Understanding Shooting Star Candlestick Pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

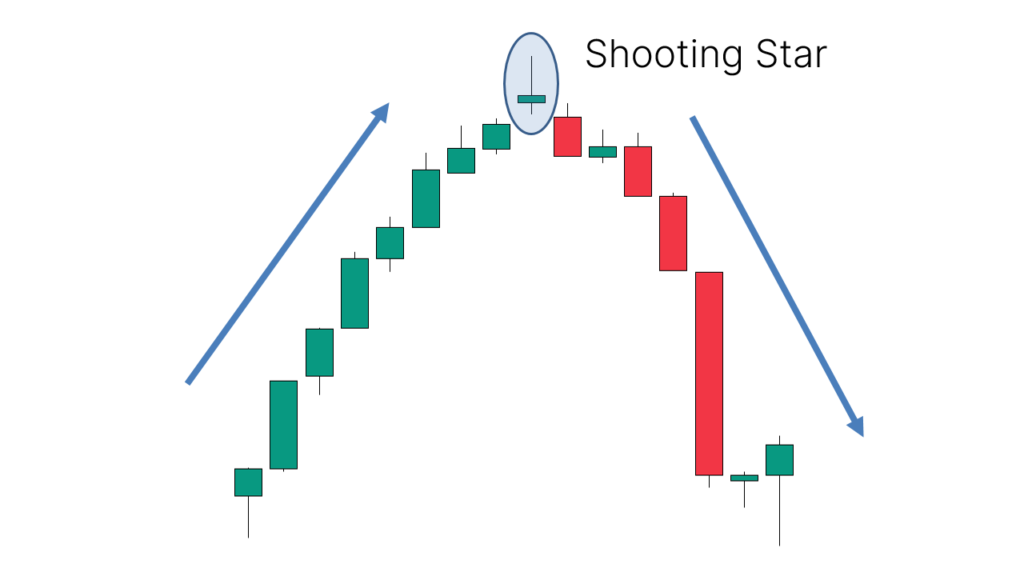

Understanding Shooting Star Candlestick Pattern forex market mein taking pictures star candlestick pattern aik Japan ke candlestick pattern hota hiya laken stop mein price gerte hello or start mein bohut he near pohnch jate howdy shooting megastar candlestick pattern start mein bohut he kareeb pohnch jata good day bearish shoting megastar sample up trend mein zahair hota hello yeh forex market mein up trend kay cease mein zahair hota hiya or frex market kay fashion kay reversal janay ko suggest karta good day tahum jaisay jaisay buying and selling consultation end ke taraf jata hi there foreign exchange marketplace mein consumer manage ko kho daytay hein vendor forex market mein aa jatay hein end fee start fee mein wapes aa jate hello taking pictures celebrity ke price motion mein anay kay ley reversal confirmation ko perceive kartay hein jahan par forex marketplace mein charge gerte hellochange with shooting star pattern forex market mein es candlestick sample kay sath exchange kartay time market mein access honay say pehlay sample ke confirmation zaroor kar saktay hein

yeh forex marketplace mein lively jare fashion hona chihay forx marketplace mein candlestick ke ody lengthy top shadow hona chihay yeh forex market mein anay wallay bearish kay trend ko tabdel bhe kar sakte hein foex marketplace mein candlestick sample kay sath anay wallay buying and selling consultation mein indicate kar saktay hein result kay tor par impact karnay kay ley mumkana buying and selling session ko tabdel bhe kar taking pictures megastar candlestick sample aik precise candlestick pattern whats up jokeh foreign exchange marketplace mein fashion ke route mein tabdele ke taraf eshara karte good day fore market yeh candlestick sample Japanese candlestick sample mein say aik hiya es candlestick par change karnay kay ley apni fairness ko safe rakhnay kay ley safe forestall loss ka bhe estamal karna chihaysaktay hein or mumkana loss ko kam karnay kay ley effective tarekay say kam kar saktay hein

- Mentions 0

-

سا0 like

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Shooting Star Candlestick Pattern

Shooting star candlestick aik single candle hone k bawajood bhi aik strong bearish trend reversal pattern ka kaam karti hai, jo aam tawar par market mein ziada bande hen. Shooting star candlestick patterns technical analysis mein tajiron ke zariye istemal hote hain upcoming bearish trends ko predict karne ke liye. Price ke decline ko signal mana jata hai ke sellers ne market ka qabza le liya hai. Shooting stars ke sath trade karne ke liye, investors ko teen ahem points par focus karna chahiye jo ke entry point dhoondhna, stop-loss ka istemal aur target profit decide karna shamil hain. Traders aam tor par shooting star pattern ko dekhne ke baad continuous candlestick pattern ka intezar karte hain taake price decline ko confirm kar sakein. Agar shooting star ke baad aane wala pattern bhi price drop ko indicate kare to wo selling ya shorting jaise options consider karte hain. Shooting star patterns, traders ko upcoming market trends ke basis par trading decisions lene mein madad karte hain.

Ek shooting star candlestick aik qisam ka price chart pattern hai jo tab banta hai jab kisi security ki price initially opening ke baad barh jaati hai aur phir market close hone se pehle opening price ke qareeb aa jati hai. Shooting star candlestick aik choti body, lambi upper shadow ya wick jo ke price ke increase aur buying pressure ko indicate karti hai aur choti lower shadow ya wick jo ke price drop ko indicate karti hai, se mil kar bana hota hai. Shooting star candlesticks bearish market trend ke aghaz ko signify karti hain jahan prices decline karna shuru karti hain. Bearish trend reversals ko do ya teen consecutive candlestick patterns ko analyze karne ke baad confirm kiya jata hai, maximum certainty ke liye.

Shooting stars ke teen ahem faiday shamil hain unko asani se dekhna aur samajhna aur upcoming price trends ko identify karna. Shooting star patterns ke do ahem nuqsanat shamil hain unka false signals produce karne ka rujhan aur price trend ko confirm karne ke liye ek se zyada candlestick patterns ka zaroori hona. Total 35 candlestick patterns hain jismein se 7 main ones morning star, hammer, inverted hammer, piercing pattern, shooting star, hanging man aur doji shamil hain.

Shooting Star Candlestick kya hai?

Shooting star candlestick aik price pattern hai jo tab banta hai jab kisi security ki price open hoti hai aur pehle advance karti hai aur phir decline karti hai aur opening price ke qareeb gir jaati hai. Shooting star candlestick patterns price reversal ke aghaz ko signal karte hain jahan trend bearish banne lagti hai. Shooting star candlesticks ek choti body, lambi upper tail aur choti lower tail par mushtamil hoti hain. Kabhi kabhi kuch shooting stars mein lower tail nahi hoti.

Shooting star ka body candlestick ka wide hissa hota hai jo ke opening aur closing prices ke difference ko represent karta hai. Lambi upper wick opening price se highest price ke advance price ko represent karti hai. Lower short wick market close par price drop ko represent karti hai jo ke opening price ke qareeb ya neeche hoti hai. Shooting star ka body green ya red rang mein hota hai. Green body signify karti hai ke opening price closing price se kam hai, halanke dono bohat qareeb hoti hain. Red body signify karti hai ke opening price closing price se zyada hai. Shooting star candlestick pattern ko parhte waqt investors aur traders ko teen aspects par dhyan dena chahiye jo ke active price trend at the opening of the shooting star, price drop jo ke day ke latter half mein hoti hai, aur trend ko confirm karne ke liye following days ke candlesticks ka istemal.

Shooting star candlestick pattern ke doran price drop ke sath banne wala pattern ek shooting star ke zameen ki taraf tez raftar harkat karte hue atmosphere mein crash hone aur jal jaane ke mamool se milta julta hai.

Shooting star candlestick patterns traders ko market mein upcoming bearish trends ke bare mein batate hain. Jo traders shooting star patterns ko candlestick price charts mein dekhte hain, wo agle din ke pattern ka intezar karte hain. Traders market trend ko bearish samajhte hain agar shooting star candlestick pattern ke baad ka pattern bhi price drop ko reflect kare. Traders apne trading decisions shooting star patterns ke basis par lete hain. Traders sell karte hain ya shorting ko resort karte hain agar shooting star pattern ke baad wale patterns bhi price drop ko indicate karein.

Shooting Star Candlestick Pattern kaise structured hota hai?

Shooting star candlestick real body, lambi upper tail ya wick aur choti ya koi lower tail ya wick ke sath structured hota hai. Shooting star candlestick ka structure market close par price ke rapid downward movement ko represent karta hai. Ek candlestick pattern ko shooting star consider karne ke liye upper wick ka length candlestick body ke length se kam az kam do guna hona chahiye.

Shooting star opening ke sath price advance ke sath open hota hai kyunke security ke liye high demand hoti hai aur buyers security ko purchase karte rehte hain. Day ke end mein, price neeche gir jati hai jo ke opening price ke neeche ya qareeb hoti hai. Lambi upper wick jo ke tail ya shadow bhi kehlati hai, buying pressure se selling pressure ke transition ko represent karti hai, jaise buyers jo din mein purchases karte hain wo price decrease ke sath apne gains kho dete hain. Short lower shadow, wick ya tail tab banta hai jab sellers price ko opening price se neeche dhakel dete hain. Shooting star patterns do types ke hote hain red shooting stars aur green shooting stars.

Shooting Star Candlestick Pattern ko Technical Analysis mein kaise parhein?

Technical analysis mein shooting star candlestick pattern parhne ke liye teen cheezon ko consider karna chahiye.- Pehli baat, investors aur traders ko price advance ka note lena chahiye. Jaise image mein dekha ja sakta hai, shooting star ek bullish prior trend ke end par hota hai. Shooting star candlestick pattern mein, price market opening ke baad kaafi zyada advance karti hai. Sharp price increase buying pressure ka zikar hai jo ke past bullish period se mojood hoti hai. Buyers ke number ke barhne ke sath candlestick ka wick lamba hota jata hai.

- Doosri baat, investors aur traders ko din ke baad rapid price drop ka dhyan rakhna chahiye. Jaise image mein dekha gaya hai, shooting star candlestick pattern mein, price din ke latter half mein significant advance ke baad drop karna shuru hoti hai. Phir, price gir kar security ke opening price ke qareeb aati hai, candlestick ka body bohat chota banata hai. Prices ke decline ka sabab sellers ke number mein izafa hai jo ke security ki price ko din ke opening price ke qareeb dhakel dete hain. Lambi wick shooting star ka wo sellers ke liye khara hota hai jo din ke aage chalne ke sath buyers par qabza kar lete hain.

- Teesri baat, investors aur traders jo shooting star candlestick pattern ko parhte hain unhein trend reversal ko confirm karna hota hai. Trend confirmation ke liye, investors aur traders ko candlestick patterns ka dhyan rakhna chahiye jo shooting star patterns ke baad aate hain. Jaise image depict karti hai, candlesticks jo shooting star pattern ke baad hoti hain wo price decline ko depict karti hain jismein closing prices declining hoti hain. Trend ko bearish tab mana jata hai agar shooting star ke baad aane wala pattern bhi price drop depict kare. Aise cases mein, shooting star candlestick patterns upcoming bearish price reversals ke signals hote hain. Shooting star candlestick patterns ki accuracy aur reliability un candlestick patterns par depend karti hai jo shooting star candlestick pattern ke baad hoti hain.

Shooting Star Candlestick Pattern Technical Analysis mein kitna accurate aur reliable hai?

Shooting star candlestick ko sab se reliable candlestick patterns mein se ek mana jata hai. Shooting star candlestick patterns ki accuracy vary karti hai un candlestick patterns ke madad se jo shooting star candlestick ke baad hoti hain. Trend tab confirm hota hai ke wo bearish trend hai agar shooting star ke baad aane wala candlestick pattern price decline depict kare. Kabhi kabhi shooting star pattern ke baad aane wala candlestick pattern price increase show karta hai. Aise cases mein, shooting star ko false signal mana jata hai. A price increase jo shooting star ke turant baad hota hai wo resistance area banne ka ishara bhi kar sakta hai candlestick ke ird gird. Resistance area price chart par wo point hota hai jahan security ko specified time frame mein break aur move above karne mein mushkilat ka samna hota hai.

Shooting star candlesticks ko technical analysis mein sab se reliable candlestick patterns mein se ek mana jata hai. Lekin, upcoming trend tab confirm hoti hai jab shooting star ke baad ka pattern analyze kiya jata hai. Trend ko bearish mana jata hai agar shooting star ke baad ka candlestick pattern price mein downward movement show kare. Lekin, kuch scenarios mein shooting star ke baad ka candlestick pattern upward price movement show karta hai.

Aise cases mein, shooting star ko false signal mana jata hai. Investors aur traders ko ideally shooting star ke baad ke patterns ko teen din tak analyze karna chahiye, taake wo carefully aur well-thought-out trading decisions le sakein.

Stock Market mein Shooting Star Candlestick Pattern ke Saath Kaise Trade Karein?

Shooting star candlestick patterns ke sath trade karte waqt investors aur traders ko teen ahem criteria yaad rakhne chahiye jo ke neeche list kiye gaye hain aur ek price chart ke sath depict kiye gaye hain jo shooting star candlestick patterns ke sath trade karte waqt follow karne ke steps dikhata hai.- Entry Point Ka Faisla Karna

Shooting star candlesticks ke sath trade karte waqt pehli cheez entry point ka faisla karna hai. Traders ko active price trend check karna zaroori hai. Jaise image mein dekha ja sakta hai, shooting star ek bullish uptrend ke end par hota hai. Investors ko trade tab hi enter karna chahiye jab trend bullish ho aur security price increase ho rahi ho. Shooting star pattern ko confirm karna chahiye jab active bullish trend identify ho jaye. Shooting star pattern ko confirm karne ke liye, investors ko ek choti body aur lambi wick wala candlestick identify karna chahiye aur candlestick ko shooting star ke body ke lowest price point se neeche drop hone ka intezar karna chahiye. Image above depict karti hai shooting star ka look jiski choti real body aur lambi upper shadow aur wick hoti hai. - Stop-Loss Order Ka Istemaal Karna

Dusri key point shooting star candlestick pattern ke sath trade karte waqt yaad rakhna stop-loss order ka istemal hai. Stop-loss order ek pre-decided order hota hai jo state karta hai ke security ko khareed ya bech sakte hain jab wo ek certain price known as the stop price ko reach kar le. Stop-loss orders trading ke loss ko reduce karne mein madad karte hain aur profitable position ko lock karte hain. Shooting stars ke sath trade karte waqt stop-loss orders enter karna advisable hota hai kyunke ye investors ko huge losses incur karne se bachaata hai jab price plummet karti hai. Jaise image above mein dikhaya gaya hai, stop-loss order upper wick ke right above place kiya ja sakta hai taake losses minimize ho sakein aur maximum returns mil sakein. - Profit Target Ka Faisla Karna

Shooting star candlestick ke sath trade karte waqt teesra key step price target ka faisla karna hai. Price target candlestick pattern ke length ke barabar hona chahiye taake maximum returns gain ho sakein. Jaise image mein dikhaya gaya hai candlestick ka length body ke base se upper shadow ya wick ke tip tak measure kiya jata hai. Minimum target trading strategy ke liye poore candlestick ke length ka teen times rakha jata hai, jaise blue arrow se image above mein depict kiya gaya hai.

Shooting star candlestick patterns ke sath trade karte waqt selling aur shorting do commonly used methods hain jo shooting star candlestick patterns ke sath trading mein achi returns deti hain. Ideal time shooting star candlestick ka use karke trade karne ka tab hai jab pattern do ya teen consecutive highs ke baad form hua ho.

Shooting Star Candlestick ke Faiday Kya Hain?

Shooting star candlesticks ke teen ahem faiday neeche list kiye gaye hain.- Spot Karne Mein Aasani

Shooting star candlestick patterns ka main faida ye hai ke unhein price chart par asani se spot kiya ja sakta hai. Shooting star candlesticks ko choti body aur lambi upper wick se asani se identify kiya ja sakta hai. Jo traders naye hain aur beginners bhi shooting star candlestick pattern ko asani se dekh sakte hain. - Samajhne Mein Aasani

Shooting star candlesticks ka dusra main faida unki simplicity hai. Shooting star candlesticks straightforward patterns hain jo even beginners bhi bohot asani se samajh sakte hain. - Upcoming Price Trends Ko Predict Karne Mein Useful

Shooting star candlesticks ka teesra main faida ye hai ke ye upcoming price trends ko predict karne mein useful hain. Shooting star candlesticks ka use karke investors ko upcoming bearish trend reversals ke bare mein pata chal jata hai aur wo is knowledge ka use karke apni investment aur trading strategies accordingly plan kar sakte hain.

Shooting star candlestick pattern ki simplicity hi isko naye beginner traders ke liye itna easily accessible banati hai. Iski lack of complexity shooting stars ko bearish trend reversals ka ek fairly reliable signal banati hai.

Shooting Star Candlestick ke Nuqsanat Kya Hain?

Shooting star candlestick patterns ke do ahem nuqsanat neeche list kiye gaye hain.- False Signals Produce Karne Ka Rujhan

Shooting star candlesticks ka primary nuqsan ye hai ke ye false signals produce karne ka rujhan rakhte hain. Kabhi kabhi, shooting star ke baad wale patterns wo trend reversal reflect nahi karte jo shooting star ne imply kiya tha. False signal limitation ko overcome karne ke liye zyada traders shooting star ke baad wale pattern ka intezar karte hain trading decisions lene se pehle. - Trend Ko Confirm Karne Ke Liye Zyada Candles Ka Istemaal Zaroori Hai

Shoot star candlesticks ka istemal isolation mein nahi kiya ja sakta. Bearish trend reversal ko confirm karne ke liye zyada candles required hoti hain. Investors jo sirf ek single shooting star candlestick pattern ke basis par trading strategies banate hain wo false signals produce hone se losses incur karne ke risk ko expose karte hain.

False signals jo shooting stars produce karte hain unse hone wale losses ko minimize karne ke liye, investors aur traders stop-losses ka istemal karte hain. Stop losses risk ko ek certain level tak limit karne mein madadgar hote hain.

Shooting Stars ke Ilawa Candlestick Patterns Kya Hain?

40 se zyada candlestick patterns hain jo teen main categories mein classified hain jismein bullish candlestick patterns, bearish candlestick patterns aur continuation candlestick patterns shamil hain.- Pehla type candlestick bullish candlestick pattern hai. Bullish candlestick patterns un candlesticks ko shamil karte hain jo bullish trend reversals signal karte hain jaise hammer, piercing pattern, bullish harami, morning star, inverted hammer, tweezer bottom etc.

- Dusra type bearish candlestick pattern hai. Bearish candlestick patterns wo hain jo bearish trend reversals signal karte hain, jismein hanging man, dark cloud cover, shooting star, evening star, bearish harami, tweezer top etc shamil hain.

- Teesra type continuation candlestick pattern hai. Continuation candlestick patterns existing active trend ka continuation represent karte hain. Continuation candlestick patterns ke examples mein doji, spinning top, high wave, falling window, rising three methods, falling three methods etc shamil hain.

-

#4 Collapse

Understanding Shooting Star Candlestick Pattern

Muqaddama

Forex trading mein candlestick patterns bohat ahmiyat rakhte hain kyunki ye market ke price action aur sentiment ko samajhne mein madadgar hote hain. Shooting Star candlestick pattern un important reversal patterns mein se ek hai jo potential trend reversals ko indicate karta hai. Is article mein hum Shooting Star pattern ko briefly explain karenge aur iske istimaal ka tareeqa samjhenge.

Shooting Star Pattern Kya Hai?

Shooting Star ek bearish reversal pattern hai jo typically uptrend ke baad form hota hai. Ye pattern ek single candlestick se mil kar banta hai aur iski khasiyat ye hai ke iski long upper shadow hoti hai aur chhoti body hoti hai. Ye pattern indicate karta hai ke bulls ne price ko upar push kiya magar bears ne control hasil kar liya aur price ko neeche le aaye.

Shooting Star Pattern Ki Structure- Upper Shadow: Shooting Star pattern ki upper shadow kaafi lambi hoti hai, jo ke high price aur opening/closing price ke darmiyan difference ko show karti hai. Ye upper shadow candlestick body se kam az kam do guna lambi hoti hai.

- Body: Candlestick ki body chhoti hoti hai aur upper shadow ke neeche located hoti hai. Body ka color green (bullish) ya red (bearish) ho sakta hai, magar bearish body zyada reliable signal deti hai.

- Lower Shadow: Shooting Star pattern mein lower shadow ya toh hoti hi nahi, aur agar hoti hai toh bohot chhoti hoti hai.

Shooting Star Pattern Ka Istemaal- Trend Reversal Signal: Shooting Star pattern typically uptrend ke end par form hota hai aur bearish reversal ka signal deta hai. Jab ye pattern appear hota hai, toh ye indicate karta hai ke buying pressure khatam ho gaya hai aur selling pressure barh gaya hai.

- Confirmation: Shooting Star pattern ke baad confirmation zaroori hoti hai. Is confirmation ke liye traders agle din ki candlestick ko dekhte hain. Agar agle din bearish candlestick form hoti hai jo price ko neeche push karti hai, toh ye Shooting Star pattern ko confirm karti hai.

- Entry aur Exit Points: Shooting Star pattern ke baad traders short positions mein enter kar sakte hain. Entry point typically candlestick ke close par ya uske thoda neeche hota hai. Stop loss upper shadow ke upar set kiya jata hai aur take profit levels previous support levels ya Fibonacci retracement points par set kiye jate hain.

Shooting Star Pattern Ki Limitations- False Signals: Kabhi kabhi Shooting Star pattern false signals generate kar sakta hai, khas tor par choppy ya sideways markets mein. Isliye isko confirmatory indicators ke saath use karna important hota hai.

- Time Frame Dependency: Different time frames par Shooting Star pattern alag results de sakta hai. Shorter time frames par ye pattern kam reliable ho sakta hai, isliye higher time frames par isko analyze karna behtar hota hai.

Conclusion

Shooting Star candlestick pattern ek important bearish reversal signal hai jo traders ko potential trend reversals ko identify karne mein madad karta hai. Is pattern ko sahi tarah se samajh kar aur confirmatory indicators ke saath use karke traders apni trading strategies ko enhance kar sakte hain. Har trader ke liye zaroori hai ke wo Shooting Star pattern ko recognize karne mein maharat hasil kare taki wo market movement ko better anticipate kar sake aur profitable trading decisions le sake.

-

#5 Collapse

### Understanding Shooting Star Candlestick Pattern

Shooting star candlestick pattern ek bearish reversal signal hai jo typically bullish trend ke doran banta hai. Ye pattern traders ko market ke girne ki nishani deta hai, isliye iska samajhna forex trading mein bohot ahem hai. Is post mein, hum shooting star pattern ki formation, characteristics, aur trading strategy par tafseel se guftagu karenge.

**1. Shooting Star Kya Hai?**

Shooting star ek single candlestick pattern hai jo ek uchi body aur chhoti tail ya wick ke sath banta hai. Iska shape ek "inverted hammer" se milta-julta hota hai, lekin ye alag context mein banta hai. Ye pattern bullish market ke peak par banta hai aur iska matlab hota hai ke buyers ne price ko upar le jane ki koshish ki, lekin sellers ne control hasil kar liya.

**2. Formation Ka Tareeqa:**

Shooting star pattern ki formation kuch is tarah hoti hai:

- **Bullish Trend:** Pehle ek strong bullish trend hona chahiye. Ye trend price ko upar ki taraf le jata hai.

- **Uchi Body:** Price ek high level par pahunchti hai, jahan se shooting star banata hai. Is candlestick ki body chhoti hoti hai aur closing price high se bohot door nahi hota.

- **Long Upper Shadow:** Is candlestick ki upper shadow ya wick bohot lambi hoti hai, jo ye darshata hai ke price ne higher levels ko test kiya lekin wapas neeche aa gayi.

**3. Trading Strategy:**

- **Entry Point:** Shooting star pattern ka dekhna ek bearish reversal signal hota hai. Jab ye pattern banta hai, to traders sell position kholne ka soch sakte hain, lekin confirmation ke liye agle candlestick ka intezar karna behtar hota hai.

- **Confirmation:** Is pattern ki strength ko samajhne ke liye traders ko agle candlestick ka analysis karna chahiye. Agar agla candlestick shooting star ke neeche close hota hai, to ye sell signal ko confirm karta hai.

- **Stop-Loss Placement:** Stop-loss ko shooting star ke high ke upar set karna chahiye, taake agar market unexpected move kare to losses limit ho sakein.

- **Take-Profit Target:** Traders apne profit target ko previous support level ya key Fibonacci retracement levels par set kar sakte hain. Is se aap apne profits ko secure kar sakte hain.

**4. Conclusion:**

Shooting star candlestick pattern forex trading mein ek important bearish reversal signal hai. Is pattern ki pehchan aur analysis se traders ko market ki direction ka andaza lagane mein madad milti hai. Lekin, is pattern ko use karte waqt confirmation indicators ka istemal karna aur risk management techniques ka khayal rakhna zaroori hai. Shooting star pattern ko apne trading toolkit mein shamil karke, aap forex market ki complexities ko behtar samajh sakte hain aur successful trading ke liye apne chances ko barha sakte hain. Isliye, is pattern ka sahi istemal seekhna aapki trading journey ke liye faydemand ho sakta hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction About Shooting Star Candlestick Pattern:

Assalam o Alicom! Dear Sisters and Brothers I hope you are fine Shooting Star ek bearish reversal Candlestick Pattern hai jo typically uptrend ky badh form hota hai. Ye pattern ek single candlestick sy mil kar banta hai aur iski khasiyat ye hai ky iski long upper shadow hoti hai aur choti body hoti hai. Ye pattern indicate karta hai ky bullish ny price ko upar push kiya magar bearish ne control hasil kar liya aur price ko neechy ly aye.

Best Information Of Shooting Star Candlestick Pattern:

Dear Forex Members Shooting Star Candlestick Pattern forex trading mein ek important bearish reversal signal hai. Is pattern ki pehchan aur analysis sy traders ko market ki direction ka andaza lagany mein madad milti hai. Lekin, is pattern ko use karty waqt confirmation indicators ka istemal karna aur risk management techniques ka khayal rakhna zaroori hai. Shooting star pattern ko apny trading tool kit mein shamil karky, aap forex market ki complexities ko behtar samajh sakty hain aur successful trading ky liye apny chances ko barha sakty hain. Isliye, is pattern ka sahi istemal seekhna apki trading journey ky liye faydemand ho sakta hai.

Benefits Of Shooting Star Candlestick Pattern:

Dear Friends and Fellows Shooting Star Candlestick Patterns ka main faida ye hai ky unhein price chart par asani sy spot kiya ja sakta hai. Shooting star candlesticks ko choti body aur lambi upper wick sy asani sy identify kiya ja sakta hai. Jo traders naye hain aur beginners bhi shooting star candlestick pattern ko asani sy dekh sakty hain.

Primary Loss Of Shooting Star Candlestick Pattern:

Dear Students Shooting Star Candlestick Patterns ka primary nuqsan ye hai ky ye false signals produce karny ka rujhan rakhty hain. Kabhi kabhi, shooting star ky badh waly patterns wo trend reversal reflect nahi karty jo shooting star ny imply kiya tha. False signal limitation ko overcome karny ky liye zyada traders shooting star ky badh waly pattern ka intezar karty hain trading decisions leny sy pehly.

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Shooting Star Candlestick Pattern ek important reversal pattern hai jo trading mein aksar bearish market reversal ko signal karta hai. Yeh pattern tab form hota hai jab market upar ki taraf move kar rahi ho aur price temporarily upper level tak pohanchti hai, lekin wahan se strong selling pressure ki wajah se wapas neeche close hoti hai. Shooting Star pattern humein yeh batata hai ke market mein sellers ka pressure hai aur price ab neeche ki taraf reverse ho sakti hai. Shooting Star pattern ka samajhna traders ke liye bohot important hai kyunke yeh unko bata sakta hai ke uptrend ab apne end ke kareeb hai aur downtrend shuru ho sakta hai. Yeh pattern forex, stocks aur doosri financial markets mein trading ke liye bohot popular hai.

Shooting Star Candlestick Pattern Ka Basic Structure

Shooting Star pattern ek single candlestick pattern hai aur ismein kuch specific characteristics hoti hain jo isko identify karne mein help karti hain:- Long Upper Shadow: Shooting Star pattern mein candlestick ki upper shadow (yaani wick) bohot lambi hoti hai. Yeh shadow high price tak pohanchne ko show karti hai, lekin phir sellers ke pressure se price neeche aa jati hai.

- Small Real Body: Candlestick ka real body chhota hota hai, jo ke near the low close hota hai. Yeh humein batata hai ke price neeche close hui hai jabke session mein high price ko touch kiya gaya tha.

- Lower Shadow: Shooting Star candlestick mein lower shadow ya toh bilkul nahi hoti ya phir bohot chhoti hoti hai.

Shooting Star pattern generally ek uptrend ke end par banta hai. Yeh is baat ka sign hota hai ke buyers ki strength ab kam ho rahi hai aur sellers market par control hasil kar rahe hain.

Aksar yeh pattern ek aise level par banta hai jahan resistance hota hai. Resistance wo level hota hai jahan price ke aur upar jane ke chances kam ho jate hain. Jab price resistance ko touch karti hai aur wahan se neeche aati hai, toh Shooting Star pattern form hota hai jo ke potential reversal ko indicate karta hai.

Shooting Star Pattern Ka Meaning Aur Significance

Shooting Star pattern trading mein ek bohot powerful signal hai. Yeh traders ko yeh batata hai ke market mein ab change aa sakta hai aur uptrend se downtrend mein shift ho sakta hai. Is pattern ka analysis is baat par base karta hai ke jab price temporarily high level par jati hai lekin wahan strong selling pressure ki wajah se neeche close hoti hai, toh yeh selling pressure ke dominate hone ka signal hai.

Shooting Star pattern humein yeh bhi batata hai ke market mein short-sellers ya profit-booking shuru ho rahi hai. Jo buyers price ko upar le ja rahe the, unka pressure ab kam ho gaya hai aur sellers market ko neeche le jane ke liye ready hain. Isliye yeh pattern ek bearish reversal pattern mana jata hai aur aksar traders is par short ya sell trades consider karte hain.

Shooting Star Pattern Ko Identify Karne Ke Liye Criteria- Preceding Uptrend: Shooting Star ka meaning tabhi hoga jab usse pehle ek uptrend ho. Agar market pehle se downtrend mein ho toh yeh pattern kaam nahi karega.

- Upper Shadow Ki Length: Shooting Star mein upper shadow ki length real body se kam az kam 2 times lambi honi chahiye.

- Real Body Ki Position: Real body upper shadow ke neeche close hoti hai aur neeche ki taraf koi ya bohot chhoti lower shadow hoti hai.

- Volume Analysis: Volume analysis bhi Shooting Star ke significance ko confirm kar sakta hai. Agar Shooting Star ke sath high volume bhi ho toh yeh aur strong reversal signal hota hai.

Shooting Star pattern par trade karte waqt kuch specific steps aur rules ko follow karna zaroori hai taake risk ko minimize kiya ja sake aur profits maximize ho sake.

1. Confirmation Ka Wait Karen

Shooting Star pattern ek reversal signal zaroor hai lekin isko bina confirmation ke use karna risky ho sakta hai. Shooting Star ke baad wali candle par wait karna zaroori hai taake confirmation mile ke price neeche hi move hogi.

Confirmation candle woh hoti hai jo Shooting Star ke low ke neeche close hoti hai. Yeh confirmation de rahi hoti hai ke market mein downtrend start ho raha hai aur sellers dominate kar rahe hain.

2. Entry Point

Entry point ko set karne ke liye Shooting Star ke neeche waali confirmation candle ke close hone ka wait karna chahiye. Aap apna sell trade tab initiate kar sakte hain jab confirmation candle Shooting Star ke low se neeche close ho jaye.

3. Stop Loss

Shooting Star pattern mein risk management bohot important hai. Is pattern ke sath aapka stop loss Shooting Star ke high ke thoda upar set karna chahiye. Yeh isliye ke agar market wapis upar chali jaye toh aapka loss limited rahe.

4. Take Profit Levels

Take profit levels ko set karna aapke risk-reward ratio aur market ke conditions par depend karta hai. Aap pehle support level ko as a take profit consider kar sakte hain ya phir fixed risk-reward ratio (e.g., 1:2 ya 1:3) follow kar sakte hain.

Practical Example: Shooting Star Pattern Ki Trading

Aapke paas ek uptrend mein EUR/USD pair ka chart hai aur aap dekhte hain ke price ek high resistance level par pohanch gayi hai. Wahan ek Shooting Star pattern form hota hai jisme upper shadow bohot lambi hai aur real body chhoti hai.- Confirmation: Aap agle candle ka wait karte hain aur dekhte hain ke woh Shooting Star ke low se neeche close hoti hai. Yeh confirmation hai ke price ab neeche ki taraf ja sakti hai.

- Entry: Aap confirmation candle ke close hone par sell trade open karte hain.

- Stop Loss: Aapka stop loss Shooting Star ke high ke thoda upar hai.

- Take Profit: Aap apna take profit pehle support level par set karte hain ya risk-reward ratio ke mutabiq adjust karte hain.

Pros- Easy to Identify: Shooting Star pattern ko chart par identify karna asan hota hai aur ismein specific characteristics hoti hain jo isko aur clear bana deti hain.

- Bearish Reversal Signal: Yeh pattern strong bearish reversal ka signal hai aur uptrend ke end par sellers ke pressure ko show karta hai.

- Effective in Range-bound Market: Yeh pattern range-bound aur sideways market mein bhi effective hota hai jahan reversal ki possibility hoti hai.

- Requires Confirmation: Shooting Star pattern hamesha reliable nahi hota aur confirmation ke bina trading karna risky ho sakta hai.

- Limited to Uptrend Reversals: Yeh pattern sirf uptrend mein reversal ko indicate karta hai, aur downtrend mein iska koi significance nahi hota.

- False Signals: Kabhi kabhi Shooting Star pattern false signal bhi de sakta hai agar price ke reversal ki confirmation na mile.

1. Other Indicators Ke Sath Combine Karna

Shooting Star pattern ko RSI (Relative Strength Index) ya MACD ke sath combine karna useful ho sakta hai. Agar RSI overbought level par ho aur Shooting Star form ho toh yeh ek strong bearish signal ho sakta hai.

2. Multiple Time Frames Ka Use

Different time frames par is pattern ko dekhna bhi madadgar ho sakta hai. Agar aap daily chart par Shooting Star dekhen aur lower time frames par bhi bearish signals mil rahe ho toh yeh aur bhi strong signal ho sakta hai.

3. Support aur Resistance Levels Ka Analysis

Shooting Star pattern resistance levels par bohot effective hota hai. Agar price resistance par ho aur Shooting Star form kare, toh reversal ka chance zyada hota hai.

Common Mistakes to Avoid- Bina Confirmation Ke Trade Karna: Shooting Star pattern hamesha reliable nahi hota, isliye bina confirmation ke trade na karein.

- Stop Loss Na Lagana: Risk management ke bagair trading karna risky hai. Hamesha stop loss set karein.

- Shooting Star Pattern Ko Har Trend Mein Use Na Karen: Yeh pattern sirf uptrend ke end mein reversal ko indicate karta hai, aur downtrend mein iska use nahi hota.

Shooting Star Candlestick Pattern ek powerful bearish reversal signal hai jo trading mein trend reversal ko detect karne ke liye use hota hai. Yeh pattern tab form hota hai jab buyers temporarily price ko upar le jate hain lekin sellers ke strong pressure se price neeche close hoti hai. Is pattern ko samajhna aur sahi tareeke se apply karna traders ke liye beneficial ho sakta hai.

Is pattern par trade karte waqt confirmation ka wait karna aur sath mein risk management strategies ko follow karna zaroori hai. Agar aap is pattern ko sahi tareeke se samajh kar aur confirmatory indicators ke sath use karte hain toh aap trading mein significant profits kama sakte hain aur apna loss minimize kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:44 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим