candle ki body pehli candle ki body ke upar extend hoti hai aur iski close pehli candle ki body ke neeche hoti hai. Is tarah ki formation downtrend ke continuation ka indication deta hai. Confirmation: Traders is pattern ko confirm karne ke liye doosre technical indicators aur price action patterns ki madad lete hain. Is pattern ko confirm karne se pehle, traders ko market context aur overall trend ko bhi consider karna chahiye. Yad rahe ke trading decisions lene se pehle, aapko market ke situation ko acche se analyze karna chahiye aur risk management ko bhi dhyan mein rakhna chahiye. Trading mein practice, knowledge, aur experience ka hona bahut zaroori hai. Agar aap trading kar rahe hain, to demo account mein practice karna aur ek professional financial advisor se salah lena bhi behad important hai.

First Candle: Pehli candle bearish hoti hai aur iski body chhoti hoti hai. Yeh bearish trend ko confirm karta hai. Second Candle: Dusri candle bhi bearish hoti hai aur iski body pehli candle ke andar open hoti hai. Dusri candle ki body pehli candle ki body ke upar extend hoti hai aur iski close pehli candle ki body ke neeche hoti hai. Is tarah ki formation downtrend ke continuation ka indication deta hai. Confirmation: Traders is pattern ko confirm karne ke liye doosre technical indicators aur price action patterns ki madad lete hain. Is pattern ko confirm karne se pehle, traders ko market context aur overall trend ko bhi consider karna chahiye. Yad rahe ke trading decisions lene se pehle, aapko market ke situation ko acche se analyze karna chahiye aur risk management ko bhi dhyan mein rakhna chahiye. Trading mein practice, knowledge, aur experience ka hona bahut zaroori hai. Agar aap trading kar rahe hain, to demo account mein practice karna aur ek professional financial advisor se salah lena bhi behad important hai.

- Mentions 0

-

سا0 like

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

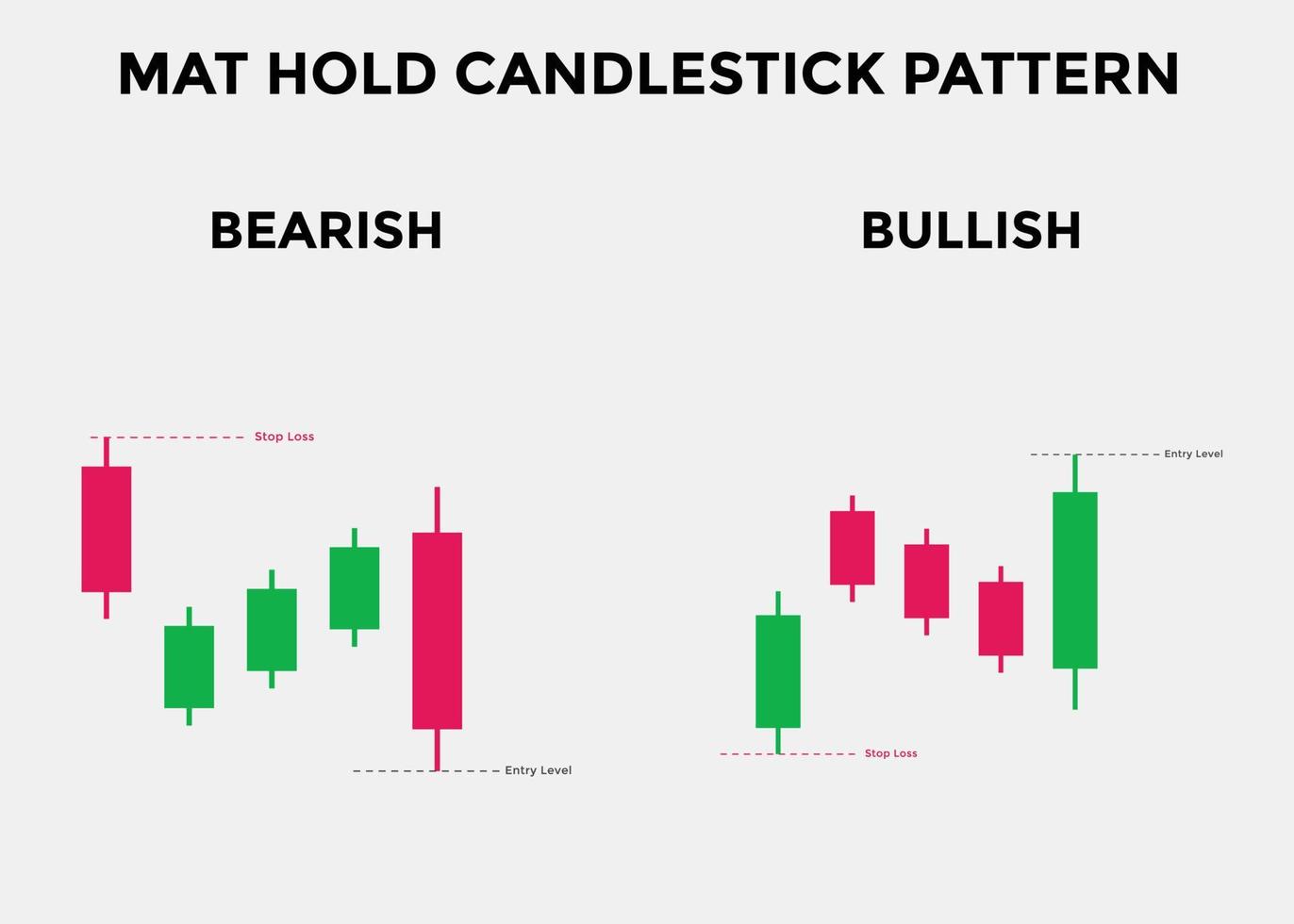

"Bearish Mat Hold" aur "Bullish Mat Hold" candlestick patterns, "Rising Three Methods" aur "Falling Three Methods" patterns ka hissa hote hain. Yeh patterns continuation patterns hote hain, yani ke market ke existing trend ko continue karne ka indication dete hain. Neeche in patterns ki tafseel aur risk-free trade karne ka tarika diya gaya hai: Bearish Mat Hold Candlestick Pattern: Pattern Ki Tasveer (Appearance): Bearish Mat Hold pattern ek downtrend ke baad aata hai. Is pattern mein pehla candlestick ek bearish (downward movement) candle hota hai. Uske baad teen bullish (upward movement) candles follow hoti hain, jinmein doosri aur teesri candles pehli bearish candlestick ke neeche rehti hain aur doosri aur teesri candles pehli candlestick ki body ko partially cover karti hain. Downtrend Ki Tasdeeq (Confirmation of Downtrend): Pehle yeh confirm karein ke market actual mein downtrend mein hai. Bearish Mat Hold pattern ka zyada effect tab hota hai jab woh downtrend ke baad nazar aata hai. Pattern Ki Tasdeeq (Pattern Confirmation): Agar Bearish Mat Hold pattern nazar aaye, to next candlestick ka price action dekhein. Agar next candlestick pattern ki direction mein move karta hai, to pattern ki confirmation hoti hai. Bullish Mat Hold Candlestick Pattern: Pattern Ki Tasveer (Appearance): Bullish Mat Hold pattern ek uptrend ke baad aata hai. Is pattern mein pehla candlestick ek bullish (upward movement) candle hota hai. Uske baad teen bearish (downward movement) candles follow hoti hain, jinmein doosri aur teesri candles pehli bullish candlestick ke neeche rehti hain aur doosri aur teesri candles pehli candlestick ki body ko partially cover karti hain. Uptrend Ki Tasdeeq (Confirmation of Uptrend): Pehle yeh confirm karein ke market actual mein uptrend mein hai. Bullish Mat Hold pattern ka zyada effect tab hota hai jab woh uptrend ke baad nazar aata hai. Pattern Ki Tasdeeq (Pattern Confirmation): Agar Bullish Mat Hold pattern nazar aaye, to next candlestick ka price action dekhein. Agar next candlestick pattern ki direction mein move karta hai, to pattern ki confirmation hoti hai. Risk-Free Trade Ka Tarika: Kisi bhi pattern ya indicator ke saath, bilkul risk-free trade ka concept realistic nahi hota, lekin aap kuch tareeqe istemal karke apne risk ko minimize kar sakte hain: Use a Tight Stop Loss: Apne trades ke liye tight stop loss set karke risk ko minimize kar sakte hain. Position Size Ko Control Karein: Position size ko apne risk tolerance aur trading capital ke hisab se set karein. Diversify: Ek hi trade mein sabhi capital invest na karein. Multiple trades mein invest karke risk ko spread karein. Stay Informed: Market trends, news, aur economic events ko track karte rahein taki aap unexpected events se bach sakein. Practice on Demo Account: Agar aap Mat Hold patterns ko try kar rahe hain, to pehle demo account par practice karein. Isse aap apni strategy ko refine kar sakte hain. Risk Management: Position size, stop loss, aur target levels ko control karke apne risk management ko maintain karein. Remember, bilkul risk-free trade possible nahi hai, lekin in steps ko follow karke aap apne trading risk ko minimize kar sakte hain. Practice aur experience ke saath aap apni skills ko improve kar sakte hain aur candlestick patterns ko effectively use kar sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Bearish Mat Hold Chart Pattern: Bearish Or Negative Mat-Hold candles, ek explicit tareeqay se structure hoti hain hit do successive candles ki bodies aur shadows comparable hoti hain. Pehli flame down move ki taraf show karti hai aur doosri light usi range mein close hoti hai ya thori si up move karti hai. Is tarah ka design negative force ki tasdeeq karta hai.Is design se faida uthane ke liye merchants ko kuch muddaton tak notice karna hota hai. Agar do continuous candles is design mein structure hoti hain, to ye selling opportunity show kar sakti hain. Brokers apni passage sell stop request se set kar sakte hain, pehli flame ki low ke neechay. Stop misfortune unko pehli light ki high ke above rakhna chahiye.Bearish Mat-Hold candles, candle outline examination ka aik mahirana hissa hain jo brokers ko market mein nishandehi se faida hasil karne ka moka dete hain. Ye candles commonly downtrend ya cost decline periods mein nazar aate hain aur neechay diye gaye tareeqon se istemal kiye ja sakte hain. Candle ki taraf se solid selling movement aur downtrend ka sign hota hai.Dusri flame ki opening pehli candle ke specialty hoti hai, jisse negative energy proceed hota hai.Is design mein, pehli candle ki low cost ko break karke cost further down ja sakta hai, jisse downtrend ki continuation hoti hai.Traders aur financial backers is design ko market setting ke saath consider karte hain aur extra specialized pointers aur cost activity designs ki madad se apne exchanging choices lete hain. Design acknowledgment mein practice aur experience hona zaroori hai. Exchanging mein risk the executives ka bhi dhyaan rakhna bahut zaroori hai, aur preferably ek proficient monetary consultant se bhi salah lena chahiye. Chart Pattern Formation: Candle design ek explicit sort ka negative continuation design hai jo specialized examination mein istemal hota hai. Ye design downtrend ke dauran seem hota hai aur cost development ke continuation ka sign deta hai."Bearish Mat-Hold Candles" design ko recognize karne ke liye, kuch significant focuses hote Hain Ye design do candles se mil kar banta hai. Pehli flame ek downtrend ke dauran seem hoti hai, jo ek long dark (negative) light hoti hai, jise "opening marubozu" kehte hain. Iski opening cost ki taraf koi shadow nahi hoti, aur iska shutting cost low cost se kuch had tak close hota ha Dusri candle bhi ek dark (negative) candle hoti hai, jo pehli light ke specialty open hoti hai. Iski body pehli candle ki body ke neeche rehti hai.Is design ki affirmation ke liye, pehli light ke low cost ko break karne wali selling ki movement zaroori hoti hai.

Candle ki taraf se solid selling movement aur downtrend ka sign hota hai.Dusri flame ki opening pehli candle ke specialty hoti hai, jisse negative energy proceed hota hai.Is design mein, pehli candle ki low cost ko break karke cost further down ja sakta hai, jisse downtrend ki continuation hoti hai.Traders aur financial backers is design ko market setting ke saath consider karte hain aur extra specialized pointers aur cost activity designs ki madad se apne exchanging choices lete hain. Design acknowledgment mein practice aur experience hona zaroori hai. Exchanging mein risk the executives ka bhi dhyaan rakhna bahut zaroori hai, aur preferably ek proficient monetary consultant se bhi salah lena chahiye. Chart Pattern Formation: Candle design ek explicit sort ka negative continuation design hai jo specialized examination mein istemal hota hai. Ye design downtrend ke dauran seem hota hai aur cost development ke continuation ka sign deta hai."Bearish Mat-Hold Candles" design ko recognize karne ke liye, kuch significant focuses hote Hain Ye design do candles se mil kar banta hai. Pehli flame ek downtrend ke dauran seem hoti hai, jo ek long dark (negative) light hoti hai, jise "opening marubozu" kehte hain. Iski opening cost ki taraf koi shadow nahi hoti, aur iska shutting cost low cost se kuch had tak close hota ha Dusri candle bhi ek dark (negative) candle hoti hai, jo pehli light ke specialty open hoti hai. Iski body pehli candle ki body ke neeche rehti hai.Is design ki affirmation ke liye, pehli light ke low cost ko break karne wali selling ki movement zaroori hoti hai.  Negative mat hold design cost outline standard sabeqa negative pattern ko apni semat fundamental agay ki taraf barhate hen. Design panch candles ka aik majmoa hai, jiss primary pehli flame areas of strength for aik light hoti hai, jiss se pechle negative pattern ki data melti hai, aur ye candle aik long genuine body principal hoti hai. Design ki agli adolescent candles little genuine body principal bullish hoti hai, jiss primary example ki dosri pehli negative flame k lower side standard hole fundamental open hoti hai, lekin close ussi k genuine body principal hoti hai. Design ki teesri aur chothi candles pehli candle k genuine body fundamental aur close dono hote hen. Design ki little genuine body wali candles se costs negative side standard mazeed nechay jane se thore se rok jati hai. Poke k last flame wapis negative pattern karwati q k ye aik long genuine body wali negative candle hoti hai. Trading View: Design costs k leye merchants k market fundamental ziada positive dilchaspi ki waja se banta hai, lekin kuch waqfay k leye market principal hole banta hai, jiss k leye sarmayakar soch rahe hote hen, k aya same pattern standard costs ko proceed hona chaheye ya pattern inversion hona chaheye, lekin akher primary faisala pattern inversion k haq primary hota hai. Negative mat hold design k leye negative candle k baad market principal sell ki section hoti hai, jo k affirmation candle k leye ziada achah result deta hai. Stop Misfortune design k sab se upper ya top standard hona chaheye, jahan standard pehli negative flame open hoti hai, se taqreeban two pips above set karen. Negative mat hold design ki last aur fifth candle aik long genuine body fundamental hoti hai, jo k chothi candle k baad lower standard open ho kar teeno little candles k top standard close hoti hai. Ye flame dark ya red hoti hai, jo ziada tar bagher long shadow k hoti hai.

Negative mat hold design cost outline standard sabeqa negative pattern ko apni semat fundamental agay ki taraf barhate hen. Design panch candles ka aik majmoa hai, jiss primary pehli flame areas of strength for aik light hoti hai, jiss se pechle negative pattern ki data melti hai, aur ye candle aik long genuine body principal hoti hai. Design ki agli adolescent candles little genuine body principal bullish hoti hai, jiss primary example ki dosri pehli negative flame k lower side standard hole fundamental open hoti hai, lekin close ussi k genuine body principal hoti hai. Design ki teesri aur chothi candles pehli candle k genuine body fundamental aur close dono hote hen. Design ki little genuine body wali candles se costs negative side standard mazeed nechay jane se thore se rok jati hai. Poke k last flame wapis negative pattern karwati q k ye aik long genuine body wali negative candle hoti hai. Trading View: Design costs k leye merchants k market fundamental ziada positive dilchaspi ki waja se banta hai, lekin kuch waqfay k leye market principal hole banta hai, jiss k leye sarmayakar soch rahe hote hen, k aya same pattern standard costs ko proceed hona chaheye ya pattern inversion hona chaheye, lekin akher primary faisala pattern inversion k haq primary hota hai. Negative mat hold design k leye negative candle k baad market principal sell ki section hoti hai, jo k affirmation candle k leye ziada achah result deta hai. Stop Misfortune design k sab se upper ya top standard hona chaheye, jahan standard pehli negative flame open hoti hai, se taqreeban two pips above set karen. Negative mat hold design ki last aur fifth candle aik long genuine body fundamental hoti hai, jo k chothi candle k baad lower standard open ho kar teeno little candles k top standard close hoti hai. Ye flame dark ya red hoti hai, jo ziada tar bagher long shadow k hoti hai.  Design dekhne primary "Rising Three Strategies Example" aur Three line strike design se melta julta design hai, jo negative pattern principal banta hai, jo pattern continuation k leye jana jata hai. Ye design panch candles standard mushtamil hota hai, jiss principal pehli flame aik long genuine body wali negative light hota hai, jiss k baad little genuine body fundamental youngster bullish candles hote hen. Little dosri bullish candles pehli flame ki genuine body fundamental open ho kar uss k genuine body principal close hoti hai. Hit k teesri aur chothi little candles open aur close pehli light ki genuine body primary hoti hai. Design ki akhari flame aik long genuine body wali negative candle hoti hai, jo teeno little bullish candles k top standard open ho kar uss k n3chay close hoti hai.

Design dekhne primary "Rising Three Strategies Example" aur Three line strike design se melta julta design hai, jo negative pattern principal banta hai, jo pattern continuation k leye jana jata hai. Ye design panch candles standard mushtamil hota hai, jiss principal pehli flame aik long genuine body wali negative light hota hai, jiss k baad little genuine body fundamental youngster bullish candles hote hen. Little dosri bullish candles pehli flame ki genuine body fundamental open ho kar uss k genuine body principal close hoti hai. Hit k teesri aur chothi little candles open aur close pehli light ki genuine body primary hoti hai. Design ki akhari flame aik long genuine body wali negative candle hoti hai, jo teeno little bullish candles k top standard open ho kar uss k n3chay close hoti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:37 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим