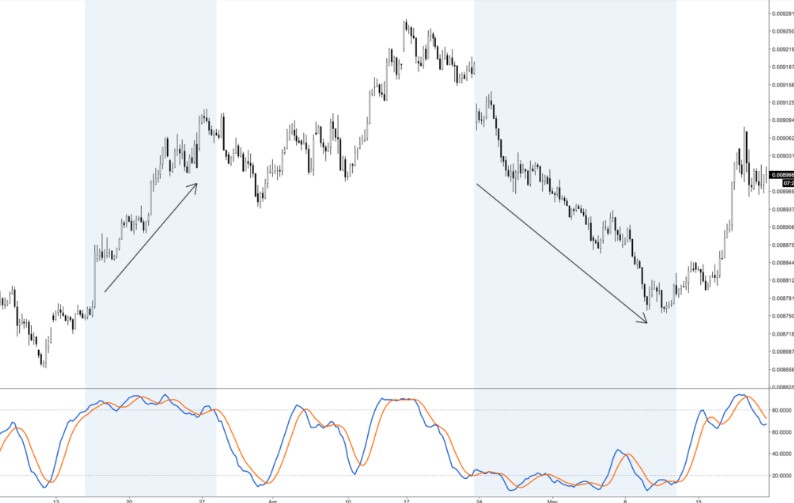

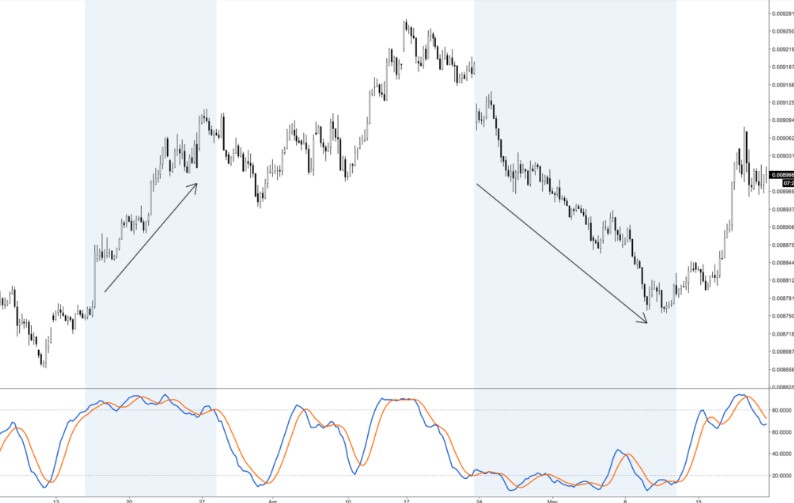

Pehchaan Mutaharrik: the Forex market Trading Mein Aagahi Ki Roshni Mein : the Forex market trading is a complex and dynamic enterprise, related to the exchange of currencies with the goal of creating income. To navigate this ever-converting landscape, buyers often rely on numerous equipment and signs to assist them make informed choices. One such tool is the "leading indicator," which plays a pivotal function in forecasting fee movements and assisting investors in devising powerful strategies.Leading signs, called "Peshgoi Mutaharrik" in Roman Urdu, are analytical gear used by forex traders to predict potential fee moves earlier than they occur. Unlike lagging signs that observe fee traits, main signs are designed to anticipate marketplace shifts and offer buyers early insights into potential trading opportunities. These indicators purpose to offer a ahead-looking attitude, allowing traders to make timely choices and capitalize on rising traits.One of the essential aspects of main indicators is their potential to assist investors in identifying overbought or oversold conditions inside the marketplace. This allows investors count on potential reversals or corrections in rate traits. Leading indicators accomplish this by way of generating signals based on factors inclusive of momentum, volatility, and marketplace sentiment. By reading these factors, investors can advantage an area of their choice-making procedure.One typically used main indicator is the Moving Average Convergence Divergence (MACD). It involves the comparison of transferring averages of a foreign money pair's fee. The interaction among those moving averages generates indicators that suggest potential fashion changes. When the faster transferring average crosses above the slower one, it's considered a bullish sign, suggesting a capability upward trend. Conversely, a bearish sign is generated whilst the faster moving common crosses beneath the slower one. Forex market Trading Mein Aagey Ki Soch Ko Pesh Karnay Wale Aalaat :Another leading indicator is the Relative Strength Index (RSI), which measures the rate and alternate of price actions. RSI values above 70 indicate overbought conditions, signaling a capability reversal or corrective decline. On the other hand, RSI values under 30 imply oversold conditions, implying a probable upward reversal.Traders have to workout warning whilst the use of leading indicators, as they're not infallible. False alerts can arise because of surprising marketplace information, geopolitical activities, or surprising financial facts releases. Therefore, it's crucial to apply leading indicators in conjunction with other varieties of analysis, inclusive of essential analysis and threat management strategies.In conclusion, leading indicators are useful gear within the foreign exchange trader's arsenal, offering insights into capacity marketplace shifts before they materialize. By identifying overbought and oversold conditions, those signs empower buyers to make more informed decisions and increase their probabilities of making the most of emerging developments. However, traders have to don't forget that no single indicator ensures achievement. A holistic approach, combining main indicators with other analytical techniques, is crucial for attaining sustainable fulfillment in the dynamic international of forex buying and selling.

Forex market Trading Mein Aagey Ki Soch Ko Pesh Karnay Wale Aalaat :Another leading indicator is the Relative Strength Index (RSI), which measures the rate and alternate of price actions. RSI values above 70 indicate overbought conditions, signaling a capability reversal or corrective decline. On the other hand, RSI values under 30 imply oversold conditions, implying a probable upward reversal.Traders have to workout warning whilst the use of leading indicators, as they're not infallible. False alerts can arise because of surprising marketplace information, geopolitical activities, or surprising financial facts releases. Therefore, it's crucial to apply leading indicators in conjunction with other varieties of analysis, inclusive of essential analysis and threat management strategies.In conclusion, leading indicators are useful gear within the foreign exchange trader's arsenal, offering insights into capacity marketplace shifts before they materialize. By identifying overbought and oversold conditions, those signs empower buyers to make more informed decisions and increase their probabilities of making the most of emerging developments. However, traders have to don't forget that no single indicator ensures achievement. A holistic approach, combining main indicators with other analytical techniques, is crucial for attaining sustainable fulfillment in the dynamic international of forex buying and selling.

تبصرہ

Расширенный режим Обычный режим