Spinning top candle stick pattern Kia h??

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

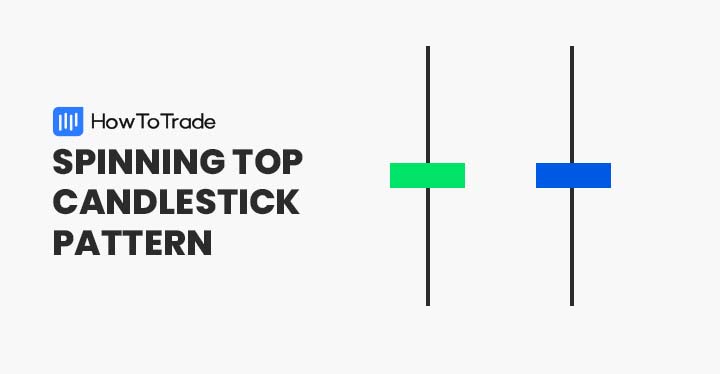

Assalam alaikum dear forum members! umeed karta hun aap sb khairiat se hn gy or apki trading achi jaa rahi ho ge. dear members trading karty hovy hmara hr waqt candlesticks se taluq hota ha or hum inko dkh kr price read karty hain. ye candle sticks price k ilawa or b bahut kuch btati hain jesa k tredn k bary main support resitance k bary main or reversal k bary main bhi btati hain. esi silsly main aj hum aik important candle ko read karen gy jisy k spinning top candle stick kaha jata ha. What is Spinning Top Candlestick? dear members spinning top candle ki short real body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body bearish ya bullish ho skti ha. spinning top market main indecission ko zahir karti ha mtlb k buyer or sellers equal force main thy or market main koe faisla ni ho ska. Jb market opr hai to seller ny sell kia or opr ki trf wick ya shadow bn gya or jb market nechy gai to buyers ny buy kia jski waja se nechy se wick bn gai or darmyan main choti c body bni ha. agr ye pattern strong support ya resistance py bny or es se agli candle eski confirmation kar dy to ye trend reversal ka sign ho skta ha. Importance of spinning top pattern, Yeh candlestick pattern us time banta ha jab buyers aik given time k doran price ko down push kr deta ha. Liken closing price open k bht qareeb close hojati ha. Strong price mein izafa ya kami k baad, spinning top potential price reversal ka signals dy sakti ha. Spinning top above open k oper ya below close ho sakti ha. Liken dono prices hamesha aik dusry k qareeb hoti hein. Spinning top aik candlestick pattern ha jis ki short real body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki real body choti honi chaiye jo open aur close prices mein thora farq dekhata hai. Kyun k buyers aur sellers dono ny price ko agy barhaya liken usy maintain nae rakh saky. Pattern indecision ko show karta ha aur us k sath sath mazid sideways movement bhi ho sakti hai. Umeed ha k aj ka topic ap sab doston ko zarur samjh aye ga ta k ap trading k doran is candle ko pehchan saken aur us k baad he apni trade ko active karen ta k ap loss sy bach saken. Bullish reversal Spinning top pattern: Dear members ye pattern bearish trend k end main support py banta ha or ye reversal ki nishani hota ha es k bad market bullish ho jati ha. laikin es se phly eski confirmation lazmi ha. eski confirmation ye ha k support muqam py phly spinning top candle bny bullish body k sth or phr us k bad usi time frame main next candle spinning top ki closing price se opr close ho. main hum dosri candle ki confirmation k bad buy ki trade lety hain or hmara stop loss spinning top candle k low k equal hota ha. Bearish reversal Spinning top candlestick: Dear memebrs ye pattern bullish trend k end main resistance muqam py bnta ha. Resistance py aikspinning top candle banti ha bearish body k sth or eski confirmation k lye next bearish candle ko spinning top candle k low k nechy close hona chahye. Es k bad market ka trend reverse hota ha or market bearish move karti ha. main dosri candle k closing k bad hum sell ki trade lety hain or hmara stop loss spinning top candle k high k equal hota ha. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

SPINNING TOP CANDLESTICK PATTERN IN FOREX TRADING INTRODUCTION Forex mn Spinning Top, ya Charkhi Top Ki Moomi, ek mumkin candlestick pattern hai jo share market mein dekha ja sakta hai. Is pattern mein candle ki body choti hoti hai aur upper aur lower shadows ziada lambe hote hain. SMALL BODY CANDLESTICK Charkhi Top pattern mein candle ki body choti hoti hai. Yani open aur close prices mein kam farq hota hai. Iska matlab hai ke market mein kam volatility hai aur buyers aur sellers mein mushkil hoti hai tafreeq banane mein. LONG SHADOW Is pattern mein candle ke upper aur lower shadows ziada lambe hote hain. Yani, price ne candle ki opening aur closing levels se ziada movement kiya hota hai. Ye is baat ki wazahat karta hai ke market mein kisi direction mein tawanai nahi hai. INTERPRETATION Agar Spinning Top pattern uptrend (bullish) ke baad aaye to ise Bullish Spinning Top kehte hain. Agar ye pattern downtrend (bearish) ke baad aaye to ise Bearish Spinning Top kehte hain. Ye pattern trend reversal ki indication bhi de sakta hai.Spinning Top pattern market ke indecision ko darshaata hai. Yani, buyers aur sellers confused hote hain aur koi tawanai kisi direction mein nazar nahi aati. Agar ye pattern trend ke against aaye to future mein price mein change ho sakta hai. TECHNICAL STRATEGIES Charkhi Top pattern ke base par trading decisions na len, balkay isay confirm karne ke liye aur bhi technical aur fundamental analysis karna behtar hota hai.Spinning Top candlestick pattern ek aham tool ho sakta hai share market analysis mein, lekin isay akele mein istemal na karein. Isay dusri indicators aur analysis ke sath combine karna zaroori hai trading decisions lene ke liye.Mujhe umeed hai ke yeh wazahat aap ke liye mufeed sabit hogi. Agar aapko mazeed maloomat chahiye, to barah-e-karam sawaal karein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Spinning Top Chart Pattern: Turning top (Spinning Top) asi candle hoti hai jo up pattern k pinnacle standard ya down pattern k base standard or pattern k center mama b ho aksar nazar ati hai. Ye candle negative or bullish 2no kisam ki ho sakti hai. Ye light little body standard mushtamil hoti hai jis k opening point or shutting point ik dosray k kareeb hoty hain. Ye design us sorat mama banta hai jb purchaser or sell k dermeyan uncertain circumstance hu. Ye candle forex pattern k conceivable change hony ko show karti hai. Merchants ko market mama jb ya candle nazar ah jae to unko apni exchange ko hold kar lena chahe or market ki next move k lae stand by karna chahe.Ye candle market ki backing or opposition k bary mama data b deti hai. So age ye Market k upswing mama agr bullish turning top candle support level standard show ho jae to ham es point ko as an entery point hasil kar sakty hain es sorat mama stop misfortune ham support level k nechy place kar sakty hain k market agr support ko break kar jae to ham most extreme misfortune sy bach jaynCandle of greatest exchanging an open door to give Karti hai jisne of exchange open karke benefit le sakte ho bullish turning top and negative turning top candle exchanging market primary aapko passage and leave point choice deti hai turning candle se hamen maloom hota hai ki market ka companion proceed rahega ya stream ho jaega iske sath agar ham exchanging ke liye moving normal use Karen oscillator marker best direction ke liye use kar len do ham significant data lekar most extreme benefit le sakte hain bullish turning top ka matlab hota hai ki train abhi proceed rahega. agr negative spining top wali candle obstruction level standard show ho jae to ham esko leave point k peak standard use kar sakty hain. Ik bar ye candle design market ki perusing mama help kar dey to ham esk sath following stop ko b use kar sakty hain. In any case, merchant ko ye bat zehan mama rakhni chahe k kio b design 100% achievement ki gurantee ni hota. Market kisi b place standard apni position ko change kar sakti hai. Acha merchant wo he hai jo market k strange conduct k lae prepared rahy or es ka schoolwork us ny pehle sy kiya howa hu. Chart Pattern Identification And Formation: Spinning top candle ko kaise pahchan sakte hain to uska aasan tarika yah hai ki iski body jo hai vah chhoti hoti hai aur iske shadows Jo stick hoti hain vah badi hoti hai punch bhi aap Koi light dekhen chahe vah police Ho ya negative Ho isase Fark nahin padta lekin agar uski body chhoti hai matlab uski opening aur uski shutting kareeb hai aur uske shadows bade Hain to iska matlab yah hai ki yah ek turning top candle hai turning top candle bullish bhi ho sakti hai aur negative bhi ho sakti hai.jab bhi aap dekhen ke pichhali kuchh candles musalsal bullish a rahi hai aur usse aage aapko negative immersing turning top candle milati hai to iska matlab yah hai ki yahan se market invert sharpen wali hai aur aapki market it down ki taraf jaane wali hai to agar aapane purchase Kiya hua hai to yahan per aapko apne share deal kar dena chahie kyunki agar aap nahin karenge to yah inversion sign hai aur aapko misfortune ho sakta hai.

Candle design" ka matlab hota hai ke khareedne grain aur farokht karne ridge ke darmiyan mubadala kam ho raha hai aur market mein tabdeeli ki tawaqo hai. Is design mein mum ki shama ka focal hissa chhota hota hai, jo keemat ke samne aur peeche ki taraf barabar hoti hai. Is se yeh pata chalta hai ke tajarbat karne ridge confounded hain aur market mein vulnerability hai.Is design ko dekh kar tajarati faislay karne se pehle, zaroori hai ke aap isko doosre tajarati isharon jaise pattern lines, moving midpoints, aur RSI ke saath mawazna karein. Aksar yeh design ek inversion ya pattern change ki nishani ho sakti hai. Lekin aapko tajarati faisla lene se pehle market ki mukhtalif pehluon ko madd-e-nazar rakhte shade soch samajh kar faisla karna chahiye. Chart Pattern Trading View: Spinning Top Or Turning Top ka candle design exchanging mein istemal sharpen wala ek specialized examination device hai, jisse pattern ki heading mein potenti changing ka pata lagaya jata hai. Punch kisi stock ya resource ki opening aur shutting cost ek dosray se bahut qareeb ho jatay hai, toh usay dekhnay mein ek chota genuine body ki shakal mein dikhai deti hai jo slender line se address kiya jata hai. Upper aur neeche genuine body ke wicks high aur low exchanging meeting ki taraf ishara kartay hain. Turning Top ka candle design, markets mein hesitation ka ek sign mana jata hai, iska matlab yeh hai k koi purchasers ya venders apni control hasil nahin kar saktay. Is hesitation ko aam peak standard up ya down major areas of strength for ky baad paaya jaata hai. Experienced brokers is design ko dekh kar apni existing exchanges mein enter aur exit kab karna hai iska investigation kartay hain. Iska istemal force ki depletion aur potentiall inversion ka pata lagane mein bhi hota hai.

Candle design" ka matlab hota hai ke khareedne grain aur farokht karne ridge ke darmiyan mubadala kam ho raha hai aur market mein tabdeeli ki tawaqo hai. Is design mein mum ki shama ka focal hissa chhota hota hai, jo keemat ke samne aur peeche ki taraf barabar hoti hai. Is se yeh pata chalta hai ke tajarbat karne ridge confounded hain aur market mein vulnerability hai.Is design ko dekh kar tajarati faislay karne se pehle, zaroori hai ke aap isko doosre tajarati isharon jaise pattern lines, moving midpoints, aur RSI ke saath mawazna karein. Aksar yeh design ek inversion ya pattern change ki nishani ho sakti hai. Lekin aapko tajarati faisla lene se pehle market ki mukhtalif pehluon ko madd-e-nazar rakhte shade soch samajh kar faisla karna chahiye. Chart Pattern Trading View: Spinning Top Or Turning Top ka candle design exchanging mein istemal sharpen wala ek specialized examination device hai, jisse pattern ki heading mein potenti changing ka pata lagaya jata hai. Punch kisi stock ya resource ki opening aur shutting cost ek dosray se bahut qareeb ho jatay hai, toh usay dekhnay mein ek chota genuine body ki shakal mein dikhai deti hai jo slender line se address kiya jata hai. Upper aur neeche genuine body ke wicks high aur low exchanging meeting ki taraf ishara kartay hain. Turning Top ka candle design, markets mein hesitation ka ek sign mana jata hai, iska matlab yeh hai k koi purchasers ya venders apni control hasil nahin kar saktay. Is hesitation ko aam peak standard up ya down major areas of strength for ky baad paaya jaata hai. Experienced brokers is design ko dekh kar apni existing exchanges mein enter aur exit kab karna hai iska investigation kartay hain. Iska istemal force ki depletion aur potentiall inversion ka pata lagane mein bhi hota hai.  Candle design hai jo tab banta hai hit candle ka open aur close ek dusre ke bahut karib hote hain, jisse little ya nonexistent body boycott jati hai, aur candle ki high aur low ke beech long upper or lower wicks bante hain. Is candle design ka presence market me hesitation ki ek nishani mana jata hai, kyun ke brokers ko disarray hota hai ki cost ko upar jana chahiye ya neeche. Yeh outline design aapko latest thing decelerate sharpen ka bhi andaza lagane me madad karta hai poke purchasers or dealers market phirne me lagi tint hon. Light body red ya green hoti hai, jo long upturn ya downtrend ko address karti hai, lekin Turning Top example me candle ki little body red ya green dono address kar sakti hai, market ke heading standard depend karke. Candle graph use karo tab Turning Top example ko effectively perceive karne me madad milti hai. Yeh negative ya bullish dono markets me dekhne ko milta hai, lekin market ki course se bilkul bhi related nahi hai

Candle design hai jo tab banta hai hit candle ka open aur close ek dusre ke bahut karib hote hain, jisse little ya nonexistent body boycott jati hai, aur candle ki high aur low ke beech long upper or lower wicks bante hain. Is candle design ka presence market me hesitation ki ek nishani mana jata hai, kyun ke brokers ko disarray hota hai ki cost ko upar jana chahiye ya neeche. Yeh outline design aapko latest thing decelerate sharpen ka bhi andaza lagane me madad karta hai poke purchasers or dealers market phirne me lagi tint hon. Light body red ya green hoti hai, jo long upturn ya downtrend ko address karti hai, lekin Turning Top example me candle ki little body red ya green dono address kar sakti hai, market ke heading standard depend karke. Candle graph use karo tab Turning Top example ko effectively perceive karne me madad milti hai. Yeh negative ya bullish dono markets me dekhne ko milta hai, lekin market ki course se bilkul bhi related nahi hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:40 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим