What Is a Breakout?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Explanation of Trading device in forex buying and selling? Assalamualaikum kise ho ap sab log me bilkul thek or khariyat see ho or umeed karta ho ke ap sab log bhi bilkul thek or khariyat sebho ge aj is thread me apko Me Pakistan foreign exchange trading or ak hhot he essential subject matter trading device ke naked me btao ga or me umeed karta ho or jo records me apseproportion Karo ga woApke expertise or enjoy me zaror izafa Kare ge.The Forex market buying and selling gadget forex trading ka aik tareeqa hai jo ke tajzia ki aik collection par mabni hai taakay yeh taayun kya ja sakay ke aaya dakhlay aur ikhraj ke maqamat ke sath sath rissk managment ke miyaar ka taayun karne ke liye pehlay se tay shuda tareeqa vehicle ke sath currency ke jore ko khareedna ya bechna hai .What Is a Breakout? Brek aaؤt aek astak ke qemt hay jo brrhay hoe'ay hjm kay sath aek mtaen hmaet ya mzahmte sth say bahr hote hay۔ aek brek aaؤt tredr stak ke qemt mzahmt say aopr totnay kay horrific lmbe pozeshn men dakhl hota hay ya recreation say nechay stak totnay kay awful mkhtsr pozeshn guys dakhl hota hay۔ aek bar jb astak qemt ke rkaot say bahr tjart krta hay، atar chrrhaؤ brrh jata hay aor qemten aam tor pr brek aaؤt ke smt guys rjhan rkhte hen۔ brek aaؤt ke atne ahm tjarte hkmt amle ke ojh yh hay kh yh set ap mstqbl men atar chrrhaؤ guys azafay، qemton men brray jholon aor bht say halat guys qemt kay ahm rjhanat ka nqth aaghaz fowl۔the Forex market buying and selling system krnsyon ki tijarat ke liye aik usool par mabni nuqta nazar hai. Foreign exchange buying and selling device ko khudkaar banaya ja sakta hai kyunkay yeh bunyadi tor par sirf allogrithm hain jo ke aik tajir market ke ishaaron par chalta hai. Seekhnay ka vicar .The Forex market machine buying and selling buying and selling ke liye sakhti se qawaneen par mabni tareeqa hai. Sab se pehlay, aik tajir pairwi karne ke liye aik majmoi hikmat e amli ya tarz ka intikhab karta hai aur phir un signals aur un puts ki shanakht karta hai jo tijarat ka ishara dete hain. Aik baar tijarat ki nishandahi ho jane ke baad, forex buying and selling machine ke zariye anay wali har cheez ka taayun kya jata hai. Is par munhasir hai ke nizaam kis qader taraqqi Yafta hai, is ka seedha matlab yeh ho sakta hai ke kahan stap lagana hai aur kab munafe haasil karna hai ya yeh ziyada paicheeda ho sakta hai aur is mein pairwi shaamil hai. Allag allag asasa jaat ki classon mein karwaiyon ko barhana ya pozishnon ko hadge karne ke ikhtiyarat jaisay jaisay marketplace ka rujhan taraqqi karta rehta hai .

-

#3 Collapse

Breakout ek technical analysis concept hai, jise traders price chart patterns ke through use karte hain. Yeh ek situation hoti hai jab price ek specific level ya range ko cross karta hai, aur isse ek new trend ya price movement ka indication hota hai. Breakout patterns traders ke liye entry aur exit points identify karne mein madad karte hain. **Explanation of Breakout**: Breakout ek aise scenario ko refer karta hai jab price ek specific resistance (upper level) ya support (lower level) level ko cross karta hai. Yeh typically kisi pattern ki upper or lower boundary ko break karke hota hai, jaise ki triangle, rectangle, head and shoulders, etc. Breakout ek trend continuation ya reversal ka potential indication deta hai. **Types of Breakout**: 1. **Bullish Breakout**: Jab price resistance level ko cross karke upar badhta hai, toh yeh bullish breakout kehlata hai, aur bullish trend ka indication hota hai. 2. **Bearish Breakout**: Jab price support level ko break karke neeche jata hai, toh yeh bearish breakout kehlata hai, aur bearish trend ka indication hota hai. **Characteristics of Breakout**: - Volume ki bhi importance hoti hai, kyun ki breakout mein higher volume trend confirmation deta hai. - Breakout ke baad price movement usually substantial hota hai. **Benefits (Fawaid) of Breakout**: - Breakout patterns traders ko potential trend reversal ya trend continuation points identify karne mein madad dete hain. - Breakout points traders ko profitable entry aur exit points provide karte hain. - Breakout se traders significant price movement ka advantage utha sakte hain. **Drawbacks (Nuqsan) of Breakout**: - False breakouts ka possibility hota hai, jahan price briefly level ko cross karta hai lekin phir wapas move karta hai. - Breakout patterns ka interpretation challenging ho sakta hai, aur confirmatory signals ka istemal zaroori hota hai. **Conclusion**: Breakout ek important concept hai jo traders ko price movement aur trend direction ke bare mein insight deta hai. Lekin isey istemal karne se pehle, traders ko confirmatory signals aur dusre technical analysis tools ka istemal karna chahiye. Market mein hone wali aur hone wale events ke madd-o-jazar se pehle, proper research aur analysis karna zaroori hai. -

#4 Collapse

Breakout ek trading term hai jo ishara karta hai jab kisi financial instrument ki price ek specific level ya range ko paar karte hain. Breakout usually strong price movement ya volatility ke saath hota hai aur traders is situation mein often new trading opportunities dhoondte hain. Breakout ka matlab hota hai ke price kisi specific resistance level (upar wala had) ko paar karke upar jata hai ya fir kisi support level (neechay wala had) ko paar karke neechay jata hai. Yeh movement traders ke liye important hota hai kyun ke is se market mein trend change ho sakta hai ya fir existing trend aur zyada strong ho sakta hai. Ek Breakout situation ko recognize karne ke liye traders usually price charts aur technical indicators ka istemal karte hain. Breakout trading strategy mein traders price ke breakout ke baad new positions enter karte hain, ummid hai ke price movement unke favor mein hoga. Breakout trading mein dhyaan rakhne wali kuch important baatein hain: · Confirmations: Sirf breakout ko dekh kar trade na karen. Confirmations ke liye volume aur price movement ko closely monitor karen. · False Breakouts: Kabhi kabhi breakout fake ho sakta hai, isliye confirmations ke bina trade nahi karna chahiye. · Stop Loss: Breakout trading mein stop loss ka istemal zaroori hai takay agar trade against direction jaata hai to nuksan kam ho sake. · Volatility: Breakouts often volatility ke saath aate hain, isliye risk management par zyada focus karna chahiye. · Backtesting: Apni strategy ko pehle backtesting karen aur historical data par test karen. Breakout trading strategy advanced traders ke liye useful ho sakti hai, lekin ismein bhi risk management aur market understanding zaroori hai. -

#5 Collapse

Breakout trading aik bohot mashhoor aur mukhtalif tarikon se istamal hone wala concept hai jo traders aur investors dono ke liye bohot zaroori hai. Trading aur investment ki dunya mein, breakout ka matlab hota hai jab aik asset ka price aik mukarrar level ko cross kar leta hai jahan pehle woh ruka hota hai. Ye level support ya resistance level ho sakta hai. Aksar ye level pehle se hi established hota hai aur jab price is level ko break karta hai to nayi trends shuru ho sakti hain.

Breakout trading aik strategy hai jahan trader woh point identify karta hai jahan price aik defined level ko cross karta hai. Jab ye price level break hota hai, toh aksar price main strong movement dekhi ja sakti hai. Ye level ya toh resistance hota hai (upar ka level jahan price rukta hai) ya support hota hai (neeche ka level jahan price rukta hai). Breakout trading ka maqsad hai ke price action ko leverage karte hue profit earn kiya jaye jab market nayi direction mein move karna shuru karta hai.

Support aur Resistance Levels

Support aur resistance levels trading ke bohot important concepts hain jo breakouts ko samajhne mein madad dete hain.- Support Level: Ye woh price level hai jahan demand strong hoti hai aur price neeche girne se rukta hai. Support level pe buyers price ko aur neeche girne nahi dete.

- Resistance Level: Ye woh price level hai jahan supply strong hoti hai aur price upar chadne se rukta hai. Resistance level pe sellers price ko aur upar chadne nahi dete.

Breakouts ko mukhtalif qisamoun mein taqseem kiya ja sakta hai, kuch important types hain:- Price Breakout: Ye woh breakout hai jo jab price support ya resistance level ko cross karta hai. Ye aksar strong price movement ka signal hota hai.

- Volume Breakout: Volume breakout tab hota hai jab trading volume kisi particular level se zyada ho jata hai. High volume breakout price movement ko confirm kar sakta hai.

- Volatility Breakout: Ye tab hota hai jab market volatility ikdum se barh jati hai. Is breakout mein price bahut jaldi aur bohot zyada move karta hai.

- Chart Pattern Breakout: Chart patterns jaise ke triangles, head and shoulders, aur flags bhi breakout ko indicate karte hain. Jab price in patterns ko break karta hai toh strong trend reversal ya continuation signal hota hai.

Breakout trading strategy ko implement karne ke liye kuch steps follow kiye jate hain:- Identify Support and Resistance Levels: Pehle, aapko support aur resistance levels ko identify karna hota hai. Ye levels wo hotay hain jahan price aksar rukta hai aur reverse hota hai.

- Wait for the Breakout: Jab aap levels ko identify kar lete hain, toh agli step hoti hai breakout ka intezar karna. Isme price ka support ya resistance level ko cross karna zaroori hota hai.

- Confirm the Breakout: Breakout ko confirm karna bhi bohot zaroori hai. Aksar false breakouts bhi hotay hain jahan price temporarily level ko cross karta hai aur phir wapas chala jata hai. Confirmation ke liye aap volume, candlestick patterns aur momentum indicators ka istamal kar sakte hain.

- Enter the Trade: Jab aap breakout ko confirm kar lete hain, toh aap trade enter karte hain. Is waqt aap buy ya sell order place karte hain depending on the breakout direction.

- Set Stop Loss and Take Profit: Har trade ke saath risk management zaroori hota hai. Stop loss order place karke aap apne loss ko limit kar sakte hain. Take profit order place karke aap apne profit ko secure kar sakte hain.

- Monitor the Trade: Trade ko enter karne ke baad usko monitor karte rehna bohot zaroori hai. Market conditions jaldi se change ho sakti hain isliye aapko apne trade ko adjust karna pad sakta hai.

Breakout trading ko asaan samjha jata hai lekin isme kuch common mistakes hoti hain jo traders karte hain:- False Breakouts: Ye tab hota hai jab price temporarily support ya resistance level ko break karta hai aur phir wapas chala jata hai. Isko avoid karne ke liye confirmation bohot zaroori hoti hai.

- Lack of Patience: Breakout trading mein patience bohot zaroori hai. Bohat se traders jaldbazi mein trade enter kar lete hain bina proper confirmation ke.

- Ignoring Volume: Volume breakout ko confirm karne ke liye bohot important indicator hai. Low volume breakouts aksar successful nahi hote.

- Improper Risk Management: Stop loss aur take profit levels ko set karna bohot zaroori hota hai. Bohat se traders bina stop loss ke trade karte hain jo ke bohot risky hota hai.

Breakout trading aik effective aur profitable strategy ho sakti hai agar isko sahi tarike se implement kiya jaye. Ye strategy support aur resistance levels ko leverage karte hue market ki nayi trends ko capture karti hai. Isme sabse zaroori cheez hai patience aur proper risk management. Breakout trading ko samajhne aur effectively istamal karne ke liye practice aur continuous learning bohot zaroori hai. Trading mein successful hone ke liye aapko market ka acchi tarah analysis karna aana chahiye aur apne emotions ko control mein rakhna bohot zaroori hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#6 Collapse

What is Breakout

Assalam o Alaikum Dear Friends and Fellows, Breakout strategy aik trading technique hy jo financial markets me price movements ko exploit karti hy. Yeh strategy aksar stock, forex, aur commodities markets me use hoti hy. Is strategy ka basic aim hota hy ke jab price ek specific range ya level ko cross karti hy, to us waqt trade karna take profit kamaya ja sake. Breakout strategy ko samajhne ke liye kuch important points hein jo hume discuss karny chahiyein. Breakout trading strategy, ya Breakout Tarazu Ki Tehqeeq, ek qisam ka trading strategy hy jisme traders ko market me mojood breakout points ko dhoondhna hota hy. Ye points woh jagah hoti hein jahan price ek specific level ko cross karti hy aur phir agey move karna shuru karti hy. Is strategy me traders is ummid par kam karty hein ke jab ek asset ya stock breakout karta hy, to wo usi direction me tezi se move karega.

Breakout of range:

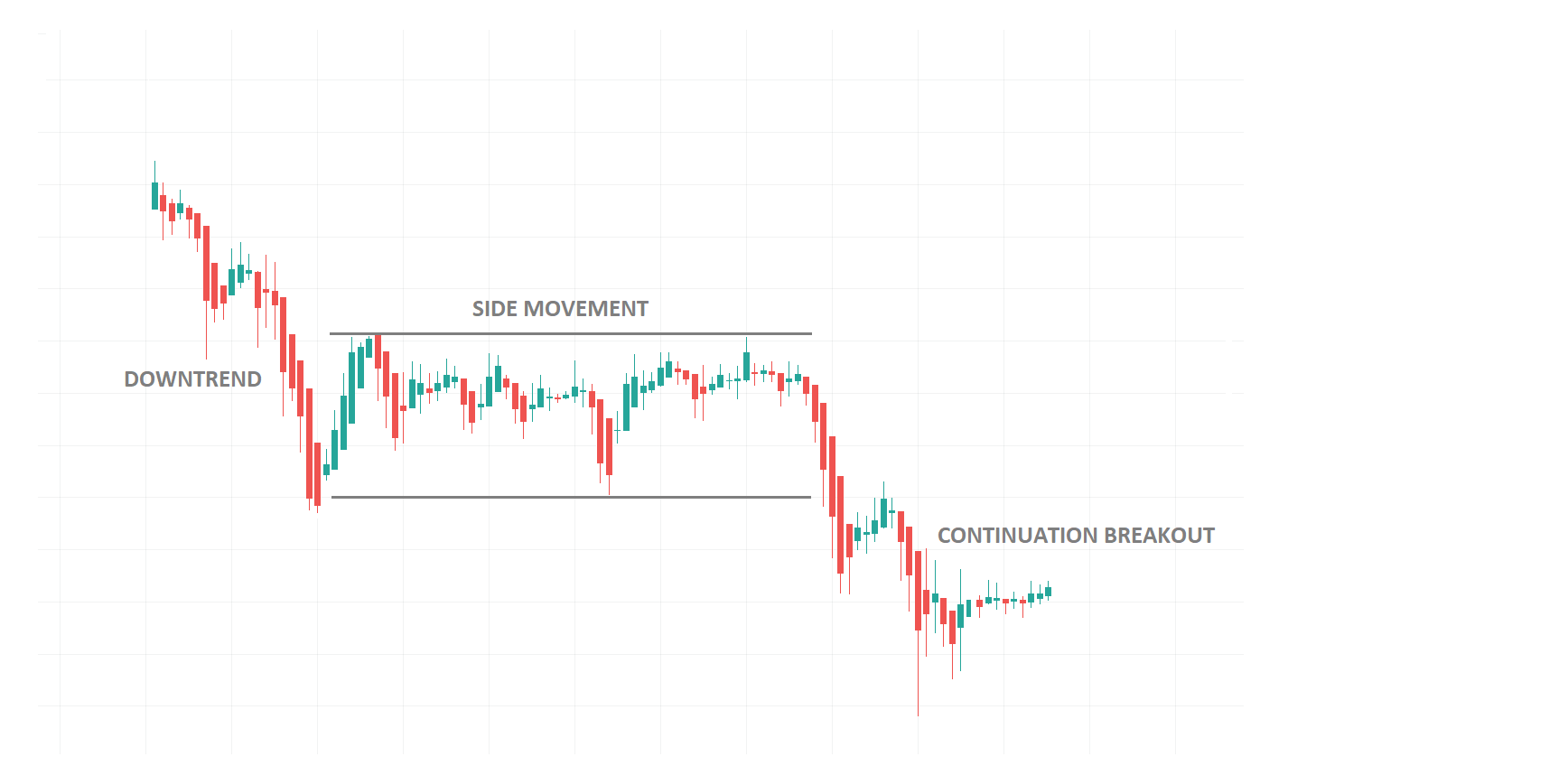

Dear members range aik aisy area ko khty hein js k nechy support ho or opar resistance ho or market in 2 support or resistance k darmyan phnsi rahy mtlb move karti rahy. Es main hum support ka breakout or resistance ka breakout dono ko discus kar laity hein. jb market range ki support ya resistance ko break kr k bhr nklti ha to esko range ka breakout kaha jata ha or es main agr support ka breakout ho to sell ki trade lyty hein jb k resistance k breakout py buy ki trade lety hein. jb market ksi bhi trend main opr ya nechy ja rahi hoti ha to wo aik trendline ko follow karti hovi jati ha.

jesa k nechy jaty hovy market lower highs bnati ha to in highs ko mla k aik trendline banti ha jo k resisting trendline kehlati ha. jb market es ko break kr k es k opr closing dy to esko breakout of trendline kaha jata ha or estrha resisting trendline k breakout py hum buy ki trade lety han

Top 5 Types of Breakouts

Breakouts different types ke ho sakty hein jo various market conditions aur price patterns ko represent karty hein. Yeh types include:- Support and Resistance Breakouts

- Trendline Breakouts

- Chart Pattern Breakouts

- Volatility Breakouts

- False Breakouts

1. Support and resistance breakouts: forex trading me sabse common breakouts hein. Support level ek aisa price point hy jahan buying pressure zyada hota hy, jo price ko niche girne se rokti hy. Resistance level ek aisa price point hy jahan selling pressure zyada hota hy, jo price ko upar badhne se rokti hy.- Support Breakout: Jab price support level ko breach karty hue niche chali jati hy, to support breakout hota hy. Yeh usually ek bearish signal hota hy jo indicate karta hy ke market downtrend me enter ho rahi hy.

- Resistance Breakout: Jab price resistance level ko breach karty hue upar chali jati hy, to resistance breakout hota hy. Yeh usually ek bullish signal hota hy jo indicate karta hy ke market uptrend me enter ho rahi hy.

Trendline breakouts us waqt hoti hein jab price ek trendline ko breach karti hy. Trendlines upward ya downward sloping lines hoti hein jo price ke high ya low points ko connect karti hein aur existing trend ko indicate karti hein.- Uptrend Breakout: Uptrend me jab price lower trendline ko breach karty hue niche chali jati hy, to uptrend breakout hota hy. Yeh bearish signal hota hy jo trend reversal indicate karta hy.

- Downtrend Breakout: Downtrend me jab price upper trendline ko breach karty hue upar chali jati hy, to downtrend breakout hota hy. Yeh bullish signal hota hy jo trend reversal indicate karta hy.

Chart pattern breakouts us waqt hoti hein jab price specific chart patterns ko complete karty hue break karti hy. Common chart patterns jo breakouts generate karty hein unme head and shoulders, double top, double bottom, triangles, aur rectangles shamil hein.- Head and Shoulders Breakout: Jab price head and shoulders pattern ki neckline ko break karty hue niche chali jati hy, to bearish breakout hota hy.

- Inverse Head and Shoulders Breakout: Jab price inverse head and shoulders pattern ki neckline ko break karty hue upar chali jati hy, to bullish breakout hota hy.

- Triangle Breakout: Triangles (ascending, descending, symmetrical) jab complete hote hein aur price triangle boundaries ko break karti hy, to breakout hota hy. Ascending triangle ka bullish breakout aur descending triangle ka bearish breakout hota hy.

Volatility breakouts: us waqt hoti hein jab market me sudden increase in volatility hoti hy jo price ko significant levels par breach karny pe majboor karti hy. Volatility breakouts usually economic news releases, geopolitical events, ya market anomalies ke natijay me hote hein.- News-Driven Breakout: Economic indicators jaise GDP, employment data, interest rate decisions ke release hone par price me sudden movements hoti hein jo volatility breakout create karti hein.

- Event-Driven Breakout: Geopolitical events jaise elections, wars, ya natural disasters bhi volatility breakouts create karty hein kyunke market sentiment sharply change hota hy.

False breakouts: us waqt hoti hein jab price temporarily support ya resistance levels ko breach karti hy lekin trend sustain nahi hota. False breakouts traders ko trap kar sakti hein aur losses generate kar sakti hein.- False Support Breakout: Jab price support level ko breach karty hue niche jati hy lekin quickly recover karke wapas support level ke upar a jati hy, to false support breakout hota hy.

- False Resistance Breakout: Jab price resistance level ko breach karty hue upar jati hy lekin quickly reverse karke wapas resistance level ke niche a jati hy, to false resistance breakout hota hy.

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

Breakout Kya Hai?

Breakout trading ka ek bohot important concept hai jo financial markets mein price movements aur trends ko analyze karne ke liye use hota hai. Breakout tab hota hai jab price ek predefined support ya resistance level ko cross karti hai aur uske baad ek new trend establish karti hai. Yeh concept stocks, Forex, commodities, aur cryptocurrencies jaise different financial instruments par apply hota hai.

Breakout Ki Types

1. Bullish Breakout:

Bullish breakout tab hota hai jab price ek resistance level ko cross karti hai aur upar ki taraf move karti hai. Iska matlab yeh hota hai ke buyers market mein zyada active hain aur price ko upar le ja rahe hain.

2. Bearish Breakout:

Bearish breakout tab hota hai jab price ek support level ko cross karti hai aur neeche ki taraf move karti hai. Iska matlab yeh hota hai ke sellers market mein zyada active hain aur price ko neeche le ja rahe hain.

Breakout Ki Importance

1. New Trends:

Breakouts new trends ka signal hote hain. Jab price ek important level ko break karti hai, toh yeh usually ek new trend ki shuruaat hoti hai.

2. Market Sentiment:

Breakouts market sentiment ko reflect karte hain. Bullish breakout indicate karta hai ke market mein optimism hai aur buyers dominant hain. Bearish breakout indicate karta hai ke market mein pessimism hai aur sellers dominant hain.

3. Trading Opportunities:

Breakouts trading opportunities ko identify karne mein madadgar hote hain. Traders breakout levels ko dekh kar entry aur exit points determine kar sakte hain.

How to Identify Breakouts

1. Support and Resistance Levels:

Support aur resistance levels ko identify karna bohot zaroori hai. Yeh levels wo points hote hain jahan price pehle ruk gayi thi ya bounce back hui thi.

2. Volume Analysis:

Volume breakout ko confirm karne mein madad karta hai. High volume ke sath breakout strong hota hai aur new trend ki confirmation provide karta hai. Low volume ke sath breakout weak hota hai aur false breakout ho sakta hai.

3. Chart Patterns:

Different chart patterns jaise ke triangles, flags, aur head and shoulders breakout signals provide karte hain. Yeh patterns market participants ke behavior ko reflect karte hain aur breakout direction ko indicate karte hain.

Example of Breakout in Action

Sochiye ke aap ek stock ka daily chart dekh rahe hain aur stock ek resistance level par consolidate ho raha hai:

1. Resistance Level:

Aapne notice kiya ke stock $50 par resistance face kar raha hai. Yeh wo level hai jahan price pehle multiple times ruk gayi thi.

2. Volume Analysis:

Aap volume bars ko observe karte hain aur dekhte hain ke jab stock $50 level ko break karta hai, toh volume significantly increase hota hai. Yeh high volume bullish breakout ko confirm karta hai.

3. Trade Execution:

Aap bullish breakout ke confirmation par buy position enter karte hain. Stop-loss order ko recent support level ke neeche set karte hain aur profit target ko previous high ya technical indicators ke basis par determine karte hain.

Advantages of Trading Breakouts

1. Clear Entry and Exit Points:

Breakout trading clear entry aur exit points provide karti hai, jo trading decisions ko simplify karte hain.

2. Potential for Large Moves:

Breakouts new trends ko indicate karte hain jo large price moves ka potential rakhte hain.

3. High Probability Setups:

Strong breakouts high probability setups hote hain jo profitable trading opportunities ko identify karne mein madadgar hote hain.

Disadvantages of Trading Breakouts

1. False Breakouts:

False breakouts common hain jahan price briefly support ya resistance level ko cross karti hai lekin phir wapas move karti hai. Yeh misleading signals generate kar sakte hain.

2. Whipsaws:

Volatile markets mein whipsaws common hote hain jahan price multiple times support aur resistance levels ko cross karti hai bina clear trend establish kiye.

3. Risk Management:

Breakout trading mein proper risk management bohot zaroori hai. Stop-loss orders aur position sizing ko effectively use karna losses ko minimize karne ke liye zaroori hai.

Conclusion

Breakout trading ek powerful strategy hai jo financial markets mein price movements aur trends ko analyze karne mein madad karti hai. Support aur resistance levels, volume analysis, aur chart patterns ka use karke traders breakout opportunities ko identify kar sakte hain aur profitable trading decisions le sakte hain. Breakout trading ko effectively use karne ke liye proper risk management aur disciplined trading approach zaroori hai. Forex, equities, commodities, aur cryptocurrencies jaise different markets mein breakout trading ko incorporate karke aap apni trading strategy ko enhance kar sakte hain aur better trading results hasil kar sakte hain. -

#8 Collapse

What Is a Breakout?

Breakout aik technical analysis term hai jo aksar financial markets, jaise stock market aur forex market mein use hota hai. Yeh term us waqt use ki jati hai jab kisi asset ka price apni support ya resistance level ko cross karta hai. Support level woh point hota hai jahan se price girte girte wapas upar jati hai, aur resistance level woh point hota hai jahan se price barh kar wapas neeche aati hai.

Jab price apni support level ko neeche cross karti hai ya resistance level ko upar cross karti hai, is action ko "breakout" kehte hain. Yeh breakout investors aur traders ke liye ek significant event hota hai kyun ke is se market ke trend mein potential change aane ke chances hote hain.

Types of Breakouts

1. Bullish Breakout:

- Yeh tab hota hai jab asset ka price apni resistance level ko cross karta hai. Is ka matlab hai ke buyers market mein strong hain aur price aur barhne ke chances hain.

- Example: Agar ek stock ka price consistently $50 pe ruk raha tha, aur achanak se $55 pe reach kar jaye, toh yeh bullish breakout kehlayega.

2. Bearish Breakout:

- Yeh tab hota hai jab asset ka price apni support level ko cross karta hai. Is ka matlab hai ke sellers market mein strong hain aur price aur girne ke chances hain.

- Example: Agar ek stock ka price consistently $50 pe ruk raha tha, aur achanak se $45 pe aa jaye, toh yeh bearish breakout kehlayega.

Importance of Breakouts

1. Trend Identification:

- Breakouts aksar new trends ko indicate karte hain. Agar bullish breakout hota hai, toh new upward trend start hone ke chances hote hain, aur bearish breakout downward trend ko indicate karta hai.

2. Trading Opportunities:

- Breakouts traders ko nayi trading opportunities provide karte hain. Jab price apne support ya resistance level ko break karta hai, traders is moment ko use kar ke buy ya sell karte hain.

3. Risk Management:

- Breakouts risk management mein bhi madadgar hote hain. Traders stop-loss orders ko strategically place karte hain taake losses ko minimize kiya ja sake agar price unke favor mein na jaye.

Conclusion

Breakouts trading aur investment strategies ka aik integral part hain. Yeh traders aur investors ko market movements ke baare mein valuable insights dete hain aur profitable trading opportunities identify karne mein madad karte hain. Magar, successful trading ke liye sirf breakouts pe rely karna theek nahi hota. Comprehensive analysis aur risk management techniques ka use bhi zaroori hai taake market volatility aur unexpected price movements se bach sakein. -

#9 Collapse

Breakout kya hai?

Stock trading mein, breakout ek aisi sthiti hai jab kisi asset ki kimat ek support ya resistance level se uper ya niche chali jaati hai. Iska matlab yeh hai ki market ki trend badal rahi hai aur yeh traders ke liye ek trading opportunity ho sakti hai.

Do prakar ke breakout hote hain:- Upward breakout: Jab koi asset apne resistance level ko todta hai aur usse uper chala jata hai. Yeh ek bullish signal hai aur yeh is baat ka sanket deta hai ki kimat badhana jari rakh sakti hai.

- Downward breakout: Jab koi asset apne support level ko todta hai aur usse niche chala jata hai. Yeh ek bearish signal hai aur yeh is baat ka sanket deta hai ki kimat girna jari rakh sakti hai.

Breakout kaise identify karein:

Breakout ko identify karne ke liye, traders aamtaur per charts ka use karte hain aur technical analysis tools ka use karte hain. Kuchh sabse aam technical indicators jo traders breakout ko identify karne ke liye use karte hain, unmen shamil hain:- Moving averages: Moving averages ek trend ka average hain jo time ke sath badalte hain. Jab koi asset apne moving average se uper ya niche chala jata hai, to yeh ek breakout ka sanket ho sakta hai.

- Support and resistance levels: Support aur resistance levels woh price points hain jahan par traders ko lagta hai ki demand aur supply ek dusre ke barabar hain. Jab koi asset in levels ko todta hai, to yeh ek breakout ka sanket ho sakta hai.

- Volume: Volume ek asset mein trade kiye jaane wale shares ki sankhya hai. Jab koi breakout ke sath high volume hota hai, to yeh is baat ka sanket hai ki breakout majboot hai aur iske barbad hone ki sambhavna kam hai.

Breakout ka use kaise karein:

Breakout ka use karke traders apne trading mein faida utha sakte hain. Yahan kuchh tarike diye gaye hain jinse traders breakout ka use kar sakte hain:

- Long positions enter karein: Jab koi asset ek upward breakout karta hai, to traders long positions enter kar sakte hain. Iska matlab hai ki ve asset ko kharid rahe hain aur is baat ki ummid kar rahe hain ki kimat badhegi.

- Short positions enter karein: Jab koi asset ek downward breakout karta hai, to traders short positions enter kar sakte hain. Iska matlab hai ki ve asset ko bech rahe hain aur is baat ki ummid kar rahe hain ki kimat giregi.

- Stop-loss orders ka use karein: Stop-loss orders ek prakar ka order hai jo jab kimat ek nishchit level tak pahunch jaati hai to apni khud ki position ko bech deta hai. Yeh traders ko nuksan ko simit karne mein madad kar sakta hai agar breakout fail ho jata hai.

Yeh dhyan rakhna important hai ki breakout hamesha sahi nahin hote hain. Kuchh breakout fail ho jaate hain aur kimat breakout ke viprit disha mein chali jaati hai. Isliye, breakout ka use karte samay hamesha stop-loss orders ka use karna important hai.

Yahan kuchh atirikt tips hain jo aapko breakout trading mein madad kar sakti hain:- Apna research karein: Kisi bhi asset mein trade karne se pahle, apna research karna aur uske fundamentals aur technicals ko samajhna mahatvpurn hai.

- Risk management ka practice karein: Koi bhi trade karne se pahle, apne risk ko samajhna aur risk management ka practice karna mahatvpurn hai.

- Emotion mein trade na karein: Trading mein emotion mein aana ek aam galti hai jo nuksan ka karan ban sakti hai. Jab aap trade kar rahe hon to hamesha shant aur objective rahen.

-

#10 Collapse

What Is a Breakout

Definition of Breakout.....

Definition of Breakout

Breakout trading forex trading ka aik bohot aham hissa hai. Jab market ki price aik specific level ko cross kar deti hai, jahan pe support ya resistance hota hai, usay breakout kehte hain. Ye aik significant move hota hai jo traders ko bohot saari trading opportunities provide karta hai.

Types of Breakouts

Support Breakout: Jab price aik specific support level ko neeche cross kar jati hai. Ye signify karta hai ke buyers ki strength kam ho rahi hai aur sellers zyada powerful ho rahe hain.

Resistance Breakout: Jab price aik specific resistance level ko upar cross kar jati hai. Ye indicate karta hai ke buyers ki strength badh rahi hai aur sellers ki power kam ho rahi hai.

Importance of Breakouts

Breakouts trading mein ek critical role play karte hain. Jab price ek breakout karti hai, to ye usually strong price movement ka shuruwaat hoti hai. Isse traders ko trend ko identify karne aur capitalize karne ka moka milta hai.

Identifying Potential Breakouts

Breakout identify karne ke liye traders kaafi techniques use karte hain, jaise ke:

Chart Patterns: Patterns jaise ke triangles, head and shoulders, and flags potential breakouts ko identify karne mein help karte hain.

Volume Analysis: Volume analysis bhi kaafi madadgar hota hai. Jab price ek significant level ko break karti hai aur volume high hota hai, to ye breakout ke confirmation ka signal hota hai.

Technical Indicators: Indicators jaise ke Moving Averages, Bollinger Bands, and RSI bhi breakouts ko identify karne mein madad karte hain.

Trading Breakouts

Breakout trading ka ek popular method hai. Lekin, isme kuch risks bhi involve hote hain, jo traders ko manage karne hote hain.

Entry and Exit Points: Jab price breakout karti hai, to entry aur exit points ka selection critical hota hai. Entry point tab choose karna chahiye jab price ek significant level ko cross kare, aur exit point set karna chahiye jahan pe profit booking ki zarurat ho.

Stop-Loss Orders: Stop-loss orders lagana zaroori hota hai taake unexpected price movements se protect kiya ja sake. Ye orders ek predefined level pe set kiye jate hain jahan pe trader apni position close kar leta hai taake zyada losses na ho.

False Breakouts

False breakouts bhi kaafi common hote hain jahan price ek significant level ko cross kar leti hai, lekin phir wapas ussi range mein aajati hai. False breakouts ko avoid karne ke liye:

Confirmation: Ek strong confirmation ka wait karna chahiye, jaise ke high volume ya ek sustained move in the breakout direction.

Multiple Indicators: Multiple indicators ka use karna chahiye taake breakout ka confirmation mile. Agar different indicators same signal de rahe hain, to breakout ke success ka chance zyada hota hai.

Breakout Strategies

Trendline Breakout: Trendlines use karke breakouts ko identify kiya jata hai. Jab price ek trendline ko break karti hai, to ye ek strong breakout ka signal hota hai.

Range Breakout: Jab price ek range mein trade kar rahi hoti hai aur phir us range ko break karti hai, to range breakout strategy use hoti hai.

Pullback Breakout: Is strategy mein trader breakout ke baad pullback ka wait karta hai. Jab price wapas breakout level ke paas aati hai, to trader entry leta hai.

Risk Management in Breakout Trading

Position Sizing: Position size ko manage karna zaroori hota hai taake risk ko control kiya ja sake. Traders apni capital ka sirf ek chota portion risk mein daalte hain.

Diversification: Diversification bhi important hota hai. Ek hi asset pe zyada dependency se avoid karne ke liye different assets mein trade karna chahiye.

Monitoring: Breakout trading ke dauran market ko closely monitor karna hota hai taake timely decisions liye ja sakein.

Conclusion

Breakout trading forex trading mein ek powerful strategy hai, jo significant price movements ko capture karne ka moka deti hai. Lekin, isme risks bhi involve hote hain, jo proper analysis aur risk management techniques se mitigate kiye ja sakte hain. Breakouts ko effectively trade karne ke liye proper tools aur strategies ka use karna zaroori hota hai.

-

#11 Collapse

What is Bearkout

Ek breakout ek trading term hai jo iska matlab hai ki ek security ya ek market index ek naye high ya naye low par pahunch gaya hai, ya ek specific level ko cross kar gaya hai. Ye ek important event hai kyunki ye ek naye trend ki shuruaat ho sakta hai.

Breakout ki visheshataen:

Ek breakout ek sudden aur unexpected movement hai.

Ek breakout ek specific level ko cross karta hai.

Ek breakout ek naye trend ki shuruaat ho sakta hai.

Ek breakout traders ko buy ya sell signals deta hai.

Breakout ki types:

1. Bullish breakout:

Ye ek breakout hai jo ek security ya ek market index ek naye high par pahunch gaya hai.

2. Bearish breakout:

Ye ek breakout hai jo ek security ya ek market index ek naye low par pahunch gaya hai.

3. Fake breakout:

Ye ek breakout hai jo ek false signal deta hai.

Breakout ki strategy:

1. Buy ya sell signals:

Ek breakout traders ko buy ya sell signals deta hai.

2. Trend following:

Ek breakout ek naye trend ki shuruaat ho sakta hai.

3. Risk management:

Ek breakout traders ko risk management mein madad karta hai.

Breakout ki faide:

1. Ek breakout traders ko buy ya sell signals deta hai.

2. Ek breakout traders ko trend following mein madad karta hai.

3. Ek breakout traders ko risk management mein madad karta hai.

4. Ek breakout traders ko profit mein madad karta hai.

Conclusions

Ek breakout ek important event hai kyunki ye ek naye trend ki shuruaat ho sakta hai. Traders ko breakout ki settings aur strategy market ki conditions aur traders ki strategy par depend karti hai. -

#12 Collapse

What Is a Breakout?

Breakout trading ek mashhoor strategy hai jo traders istemal karte hain jab market prices ek specific range ko cross karti hain. Yeh range ek support aur resistance levels se define hoti hai. Jab price is range se bahar nikalti hai, yeh breakout kehlata hai aur yeh signify karta hai ke market mein nayi trend shuru ho sakti hai.

Breakouts do tarah ke hote hain: bullish aur bearish. Bullish breakout tab hota hai jab price resistance level ko cross karke upar chali jati hai. Iska matlab yeh hota hai ke buyers market mein dominate kar rahe hain aur prices aur upar ja sakti hain. Bearish breakout tab hota hai jab price support level ko cross karke neeche chali jati hai, jo indicate karta hai ke sellers dominate kar rahe hain aur prices aur neeche ja sakti hain.

Breakout trading ke liye pehle traders ko support aur resistance levels identify karne hote hain. Support level woh hota hai jahan price bar-bar gir kar wapas upar chali jati hai, aur resistance level woh hota hai jahan price bar-bar upar jakar wapas neeche aati hai. Jab price in levels ko break kar deti hai, toh yeh signal hota hai ke market mein nayi movement start hone wali hai.

Breakout trading mein entry points identify karna zaroori hota hai. Bullish breakout ke liye entry point woh hota hai jab price resistance level ke upar close hoti hai. Bearish breakout ke liye entry point woh hota hai jab price support level ke neeche close hoti hai. Entry ke baad traders ko apne trades manage karne hote hain aur stop-loss orders lagane hote hain taake losses ko minimize kiya ja sake.

Breakout trading ke fayde bohot hain. Sabse pehla fayda yeh hai ke yeh clear signals provide karta hai jab market ek new trend mein enter kar rahi hoti hai. Yeh strategy simple hoti hai aur isme technical analysis ka istemal hota hai jo most traders ke liye accessible hota hai. Dusra fayda yeh hai ke breakout trading se large price movements capture ki ja sakti hain jo significant profits de sakti hain.

Lekin breakout trading mein kuch challenges bhi hain. False breakouts ek common issue hain jahan price temporarily breakout karti hai aur phir wapas range mein aajati hai. Iski wajah se traders ko losses face karne padte hain. Is problem se bachne ke liye, traders ko confirmation signals ka intezar karna chahiye aur multiple time frames ko analyze karna chahiye.

In conclusion, breakout trading ek powerful strategy hai jo market trends ko identify aur capitalize karne mein madadgar hoti hai. Isme success pane ke liye traders ko support aur resistance levels ko accurately identify karna hota hai aur apne risk management techniques ko implement karna hota hai. Breakout trading ke saath, traders market opportunities ko effectively utilize kar sakte hain aur significant profits generate kar sakte hain.

- CL

- Mentions 0

-

سا1 like

-

#13 Collapse

What Is a Breakout?

Breakout trading ek bohot mashhoor aur important technique hai jo traders forex, stocks, commodities, aur cryptocurrencies mein istemal karte hain. Jab price ek specific range ya level se bahar nikalta hai, uss movement ko breakout kehte hain. Yeh technique usually strong price movements ko predict karne ke liye use hoti hai, jo ke significant profit opportunities provide karti hai.

Breakout do tarah ke hotay hain: upside breakout aur downside breakout. Upside breakout tab hota hai jab price resistance level ko cross kar jata hai, yani ek aise level ko jo price ke upper movement ko roknay ki koshish kar raha hota hai. Iska matlab hai ke buyers ki strength zyada ho gayi hai aur price aur ooper jaane ki umeed hai. On the other hand, downside breakout tab hota hai jab price support level ko break kar deta hai, yani ek aise level ko jo price ke niche girnay se roknay ki koshish kar raha hota hai. Yeh indicate karta hai ke sellers dominate kar rahe hain aur price aur niche ja sakti hai.

Breakout trading mein successful hone ke liye kuch important factors ko dekhna zaroori hai:- Volume: Volume ko dekhna bohot zaroori hai. High volume ke sath breakout zyadah reliable hota hai, kyun ke yeh indicate karta hai ke market participants naye trend mein interest le rahe hain. Agar volume low ho, to breakout ka false hone ka chance badh jata hai.

- Chart Patterns: Breakouts usually chart patterns se associate hote hain, jaise ke triangles, rectangles, head and shoulders, etc. Yeh patterns breakouts ko identify karne mein help karte hain aur market sentiment ko samajhne mein madadgar hote hain.

- Retest: Kabhi kabhi breakout hone ke baad price wapas aakar uss level ko retest karti hai jisko break kiya tha. Agar price wapas bounce karti hai aur breakout level hold karti hai, to yeh aur bhi strong confirmation hota hai ke breakout genuine hai.

- Stop-Loss Orders: Breakout trading risky ho sakti hai, isliye risk management bohot zaroori hai. Stop-loss orders lagane se aap apne losses ko control mein rakh sakte hain. Yeh orders automatically aapki position ko close kar dete hain agar price aapke against jaye.

- Timeframes: Breakouts alag-alag timeframes par ho sakte hain, jese ke daily, hourly, aur minute charts. Higher timeframes usually zyada reliable breakouts dete hain kyunke yeh broader market trend ko reflect karte hain.

Breakout trading beginners ke liye thoda challenging ho sakta hai, lekin practice aur patience ke sath yeh ek profitable strategy ban sakti hai. Hamesha market conditions ko analyze karein aur apni trading strategy ko disciplined tarike se follow karein. Is tarah, aap breakout trading se consistent profits kama sakte hain aur apne trading goals achieve kar sakte hain. -

#14 Collapse

What Is a Breakout:

Breakout trading ek important concept hai jo traders bohot zyada use karte hain, especially technical analysis mein. Breakout tab hota hai jab price ek specific level ko cross karta hai, jo pehle resistance ya support level ke tor par kaam karta tha. Breakout trading ka main idea yeh hai ke jab price ek significant level ko cross karta hai, toh price action mein ek significant movement aasakti hai.

Breakouts do tarah ke hote hain: support level break aur resistance level break. Support level break tab hota hai jab price ek lower level ko cross kar ke niche girta hai. Yeh bearish signal hota hai, aur is se yeh indication milti hai ke price further niche ja sakti hai. Resistance level break tab hota hai jab price ek upper level ko cross karta hai. Yeh bullish signal hota hai aur is se yeh indication milti hai ke price further upar ja sakti hai.

Breakout trading ke liye kuch important tools aur techniques hain jo traders use karte hain. Sab se pehle, support aur resistance levels ko identify karna bohot zaroori hai. Yeh levels wo hain jahan price pehle rukta ya revers hota raha hai. Technical indicators jaise ke moving averages, Bollinger Bands, aur Relative Strength Index (RSI) bhi use kiye ja sakte hain taake breakouts ko identify kiya ja sake.

Jab breakout ho jata hai, traders aksar volume ko bhi check karte hain. High volume ka hona indicate karta hai ke breakout strong hai aur price move ko sustain kar sakta hai. Low volume breakout ka matlab yeh hota hai ke move shayad fake ho aur price wapas support ya resistance level ke andar aa jaye.

Breakout trading strategy mein kuch risks bhi hain. Kabhi kabhi price false breakout karti hai, yani price briefly ek level ko cross karti hai aur phir wapas return hoti hai. Is se traders ko losses ho sakte hain. Is liye stop-loss orders lagana zaroori hai taake potential losses ko minimize kiya ja sake.

Ek example ke tor par, agar ek stock ka resistance level $100 per share hai aur price us level ko cross karta hai, toh breakout trader yeh samjhega ke stock price further upar ja sakti hai. Is situation mein, trader stock ko buy kar sakta hai aur ek stop-loss order ko us level ke niche set kar sakta hai.

Breakout trading disciplined approach demand karti hai aur successful hone ke liye proper analysis aur risk management strategies ko follow karna zaroori hai. Jab sahi tarike se ki jaye, breakout trading ek profitable strategy ban sakti hai jo traders ko significant returns de sakti hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

**Breakout Kya Hai? Forex Trading Mein Iska Role Aur Importance**

Forex trading mein "breakout" ek important concept hai jo traders ko price movements aur market trends ko samajhne mein madad karta hai. Breakout ka matlab hai ke price ek specific level ko cross kar jati hai, jo trend reversal ya trend continuation ka indication ho sakta hai. Is post mein hum breakout ke concept, types aur forex trading mein iski importance ko detail mein samjhenge.

### Breakout Kya Hai?

Breakout tab hota hai jab price chart par koi major support ya resistance level ko break karti hai. Yeh level woh price point hota hai jahan price pehle se stable thi ya jahan price ka movement restrict hota hai. Jab price is level ko cross karti hai, to yeh market mein significant change ko indicate karta hai, jo traders ke liye trading opportunities create karta hai.

### Types of Breakouts

1. **Bullish Breakout:** Bullish breakout tab hota hai jab price resistance level ko upward direction mein cross karti hai. Yeh usually bullish trend continuation ya new bullish trend ka signal hota hai. For example, agar ek currency pair ka resistance level 1.2000 hai aur price usse upar move karti hai, to yeh bullish breakout ko indicate karta hai.

2. **Bearish Breakout:** Bearish breakout tab hota hai jab price support level ko downward direction mein cross karti hai. Yeh usually bearish trend continuation ya new bearish trend ka signal hota hai. For example, agar ek currency pair ka support level 1.1000 hai aur price usse niche move karti hai, to yeh bearish breakout ko indicate karta hai.

### Breakout Ka Use in Forex Trading

1. **Trading Opportunities:** Breakouts traders ko new trading opportunities provide karte hain. Jab price breakout hota hai, to traders is movement ka faida uthane ke liye trades open karte hain. Bullish breakouts ke liye buy trades aur bearish breakouts ke liye sell trades execute kiye jate hain.

2. **Confirmation:** Breakout ke signals ko confirm karna zaroori hota hai. Traders technical indicators jaise Moving Averages, Relative Strength Index (RSI), aur volume analysis ka use karke breakout ki authenticity ko confirm karte hain. Confirmed breakouts zyada reliable aur profitable hote hain.

3. **Risk Management:** Breakouts ke dauran risk management zaroori hota hai. Stop-loss orders ko use karke traders apne trades ko protect karte hain aur unexpected market movements se bachav karte hain. Risk-reward ratio ko analyze karke trades ko manage kiya jata hai.

### Practical Tips

1. **Pre-Breakout Analysis:** Breakout ke potential ko analyze karne ke liye pre-breakout analysis zaroori hota hai. Traders ko support aur resistance levels ko identify karna chahiye aur market conditions ko closely monitor karna chahiye.

2. **Volume Analysis:** Breakout ki authenticity ko confirm karne ke liye volume analysis helpful hoti hai. High trading volume breakout ke saath zyada reliable hota hai, jabke low volume breakout less significant ho sakta hai.

3. **Post-Breakout Strategies:** Post-breakout strategies ko implement karna bhi zaroori hota hai. Traders ko breakout ke baad price action ko track karna chahiye aur apne trading positions ko adjust karna chahiye.

### Conclusion

Forex trading mein breakout ek crucial concept hai jo traders ko price movements aur market trends ko samajhne mein madad karta hai. Bullish aur bearish breakouts trading opportunities ko create karte hain, lekin inke signals ko confirm karna aur risk management apply karna zaroori hota hai. Pre-breakout analysis, volume analysis, aur post-breakout strategies ko use karke traders breakout se maximum benefit utha sakte hain aur apne trading decisions ko enhance kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:16 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим