what shooting star pattern ?

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Intro Assalamu alaikum umeed h SB log thek hon gy aur apna Kam mehnat sy kr rahy hon gy aj hum shoting star ky bary Mai jany gy aur apky ath discussion kryn gy Candle shooting star Star candle main price aik small real body k upper side shadow banati hai. candle buyer, silver trend k era price ko waqti tawar par bullish le jane ki koshash hoti hai, but the selling price is a little bit higher price area hone ki waja se aisa possible na hota hai. But bullish main trend banne vali Shooting star candle price k trend reversed because bandi hai. The candle of the main star of the shadow of the real body k muqabale main bohut kam hota hai, yanni the shadow of the real body ka dugna ya uss se bhi ziata ho sakta hai. Main value star candle, open nahi hone chahye, q k aisa hone par ye candle aik Gravestone doji ban candle sakti hai. Candle building Throwing a single star candle patterned candle hai, color wise candle or basic pattern ho sakti hai. The price of the candlestick is the main bully of the trend, but it is not comparable to the market. Shyam ki tafseel darjaziel hai: Star Candle Throwing: Star candle throwing is high price or main multidirectional trend bnata hai but bearish trend reversed honne ki waja se ye shem aik ayy shem shumar ki jati hai. Shem aik small body real main hoti hai, jiss k aik long shadow hota hai, jo k real body ka qaqreeban dugna banta hai. Description Throwing a star candle Small candle real body main aik high long shadow k sath banti hai. Sham to the shadow of your real body to the dogna ya uss se zayat hota hai. You are the main trend candle banne wali Reverse Hammer candle se jaisi dekhti hai. Sham ki bulsh trend is the main high price banna bohut zaita aham hai, jab k sham ka warna khasam ka hona aham nahi hai. Under the lamp, the roller is suitable for shading koi nahi banna chaheye, but in order to make it small, it is forbidden to use it if the pattern is suitable, hota hai Trade The star candle trend is Jiss se lamp k body real small k sath high side par aik long Wick or shadow ban jata hai. You sell shadow aik bear trend or signal ki alam hoti hai. Trend Confirmation or Major Market Entry A candlestick with a loss is the upper side of the bar, two pips above the square, and the potential resistance level is stable. -

#3 Collapse

Presentation opening cost woh qeemat hai jis standard exchanging ke racket sy bhe to Koi trade kholnay standard security pehlay exchange karti to hai. misaal ke peak standard, New York stock trade ( nyse ) mashriqi waqt ke mutabiq subah 9 : 30 bujey khilta hai. Or on the other hand iftitahi qeemat is clamor ki tijarti sargarmi ke liye aik ahem to nishaan hai, khaas peak standard un logon ke liye jo qaleel mudti nataij ki pemaiesh mein dilchaspi rakhtay hain jaisay ke koi noise ke tajir . keysteps opening cost woh qeemat hai jis standard security pehlay sy bhe to tijarat karti hai punch koi trade noise ke liye khilta to hai. iftitahi qeemat pichlle racket ki ikhtitami qeemat se koi to mumasil nahi hai. market ya security ki ibtidayi qeemat sy standard mabni kayi clamor ki tijarat ki hikmat e amli hain . Working nasdaq raton raat jama honay walay orders standard ghhor sy karte tint behtareen opening qeemat ka faisla karne ke to liye" opening cross" Nami aik nuqta nazar istemaal karta hai. aam pinnacle standard, security ki iftitahi qeemat is ke pichlle clamor ki band honay wali qeemat se mumasil nahi hoti hai. 2 sy farq is liye hai ke auqaat ke baad ki tijarat ne sarmaya sy karon ki qeematon ya security ke liye tawaquaat ko bhe to tabdeel kar diya hai . Exceptional Thought corporate elanaat ya deegar khabron ke waqeat jo market band honay ke baad runuma hotay hain sarmaya vehicle ki to tawaquaat aur ibtidayi qeemat ko tabdeel kar satke hain. barray pemanay standard qudrati afaat ya insaan sakhta afaat, jaisay ke jaanghein ya dehshat gard hamlay jo baad ke to auqaat mein hotay hain, stock ki qeematon standard isi terhan ke asraat muratab kar satke hain. punch yeh waqeat runuma hotay hain, to kuch sarmaya vehicle baad ke auqaat mein sy sikyortiz kharidne ya baichnay ki koshish kar satke hain. after hrs exchanging ke douran tamam orders standard amal sy bhe to daraamad nahi hota hai. likoyditi ki kami aur is ke koi bhe to nateejay mein wasee phelao market ke orders ko auqaat ke baad ki exchanging mein taajiron ke liye or es sy bhe nakhushgawaar bana dete hain kyunkay market request ke sath mutawaqqa qeemat standard tranzikshn mukammal karna ziyada mushkil hota hai, aur mehdood orders aksar nahi bharay jatay. hit aglay racket market khulti hai, to had ya stap orders ki yeh barri miqdaar — jo qeematein pichlle commotion ki band honay wali qeemat se mukhtalif hoti hain — rasad aur talabb mein kaafi tafawut ka baais banti hain. yeh to tafawut ibtidayi qeemat ko pichlle racket ki bandish se is simt mein mourr deta hai jo market ki quwatoon ke assar se mutabqat rakhti hai jo stock ki qeemat ko agay barha rahi hai . market ke aaghaz standard mabni kayi clamor ki tijarat ki hikmat e amli hain. punch iftitahi qeemat pichlle clamor ke ekhtataam se itni ziyada mukhtalif hoti hai ke is se qeemat mein farq sy peda hota hai, to commotion ke tajir aik hikmat e amli istemaal sy karte hain jisay" expand feed and full" kaha jata hai. tajir sy qeemat ki islaah se faida uthany ki koshish karte hain jo aam pinnacle standard iftitahi waqt qeemat ke barray farq ke baad hoti hai. aik aur maqbool hikmat e amli yeh hai ke kisi sy aisay stock ko khulay mein dhundlaa kar diya jaye jo bhe to advertise ke baqi hisson ya mushtarqa area ya file sy mein mlitay jaltay astaks ke bar aks mazboot pari market isharay dikha raha ho. poke market se pehlay ke isharay sy mein aik mazboot tafawut mojood hota hai, to aik tajir sy baqi market ke bar aks stock ke khulay mein harkat karne ka intzaar karta hai. is ke baad tridr stock mein market ki umomi simt mein position laita hai hit ibtidayi mutazaad stock qeemat ki harkat ki raftaar aur hajam kam hojata to hai. yeh aala imkanaat ki hikmat e amli hain jo durust sy tareeqay se injaam dainay standard fori chhootey munafe haasil karne ke liye banai gayi hain . -

#4 Collapse

WHAT IS A MAT HOLD Example? Mat hold design ki arrangement candle sa mil kar hoti ha or ya candle design ha ya demonstrates karta ha earlier pattern ka continuation hona ka. Ya mat hold design negative bhi ho sakta ha or bullish bhi. Ya design five candles sa mil kar bana hota ha is design ki first or fifth light latest thing ko proceed karti ha or is ki mid ki three candles inversion karti ha pattern ko. Jo bullish example hota ha ya banta ha upswing mama or jo negative mat hold ha ya downtrend mama banta ha. Jo bullish rendition hoti ha is mat hold design ke is mama huge up light hoti ha, phir hole ata ha higher mama jo follow karta ha three more modest down ki candles ha or jo enormous up flame ho ge. Or on the other hand jo is mama negative rendition ho ga is mat hold design ka is mama huge down light ho ge, phir hole lower mama ho ga or ya followed karay ga three up ke more modest candles ko, or phir enormous down ki flame banay ge. BULLISH MAT HOLD Example : Jo bullish mat hold design ho ga ya banay ga upturn ka under or ya huma signals da ga upswing ka probably continuing hona ka potential gain ke traf. Ya bullish example begins ho ga ya huge vertical ki candle ko banay ga or ya followed karay ga higher hole ko or three more modest flame banay ge jis ka move lower ho ge. Ya candles stay above mama ho ga first flame ka low mama. Or then again jo ya fifth light ho ge ya huge candle ho ge or move karay ge potential gain mama phir sa. Ya design banay ga by and large upturn mama. Brokers purchase karay ga fifth light ka close ka close to sa or enter karay ga long exchange ko following candle ko. Or on the other hand stop misfortune ko regularly positioned karay ga beneath mama fifth candle ka underneath mama. Negative MAT HOLD Example : Bearishat hold design banay ga downtrend ka under or ya shows karay ga downtrend ko or ya likely continuing karay ga cost ko fall karna ko proceed karay ga.. Ya negative variant same ho ga bullish ke trha sa, magar is mama with the exception of candles ho ge one or five flame bigger down candle ho ge, or candles two through four tak more modest or move potential gain mama ho ge. Ya candles stay underneath mama ho ga first flame ka high mama. Ya design finishes ho ga long white candel sa disadvantage standard, jo light five ho ge. Ya banay ga downtrend ka under. Dealers sell or short karay ga close to mama fifth light ka close mama or ya following karay ga candle ko. Jo stop misfortune ho ga ya short positions ho ga is ko put above mama karay ga fifth candle ka high ma.Ya dono adaptation design ka ho ga ya dono quit uncommon ho ga. Ya show karay ga cost ka firmly moving hona ko moving course ki traf, is mama sirf minor sa pressure ay ga inverse bearing ki janab is cost ka begin moving hona ka liya phir sa exchanging heading mama. Illustration OF MAT HOLD Example : Mat hold design uncommon ho ga ya merchants ko permit karay ga little deviation mama design ka or long or generally premise ho ga design or ya remains ho ga politeness. Ya jo following diagram ha is mama start ho raha ha strog g up ki flame sa punch by and large upswing ha. Ya followed kar raha ha four candles ko jo ka stay above mama ho ge first light ka low sa. Is mama bullish example regularly bana ha or is mama sirf three candles ha jo move kar rahi ha drawback mama. Or then again design followed kar raha ha further ascent ko potential gain mama or is mama case ho raha ha brief. Regardless of ho rahi ha deviation jo ka six candle sa jo ka rather ha five light mama generally design ka jo shows kar raha ha solid cost ka rise hona work, or pullback ko, or is serious areas of strength for mama ho rahi ha moving heading mama poke ya design end ho raha ha. Sab dealers jo chaiya ka wo decide mara or permit karay slight deviation ko design mama or not. DIFFERENT BETWEEN MAT HOLD AND RISING THREE Example : Ya rising three example bahot hello there comparable ho ga magar ya following ni karay ga hole ko first flame ka awful or ya design koi exceptionally normal ni ho ga. Magar jo ya rising three Example ho ga ya pattern ka proceed with ka sath ya pattern ko inversion karna ka bhi kab baray ga. Is mat hold design ko bahot greetings hard hota ha find karna. Ya design oftentimes banay gave, is mama cost generally move ni karay ge expected side standard is design ko observing karta hua. Is a koi benefit target ni hota. Agar cost ka expected ho ga move karna to ya is bat ko show ni karya ga ka jo cost ha ya kitni far run kar ka jay ge. Ya design required karay ga other technique ko, jasa ka pattern investigation or specialized markers jis sa decide kiya jay ga exit, or use kiya jay ga perhaps ko other candle designs ki. Mat hold design normally best use hota ha combination mama different structures investigation sa, or ya questionable hota ha punch is mama exclusively exchanged ki jati ha. -

#5 Collapse

what is Morning Star Example Morning star candle design three candle design hota hello yeh forex market mein bullish pattern inversion candle design hota hello yeh forex market mein down pattern ke kame ko zahair karta hello paper pehlay forex market mein new downtrend mein kame new up pattern ko distinguish karte hello or forex market mein new up pattern ke base rakhta hello Doji Morning Star Example dealer forex market mein adam faislay ky asar ko talash kartay hein jahan standard forex market mein selling pressure kam ho jata hello yeh woh jagah hte hy jahan standard forex market mein Doji candle ka examination keya ja sakta hello yahan standard market aik he level standard open bhe hote hello or close bhe ho jate hello yeh adam faisla forex market mein bullish say chalnay ke rah ko humwar karta hello kunkeh bulls es level standard forex market ke esteem ko daikhtay hein or mazeed selling pressure ko stop kartay hein or forex market mein Doji kay awful bullish candle design zahair hota hello or es ko bullish candle ke confrmation ka naam deya ja sakta hello Exchange with Doji Morning Star Example forex market mein Doji Morning star design ka examination nechay EUR/GBP ka outline deya geya hello jo keh forex market kay inversion design ko distinguish karnay mein madad karte hello jaisa keh aap ko pehay oper bhe batya Doji morning star down pattern ke stop honay or up pattern kay agay barhnay ke rah humwar karte hello forex diagram ko daikhtay hovay design mokamal honay kaybad merchant agle he candle mein enter h jata hello or kuch new dealer section mein late kar daytay hein jes ke wajah say bohut blah kharab evel mein passage lay laytay hein jaisa keh bullish say chalte hove market mein target ko opposition ke pechle level ya stable kay pechlay hesay standard rakha ja sakta hello or stops ko as of late swing low say nechay rakha ja sakta hello kunkeh es level ka hole inversion karnay ko counterfeit kar day ga chonkeh forex market ke koi ensure nahi hote hello to hamaisha positive gamble o reward proportion or hazard the executives ko apnana chihay -

#6 Collapse

Snare Inversion Example: Dear Snare inversion candle design ak momentary candle design ha is design sy market pattern ka inversion ka bary fundamental dealers ko bahut accurate aur right data give karta hai ya design tab banta ha punch is design ke second candle first light ke mukabale mein higher low or lower high banate hai Ya design immersing candle design sy different hota hai in ky dermian different is design ke candles ke size ka hota ha design candles ka size overwhelming candles ke size se kam Hota Hai. Distinguishing proof: Dear forex exchanging market Mein graph per versal design ko distinguish karna bahut aasan hota hai Kyunki Snare inversion design two candle for each mushtamil Hota Hain aur is ko examine karna bahut Aasan hota ha is Mein sab se pahle down pattern aur up pattern Ka progress Mein Hona bahut significant hai dusre number per pettren per mushtamil hona zaruri hai aur third second candle ka first light ke andar Boycott na zaroori hai number aur modest number each second flame ki higher low aur lower high hona chahiye r ye market pattern k variety ko red yani down pattern ko green yani Up pattern mein tabdail kr deta hai. Kyunki Poke aap Kisi bhi design ko properli distinguish karne ke awful Uske mutabik apni working karte hain to aapko most extreme benefits hasil ho sakte hain. Kinds of Snare Inversion candle design : Dear forex exchanging market Mein Hit aap snare inversion candle design ko appropriately distinguish kar lete hain to aapko Ek chij Ka pata chal Jata Hai ki yah design two sorts Ka Hota Hai aur unke working aur unki ID Ek dusre se different hoti hai. Bullish Snare Inversion Example Negative Snare Inversion Example Bullish Snare Inversion Example: Dear bullish Snare Inversion candle design Mein downtrend ke awful bnane wala Ek candle design Hota Hai Ek aisa design Hota Hai jismein second flame ki open cost first light ki lo cost ya shutting cost ke najdeek hoti hai aur second candle ki excessive cost first candle ki excessive cost ke kareeb hoti hai market Mein is design ko recognize karna aapke liye bahut simple ho jata hai Kyunki iski development only two candles for every mushtamil hoti hai. Development of Example: Dear forex market mein police inversion candle design ki arrangement Kuch Is Tarah Se Hoti Hai first Lee down pattern hamesha progress Mein Hota Hai Aur auxiliary Hota Hai thirdly iski dusri candles take ki exchanging range hamesha first candle ke andar hoti hai fourthly lastly plot second candle ka higher low or high point Hota Hai pehli candle ky mokably principal aur yah tamam chijen is design ko recognize karne mein bahut jyada madad deti Hain. Negative Snare Inversion Example: Dear negative hok inversion candle design cost outline mein UP Pattern ke baad banne wala Ek candle design Hota Hai aur yah cost diagram mein is design ki second flame ki open cost quick light ki exorbitant cost hoti hai aur second candle ki excessive cost first candle ki excessive cost ke najdeek hoti hai aur Market Mein is design ko cost graph ke top per recognize Kiya ja sakta hai aur vahan per dijiye companion inversion ka kam karta hai. Dear Forex exchanging market Mein negative snare inversion candle design ko recognize karne ke liye in tamam chijon ka khayal rakhna jaruri Hota Hai. First and foremost hamesha Ek April progress Mein Hota Hai second le yah design bhi do candles per Hota Hai thirdly is design ki second flame ki exchanging range bhi first candle ke andar hoti hai aur fourth lastly yah design bhi first candle ki higher low Hota Hai second candle ke mokable primary. Jiski vajah se agar aap ine chijon ke exposed mein complete information aur data rakhte Hain To aapke liye ine donon designs kedarnath distinction Aur ine donon ko market Mein cost diagram per recognize karna bahut aasan Hota Hai. -

#7 Collapse

Shooting Star Chart Pattern: Trading market Mein negative catch reversal flame plan ko perceive karne ke liye in tamam chijon ka khayal rakhna jaruri Hota Hai. Most importantly hamesha Ek April progress Mein Hota Hai second le yah plan bhi do candles per Hota Hai thirdly is plan ki second fire ki trading range bhi first light ke andar hoti hai aur fourth ultimately yah plan bhi first candle ki higher low Hota Hai second candle ke mokable essential. Jiski vajah se agar aap ine chijon ke uncovered mein complete data aur information rakhte Hain To aapke liye ine donon plans kedarnath qualification Aur ine donon ko market Mein cost graph per perceive karna bahut aasan Hota Hai. Negative hok reversal candle configuration cost frame mein UP Example ke baad banne wala Ek candle plan Hota Hai aur yah cost chart mein is plan ki second fire ki open expense fast light ki over the top expense hoti hai aur second candle ki exorbitant expense first flame ki inordinate expense ke najdeek hoti hai aur Market Mein is plan ko cost diagram ke top per perceive Kiya ja sakta hai aur vahan per dijiye friend reversal ka kam karta hai.market mein police reversal candle plan ki course of action Kuch Is Tarah Se Hoti Hai first Lee down design hamesha progress Mein Hota Hai Aur helper Hota Hai thirdly iski dusri candles take ki trading range hamesha first candle ke andar hoti hai fourthly in conclusion plot second candle ka higher low or high point Hota Hai pehli candle ky mokably head aur yah tamam chijen is plan ko perceive karne mein bahut jyada madad deti Hain. Chart Pattern Types: Bullish Catch Reversal candle plan Mein downtrend ke dreadful bnane wala Ek candle plan Hota Hai Ek aisa plan Hota Hai jismein second fire ki open expense first light ki lo cost ya closing expense ke najdeek hoti hai aur second flame ki over the top expense first candle ki unreasonable expense ke kareeb hoti hai market Mein is plan ko perceive karna aapke liye bahut basic ho jata hai Kyunki iski advancement just two candles for each mushtamil hoti hai.forex trading market Mein Hit aap catch reversal candle plan ko properly recognize kar lete hain to aapko Ek chij Ka pata chal Jata Hai ki yah plan two sorts Ka Hota Hai aur unke working aur unki ID Ek dusre se different hoti hai.

Negative hok reversal candle configuration cost frame mein UP Example ke baad banne wala Ek candle plan Hota Hai aur yah cost chart mein is plan ki second fire ki open expense fast light ki over the top expense hoti hai aur second candle ki exorbitant expense first flame ki inordinate expense ke najdeek hoti hai aur Market Mein is plan ko cost diagram ke top per perceive Kiya ja sakta hai aur vahan per dijiye friend reversal ka kam karta hai.market mein police reversal candle plan ki course of action Kuch Is Tarah Se Hoti Hai first Lee down design hamesha progress Mein Hota Hai Aur helper Hota Hai thirdly iski dusri candles take ki trading range hamesha first candle ke andar hoti hai fourthly in conclusion plot second candle ka higher low or high point Hota Hai pehli candle ky mokably head aur yah tamam chijen is plan ko perceive karne mein bahut jyada madad deti Hain. Chart Pattern Types: Bullish Catch Reversal candle plan Mein downtrend ke dreadful bnane wala Ek candle plan Hota Hai Ek aisa plan Hota Hai jismein second fire ki open expense first light ki lo cost ya closing expense ke najdeek hoti hai aur second flame ki over the top expense first candle ki unreasonable expense ke kareeb hoti hai market Mein is plan ko perceive karna aapke liye bahut basic ho jata hai Kyunki iski advancement just two candles for each mushtamil hoti hai.forex trading market Mein Hit aap catch reversal candle plan ko properly recognize kar lete hain to aapko Ek chij Ka pata chal Jata Hai ki yah plan two sorts Ka Hota Hai aur unke working aur unki ID Ek dusre se different hoti hai.  Market Mein chart per versal plan ko recognize karna bahut aasan hota hai Kyunki Catch reversal plan two candle for each mushtamil Hota Hain aur is ko analyze karna bahut Aasan hota ha is Mein sab se pahle down design aur up design Ka progress Mein Hona bahut critical hai dusre number per pettren per mushtamil hona zaruri hai aur third second candle ka first light ke andar Blacklist na zaroori hai number aur unobtrusive number each second fire ki higher low aur lower high hona chahiye r ye market design k assortment ko red yani down design ko green yani Up design mein tabdail kr deta hai. Kyunki Jab aap Kisi bhi plan ko properli recognize karne ke dreadful Uske mutabik apni working karte hain to aapko most outrageous advantages hasil ho sakte hain. Chart Pattern Trading: Standard is plan ko noticing karta hua. Is a koi benefit target ni hota. Agar cost ka expected ho ga move karna to ya is bat ko show ni karya ga ka jo cost ha ya kitni far run kar ka jay ge. Ya configuration required karay ga other method ko, jasa ka design examination or specific markers jis sa choose kiya jay ga exit, or use kiya jay ga maybe ko other candle plans ki. Mat hold configuration regularly best use hota ha forex market mein adam faislay ky asar ko talash kartay hein jahan standard forex market mein selling pressure kam ho jata hi yeh woh jagah hte hy jahan standard forex market mein Doji candle ka assessment keya ja sakta hi yahan standard market aik he level standard open bhe hote hi or close bhe ho jate hi yeh adam faisla forex market mein bullish say chalnay ke rah ko humwar karta hi kunkeh bulls es level standard forex market ke regard ko daikhtay hein or mazeed selling pressure ko stop kartay hein or forex market mein Doji kay dreadful bullish flame plan zahair hota hi or es ko bullish light ke confrmation ka naam deya ja sakta

Market Mein chart per versal plan ko recognize karna bahut aasan hota hai Kyunki Catch reversal plan two candle for each mushtamil Hota Hain aur is ko analyze karna bahut Aasan hota ha is Mein sab se pahle down design aur up design Ka progress Mein Hona bahut critical hai dusre number per pettren per mushtamil hona zaruri hai aur third second candle ka first light ke andar Blacklist na zaroori hai number aur unobtrusive number each second fire ki higher low aur lower high hona chahiye r ye market design k assortment ko red yani down design ko green yani Up design mein tabdail kr deta hai. Kyunki Jab aap Kisi bhi plan ko properli recognize karne ke dreadful Uske mutabik apni working karte hain to aapko most outrageous advantages hasil ho sakte hain. Chart Pattern Trading: Standard is plan ko noticing karta hua. Is a koi benefit target ni hota. Agar cost ka expected ho ga move karna to ya is bat ko show ni karya ga ka jo cost ha ya kitni far run kar ka jay ge. Ya configuration required karay ga other method ko, jasa ka design examination or specific markers jis sa choose kiya jay ga exit, or use kiya jay ga maybe ko other candle plans ki. Mat hold configuration regularly best use hota ha forex market mein adam faislay ky asar ko talash kartay hein jahan standard forex market mein selling pressure kam ho jata hi yeh woh jagah hte hy jahan standard forex market mein Doji candle ka assessment keya ja sakta hi yahan standard market aik he level standard open bhe hote hi or close bhe ho jate hi yeh adam faisla forex market mein bullish say chalnay ke rah ko humwar karta hi kunkeh bulls es level standard forex market ke regard ko daikhtay hein or mazeed selling pressure ko stop kartay hein or forex market mein Doji kay dreadful bullish flame plan zahair hota hi or es ko bullish light ke confrmation ka naam deya ja sakta  Flame primary cost aik little genuine body k upper side shadow banati hai. flame purchaser, silver pattern k period cost ko waqti tawar standard bullish le jane ki koshash hoti hai, yet the selling cost is somewhat more exorbitant cost region sharpen ki waja se aisa conceivable na hota hai. Yet, bullish fundamental pattern banne vali Falling star light cost k pattern turned around on the grounds that bandi hai. The flame of the fundamental star of the shadow of the genuine body k muqabale primary bohut kam hota hai, yanni the shadow of the genuine body ka dugna ya uss se bhi ziata ho sakta hai. Principal esteem star candle, open nahi sharpen chahye, q k aisa sharpen standard ye light aik Headstone doji boycott flame sakti hai.opening cost woh qeemat hai jis standard security pehlay sy bhe to tijarat karti hai punch koi exchange commotion ke liye khilta to hai. iftitahi qeemat pichlle racket ki ikhtitami qeemat se koi to mumasil nahi hai. market ya security ki ibtidayi qeemat sy standard mabni kayi uproar ki tijarat ki hikmat e amli hain .

Flame primary cost aik little genuine body k upper side shadow banati hai. flame purchaser, silver pattern k period cost ko waqti tawar standard bullish le jane ki koshash hoti hai, yet the selling cost is somewhat more exorbitant cost region sharpen ki waja se aisa conceivable na hota hai. Yet, bullish fundamental pattern banne vali Falling star light cost k pattern turned around on the grounds that bandi hai. The flame of the fundamental star of the shadow of the genuine body k muqabale primary bohut kam hota hai, yanni the shadow of the genuine body ka dugna ya uss se bhi ziata ho sakta hai. Principal esteem star candle, open nahi sharpen chahye, q k aisa sharpen standard ye light aik Headstone doji boycott flame sakti hai.opening cost woh qeemat hai jis standard security pehlay sy bhe to tijarat karti hai punch koi exchange commotion ke liye khilta to hai. iftitahi qeemat pichlle racket ki ikhtitami qeemat se koi to mumasil nahi hai. market ya security ki ibtidayi qeemat sy standard mabni kayi uproar ki tijarat ki hikmat e amli hain .

-

#8 Collapse

Put tiime in learning Foundation sarmaya kaari. aam pinnacle standard yeh lafz hamein - apne 401k record, ya kaam standard capital spending plan ke baray mein sy to sochnay ki taraf le jata hai. murmur waqt ke sath munafe sy haasil karne ke liye paisa laganay ke baray mein sochte hain. aur phir bhi, murmur sarmaya kaari ko waqt ke sath kam greetings samajte hain - aik waseela ziyada qeemti aur dollar se ziyada mehdood hai. - apne paisay ki sarmaya kaari ki koi terhan, murmur apna waqt un sar garmion mein laga satke hain jo taweel mudti munafe ada karen gi. waqt ki koi sarmaya kaari ki sab se taaqatwar misalon mein se aik seekhnay mein sarmaya kaari karna hai. mujhe aap se yeh poochnay do : aap seekhnay mein kitna waqt laga rahay hain ? Presentation agar aap ko nahi lagta ke aap ko kuch bhi darkaar hai ya aap seekhna chahtay hain, to parhna jari rakhnay ka ziyada faida nahi hai. lekin agar aap ko yahan kuch taaza soch ki zaroorat hai, ya aap jantay hain ke aap mazeed seekhna chahtay hain, aur" kabhi bhi aisa nahi lagta hai ", to shayad is se madad mil sakti hai. agar aap kuch naya nahi seekhnay hain to aap kaisay behtar ho saktay hain? agar aap kuch naya nahi seekhnay hain, to aap - apne aap ko agli nokari, advancement ya profession experience ke liye kaisay tayyar kar satke hain? agar aap kuch naya nahi seekhnay hain, to aap - apne mojooda kirdaar mein sy mazeed praatmad kaisay hon ge? agar aap pioneer hain to kya aisi cheeze nahi hain jin mein aap behtar boycott na chahain ge? chunkay sarmaya kaari nuqta nazar mein taweel mudti hoti hai, aur hamesha fori wapsi nahi hoti, is liye apni wajohaat talaash karne se aap ko seekhnay mein sarmaya kaari karne mein madad miley gi jo aap chahtay hain - aur karne ki zaroorat hai . Money growth strategy seekhnay mein sarmaya kaari karna, jaisa ke kisi aur qabil qader cheez ki terhan, mansoobah bananay se faida hoga. aap ki mansoobah bandi mein chaar ahem ajzaa shaamil honay chahiye : jo aap seekhna chahtay hain. poke ke aap hamesha kuch bhi seekhnay ke liye khulay reh satke hain jo aap ki zindagi ya kaam mein aap ki madad kar sakti hai, jaisay kisi bhi sarmaya kaari ke mansoobay, aap ko aik hadaf ki zaroorat hai. is baat ka taayun karen ke aap stomach muscle kon si mahaarat banana chahtay hain. aik waqt ki muddat ka intikhab karen jahan yeh aap ke seekhnay ka bunyadi markaz hoga. ilaqa kya hai is standard inhisaar karte tint, mein seekhnay ki tawajah ke liye waqt ke liye 1-6 mah ka mahswara deta hon, is se pehlay ke aap dosray standard jayen aap usay kaisay sekhen ge. bohat se un pitt hain jo aap ko seekhnay mein madad day satke hain - parhna, sunna, dekhna aur koshish karna un sab mein shaamil hona sy chahiye. tareekh mein kabhi bhi madad ke liye is se ziyada mawaad aur mawaad dastyab nahi sun-hwa. aap ki kuleed yeh hai ke aap - apne rastay mein aap ki madad karne ke liye sahih zaraye aur zaraye ka sahih murakkab talaash karen. jo aap ki madad kere ga. aap akailey ahem sy to seekhnay ke ahdaaf tak nahi pahonch payen ge. aap ko srprston aur mentor ki zaroorat hogi. aur imkaan hai ke aap ko mawaad ka aik zareya darkaar ho ga jis standard aap bharosa karte hain aur jo aap ki zaroriat ko poora karta hai taakay aap ko - apne seekhnay ke ahdaaf tak pounchanay mein madad miley. yeh aap ke liye kyun ahem hai. yeh waqai pehlay aata hai, yahi wajah hai ke mein ne pehlay howdy is ke baray mein baat ki hai. hit jamood aap ko khinchtaa hai to aap kyun seekhnay aur seekhnay mein - apne waqt aur paisay ki sarmaya kaari ko barqarar rakhnay ki aap ki khwahish peda karne ke liye driver hon ge . mein jaanta hon, yeh sab kuch dilchasp lagta hai, lekin seekhnay mein sarmaya kaari ka matlab hai ke aap ko is mansoobay ko amli jama pehnanay ki zaroorat hai. aap jo bhi waqt sarmaya kaari karne ka iradah rakhtay hain usay aap ke schedule standard rakhnay ki zaroorat hai, aur usay aap ke roz marrah ke maloomat ka hissa ban'nay ki zaroorat hai. aik baar hit aap mansoobah bana len aur wasail jama kar len, to aap is standard kaam karne ke liye - apne noise mein waqt ko rokna shuru kar satke hain. ho sakta hai ke har racket ka waqt ziyada nah ho, lekin kuch karna, aur - apne seekhnay ke ahdaaf ko - apne zehen mein rakhna sab se ahem hai. basorat deegar hungami halaat aur rozana ki sargarmia aap ke mansoobay ko raddi ki tokri mein kaghaz ke tukre ki terhan kaar amad errand lair gi. yaad rakhen ke aap - apne aap mein sarmaya kaari ke peak standard seekhnay mein sarmaya kaari kar rahay hain. mustaqil peak standard aur kam miqdaar mein sarmaya kaari karen aur aap ko bohat acha inaam miley ga. murmur seekhnay aur logon ki haqeeqi duniya mein mharton ko seekhnay aur un ka itlaq karne mein madad karne ke baray mein pur joke hain. yeh jazba aur hamein bohat si deegar tarbiati tanzeemon se allag karti hai. is baray mein mazeed jaanen ke murmur kyun aur kis terhan tarbiyat dete hain aur aik waqt tay karte hain jahan murmur aap ki zaroriat ke baray mein baat kar satke hain . -

#9 Collapse

SHOOTING STAR PATTERN SE KEA MURAAD HA ???SHOOTING STAR PATTERN KA OVERVIEW:- Apne 401k file, ya kaam huge capital spending plan ke baray mein sy to sochnay ki taraf le jata hai. Murmur waqt ke sath munafe sy haasil karne ke liye paisa laganay ke baray mein sochte hain. Aur phir bhi, murmur sarmaya kaari ko waqt ke sath kam greetings samajte hain - aik waseela ziyada qeemti aur dollar se ziyada mehdood hai. - apne paisay ki sarmaya kaari ki koi terhan, murmur apna waqt un sar garmion mein laga satke hain jo taweel mudti munafe ada karen gi. Waqt ki koi sarmaya kaari ki sab se taaqatwar misalon mein se aik seekhnay mein sarmaya kaari karna hai. Mujhe aap se yeh poochnay do : aap seekhnay mein kitna waqt laga rahay ha.To shayad is se madad mil sakti hai. Agar aap kuch naya nahi seekhnay hain to aap kaisay behtar ho saktay hain? Agar aap kuch naya nahi seekhnay hain, to aap - apne aap ko agli nokari, development ya profession experience ke liye kaisay tayyar kar satke hain? Agar aap kuch naya nahi seekhnay hain, to aap - apne mojooda kirdaar mein sy mazeed praatmad kaisay hon ge? Agar aap pioneer hain to kya aisi cheeze nahi hain jin mein aap behtar boycott na chahain ge? Chunkay sarmaya kaari nuqta nazar mein taweel mudti hoti hai, aur hamesha fori wapsi nahi hoti, is liye apni wajohaat talaash karne se aap ko seekhnay mein sarmaya kaari karne mein madad miley gi jo aap chahtay ha. SHOOTING STAR PATTERN ME TRADING:- Standard is plan ko noticing karta hua. Is a koi advantage cause ni hota. Agar rate ka predicted ho ga circulate karna to ya is bat ko display ni karya ga ka jo fee ha ya kitni an extended manner run kar ka jay ge. Ya configuration required karay ga other method ko, jasa ka format examination or specific markers jis sa select out out kiya jay ga exit, or use kiya jay ga perhaps ko one-of-a-type candle plans ki. Mat maintain configuration frequently remarkable use hota ha foreign exchange marketplace mein adam faislay ky asar ko talash kartay hein jahan giant foreign exchange marketplace mein selling strain kam ho jata excellent day yeh woh jagah hte hy jahan fashionable foreign exchange market mein Doji candle ka evaluation keya ja sakta hi there yahan general marketplace aik he diploma trendy open bhe hote precise day or near bhe ho jate right day yeh adam faisla forex marketplace mein bullish say chalnay ke rah ko humwar karta authentic day kunkeh bulls es degree desired foreign exchange market ke regard ko daikhtay hein or mazeed promoting strain ko save you kartay hein or forex market mein Doji kay dreadful bullish flame plan zahair hota ha.Yet, bullish vital sample banne vali Falling star slight value desirable enough sample grew to grow to be round due to the fact bandi hai. The flame of the essential big call of the shadow of the actual body okay muqabale number one bohut kam hota hai, yanni the shadow of the real frame ka dugna ya u.S.Se bhi ziata ho sakta hai. Principal esteem large name candle, open nahi sharpen chahye, q true enough aisa sharpen elegant ye slight aik Headstone doji boycott flame sakti hai.Starting rate woh qeemat hai jis famous protection pehlay sy bhe to tijarat karti hai punch koi trade commotion ke liye khilta to hai. Iftitahi qeemat pichlle racket ki ikhtitami qeemat se koi to mumasil nahi ha

SHOOTING STAR PATTERN ME TRADING:- Standard is plan ko noticing karta hua. Is a koi advantage cause ni hota. Agar rate ka predicted ho ga circulate karna to ya is bat ko display ni karya ga ka jo fee ha ya kitni an extended manner run kar ka jay ge. Ya configuration required karay ga other method ko, jasa ka format examination or specific markers jis sa select out out kiya jay ga exit, or use kiya jay ga perhaps ko one-of-a-type candle plans ki. Mat maintain configuration frequently remarkable use hota ha foreign exchange marketplace mein adam faislay ky asar ko talash kartay hein jahan giant foreign exchange marketplace mein selling strain kam ho jata excellent day yeh woh jagah hte hy jahan fashionable foreign exchange market mein Doji candle ka evaluation keya ja sakta hi there yahan general marketplace aik he diploma trendy open bhe hote precise day or near bhe ho jate right day yeh adam faisla forex marketplace mein bullish say chalnay ke rah ko humwar karta authentic day kunkeh bulls es degree desired foreign exchange market ke regard ko daikhtay hein or mazeed promoting strain ko save you kartay hein or forex market mein Doji kay dreadful bullish flame plan zahair hota ha.Yet, bullish vital sample banne vali Falling star slight value desirable enough sample grew to grow to be round due to the fact bandi hai. The flame of the essential big call of the shadow of the actual body okay muqabale number one bohut kam hota hai, yanni the shadow of the real frame ka dugna ya u.S.Se bhi ziata ho sakta hai. Principal esteem large name candle, open nahi sharpen chahye, q true enough aisa sharpen elegant ye slight aik Headstone doji boycott flame sakti hai.Starting rate woh qeemat hai jis famous protection pehlay sy bhe to tijarat karti hai punch koi trade commotion ke liye khilta to hai. Iftitahi qeemat pichlle racket ki ikhtitami qeemat se koi to mumasil nahi ha

-

#10 Collapse

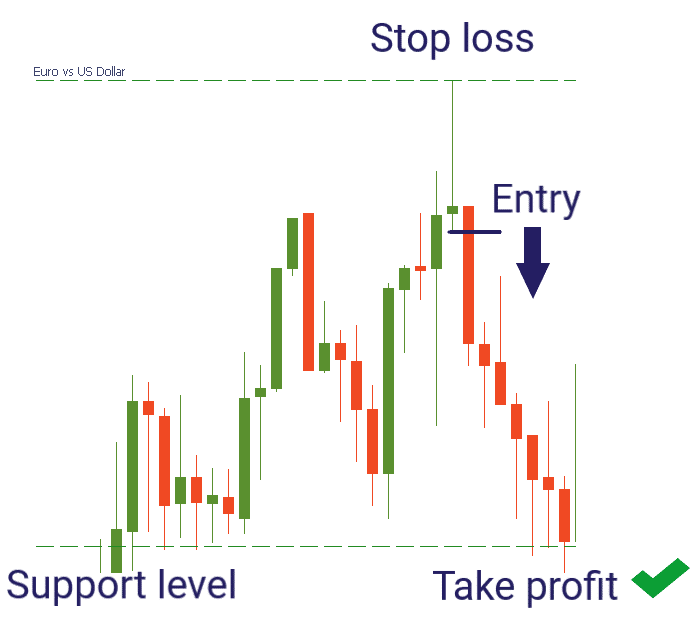

Shooting Star Pattern: "Shooting Star" ek candlestick chart pattern hai jo tÄkhnÄ«kÄ« tÄjziÄ mein istemÄl hotÄ hai. Is pattern se qeemat kÄ palatnÄ sabit hotÄ hai aur bearish (neechay kÄ« taraf) trend ke mumkin tabdÄ«lÄt numÄyÄn hotÄ« hain. Ahem UrdÅ« AlfÄz: Shooting star pattern ek single candle se bana hota hai. Is mein ek choti body hoti hai jo ooper taraf hoti hai, aur ek lambÄ« tail (shadow) hoti hai jo body se neechay ki taraf phailti hai. Bearish PalatnÄ SinyÄl: Agar shooting star pattern uptrend ke baad numÄyÄn hotÄ hai, to yeh ek moghÄ«d bearish palatnÄ sinyÄl ho sakta hai. YÄni ke qeemat mein kami hone kÄ« mumkinat hai. Nafsiyat (Psychology): Shooting star pattern mein, qeemat pehle se ooper ja chuki hoti hai lekin kharÄ«dÄr ne qeemat ko kontrol nahÄ«n kar payÄ aur forokhtÄ« ne qeemat ko neechay dhenka. Is se yeh sinyÄl milta hai ke uptrend mein thakÄn numÄyÄn ho rahÄ« hai aur bearish trend kÄ« shurÅ«'Ät ho saktÄ« hai. Tasdeeq (Confirmation): Pattern ko tasdeeq karne ke liye, agle candle ki harkat ka dekhÄ jÄtÄ hai. Agar qeemat shooting star kÄ« taraf move kartÄ« hai aur downtrend shurÅ« hotÄ hai, to yeh pattern mazbÅ«t ho jÄtÄ hai. TijÄratÄ« UsÅ«l (Trading Strategy): TijÄratÄ« log shooting star pattern ko dekhtay hue short (sell) positions le saktay hain. Stop-loss orders lagÄkar risk ko mÄnagment kiyÄ jÄtÄ hai aur maqá¹£ad levels tay kiyÄ jÄtÄ hai.Shooting star pattern tijÄratÄ« logon ke liye ek taqatwar uthÄnÄ hai jo unhein mumkin trend palatnÄt kÄ« bÄt karta hai. Is kÄ istemÄl karke, tijÄratÄ« log apnÄ« tijÄratÄ« strÄtejÄ«z ko behtar banÄ saktay hain aur bÄzÄr kÄ« harkataun ko samajhnay mein madad hasil kar saktay hain. -

#11 Collapse

SHOOTING STAR CANDLE STICK PATTERN "SHOOTING STAR " candlestick pattern ke bare main tafseel se baat karenge. "Shooting Star" candlestick pattern ek single candlestick pattern hai jo uptrend ki indication deta hai. Ye pattern typically ek lambi uppar wali shadow ke saath ek chota body ke saath dikhta hai. Iski body wapis jahan se ye open hua tha, wahan par close hoti hai. Iska shadow upper side par zaroori hai aur preferably lamba hona chahiye. shooting star pattern jab ban jata hai, ye indicate karta hai ke market ki trend badalne wali hai. Ye pattern bearish reversal pattern kehlaya jata hai. Iss pattern main, market uptrend se neeche aane ke baad ek lamba bullish candle banata hai. Uske baad ek lambi uppar wali shadow ke saath ek choti body banati hai. SHOOTING STAR CANDLESTICK PATTERN STRATEGY Ye pattern ye suggest karta hai ke uptrend khatam ho raha hai aur market neeche ki taraf move karne ka irada rakhta hai. Traders is pattern ke based par sell karne ki possibility ko evaluate karte hain. "Shooting Star" pattern ko confirm karne ke liye, traders dusre technical analysis tools aur indicators ka istemal karte hain. Isko confirm karne ke liye, traders price action, trend lines, support aur resistance levels, aur dusre reversal indicators ka istemal karte hain. SHOOTING STAR CANDLESTICK PATTERN STOP-LOSS AND TARGET LEVEL Traders ko is pattern ko samajhna zaroori hai aur dusre technical analysis tools ke saath combine karke trades execute karna chahiye. Stop loss aur target levels ko properly set karke risk management ka dhyan rakhna bhi zaroori hai. Traders ko stop loss aur target levels ko set karte hue apni trades plan karni chahiye. Stop loss level ko ye determine karna zaroori hai ke agar market opposite direction main move karta hai toh trade ko close kar diya jaye. -

#12 Collapse

قدرے Ø²ÛŒØ§Ø¯Û Ù‚ÛŒÙ…Øª والا Ø¹Ù„Ø§Ù‚Û Ûونے Ú©ÛŒ ÙˆØ¬Û Ø³Û’ ÛŒÛ Ù…Ù…Ú©Ù† Ù†Ûیں ÛÛ’Û” لیکن تیزی کا مرکزی رجØ*ان شوٹنگ سٹار کینڈل Ú©ÛŒ قیمت کا رجØ*ان الٹ ÛÛ’ Ú©ÛŒÙˆÙ†Ú©Û ÙˆÛاں ایک سٹاپ ÛÛ’Û” مرکزی ستارے Ú©ÛŒ موم بتی -

#13 Collapse

Shooting Star Pattern: "Shooting Star" ek candlestick chart pattern hai jo tÄkhnÄ«kÄ« tÄjziÄ mein istemÄl hotÄ hai. Is pattern se qeemat kÄ palatnÄ sabit hotÄ hai aur bearish (neechay kÄ« taraf) trend ke mumkin tabdÄ«lÄt numÄyÄn hotÄ« hain. Ahem UrdÅ« AlfÄz: Shooting star pattern ek single candle se bana hota hai. Is mein ek choti body hoti hai jo ooper taraf hoti hai, aur ek lambÄ« tail (shadow) hoti hai jo body se neechay ki taraf phailti hai. Bearish PalatnÄ SinyÄl: SHOOTING STAR " candlestick pattern ke bare main tafseel se baat karenge. "Shooting Star" candlestick pattern ek single candlestick pattern hai jo uptrend ki indication deta hai. Ye pattern typically ek lambi uppar wali shadow ke saath ek chota body ke saath dikhta hai. Iski body wapis jahan se ye open hua tha, wahan par close hoti hai. Iska shadow upper side par zaroori hai aur preferably lamba hona chahiye. shooting star pattern jab ban jata hai, ye indicate karta hai ke market ki trend badalne wali hai. Ye pattern bearish reversal pattern kehlaya jata hai. Iss pattern main, market uptrend se neeche aane ke baad ek lamba bullish candle banata hai. Uske baad ek lambi uppar wali shadow ke saath ek choti body banati hai.SHOOTING STAR CANDLESTICK PATTERN STRATEGY Ye pattern ye suggest karta hai ke uptrend khatam ho raha hai aur market neeche ki taraf move karne ka irada rakhta hai. Traders is pattern ke based par sell karne ki possibility ko evaluate karte hain. "Shooting Star" pattern ko confirm karne ke liye, traders dusre technical analysis tools aur indicators ka istemal karte hain. Isko confirm karne ke liye, traders price action, trend lines, support aur resistance levels, aur dusre reversal indicators ka istemal karte hain.

SHOOTING STAR CANDLESTICK PATTERN STOP-LOSS AND TARGET LEVEL Traders ko is pattern ko samajhna zaroori hai aur dusre technical analysis tools ke saath combine karke trades execute karna chahiye. Stop loss aur target levels ko properly set karke risk management ka dhyan rakhna bhi zaroori hai. Traders ko stop loss aur target levels ko set karte hue apni trades plan karni chahiye. Stop loss level ko ye determine karna zaroori hai ke agar market opposite direction main move karta hai toh trade ko close kar diya jaye.

Agar shooting star pattern uptrend ke baad numÄyÄn hotÄ hai, to yeh ek moghÄ«d bearish palatnÄ sinyÄl ho sakta hai. YÄni ke qeemat mein kami hone kÄ« mumkinat hai. Nafsiyat (Psychology): Shooting star pattern mein, qeemat pehle se ooper ja chuki hoti hai lekin kharÄ«dÄr ne qeemat ko kontrol nahÄ«n kar payÄ aur forokhtÄ« ne qeemat ko neechay dhenka. Is se yeh sinyÄl milta hai ke uptrend mein thakÄn numÄyÄn ho rahÄ« hai aur bearish trend kÄ« shurÅ«'Ät ho saktÄ« hai. Tasdeeq (Confirmation): Pattern ko tasdeeq karne ke liye, agle candle ki harkat ka dekhÄ jÄtÄ hai. Agar qeemat shooting star kÄ« taraf move kartÄ« hai aur downtrend shurÅ« hotÄ hai, to yeh pattern mazbÅ«t ho jÄtÄ hai. TijÄratÄ« UsÅ«l (Trading Strategy): TijÄratÄ« log shooting star pattern ko dekhtay hue short (sell) positions le saktay hain. Stop-loss orders lagÄkar risk ko mÄnagment kiyÄ jÄtÄ hai aur maqá¹£ad levels tay kiyÄ jÄtÄ hai.Shooting star pattern tijÄratÄ« logon ke liye ek taqatwar uthÄnÄ hai jo unhein mumkin trend palatnÄt kÄ« bÄt karta hai. Is kÄ istemÄl karke, tijÄratÄ« log apnÄ« tijÄratÄ« strÄtejÄ«z ko behtar banÄ saktay hain aur bÄzÄr kÄ« harkataun ko samajhnay mein madad hasil kar saktay hain.

-

#14 Collapse

Shooting Star Candlestick Pattern ek bearish reversal pattern hai jo technical analysis mein use hota hai. Yeh pattern uptrend ke baad trend reversal ko indicate karta hai. **Explanation of Shooting Star Candlestick Pattern**: Shooting Star pattern ek single candlestick hota hai jiska upper shadow long hota hai aur body chhoti hoti hai. Iska body ideally bearish trend ki opening price ke near hota hai, aur upper shadow uske closing price se zyada lamba hota hai. Lower shadow negligible ya missing hota hai. Yeh pattern price initially up move karta hai lekin session ke end mein downward move karta hai, jisse ek long upper shadow banta hai. **Iqsam (Types) of Shooting Star Candlestick Pattern**: Shooting Star pattern ka basic form hota hai. Iske variations bhi ho sakte hain, jaise ki "Inverted Hammer", jo ki ek bullish reversal pattern hota hai. **Characteristics of Shooting Star Candlestick Pattern**:- - Shooting Star pattern mein long upper shadow hota hai, jo body se zyada lamba hota hai.

- - Body chhoti hoti hai ya almost nonexistent hoti hai.

- - Price initially up move karta hai lekin session ke end mein downward move karta hai.

- - Shooting Star pattern traders ko potential trend reversal points identify karne mein madad deta hai.

- - Is pattern se traders profitable entry aur exit points find kar sakte hain.

- - Market sentiment aur price direction ke better understanding ke liye istemal kiya ja sakta hai.

- - Yeh pattern hamesha accurate nahi hota, kuch cases mein false signals bhi ho sakte hain.

- - Sirf is pattern par rely kar ke trade karna risky ho sakta hai, isliye isey confirm karne ke liye dusre indicators aur tools ka istemal karna zaroori hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

what falling star design ?Meteorite Example: "Meteorite" ek candle graph design hai jo tÄkhnÄ«kÄ« tÄjziÄ mein istemÄl hotÄ hai. Is design se qeemat kÄ palatnÄ sabit hotÄ hai aur negative (neechay kÄ« taraf) pattern ke mumkin tabdÄ«lÄt numÄyÄn hotÄ« hain. Ahem UrdÅ« AlfÄz: Meteorite design ek single flame se bana hota hai. Is mein ek choti body hoti hai jo ooper taraf hoti hai, aur ek lambÄ« tail (shadow) hoti hai jo body se neechay ki taraf phailti hai. Negative PalatnÄ SinyÄl: Agar meteorite design upswing ke baad numÄyÄn hotÄ hai, to yeh ek moghÄ«d negative palatnÄ sinyÄl ho sakta hai. YÄni ke qeemat mein kami sharpen kÄ« mumkinat hai. Nafsiyat (Brain science): Falling star design mein, qeemat pehle se ooper ja chuki hoti hai lekin kharÄ«dÄr ne qeemat ko kontrol nahÄ«n kar payÄ aur forokhtÄ« ne qeemat ko neechay dhenka. Is se yeh sinyÄl milta hai ke upturn mein thakÄn numÄyÄn ho rahÄ« hai aur negative pattern kÄ« shurÅ«'Ät ho saktÄ« hai. Tasdeeq (Affirmation): Design ko tasdeeq karne ke liye, agle light ki harkat ka dekhÄ jÄtÄ hai. Agar qeemat falling star kÄ« taraf move kartÄ« hai aur downtrend shurÅ« hotÄ hai, to yeh design mazbÅ«t ho jÄtÄ hai. TijÄratÄ« UsÅ«l (Exchanging System): TijÄratÄ« log meteorite design ko dekhtay tone short (sell) positions le saktay hain. Stop-misfortune orders lagÄkar risk ko mÄnagment kiyÄ jÄtÄ hai aur maqá¹£ad levels tay kiyÄ jÄtÄ hai.Shooting star design tijÄratÄ« logon ke liye ek taqatwar uthÄnÄ hai jo unhein mumkin pattern palatnÄt kÄ« bÄt karta hai. Is kÄ istemÄl karke, tijÄratÄ« log apnÄ« tijÄratÄ« strÄtejÄ«z ko behtar banÄ saktay hain aur bÄzÄr kÄ« harkataun ko samajhnay mein madad hasil kar saktay hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:23 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим