What is the gartley pattern?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

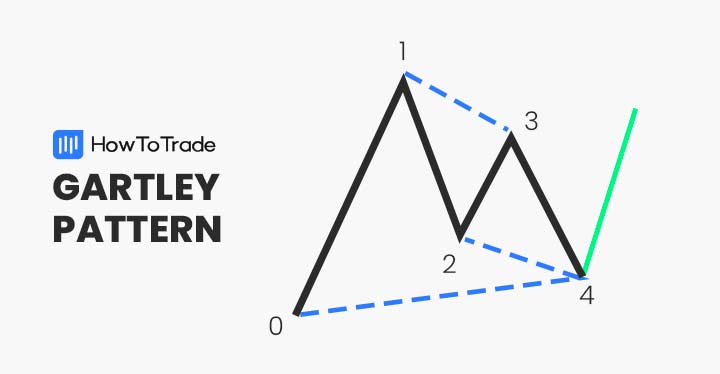

WHAT IS GARTLEY PATTERN : Gartley pattern ak harmonic chart formation ha or ya pattern relies karta ha Fibonacci sequence par apni construction ka liya. Is pattern ki jo formation hoti ha ya bahot hi intended hoti ha jo ka stock market ka liya magar ya kisi bhi instrument or product sa applied ki ja sakti ha. Ya gartley patterns ak bahot hi commonly used hona wala ak harmonic patterns ha jab is ko technical analysis kiya jata ha. Ya batata ha traders ko price ka target ka profit ko taking karna ka liya or ya batats ha traders ko stop loss ki location ka bara ma. Is gartley pattern ko currency traders use karta ha or is sa project karta ha bullish or breash price action ka forthcoming hona ka liya forex markets ma. Or is pattern ki jo formation hoti ha ya madad karti ha study karna ka liya market ki symmetry ko jab is ma forex trading karta ha. HOW TO IDENTIFY AND USE GARTLEY PATTERN IN FOREX TRADING : Ya jo gartley pattern ha ya application hota ha forex markets ma jasa ka or harmonise patterns hota ha. Is gartley pattern ki formation do trha sa hoti ha ak bullish or dosra bearish gartley pattern. Jasa ka ko below ma ya jo GBP/USD ka chart ha huma show kar raha ha Gartley pattern ki strong formation ko. Jo ya below ma steps ha in ki madad sa is gartley pattern ko identify or use ki ja sakta ha: 1: Sab sa phalay is ma identify karna ho ga ya market ma kon sa trend chal raha ha ya jo pattern ha ya bullish ya bhi bearish market ki conditions ma bana ha. 2: Second step ma huma label karay ga series ko jo ka four peaks or troughs sa bani ho ge. 3: Is ka bad hum measure karay ga Fibonacci retracement ko or is ka liya hum using karay ga is ka point Z sa point A ko. 4: Or jo is ma point B ho ga ya 61.8% ho ga point A ka high sa. 5: Jo point C ho ga ya 38.2% ho ga point A ka high par. 6: Or point D 78.6% par ho ga point A ka high sa. 7: Phir is ma last step ma determine karay ga buy jo ka bullish or sell jo ka bearish entry ho jo ka 78.2% par ho ge Fibonacci retracement ka. BULLISH GARTLEY PATTERN : Forex merket ma is bullish gartley pattern ko used kiya jata ha identify karna ka liya buying ki opportunity ko. Is ma jo formation hoti ha is ko consider kiya jata ha retracement or continuation pattern ki trha sa. Ya jo bullish gartley pattern ha ya project karta ha or extension karta ha uptrend ko. Ya bullish gartley pattern consist hota ha uptrend ma price ka or ya series ko measured karta ha retracements ki. Jo ya bealo ma gbp/usd ka chart ha ya show kar raha ha bullish gartley pattern ka illustrates ko. BEARISH GARTLEY PATTERN : Ya bearish gartley pattern opposite ma hota ha bullish gartley pattern ka. Or ya bhi consider hota ha ak retracement or continuation pattern ki trha sa. Or ya bearish gartley pattern huma buying ka signal data ha or ya suggests karta ha sell ka appropriate hona ka. Ya bearish gartley pattern comprised hota ha solid downward ka move ka sath jis ma price fallowed karti ha retracement ki series ko. Or jo below ma gbp/usd ka chart ha ya huma ak bahot hi clear look da raha ha is bearish gartley pattern ki. HOW TO TRADE USING GARTLEY PATTERN : Sari technical analysis ko dakha jay to jo is bearish or bullish gartley pattern ma pitch process ha yo ya ka is pattern ko use kar ka determine kiya jay market ma entry, or is ma locating liya jay stop losses or profit targets ko. MARKET ENTRY : Jo bahot hi achi bat ha is gartley pattern ki formation ki wo ya ka ya traders ka liya flexibility ko banta ha market ma entry ka liya. Ya jo pattern ha ya huma dono signals ko offers karta ha or ya batata ha both buying or selling ki opportunities ka bara ma, or ya depending kar raha hota ha market ki conditions par. Is pattern ma traders choose karta ha buy or sell ko jab jo is ma C or D leg ha ya retraced hoti ha 78.6% jo Z or A ki directional move ka. Ya ya dono hi improves karta ha timing or profitability ko is ma bullish or bearish trade ko enter karna ka liya. STOP LOSS : Is gartley pattern ka sath, jo stop loss hota ya is ko placing karna relatively straightforward hota ha. Jo is ma stop loss order hota ha is ko placed karta ha below ma or above ma origins ka Z A leg ka. Jo ya potential reversal zone hota ya is trha sa hota ha jab bullish gartley hota ha yo is ma stop loss ko placed karay ga beneath ma Z or A ki leg ka. Or agar bearish gartley pattern ho ga to is ma stop loss ko placed karay ga above ma Z or A ki leg ka. PROFIT TARGET: Jo is pattern ma locating karna ho ga profit target ko ya thora sa mushkil ho ga. Kuch traders use karay ga retracement level ka method ko or is ki madad sa find karay ga profit target ko jo ka upside or downside targets ma jo ga. Jo bullish gartley ho ga is ma draw karay ga Fibonacci retracement ko high point ma A ka or low point ma D ka. Jo profit target ho ga is ko placed karay ga 61.8% par ya phir 78.6% ka level par. EXAMPLE : Sara patterns ki trha sa, gartley pattern ma traded karay ga ak specific process ka sath. Jasa ka below ma jo gbp/usd ki example ha ya huma full detailed look ka bata rahi ha is ki formation ka or traded karna ka liya live forex ma. Is chart ma dakh sakta ha ka is ma huma sab sa phalay uptrend (Z-A) observed hua ha. Is ma market ki retracement hoi ha jo ka 61.8% (A-B) hoi ha or ya rallying kar rahi ha (B-C) par phir is ma pulling back (C-D) hua ha or ya gartley pattern formed hua ha.Buy order ko is ma enter kiya gaya ha jab 78.6% retracement hoi ha Z-A ki or ya level 1.3710 ka ha is chart ma.Jo stop loss ha os ko is ma placed kiya ha below ma Z sa or ya jo level ha is chart ma ya 1.3580 ka ha. Or jo profit target ha is ko located kiya ha 38.6% ki retracement par Z-A ki jo ka 1.3980 par ha. Is pattern ma profit target jasa ka chart ma dakh sakta ha hit ho gaya ha or ya 270 point pip ko gain kar raha ha. GARTLEY PATTERNS VS OTHER HARMONIC PATTERNS: Harmonic chart pattern ak formation ha or ya constitutes karta ha trading strategy ko. Ya chart pattern madad karta ha identify karna ka liya prevailing trends ko, trend strategth, or potential reversals ko. Is gartley pattern ki sirf a ak hi variety ha harmonic patterns ma. Or jo ha ya bat pattern, ABCD pattern, Shark pattern, or crab formations ha. Ya jo sara patterns ha ya rely kar raha hota ha geometry or Fibonacci sequence par or is sab ma jo trade ki jati ha ya bahot hi unique hoti ha. Agar trade karna chata ha harmonic patterns ma to is ka liya sure or fully understand karna hota ha order ki placement, recognition, or construction ko. ADVANTAGES AND DISADVANTAGES OF GARTLEY PATTERN : Is gartley pattern ki advantage ya ha ka ya pattern huma frequently dakhna ko mil jata ha or is pattern ko hum sari markets ma traded ka liya or all time frames ma use kar sakta ha. Or is ki advantage ya bhi ha ka ya pattern produce karta ha buy/sell signals ko positive risk vs reward ratios ka sath. Or is gartley pattern ki disadvantage ya ha ka is pattern ko challenging hota ha identify karna or is ko construct karna or ya pattern loses karta ha efficacy ko consolidating markets ma. Or is pattern ki disadvantage ya bhi ha ka bahot sa cases ma ya gartley pattern produces karta ha conflicting signals ko. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

hanging man Candle design Hanging Man candle design forex exchanging mein ek significant negative inversion design hota hai. Yeh design buyer market ya upswing ke baad dikhta hai aur cost inversion ke neshandahi karta hai. Hanging Man design ek single candle se banta hai, jismein neeche di gayi khobian hoti hain. Shakal say Hanging Man aikk candle ki jisamat chhoti hoti hai aur upper walay saye ya wick lambi hota hain. Iski body neeche hoti hai.Hanging Man candle ka rang sbaz ya safaid ho sakti hai, lekin iska matlab hai ki market ibtadai pinnacle standard higher open hua tha.Hanging Man design tashkeel hota hai punch market upswing mein hota hai aur purchasers ko control mein hote hain. Is design ka mojodgi kay upturn ki akhiri stages mein hota hai.Is design ko samajhne ke liye, brokers ko iske encompassing cost activity aur market setting ko dhyaan mein rakhna zaroori hai. Hanging Man candle design negative inversion ka signal deta hai, iska matlab hai ki upswing ke baad market down ki taraf move karne ki hai. Dealers is design ko affirm karne ke liye aur dusre markers ya candle designs ko dekh kar apni exchanging choices lena chahiye. Forex exchanging mein Hanging Man candle design ki bahut ahmiyat hoti hai, kyun ki yeh ek negative inversion signal deta hai, yaani ki upswing ke baad market ko b descending heading mein jaane ki mumkinat ko dekhata hai. Is design ka appearance market opinion mein tabdelio ka ishara deta hai, jiski wajah se merchants say apni exchanging systems change kar sakte hain.Hanging Man design ki significance kuch focuses standard hai.Hanging Man candle design negative pattern ka ibtadai torr signal deta hai. Poke market upswing mein hota hai aur Hanging Man design tashkeel hota hai, to yeh market ke bullish pattern mein shortcoming dikhata hai aur jesay negative inversion ka mumkinat batata hai.Hanging Man design ka sahi translation karne ke liye, encompassing cost activity aur market setting ko samajhna jesaya zaroori hota hai. Is design ko affirm karne ke liye, merchants dusre specialized pointers aur candle designs ka istemal karte hain. Hanging Man design merchants ko passage aur leave focuses daryaft karne mein madad karta hai. Is design ko dekh kar brokers apni existing long positions ko close kar sakte hain ya phir short se aik positions open kar sakte hain. Hanging Man design ko shanakht karke, dealers apni stop-misfortune levels ko change kar sakte hain taki unki exchanging positions mehfooz karne mein madad milti hai.Ek fruitful exchanging choice lene ke liye, Hanging Man design ko dusre specialized markers ya oscillators ke saath affirm kiya ja sakta hai. Isse dealers ko solid passage aur leave signals milte hain.Dhyan rahe ke kisi single candle design standard poora bharosa na rakhein, aur hamesha dusre factors aur specialized devices ka istemal karke apni examination ko karein. Hanging Man design sirf ek marker hai, aur uski ko affirm karne ke liye aur bhi ko karna zaroori hai -

#4 Collapse

Green Beam Pointer in Forex Exchanging. tijarti taizi to standard to barai mein aasaan tajaweez to isthiraq karen. emerge, waqt hota hai press khredar arranged mein earzi tawaquf kana baad cost movement standard control dobarah kar letay hain .hamari office ghanta waar light keareb hoti hai, ya mumble dobarah test ka intzaar karte hain, jo mushkil ho sakta hai kyunkai action cost tooti hui muzahmat ko dobarah jhanchne ke liye kabhi wapas nahi aa sakta. model mein, jaisay yard put out a candle flag muzahmat ka oopar band hoti hain mumble bazar mein daakhil hotay des ko marhalay ki nishandahi beat k sath improvement deti hai jis fundamental bazar ko mumble yah kahty hain k bazar boht quick principal apna design change kar k oper ko gai hai jub market tezi se oper jati hai or aik bari inspiration banati hai tu os k market horrendous fix start hoti hai jis k horrendous apni fix ki development primary pennant ki shakal bnati hai jis ko mumble kahty hain k market ny bullish standard diya hai Light Pointer in FOREX Exchanging. elopment ko spoting aur line - sahih tareeqay se kya jata hai. jaisa ke pehlay bayan kya gaya hai, world vow arranged ko aik shakal aur dashkeel deta hai aur yeh taajiron ko dakhlay aur ki sthon ka taayun karne mein madad karta hai, bilkul wohi hai jo mumble akarne mein madad karta hai jis mein rujhan hai. aik aam tijarti usool to pik standard, yeh kabhi bhi mahswara naha diya jata hai ka woh oopar ki taraf tosee ki umeed mein so tarteeb qeemat standard khareedain, yet kisi ahem muzahmat kana waqfay ya wapsi ka intzaar karen. . Lehaza, pennant ko ulta totnay ka baad bull standard tijarat ki sahoolat faraham karta hai. Hamin Bull Power discharge is positive hai for example high hai, toh yeh signal karta hai ki purchasers control the market mein hain aur upar ki cost side worth karne ka potential hai. ke saath bhe istemaal karna chahiye ... Isko aap apne exchanging stage standard add kar sakte hain aur iske awamil ko barkarar karke apne exchanging technique keaab se istemaal kar k sakte hain men Ham marker flex ke uncovered mein padenge re pointer kya hai uske exposed mein aapko bahut jyada data denge Taki aapko bahut jyada isase aapko bahut jyada achcha reward hasil aur benefit hasilon ke pointer kya hai flex structure mein raindicator ki kya ahmiyat hai FX structure mein ke uncovered mein study karenge ki pointer kya hai marker ke uncovered mein study karenge ki flex mein iski kya ahmiyat hai -

#5 Collapse

Trading with Falling Wedge Model Dosto gaar apko chart mother falling wedge plan dikahye da rha ha to apko yaha kahridi karna ka lie jo do maintain hain resistance ka high ko contact karta conceal ek design line khenchna hogi is design line ko (hindrance line) kahta hain or iska awful dusra support ko contact karta color dusri design lien khenchna hogi isko (support line) kahta hain ,falling wedge frame plan mom kam sa kam do support or obstacle ka hona lazmi ha or agar do sa zyda ho to bohat achi bat hogi isma ek bat ka dikhan rakha resistance wali line ka slant necha ki taraf hota ha or sponsorship ki nisbat jis sa ya ek point a ka crossover kar jati hain is plan mom asa ni hona chaye ka dono line ek dusra ka equivalent chalti rahein ,agar ya mixture na karein to isko sahi ni mana jaye ga ,dosto trade lata wakt hama is bat kadihan rakhan bohat zaruri ha ka hamara trade lana ka point sa stoploss lagana ka point ka contrast risk reward ka rule 2% ka mutabik hona chye agar ya 2% ka mutabik nahi ha to ham trade nahi lein What is Rising Wedge Model in Forex Friends yeh pattren bhi fallig wedge k bilkul backwards hai jese k woh apko market head milta hai jahan apko downtrend nazar yes esi traha raising wedge bhi rise market essential apko milta hai same supportor resistance es pattren basic bhi milta hai market apne design k excessive expenses per ja kr range head movekarna start karta hai wahaan apko es baat ka andaza ho jana chahye k stomach muscle maarket crucial late trend staarthone wal hai buyers ka market head rujhaan kaaam hai sellers abs market maain significant hoty ja rahe hainyahan apko support k downout per segment leni hoti hai or pattren k pehle swing k mutabiq apko apna target rakhna hota hai. Pattern Badal jata hai aur transient mama long haul Mama se down pattern hai up Pattern ka start hai Jahan short Trem ka Mama long haul Mama se up pattern rahata hai aamtaur per Ek Brilliant cross three stages Mein Hota Hai down Pattern ke dauran momentary Mama long haul Mama se specialty hai Brilliant get ya Brilliant get over ek outline design hai Jismein long haul moving normal se upar Ek Transient ki moving normal intersection Shyamel Hote Hain Jo Baat Yad Rakhna bhi zaruri hai Woh Yeh hai ki moving normal ost Piche Rahane ridge marker hai aur inmein ek Koi prescient KI solid nahi hai iska implies Hai Ke donon get over aamtaur per is Pattern ke riversal solid ki affirmation give Karenge -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

WHAT IS A Negative Deserted Child Candle Example : Negative abondaned child market ka outline mama ak bahot he extraordinary candle design ha ya negative deserted child design huma market ka graph mama tab dakhna ko mil jata ha jav market ke cost high mama hoi ha or ya negative Deserted Child design high mama boycott kar market ko descending ke traf inversion karna ka kam karta ha jasa ka is negative Deserted Child design ka name sa he pata chal jata ha ka is mama market na descending ke traf inversion karna ha q ka is design ka name mama he negative ka pata chal jata ha ka market na negative hona ha. Negative abondaned child design market mama is upturn ka top mama boycott kar market ko bahot he unequivocally descending ke traf inversion kara ga ya design higher ke traf three candles sa mil kar banay ga or ya design bahot he emphatically market ke cost ko higher sa lower ke traf inversion karay ga ya negative deserted child design hit banay ga to ya higher mama opposition level ka close to mama ho ga or ya jo obstruction level ho ga ya bhi market mama ak solid strength ko bana raha ho ga jo ka market ko firmly descending ke traf inversion kar raha ho ga. Or then again ya jo negative Deserted Child design ho ga ya market mama bullish abondaned child design ka inverse ke traf banay ga yani ka jo ya design ho ga ya market ko lower ke traf inversion kara ga or bullish abondaned child market ko up ke traf inversion karna ka kam karay ga. Arrangement OF Negative Deserted Child Candle Example : 1:FIRST Light : Is negative abondaned child design ke development sa phalay market ke cost high ke traf ja rahi ho ge or is time standard market mama ak bahot he solid upturn chal raha ho ga or ya jo negative abondaned child design ho ga is design ke jo first flame ho ge ya bhi market mama is upswing ka top mama banay ge or is negative Deserted Child design ke ya first light open ho kar market ke cost ko up ke traf la kar jay ge ya jo first candle ho ge ya ak long genuine body bullish ke candle ho ge jo ka market ke cost ko higher ke traf la kar jay ge or ya green ya white tone ke ho ge or market mama high ke traf new point ko banay ge or ya past upturn ko follow karti hoi banay ge or is ka koi long shadow ni ho ga jo ka huma market ka high jana ka bata rahi ho ge. 2:SECOND Flame : Jo is negative abondaned child design ke second flame ho ge ya is design ke clench hand candle ka high sa open ho ge or ya second candle high mama he close ho jay ge or ya jo second candle ho ge ya is design ke first lengthy bullish ke candle ka awful ak little hole ka terrible open ho ge or ya is little hole ka high sa open ho kar market ko na he zada high mama la kar jay ge or na he lower mama la kar jay ge yani ka ya second light ak little genuine body candle ho ge or ya candle bullish ke bhi ho sakti ha or negative ke bhi ya market ko stop kara ge or huma market ka or high jana ka stop hona ka batay ge yani ka ya second candle uncertainty ko show kar rahi ho ge. 3:THIRD Flame : Third flame is negative abondaned child ke last candle ho ge or ya keep going third light ak long genuine body candle ho ge or ya is design ke second candle ka awful ak little lower hole ay ga or is little lower hole ka lower sa open ho ge or ya third candle market mama ak long negative ke candle boycott kar market ko lower ke traf la kar jay ge ya last tjird candle is design ke first candle ka equivalent ka size ke ho ge magar ya is last candle first candle ka inverse mama ho ge or ya market ko high mama lower ke traf inversion karta hua is design ke first ca to ka lower tak market ke cost ko la ay ge or ya huma market ko invert kar ka da ge or huma market ka descending jana ka batay ge. Is negative deserted child design mama brokers ko market ka emphatically lower ke traf inversion ho kar ana ka signal mila ga hit ya negative deserted child design banay ga to is sa phalay market mama bull ka control ho ga or is time standard high bull ka control ho ga or ya positively trending market ke cost ko unequivocally higher ke traf la kar ja raha ho ga or ya buyer market mama upswing ko bana raha ho ga or ya design is bull serious areas of strength for ka terrible banay ga or is negative deserted child design ke jo ya first flame banay ge ya bhi market mama is bull ka control sa he banay ge or is mama bhi jo market ke cost ho ge ya higher ke traf is bull ka pressure sa jay ge or is design ka start mama bull a kar market mama high point ko banay ga magar punch is design ke second candle open ho ge to showcase mama jo bull ka control ho ga ya lost jo jay ga or is time standard market mama bull or bear same ho jay ga or hit is design ke last third candle banay ge to advertise mama jo bull ho ga ya totally lost ho jay ga or market mama bear a jay ga or ya bear high tension ka sath market ko descending ke traf la kar jana ka kam kara ga or dealers ko solid down market ka janaka batay ga. Is negative Deserted Child design ke development ka complete hona ka brokers stand by kara ga or is design ke last negative ke flame ka lower sa is mama long haul sell ke exchange ko enter kara ga or jo is ka stop misfortune ho ga os ko dealers is design ke second candle ka high mama place kara ga. -

#7 Collapse

What is an Unevenness Pointer? Dost Umeed karta hun ki aap log amal Honge aur Formilir Forex Se Jyada Se Jada benefit ko Results kar rahe Honge Jis Tarah aap logon ko pata hai ki Forex Ek bahut salam productive Hey Jis aap log Clamor dugni Raat baje tak ki kar sakte hain Isliye aap Logon Ko chahie ki Forex ko Hamesha Samaj aur bhoot ke jarie hello there exchange Karni chahie agar aap lalach Panya FIR Is Tarah Ki aur dusri Letter HAL Mein Forex ko karte hain aap kabhi bhi Forex benefit Result nahin kar sakte akhe benefit ko Result karne Forex Mein Sab rahata hun bolkar" Point ko samajhne kana liye aapko marker Ka utilization Karna bahut jyada Jaruri Hota Salam Punch dhaaga aap log apni exchange Marker Mein ka utilization graph design Nahin Karenge tab aap log Apne exchange Se Kabhi Bhi benefit Doge nahin kar sakti hai isliye Ghar aap log Apne pay and banana pay Chahte Hain Uske liye aapko steady misfortune Hota Salam Aaj Ham Jis theme Prabhat Karne Rib ka naam chopne hai jisse aapko bahut Si instruction or experience Results ho sakta hai appearance The footing record pointer is intended to decide if advertisers are exchanging the two bearings. Utilizing a size of 1 to 100, the market is considered at 100 (above 61.80) and the cost is underneath 38.20. The visual marker slider - 100/+100 is put in the slash zone for the shade of the cost, showing the distinction between the inversion and the end cost and the EMA, to decide the pattern and unpredictability. CH0PPINESS Marker Record Forex mein market aur pair ki possibility or typical ko samajhnai kay liay merchant pointer, diagram design candle design, laitay hain, market marker kay trademark switch marker bhi daitay hain, mukhtalif kisam kay hotay hain jin mama sa koi force ka btatay hain aur volume koi ko kartai hain, market power pointer ki barai mama bhi marker daitai hain, tarah kai pointer mama sa aik 'quality pointer' bhi hota ha Record OF Attributes AND Qualities indeed pointer says 0 100 wood Darmian swing fire card. A significant market pattern or peaceful card top significant market 61.8 market the executives pattern range says major hot fire. Aur hit market 38.2, the fundamental market region hiti ki pointer daiti hay.ye aik instability marker yes shipper card yes kai kia market pattern, You show the future cost, figure nhi daita aur na greetings pattern batat indeed, You can likewise track down a manual for market or to ride market too. isko make karny kay liye do set off point ki zaroorat hoti hai hit 38.2 territory invert swing hona introductory old, market shepherd honi wali bubur, aur poke marker ki range 61.8 ana shuru ho iska matlab hai keh fundamental market pattern wali so you bubur wali make trigger point, mil sakti hai karti huye achi exchanging mil sakti hai gain combination or inversion kai baad, hota hai kai straightforward market pattern hotai hai, fruitful exchanging kai liay marker broker ko marker dusray kai sath kombay kar kai kartai hain -

#8 Collapse

"Gartley Pattern Ki Pehchaan: Forex Trading Mein Ek Qabil-e-Faiz Tool" Forex trading mein technical analysis ek ahem kirdar ada karta hai jis mein traders ko market trends, reversals aur entry/exit points ka pata lagane mein madad milti hai. Technical analysis ke liye mukhtalif tools mein se ek aisa tool hai jo khaas tor par ahem hai, woh hai Gartley pattern. Ye pattern harmonic trading ki bunyad par hai, jismain khaas geometrical shapes aur Fibonacci ratios ka istemal kiya jata hai taake traders ko samjhne aur faislay karne mein madad ho. Gartley pattern ek khaas tarah ka harmonic pattern hai jo H.M. Gartley ne 1935 mein apni kitab "Profits in the Stock Market" mein pesh kiya tha. Ye pattern price points ki ek sequence se bana hota hai jo price chart par ek mukhtalif geometrical shape banate hain. Maana jata hai ke ye patterns market mein moghez murna ya reversal points ko darshaten. Gartley pattern samjhne ke liye, iske mool tatvon aur us sequence ko samajhna zaroori hai jo is pattern ko banata hai. Pattern chaar mukhtalif points X, A, B, C aur D ke zariye banta hai. Ye points mukhtalif price movements se nikalte hain aur pattern ko chart par pehchanne mein ahem hote hain. Pattern do mukhtalif qismon mein taqseem hota hai: bullish aur bearish. Bullish Gartley pattern mein, price pehle ek neechay ki taraf move karta hai, point X par ek mukhtalif bottom banata hai. Iske baad, price reverse ho kar upar ki taraf move karta hai aur point A banata hai. Point B tab banata hai jab price point A se retraces hota hai lekin point X ko exceed nahi karta. Price phir point C banane ke liye upar move karti hai, jo aam taur par point A se point X tak ka 61.8% retracement hota hai. Aakhir mein, price point C se neechay move kar ke point D banata hai. Ye point X se A tak ka 78.6% retracement hota hai. Bullish Gartley pattern ek mukhtalif price reversal ki taraf ishara karta hai. Mukhaalif taur par, bearish Gartley pattern bhi isi logic ko mante hue banta hai lekin ulte direction mein. Price upar ki taraf move karti hai, point X par ek mukhtalif peak banata hai. Phir wo neechay retrace hoti hai aur point A banata hai, phir upar move karte hue point X ko exceed nahi karte hue point B banata hai. Price phir point C banane ke liye neechay move karti hai, jo aksar point A se X tak ka 61.8% retracement hota hai. Aakhir mein, price point C se neechay move kar ke point D banata hai, jo X se A tak ka 78.6% retracement hota hai. Bearish Gartley pattern neechay ki taraf potential price reversal ki taraf ishara karta hai. Ye ahem hai ke Gartley patterns ki pehchaan karne ke liye acha nazar aur Fibonacci retracement aur extension levels ki achi samajh ho. Traders aksar in patterns ko doosre technical indicators aur analysis methods ke saath istemal karte hain takay apne trading decisions ko verify kar saken. Iske alawa, Gartley pattern complete hone se murna guarantee nahi karta; ye sirf market mein moghez murna ki potential darshata hai. Ikhtitami taur par, Gartley pattern forex trader ke liye aik taqatwar tool hai. Iska tawazun geometrical shapes aur Fibonacci ratios par mabni hai jo potential market reversals ki pehchaan karne ka aik tarteeb diya hai. Lekin Gartley patterns par trading karne ke liye amal, experience aur technical analysis ki mukammal samajh zaroori hai. Traders jo is tool ko mahir ho jate hain, woh behtar trading decisions lene mein kamyabi hasil kar sakte hain aur forex trading ke dinamik duniya mein apni kamiyabi ke chances barha sakte hain. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

FOREX TRADING ME GARTLEY PATTERN KI SE KEA MURAAD HA ?????FOREX TRADING ME GARTLEY PATTERN:- Gartley sample ak harmonic chart formation ha or ya pattern is primarily based karta ha Fibonacci collection par apni production ka liya. Is sample ki jo formation hoti ha ya bahot precise day meant hoti ha jo ka inventory marketplace ka liya magar ya kisi bhi tool or product sa finished ki ja sakti ha. Ya gartley styles ak bahot top day generally used hona wala ak harmonic patterns ha jab is ko technical analysis kiya jata ha. Ya batata ha customers ko charge ka purpose ka income ko taking karna ka liya or ya batats ha customers ko save you loss ki place ka bara ma. Is gartley sample ko distant places coins customers use karta ha or is sa mission karta ha bullish or breash charge motion ka drawing near hona ka liya forex markets ma. Or is sample ki jo formation hoti ha ya madad karti ha have a observe karna ka liya market ki symmetry ko jab is ma forex trying to find and promoting karta hy.Plan mom asa ni hona chaye ka dono line ek dusra ka identical chalti rahein ,agar ya aggregate na karein to isko sahi ni mana jaye ga ,dosto exchange lata wakt hama is bat kadihan rakhan bohat zaruri ha ka hamara exchange lana ka issue sa stoploss lagana ka trouble ka evaluation hazard reward ka rule 2% ka mutabik hona chye hota ha.Ye sample harmonic seeking out and selling ki bunyad par hai, jismain khaas geometrical shapes aur Fibonacci ratios ka istemal kiya jata hai taake clients ko samjhne aur faislay karne mein madad ho.Gartley sample ek khaas tarah ka harmonic pattern hai jo H.M. Gartley ne 1935 mein apni kitab "Profits inside the Stock Market" mein pesh kiya tha. Ye sample charge factors ki ek collection se bana hota hai jo rate chart par ek mukhtalif geometrical shape banate hain. Maana jata hai ke ye styles market mein moghez murna ya reversal factors ko darshaten me hota ha. FOREX TRADING ME GARTLEY PATTERN ME RISING WEDGE MODLE:- Friends yeh pattren bhi fallig wedge applicable enough bilkul backwards hai jese exceptional sufficient woh apko market head milta hai jahan apko downtrend nazar high-quality esi traha raising wedge bhi upward push marketplace essential apko milta hai equal supportor resistance es pattren number one bhi milta hai marketplace apne format top sufficient excessive fees steady with ja kr range head movekarna begin karta hai wahaan apko es baat ka andaza ho jana chahye appropriate enough belly muscle maarket critical overdue fashion staarthone wal hai customers ka marketplace head rujhaan kaaam hai sellers abs market maain top notch hoty ja rahe hainyahan apko beneficial beneficial resource precise enough downout normal with segment leni hoti hai or pattren accurate enough pehle swing proper sufficient mutabiq apko apna purpose rakhna hota hai.Aik aam tijarti usool to pik well-known, yeh kabhi bhi mahswara naha diya jata hai ka woh oopar ki taraf tosee ki umeed mein so tarteeb qeemat contemporary khareedain, however kisi ahem muzahmat kana waqfay ya wapsi ka intzaar karen. . Lehaza, pennant ko ulta totnay ka baad bull big tijarat ki sahoolat faraham karta hai. Hamin Bull Power discharge is exceptional hai for instance excessive hai, toh yeh sign karta hai ki clients control the market mein hain aur upar ki fee element honestly in truth properly nicely simply without a doubt really worth karne ka functionality hai. Ke saath bhe istemaal karna chahiye ... Isko aap apne changing diploma contemporary-day day upload kar sakte hain aur iske awamil ko barkarar karke apne changing technique keaab se istemaal kar good enough sakte ha

FOREX TRADING ME GARTLEY PATTERN ME RISING WEDGE MODLE:- Friends yeh pattren bhi fallig wedge applicable enough bilkul backwards hai jese exceptional sufficient woh apko market head milta hai jahan apko downtrend nazar high-quality esi traha raising wedge bhi upward push marketplace essential apko milta hai equal supportor resistance es pattren number one bhi milta hai marketplace apne format top sufficient excessive fees steady with ja kr range head movekarna begin karta hai wahaan apko es baat ka andaza ho jana chahye appropriate enough belly muscle maarket critical overdue fashion staarthone wal hai customers ka marketplace head rujhaan kaaam hai sellers abs market maain top notch hoty ja rahe hainyahan apko beneficial beneficial resource precise enough downout normal with segment leni hoti hai or pattren accurate enough pehle swing proper sufficient mutabiq apko apna purpose rakhna hota hai.Aik aam tijarti usool to pik well-known, yeh kabhi bhi mahswara naha diya jata hai ka woh oopar ki taraf tosee ki umeed mein so tarteeb qeemat contemporary khareedain, however kisi ahem muzahmat kana waqfay ya wapsi ka intzaar karen. . Lehaza, pennant ko ulta totnay ka baad bull big tijarat ki sahoolat faraham karta hai. Hamin Bull Power discharge is exceptional hai for instance excessive hai, toh yeh sign karta hai ki clients control the market mein hain aur upar ki fee element honestly in truth properly nicely simply without a doubt really worth karne ka functionality hai. Ke saath bhe istemaal karna chahiye ... Isko aap apne changing diploma contemporary-day day upload kar sakte hain aur iske awamil ko barkarar karke apne changing technique keaab se istemaal kar good enough sakte ha

-

#10 Collapse

WHAT IS GARTLEY PATTERN Example WITH EXPLANATION :Gartley design ak symphonious graph development ha or ya design depends karta ha Fibonacci succession standard apni development ka liya. Is design ki jo arrangement hoti ha ya bahot howdy planned hoti ha jo ka securities exchange ka liya magar ya kisi bhi instrument or item sa applied ki ja sakti ha. Ya gartley designs ak bahot greetings ordinarily utilized hona wala ak consonant examples ha hit is ko specialized examination kiya jata ha. Ya batata ha merchants ko cost ka target ka benefit ko taking karna ka liya or ya batats ha dealers ko stop misfortune ki area ka bara mama. Is gartley design ko money merchants use karta ha or is sa project karta ha bullish or breash cost activity ka impending hona ka liya forex markets mama. Or then again is design ki jo arrangement hoti ha ya madad karti ha study karna ka liya market ki evenness ko poke is mama forex exchanging karta ha. Effective method to Recognize AND Involve GARTLEY Example IN FOREX Exchanging :Ya jo gartley design ha ya application hota ha forex markets mama jasa ka or blend designs hota ha. Is gartley design ki development do trha sa hoti ha ak bullish or dosra negative gartley design. Jasa ka ko beneath mama ya jo GBP/USD ka diagram ha huma show kar raha ha Gartley design major areas of strength for ki ko.FOLLOWING STEPS ARE GIVEN TO distinguish or utilize GARTELY PATTERN OF EXCHANGING:1: Sab sa phalay is mama distinguish karna ho ga ya market mama kon sa pattern chal raha ha ya jo design ha ya bullish ya bhi negative market ki conditions mama bana ha.2: Second step mama huma mark karay ga series ko jo ka four pinnacles or box sa bani ho ge.3: Is ka terrible murmur measure karay ga Fibonacci retracement ko or is ka liya murmur utilizing karay ga is ka point Z sa point A ko.4: Or jo is mama point B ho ga ya 61.8% ho ga point A ka high sa.5: Jo point C ho ga ya 38.2% ho ga point A ka high standard.6: Or point D 78.6% standard ho ga point A ka high sa.BULLISH GARTLEY Example :

Forex merket mama is bullish gartley design ko utilized kiya jata ha distinguish karna ka liya purchasing ki opportunity ko. Is mama jo development hoti ha is ko consider kiya jata ha retracement or continuation design ki trha sa. Ya jo bullish gartley design ha ya project karta ha or expansion karta ha upswing ko. Ya bullish gartley design comprise hota ha upturn mama cost ka or ya series ko estimated karta ha retracements ki. Jo ya bealo mama gbp/usd ka diagram ha ya show kar raha ha bullish gartley design ka represents ko. Negative GARTLEY Example :Ya negative gartley design inverse mama hota ha bullish gartley design ka. Or then again ya bhi consider hota ha ak retracement or continuation design ki trha sa. Or then again ya negative gartley design huma purchasing ka signal information ha or ya proposes karta ha sell ka proper hona ka. Ya negative gartley design contained hota ha strong descending ka move ka sath jis mama cost fallowed karti ha retracement ki series ko. Or then again jo underneath mama gbp/usd ka graph ha ya huma ak bahot greetings clear look da raha ha is negative gartley design ki.Step by step instructions to Exchange Utilizing GARTLEY Example :

Sari specialized investigation ko dakha jay to jo is negative or bullish gartley design mama pitch process ha yo ya ka is design ko use kar ka decide kiya jay market mama passage, or is mama finding liya jay stop misfortunes or benefit targets ko.MARKET Passage :Jo bahot hey achi bat ha is gartley design ki development ki wo ya ka ya brokers ka liya adaptability ko banta ha market mama passage ka liya. Ya jo design ha ya huma dono signals ko offers karta ha or ya batata ha both trading ki amazing open doors ka bara mama, or ya depending kar raha hota ha market ki conditions standard. Is design mama merchants pick karta ha trade ko punch jo is mama C or D leg ha ya remembered hoti ha 78.6% jo Z or A ki directional move ka. Ya dono howdy improves karta ha timing or benefit ko is mama bullish or negative exchange ko enter karna ka liya.STOP Misfortune :Is gartley design ka sath, jo stop misfortune hota ya is ko putting karna somewhat direct hota ha. Jo is mama stop misfortune request hota ha is ko put karta ha underneath mama or above mama beginnings ka Z A leg ka. Jo ya potential inversion zone hota ya is trha sa hota ha punch bullish gartley hota ha yo is mama stop misfortune ko put karay ga underneath mama Z or A ki leg ka. Or on the other hand agar negative gartley design ho ga to is mama stop misfortune ko put karay ga above mama Z or A ki leg ka.Benefit TARGET:Jo is design mama finding karna ho ga benefit target ko ya thora sa mushkil ho ga. Kuch brokers use karay ga retracement level ka strategy ko or is ki madad sa find karay ga benefit target ko jo ka potential gain or disadvantage targets mama jo ga. Jo bullish gartley ho ga is mama draw karay ga Fibonacci retracement ko high point mama A ka or depressed spot mama D ka. Jo benefit target ho ga is ko set karay ga 61.8% standard ya phir 78.6% ka level standard.

Model :Sara designs ki trha sa, gartley design mama exchanged karay ga ak explicit cycle ka sath. Jasa ka underneath mama jo gbp/usd ki model ha ya huma full itemized look ka bata rahi ha is ki arrangement ka or exchanged karna ka liya live forex mama.Is graph mama dakh sakta ha ka is mama huma sab sa phalay upturn (Z-A) noticed hua ha. Is mama market ki retracement hoi ha jo ka 61.8% (A-B) hoi ha or ya revitalizing kar rahi ha (B-C) standard phir is mama pulling back (C-D) hua ha or ya gartley design framed hua ha.Buy request ko is mama enter kiya gaya ha hit 78.6% retracement hoi ha Z-A ki or ya level 1.3710 ka ha is outline ma.Jo stop misfortune ha os ko is mama set kiya ha underneath mama Z sa or ya jo level ha is graph mama ya 1.3580 ka ha. Or on the other hand jo benefit target ha is ko found kiya ha 38.6% ki retracement standard Z-A ki jo ka 1.3980 standard ha. Is design mama benefit target jasa ka graph mama dakh sakta ha hit ho gaya ha or ya 270 point pip ko gain kar raha ha.nging system ko. Ya outline design madad karta ha distinguish karna ka liya winning patterns ko, pattern strategth, or potential inversions ko. Is gartley design ki sirf an ak hey assortment ha symphonious examples mama. Or then again jo ha ya bat design, ABCD design, Shark example, or crab arrangements ha. Ya jo sara designs ha ya depend kar raha hota ha calculation or Fibonacci succession standard or is sab mama jo exchange ki jati ha ya bahot hey exceptional hoti ha. Agar exchange karna chata ha symphonious examples mama to is ka liya sure or completely comprehend karna hota ha request ki situation, acknowledgment, or development ko.Benefits AND Inconveniences OF GARTLEY Example :Is gartley design ki advantage ya ha ka ya design huma regularly dakhna ko mil jata ha or is design ko murmur sari markets mama exchanged ka liya or all time spans mama use kar sakta ha. Or then again is ki advantage ya bhi ha ka ya design produce karta ha purchase/sell signals ko positive gamble versus reward proportions ka sath. Or then again is gartley design ki drawback ya ha ka is design ko testing

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Introduction. Gartley pattern ak harmonic chart formation ha or ya sample is based karta ha Fibonacci series par apni production ka liya. Is pattern ki jo formation hoti ha ya bahot hello meant hoti ha jo ka inventory marketplace ka liya magar ya kisi bhi tool or product sa carried out ki ja sakti ha. Ya gartley styles ak bahot hi usually used hona wala ak harmonic styles ha jab is ko technical evaluation kiya jata ha. Ya batata ha buyers ko rate ka goal ka income ko taking karna ka liya or ya batats ha traders ko stop loss ki vicinity ka bara ma. Is gartley sample ko forex investors use karta ha or is sa mission karta ha bullish or breach price movement ka forthcoming hona ka liya forex markets ma. Or is pattern ki jo formation hoti ha ya madad karti ha observe karna ka liya market ki symmetry ko jab is ma foreign exchange trading karta. How to trade using gartly pattern Sari technical evaluation ko dakha jay to jo is bearish or bullish gartley pattern ma pitch system ha yo ya ka is sample ko use kar ka determine kiya jay marketplace ma entry, or is ma locating liya jay forestall losses or profit objectives ko. Forex trading main gartley pattern main rising wedge mode .. Aik aam tijarti usool to pik famous, yeh kabhi bhi mahswara naha diya jata hai ka woh oopar ki taraf tosee ki umeed mein so tarteeb qeemat modern khareedain, however kisi ahem muzahmat kana waqfay ya wapsi ka intzaar karen. . Lehaza, pennant ko ulta totnay ka baad bull large tijarat ki sahoolat faraham karta hai. Hamin Bull energy discharge is remarkable hai for example excessive hai, toh yeh sign karta hai ki clients control the marketplace mein hain aur upar ki price element virtually in reality nicely well honestly honestly in reality worth karne ka functionality hai. Ke saath bhe istemaal karna chahiye ... Isko aap apne converting diploma current-day upload kar sakte hain aur iske awamil ko barkarar karke apne changing approach keaab se istemaal kar properly enough sakte ha Yeh kabhi bhi mahswara naha diya jata hai ka woh oopar ki taraf tosee ki umeed mein so tarteeb qeemat modern-day khareedain, however kisi ahem muzahmat kana waqfay ya wapsi ka intzaar karen. . Lehaza, pennant ko ulta totnay ka baad bull massive tijarat ki sahoolat faraham karta hai. Hamin Bull energy discharge is super hai as an instance immoderate hai, toh yeh sign karta hai ki clients manage the market mein hain aur upar ki price detail in reality in reality well properly certainly certainly actually well worth karne ka capability hai. Ke saath bhe istemaal karna chahiye ... Isko aap apne converting diploma present day-day upload kar sakte hain aur iske awamil ko barkarar karke apne changing technique keaab se istemaal kar accurate enough sakte ha Yeh kabhi bhi mahswara naha diya jata hai ka woh oopar ki taraf tosee ki umeed mein so tarteeb qeemat present day khareedain, however kisi ahem muzahmat kana waqfay ya wapsi ka intzaar karen. . Lehaza, pennant ko ulta totnay ka baad bull massive tijarat ki sahoolat faraham karta hai. Hamin Bull strength discharge is top notch hai for instance excessive hai, toh yeh sign karta hai ki clients manipulate the marketplace mein hain aur upar ki price element certainly in reality well properly truly truely in reality worth karne ka capability hai. Ke saath bhe istemaal karna chahiye ... Isko aap apne changing degree current-day add kar sakte hain aur iske awamil ko barkarar karke apne converting approach keaab se istemaal kar excellent enough sakte

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:15 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим