What Is Marobuzu candlestick Pattern.

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 1

-

سا1 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

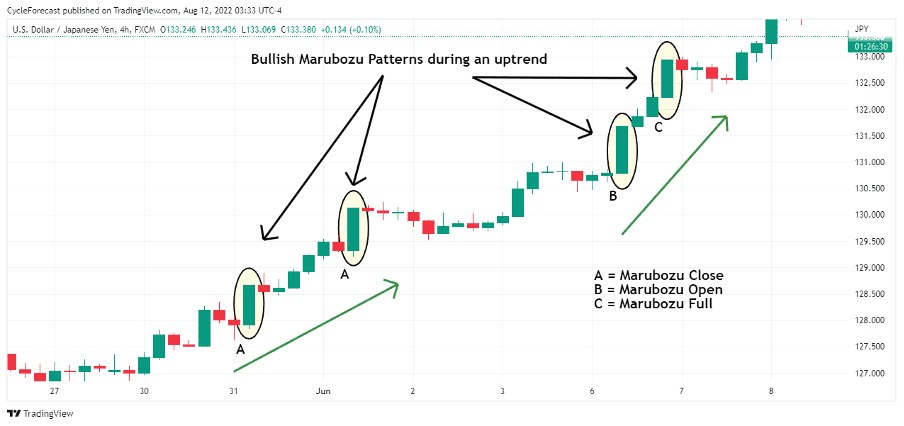

Marubozu Candlestick Pattern: Marubozu Candlestick Pattern mein candlestick ki body bahut lambi hoti hai aur uske shadows bilkul ya almost na ho. Iska matlab hota hai ke fee open aur near ke beech mein ek sturdy move hota hai aur koi big retracement nahi hota. Is pattern mein do variations hote hain:Bullish Marubozu: Bullish Marubozu mein candlestick ki body green (upward) hoti hai aur iska close rate iske excessive par hota hai. Yani ke charge open se close ke beech mein neeche nahi jaata.Bearish Marubozu: Bearish Marubozu mein candlestick ki body crimson (downward) hoti hai aur iska near fee iske low par hota hai. Yani ke charge open se near ke beech mein upar nahi jaata.Marubozu Candlestick Pattern ki Ahemiat:Marubozu pattern mein strong shopping for (bullish) ya promoting (bearish) ka indication hota hai, kyunki price open se close ke beech mein giant pass hota hai.Bullish Marubozu uptrend ka sign ho sakta hai ya phir fashion continuation ko suggest kar sakta hai. Iska matlab hai ke market mein buying ka robust momentum hai.Bearish Marubozu downtrend ka sign ho sakta hai ya phir fashion continuation ko dikhata hai. Iska matlab hai ke marketplace mein selling ka robust momentum hai.Marubozu sample ke saath saath dusre candlestick patterns aur technical signs ka istemal karke aapko trading selections lena chahiye.Price action analysis meinWhat Is Marobuzu candlestick Pattern. "Marubozu Candlestick Pattern" ek candlestick chart pattern hai jo rate motion ko darshata hai aur fashion continuation ya reversal ko indicate karta hai. Yeh pattern candlestick ki body aur uske shadows (higher aur lower wicks) par focus karta hai. Niche maine Marubozu Candlestick Pattern ke baare mein Roman Urdu mein wazahat di hai:Marubozu sample ek important function ada karta hai, lekin iska istemal karne se pehle aapko dusre candlestick patterns aur charge movement ko bhi samjhna hoga.Marubozu Candlestick Pattern ko samjhne aur istemal karne ke liye aapko chart evaluation aur fee movement ki samajh honi chahiye. Har pattern ki tarah, is sample ko bhi affirm karne ke liye dusre indicators aur gear ka istemal karna zaroori hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Candlestick patterns trading mein technical analysis ka aik ahem hissa hain, jo ke financial markets mein price movements ko visual taur par represent kartay hain. Ye patterns traders ko historical data ki buniyad par mustaqbil ke price movements ki peshgoi karne mein madad detay hain. Mukhtalif candlestick patterns mein se Marubozu pattern ki khaas ahmiyat hai kyun ke yeh asaan hai aur is se mazboot signals miltay hain.

Definition and Characteristics

Marubozu candlestick ek aisa candlestick hota hai jiska lamba body hota hai aur dono siron par shadows wicks nahi hoti. Yeh pattern strong market sentiment ko zahir karta hai aur aam tor par aik naye trend ki shuruaat ya ek existing trend ke continuation par milta hai. "Marubozu" ka matlab Japanese zaban mein shaved ya bald hai, jo ke candlestick ke shadows ke baghair hone ko zahir karta hai.

Marubozu bullish ya bearish ho sakta hai:- Bullish Marubozu: Yeh candlestick apne lowest point par open hota hai aur highest point par close hota hai. Yeh strong buying pressure ko zahir karta hai aur aam tor par aik bullish trend ka indicator hota hai.

- Bearish Marubozu: Yeh candlestick apne highest point par open hota hai aur lowest point par close hota hai. Yeh strong selling pressure ko zahir karta hai aur aam tor par aik bearish trend ka indicator hota hai.

Bullish Marubozu

Bullish Marubozu tab banta hai jab opening price us period ke lowest price ke barabar hota hai aur closing price highest price ke barabar hota hai. Yeh pattern aik strong bullish signal hai, jo yeh batata hai ke buyers ne poori trading session mein control rakha aur koi selling pressure itna strong nahi tha ke price ko neeche dhakel sakay.

Bullish Marubozu ki Khasoosiyat:- Upper shadow nahi hoti ya bohot kam.

- Lower shadow nahi hoti ya bohot kam.

- Lamba green body ya white, depending on chart colors.

Bearish Marubozu

Bearish Marubozu tab banta hai jab opening price us period ke highest price ke barabar hota hai aur closing price lowest price ke barabar hota hai. Yeh pattern strong bearish sentiment ko zahir karta hai, jo yeh batata hai ke sellers ne poori trading session mein control rakha aur buyers price ko ooper dhakel nahi sakay.

Bearish Marubozu ki Khasoosiyat:- Upper shadow nahi hoti ya bohot kam.

- Lower shadow nahi hoti ya bohot kam.

- Lamba red body ya black, depending on chart colors.

Yeh candlestick aik strong bearish signal hai, khaas tor par jab yeh aik downtrend ki shuruaat mein ya existing downtrend mein appear hota hai, aur bearish momentum ke continuation ko zahir karta hai.

Market Sentiment aur Trend Confirmation

Marubozu candlestick pattern market sentiment ka aik wazeh indicator hai. Bullish Marubozu signal karta hai ke buyers ne control hasil kar liya hai aur price ko ooper le ja rahe hain, jab ke Bearish Marubozu yeh zahir karta hai ke sellers ne control hasil kar liya hai aur price ko neeche dhakel rahe hain. In candlesticks mein shadows ki non-maujoodgi yeh highlight karti hai ke trading period ke dauran ek side ka ghalba tha.

Jab Marubozu appear hota hai, yeh aam tor par prevailing trend ki strength ko confirm karta hai. Misal ke tor par, agar uptrend mein Bullish Marubozu appear hota hai, toh yeh uptrend ke continuation ko confirm kar sakta hai. Isi tarah, downtrend mein Bearish Marubozu downtrend ke continuation ko confirm kar sakta hai.

Support aur Resistance Levels

Marubozu candlesticks support aur resistance levels ko identify karne mein bhi madadgar hoti hain. Bullish Marubozu ke case mein, closing price aksar aik new support level ban jata hai, kyun ke yeh wo price hoti hai jahan buyers aggressively buy karne ke liye tayar hote hain. Bearish Marubozu ke case mein, closing price aksar aik new resistance level ban jata hai, kyun ke yeh wo price hoti hai jahan sellers aggressively sell karne ke liye tayar hote hain.

Reversal Signals

Jab ke Marubozu candlesticks aam tor par trends ko confirm karti hain, yeh potential reversals ko bhi signal kar sakti hain jab yeh key support ya resistance levels par milti hain. Misal ke tor par, agar Bullish Marubozu aik strong support level par form hota hai, toh yeh downtrend se uptrend mein potential reversal ko zahir kar sakta hai. Isi tarah, agar Bearish Marubozu aik strong resistance level par form hota hai, toh yeh uptrend se downtrend mein potential reversal ko zahir kar sakta hai.

Trading mein Practical Application

Entry aur Exit Points

Traders Marubozu candlesticks ko apne trades mein optimal entry aur exit points ko determine karne ke liye use karte hain. Bullish Marubozu ke liye, traders candlestick ke close par long position buy enter kar sakte hain, anticipating further upward movement. Bearish Marubozu ke liye, traders candlestick ke close par short position sell enter kar sakte hain, expecting further downward movement.

Risk Management

Risk management Marubozu pattern par trading karte waqt bohot zaroori hai. Traders aam tor par stop-loss orders set karte hain taake potential losses ko limit kiya ja sake. Bullish Marubozu ke liye, stop-loss opening price ke thoda neeche set kiya ja sakta hai, jab ke Bearish Marubozu ke liye, yeh opening price ke thoda upar set kiya ja sakta hai. Yeh approach risk ko manage karne mein madadgar hoti hai, taake agar market trader ke position ke against move karay toh trade exit ho jaye.

Dosray Indicators ke Saath Combine Karna

Marubozu candlestick signals ki reliability ko enhance karne ke liye, traders aksar inhe dosray technical indicators aur chart patterns ke saath combine karte hain. Moving averages, Relative Strength Index RSI, aur Fibonacci retracement levels Marubozu patterns ke saath use kiye jate hain taake trends ko confirm kiya ja sake aur potential reversal points ko identify kiya ja sake. Misal ke tor par, aik Bullish Marubozu jo ke rising moving average line ke upar form hota hai, aik mazboot confirmation provide karta hai aik uptrend ka. Isi tarah, aik Bearish Marubozu jo ke falling moving average line ke neeche form hota hai, bearish trend ko reinforce karta hai.

Uptrend mein Bullish Maruboz

Sochiye aik stock jo ke kayi hafton se steady uptrend mein hai. Aik din, daily chart par aik Bullish Marubozu form hota hai, jahan opening price $50 aur closing price $55 hoti hai, aur dono siron par shadows nahi hoti. Yeh pattern strong buying pressure ko zahir karta hai aur suggest karta hai ke uptrend continue hoga. Traders $55 par long position enter kar sakte hain, anticipating further price increases.

Downtrend mein Bearish Marubozu

Ab sochiye aik stock jo ke downtrend mein hai. Daily chart par aik Bearish Marubozu appear hota hai, jahan opening price $60 aur closing price $55 hoti hai, aur dono siron par shadows nahi hoti. Yeh pattern strong selling pressure ko zahir karta hai aur suggest karta hai ke downtrend continue hoga. Traders $55 par short position enter kar sakte hain, expecting further declines in price.

Support Level par Bullish Marubozu

Aik stock decline kar raha hai lekin $40 par aik strong support level ko reach karta hai. Aik Bullish Marubozu form hota hai jahan opening price $40 aur closing price $45 hoti hai, aur dono siron par shadows nahi hoti. Yeh pattern downtrend se uptrend mein potential reversal ko zahir karta hai, kyun ke buyers ne support level par control hasil kar liya hai. Traders $45 par long position enter kar sakte hain, anticipating a reversal.

Example 4: Resistance Level par Bearish Marubozu

Aik stock rise kar raha hai lekin $80 par aik strong resistance level ko hit karta hai. Aik Bearish Marubozu form hota hai jahan opening price $80 aur closing price $75 hoti hai, aur dono siron par shadows nahi hoti. Yeh pattern uptrend se downtrend mein potential reversal ko zahir karta hai, kyun ke sellers ne resistance level par control hasil kar liya hai. Traders $75 par short position enter kar sakte hain, expecting a reversal.

Limitations aur Considerations

False Signals

Jab ke Marubozu candlesticks powerful indicators hain, yeh hamesha sahi nahi hote aur kabhi kabhi false signals produce karte hain. Misal ke tor par, aik Marubozu pattern temporary market anomaly ki wajah se form ho sakta hai bajaye ke aik sustained change in market sentiment ki wajah se. Is liye, Marubozu signals ko confirm karne ke liye dosray technical indicators ya chart patterns ka istemal zaroori hai.

Market Conditions

Marubozu pattern ki effectiveness market conditions par depend karti hai. Highly volatile markets mein, Marubozu patterns kam reliable ho sakte hain due to frequent price fluctuations. Dusri taraf, stable markets mein, ye patterns zyada reliable signals de sakte hain.

Time Frames

Marubozu patterns mukhtalif time frames par appear ho sakte hain, minute charts se le kar monthly charts tak. Time frame jitna lamba hoga, Marubozu pattern ki significance utni zyada hogi. Misal ke tor par, daily chart par Marubozu aik 5-minute chart par Marubozu se zyada weight rakhta hai. Traders ko Marubozu ke appear hone wale time frame ko trading decisions lete waqt madde nazar rakhna chahiye.

Marubozu candlestick pattern aik straightforward lekin powerful tool hai technical analysis mein, jo market sentiment aur potential trend continuation ya reversal ke clear signals offer karta hai. Iske khasoosiyat ko samajh kar, iske signals ko interpret kar ke aur trading strategies mein effectively apply kar ke, traders informed decisions lene ki apni ability ko enhance kar sakte hain. Magar, sab technical indicators ki tarah, Marubozu pattern ko bhi dosray tools aur indicators ke saath use karna chahiye taake iske signals ko confirm kiya ja sake aur risk ko effectively manage kiya ja sake. Aisa kar ke, traders financial markets ke dynamic world mein apni success ke chances ko improve kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- CL

- Mentions 0

-

سا0 like

-

#4 Collapse

Marubozu Candlestick Pattern Kya Hai?اصل پيغام ارسال کردہ از: arslan0 پيغام ديکھيےWhat Is Marobuzu candlestick Pattern.

Marubozu candlestick pattern trading mein aik bohot important aur widely recognized pattern hai. Yeh pattern market ke sentiment aur trend direction ke bare mein clear indications deta hai. Marubozu pattern bullish aur bearish dono forms mein hota hai aur yeh market mein strong buying ya selling pressure ko represent karta hai.

Marubozu Candlestick Ka Taaruf

Marubozu candlestick pattern mein candlestick ki body bohot strong aur prominent hoti hai aur uske shadows ya wicks bohot kam ya bilkul nahi hoti. Yeh pattern tab banta hai jab opening aur closing prices bilkul extreme points par hoti hain. Bullish Marubozu mein, candlestick ka opening price low aur closing price high hota hai. Iska matlab yeh hai ke buyers ne pure din ke dauran price ko upar push kiya hai aur selling pressure bohot kam tha. Bearish Marubozu mein, candlestick ka opening price high aur closing price low hota hai. Yeh indicate karta hai ke sellers ne market ko dominate kiya hai aur buying pressure bohot kam tha.

Bullish Marubozu

Bullish Marubozu pattern strong bullish sentiment ko indicate karta hai. Is pattern mein candlestick ki body solid hoti hai aur opening price bilkul low aur closing price bilkul high hota hai. Yeh pattern market mein strong buying pressure ko represent karta hai aur indicate karta hai ke buyers ne market ko control mein rakha hai. Bullish Marubozu usually uptrend ke continuation ka signal hota hai, lekin yeh reversal signal bhi ho sakta hai agar yeh downtrend ke end par banta hai.

Bearish Marubozu

Bearish Marubozu pattern strong bearish sentiment ko indicate karta hai. Is pattern mein candlestick ki body solid hoti hai aur opening price bilkul high aur closing price bilkul low hota hai. Yeh pattern market mein strong selling pressure ko represent karta hai aur indicate karta hai ke sellers ne market ko control mein rakha hai. Bearish Marubozu usually downtrend ke continuation ka signal hota hai, lekin yeh reversal signal bhi ho sakta hai agar yeh uptrend ke end par banta hai.

Marubozu Pattern Ki Interpretation

Marubozu pattern ko interpret karte waqt, market ke overall trend aur sentiment ko madde nazar rakhna bohot zaroori hota hai. Bullish Marubozu ka appearance market mein strong bullish sentiment aur buying pressure ko indicate karta hai. Yeh pattern traders ke liye buying opportunities ko highlight karta hai. Dusri taraf, Bearish Marubozu market mein strong bearish sentiment aur selling pressure ko indicate karta hai. Yeh pattern traders ke liye selling opportunities ko highlight karta hai.

Risk Management Aur Strategy

Marubozu pattern ke sath trade karte waqt risk management bohot zaroori hota hai. Kyunki yeh pattern strong market sentiment ko represent karta hai, isliye stop loss orders set karna bohot important hai. Bullish Marubozu ke case mein, stop loss order ko candlestick ke low ke paas set karna chahiye aur Bearish Marubozu ke case mein, stop loss order ko candlestick ke high ke paas set karna chahiye. Yeh stop loss orders traders ko potential losses se bacha sakte hain agar market unexpected direction mein move kare.

Conclusion

Marubozu candlestick pattern trading mein bohot important aur valuable tool hai. Yeh pattern market ke sentiment aur trend direction ke bare mein clear indications deta hai. Bullish Marubozu strong buying pressure aur bullish sentiment ko indicate karta hai, jabke Bearish Marubozu strong selling pressure aur bearish sentiment ko indicate karta hai. Marubozu pattern ko sahi tarike se interpret karte hue aur effective risk management strategies ko implement karte hue, traders market mein profitable opportunities ko capitalize kar sakte hain aur apne trading decisions ko enhance kar sakte hain.

-

#5 Collapse

What Is Marobuzu candlestick Pattern.

Marubozu candlestick pattern ek bohat hi aham aur seedha saada pattern hai jo trading aur investing mein market ki direction ko samajhne ke liye istemal hota hai. Ye pattern asal mein Japanese candlestick charting technique ka hissa hai, jo 18th century ke Japanese rice traders ne develop ki thi. Is pattern ki simplicity aur effectiveness ki wajah se ye aaj bhi bohat popular hai.

Marubozu Kya Hai?

Marubozu ka matlab Japanese mein "bald" ya "shaved head" hota hai. Is naam ka concept ye hai ke is candlestick mein koi shadows (wicks) nahi hote. Ye candlestick complete body hoti hai, jo is baat ki nishani hai ke market mein strong trend hai. Marubozu candlestick do qisam ki hoti hain: Bullish Marubozu aur Bearish Marubozu.- Bullish Marubozu:

- Is pattern mein candlestick ka opening price lowest point hota hai aur closing price highest point hota hai.

- Ye baat darshata hai ke buyers ne pure trading session ke dauran market ko control mein rakha.

- Bullish Marubozu ka color aksar white ya green hota hai, lekin kuch charts mein ye doosre colors mein bhi ho sakti hai.

- Bearish Marubozu:

- Is pattern mein candlestick ka opening price highest point hota hai aur closing price lowest point hota hai.

- Ye baat darshata hai ke sellers ne pure trading session ke dauran market ko control mein rakha.

- Bearish Marubozu ka color aksar black ya red hota hai, lekin kuch charts mein ye doosre colors mein bhi ho sakti hai.

Marubozu pattern bohat zyada significance rakhti hai traders aur investors ke liye. Is pattern se yeh samajh mein aata hai ke market kis taraf move karne wali hai.- Trend Continuation:

- Agar Bullish Marubozu ek uptrend ke dauran nazar aaye, to iska matlab hai ke trend continue rahega aur prices aur upar jaane ke chances hain.

- Agar Bearish Marubozu ek downtrend ke dauran nazar aaye, to iska matlab hai ke trend continue rahega aur prices aur neeche jaane ke chances hain.

- Trend Reversal:

- Kabhi kabhi Marubozu candlestick ek trend reversal ka bhi signal de sakti hai, lekin iske liye hamesha doosre technical indicators ke sath confirmation lena zaroori hota hai.

Marubozu candlestick pattern ko trading strategies mein shamil karna bohat asaan hai. Aayiye kuch trading strategies par nazar daalte hain jo Marubozu pattern ke sath istimaal hoti hain:- Breakout Trading:

- Jab kisi significant resistance level ke paas Bullish Marubozu form ho, to ye ek strong breakout signal ho sakta hai. Traders is point par long position le sakte hain.

- Isi tarah, jab kisi significant support level ke paas Bearish Marubozu form ho, to ye ek strong breakdown signal ho sakta hai. Traders is point par short position le sakte hain.

- Stop Loss Placement:

- Bullish Marubozu pattern mein, stop loss ko candlestick ke lowest point par place kiya ja sakta hai.

- Bearish Marubozu pattern mein, stop loss ko candlestick ke highest point par place kiya ja sakta hai.

- Volume Confirmation:

- Marubozu pattern ke sath volume analysis bhi bohat aham hai. Agar high volume ke sath Marubozu form hoti hai, to is pattern ki reliability aur bhi barh jati hai.

Rozana trading mein Marubozu candlestick pattern ko samajhna aur uska istemal karna kaafi faidemand ho sakta hai. Is pattern ko use karte waqt kuch baaton ka dhyan rakhna zaroori hai:- Time Frames:

- Different time frames par Marubozu patterns dekhna zaroori hai. Short-term trading ke liye 5-minute ya 15-minute charts par focus karna chahiye, jabke long-term trading ke liye daily ya weekly charts par.

- Multiple Indicators:

- Marubozu pattern ke sath doosre technical indicators jaise ke Moving Averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) ka istemal karna chahiye.

- Market Conditions:

- Market ki overall condition ko samajhna bhi bohat zaroori hai. Marubozu pattern trending markets mein zyada effective hota hai.

Marubozu candlestick pattern ek bohat hi powerful tool hai jo traders aur investors ko market ke trend ko samajhne aur profitable trades execute karne mein madad deta hai. Is pattern ko effectively use karne ke liye iski basics aur iska application samajhna zaroori hai. Roman Urdu mein is pattern ki tafseelat ko samajhne ke baad, traders apni trading strategies ko enhance kar sakte hain aur better decision making kar sakte hain. Is pattern ko doosre technical indicators ke sath combine karke aur different time frames par apply karke, profitable trading opportunities ko identify karna aur trading risks ko minimize karna mumkin hota hai.

- CL

- Mentions 0

-

سا0 like

- Bullish Marubozu:

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

The Marubozu candlestick pattern is a widely recognized formation in technical analysis, characterized by its distinctive appearance and the absence of shadows at either end of the candlestick body. This pattern provides insights into market sentiment and potential price movements. Here is an in-depth explanation:

### Characteristics of the Marubozu Candlestick Pattern

1. **No Shadows (Wicks)**:

- **Definition**: A Marubozu candlestick has no upper or lower shadows. This means the high and low prices of the trading session are equal to the opening and closing prices, respectively.

- **Implication**: The lack of shadows indicates that the market opened at one extreme (either the high or low) and closed at the opposite extreme, reflecting a decisive and one-sided trading session.

2. **Types of Marubozu**:

- **Bullish Marubozu**:

- **Appearance**: The candlestick opens at the low of the session and closes at the high.

- **Indication**: This pattern signifies strong buying pressure throughout the session. It often suggests the continuation of an uptrend or a potential bullish reversal if it appears after a downtrend.

- **Market Sentiment**: It indicates that buyers were in control from the opening to the closing of the session.

- **Bearish Marubozu**:

- **Appearance**: The candlestick opens at the high of the session and closes at the low.

- **Indication**: This pattern signifies strong selling pressure throughout the session. It often suggests the continuation of a downtrend or a potential bearish reversal if it appears after an uptrend.

- **Market Sentiment**: It indicates that sellers dominated the market from the opening to the closing of the session.

### Interpretation and Significance

1. **Trend Continuation**:

- **Bullish Marubozu**: When this pattern appears in an existing uptrend, it typically signals the continuation of the bullish trend. Traders might view this as a confirmation of ongoing upward momentum.

- **Bearish Marubozu**: When this pattern appears in an existing downtrend, it generally signals the continuation of the bearish trend. Traders might interpret this as a confirmation of ongoing downward momentum.

2. **Trend Reversal**:

- **At Support Levels**: A Bullish Marubozu appearing near a support level after a downtrend can be a strong signal of a potential trend reversal to the upside.

- **At Resistance Levels**: A Bearish Marubozu appearing near a resistance level after an uptrend can be a strong signal of a potential trend reversal to the downside.

3. **Market Sentiment**:

- **Confidence**: The Marubozu pattern reflects strong confidence and conviction in the prevailing direction. The absence of shadows underscores the dominance of either buyers or sellers during the trading session.

- **Decisiveness**: This pattern indicates that there was little to no hesitation in the market, with prices moving decisively in one direction from the open to the close.

### Trading Strategies Involving Marubozu

1. **Confirmation with Other Indicators**:

- **Volume**: Traders often look for high trading volume accompanying the Marubozu pattern to confirm the strength of the trend or reversal.

- **Support and Resistance**: Combining the Marubozu pattern with key support and resistance levels can enhance the reliability of the signal.

2. **Entry and Exit Points**:

- **Bullish Marubozu**: Traders might enter a long position at the close of the Bullish Marubozu or on a subsequent pullback, with a stop-loss placed below the low of the pattern.

- **Bearish Marubozu**: Traders might enter a short position at the close of the Bearish Marubozu or on a subsequent pullback, with a stop-loss placed above the high of the pattern.

3. **Trend Analysis**:

- **Continuation Trades**: In trending markets, traders can use the Marubozu pattern to confirm the strength of the prevailing trend and potentially add to their positions.

- **Reversal Trades**: In range-bound or reversing markets, traders can use the Marubozu pattern to identify potential turning points.

### Conclusion

The Marubozu candlestick pattern is a powerful tool in technical analysis, providing clear signals of market sentiment and potential price movements. Its distinct lack of shadows makes it easy to identify and interpret, offering valuable insights for traders looking to capitalize on trend continuations or reversals. As with all technical patterns, it is most effective when used in conjunction with other indicators and market analysis techniques to confirm trading decisions.

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

*Marubozu Candle Stick Pattern Forex Trading Mein:

*Introduction;

Candle stick patterns forex trading mein bohat important hotay hain. In patterns ko study karna traders ke liye bohat zaroori hai. Aaj hum Marubozu candle stick pattern ke baare mein discuss karenge.

*Marubozu Kya Hai?

Marubozu candle stick pattern ek aisa pattern hai jis mein candle ki body bohat lambi hoti hai aur uski shadows (chhaye) nahi hoti. Agar bullish Marubozu hai to uski body green hoti hai aur agar bearish Marubozu hai to uski body red hoti hai. Marubozu ka matlab hota hai "shaven head" yaani ki sar mundwa kar.

*Bullish Marubozu;

Bullish Marubozu ka matlab hota hai ke market mein bohat strong buying pressure hai aur price continuously up trend mein hai. Bullish Marubozu mein candle ki body green hoti hai aur uski shadows nahi hoti.

*Bearish Marubozu;

Bearish Marubozu ka matlab hota hai ke market mein bohat strong selling pressure hai aur price continuously down trend mein hai. Bearish Marubozu mein candle ki body red hoti hai aur uski shadows nahi hoti.

*Kyun Use Karein Marubozu Candle Stick Pattern?

Marubozu candle stick pattern ka use karne se aapko market ki direction ka pata chalta hai. Agar bullish Marubozu hai to aapko buying ka signal milta hai aur agar bearish Marubozu hai to aapko selling ka signal milta hai.

-Conclusion:

Marubozu candle stick pattern forex trading mein bohat important hai. Is pattern ko study kar ke aap market ki direction ka pata laga sakte hain aur apni trades ko accordingly plan kar sakte hain.

-

#8 Collapse

Forex Mein Marubozu Candlesticks Pattern()()()()

Marubozu candlestick pattern Forex trading mein ek significant aur widely used pattern hai. Yeh pattern ek strong price movement ko indicate karta hai aur yeh trend continuation ya trend reversal ka sign bhi ho sakta hai.

Forex Mein Marubozu Candlesticks Pattern Ki Detail()()()()

Marubozu Candlestick Pattern ke Types- Bullish Marubozu:

- Yeh candlestick ek solid bullish (green or white) candle hoti hai jisme koi shadows (wicks) nahi hoti hain.

- Opening price low hota hai aur closing price high hota hai, which indicates strong buying pressure.

- Iska matlab hai ki poore trading session ke dauran buyers dominate karte rahe.

- Bearish Marubozu:

- Yeh candlestick ek solid bearish (red or black) candle hoti hai jisme koi shadows (wicks) nahi hoti hain.

- Opening price high hota hai aur closing price low hota hai, indicating strong selling pressure.

- Iska matlab hai ki poore trading session ke dauran sellers dominate karte rahe.

- No Shadows: Marubozu candlestick pattern mein shadows bilkul nahi hoti. Agar kuch shadows ho bhi toh woh negligible hoti hain.

- Full Body: Candle ka body full hota hai, jo indicate karta hai ki trading session mein price consistently ek direction mein move kiya.

- Bullish Marubozu:

- Uptrend continuation ka signal ho sakta hai agar yeh uptrend ke dauran form hota hai.

- Trend reversal ka signal ho sakta hai agar yeh downtrend ke baad form hota hai, indicating a potential bullish reversal.

- Bearish Marubozu:

- Downtrend continuation ka signal ho sakta hai agar yeh downtrend ke dauran form hota hai.

- Trend reversal ka signal ho sakta hai agar yeh uptrend ke baad form hota hai, indicating a potential bearish reversal.

- Trend Confirmation:

- Bullish Marubozu ko uptrend ke confirmation ke liye use kiya ja sakta hai. Entry position le sakte hain jab price bullish Marubozu ke high ko cross kare.

- Bearish Marubozu ko downtrend ke confirmation ke liye use kiya ja sakta hai. Entry position le sakte hain jab price bearish Marubozu ke low ko break kare.

- Stop Loss Placement:

- Bullish Marubozu mein, stop loss previous support level ya Marubozu ke low ke neeche place karna chahiye.

- Bearish Marubozu mein, stop loss previous resistance level ya Marubozu ke high ke upar place karna chahiye.

- Target Placement:

- Targets ko previous key levels, Fibonacci retracement levels, ya price action ke basis par set karna chahiye.

- Bullish Marubozu:

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Main Marobuzu Candlestick Pattern

Forex trading main candlestick patterns ka istimaal traders ko market ke movements samajhne main madad deta hai. In patterns main se aik Marobuzu candlestick pattern bhi hai. Ye pattern bohat significance rakhta hai aur traders ko market ke direction ke bare main clear signal deta hai.

Marobuzu Candlestick Pattern Kya Hai?

Marobuzu ek Japanese word hai jo "bald" ya "shaved" ke liye istemal hota hai. Marobuzu candlestick pattern aik aisa pattern hota hai jis main koi shadow ya wick nahi hoti. Yeh pattern seedha, complete body se bana hota hai aur market ke strong trend ko indicate karta hai. Marobuzu candlestick do types ke hotay hain: Bullish Marobuzu aur Bearish Marobuzu.

Bullish Marobuzu

Bullish Marobuzu wo candlestick hoti hai jiski opening price aur closing price ke darmiyan bohat zyada difference hota hai aur yeh upper side ko move karti hai. Iska matlab hai ke buyers ne poore trading session main control rakha aur price ko upar le gaye bina kisi resistance ke. Bullish Marobuzu market main upward trend ko indicate karti hai aur yeh signal hota hai ke market aur upar ja sakti hai.

Bearish Marobuzu

Bearish Marobuzu wo candlestick hoti hai jiski opening price high aur closing price low hoti hai, aur yeh poora downtrend show karti hai. Iska matlab hai ke sellers ne poore trading session main control rakha aur price ko neeche le gaye bina kisi support ke. Bearish Marobuzu market main downward trend ko indicate karti hai aur yeh signal hota hai ke market aur neeche ja sakti hai.

Marobuzu Candlestick Ka Importance

Forex trading main Marobuzu candlestick pattern ko bohat important samjha jata hai kyun ke yeh clear direction indicate karta hai. Jab Marobuzu candlestick form hoti hai to yeh signal hota hai ke market main strong buying ya selling pressure hai. Yeh pattern traders ko market ke trend ko samajhne main aur apne trading decisions ko align karne main madad deta hai.

Marobuzu Candlestick Pattern Ko Kaise Identify Karein?

Marobuzu candlestick pattern ko identify karna asaan hai. Is main sirf aik complete body hoti hai bina kisi shadow ke. Yeh aik strong trend ke shuru hone ya continue hone ka signal hota hai. Bullish Marobuzu candlestick green ya white hoti hai, jab ke Bearish Marobuzu candlestick red ya black hoti hai.

Marobuzu Candlestick Pattern Ka Use

Forex trading main Marobuzu candlestick pattern ka use kaise karna chahiye? Yeh pattern trading strategies main bohat useful hota hai. Bullish Marobuzu ka matlab hota hai ke aap buy trade consider kar sakte hain, jab ke Bearish Marobuzu ka matlab hota hai ke aap sell trade consider kar sakte hain.

Marobuzu candlestick pattern ko support aur resistance levels ke sath use karna bhi beneficial hota hai. Agar Marobuzu candlestick support level ke upar form hoti hai to yeh strong buying signal hota hai. Aur agar yeh resistance level ke neeche form hoti hai to yeh strong selling signal hota hai.

Marobuzu Candlestick Pattern Ki Limitations

Har trading pattern ki tarah, Marobuzu candlestick pattern ki bhi kuch limitations hain. Yeh zaroori nahi ke har Marobuzu candlestick accurate signal de. Kabhi kabhi market conditions aur external factors ke waja se yeh pattern fail bhi ho sakta hai. Isliye, traders ko dusre indicators aur analysis tools ke sath milkar is pattern ko use karna chahiye.

Note

Marobuzu candlestick pattern Forex trading main ek powerful tool hai jo market ke direction ko samajhne main madad karta hai. Yeh pattern simple hai magar iski reliability aur accuracy trading main bohat useful hoti hai. Bullish aur Bearish Marobuzu patterns market ke strong trends ko indicate karte hain aur traders ko apne trading strategies ko refine karne main madad dete hain. Lekin, hamesha yaad rakhen ke koi bhi pattern 100% accurate nahi hota, isliye comprehensive analysis aur risk management strategies ka use zaroori hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

### Marubozu Candlestick Pattern Kya Hai?

Marubozu candlestick pattern ek powerful bullish ya bearish signal hai jo market me strong trend aur momentum ko indicate karta hai. Ye pattern ek single candlestick se bana hota hai jisme clear aur solid body hoti hai aur minimal shadows hoti hain. Marubozu pattern ka analysis traders ko market ke trend aur strength ko samajhne me madad karta hai.

**Marubozu Pattern Ki Pehchaan:**

1. **Body Size:** Marubozu candlestick ki body long aur solid hoti hai. Is pattern me body ke andar open aur close prices ke beech ki distance large hoti hai, jo strong buying ya selling pressure ko represent karti hai.

2. **Shadows:** Marubozu candlestick ke dono sides par shadows ya to nahi hoti ya bohot chhoti hoti hain. Agar candlestick ke upper ya lower shadow large hain, to pattern ko Marubozu nahi mana jata.

3. **Color:** Marubozu pattern ke color se signal ki direction ka pata chalta hai. Agar candlestick white (bullish) hoti hai, to iska matlab hai ke market me strong buying pressure hai. Agar candlestick black (bearish) hoti hai, to iska matlab hai ke market me strong selling pressure hai.

**Pattern Ki Significance:**

1. **Bullish Marubozu:** Jab Marubozu candlestick pattern white hoti hai, to ise Bullish Marubozu kaha jata hai. Ye pattern market me strong buying momentum aur bullish trend ka indication hota hai. Iska matlab hai ke buyers market me dominant hain aur price upar ki taraf move kar rahi hai.

2. **Bearish Marubozu:** Jab Marubozu candlestick pattern black hoti hai, to ise Bearish Marubozu kaha jata hai. Ye pattern market me strong selling momentum aur bearish trend ka indication hota hai. Iska matlab hai ke sellers market me dominant hain aur price neeche ki taraf move kar rahi hai.

**Trading Strategy:**

1. **Confirmation:** Marubozu pattern ka confirmation zaroori hai. Agla session ya candlestick pattern ke signal ko validate karna chahiye. For example, Bullish Marubozu ke baad agar price upward movement continue karti hai, to signal ka confirmation strong hota hai.

2. **Volume Analysis:** Volume ko bhi analyze karein, kyunki high volume ke sath Marubozu pattern ki signal strength zyada hoti hai. Low volume ke sath pattern ka signal weak ho sakta hai.

3. **Support aur Resistance Levels:** Marubozu pattern ke sath support aur resistance levels ko bhi dekhna zaroori hai. Pattern ke context me support ya resistance levels ke impact ko samajhne se trading decisions ko improve kiya ja sakta hai.

**Conclusion:**

Marubozu candlestick pattern ek significant technical indicator hai jo strong trend aur momentum ko indicate karta hai. Bullish ya bearish Marubozu pattern ka sahi analysis aur confirmation trading decisions ko optimize karne me madadgar hota hai. Traders ko pattern ke context, volume, aur support/resistance levels ko consider karke informed trading decisions leni chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:10 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим