Advance Decline Line (ADL) in Forex

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Advance Decline Line (ADL) in Forex "Advance Decline Line" (ADL) ek technical indicator hai jo forex market mein istemal hota hai. Yeh indicator market ke trend aur price movements ko samajhne mein madad karta hai. Isko istemal karke traders market ke strength aur weakness ko samajh sakte hain.Traders is indicator ki madad se trend changes aur potential reversals ko pehchan sakte hain. **Advance Decline Line Kya Hai?** Advance Decline Line (ADL) ek cumulative indicator hai jo stock ya forex market ke advance aur decline ke numbers ko jama karke dikhata hai. Ismein upar aur niche jate samay stocks ya currencies ke buying aur selling ka comparison hota hai. Yeh indicator market sentiment ko measure karne mein madad karta hai. **ADL Kaise Kaam Karta Hai?** ADL ka calculation daily basis par hota hai. Har trading day ke end mein, market mein jo bhi stocks ya currencies higher close price se close hoti hain, unka count hota hai aur advance mein joda jata hai. Wahi, jo stocks ya currencies lower close price se close hoti hain, unka count hota hai aur decline mein joda jata hai. ADL ko graph par plot karke traders ko market ke strength aur weakness ka idea mil jata hai. **ADL Ka Istemal Forex Market Mein** Forex market mein ADL ka istemal market breadth aur market sentiment ko samajhne ke liye hota hai. Agar ADL line upar ja rahi hai, to yeh ek positive market sentiment indicate kar sakta hai, jabki agar ADL line niche ja rahi hai, to yeh negative market sentiment ko darshata hai. Traders is indicator ki madad se trend changes aur potential reversals ko pehchan sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Advance Decline Line (ADL) trading mein ek technical analysis tool hai jo traders aur investors istemal karte hain taake market breadth ko measure karein aur market trend ki overall strength ya weakness ko assess karein. Ye ek cumulative indicator hai jo ek diye gaye market index mein advancing aur declining stocks ka net difference track karta hai. ADL khaas taur par market trend ki underlying strength ya weakness ko identify karne, price movements ki direction ko confirm karne aur potential market reversals ko detect karne mein kaam aata hai.

The Advance Decline Line Works- Data Collection: ADL ka calculation karne ka pehla step hai specific market index mein advancing aur declining stocks ka data gather karna. Ye data daily, hourly ya kisi bhi time interval par collect kiya ja sakta hai jo trader ki preference par depend karta hai.

- Cumulative Nature: ADL ek cumulative indicator hai, jo har din ki ADL value ko previous day ki value mein add karta hai. Ye cumulative nature help karta hai overall trend strength ko extended period mein track karne mein.

- Interpretation of ADL Values:

- Positive ADL: Jab ADL badh rahi hoti hai, to ye indicate karta hai ke advancing stocks declining stocks se zyada hain. Ye ek strong market trend ko suggest karta hai aur bullish sentiment ko reinforce karta hai.

- Negative ADL: Ulta, jab ADL ghat rahi hoti hai, to ye indicate karta hai ke declining stocks advancing stocks se zyada hain. Ye ek weak market trend ko suggest karta hai aur bearish sentiment ko reinforce karta hai.

- Divergence: ADL aur price movements ke beech ka divergence bhi valuable insights provide kar sakta hai. For example, agar ADL badh rahi hai jab prices ghat rahi hain, to ye ek potential bullish reversal ko signal kar sakta hai, aur ulta bhi.

Key Uses and Interpretations of ADL- Trend Confirmation:

- Uptrend Confirmation: Ek uptrend mein, ek rising ADL trend ki strength ko confirm karta hai by showing ke advancing stocks declining stocks se zyada hain.

- Downtrend Confirmation: Ek downtrend mein, ek falling ADL trend ki strength ko confirm karta hai by showing ke declining stocks advancing stocks se zyada hain.

- Identification of Market Reversals:

- Bullish Reversal: Ek divergence jahan ADL badh rahi hai jab prices ghat rahi hain, ek potential bullish reversal ko indicate kar sakta hai. Ye divergence suggest karta hai ke despite falling prices, advancing stocks ki number increase ho rahi hai, jo market mein underlying strength ko signal karta hai.

- Bearish Reversal: Ulta, ek divergence jahan ADL ghat rahi hai jab prices badh rahi hain, ek potential bearish reversal ko indicate kar sakta hai. Ye divergence suggest karta hai ke despite rising prices, declining stocks ki number increase ho rahi hai, jo market mein underlying weakness ko signal karta hai.

- Confirmation of Price Movements:

- Breakout Confirmation: Jab prices new highs ya lows par break karte hain, ADL breakout ki strength ko confirm kar sakta hai by showing corresponding increase ya decrease in advancing aur declining stocks ki numbers.

- Market Breadth Analysis:

- ADL market breadth ka measure hai, jo stocks ki extent of participation ko refer karta hai ek market index mein. Ek strong ADL broad-based participation ko indicate karta hai, jabki weak ADL limited participation aur potential fragility ko indicate karta hai.

- Comparison with Price Index:

- Traders often ADL ko market ke price index ke sath compare karte hain divergences aur potential market turning points ko identify karne ke liye. ADL aur price index ke beech ke divergences traders ke liye valuable signals provide kar sakte hain.

Advantages of Using Advance Decline Line- Market Breadth Analysis:

- ADL market breadth mein insights provide karta hai by tracking performance of large number of stocks. Ye broad-based analysis traders ko overall market trend ki strength ya weakness ko assess karne mein help karta hai.

- Trend Confirmation:

- Price movements ki direction ko confirm karke, ADL traders ko unke trading decisions mein confidence deta hai, specially during strong trends.

- Early Warning Signals:

- ADL aur price movements ke beech ke divergences ek early warning signal provide kar sakte hain for potential market reversals, allowing traders ko apne positions ko adjust karne ki ability dete hain.

- Simple Calculation:

- ADL ka calculation straightforward aur easy to understand hai, making it accessible to traders of all experience levels.

- Long-Term Trend Analysis:

- ADL ka cumulative nature long-term trend analysis ke liye suitable hai, enabling traders ko major trend shifts ko identify karne mein help karta hai over extended periods.

Limitations of Advance Decline Line- Lagging Indicator:

- Jaise ki bohot se other cumulative indicators, ADL bhi ek lagging indicator hai, jo past price movements ko reflect karta hai future price movements ko predict karne ke bajaye. Traders ko forward-looking analysis ke liye other tools aur indicators ka use karna chahiye.

- Market Composition Bias:

- Market index ka composition ADL readings ko influence kar sakta hai. For example, agar kuch large-cap stocks index ko dominate karte hain, to unka performance ADL readings ko disproportionately affect kar sakta hai.

- False Signals:

- Jabki ADL aur price movements ke beech ke divergences potential reversals ko identify karne mein useful hote hain, woh false signals bhi produce kar sakte hain. Traders ko ADL signals ko act karne se pehle additional analysis aur confirmation ka use karna chahiye.

- Not Suitable for All Markets:

- ADL sabhi markets ke liye suitable nahi ho sakta, specially jo limited stock participation wale hote hain ya jahan other factors like geopolitical events heavily influence price movements.

Strategies for Using Advance Decline Line- Trend Confirmation:

- ADL ka use karein to confirm other technical indicators ya chart patterns dwara identify ki gayi trends ki strength. Ek rising ADL bullish trends ko confirm karta hai, jabki falling ADL bearish trends ko confirm karta hai.

- Divergence Analysis:

- ADL aur price movements ke beech ke divergences ko monitor karein potential market reversals ko identify karne ke liye. Situations ko dekhein jahan ADL prices ke opposite direction mein move kar rahi hai, underlying strength ya weakness ko signal karte hue.

- Volume Confirmation:

- ADL ko volume analysis ke sath combine karein price movements ki strength ko confirm karne ke liye. High volume jo ek rising ADL ke sath hai, bullish sentiment ko reinforce karta hai, jabki high volume ek falling ADL ke sath, bearish sentiment ko reinforce karta hai.

- Long-Term Trend Analysis:

- ADL ko longer timeframes par use karein, jaise weekly ya monthly charts, long-term trends ko analyze karne ke liye aur major trend shifts ko identify karne ke liye. Ye specially investors ke liye useful ho sakta hai extended market trends ke liye.

- Risk Management:

- ADL analysis ko apne risk management strategy mein incorporate karein by using it to assess overall market health aur position sizes ko accordingly adjust karein. Ek strong ADL larger positions ko warrant karta hai, jabki weak ADL caution signal karta hai.

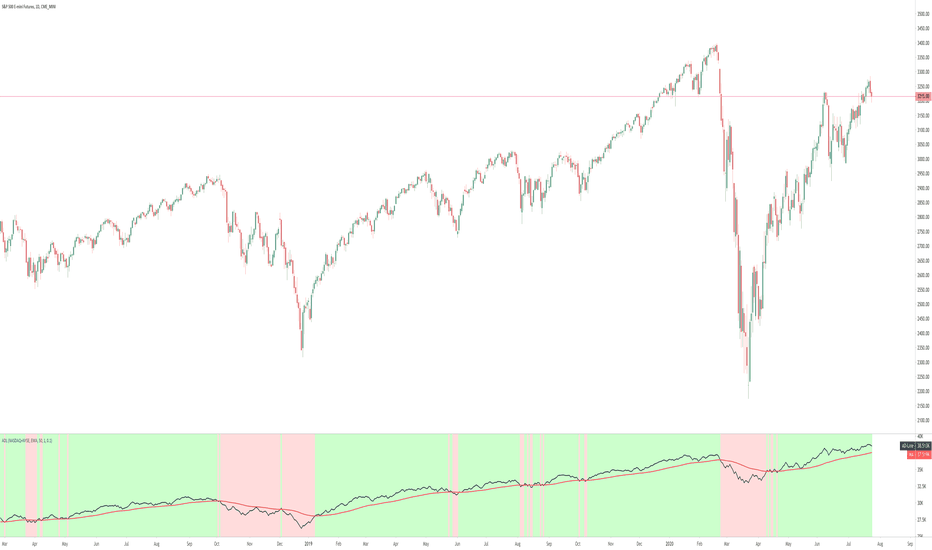

Example of Advance Decline Line Analysis- Data Collection: Traders daily data gather karte hain advancing aur declining stocks ka ek major market index mein, jaise S&P 500.

- ADL Calculation: Mentioned formula ka use karke traders daily ADL values calculate karte hain based on net difference between advancing aur declining stocks.

- Trend Confirmation: Traders notice karte hain ke ADL kuch weeks se consistently rise kar rahi hai, indicating broad-based strength in the market. Ye bullish trend ko confirm karta hai jo other technical indicators aur chart patterns dwara identify hua tha.

- Divergence Analysis: Jab prices new highs tak pohochte hain, traders ek divergence ko observe karte hain jahan ADL new highs nahi bana rahi hai, suggesting a potential weakening of market breadth despite upward price movement. Ye divergence ek warning signal provide karta hai potential profit-taking ya market correction ke liye.

- Volume Confirmation: Traders trading volume ko analyze karte hain price rallies ke dauran aur confirm karte hain ke high volume ek rising ADL ke sath hai, further reinforcing bullish sentiment.

- Risk Management: ADL analysis aur other factors ke basis par, traders apne risk management strategy ko adjust karte hain by tightening stop-loss levels ya taking partial profits to protect gains in case of a market pullback.

Advance Decline Line (ADL) ek powerful technical analysis tool hai jo market breadth, trend confirmation, aur potential market reversals mein insights provide karta hai. Advancing aur declining stocks ka net difference track karke, ADL traders ko underlying market trends ki strength ya weakness ko assess karne mein help karta hai aur informed trading decisions lene mein madad karta hai.

Jabki ADL apne limitations rakhta hai ek lagging indicator ke roop mein aur false signals produce kar sakta hai, woh ek valuable tool rehta hai jab ise other technical indicators, chart patterns, aur risk management strategies ke saath istemal kiya jata hai. Traders ko ADL analysis ko apne trading approach mein incorporate karke market dynamics ka comprehensive understanding gain kar sakte hain aur apne overall trading performance ko improve kar sakte hain.Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Advance decline line in forex

Forex market kaafi complex aur volatile hota hai, isme traders ko naye aur mukhtalif tools aur indicators ka istemal karna parta hai taake wo market trends ko samajh sakein aur behtar trading decisions le sakein. Ek aham tool jo Forex market mein istemal hota hai, wo hai Advance Decline Line (ADL). Is article mein hum ADL ke mutaliq Roman Urdu mein 1000 words tak ki maloomat par ghaur karenge, jismein neeche diye gaye headings honge:- Forex Market ki Introduction

- Advance Decline Line (ADL) ki Tareef

- ADL ka Working Mechanism

- ADL ka Importance Forex Market mein

- ADL ka Istemal Trading Strategies mein

- ADL ke Advantages aur Disadvantages

- Conclusion

1. Forex Market ka Introduction

Forex market, ya foreign exchange market, dunya ka sabse bada aur liquid financial market hai jahan currencies ko kharida aur becha jata hai. Yahan par trillions of dollars ki daily trading hoti hai, jo is market ko sabse attractive aur active banati hai. Forex market mein traders currencies ke pairs mein trading karte hain, jismein unka maqsad hota hai ke woh currency pair ka future direction sahi taur par predict karke profit kamayen.

2. Advance Decline Line (ADL) ki Tareef

Advance Decline Line (ADL) ek technical analysis tool hai jo market ke overall health aur strength ko measure karne mein madad deta hai. ADL ka basic concept yeh hai ke agar zyada stocks market mein upar ja rahe hain (advance) aur kam stocks neeche ja rahe hain (decline), toh market strong hai. Jabke agar zyada stocks neeche ja rahe hain aur kam stocks upar ja rahe hain, toh market weak hai.

3. ADL ka Working Mechanism

ADL ka calculation market ke volume aur price movements par based hota hai. Har ek trading day ke end par, agar stock price us din upar gaya hai to uska volume positive contribute karta hai ADL mein. Aur agar stock price neeche gaya hai to uska volume negative contribute karta hai ADL mein. Is tarah se, ADL ek cumulative indicator hai jo market ke trend ko represent karta hai.

4. Forex Market me ADL ki importance

Forex market mein bhi ADL ka istemal hota hai market ke overall direction aur strength ko samajhne ke liye. ADL ki madad se traders ye determine kar sakte hain ke market mein buying pressure kitna hai aur selling pressure kitni hai. Isse unko behtar trading decisions lene mein madad milti hai aur wo market trends ko samajhne mein expert ho jate hain.

5. Trading Strategies me ADL ka istemal

ADL ka istemal kai trading strategies mein hota hai. Kuch traders ADL ko trend confirmation ke liye istemal karte hain, matlab jab ADL aur price movement dono same direction mein hote hain, toh wo trend ko confirm karte hain. Dusri taraf, kuch traders ADL ko divergence patterns ke liye istemal karte hain, jaise ke ADL neeche ja raha hai aur price upar ja raha hai, ya vice versa.

6. ADL ke Advantages aur Disadvantages

ADL ke kuch advantages aur disadvantages hain. Iska sabse bara advantage ye hai ke ye market ke overall health ko measure karta hai, jo traders ko market ki strength aur weaknesses ko samajhne mein madad deta hai. Iske saath saath, ye trend reversals ko detect karne mein bhi helpful hai. Lekin iska disadvantage ye hai ke ye sirf price aur volume ko hi consider karta hai aur fundamental factors ko ignore karta hai, jo kabhi kabhi inaccurate signals produce kar sakta hai.

7. Conclusion

Advance Decline Line (ADL) ek useful tool hai jo Forex market mein traders ko market trends ko samajhne aur trading decisions lene mein madad deta hai. Iska istemal karte waqt, traders ko iski limitations ko bhi dhyan mein rakhna chahiye aur doosre indicators aur tools ke saath combine karke istemal karna chahiye taake more accurate predictions aur trading outcomes hasil kiya ja sakein -

#5 Collapse

Advance Decline Line (ADL) in Forex

Advance Decline Line (ADL) in Forex

Heading:

Forex Mein Advance Decline Line (ADL)

Tafseel:- Kya Hai ADL?

Advance Decline Line (ADL) ek technical indicator hai jo ke market sentiment ko measure karne ke liye istemal hota hai. Yeh indicator market mein mojud currencies ya currency pairs ke price changes ko analyze karta hai aur unki overall strength ya weakness ko darust karta hai. - Kaise Kaam Karta Hai?

- ADL indicator market mein mojud har currency ya currency pair ke advance aur decline ko count karta hai.

- Har bar jab ek currency ya pair ki price upar jaati hai, ADL mein ek "advance" count kiya jata hai. Jab price neeche jaati hai, toh ek "decline" count kiya jata hai.

- Is tarah se, ADL ek cumulative line banata hai jo ke overall market sentiment ko darust karta hai.

- Faida (Advantages)

- ADL traders ko market sentiment ko samajhne mein madad karta hai. Agar ADL line upar ja rahi hai, toh yeh bullish sentiment ko indicate karta hai, jabke agar ADL line neeche ja rahi hai, toh yeh bearish sentiment ko indicate karta hai.

- Iske alawa, ADL indicator divergence ko bhi identify karne mein madadgar hota hai. Agar price higher highs banata hai lekin ADL lower highs banata hai, toh yeh bearish divergence ko indicate karta hai, aur vice versa.

- Istemal (Usage)

- Traders ADL indicator ko trend confirmation ke liye istemal karte hain. Agar ADL line price ke sath upar ja rahi hai, toh yeh uptrend ko confirm karta hai, jabke agar ADL line price ke sath neeche ja rahi hai, toh yeh downtrend ko confirm karta hai.

- Iske alawa, ADL indicator ko market reversals ko bhi anticipate karne ke liye istemal kiya jata hai. Agar ADL line price ke sath diverge kar rahi hai, toh yeh potential reversal ka indication ho sakta hai.

ADL ek powerful tool hai jo ke market sentiment ko analyze karne mein madad deta hai. Lekin, is indicator ko istemal karne se pehle traders ko market context aur dusre technical indicators ka bhi istemal karke thorough analysis karna chahiye.

- Kya Hai ADL?

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Advance Decline Line (ADL) in Forex (Forex Mein Advance Decline Line):

Advance Decline Line (ADL) ek technical indicator hai jo Forex trading mein istemal hota hai takay market ke strength aur direction ka andaza lagaya ja sake. Yeh indicator market ke breadth ko measure karta hai, yani ke kitni stocks ya currencies mein izafa ho raha hai aur kitni mein girawat.

1. Kya Hai Advance Decline Line?

Advance Decline Line (ADL) ek line chart hoti hai jo ke market ke advance aur decline ke ratio ko darust karti hai. Agar ADL line upar ja rahi hai, toh yeh indicate karta hai ke zyada currencies ya stocks mein izafa ho raha hai, jo ke bullish trend ko darust karta hai. Agar ADL line neeche ja rahi hai, toh yeh bearish trend ki nishandahi karta hai.

2. Kaise Kaam Karta Hai?

ADL indicator kaam karta hai market mein maujood stocks ya currencies ke price movements ko analyze karke. Agar ek stock ya currency ka price upar ja raha hai, toh usko 'advance' mana jata hai aur agar price neeche ja raha hai, toh usko 'decline' kaha jata hai. ADL line in advance aur decline ke ratio ko graphically represent karti hai.

3. Trading Strategy:

Forex traders ADL indicator ka istemal karte hain takay market ke trend aur strength ko samajh sakein. Agar ADL line upar ja rahi hai aur price bhi upar ja raha hai, toh yeh bullish trend ko confirm karta hai. Agar ADL line neeche ja rahi hai aur price bhi neeche ja raha hai, toh yeh bearish trend ki nishandahi karta hai.

Traders ADL indicator ka istemal karke entry aur exit points tay karte hain aur market ke trend ko samajhne mein madad lete hain.

Umeed hai ke yeh mukhtasar tafseel aapko samajhne mein madad karegi ke Advance Decline Line (ADL) kya hai aur iska istemal kaise kiya jata hai Forex trading mein.

-

#7 Collapse

Advance decline line in forex

Definition

Advance Decline Line (ADL) ek technical indicator hai jo market ke overall strength aur direction ko measure karta hai. Ye indicator market mein hone wale advances (positively closing securities) aur declines (negatively closing securities) ko count karke ek line banata hai. Chaliye detail mein samajhte hain ke Advance Decline Line kya hota hai aur kaise istemal hota hai forex trading mein:

Advance Decline Line (ADL):

- Calculation: Advance Decline Line ko calculate karne ke liye, market mein har din hone wale advances aur declines ko count kiya jata hai. Phir, advances se declines ko minus karke ek cumulative line banai jati hai.

- Interpretation: ADL ki interpretation market ke overall strength aur direction ko measure karne mein madad karta hai. Agar ADL line upar ja rahi hai, to ye indicate karta hai ke market mein zyada securities positive territory mein ja rahi hain, jo ek bullish sign hai. Jabki agar ADL line neeche ja rahi hai, to ye indicate karta hai ke market mein zyada securities negative territory mein ja rahi hain, jo ek bearish sign hai.

Advance Decline Line ka Istemal:

- Market Direction ka Pata Lagana: ADL ka istemal karke traders market ke direction ka pata lagate hain. Agar ADL line upar ja rahi hai, to ye indicate karta hai ke market bullish hai aur agar neeche ja rahi hai, to ye bearish market ko indicate karta hai.

- Divergence ki Confirmation: ADL ko price action ke saath compare karke divergence identify ki ja sakti hai. Agar market new high banata hai lekin ADL line new high nahi banati hai, to ye bearish divergence ka indication ho sakta hai aur vice versa.

- Trend Reversals ka Anticipation: ADL ki help se traders trend reversals ko anticipate kar sakte hain. Agar ADL line trend ke against move kar rahi hai, to ye indicate karta hai ke trend reversal hone ka possibility hai.

- Market Strength ka Measure: ADL market ke overall strength ko measure karta hai. Agar ADL line upar ja rahi hai, to ye indicate karta hai ke market mein strength hai aur traders long positions enter kar sakte hain.

Conclusion:

Advance Decline Line (ADL) ek powerful technical indicator hai jo market ke overall strength aur direction ko measure karta hai. Is indicator ki help se traders market direction ka pata lagate hain, trend reversals ko anticipate karte hain aur market ki overall strength ko evaluate karte hain. Lekin, is indicator ko istemal karne se pehle, traders ko dusre technical indicators aur market analysis tools ke saath ADL ko combine karna chahiye taake accurate trading decisions liya ja sake.

-

#8 Collapse

Advance Decline Line (ADL) ek technical indicator hai jo market breadth ya market sentiment ko measure karne mein istemal hota hai. Yeh indicator market mein overall strength ya weakness ko quantify karta hai, jo traders ko market direction ka insight provide karta hai. Although originally developed for stock markets, ADL bhi forex trading mein istemal kiya ja sakta hai.

ADL Calculation:

ADL ka calculation price ke advance aur decline ke basis par hota hai. Iske liye har trading session ke dauraan jo stocks ya securities upar jaate hain ya neeche jaate hain unka volume ko total karte hain. Agar price higher close par close karta hai to us volume ko positive (+) count karte hain, aur agar price lower close par close karta hai to us volume ko negative (-) count karte hain. ADL line ka value previous day ke ADL value aur current day ke net volume ke sum ke basis par calculate kiya jata hai.

ADL Interpretation:- Upward Trend: Agar ADL line upwards move kar raha hai, toh ye indicate karta hai ki buying pressure strong hai aur market mein uptrend ho sakta hai.

- Downward Trend: Agar ADL line downwards move kar raha hai, toh ye indicate karta hai ki selling pressure strong hai aur market mein downtrend ho sakta hai.

- Divergence: ADL line aur price movement ke beech mein divergences ko identify karke traders market direction ke potential changes ko anticipate kar sakte hain.

- Trend Confirmation: ADL line ka istemal karke traders trend direction ko confirm kar sakte hain. Agar ADL line price ke sath move kar raha hai, toh ye current trend ko confirm karta hai.

- Divergence Trading: ADL line aur price movements ke beech mein divergences ko identify karke traders trend reversals ka anticipation kar sakte hain.

- Overbought aur Oversold Conditions: Agar ADL line ek extreme level par hai, jaise ki higher highs ya lower lows, toh ye indicate karta hai ki market overbought ya oversold ho sakta hai, aur potential reversal ke chances hote hain.

- Market Breadth ka Measure: ADL market breadth ya overall market sentiment ko measure karta hai, jo traders ko market ki overall strength ya weakness ka idea deta hai.

- Trend Confirmation: ADL line trend direction ko confirm karta hai, jo traders ko trading decisions lene mein madad karta hai.

- Whipsaws: ADL line choppy market conditions mein whipsaws generate kar sakta hai, jisse traders ko false signals milte hain.

- Dependence on Volume Data: ADL line ka accuracy volume data par depend karta hai. Agar volume data accurate nahi hai, toh ADL line bhi reliable nahi hoga.

ADL ek useful indicator hai market sentiment aur trend direction ke analysis mein, lekin iska istemal karne se pehle traders ko thorough analysis aur confirmatory signals ka istemal karna zaroori hai. Additionally, proper risk management aur discipline maintain karna bhi mahatvapurna hai trading ke liye.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Advance Decline Line (ADL) in Forex:

1. Tareef:

Advance Decline Line (ADL) ek technical indicator hai jo market ke overall strength aur direction ko measure karne mein madad karta hai. Ye indicator stock market mein bhi istemal hota hai lekin forex market mein bhi useful hai.

2. Kaise Kaam Karta Hai:

ADL indicator market mein har trading session mein advance aur decline karne wale currency pairs ka total count calculate karta hai. Advance wale currency pairs jo uptrend mein hain aur decline wale currency pairs jo downtrend mein hain unka total count hota hai.

3. Ahmiyat:

ADL indicator market ke overall sentiment ko samajhne mein madad karta hai. Agar ADL line upar ja rahi hai, to ye bullish sentiment ko darust karta hai aur agar ADL line neeche ja rahi hai, to ye bearish sentiment ko darust karta hai.

4. Trading Strategies:

Traders ADL indicator ko trend confirmation aur entry/exit points tay karne ke liye istemal karte hain. Agar ADL line price ke sath move kar rahi hai, to ye trend ka confirmation hai aur traders us direction mein trade karte hain.

5. Limitations:

ADL indicator ke istemal mein kuch limitations bhi hain. Ye indicator sirf advance aur decline currency pairs ka total count batata hai lekin individual currency pairs ke performance ko nahi dekhta.

ADL indicator forex market mein traders ke liye ek mukhsoos tool hai jo overall market sentiment ko measure karne mein madad karta hai. Iske istemal se traders market trends ko samajhte hain aur sahi trading decisions lete hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

**Advance Decline Line (ADL) in Forex Trading**

Forex trading mein indicators ka role bohot important hota hai, aur in mein se aik key indicator hai Advance Decline Line (ADL). Ye indicator traders ko market ki overall breadth yaani uske scope ko samajhne mein madad deta hai. Is post mein, hum ADL ke concept, uski calculation, aur Forex market mein uska istamal discuss karenge.

### ADL Kya Hai?

ADL ek cumulative indicator hai jo market ki bullish aur bearish sentiments ko measure karta hai. Yeh advance aur decline honay wali securities ka difference calculate karta hai aur usko aggregate form mein present karta hai. Forex market mein, yeh indicator specific currencies ya currency pairs ke sentiment ko assess karne mein help karta hai.

### ADL Ki Calculation

ADL ko calculate karna asan hai. Pehle, aapko advance honay wali currencies ka total nikalna hota hai, jo positive change show karti hain, aur decline honay wali currencies ka total, jo negative change show karti hain. In dono ka difference nikala jata hai aur phir usko cumulative basis par add ya subtract karte jate hain previous ADL value se.

Formula kuch is tarah se hai:

\[ \text{ADL Current} = \text{Previous ADL} + (\text{Number of Advances} - \text{Number of Declines}) \]

### ADL Ka Forex Market Mein Istemaal

Forex market mein ADL ka primary purpose ye hota hai ke yeh overall market trend ko identify karne mein madad kare. Agar ADL value consistently upward trend show kare, to yeh indication hoti hai ke market mein bullish trend hai aur zyada traders buy positions hold kar rahe hain. Agar ADL downward trend mein ho, to yeh bearish market ka signal hota hai.

Traders ADL ko usually moving averages ke sath combine karte hain taake zyda accurate signals mil sakein. Agar ADL moving average ko cross kare, to yeh trend reversal ka signal ho sakta hai, jo ke trading decisions ke liye bohot important ho sakta hai.

### Conclusion

Advance Decline Line ek powerful indicator hai jo Forex trading mein market breadth ko samajhne mein madad deta hai. Yeh indicator traders ko market ke sentiment ko accurately gauge karne mein help karta hai, jo ke profitable trading decisions lene ke liye zaroori hai. Agar aap Forex trading mein successful hona chahte hain, to ADL ko apne analysis mein zaroor shamil karein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:42 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим