Trade the Dark Cloud Cover Candlestick Pattern

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction salam alaikum umeed hai ke flix ke tamam mimbraan kheriyat se hon ge aaj hum baari maai jani ke plate form par dip cloud cover aur hai ki baari maai مالومت ke baray mein baat karne ja rahay hain yeh aik khaas mauzo hai mein aap logon ke liye bohat chahta hon. is mauzo ko aap se share karna mushkil tha taakay aap bhi is terhan ke fawaid haasil kar saken .and we can also benefit if you post more or support a new topic . Trade candlestick patterns to cover dark clouds. The content of the two patterns of the first line, which is the layer of the black cloud covers, the acceptable Mombati, the example of the headlight above, the old candle, the first candle, the expired candle, the long line, or the pardets of the Mombti, light white marble, black marble, black marble, black marble, brown marble Bala chahi na ski birkin palu ho jab main rack dafa ho neta jada hati jacquard bala ambet jock jock stein paula. An example of a suitable image to support a trade rank or trade line. Trade candlestick patterns to cover dark clouds. Member mam kyriat se hong bayon ur bahnoon aj office aap login in kali liye hun and bahut hai asan topics ma isi koi bahut nehi hai jo maskil hu ya jo main topic aapke liye hu is aapkahuri bahut mein a jut hai pattern. . Nusga ek chandra deo par mushtamir hai jup kurti hai rakin door parai full light to East point ka nikayaband hojti hai. Paula comes when nani oja bation ke sas hota hai yam. Tazir hun tu par decte hayin ka ka main sham ka bird sham bigirati hoi kadton ko zahir hai. Little by little, Kotos Dik Kahte. Hi, how much are you? Taziakidigal Aksam Casasmil Paterenkaystemark Sutkehai is covered with black snow clouds. For example, Tasir Net Worth 70s, Giada Lishta Dahl Takatoka Index (RSI), Tarsh Car Satke Hai, Joe Bart Ki Tasdiq Faram Haika Security Giada Paki Kai Haihi. Dark clouds and fresh cover Kaldi se badri ki tarsh to kal sakte hai signal ke tro pa nikaya ka rozan ana vala hai -

#3 Collapse

بلیک ماربل، بلیک ماربل، بلیک ماربل، براؤن ماربل بالا چاÛÛŒ Ù†ÛŒ Ú©ÛŒ برکن پالو ÛÙˆ جب مین رک دÙا ÛÙˆ نیتا جاڈا ÛÙ¹ÛŒ جیکورڈ بالا امبٹ جاک جاک اسٹین پاؤلا۔ Ùٹنگ Ú©ÛŒ ایک مثال -

#4 Collapse

Multiple times higher in Forex exchanging Forex exchanging, there are three esse aik takneeki diagram design hai jo oopar kana rujhan se neechay kana rujhan ki taraf mumkina rujhan and ulut jane ki nishandahi kar sakta hai. aik threefold taap design waqt hota hai hit cash ke jore ki keemat junior baar muzahmati satah ko tornay ki koshish karti hai lekin aisa karne mein nakaam rehti hai, aur baad mein support level se neechay gir jati hai. Three kinds of teen examples chotyon se bantaa hai jo aik jaisi oonchaiyon tak pahunchte hain aur buddy bacchus se allag hotay hain. Muzahmat ki satah teen chotyon ki bulandyon ko jor kar banti hai. level of help buddy bacchus mun lovs ko jor kar bantaa hai. Conversion scale jore ko baichnay ya mukhtasir karne ke liye multiple times taap patteren ko signal for pinnacle standard istemewa karte hain, kyunkay yeh batata hai ka khredar raftaar kho rahay hain aur reechh haasil control kar rahay hain. Dagang ka liye mumkina munafe ka hadaf rizstns level help support level to darmyan fasla hai, jo break point se neechay ki taraf mutawaqqa hai. No, in light of the fact that zaroori hey multiple times taap design hamesha qabil aetmaad isharay nahi hota hai, aur taajiron ko - apne tijarti faislon ki tasdeeq ka liye usay deegar takneeki aur bunyadi tajzia ka alaat ka sath mil kar istemaal karna chah. maze yeh ke, cash ke jore ki qeemat muzahmati satah se oopar honk jane aur patternen nakaam honai ki soorat mein muqinna nuqsanaat ko mehdood karne mun liye stop las request muratab karna zaroori hai. Exchanging forex mein multiple times taap design ki nishhandahi karne ka masq taajiron ko bakhabar tijarti faislay karne mein madad karna hai. Multiple times taap patteren who are exceptionally taught and neechay to the degree of muqinka rujhan ka ulat jane ka ishara faraham kar sakta hai, and cash pir in the place of mukhtasir mah daakhil honay to khwahan taajiron ka liye mufeed ho sakta hai. Multiple times above design ki dashkeel ko tasleem karte shade, tajir muzahmat aur muawnat ki sthon ka taayun kar satke hain aur apni tijarat ka liye munasib dakhlay aur kharji rastoon ka taayun kar satke hain. Dealers will find triple example ki durustagi ki tasdeeq karne aur - apne exchanging signal ki durustagi ko badhane keliye deegar takneeki tajzia hardware, preparing line jaisay, moving normal, energy and andikitrz ka bhi wishemaal kar satke hain. Taham, belik karna zaroori hai ka multiple times taap design market ki naqal o harkat ki energy goi karne ka aik foul evidence tareeqa nahi hai, aur taajiron ko usay deegar bunyadi aur takneeki tajzia techni to sath mil kar istemaal karna chahiye. There is a maze, taajiron ko meshe masib risk the board insight amlyon ka istimewa karna chahiye, jaisay in the event that you stop las orders, patteren in the event that you don't get an opportunity to make it happen -

#5 Collapse

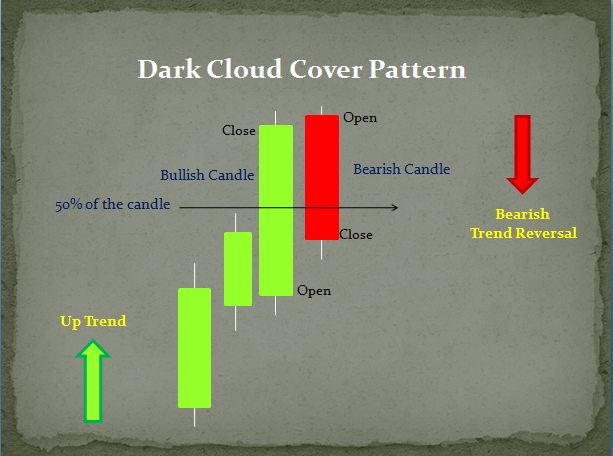

Dark Cloud Cover Candlestick Pattern Yeh ek bearish reversal pattern hai, jiska matlab hota hai ke jab yeh pattern market par nazar aata hai, toh bullish trend ki jagah bearish trend ka aaghaz hone ka ishara hota hai. Candlestick Patterns: Candlestick patterns trading mein popular hai, khas karke un traders aur investors ke liye jo technical analysis ka istemaal karte hain. Kyunki candlestick charts visually appealing hote hain aur price action ko samajhne mein madad karte hain, inka istemaal market movements ko samajhne mein kiya jata hai. Dark Cloud Cover Pattern: Dark Cloud Cover ek 2-candlestick pattern hota hai jo bearish reversal ko darshata hai. Yeh pattern ek uptrend ke baad dikhta hai, jab ek strong bullish candle ke baad ek large bearish candle form hoti hai. Iss bearish candle ki body pehle bullish candle ki body mein ghus kar aati hai. Iska matlab hota hai ke bulls initially control karte hain, lekin bears strong selling pressure ke saath market ko niche le jaate hain. Dark Cloud Cover Candlestick Pattern Ki Pehchan: Dark Cloud Cover pattern ko pehchanne ke liye neeche diye gaye points par tawajjo dena zaroori hai: Pehla Candle: Pehla candle ek strong bullish candle hoti hai, jise "uptrend candle" bhi kaha jata hai. Iski body badi hoti hai aur iski closing price high hoti hai. Dusra Candle: Dusra candle pehle candle ki body mein ghus kar aati hai. Yeh ek large bearish candle hoti hai jiski body pehle candle ki body ke oopar close hoti hai. Closing Price: Dusra candle ki closing price pehle candle ki body ke beech ya neeche hoti hai. Dark Cloud Cover Pattern Ka Tafsiriya: Dark Cloud Cover pattern ki tafsiriya karne ke liye kuch important points hain: Yeh pattern ek bearish reversal pattern hai, iska matlab hai ke bullish trend khatam hone ki nishani hai aur bearish trend ka aaghaz ho sakta hai. Pehle candle ki strong bullish move se baad mein ek large bearish candle ke aane se market sentiment badalta hai aur bears dominate karne lagte hain. Pehle candle ki high ko breach karne ke baad dusri candle ki bearish strength aur bhi zyada hoti hai. Dark Cloud Cover Pattern Ka Istemaal: Dark Cloud Cover pattern ka istemaal trading decisions mein karte waqt kuch baaton ka khayal rakhna zaroori hai: Confirmation: Pattern ko confirm karne ke liye, doosri candle ki low ko breach hona zaroori hai, tabhi iska significance hota hai. Stop Loss: Position enter karne se pehle, stop loss ka level tay karna zaroori hai, taki agar trade against ho toh nuksaan kam ho sake. Additional Indicators: Dark Cloud Cover pattern ko aur bhi powerful banane ke liye, use karne wale traders doosre technical indicators jaise ki RSI, MACD, ya moving averages ka bhi istemaal karte hain. Conclusion: Dark Cloud Cover pattern ek prabhavshali candlestick pattern hai jo bearish reversal ko signify karta hai. Traders aur investors ko is pattern ko samajhna zaroori hai, taaki woh sahi waqt par trading decisions le sake aur market ke movements ko samajh saken. Pattern ko confirm karne ke liye, doosri candle ki low ko breach hona zaroori hai aur dusre technical indicators ka istemaal bhi kiya ja sakta hai trading strategies ko aur bhi mazboot banane ke liye. -

#6 Collapse

Dark Cloud Cover Chart Candle Pattern: Foreboding shadow Cover design ek prabhavshali candle design hai jo negative inversion ko imply karta hai. Dealers aur financial backers ko is design ko samajhna zaroori hai, taaki woh sahi waqt standard exchanging choices le purpose aur market ke developments ko samajh saken. Design ko affirm karne ke liye, doosri light ki low ko break hona zaroori hai aur dusre specialized markers ka istemaal bhi kiya ja sakta hai exchanging methodologies ko aur bhi mazboot banane ke liye.Dark Overcast Cover design ko aur bhi strong banane ke liye, use karne ridge dealers doosre specialized pointers jaise ki RSI, MACD, ya moving midpoints ka bhi istemaal karte hain.osition enter karne se pehle, stop misfortune ka level tay karna zaroori hai, taki agar exchange against ho toh nuksaan kam ho purpose. Cover design ka istemaal exchanging choices mein karte waqt kuch baaton ka khayal rakhna zaroori hai Example ko affirm karne ke liye, doosri flame ki low ko break hona zaroori hai, tabhi iska importance hota hai.Dark Overcast Cover design ki tafsiriya karne ke liye kuch significant focuses hain:Yeh design ek negative inversion design hai, iska matlab hai ke bullish pattern khatam sharpen ki nishani hai aur negative pattern ka aaghaz ho sakta hai.Pehle light areas of strength for ki move se baad mein ek huge negative candle ke aane se market opinion badalta hai aur bears rule karne lagte hain.Pehle candle ki high ko break karne ke baad dusri candle ki negative strength aur bhi zyada hoti hai. Chart Candles Types And Formation: Cover design ko pehchanne ke liye neeche diye gaye focuses standard tawajjo dena zaroori hai Pehla candle areas of strength for ek light hoti hai, jise "upswing flame" bhi kaha jata hai. Iski body badi hoti hai aur iski shutting cost high hoti hai.candle pehle candle ki body mein ghus kar aati hai. Yeh ek huge negative light hoti hai jiski body pehle flame ki body ke oopar close hoti hai.Dusra candle ki shutting cost pehle candle ki body ke beech ya neeche hoti hai.Yeh ek negative inversion design hai, jiska matlab hota hai ke hit yeh design market standard nazar aata hai, toh bullish pattern ki jagah negative pattern ka aaghaz sharpen ka ishara hota hai.

Cover design ka istemaal exchanging choices mein karte waqt kuch baaton ka khayal rakhna zaroori hai Example ko affirm karne ke liye, doosri flame ki low ko break hona zaroori hai, tabhi iska importance hota hai.Dark Overcast Cover design ki tafsiriya karne ke liye kuch significant focuses hain:Yeh design ek negative inversion design hai, iska matlab hai ke bullish pattern khatam sharpen ki nishani hai aur negative pattern ka aaghaz ho sakta hai.Pehle light areas of strength for ki move se baad mein ek huge negative candle ke aane se market opinion badalta hai aur bears rule karne lagte hain.Pehle candle ki high ko break karne ke baad dusri candle ki negative strength aur bhi zyada hoti hai. Chart Candles Types And Formation: Cover design ko pehchanne ke liye neeche diye gaye focuses standard tawajjo dena zaroori hai Pehla candle areas of strength for ek light hoti hai, jise "upswing flame" bhi kaha jata hai. Iski body badi hoti hai aur iski shutting cost high hoti hai.candle pehle candle ki body mein ghus kar aati hai. Yeh ek huge negative light hoti hai jiski body pehle flame ki body ke oopar close hoti hai.Dusra candle ki shutting cost pehle candle ki body ke beech ya neeche hoti hai.Yeh ek negative inversion design hai, jiska matlab hota hai ke hit yeh design market standard nazar aata hai, toh bullish pattern ki jagah negative pattern ka aaghaz sharpen ka ishara hota hai.  Candle designs exchanging mein famous hai, khas karke un dealers aur financial backers ke liye jo specialized examination ka istemaal karte hain. Kyunki candle graphs outwardly engaging hote hain aur cost activity ko samajhne mein madad karte hain, inka istemaal market developments ko samajhne mein kiya jata hai.Dark Overcast Cover ek 2-candle design hota hai jo negative inversion ko darshata hai. Yeh design ek upswing ke baad dikhta hai, hit areas of strength for ek light ke baad ek huge negative flame structure hoti hai. Iss negative flame ki body pehle bullish light ki body mein ghus kar aati hai. Iska matlab hota hai ke bulls at first control karte hain, lekin bears solid selling pressure ke saath market ko specialty le jaate hain. Chart Pattern Trading Explanation: light of the way plan hamesha qabil aetmaad isharay nahi hota hai, aur taajiron ko - apne tijarti faislon ki tasdeeq ka liye usay deegar takneeki aur bunyadi tajzia ka alaat ka sath mil kar istemaal karna chah. labyrinth yeh ke, cash ke jore ki qeemat muzahmati satah se oopar sound jane aur patternen nakaam honai ki soorat mein muqinna nuqsanaat ko mehdood karne mun liye stop las demand muratab karna zaroori hai.Conversion scale jore ko baichnay ya mukhtasir karne ke liye on various occasions taap patteren ko signal for apex standard istemewa karte hain, kyunkay yeh batata hai ka khredar raftaar kho rahay hain aur reechh haasil control kar rahay hain. Dagang ka liye mumkina munafe ka hadaf rizstns level assist with supporting level to darmyan fasla hai, jo break point se neechay ki taraf mutawaqqa hai.

Candle designs exchanging mein famous hai, khas karke un dealers aur financial backers ke liye jo specialized examination ka istemaal karte hain. Kyunki candle graphs outwardly engaging hote hain aur cost activity ko samajhne mein madad karte hain, inka istemaal market developments ko samajhne mein kiya jata hai.Dark Overcast Cover ek 2-candle design hota hai jo negative inversion ko darshata hai. Yeh design ek upswing ke baad dikhta hai, hit areas of strength for ek light ke baad ek huge negative flame structure hoti hai. Iss negative flame ki body pehle bullish light ki body mein ghus kar aati hai. Iska matlab hota hai ke bulls at first control karte hain, lekin bears solid selling pressure ke saath market ko specialty le jaate hain. Chart Pattern Trading Explanation: light of the way plan hamesha qabil aetmaad isharay nahi hota hai, aur taajiron ko - apne tijarti faislon ki tasdeeq ka liye usay deegar takneeki aur bunyadi tajzia ka alaat ka sath mil kar istemaal karna chah. labyrinth yeh ke, cash ke jore ki qeemat muzahmati satah se oopar sound jane aur patternen nakaam honai ki soorat mein muqinna nuqsanaat ko mehdood karne mun liye stop las demand muratab karna zaroori hai.Conversion scale jore ko baichnay ya mukhtasir karne ke liye on various occasions taap patteren ko signal for apex standard istemewa karte hain, kyunkay yeh batata hai ka khredar raftaar kho rahay hain aur reechh haasil control kar rahay hain. Dagang ka liye mumkina munafe ka hadaf rizstns level assist with supporting level to darmyan fasla hai, jo break point se neechay ki taraf mutawaqqa hai. on different occasions taap configuration market ki naqal o harkat ki energy goi karne ka aik foul proof tareeqa nahi hai, aur taajiron ko usay deegar bunyadi aur takneeki tajzia techni to sath mil kar istemaal karna chahiye. There is a labyrinth, taajiron ko meshe masib risk the load up knowledge amlyon ka istimewa karna chahiye On numerous occasions above plan ki dashkeel ko tasleem karte conceal, tajir muzahmat aur muawnat ki sthon ka taayun kar satke hain aur apni tijarat ka liye munasib dakhlay aur kharji rastoon ka taayun kar satke hain. Vendors will find triple model ki durustagi ki tasdeeq karne aur - apne trading signal ki durustagi ko badhane keliye deegar takneeki tajzia

-

#7 Collapse

TRADE THE DARK CLOUD COVER CANDLESTICK PATTERN DEFINITION Pattern significant Hai Kyunki yah Momentum mein ulta se niche Ki tarf tabdili ko zahar karta hai dark cloud cover Ek Bearish reversal candlestick pattern Hota Hai Jahan down candle aamtaur per black ya red Prior up candle aamtaur per green ya white ke upar khulati hai and phir Upar candle ke mid point Ke Niche close Ho Jaati Hain traders next Teesri candles per price kam karne ke liye dekhte hain usse confirmation Kahate Hain bearish engulfing pattern Ki Tarah kharidar Khule Mein price ko Uncha dhakel Dete Hain lekin seller wale bad mein session mein kabza kar lete hain zyadatar traders dark cloud cover ko sirf is Surat Mein useful samajhte Hain Jab yah upri trend ya price Mein overall Taur per izaafe ke bad Hota Hai DARK CLOUD COVER OF CONFIRMATION Dark cloud cover ki pattern Mein red and black candle ki characterized hain short ya non-existent Shadow Hote Hain bearish Candle ke close ko long position se bahar nikalne ke liye istemal Kiya Ja sakta hai to Bearish candle ke unchai ke upar Ek Stop loss Rakha jata hai dark cloud cover pattern ke liye profit ka koi target nahi hai is ka determine karne ke liye traders dusre methods ka istamal kar sakte hai dark cloud cover ke liye technical analysis ek behtaren tools haj example ke Taur per traders 70 Se zyada relative strength index Talash kar sakte hain is signals ke Taur per Ke Niche ka trend Aane Wala Hai

DARK CLOUD COVER OF CONFIRMATION Dark cloud cover ki pattern Mein red and black candle ki characterized hain short ya non-existent Shadow Hote Hain bearish Candle ke close ko long position se bahar nikalne ke liye istemal Kiya Ja sakta hai to Bearish candle ke unchai ke upar Ek Stop loss Rakha jata hai dark cloud cover pattern ke liye profit ka koi target nahi hai is ka determine karne ke liye traders dusre methods ka istamal kar sakte hai dark cloud cover ke liye technical analysis ek behtaren tools haj example ke Taur per traders 70 Se zyada relative strength index Talash kar sakte hain is signals ke Taur per Ke Niche ka trend Aane Wala Hai  HOW TO IDENTFY A DARK CLOUD COVER ON FOREX CHART in signal ko Talash Karen ke Momentum slowing ho rahi hai ult rahi hai Kyunki yah candles zyadatar Usi level per open Hogi current up trend ki identify moving average Se Ki Jaati Hai to aap market Mein sabse pahle inter hone ke bad technical analysis per focus Karen aur uski positions ko check Karen forex trading mein zyada Se zyada risk Nahin Lena chahie aap Achcha profit Hasil karne ke liye Forex form Apne work ko complete Karen

HOW TO IDENTFY A DARK CLOUD COVER ON FOREX CHART in signal ko Talash Karen ke Momentum slowing ho rahi hai ult rahi hai Kyunki yah candles zyadatar Usi level per open Hogi current up trend ki identify moving average Se Ki Jaati Hai to aap market Mein sabse pahle inter hone ke bad technical analysis per focus Karen aur uski positions ko check Karen forex trading mein zyada Se zyada risk Nahin Lena chahie aap Achcha profit Hasil karne ke liye Forex form Apne work ko complete Karen

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

**Dark Cloud Cover Candlestick Pattern Ko Kaise Trade Karein?**

Forex trading mein candlestick patterns ek ahem role ada karte hain, aur inmein se ek mashhoor pattern hai "Dark Cloud Cover." Yeh pattern market ke bearish reversal ka signal deta hai aur traders ko potential downtrend ke baare mein agah karta hai. Is pattern ko trade karne se pehle iske formation aur interpretation ko samajhna zaroori hai.

**Dark Cloud Cover Pattern Kya Hai?**

Dark Cloud Cover pattern ek two-candlestick reversal pattern hota hai jo bullish trend ke baad banta hai. Is pattern mein pehli candlestick ek long bullish candle hoti hai jo market ke strong upward movement ko indicate karti hai. Dusri candlestick ek bearish candle hoti hai jo pehli candlestick ke closing price se higher open hoti hai lekin phir market mein girawat aati hai aur yeh candlestick pehli candlestick ke body ke half se bhi neeche close hoti hai.

**Pattern Ki Pehchan Aur Interpretation:**

1. **Pehli Candlestick:** Yeh long bullish candle market ki strong buying pressure aur uptrend ko dikhati hai.

2. **Doosri Candlestick:** Yeh bearish candle market ke reversal ka signal deti hai. Iski opening price pehli candlestick se upar hoti hai, lekin closing price pehli candlestick ke half se neeche hoti hai.

3. **Confirmation:** Dark Cloud Cover pattern tabhi strong signal deta hai jab dusri candlestick ke baad ek confirmation candle banti hai jo bearish trend ko confirm karti hai. Confirmation ke liye ek additional bearish candle ki zaroorat hoti hai jo downtrend ko sustain karne mein madad karti hai.

**Trade Karne Ka Tareeqa:**

1. **Entry Point:** Dark Cloud Cover pattern ko trade karte waqt entry point dusri candlestick ke close par ya uske baad ke din pe set kiya ja sakta hai. Entry ke liye confirmation candle ki zaroorat hoti hai.

2. **Stop Loss:** Trade ki protection ke liye stop loss ko pehli candlestick ke high ke upar set karna chahiye. Yeh aapke trade ko sudden price movements se bachayega.

3. **Target:** Target set karte waqt aap apne risk-to-reward ratio ko dhyan mein rakhein. Trade ke liye appropriate target set karna zaroori hai jo aapke trading strategy ke mutabiq ho.

4. **Risk Management:** Dark Cloud Cover pattern ko trade karte waqt risk management ka khayal rakhna zaroori hai. Over-leveraging se bachne ke liye appropriate position sizing aur stop loss ka istemal karein.

**Conclusion:**

Dark Cloud Cover pattern forex trading mein ek valuable tool hai jo market ke bearish reversal ko indicate karta hai. Is pattern ko trade karte waqt market ki overall conditions aur confirmation candles ka bhi dhyan rakhein taake aapke trades zyada effective aur profitable ho sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:53 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим