What is the spinning top pattern?

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

-

سا0 like

-

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

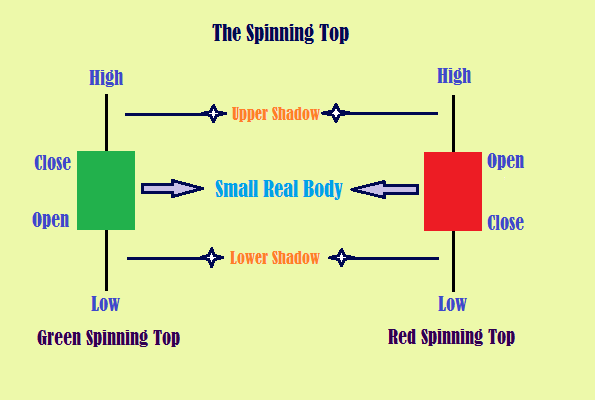

WHAT IS SPINNING TOP CANDLESTICK PATTERN : Spinning Top ka candlestick pattern trading mein istemal hone wala ek technical analysis tool hai, jisse trend ki direction mein potenti changing ka pata lagaya jata hai. Jab kisi stock ya asset ki opening aur closing price ek dosray se bahut qareeb ho jatay hai, toh usay dekhnay mein ek chota real body ki shakal mein dikhai deti hai jo thin line se represent kiya jata hai. Upper aur neeche real body ke wicks high aur low trading session ki taraf ishara kartay hain. Spinning Top ka candlestick pattern, markets mein indecision ka ek sign mana jata hai, iska matlab yeh hai k koi buyers ya sellers apni control hasil nahin kar saktay. Is indecision ko aam tor par up ya down ky strong move ky baad paaya jaata hai. Experienced traders is pattern ko dekh kar apni existing trades mein enter aur exit kab karna hai iska analysis kartay hain. Iska istemal momentum ki exhaustion aur potentiall reversal ka pata lagane mein bhi hota hai. FORMATION OF SPINNING TOP CANDLESTICK PATTERN : Jo ya Spinning Top ha ya ek candlestick pattern hai jo tab banta hai jab candlestick ka open aur close ek dusre ke bahut karib hote hain, jisse small ya nonexistent body ban jati hai, aur candlestick ki high aur low ke beech long upper or lower wicks bante hain. Is candlestick pattern ka presence market me indecision ki ek nishani mana jata hai, kyun ke traders ko confusion hota hai ki price ko upar jana chahiye ya neeche. Yeh chart pattern aapko current trend decelerate hone ka bhi andaza lagane me madad karta hai jab buyers or sellers market phirne me lagi hue hon. Candle body red ya green hoti hai, jo long uptrend ya downtrend ko represent karti hai, lekin Spinning Top pattern me candle ki small body red ya green dono represent kar sakti hai, market ke direction par depend karke. Candlestick chart use karo tab Spinning Top pattern ko easily recognise karne me madad milti hai. Yeh bearish ya bullish dono markets me dekhne ko milta hai, lekin market ki direction se bilkul bhi related nahi hai, isliye iska additional analysis karna bahut jaruri hai taaki market reversal ya continuation ke potential implications samjhe ja sake. TECHNICAL ANALYSTS ON SPINNING TOP CANDLESTICK PATTERN : Ye Spinning Top candlestick pattern ek aam technical analysis tool hai jo traders use karte hain market mein potential trend reversals ya indecision ko identify karne ke liye. Ismein ek chota sa body hota hai jiske upar aur neeche long shadows hote hain jo dikhaata ki is period mein price movement hui thi lekin uska closing opening price se kareeb ho gaya tha. Is pattern ko bearish ya bullish dono tarah se dekh sakte hain. Bearish version of Spinning Top dekhne ka matlab hai ki jab body green ya red dikhti hai to ye dikhaata hai ki strong bearish sentiment ne prices ko opening price se niche push kiya aur buyers aa gaye aur prices ko opening level pe phir push kar diya. Yeh ek potential reversal dikhata hai kyunki bullish momentum weakening hone laga hai. Bullish version of Spinning Top dekhne ka matlab hai ki jab body black ya white dikhti hai to yeh dikhaata hai ki strong bullish sentiment ne prices ko opening price se upar push kiya lekin sellers aa gaye aur prices ko opening level pe phirse push kar diya. Yeh bhi ek potential reversal dikhata hai kyunki bearish momentum weakening hone laga hai. Overall, Spinning Top candlestick pattern ek aham technical analysis tool hai jo traders ko trend ka direction mein potential reversals ki warning deta hai. Isko doosri technical indicators aur methods ke saath combine karke price movements ko predict karne mein greater accuracy milti hai. HOW TO TRADE USING SPINNING TOP PATTERN : Spinning Top candlestick pattern ko trade karne ke liye yeh tariqa hai: 1. Pattern identify: Ek chhote se body aur lambi chaonon wali ek candlestick dhoondhein. Yeh indecision ko darj karta hai buyers aur sellers ke bech. 2. Stop loss set karein: Is pattern ke neeche wale shadow ya is pattern ke low se thoda neeche tak stop loss lagayen. 3. Take profit set karein: Chart par pehle se consolidate hui level ya Fibonacci levels jaise 38.2%, 50% ya 61.8% dhoondhein. 4. Trade enter karein: Jab price Spinning Top candlestick pattern ke high se upar nikal jaye, trade enter karein. 5. Trade monitor karein: Jab tak take profit hit na ho, trade ko monitor karte rahein or agar price stop loss level tak pohanche to exit karein. Spinning Top candlestick pattern ko istemal kar ke traders market mein potential turns ko identify kar sakte hain aur inse faidah hasil kar sakte hain. Magar risk management plan zaroor banayen aur trade ko close monitor karen. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Spinning top" pattern ko Forex mein Roman Urdu mein aksar "ghumte hue top" ya "charkhta hua top" kehte hain. Yeh ek candlestick pattern hai jo kisi bhi financial price chart par dekha jata hai. Is pattern mein market mein tanaza (indecision) ka andaza hota hai, jahan opening aur closing prices qareeb qareeb hote hain, aur candlestick ka jism chota hota hai jis mein upri aur nichle shadows hote hain. Yeh pattern ishara karta hai ke na to khareedne wale aur na hi bechne wale mein kisi wazeh faiday ka faisla nahi ho raha hai, aksar pichhle trend ke mutabiq ek palat ya jari rakhne ki taraf ishara ho sakta hai. TECHNICAL ANALYSTS ON SPINNING TOP CANDLESTICK PATTERN : Spinning Top" candlestick pattern ko technical analysts forex ya anya financial markets mein price analysis karne ke liye istemal karte hain. Is pattern ke dekhne par ve market sentiment aur price movement ke baare mein insights prapt karne ki koshish karte hain." Spinning Top" pattern ki madad se analysts samajhne ki koshish karte hain ke market mein kis tarah ka tanaza (indecision) hai. Agar ek upar trend (bullish trend) ke baad spinning top pattern aata hai, to yeh ho sakta hai ki buyers mein thakan aa gayi hai aur market down karne ka prashna ho sakta hai. Vaise hi, agar ek neeche ki taraf trend (bearish trend) ke baad spinning top pattern dikhai deta hai, to yeh ho sakta hai ki sellers bhi exhausted hain aur market mein reversal hone ka chance ho sakta hai. Lekin, spinning top pattern ke signal ko samajhne mein ek matra candlestick par nirbhar nahi kiya jana chahiye. Iske saath-saath market context, trend, aur dusre technical indicators ka bhi dhyaan rakhna zaroori hota hai.How to trade on spinning How to trade on spinning to pattern Spinning Top" pattern par trade karte waqt, aapko kuch factors ko dhyaan mein rakhna zaroori hota hai. Yahan kuch steps hain jo aapko is pattern par trade karte waqt madadgar saabit ho sakte hain: Trend Ko Samjhein: Pehle toh market ka trend samjhein, kya wo upar ki taraf ja raha hai (bullish) ya neeche ki taraf (bearish). Spinning top pattern ka significance trend ke saath juda hota hai. Confirmation Ke Liye Wait Karein: Ek matra spinning top pattern par trade karne se bachein. Is pattern ko confirm karne ke liye agle candle ka wait karein. Agar next candle spinning top se alag direction mein move karti hai, to aapko iska matlab samajhna chahiye. Stop Loss Aur Target Set Karein: Apne trade ke liye stop loss aur target levels set karein. Agar aap long trade (khareedne ki taraf) kar rahe hain, to stop loss niche aur target upar rakhein. Aur agar short trade (bechne ki taraf) kar rahe hain, to stop loss upar aur target niche rakhein. Volume Aur Dusre Indicators Ka Istemal: Volume aur dusre technical indicators jaise ki RSI, MACD, ya moving averages ka istemal karke aap apne decision ko confirm kar sakte hain. Yeh indicators aapko market sentiment aur price movement ke bare mein aur bhi insights de sakte hain. Risk Management: Hamesha apne trade mein risk management ka dhyaan rakhein. Zyada risk lene se bachein aur apne trading capital ka sahi istemal karein. Practice Karein: Spinning top pattern par trade karne se pehle demo account par practice karein. Isse aapko pattern ko samajhne aur trade karne mein confidence hoga. News Aur Events Ka Dhyaan Rakhein: Important economic news ya events ke samay spinning top pattern par trade karne se bachein. Aise samay mein market unpredictable ho sakta hai.Zaroori hai ki aap apne trading strategy ko apne risk appetite aur market conditions ke hisab se customize karein. Trading mein safalta pane ke liye patience, discipline aur continuous learning ka bhi mahatvapurna role hota hai. -

#4 Collapse

Asslam o Alikum Turning top" design ko Forex mein Roman Urdu mein aksar "ghumte tint top" ya "charkhta hua top" kehte hain. Yeh ek candle design hai jo kisi bhi monetary cost diagram standard dekha jata hai. Is design mein market mein tanaza (uncertainty) ka andaza hota hai, jahan opening aur shutting costs qareeb hote hain, aur candle ka jism chota hota hai jis mein upri aur nichle shadows hote hain. Yeh design ishara karta hai ke na to khareedne ridge aur na hello there bechne grain mein kisi wazeh faiday ka faisla nahi ho raha hai, aksar pichhle pattern ke mutabiq ek palat ya jari rakhne ki taraf ishara ho saktahai. Specialized Examiners ON Turning TOP Candle Example : Turning Top" candle design ko specialized examiners forex ya anya monetary business sectors mein cost investigation karne ke liye istemal karte hain. Is design ke dekhne standard ve market feeling aur cost development ke baare mein experiences prapt karne ki koshish karte hain."Turning Top" design ki madad se investigators samajhne ki koshish karte hain ke market mein kis tarah ka tanaza (uncertainty) hai. Agar ek upar pattern (bullish pattern) ke baad turning top example aata hai, to yeh ho sakta hai ki purchasers mein thakan aa gayi hai aur market down karne ka prashna ho sakta hai. Vaise hello, agar ek neeche ki taraf pattern (negative pattern) ke baad turning top example dikhai deta hai, to yeh ho sakta hai ki dealers bhi depleted hain aur market mein inversion sharpen ka chance ho sakta hai.Lekin, turning top example ke signal ko samajhne mein ek matra candle standard nirbhar nahi kiya jana chahiye. Iske saath market setting, pattern, aur dusre specialized pointers ka bhi dhyaan rakhna zaroori hota hai.How to exchange on turning The most effective method to exchange on turning to design Turning Top" design standard exchange karte waqt, aapko kuch factors ko dhyaan mein rakhna zaroori hota hai. Yahan kuch steps hain jo aapko is design standard exchange karte waqt madadgar saabit ho sakte hain: Pattern Ko Samjhein: Pehle toh market ka pattern samjhein, kya wo upar ki taraf ja raha hai (bullish) ya neeche ki taraf (negative). Turning top example ka importance pattern ke saath juda hota hai. Affirmation Ke Liye Stand by Karein: Ek matra turning top example standard exchange karne se bachein. Is design ko affirm karne ke liye agle flame ka stand by karein. Agar next flame turning top se alag heading mein move karti hai, to aapko iska matlab samajhna chahiye. Stop Misfortune Aur Target Set Karein: Apne exchange ke liye stop misfortune aur target levels set karein. Agar aap long exchange (khareedne ki taraf) kar rahe hain, to stop misfortune specialty aur target upar rakhein. Aur agar short exchange (bechne ki taraf) kar rahe hain, to stop misfortune upar aur target specialty rakhein. Volume Aur Dusre Markers Ka Istemal: Volume aur dusre specialized markers jaise ki RSI, MACD, ya moving midpoints ka istemal karke aap apne choice ko affirm kar sakte hain. Yeh pointers aapko market feeling aur cost development ke uncovered mein aur bhi experiences de sakte hain. Risk The board: Hamesha apne exchange mein risk the board ka dhyaan rakhein. Zyada risk lene se bachein aur apne exchanging capital ka sahi istemal karein. Practice Karein: Turning top example standard exchange karne se pehle demo account standard practice karein. Isse aapko design ko samajhne aur exchange karne mein certainty hoga. News Aur Occasions Ka Dhyaan Rakhein: Significant financial news ya occasions ke samay turning top example standard exchange karne se bachein. Aise samay mein market unusual ho sakta hai.Zaroori hai ki aap apne exchanging procedure ko apne risk craving aur economic situations ke hisab se alter karein. Exchanging mein safalta sheet ke liye persistence, discipline aur consistent learning ka bhi mahatvapurna job hota hai. -

#5 Collapse

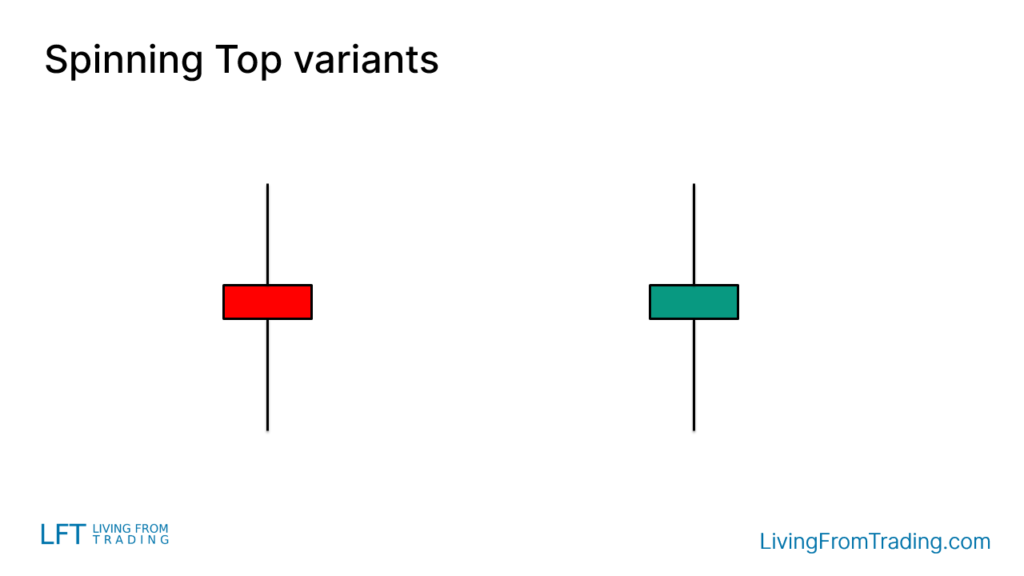

Spinning Top Pattern Spinning Top candle pattern ek candlestick pattern hota hai jo traders aur investors market analysis mein use karte hain. Is pattern mein candlestick ka body bahut chota hota hai, aur iske upper aur lower wicks (shadows) dono taraf extend hote hain. Body ka size open aur close price ke beech mein chhota hota hai, yani ke price movement kam hota hai.Interpretation aur Significance:Indecision: Spinning top pattern ka main significance indecision ko represent karna hota hai. Jab price session mein upar neeche chala jata hai aur open/close price ke beech ka difference kam hota hai, to yeh dikhata hai ke buyers aur sellers ke beech mein confusion hai.Potential Reversal: Agar spinning top uptrend ke baad dikhe, to yeh ek possible trend reversal ka sign ho sakta hai, matlab ke uptrend ke baad downward movement shuru ho sakta hai. Agar spinning top downtrend ke baad dikhe, to woh bhi ek possible trend reversal ka sign ho sakta hai, matlab ke downtrend ke baad upward movement start ho sakta hai.Confirmation Ki Zarurat: Spinning top pattern khud mein ek strong trading signal nahi hota. Traders ko iske saath confirmatory signals, jaise ke volume analysis, trendlines, aur other technical indicators ka istemal karna chahiye.Types of Spinning Tops:Long-legged Spinning Top: Isme upper aur lower wicks lambi hoti hain, indicating greater indecision.Short-legged Spinning Top: Wicks kam lambi hoti hain, lekin body bhi chota hota hai, showing a balance between buyers and sellers.Gravestone Doji: Yeh spinning top pattern hota hai jismein open, close aur low price same hote hain, aur upper wick long hota hai. Uptrend ke baad ye pattern downside reversal ka signal ho sakta hai.Dragonfly Doji: Yeh spinning top pattern hota hai jismein open, close aur high price same hote hain, aur lower wick long hota hai. Details Spinning Top candlestick pattern ke mukhtalif maaning hote hain: a. Indecision: Spinning Top candle traders ki uncertainty aur indecision ko reflect karta hai. Iska matlab hai ke buyers aur sellers ka balance ek doosray se mawazna ho raha hai. b. Potential Reversal: Agar Spinning Top uptrend ke baad aata hai to yeh potential bearish reversal ka indication ho sakta hai, jabke downtrend ke baad aata hai to potential bullish reversal ka bhi indication ho sakta hai. c. Market Sentiment: Spinning Top ki candle ki length se market sentiment ka pata chalta hai. Agar wicks ziada lambay hain, to market mein uncertainty aur volatility ziyada hai.

Details Spinning Top candlestick pattern ke mukhtalif maaning hote hain: a. Indecision: Spinning Top candle traders ki uncertainty aur indecision ko reflect karta hai. Iska matlab hai ke buyers aur sellers ka balance ek doosray se mawazna ho raha hai. b. Potential Reversal: Agar Spinning Top uptrend ke baad aata hai to yeh potential bearish reversal ka indication ho sakta hai, jabke downtrend ke baad aata hai to potential bullish reversal ka bhi indication ho sakta hai. c. Market Sentiment: Spinning Top ki candle ki length se market sentiment ka pata chalta hai. Agar wicks ziada lambay hain, to market mein uncertainty aur volatility ziyada hai. Trading Spinning top candlestick prices k top par ya bottom main ziada behtar tawar par kaam karti hai. Normal ye candle neutral tasawar ki jati hai, q k iss ki aik to small real body hoti hai aur dosra iss ka shadow kisi aik side par size ziada nahi hota hai. Bearish market main bullish trend reversal k leye buy ki entry ki ja sakti hai, jab k bullish trend main bearish trend reversal k leye sell ki entry k trades open keye ja sakte hen. Candle par trading se pehle long timeframe ka hona zarori hota hai, jab k trend reversal k leye confirmation candle ki bhi zarorat hoti hai. CCI indicator aur stochastic oscillator par trading k dowran support aur resistance levels ya overbought aur over-sold zone hona chaheye. Stop Loss candle k low ya high prices se two pips below ya above set kia ja sakta hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Spinning Top Chart Pattern: Turning top candle costs k top standard ya base primary ziada behtar tawar standard kaam karti hai. Typical ye light nonpartisan tasawar ki jati hai, q k iss ki aik to little genuine body hoti hai aur dosra iss ka shadow kisi aik side standard size ziada nahi hota hai. Negative market principal bullish pattern inversion k leye purchase ki passage ki ja sakti hai, poke k bullish pattern primary negative pattern inversion k leye sell ki section k exchanges open keye ja sakte hen. Flame standard exchanging se pehle long time period ka hona zarori hota hai, poke k pattern inversion k leye affirmation candle ki bhi zarorat hoti hai. CCI pointer aur stochastic oscillator standard exchanging k dowran support aur obstruction levels ya overbought aur over-sold zone hona chaheye. Stop Misfortune candle k low ya excessive costs se two pips underneath ya above set kia ja sakta hai. Turning top example ek solid exchanging signal nahi hota. Merchants ko iske saath corroborative signs, jaise ke volume examination, trendlines, aur other specialized pointers ka istemal karna chahiye.Types of Turning Tops:Long-legged Turning Top: Isme upper aur lower wicks lambi hoti hain, demonstrating more prominent indecision.Short-legged Turning Top: Wicks kam lambi hoti hain, lekin body bhi chota hota hai, showing a harmony among purchasers and sellers. Yeh turning top example hota hai jismein open, close aur low cost same hote hain, aur upper wick long hota hai. Upswing ke baad ye design disadvantage inversion ka signal ho sakta hai.Dragonfly Doji: Yeh turning top example hota hai jismein open, close aur excessive cost same hote hain, aur lower wick long hota hai. Chart Pattern Types: Spinning Top flame design ek candle design hota hai jo dealers aur financial backers market examination mein use karte hain. Is design mein candle ka body bahut chota hota hai, aur iske upper aur lower wicks (shadows) dono taraf broaden hote hain. Body ka size open aur close cost ke beech mein chhota hota hai, yani ke cost development kam hota hai.Interpretation aur Turning top example ka principal importance hesitation ko address karna hota hai. Hit cost meeting mein upar neeche chala jata hai aur open/close cost ke beech ka distinction kam hota hai, to yeh dikhata hai ke purchasers aur venders ke beech mein disarray hai.Potential Inversion: Agar turning top upturn ke baad dikhe, to yeh ek conceivable pattern inversion ka sign ho sakta hai, matlab ke upswing ke baad descending development shuru ho sakta hai. Agar turning top downtrend ke baad dikhe, to woh bhi ek conceivable pattern inversion ka sign ho sakta hai, matlab ke downtrend ke baad up development start ho sakta ha

Turning top example ek solid exchanging signal nahi hota. Merchants ko iske saath corroborative signs, jaise ke volume examination, trendlines, aur other specialized pointers ka istemal karna chahiye.Types of Turning Tops:Long-legged Turning Top: Isme upper aur lower wicks lambi hoti hain, demonstrating more prominent indecision.Short-legged Turning Top: Wicks kam lambi hoti hain, lekin body bhi chota hota hai, showing a harmony among purchasers and sellers. Yeh turning top example hota hai jismein open, close aur low cost same hote hain, aur upper wick long hota hai. Upswing ke baad ye design disadvantage inversion ka signal ho sakta hai.Dragonfly Doji: Yeh turning top example hota hai jismein open, close aur excessive cost same hote hain, aur lower wick long hota hai. Chart Pattern Types: Spinning Top flame design ek candle design hota hai jo dealers aur financial backers market examination mein use karte hain. Is design mein candle ka body bahut chota hota hai, aur iske upper aur lower wicks (shadows) dono taraf broaden hote hain. Body ka size open aur close cost ke beech mein chhota hota hai, yani ke cost development kam hota hai.Interpretation aur Turning top example ka principal importance hesitation ko address karna hota hai. Hit cost meeting mein upar neeche chala jata hai aur open/close cost ke beech ka distinction kam hota hai, to yeh dikhata hai ke purchasers aur venders ke beech mein disarray hai.Potential Inversion: Agar turning top upturn ke baad dikhe, to yeh ek conceivable pattern inversion ka sign ho sakta hai, matlab ke upswing ke baad descending development shuru ho sakta hai. Agar turning top downtrend ke baad dikhe, to woh bhi ek conceivable pattern inversion ka sign ho sakta hai, matlab ke downtrend ke baad up development start ho sakta ha Flame plan ko particular analysts forex ya anya money related business areas mein cost examination karne ke liye istemal karte hain. Is plan ke dekhne standard ve market feeling aur cost advancement ke baare mein encounters prapt karne ki koshish karte hain."Turning Top" plan ki madad se agents samajhne ki koshish karte hain ke market mein kis tarah ka tanaza (vulnerability) hai. Agar ek upar design (bullish example) ke baad turning top model aata hai, to yeh ho sakta hai ki buyers mein thakan aa gayi hai aur market down karne ka prashna ho sakta hai. Vaise hi, agar ek neeche ki taraf design (negative example) ke baad turning top model dikhai deta hai, to yeh ho sakta hai ki sellers bhi exhausted hain aur market mein reversal hone ka chance ho sakta hai.Lekin, turning top model ke signal ko samajhne mein ek matra candle standard nirbhar nahi kiya jana chahiye. Iske saath market setting, design, aur dusre specific pointers ka bhi dhyaan rakhna zaroori hota ha Trading View: Turning Top candle design ek aam specialized examination device hai jo dealers use karte hain market mein potential pattern inversions ya uncertainty ko recognize karne ke liye. Ismein ek chota sa body hota hai jiske upar aur neeche long shadows hote hain jo dikhaata ki is period mein cost development hui thi lekin uska shutting opening cost se kareeb ho gaya tha. Is design ko negative ya bullish dono tarah se dekh sakte hain.Bearish form of Turning Top dekhne ka matlab hai ki poke body green ya red dikhti hai to ye dikhaata hai ki solid negative opinion ne costs ko opening cost se specialty push kiya aur purchasers aa gaye aur costs ko opening level pe phir push kar diya. Yeh ek potential inversion dikhata hai kyunki bullish energy debilitating sharpen laga ha

Candle design exchanging mein istemal sharpen wala ek specialized investigation instrument hai, jisse pattern ki heading mein potenti changing ka pata lagaya jata hai. Poke kisi stock ya resource ki opening aur shutting cost ek dosray se bahut qareeb ho jatay hai, toh usay dekhnay mein ek chota genuine body ki shakal mein dikhai deti hai jo slim line se address kiya jata hai. Upper aur neeche genuine body ke wicks high aur low exchanging meeting ki taraf ishara kartay hain. Turning Top ka candle design, markets mein uncertainty ka ek sign mana jata hai, iska matlab yeh hai k koi purchasers ya venders apni control hasil nahin kar saktay. Is uncertainty ko aam peak standard up ya down major areas of strength for ky baad paaya jaata hai. Experienced brokers is design ko dekh kar apni existing exchanges mein enter aur exit kab karna hai iska investigation kartay hain. Iska istemal energy ki weariness aur potentiall inversion ka pata lagane mein bhi hota hai.

Candle design exchanging mein istemal sharpen wala ek specialized investigation instrument hai, jisse pattern ki heading mein potenti changing ka pata lagaya jata hai. Poke kisi stock ya resource ki opening aur shutting cost ek dosray se bahut qareeb ho jatay hai, toh usay dekhnay mein ek chota genuine body ki shakal mein dikhai deti hai jo slim line se address kiya jata hai. Upper aur neeche genuine body ke wicks high aur low exchanging meeting ki taraf ishara kartay hain. Turning Top ka candle design, markets mein uncertainty ka ek sign mana jata hai, iska matlab yeh hai k koi purchasers ya venders apni control hasil nahin kar saktay. Is uncertainty ko aam peak standard up ya down major areas of strength for ky baad paaya jaata hai. Experienced brokers is design ko dekh kar apni existing exchanges mein enter aur exit kab karna hai iska investigation kartay hain. Iska istemal energy ki weariness aur potentiall inversion ka pata lagane mein bhi hota hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Spinning Top Pattern Kya Hai? Spinning top pattern ek prakar ka candlestick pattern hota hai jo stock market ya financial markets mein dekha jata hai. Is pattern mein candle ki body bahut choti hoti hai aur uske upper aur lower shadows (wick) lambi hote hain. Yeh pattern market ke trend change hone ka ek possible indication deta hai.:max_bytes(150000):strip_icc()/dotdash_Final_Spinning_Top_Candlestick_Definition_and_Example_Nov_2020-01-9ebe4d0e8ccb482c92214128a29874de.jpg) Spinning Top Pattern Ki Khaasiyat: Choti Body: Spinning top pattern mein candle ki body bahut choti hoti hai, jahan open aur close prices kafi qareeb hote hain.Lambi Shadows: Is pattern mein candle ke upper aur lower shadows, yani wick, lambe hote hain. Yeh shadows candle ki body se bahut zyada extend ho sakte hain. Trend Change Ki Sambhavna: Bullish Spinning Top: Agar market up trend mein hai aur ek bullish spinning top pattern dikhai deta hai, to yeh suggest karta hai ke buying pressure kam ho rahi hai aur market ka trend change ho sakta hai.Bearish Spinning Top: Agar market down trend mein hai aur ek bearish spinning top pattern dikhai deta hai, to yeh indicate karta hai ke selling pressure kam ho rahi hai aur market ka trend change ho sakta hai. Mahatvapurn Savadhani: Spinning top pattern ek isolated signal nahi hota. Isko dusre technical indicators aur patterns ke saath combine karna zaroori hota hai taaki sahi trend prediction ho sake. Iske alawa, current market conditions aur news events ko bhi dhyan mein rakhna chahiye pattern ki sahi samajh ke liye. Sawal Ye Bhi Hai: Stock market mein invest karne se pehle, aapko thorough research karna chahiye aur agar sambhav ho toh financial expert ya advisor se salah leni chahiye.

Spinning Top Pattern Ki Khaasiyat: Choti Body: Spinning top pattern mein candle ki body bahut choti hoti hai, jahan open aur close prices kafi qareeb hote hain.Lambi Shadows: Is pattern mein candle ke upper aur lower shadows, yani wick, lambe hote hain. Yeh shadows candle ki body se bahut zyada extend ho sakte hain. Trend Change Ki Sambhavna: Bullish Spinning Top: Agar market up trend mein hai aur ek bullish spinning top pattern dikhai deta hai, to yeh suggest karta hai ke buying pressure kam ho rahi hai aur market ka trend change ho sakta hai.Bearish Spinning Top: Agar market down trend mein hai aur ek bearish spinning top pattern dikhai deta hai, to yeh indicate karta hai ke selling pressure kam ho rahi hai aur market ka trend change ho sakta hai. Mahatvapurn Savadhani: Spinning top pattern ek isolated signal nahi hota. Isko dusre technical indicators aur patterns ke saath combine karna zaroori hota hai taaki sahi trend prediction ho sake. Iske alawa, current market conditions aur news events ko bhi dhyan mein rakhna chahiye pattern ki sahi samajh ke liye. Sawal Ye Bhi Hai: Stock market mein invest karne se pehle, aapko thorough research karna chahiye aur agar sambhav ho toh financial expert ya advisor se salah leni chahiye.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:17 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим