Gartley pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Gartley pattern Gartley Pattern 1 harmonic chart pattern hota hai jo fibnike numbers aur tanasbo per mabni Hota Hai tajro ko rady Amal ki bulandiyon aur kemo ki identity karne mein madad Dete Hain aapane book perfect in a stock market Mein hm gartley Ne 1935 Mein harmonic chart pattern ki base Rakhi thi gartiey pattern sabse zyada use hone wala harmonic chart pattern hai:max_bytes(150000):strip_icc()/GartleyPattern-5541ce000da34023a20348e5681bbffb.png) Explained gartley pattern Harmonic pattern is base per kam karta hai ki price Mein fibnike tarteb ko geometric dhanche Jaise break out aur rateryesmints banane ke liye use karte hain finiki ki tanashab fitrat mein Aam hota hai aur takniki tajiye Karan ke difference tavajon ka ek Maqbool area ban gaya tha Rules of gartley pattern Pattern harmonic family ka rukon hota hai isliye Har jul ko maksus fibnike ki Sattu ke mutabik Hona chahie Hota Hai ab Ham gartley dhanche ke har chijon ko dekhenge XA akdam chart per price ki koi bhi sargarmi Hoti Hai Gartley chart kitakeel ke price ke ek dam Ke Silsile Mein Koi Khas takaja Nahin Hota

Explained gartley pattern Harmonic pattern is base per kam karta hai ki price Mein fibnike tarteb ko geometric dhanche Jaise break out aur rateryesmints banane ke liye use karte hain finiki ki tanashab fitrat mein Aam hota hai aur takniki tajiye Karan ke difference tavajon ka ek Maqbool area ban gaya tha Rules of gartley pattern Pattern harmonic family ka rukon hota hai isliye Har jul ko maksus fibnike ki Sattu ke mutabik Hona chahie Hota Hai ab Ham gartley dhanche ke har chijon ko dekhenge XA akdam chart per price ki koi bhi sargarmi Hoti Hai Gartley chart kitakeel ke price ke ek dam Ke Silsile Mein Koi Khas takaja Nahin Hota  Reliable is gartley pattern Ek rujan SAS Bzjar Mein Gartley Pattern ke Sahi hone ka zyada Makan Hota Hai rujan ko changes karne ka Ishara Dete Hain Ek had Tak mahdud market Mein gartley pattern kam Kabali Damad Hote Hain price ki nakal Harkat ke zarie inhen easily baten Kiya jata hai Gartley bullish are Bearish Vah bullish pattern trade ko Ala kharidari ke Mauvka Ke faram Karte Hain aur forex market mein dakhile ke positive makamat ki nishandai karne mein madad karte hain bearish pettern Mein price Mein lagatar four changes hoti hai aur Iske numaendagi Ek Hindsi pattern ke Taur per Hoti Hai jismein litter Ko Dekha jata hai isase pahle three Daryani Haddaf hote hain Chart per yah four Satya Tezi ke gartley Ke Char kam Aaz kam hadaf Hote Hain

Reliable is gartley pattern Ek rujan SAS Bzjar Mein Gartley Pattern ke Sahi hone ka zyada Makan Hota Hai rujan ko changes karne ka Ishara Dete Hain Ek had Tak mahdud market Mein gartley pattern kam Kabali Damad Hote Hain price ki nakal Harkat ke zarie inhen easily baten Kiya jata hai Gartley bullish are Bearish Vah bullish pattern trade ko Ala kharidari ke Mauvka Ke faram Karte Hain aur forex market mein dakhile ke positive makamat ki nishandai karne mein madad karte hain bearish pettern Mein price Mein lagatar four changes hoti hai aur Iske numaendagi Ek Hindsi pattern ke Taur per Hoti Hai jismein litter Ko Dekha jata hai isase pahle three Daryani Haddaf hote hain Chart per yah four Satya Tezi ke gartley Ke Char kam Aaz kam hadaf Hote Hain -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Gartley Chart Pattern

Gartley chart pattern, aam dosre harmonic patterns ki tarah hote hain, jiss mein kaye candlesticks kafi arse se aik khas shap ki talash mein hote hain. Gartley chart pattern price action ko predict karne ke liye use kiya jata hai, jisse traders buy ya sell positions ko enter karne ke liye use karte hain. Yeh pattern, ek harmonic trading pattern hai, jo Fibonacci retracement levels ko use karta hai, aur market trends aur price movement ko analyze karne ke liye useful hota hai.

Gartley chart pattern ke key points niche diye gaye hain:- Gartley Pattern Structure:

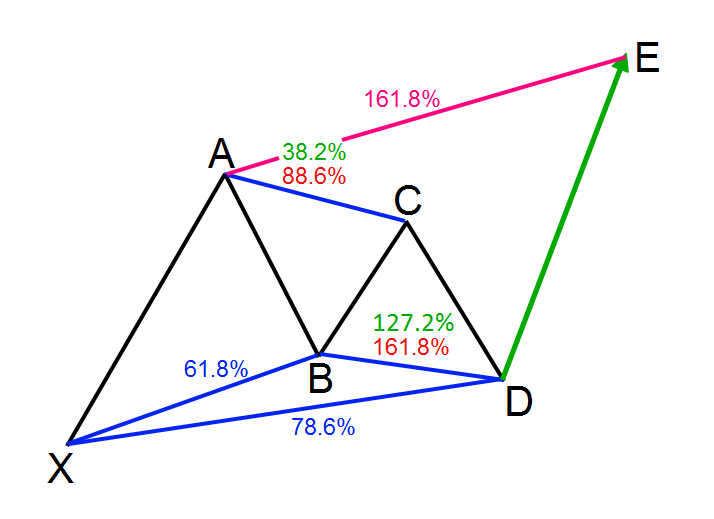

Gartley chart pattern, ek price reversal pattern hai, jo market trends aur price movement ko analyze karne mein help karta hai. Yeh pattern, four price swings se banta hai, jisme AB, BC, CD aur XA hota hai. Yeh swings, Fibonacci retracement levels ko use karte huye banaye jate hain, jisse traders ko price action ke baare mein insights milte hain. - Harmonic Trading:

Gartley chart pattern, harmonic trading patterns mein se ek hai, jo Fibonacci retracement levels ko use karta hai. Gartley pattern, Fibonacci ratios se banta hai, jisme BC aur CD legs, 0.618 Fibonacci retracement level ke close proximity mein hone chahiye, aur CD leg, AB leg ke 1.272 Fibonacci extension level par complete hona chahiye. Is tarah se, traders ko price action ke baare mein insights milte hain. - Trading Strategies:

Gartley chart pattern ko trading strategies ke liye use kiya jata hai. Gartley pattern ko trade karne ke liye, traders ko entry, stop loss aur profit target levels set karne ki zaroorat hoti hai. Agar price, Gartley pattern ke completion level par reach karta hai, to traders ko buy ya sell position enter karna recommend kiya jata hai. - Timeframe:

Gartley chart pattern ko kisi bhi timeframe par analyze kiya ja sakta hai, chahe wo short-term timeframe ho ya phir long-term timeframe. Short-term timeframe par Gartley pattern ki probability high hoti hai, lekin false signals ki possibility bhi high hoti hai. Long-term timeframe par Gartley pattern ki probability kam hoti hai, lekin false signals ki possibility kam hoti hai. - Risk Management:

Gartley pattern ko trade karte waqt, risk management ko dhyan mein rakhna zaroori hai. Traders ko stop loss level ko set karne ki zaroorat hoti hai, taki inhein loss ka risk minimize karne mein help mile. Profit target level bhi set karne ki zaroorat hoti hai, taki traders ko profit book karne mein help mile.

Gartley chart pattern, Fibonacci retracement levels ko use karte huye, price action ko predict karne ke liye use kiya jata hai, aur traders aur investors ke liye market trends aur price movement ko analyze karne mein useful hota hai.

Gartley Chart Pattern ki Tafseel

Gartley chart pattern, technical analysis ka ek powerful tool hai, jo traders aur investors ko market trends aur price movement ko analyze karne mein help karta hai. Gartley pattern, price action ko predict karne ke liye use kiya jata hai, jisse traders buy ya sell positions ko enter karne ke liye use karte hain. Yeh pattern, Fibonacci retracement levels ko use karta hai, aur market trends aur price movement ko analyze karne ke liye useful hota hai.

Gartley chart pattern ka structure four price swings se banta hai, jisme AB, BC, CD aur XA hota hai. Yeh swings, Fibonacci retracement levels ko use karte huye banaye jate hain. AB leg, market trend ke starting point se banaya jata hai aur XA leg ko connect karta hai. BC leg, AB leg ke high point se start hota hai, aur AB leg ke 0.618 Fibonacci retracement level ke close proximity mein complete hota hai. CD leg, BC leg ke low point se start hota hai, aur BC leg ke 0.618 Fibonacci retracement level ke close proximity mein complete hota hai. CD leg, AB leg ke 1.272 Fibonacci extension level par complete hona chahiye.

Gartley pattern, harmonic trading patterns mein se ek hai, jo Fibonacci retracement levels ko use karta hai. Gartley pattern, Fibonacci ratios se banta hai, jisme BC aur CD legs, 0.618 Fibonacci retracement level ke close proximity mein hone chahiye. CD leg, AB leg ke 1.272 Fibonacci extension level par complete hona chahiye. Is tarah se, traders ko price action ke baare mein insights milte hain.

Gartley chart pattern ko trading strategies ke liye use kiya jata hai. Gartley pattern ko trade karne ke liye, traders ko entry, stop loss aur profit target levels set karne ki zaroorat hoti hai. Agar price, Gartley pattern ke completion level par reach karta hai, to traders ko buy ya sell position enter karna recommend kiya jata hai. Entry level, completion level ke close proximity mein set kiya jata hai, aur stop loss level, completion level ke opposite side par set kiya jata hai. Profit target level, Fibonacci retracement levels ke close proximity mein set kiya jata hai, jisse traders ko profit book karne mein help mile.

Gartley chart pattern ko kisi bhi timeframe par analyze kiya ja sakta hai, chahe wo short-term timeframe ho ya phir long-term timeframe. Short-term timeframe par Gartley pattern ki probability high hoti hai, lekin false signals ki possibility bhi high hoti hai. Long-term timeframe par Gartley pattern ki probability kam hoti hai, lekin false signals ki possibility kam hoti hai.

Gartley pattern ko trade karte waqt, risk management ko dhyan mein rakhna zaroori hai. Traders ko stop loss level ko set karne ki zaroorat hoti hai, taki inhein loss ka risk minimize karne mein help mile. Profit target level bhi set karne ki zaroorat hoti hai, taki traders ko profit book karne mein help mile.

Bullish Gartley Chart Pattern

Bullish Gartley chart pattern, ek powerful technical analysis tool hai, jo traders aur investors ko market trends aur price movement ko analyze karne mein help karta hai. Bullish Gartley pattern, price action ko predict karne ke liye use kiya jata hai, jisse traders buy positions ko enter karne ke liye use karte hain.

Bullish Gartley chart pattern, four price swings se banta hai, jisme AB, BC, CD aur XA hote hain. Yeh swings, Fibonacci retracement levels ko use karte huye banaye jate hain. AB leg, market trend ke starting point se banaya jata hai aur XA leg ko connect karta hai. BC leg, AB leg ke high point se start hota hai, aur AB leg ke 0.618 Fibonacci retracement level ke close proximity mein complete hota hai. CD leg, BC leg ke low point se start hota hai, aur BC leg ke 0.618 Fibonacci retracement level ke close proximity mein complete hota hai. CD leg, AB leg ke 1.272 Fibonacci extension level par complete hona chahiye.

Bullish Gartley pattern, bullish trend reversal ko signal karta hai. Agar CD leg, AB leg ke 1.272 Fibonacci extension level par complete hote hue, bullish trend ki continuation se sidhe sidhe opposite direction mein move karta hai, to Bullish Gartley pattern complete ho jata hai.

Bullish Gartley chart pattern ko trading strategies ke liye use kiya jata hai. Bullish Gartley pattern ko trade karne ke liye, traders ko entry, stop loss aur profit target levels set karne ki zaroorat hoti hai. Agar price, Bullish Gartley pattern ke completion level par reach karta hai, to traders ko buy position enter karna recommend kiya jata hai. Entry level, completion level ke close proximity mein set kiya jata hai, aur stop loss level, completion level ke opposite side par set kiya jata hai. Profit target level, Fibonacci retracement levels ke close proximity mein set kiya jata hai, jisse traders ko profit book karne mein help mile.

Traders ko Bullish Gartley pattern ki authenticity ko confirm karne ke liye, iske completion level par price action ke confirmation ke liye wait karna chahiye. Bullish candlestick patterns, bullish chart patterns aur bullish indicators ke signals, Bullish Gartley pattern ke confirmation ke liye useful ho sakte hain.

Risk management ko dhyan mein rakhna, Bullish Gartley pattern ko trade karte waqt zaroori hai. Traders ko stop loss level ko set karne ki zaroorat hoti hai, taki inhein loss ka risk minimize karne mein help mile. Profit target level bhi set karne ki zaroorat hoti hai, taki traders ko profit book karne mein help mile.

Trading with Bullish Gartley Chart Pattern

Bullish Gartley chart pattern, bullish trend reversal ko signal karta hai aur traders ko buy positions enter karne ke liye recommend kiya jata hai.

- Confirming the Pattern:

Bullish Gartley pattern, four price swings se banta hai, jisme AB, BC, CD aur XA hote hain. Yeh swings, Fibonacci retracement levels ko use karte huye banaye jate hain. Traders ko is pattern ki authenticity ko confirm karne ke liye, iske completion level par price action ke confirmation ke liye wait karna chahiye. Bullish candlestick patterns, bullish chart patterns aur bullish indicators ke signals, Bullish Gartley pattern ke confirmation ke liye useful ho sakte hain. - Entry Level:

Entry level, completion level ke close proximity mein set kiya jata hai. Traders ko entry level, Fibonacci retracement levels ke close proximity mein bhi set kar sakte hain. Agar price, completion level ke close proximity mein rehta hai, to traders ko entry level par buy position enter karna recommend kiya jata hai. - Stop Loss Level:

Stop loss level, completion level ke opposite side par set kiya jata hai. Agar price, completion level ke opposite side par move karta hai, to traders ko stop loss level ko adjust karna chahiye. Stop loss level ko set karne se traders ko loss ka risk minimize karne mein help milega. - Profit Target Level:

Profit target level, Fibonacci retracement levels ke close proximity mein set kiya jata hai. Traders ko profit target level ko set karne ke liye, Fibonacci retracement levels ko use karna chahiye. Profit target level ko set karne se traders ko profit book karne mein help milega. - Risk Management:

Bullish Gartley pattern ko trade karte waqt, traders ko risk management ko dhyan mein rakhna zaroori hai. Traders ko stop loss level ko set karne ki zaroorat hoti hai, taki inhein loss ka risk minimize karne mein help mile. Profit target level bhi set karne ki zaroorat hoti hai, taki traders ko profit book karne mein help mile. - Multiple Timeframe Analysis:

Multiple timeframe analysis, traders ke liye helpful hoti hai, kyunki yeh unhein overall market trend aur price movement ke bare mein better understanding deti hai. Traders, Bullish Gartley pattern ko trade karne se pahle, multiple timeframe analysis ka use karke market ki overall trend ko analyze kar sakte hain. - Price Action Analysis:

Price action analysis, traders ke liye important hai, kyunki yeh unhein price movement ke bare mein better understanding deta hai. Traders, Bullish Gartley pattern ke completion level par price action ke confirmation ke liye wait karte hain. Price action analysis, traders ko entry level, stop loss level aur profit target level set karne mein help karta hai.

Bearish Gartley Chart Pattern

Bearish Gartley chart pattern ek technical analysis tool hai, jo traders aur investors ko market trends aur price movements ko analyze karne mein help karta hai. Yeh pattern, bearish trend reversal ko signal karta hai aur traders ko sell positions enter karne ke liye recommend kiya jata hai. Is article mein, hum bearish Gartley chart pattern par trading techniques ke bare mein discuss karenge.

Bearish Gartley pattern, four price swings se banta hai, jisme AB, BC, CD aur XA hote hain. Yeh swings, Fibonacci retracement levels ko use karte huye banaye jate hain. Traders ko is pattern ki authenticity ko confirm karne ke liye, iske completion level par price action ke confirmation ke liye wait karna chahiye. Bearish candlestick patterns, bearish chart patterns aur bearish indicators ke signals, Bearish Gartley pattern ke confirmation ke liye useful ho sakte hain.

Traders ko entry level, Fibonacci retracement levels ke close proximity mein bhi set kar sakte hain. Agar price, completion level ke close proximity mein rehta hai, to traders ko entry level par sell position enter karna recommend kiya jata hai. Agar price, completion level ke opposite side par move karta hai, to traders ko stop loss level ko adjust karna chahiye. Stop loss level ko set karne se traders ko loss ka risk minimize karne mein help milega. Traders ko profit target level ko set karne ke liye, Fibonacci retracement levels ko use karna chahiye. Profit target level ko set karne se traders ko profit book karne mein help milega.

Bearish Gartley pattern ko trade karte waqt, traders ko risk management ko dhyan mein rakhna zaroori hai. Traders ko stop loss level ko set karne ki zaroorat hoti hai, taki inhein loss ka risk minimize karne mein help mile. Profit target level bhi set karne ki zaroorat hoti hai, taki traders ko profit book karne mein help mile. Multiple timeframe analysis, traders ke liye helpful hoti hai, kyunki yeh unhein overall market trend aur price movement ke bare mein better understanding deti hai. Traders, Bearish Gartley pattern ko trade karne se pahle, multiple timeframe analysis ka use karke market ki overall trend ko analyze kar sakte hain.

Price action analysis, traders ke liye important hai, kyunki yeh unhein price movement ke bare mein better understanding deta hai. Traders, Bearish Gartley pattern ke completion level par price action ke confirmation ke liye wait karte hain. Price action analysis, traders ko entry level, stop loss level aur profit target level set karne mein help karta hai. Bearish Gartley chart pattern, ek powerful technical analysis tool hai, jo traders aur investors ko market trends aur price movement ko analyze karne mein help karta hai. Bearish Gartley pattern ko trade karne ke liye, traders ko entry, stop loss aur profit target levels set karne ki zaroorat hoti hai

Trading with Bearish Gartley Chart Pattern

Bearish Gartley chart pattern ek technical analysis tool hai, jo traders aur investors ko market trends aur price movements ko analyze karne mein help karta hai. Yeh pattern, bearish trend reversal ko signal karta hai aur traders ko sell positions enter karne ke liye recommend kiya jata hai.

- Confirming the Pattern:

Bearish Gartley pattern, four price swings se banta hai, jisme AB, BC, CD aur XA hote hain. Yeh swings, Fibonacci retracement levels ko use karte huye banaye jate hain. Traders ko is pattern ki authenticity ko confirm karne ke liye, iske completion level par price action ke confirmation ke liye wait karna chahiye. Bearish candlestick patterns, bearish chart patterns aur bearish indicators ke signals, Bearish Gartley pattern ke confirmation ke liye useful ho sakte hain. - Entry Level:

Entry level, completion level ke close proximity mein set kiya jata hai. Traders ko entry level, Fibonacci retracement levels ke close proximity mein bhi set kar sakte hain. Agar price, completion level ke close proximity mein rehta hai, to traders ko entry level par sell position enter karna recommend kiya jata hai. - Stop Loss Level:

Stop loss level, completion level ke opposite side par set kiya jata hai. Agar price, completion level ke opposite side par move karta hai, to traders ko stop loss level ko adjust karna chahiye. Stop loss level ko set karne se traders ko loss ka risk minimize karne mein help milega. - Profit Target Level:

Profit target level, Fibonacci retracement levels ke close proximity mein set kiya jata hai. Traders ko profit target level ko set karne ke liye, Fibonacci retracement levels ko use karna chahiye. Profit target level ko set karne se traders ko profit book karne mein help milega. - Risk Management:

Bearish Gartley pattern ko trade karte waqt, traders ko risk management ko dhyan mein rakhna zaroori hai. Traders ko stop loss level ko set karne ki zaroorat hoti hai, taki inhein loss ka risk minimize karne mein help mile. Profit target level bhi set karne ki zaroorat hoti hai, taki traders ko profit book karne mein help mile. - Multiple Timeframe Analysis:

Multiple timeframe analysis, traders ke liye helpful hoti hai, kyunki yeh unhein overall market trend aur price movement ke bare mein better understanding deti hai. Traders, Bearish Gartley pattern ko trade karne se pahle, multiple timeframe analysis ka use karke market ki overall trend ko analyze kar sakte hain. - Price Action Analysis:

Price action analysis, traders ke liye important hai, kyunki yeh unhein price movement ke bare mein better understanding deta hai. Traders, Bearish Gartley pattern ke completion level par price action ke confirmation ke liye wait karte hain. Price action analysis, traders ko entry level, stop loss level aur profit target level set karne mein help karta hai.

- Gartley Pattern Structure:

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:55 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим