What is bullish counter attack

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is bullish counter attack -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

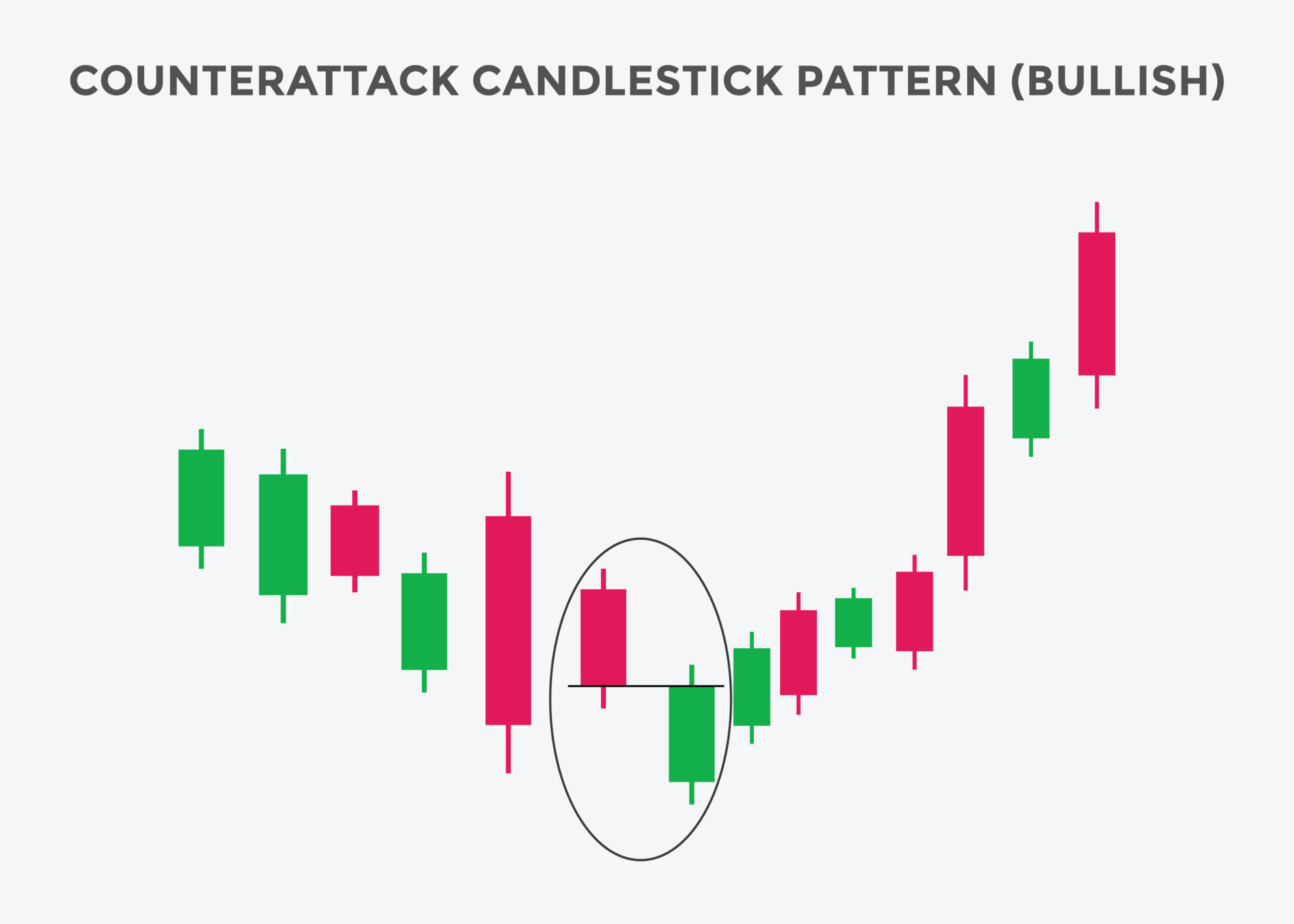

What is bullish counter attack Bullish Counter Assault" ek technical evaluation idea hai jo traders forex ya inventory markets mein istemal karte hain. Yeh ek bullish reversal sample hai, yaani ke trend palatne ki indication deta hai.Sta decrease highs banate hain, lekin unki nechai slow hoti hai. Ye sample ahasta ahsta bullish fashion ke waqat dekha jata hai aur b boht mustaqbil mein rate mein izafy ki mumkinat hoti hai.Wedge sample mein investors in fashion traces ko draw karke fee ki harkat ke breakout ka wait karte hain. Jabhi rate trend lines se bahar nikalne lagti hai, toh ye breakout sign muhaya karta hai. Breakout ke baad, buyers price ki course ke hisaab sey purchase ya promote positions lete hain.Wedge sample ke saath entry aur exit factors ko tasdeeq karne ke liye, dusre technical indi"aida hota hai. Is pattern mein charge ke better highs aur better lows bante hain, lekin unki range slender hoti jaati hai. Yeh sample ek triangle shape ki tarah hota hai, jahan fee trend traces ke beech converge hoti hain. Rising wedge pattern bearish momentum suggest karta hai aur future mein rate decline ki possibility ko darshata hai.Jab rising wedge sample form ho jaye, buyers breakout ki route ka wait karte hain.Agar rate wedge sample ke neeche damage karne lagta hai, toh yeh bearish sign hai aur investors promoting positions enter kar sakte hain. Stop-lossPattern Ki Tashreeh:Bullish Counter Assault pattern aik specific price motion mein nazaraata hai.Is pattern mein pehle ek bearish candle hoti hai (downward motion), phir ek ya zyada bullish candles (upward movement) atay hain jo bearish candle ki losses ko cover kar deti hain.Bullish candles ki variety zyada hoti hai aur bearish candle ki variety ko exceed karti hai.Aders charge ki course ke hisaab sey buy ya sell positions lete hain.Wedge sample ke saath access aur go out points ko tasdeeq karne ke liye, dusre technical indi"aida hota hai. Is pattern mein price ke higher highs aur higher lows bante hain, lekin unki variety narrow hoti jaati hai. Yeh sample eYeh sample charge action mein aksar guide stage ke qareeb nazar aata hai.Trend Reversal Indication:Bullish Counter Assault pattern bearish fashion ke baad nazar aane par trend reversal ki indication deta hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish Counterattack Candlestick Pattern ek bullish reversal pattern hai jo technical analysis mein use hota hai. Yeh pattern bearish trend ke baad trend reversal ko indicate karta hai. **Explanation of Bullish Counterattack Candlestick Pattern**: Bullish Counterattack pattern mein do consecutive candlesticks hote hain. Pehla candlestick bearish trend ke sath down move karta hai aur doosra candlestick uske neeche close karta hai. Doosra candlestick ka close price pehle candlestick ke close price se higher hota hai, jisse bearish trend ki reversal ka indication hota hai. **Types of Bullish Counterattack Pattern**: Bullish Counterattack pattern ka basic form hota hai. Lekin variations ho sakte hain jaise ki Bullish Harami Cross. **Characteristics of Bullish Counterattack Pattern**: - Pehla candlestick bearish trend ke sath down move karta hai. - Doosra candlestick neeche jata hai lekin higher close karta hai. - Doosra candlestick ka close price pehle candlestick ke close price se higher hota hai. **Benefits (Fawaid) of Bullish Counterattack Pattern**: - Bullish Counterattack pattern traders ko potential trend reversal points identify karne mein madad deta hai. - Is pattern se traders profitable entry aur exit points find kar sakte hain. - Bearish trend se bullish trend ki direction change ki indication hoti hai. **Drawbacks (Nuqsan) of Bullish Counterattack Pattern**: - Yeh pattern hamesha accurate nahi hota, kuch cases mein false signals bhi ho sakte hain. - Sirf is pattern par rely kar ke trade karna risky ho sakta hai, isliye isey confirm karne ke liye dusre indicators aur tools ka istemal karna zaroori hai. **Conclusion**: Bullish Counterattack Candlestick Pattern ek important bullish reversal pattern hai jo trend reversal points ko identify karne mein madad deta hai. Lekin isey istemal karne se pehle, traders ko confirmatory signals aur dusre technical analysis tools ka bhi istemal karna chahiye. Market mein hone wali aur hone wale events ke madd-o-jazar se pehle, proper research aur analysis karna zaroori hai. -

#4 Collapse

Candlestick Pattern ek bullish reversal pattern hai jo technical analysis mein use hota hai. Yeh pattern bearish trend ke baad trend reversal ko indicate karta hai.**Explanation of Bullish Counterattack Candlestick Pattern**: Bullish Counterattack pattern mein do consecutive candlesticks hote hain. Pehla candlestick bearish trend ke sath down move karta hai aur doosra candlestick uske neeche close karta hai. Doosra candlestick ka close price pehle candlestick ke close price se higher hota hai, jisse bearish trend ki reversal ka indication hota hai. **Types of Bullish Counterattack Pattern**: Bullish Counterattack pattern ka basic form hota hai. Lekin variations ho sakte hain jaise ki Bullish Harami Cross. **Characteristics of Bullish Counterattack Pattern**: - Pehla candlestick bearish trend ke sath down move karta hai. - Doosra candlestick neeche jata hai lekin higher close karta hai. - Doosra candlestick ka close price pehle candlestick ke close price se higher hota hai. ​

**Benefits (Fawaid) of Bullish Counterattack Pattern**: - Bullish Counterattack pattern traders ko potential trend reversal points identify karne mein madad deta hai. - Is pattern se traders profitable entry aur exit points find kar sakte hain. - Bearish trend se bullish trend ki direction change ki indication hoti hai. **Drawbacks (Nuqsan) of Bullish Counterattack Pattern**: - Yeh pattern hamesha accurate nahi hota, kuch cases mein false signals bhi ho sakte hain. - Sirf is pattern par rely kar ke trade karna risky ho sakta hai, isliye isey confirm karne ke liye dusre indicators aur tools ka istemal karna zaroori hai. markets mein istemal karte hain. Yeh ek bullish reversal sample hai, yaani ke trend palatne ki indication deta hai.Sta decrease highs banate hain, lekin unki nechai slow hoti hai. Ye sample ahasta ahsta bullish fashion ke waqat dekha jata hai aur b boht mustaqbil mein rate mein izafy ki mumkinat hoti hai.Wedge sample mein investors in fashion traces ko draw karke fee ki harkat ke breakout ka wait karte hain. Jabhi rate trend lines se bahar nikalne lagti hai, toh ye breakout sign muhaya karta hai. Breakout ke baad, buyers price ki course ke hisaab sey purchase ya promote positions lete hain.Wedge sample ke saath entry aur exit factors ko tasdeeq karne ke liye, dusre technical indi"aida hota hai. Is pattern mein charge ke better highs aur better lows bante hain, lekin unki range slender hoti jaati hai. Yeh sample ek triangle shape ki tarah hota hai, jahan fee trend traces ke beech converge hoti hain. Rising wedge pattern bearish momentum suggest karta hai aur future mein rate decline ki possibility ko darshata hai.Jab rising wedge sample form ho jaye, buyers breakout ki route ka wait karte hain.

-

#5 Collapse

Foreign trading ki mein, bullish counter attack ek technical analysis pattern hai jo ek neeche ki taraf ka trend ulta hone ki mumkin koshish ko darust karti hai. Ye ek aisa price action pattern hai jo tab hota hai jab currency pair ki keemat gir rahi hoti hai, lekin phir achanak ulta ho jati hai aur wapas upar chali jati hai. Ye pattern taqatwar khareedne ki dabao ki nishani ho sakti hai aur mumkin hai ke iska asar mazeed keemat mein izafah ho.

Bullish counter attack pattern teen mukhtasar hisson se milta hai: pehla hissa initial downtrend, doosra hissa reversal, aur teesra hissa follow-through.

Initial Downtrend

Bullish counter attack pattern ka pehla hissa initial downtrend hai. Yahan currency pair ki keemat lambay arsay se nichay ki taraf ja rahi hoti hai. Is downtrend ki lambai aur gehrai alag ho sakti hai, lekin ye wazeh hona chahiye ke market mein taqatwar farokht ki dabao hai.

Is stage mein traders currency pair ko bech sakte hain ke mazeed keemat kam hone ki tawakul mein hain. Keemat ke girne par stop-loss orders bhi chakkar khate hain, jo keemat mazeed kam hone par aur bhi bechne ki dabao dal sakte hain. Ye ek aisi khud mukhlis bhavishyavani bana sakti hai, jisme keemat barabar girte ja rahi hai jabke traders apne positions bech rahe hote hain.

Reversal

Bullish counter attack pattern ka doosra hissa reversal hai. Yahan currency pair ki keemat achanak ulta ho jati hai aur wapas upar chali jati hai. Reversal kai wajahon se ho sakta hai, lekin amuman ye darust karta hai ke market mein taqatwar khareedari hai.

Is stage mein traders currency pair khareed sakte hain ke mazeed keemat barhne ki tawakul mein hain. Keemat barhne par stop-loss orders bhi chakkar khate hain, jo keemat barhne par aur bhi khareedari ki dabao dal sakte hain. Ye ek aisi khud mukhlis bhavishyavani bana sakti hai, jisme keemat barabar badhti hai jabke traders apne positions khareed rahe hote hain.

Ye reversal kafi achanak ho sakta hai aur ye ho sakta hai ke isse pehle kuch arse tak rukawat ya side mein movement ho. Iska silsila bhi ek tez girawat ke baad ho sakta hai, jo ke spike ya gap ke tor par jana jata hai. Har surat mein, ye zaroori hai ke reversal ko pehchanain aur uske baad hone wale keemat mein izafah ka faida uthain.

Follow-Through

Bullish counter attack pattern ka teesra hissa follow-through hai. Yahan currency pair ki keemat initial reversal ke baad bhi barhti rahti hai. Is follow-through ki lambai aur gehrai alag ho sakti hai, lekin ye wazeh hona chahiye ke market mein ab bhi taqatwar khareedari hai.

Is stage mein traders apne positions ko barhne ki tawakul mein rakh sakte hain. Keemat barhne par stop-loss orders bhi chakkar khate hain, jo keemat barhne par aur bhi khareedari ki dabao dal sakte hain. Ye ek aisi khud mukhlis bhavishyavani bana sakti hai, jisme keemat barabar badhti hai jabke traders apne positions khareed rahe hote hain.

Follow-through kai dino tak ya hafton tak chal sakta hai, market ke halat par depend karta hai. Iska silsila bhi bade arse tak chal sakta hai agar koi major economic events ya news releases nahi hain jo keemat ko phir se ulta karne ka sabab ban sakte hain. Har surat mein, is stage mein risk ko hoshiyarana taur par manage karna zaroori hai aur mumkin izafah ke liye tayyar rehna bhi zaroori hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Bullish Counterattack: Tajweed-e-Sham'iyaat Mein Barhny Wale Hamlah Ki Roshan Tafseelat"

"Bullish Counterattack," ya tajweed-e-sham'iyaat mein "Bullish Counterattack" aik pattern hai jo market analysis mein istemal hota hai. Yeh aam taur par candlestick charts par dekha jata hai aur iski zahir hone wali tafseelat traders ko market mein hone wale tabdiliyon ka andaza dene mein madad karte hain.

Tajweed-e-Sham'iyaat aur Bullish Counterattack:

Tajweed-e-Sham'iyaat, ya candlestick patterns, market mein hone wale price action ko samajhne ka tareeqa hai. Bullish Counterattack pattern, jab zahir hota hai, toh yeh bullish reversal ki nishandahi karta hai, yaani ke jab market mein bearish trend ko badal kar bullish trend shuru ho sakta hai.

Bullish Counterattack Pattern Ki Khasosiyat:- Candles Ki Tafseelat: Bullish Counterattack pattern mein, aam taur par do consecutive candles hote hain. Pehli candle bearish hoti hai, jabke dosri candle bullish hoti hai.

- Size Ki Ahmiyat: Pehli candle ki body chhoti hoti hai, jo ke bearish movement ko darust karti hai. Lekin dosri candle ki body pehli candle se ziada badi hoti hai, jo ke bullish counterattack ko zahir karta hai.

- Closing Price Ki Bandish: Dosri candle ki closing price pehli candle ki opening price se ziada hoti hai, jo ke bullish reversal ko indicate karti hai.

- Volume Ki Tafseelat: Bullish Counterattack pattern ke sath hone wale volume ko bhi mad-e-nazar rakhna zaroori hai. Agar is pattern ke sath tezi ke sath tezi aaye aur volume bhi barh jaye, toh yeh bullish reversal ki tafseelat ko taayun karta hai.

Bullish Counterattack aur Trading:- Confirmation: Bullish Counterattack pattern ko confirm karne ke liye, traders ko doosre technical indicators aur market ki tafseelat ko bhi mad-e-nazar rakhna chahiye.

- Stop-Loss Aur Target Levels: Trading plan banate waqt, stop-loss aur target levels tay karna important hai takay risk management ko bhi madad mile.

- Market Context: Bullish Counterattack ko samajhne mein, market ka overall context bhi dekha jana chahiye. Yeh pattern akele mein nahi, balke doosre market factors ke sath mil kar dekha jana chahiye.

Bullish Counterattack pattern, jab sahi taur par samjha jaye aur doosre indicators ke sath milaya jaye, traders ko potential trend reversal ka pata lagane mein madadgar sabit ho sakta hai. Lekin yaad rahe ke kisi bhi trading decision se pehle market analysis aur risk management ko mad-e-nazar rakha jana chahiye

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:55 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим