Bollinger Bands aur Eska Istemal

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

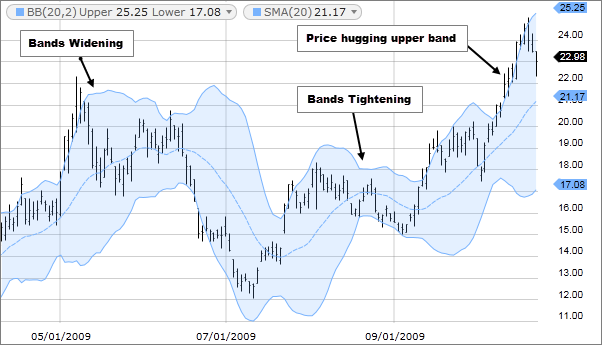

Introduction Assalamu alaikum umeeeeed h ky forex ky tmaam log blkol thek hon gy aur apny kam Mai busy hon gy aj hum Bollinger Bands ky bary Mai parhy gy aur apko information dyn gy 1. Bollinger Band Ki Dashkeel: Bollinger Bands on these 3 lines: Medium group: Yes, it is simple to move hota hai, usually 20 days to hota hai. Upper band: Middle band 2 standard deviation hota hai high. Bottom line: Middle group 2 standard deviation neeche hota hai. 2. Ki Tashkel Ka Maqsad group: Groups ka target price ki volatility samajhne aur price action ko anal me karne mein madad karna hota hai. Jab price change is more, Wide band hote hain, aur jab less ho, Band hote hote hain. 3. Ki Bands Program: Common applications of Bollinger Bands are: Trend aur Reversal Points: Price Tree Band High Band ko bagan hai, too signal signal hai aur harga ka trend neeche jane ka indicator hota hai. Jab harga Lower Band ku karta hai, too much signal ai aur baha ka trend upar jane ka hota hai indicator. Immutability to Pata Lagana: A wide group of trees, increased volatility, change in number Breakout to Identification: Upper Band or Lower Band price tree, karta hai, karta hai, you breakout to hota hai indicator aur future price action ka pata lagane mein madad karta hai.4. Using Bollinger Bands: Bollinger Bands are used as a more profitable technical indicator than the stock market. Consumption of low MACD, RSI, moving indicator jaise average and kiya ja sakta hai. 5. Required Points: Forex trading and technical indicators, meat consumption se pehle, achi tarah se Training or practice kar lena zaruri hai. Bollinger Bands is a simple tool that validates signals used in analysis and is suitable for consumption. Trading mein humesha risk management ka hyal rakhna bhi bohat ahem hai. Bollinger Bands Forex trading mein harga change the trend to pata lagane mein madad karte hain, but the signal unke confirm ko karne aur dusre indicator and karne se trading performance behtar ho sakti hai. -

#3 Collapse

Assalamu Alaikum Dosto!Bollinger Band Indicator Trading StrategyBollinger bands, market volatility ko measure karne ke liye kaafi useful hote hai. Ye indicator price ke around ek khas range ko define karta hai, jo price movement ki limit ko show karta hai. Is indicator ke use se traders ko kisi bhi trading instrument ke price movement ki information milti hai aur wo uske basis par trading decisions le sakte hai. Bollinger bands indicator ko apne chart par add karne ke liye, sabse pehle aapko apne trading platform ke indicators section mein jaana hoga. Waha par aap Bollinger bands ko select kar sakte hai. Iske baad, aapko indicator ke parameter set karna hoga. Is indicator ke parameters mein 20-day simple moving average aur 2 standard deviation ka use kiya jaata hai. Bollinger bands ke indicator mein 3 lines hote hai. Middle line hoti hai 20-day simple moving average, aur dusri 2 lines hoti hai jo standard deviation ke basis par calculate ki jaati hai. Ek line upper band ke liye hoti hai, aur dusri lower band ke liye hoti hai. Ye bands middle line ke upar aur niche 2 standard deviation distance par hoti hai.ExplanationBollinger bands trading strategy mein, traders ko in bands ke upar aur niche price movement ko follow karna hota hai. Jab price upper band se bahar nikalta hai, to ye ek signal hai ki price ki volatility increase ho rahi hai aur price trend upwards direction mein hai. Jab price lower band se bahar nikalta hai, to ye ek signal hai ki price ki volatility increase ho rahi hai aur price trend downwards direction mein hai. Bollinger bands ke signals ko confirm karne ke liye, traders kaafi aur indicators ka use bhi karte hai. Jaise ki RSI, MACD aur Stochastic. In indicators ka use karke, traders price ke direction ko confirm kar sakte hai. Bollinger bands ke signals ko trading mein istemaal karne ke liye, traders ko kuch basic rules follow karne hote hai. Jab price upper band se bahar nikalta hai, to ye ek buy signal hota hai. Jab price lower band se bahar nikalta hai, to ye ek sell signal hota hai. Iske saath saath, traders ko risk management ka bhi dhyaan rakhna hota hai. Bollinger bands ke signals ko trading mein istemaal karne ke liye, traders ko kuch basic rules follow karne hote hai. Jab price upper band se bahar nikalta hai, to ye ek buy signal hota hai. Jab price lower band se bahar nikalta hai, to ye ek sell signal hota hai. Iske saath saath, traders ko risk management ka bhi dhyaan rakhna hota hai. Is trading strategy ke liye, traders ko ek khas discipline maintain karni hoti hai. Ye strategy kaafi sensitive hai aur traders ko market ke ups and downs ko samajhna hota hai. Is strategy mein traders ko patience rakhna hota hai aur emotions ko control karna hota hai. Iske alawa, traders ko apne trading rules follow karne ki bhi aadat honi chahiye.Bollinger Band Indicator Strategy ka Technical Analysis me IstemalBollinger Bands Trading Strategy ka istemaal kar ke traders apni trading ko mazeed behtar kar sakte hain. Bollinger Bands Trading Strategy ko use kar ke traders ko market ka direction pata chal jata hai aur is ke sath hi market mein kis had tak movement ho sakti hai. Is strategy ka istemaal kar ke traders apni trades ko control kar sakte hain aur unhein profits ka maqbool hissa mil sakta hai. Bollinger Bands, technical analysis ke liye use kiye jane wale tools hain. Ye bands price volatility ko measure karte hain aur traders ko market ke trend ke bare mein information provide karte hain. Bollinger Bands, ek moving average line ke upar aur neeche do standard deviation ke bands ke roop mein nazar atay hain. In bands ka istemaal kar ke traders ko ye pata chalta hai ki market price kis had tak vary kar sakta hai. Bollinger Bands Trading Strategy ka kaam ye hai ki ye traders ko market direction aur trend ke bare mein information provide karta hai. Is strategy ke tahat, traders ko Bollinger Bands ke upar aur neeche ke levels par trades karni hoti hain. Jab price ek Bollinger Band se cross karta hai to yeh indicate karta hai ki market mein trend change hone wala hai. Agar price ek upper Bollinger Band se cross karta hai to ye bullish trend indicate karta hai aur traders ko buy karna chahiye. Jab price ek lower Bollinger Band se cross karta hai to ye bearish trend indicate karta hai aur traders ko sell karna chahiye. Bollinger Bands Trading Strategy mein ek aur concept hai jise traders ko samajhna zaroori hai. Ye hai Bollinger Squeeze. Bollinger Squeeze mein price ek tight range mein move karta hai aur Bollinger Bands ki distance narrow ho jati hai. Jab Bollinger Bands ki distance narrow hoti hai to ye indicate karta hai ki market mein volatility kam ho rahi hai aur trend change hone wala hai. Traders ko is time par trades par extra caution rakhna chahiye aur trend ke opposite direction mein trades na karen. Bollinger Bands Trading Strategy ka istemaal karne ke liye kuch steps hain jo traders ko follow karna chahiye:- Bollinger Bands ko chart par add karen.

- Upper aur lower Bollinger Bands ke beech ki distance ko observe karen.

- Price ko observe karen aur ye dekhna kya price upper aur lower Bollinger Bands ke beech move kar raha hai ya phir cross kar raha hai.

- Agar price upper Bollinger Band se cross karta hai to ye bullish trend indicate karta hai aur traders ko buy karna chahiye.

- Agar price lower Bollinger Band se cross karta hai to ye bearish trend indicate karta hai aur traders ko sell karna chahiye.

Trading TipsBollinger Bands ki ek series hoti hai jo ki price chart ke upar aur niche dikhayi deti hai. Iski calculation moving average ke upar aur niche ke 2 standard deviations par based hoti hai. Moving average ki value traders khud tay karte hain. Standard deviation ki value 20-period ke liye commonly use ki jati hai. Agar price chart ki volatility zyada hogi to Bollinger Bands ki width bhi zyada hogi aur agar price chart ki volatility kam hogi to Bollinger Bands ki width bhi kam hogi. Jab price chart ke movements range ki wajah se bandon ke upper ya lower levels tak pahunch jata hai, to isse traders ke liye signals generate hote hain. Jab price chart upper Bollinger Band ke paas pahunchta hai to isse overbought condition samjhi jati hai aur yadi price chart lower Bollinger Band ke paas pahunchta hai to isse oversold condition samjhi jati hai. Traders is information ka upyog kar ke trading strategies banate hain aur in bands ko trend identification aur reversal signals ke liye bhi use karte hain. Kuch tips Bollinger Bands ke istemal se trading ke liye:- Bollinger Bands ko trend identification ke liye istemal karen: Bollinger Bands ki help se traders market ki trend ka pata laga sakte hain. Jab price chart ki movements upper Bollinger Band ke upar hoti hai to trend up aur jab lower Bollinger Band ke niche hoti hai to trend down samjha jata hai.

- Bands ke width ka istemal karen: Bollinger Bands ki width ko traders market volatility ke analysis ke liye use kar sakte hain. Jab width zyada ho to market jyada volatile hota hai aur jab width kam ho to market kam volatile hota hai.

- Bandon ke paas pahunchne se signals generate karen: Jab price chart upper Bollinger Band ke upar pahunchta hai to isse overbought condition samjha jata hai aur jab price chart lower Bollinger Band ke niche pahunchta hai to isse oversold condition samjha jata hai. Traders is information ka upyog kar ke trading strategies develop karte hain.

- Bollinger Bands aur dusre indicators ke sath istemal karen: Bollinger Bands ko dusre technical indicators ke sath use karne se traders ko better trading signals mil sakte hain. Jaise ki RSI, MACD, aur Stochastic Oscillator, etc.

-

#4 Collapse

"Bollinger Bands" ek popular technical analysis tool hai jo forex trading mein istemal hota hai. Yeh price volatility aur potential price reversals ko identify karne mein madad karta hai. Bollinger Bands chart par price ke around ek envelope (band) create karte hain jo standard deviation ke basis par calculate hota hai. Bollinger Bands ka Istemal: Price Volatility Identify Karna: Bollinger Bands volatility ko measure karte hain. Jab price volatility zyada hoti hai, bands wide hote hain, aur jab volatility kam hoti hai, bands narrow hote hain. Traders isse yeh samajhne mein madad lete hain ke market kitna active ya dormant hai.Overbought aur Oversold Levels Detect Karna: Bollinger Bands ka istemal overbought aur oversold levels ko detect karne mein hota hai. Agar price upper band ko touch karta hai, to market overbought ho sakti hai aur reversal ki possibility ho sakti hai. Agar price lower band ko touch karta hai, to market oversold ho sakti hai aur price rebound ki possibility ho sakti hai.Trend Reversals Identify Karna: Jab price bands ke bahar jaata hai aur trend reversal ki direction mein move karta hai, to yeh ek potential trend reversal ka sign ho sakta hai. Price bands ke bahar jaane se traders ko trend reversal ka early indication mil sakta hai.Support aur Resistance Levels Determine Karna: Bollinger Bands price ke support aur resistance levels ko determine karne mein bhi istemal hota hai. Bands ke upper aur lower levels traders ko potential price levels provide karte hain jahan price reverse ho sakta hai.Volatility Breakout Identify Karna: Agar price bands ke narrow range se bahar nikalta hai, to yeh volatility breakout ka indication ho sakta hai. Traders isse price movement ke liye trading opportunities identify kar sakte hain.Bollinger Bands ka istemal karke traders price movements aur trends ko samajhte hain aur trading decisions lene mein madad lete hain. Lekin, yeh ek tool hai, isliye isko doosre indicators aur analysis tools ke saath mila kar istemal karna zaroori hai. -

#5 Collapse

"Bollinger Groups" ek well known specialized investigation apparatus hai jo forex exchanging mein istemal hota hai. Yeh cost unpredictability aur potential cost inversions ko distinguish karne mein madad karta hai. Bollinger Groups outline standard cost ke around ek envelope (band) make karte hain jo standard deviation ke premise standard work out hota hai. Bollinger Groups ka Istemal: Value Unpredictability Distinguish Karna: Bollinger Groups instability ko measure karte hain. Poke cost instability zyada hoti hai, groups wide hote hain, aur punch unpredictability kam hoti hai, groups limited hote hain. Merchants isse yeh samajhne mein madad lete hain ke market kitna dynamic ya lethargic hai.Overbought aur Oversold Levels Distinguish Karna: Bollinger Groups ka istemal overbought aur oversold levels ko identify karne mein hota hai. Agar cost upper band ko contact karta hai, to advertise overbought ho sakti hai aur inversion ki plausibility ho sakti hai. Agar cost lower band ko contact karta hai, to showcase oversold ho sakti hai aur cost bounce back ki plausibility ho sakti hai.Trend Inversions Recognize Karna: Hit cost groups ke bahar jaata hai aur pattern inversion ki heading mein move karta hai, to yeh ek potential pattern inversion ka sign ho sakta hai. Cost groups ke bahar jaane se merchants ko pattern inversion ka early sign mil sakta hai.Support aur Opposition Levels Decide Karna: Bollinger Groups cost ke support aur obstruction levels ko decide karne mein bhi istemal hota hai. Groups ke upper aur lower levels brokers ko potential cost levels give karte hain jahan cost invert ho sakta hai.Volatility Breakout Distinguish Karna: Agar cost groups ke limited range se bahar nikalta hai, to yeh unpredictability breakout ka sign ho sakta hai. Brokers isse cost development ke liye exchanging open doors recognize kar sakte hain.Bollinger Groups ka istemal karke dealers cost developments aur patterns ko samajhte hain aur exchanging choices lene mein madad lete hain. Lekin, yeh ek apparatus hai, isliye isko doosre markers aur examination instruments ke saath mila kar istemal karna zaroori hai.

- Mentions 0

-

سا0 like

-

#6 Collapse

Bollinger Gatherings" ek notable specific examination device hai jo forex trading mein istemal hota hai. Yeh cost unusualness aur potential expense reversals ko recognize karne mein madad karta hai. Bollinger Gatherings frame standard expense ke around ek envelope (band) make karte hain jo standard deviation ke premise standard work out hota hai. Bollinger Gatherings ka Istemal: Esteem Flightiness Recognize Karna: Bollinger Gatherings shakiness ko measure karte hain. Jab cost unsteadiness zyada hoti hai, bunches wide hote hain, aur punch flightiness kam hoti hai, bunches restricted hote hain. Shippers isse yeh samajhne mein madad lete hain ke market kitna dynamic ya dormant hai.Overbought aur Oversold Levels Recognize Karna: Bollinger Gatherings ka istemal overbought aur oversold levels ko distinguish karne mein hota hai. Agar cost upper band ko contact karta hai, to promote overbought ho sakti hai aur reversal ki believability ho sakti hai. Agar cost lower band ko contact karta hai, to grandstand oversold ho sakti hai aur cost return quickly ki credibility ho sakti hai.Trend Reversals Perceive Karna: Hit cost bunches ke bahar jaata hai aur design reversal ki heading mein move karta hai, to yeh ek potential example reversal ka sign ho sakta hai. Cost bunches ke bahar jaane se traders ko design reversal ka early sign mil sakta hai.Support aur Resistance Levels Choose Karna: Bollinger Gatherings cost ke support aur impediment levels ko choose karne mein bhi istemal hota hai. Bunches ke upper aur lower levels dealers ko potential expense levels give karte hain jahan cost alter ho sakta hai.Volatility Breakout Recognize Karna: Agar cost bunches ke restricted range se bahar nikalta hai, to yeh capriciousness breakout ka sign ho sakta hai. Intermediaries isse cost advancement ke liye trading open entryways perceive kar sakte hain.Bollinger Gatherings ka istemal karke sellers cost improvements aur designs ko samajhte hain aur trading decisions lene mein madad lete hain. Lekin, yeh ek contraption hai, isliye isko doosre markers aur assessment instruments ke saath mila kar istemal karna zaroori -

#7 Collapse

BOLLINGER BANDS:- Bollinger Bands ek technical analysis tool hai jo stock market mein istemal hoti hai taaki qeemat ki tabdeeli ko dekhne aur qeemat ki tashweesh ki satahain jaan ne mein madad faraham kare. Is ko janay walay asooli tor par Bollinger Bands ko teen qisam ki lines se mushtamil mukhtasir muddati taraashiyan milti hain.ollinger Bands ek prashikshan upakaran hai jo share bazaar mein istemal hota hai taki share ki keemat mein hone wali parivartan ko dekha ja sake aur keemat ki tashweesh ke staro ko jaan ne mein madad mile. Is prashikshan ko samajhne wale mool tatvo ke taur par Bollinger Bands teen prakar ki rekhaon se mil kar bani hoti hain. BOLLINGERBand Line: Yeh oopri band ke neeche qeematon ki tashweesh ki pemaish karti hai. Markazi Bollinger Band: Yeh mamoolan avariage qeemat ko zahir kerti hai aur qeemat ki tashweesh ki satahain ko maeen karne mein madad faraham kerti hai. Uppri Bollinger Band: Yeh neeche qeematon ki tashweesh ki pemaish karti hai. BOLLINGER BAND MUSHTAMIL HA:- Band Rekha: Yeh uppari band ke neeche keematon ki tashweesh ka paeman karti hai. Kendriya Bollinger Band: Yeh aam taur par avarage keemat ko darshati hai aur keemat ki tashweesh ke staron ko nirdharit karne mein madad karti hai. Upari Bollinger Band: Yeh neeche keematon ki tashweesh ka paeman karti hai. Bollinger Bands ke istemal se taraashiyon ka vishleshan hota hai jo keemat ki mantiki tashweesh ke staron ko prakat karta hai aur in madad se vyapariyon ko bazaar ki gatiyon ki bhavishyavani karne mein madad milti hai. Bollinger Bands ke istemal ke sath-sath anya takneeki vishleshan sanket bhi istemal hote hain taki taraashiyon ko sahi aur prabhavit tarike se karne mein sahayata ho.

BOLLINGERBand Line: Yeh oopri band ke neeche qeematon ki tashweesh ki pemaish karti hai. Markazi Bollinger Band: Yeh mamoolan avariage qeemat ko zahir kerti hai aur qeemat ki tashweesh ki satahain ko maeen karne mein madad faraham kerti hai. Uppri Bollinger Band: Yeh neeche qeematon ki tashweesh ki pemaish karti hai. BOLLINGER BAND MUSHTAMIL HA:- Band Rekha: Yeh uppari band ke neeche keematon ki tashweesh ka paeman karti hai. Kendriya Bollinger Band: Yeh aam taur par avarage keemat ko darshati hai aur keemat ki tashweesh ke staron ko nirdharit karne mein madad karti hai. Upari Bollinger Band: Yeh neeche keematon ki tashweesh ka paeman karti hai. Bollinger Bands ke istemal se taraashiyon ka vishleshan hota hai jo keemat ki mantiki tashweesh ke staron ko prakat karta hai aur in madad se vyapariyon ko bazaar ki gatiyon ki bhavishyavani karne mein madad milti hai. Bollinger Bands ke istemal ke sath-sath anya takneeki vishleshan sanket bhi istemal hote hain taki taraashiyon ko sahi aur prabhavit tarike se karne mein sahayata ho.

- Mentions 0

-

سا0 like

-

#8 Collapse

: Bollinger Groups aur Eska Istemal "Bollinger Gatherings" ek notable particular examination mechanical assembly hai jo forex trading mein istemal hota hai. Yeh cost capriciousness aur potential expense reversals ko recognize karne mein madad karta hai. Bollinger Gatherings frame standard expense ke around ek envelope (band) make karte hain jo standard deviation ke premise standard work out hota hai. Bollinger Gatherings ka Istemal: Esteem Unconventionality Recognize Karna: Bollinger Gatherings flimsiness ko measure karte hain. Jab cost shakiness zyada hoti hai, bunches wide hote hain, aur punch capriciousness kam hoti hai, bunches restricted hote hain. Shippers isse yeh samajhne mein madad lete hain ke market kitna dynamic ya lazy hai.Overbought aur Oversold Levels Recognize Karna: Bollinger Gatherings ka istemal overbought aur oversold levels ko distinguish karne mein hota hai. Agar cost upper band ko contact karta hai, to publicize overbought ho sakti hai aur reversal ki believability ho sakti hai. Agar cost lower band ko contact karta hai, to grandstand oversold ho sakti hai aur cost return quickly ki credibility ho sakti hai.Trend Reversals Perceive Karna: Hit cost bunches ke bahar jaata hai aur design reversal ki heading mein move karta hai, to yeh ek potential example reversal ka sign ho sakta hai. Cost bunches ke bahar jaane se shippers ko design reversal ka early sign mil sakta hai.Support aur Resistance Levels Choose Karna: Bollinger Gatherings cost ke support aur obstacle levels ko choose karne mein bhi istemal hota hai. Bunches ke upper aur lower levels specialists ko potential expense levels give karte hain jahan cost reverse ho sakta hai.Volatility Breakout Recognize Karna: Agar cost bunches ke restricted range se bahar nikalta hai, to yeh eccentricism breakout ka sign ho sakta hai. Intermediaries isse cost improvement ke liye trading open entryways perceive kar sakte hain.Bollinger Gatherings ka istemal karke sellers cost advancements aur designs ko samajhte hain aur trading decisions lene mein madad lete hain. Lekin, yeh ek contraption hai, isliye isko doosre markers aur assessment instruments ke saath mila kar istemal karna zaroori hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

BOLLINGER BANDS AUR ES KA ESTYMAAL:-Bollinger Bands ek prakar ka technical indicator hai jo stock market analysis mein istemal hota hai. Ye indicator stock price ke volatility aur trading range ko samjhne mein madadgar hota hai. John Bollinger ne inhe 1980s mein develop kiya tha. Bollinger Bands ek line chart ke saath plot kiye ja sakte hain aur traders ko market ke behavior ko samajhne mein madad karte hain.Bollinger Bands kaise kaam karte hain:Middle Band (SMA): Bollinger Bands ka middle band Simple Moving Average (SMA) hota hai. Usually, 20-day SMA ka istemal hota hai, lekin traders isko apne requirements ke hisab se customize bhi kar sakte hain. Upper Band: Upper Bollinger Band middle band ke 2 standard deviations (SD) upar hota hai. Lower Band: Lower Bollinger Band middle band ke 2 standard deviations niche hota hai. Bollinger Bands ka istemal kaise hota hai: Volatility Indicator: Bollinger Bands price volatility ko darust karti hain. Jab bands tight hote hain, iska matlab hai ki market mein kam volatility hai, aur jab bands wide hote hain, iska matlab hai ki market mein jyada volatility hai. Overbought and Oversold Conditions: Traders Bollinger Bands ka istemal overbought (jab price upper band ke paas hota hai) aur oversold (jab price lower band ke paas hota hai) conditions ke pehchan karne ke liye karte hain. Overbought conditions mein selling aur oversold conditions mein buying opportunities ki khoj ki ja sakti hai.Reversal Signals:Bollinger Bands aksar price reversals ko bhi darust karti hain. Jab price upper band ya lower band ke paas aakar rukta hai aur phir us direction mein mudkar chala jata hai, to ye ek reversal signal ho sakta hai. Trend Identification: Bollinger Bands ka istemal trend identification mein bhi hota hai. Agar price middle band ke upar rehta hai, to ye uptrend ko darust karta hai, aur agar price middle band ke niche rehta hai, to ye downtrend ko darust karta hai. Entry aur Exit Points: Traders Bollinger Bands ka istemal entry aur exit points tay karne ke liye karte hain. Upper band ko ek selling point aur lower band ko ek buying point ke roop mein dekhte hain. Yad rahe ki Bollinger Bands ke istemal ke liye dusre technical indicators aur market analysis tools ke sath sath istemal karna bhi mahatvapurn hai. Iske alawa, Bollinger Bands ka istemal ek risk management strategy ke hisab se karna bhi avashyak hai. Isse aap risk ko kam kar sakte hain aur trading decisions ko sudhar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:25 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим