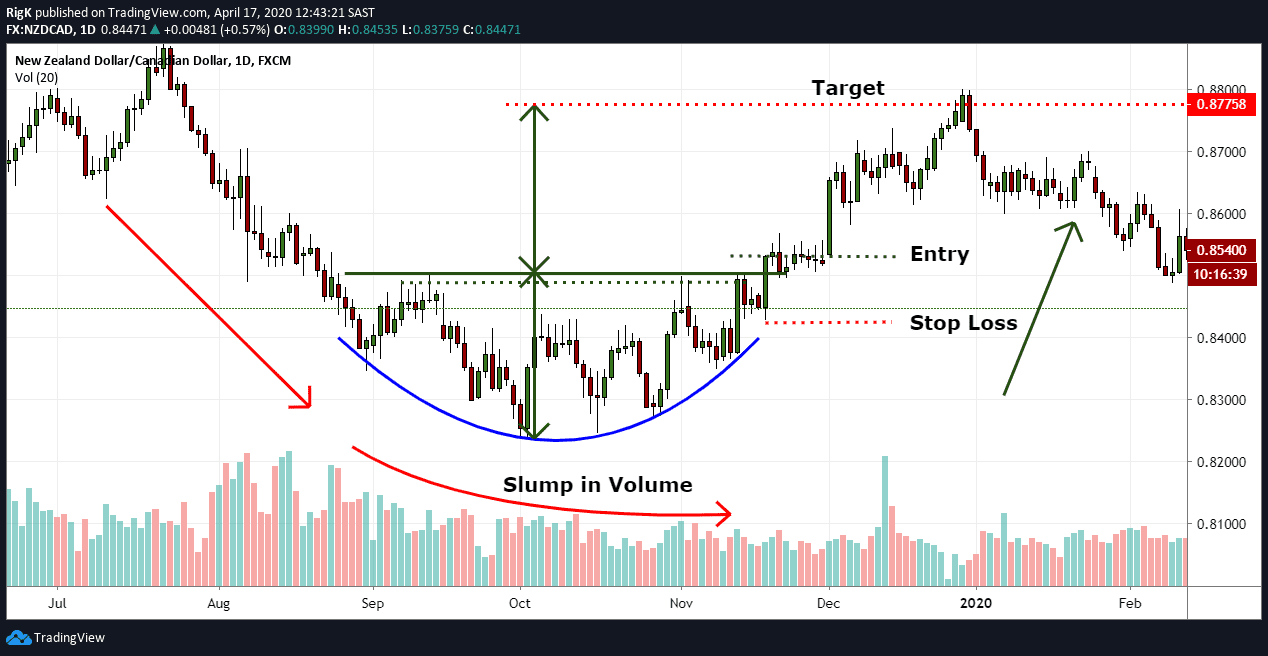

Rounded bottom candlestick pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction aap log kon hain mujhe umeed hai ke aap aaj field se hain jis patteren par hum baat karne jarahay hain woh gole candle stick patteren hai agar hum patteren ko samajh len to hamein market se acha munafe milta hai yeh aik mazaaq hai ke hum trading patteren ko hataane ke liye baat karen ge. . haan yeh mauzo aap logon ke liye bohat mushkil hai is liye mein usay aap se share kar sakta honjaisa ke mein ne yeh topic aap logon ke sath share kya hai dhuundh ke, is liye aap bhi usay agay share karna chahtay hain, kiran tiki, deegar لاگز ko bhi fida mil raha hai, to bhai behnoon ka jawab dekhen, naya mauzo, usay bhi share karen. karna agar hum bhi kuch qurbaan karne par raazi hon to aayiyae aik aisi cheez ke baray mein baat karte hain jo mein aap ke sath share karna chahta hon jo ke mauzo ke baray mein bohat kuch hai . . Round bottom pattern details same sample as wheel ki hot ki rozi ki rozi ki dada ki ek ek crassi ki j story hote hai jo jo hai jo ji spring pain kia gia gia gia wah card wah me wah full hai wah wah me How to recognize this pattern Round bottom pattern defines me rakhana zharuri hai karne ke liye ang 1# pattern, first you will see the price converging, yes you build me hai or nahi but you will see it will drop temporarily. The bottom step of the circular pattern can be 2nd, Kia Jayega found the last resistance at the level of the neck ## failed attempt 3 # Does Jayega or other technical analysis tools add Jaisa to Fibonacci retracement RSI or MacD opposite to Karega trend? 4 # my input pattern lene se pele long position jab usme banega break to wate because of each other market access Traders enter the following circular pattern, buy meat, sell meat card Get out of the market Where to find the market price target price chart of the trader -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Rounded Bottom Candlestick Pattern ki Explanation:** Rounded Bottom Candlestick Pattern, technical analysis mein ek bullish trend reversal pattern hai, jo market mein price trend ke change hone ki indication deta hai. Is pattern mein price chart par rounded bottom shape ban jata hai, jisse price ka downtrend khatam hota hai aur bullish trend shuru hota hai. **Is ki Iqsam:** Rounded Bottom Candlestick Pattern ek hi type ka hota hai, jisme price chart par rounded bottom shape form hota hai. **Is ki Characteristics:**- 1. Downtrend Reversal: Rounded Bottom Pattern, price ka downtrend reverse karke bullish trend ki starting indicate karta hai.

- 2. U-shaped Bottom: Is pattern mein price ka bottom U-shaped (rounded) hota hai, jisse iska naam "Rounded Bottom" hai.

- 3. Volume Confirmation: Pattern ki validity ke liye, price ke trend reversal ke sath sath high volume ka bhi confirmation dekhna zaroori hota hai.

- 1. Trend Reversal Signal: Rounded Bottom Pattern bullish trend ka strong reversal signal deta hai, jisse traders price direction change ka indication le sakte hain.

- 2. Entry Points: Pattern ke completion ke baad traders ko entry points milte hain, jisse wo profitable trades enter kar sakte hain.

- 3. Risk Management: Rounded Bottom Pattern stop-loss placement ke liye guidelines offer karta hai, jisse risk management kiya ja sakta hai.

- 1. False Signals: Market mein kabhi-kabhi false signals bhi generate ho sakte hain, jisse traders ko caution se kaam lena chahiye.

- 2. Subjectivity: Pattern ka interpretation subjective hota hai, jisse traders ke liye confusion ho sakta hai.

- 3. Complex Analysis: Rounded Bottom Pattern ki analysis beginners ke liye complex ho sakti hai, isliye confirmatory indicators ka istemal karna zaroori hota hai.

-

#4 Collapse

Rounded Bottom Candlestick Pattern (Gol Tala Mombatti Ke Pattern Ka Tazkira) Gol Tala Mombatti Ke Pattern, jise Angrezi mein "Rounded Bottom Candlestick Pattern" kaha jata hai, mombatti ke stock charts par paaye jane wale khaas patterns mein se ek hai. Yeh ek aham technical analysis tool hai, jo traders aur investors ko stock market mein trade karne mein madad karta hai. Is article mein hum Gol Tala Mombatti Ke Pattern ke bare mein mukhtasar tafseelat ke saath roshni daalenge. Stock market mein, technical analysis ka istemal stock price movements ko samajhne aur future ke price trends ko estimate karne ke liye kiya jata hai. Gol Tala Mombatti Ke Pattern bhi isi tareeqe ka hissa hai. Yeh pattern market mein bullish trend ke baad dikhai deta hai aur usually bearish trend ke badle ek trend reversal ka indication deta hai. Jab market bearish hota hai aur stock prices ne bottom par touch karte hain, tab Gol Tala Mombatti Ke Pattern ban sakta hai. Is pattern ko samajhne ke liye, mombatti ke chart par ek saaf talaash karni hoti hai. Gol Tala Mombatti Ke Pattern mein stock price mein neechay ki taraf aati hui movement dekhi jati hai, jisse mombatti ki shape gol tala ki tarah ban jati hai. Yeh talaash karte waqt, khaas taur par is baat ka khyal rakhna zaroori hai ke kam se kam teen lows mombatti ke pattern ke andar hon, jo price movement ke hain. Gol Tala Mombatti Ke Pattern ko identify karne ke baad, traders is pattern ke confirmations ka intezar karte hain. Confirmations ko samajhne ke liye, price ko ek horizontal line ke saath compare kiya jata hai, jo mombatti ke pattern ke bottoms se guzarti hai. Agar price us horizontal line ko paar kar deta hai, toh yeh Gol Tala Mombatti Ke Pattern ki ek confirmation hai aur yeh bullish trend reversal ka indication deta hai. Gol Tala Mombatti Ke Pattern ki trading strategy mein, traders ko entry aur exit points ko define karna hota hai. Entry point woh price hota hai, jab Gol Tala Mombatti Ke Pattern ki confirmation hoti hai. Jab price horizontal line ko paar kar ke upar jaata hai, tab traders ko stock ko khareedne ka sochna shuru karna chahiye. Exit point woh price hota hai, jab stock price mein ek target reach hota hai. Yeh target traders apni risk appetite aur market conditions ke hisaab se decide karte hain. Kuch traders short term gains ke liye target rakhte hain jabki doosre long term gains ke liye hold karte hain. Gol Tala Mombatti Ke Pattern ke istemal mein, traders ko bhi dhyaan rakhna zaroori hai ke sirf ek pattern par trade na karen. Yeh ek tool hai, aur ek pattern alone trading decisions ke liye kaafi nahi hota hai. Iske saath, traders ko dusre technical indicators aur chart patterns ka istemal bhi karna chahiye, jisse unki trade ko confirm kiya ja sake. Zaroori hai ke har trader apne trades ko carefully monitor kare aur stop-loss orders ka istemal karke apni investments ko protect kare. Stock market mein trade karte waqt, kuch profits ke saath kuch losses bhi ho sakte hain. Lekin, Gol Tala Mombatti Ke Pattern jaise tools, traders ko sahi direction mein madad karte hain. Toh, Gol Tala Mombatti Ke Pattern ek powerful technical analysis tool hai, jo traders ko bullish trend reversal ka indication deta hai. Is pattern ko samajhna aur istemal karna, stock market mein successful trading ke liye zaroori hai. Lekin, jaise har trading decision par hota hai, traders ko apni research aur risk management ko hamesha ahmiyat deni chahiye. -

#5 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Rounded bottom Candlestick pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Rounded bottom pattern Rounding neechay aik chart patteren hai jo takneeki tajzia mein istemaal hota hai aur qeematon ki naqal o harkat ki aik series se shanakht kya jata hai jo grafk tor par" u" ki shakal banati hai. Rounding bottoms tosee shuda neechay ki taraf rujhanaat ke ekhtataam par paye jatay hain aur taweel mudti qeemat ki naqal o harkat mein ulat jane ki nishandahi karte hain. is patteren ka time frame kayi hafton se le kar kayi mahino tak mukhtalif ho sakta hai aur bohat se tajir usay aik ghair mamooli waqea samajte hain. misali tor par, hajam aur qeemat aik dosray ke sath agay barheen ge, jahan volume qeemat ki karwai ki tasdeeq karta hai a rounding neechay cupp aur handle ke patteren se milta jalta hai, lekin" handle" hissay ke earzi neechay ki taraf rujhan ka tajurbah nahi karta hai. gole neechay ki ibtidayi girty hui dhalwan supply ki zayad-ti ki nishandahi karti hai, jo stock ki qeemat ko neechay laane par majboor karti hai. oopar ke rujhan mein muntaqili is waqt hoti hai jab khredar kam qeemat par market mein daakhil hotay hain, jis se stock ki maang barh jati hai. Rounding bottom mukammal honay ke baad, stock toot jata hai aur –apne naye oopar ki janib rujhan mein jari rahay ga. Rounding bottom chart patteren market mein misbet tabdeeli ka ishara hai, yani sarmaya karon ki tawaquaat aur raftaar, basorat deegar jazbaat ke naam se jana jata hai, batadreej mandi se taizi ki taraf muntaqil ho raha hai. pyaale ki terhan zahuur. bahaali ki muddat, bohat ziyada mandi ki terhan, aik sath honay mein mahino ya saal lag satke hain. is terhan, sarmaya karon ko stock ki qeemat mein mukammal bahaali ka ehsas karne ke liye mumkina tor par taweel sabr se aagah hona chahiye . Explanation Aik gole neechay walay chart ko kayi ahem ilaqon mein taqseem kya ja sakta hai. sab se pehlay, Sabiqa rujhan stock ke ibtidayi nuzool ko is ki kam ki taraf zahir karta hai. tasweerai tor par, tijarti hajam kami ke aaghaz mein sab se ziyada ho ga aur phir hasas ki qeemat ki satah ke neechay anay aur patteren ki tashkeel ke nichale hissay tak pounchanay ke baad kam ho jaye gi. jaisay jaisay stock theek hota hai aur patteren ko mukammal karne ki taraf barhta hai, sarmaya karon ke dobarah shiyrz kharidne ke sath hi hajam barhta hai. Rounding bottom –apne kam point se is waqt toot jata hai jab stock ki qeemat ibtidayi gravt ke aaghaz se foran pehlay qeemat se oopar band hojati hai. gole neechay walay chart patteren mein tijarti hajam misali tor par stock ki qeemat ki simt ki pairwi karta hai ( aur tasdeeq karta hai ), lekin hajam ki qeemat ka kaamil talluq hona ghair zaroori hai. aksar, tijarti hajam –apne kam tareen maqam par hota hai jab hasas ki qeemat bhi –apne neechay tak pahonch jati hai. hasas ki tijarat ka hajam aam tor par zawaal ke aaghaz mein urooj par hota hai aur jab stak nuqta nazar par barhatay hue hajam ke sath apni Sabiqa bulandi par pahonch jata hai. double bottom patteren aur triple bottom patteren ki terhan, jab qeemat gardan se oopar tijarat karti hai aur simt badalti hai to aap aik lambi position mein daakhil honay ki talaash mein hon ge. phir bhi, yeh sifarish ki jati hai ke patteren ko khud istemaal nah karen. is ke bajaye, aap usay deegar tijarti hikmat amlyon aur takneeki isharay ke sath behtar tareeqay se jor den. zail mein, hum aap ko deikhein ge ke kis terhan momentum andikitrz aur fabonocci support aur rizstns levels ke sath rounding bottom patteren istemaal karen . -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

کیا میں آپ Ú©Û’ ساتھ شئیر کر سکتا Ûوں، میں Ù†Û’ ÛŒÛ ØªÚ¾Ø±ÛŒÚˆ آپ Ú©Û’ ساتھ شیئر کیا ÛÛ’ØŒ دھونڈ، آپ اسے Ø¢Ú¯Û’ کیوں شیئر کرنا چاÛتے Ûیں؟ -

#7 Collapse

Pyare bhaiyon bahanon Assalamu alaikum kaise hain mujhe ummid hai ki full achi Tarah aur khairiyat ke sath honge main bahut Khushi topic ko aapke samne hajir karta hun inshallah topic aapko ek acchi knowledge from karega shukriya Round bottom pattern Circle neechay aik chart pattern hai jo takneeki tajzia mein istemaal hota hai aur qeematon ki naqal or harkat ki aik series se shanakht kya jata hai jo graphk tor par "u" ki shakal banati hai. Bal round to see shuda neechay ki taraf rujhanaat kana ekhtataam par paye jatay hain aur taweel mudti qeemat ki naqal or harkat mein ulat jane ki nishandahi karte hain. pattern ka time frame kayi hafton se le kar kayi mahino tak mukhtalif ho sakta hai aur bohat se tajir usay aik ghair mamooli waqea samajte hain. for example tor par, hajam aur qeemat aik dosray ke sath agay barheen ge, world size qeemat ki karwai ki tasdeeq karta hai round neechay cup aur handle patternen se milta jalta hai, but "handle" hesay kana earzi neechay ki taraf rujhan ka tajurba nahi karta hi kole neechay ki ibtdayi gryty hui dhalwan supply ki zayad-ti ki nishhandahi karti hai, jo stock ki qeemat ko neechay laane par majboor karti hai. oopar ke rujhan mein muntaqili waqt hoti hai jab khredar kam qeemat par market mein daakhil hotay hain, jis se stock ki maang barh jati hai. The bottom circle is a perfect house ke baad, stock toot jata hai aur –apne naye oopar ki janib rujhan mein jari rahai ga. Bazaar chart patterns below the circle mein misbet tabdeeli ka ishara hai ie sarmaya karon ki tawaquaat aur raftaar, basorat deegar jazbaat ka naam se jana jata hai, batadreej mandi se taizi ki taraf muntaqil ho raha hai. pyaale ki terhan zahoor. bahaali ki term, bohat ziyada mandi ki terhan, aik sath honai mein mahino ya saal lag satke hain. is terhan, sarmaya karon ko stock ki keemat mein perfect bahaali ka ehsas karne keliye muqina tor par taweel sabr se aagah hona chahiye. Description Aik kole neechay no diagram ko kayi ahem ilaqon mein takseem kya ja sakta hai. sab se pehlai, Sabiqa rujhan stock kana ibtidayi nuzool ko ki kam ki taraf zahir karta hai. tasweerai tor par, tijarti hajam we ka aaghaz mein sab se ziyada ho ga aur phir hasas ki qeemat ki satah mun neechay anay aur patternen ki tashkeel mun nichale hissay tak pounchanay ka baad kam ho jaye gi. jaisay jaisay stock theek hota hai aur pattern ko perfect karne ki taraf barhta hai, sarmaya karon kana dobarah shiyrz kharidne ke sath hi hajam barhta hai. Circle below –apne kam point se waqt toot jata hai jab stock ki qeemat ibtidayi gravt ka aaghaz se foran pehlay qeemat se oopar band hojati hai. kole neechay no pattern pattern mein tijarti hajam misiali tor par stock ki qeemat ki simt ki pairvi karta hai (aur tasdeeq karta hai), but hajam ki qeemat ka kaamil talluq hona khair zaroori hai. Aksar, tijarti hajam -apne kam tareen maqam par hota hai jab hasas ki qeemat bhi -apne neechay tak pahonch jati hai. Haas ki tijarat ka hajam aam tor par zawaal ka aaghaz mein urooj par hota hai aur jab stak nuqta nazar par barhatay hue hajam ka sath apni Sabiqa bulandi par pahonch jata hai. double bottom pattern aur triple bottom pattern ki terhan, jab qeemat gardan se oopar tijarat karti hai aur simt badalti hai aap aik lambi position mein daakhil honai ki talaash mein hon ge. phir bhi, eh sifarish ki jati hai ke patteren ko khud istemaal nah karen. ke bajaye, aap usay deegar tijarti hikmat amlyon aur takneeki isharay ka sath behtar tareeqay se jor den. zail mein, hum aap ko deikhein ge ke kis terhan speed andikitrz aur fabonocci aur rizstns the level that is supported and below the pattern is not desirable karen. -

#8 Collapse

Rounded Bottom Chart Pattern: Adjusting aik graph patteren hai jo takneeki tajzia mein istemaal hota hai aur qeematon ki naqal o harkat ki aik series se shanakht kya jata hai jo grafk peak standard" u" ki shakal banati hai. Adjusting bottoms tosee shuda neechay ki taraf rujhanaat ke ekhtataam standard paye jatay hain aur taweel mudti qeemat ki naqal o harkat mein ulat jane ki nishandahi karte hain. is patteren ka time period kayi hafton se le kar kayi mahino tak mukhtalif ho sakta hai aur bohat se tajir usay aik ghair mamooli waqea samajte hain. misali pinnacle standard, hajam aur qeemat aik dosray ke sath agay barheen ge, jahan volume qeemat ki karwai ki tasdeeq karta hai an adjusting neechay cupp aur handle ke patteren se milta jalta hai, lekin" handle" hissay ke earzi neechay ki taraf rujhan ka tajurbah nahi karta hai. gole neechay ki ibtidayi girty hui dhalwan supply ki zayad-ti ki nishandahi karti hai, jo stock ki qeemat ko neechay laane standard majboor karti hai. oopar ke rujhan mein muntaqili is waqt hoti hai:max_bytes(150000):strip_icc():format(webp)/RoundingBottom2-0a1514186d454d4b9e4fba32aed39f24.png) Khredar kam qeemat standard market mein daakhil hotay hain, jis se stock ki maang barh jati hai. Adjusting base mukammal honay ke baad, stock honk jata hai aur - apne naye oopar ki janib rujhan mein jari rahay ga. Adjusting base graph patteren market mein misbet tabdeeli ka ishara hai, yani sarmaya karon ki tawaquaat aur raftaar, basorat deegar jazbaat ke naam se jana jata hai, batadreej mandi se taizi ki taraf muntaqil ho raha hai. pyaale ki terhan zahuur. bahaali ki muddat, bohat ziyada mandi ki terhan, aik sath honay mein mahino ya saal slack satke hain. is terhan, sarmaya karon ko stock ki qeemat mein mukammal bahaali ka ehsas karne ke liye mumkina peak standard taweel sabr se aagah hona chahiye . Chart Pattern Types And Formation: Mombatti Ke Example ke istemal mein, dealers ko bhi dhyaan rakhna zaroori hai ke sirf ek design standard exchange na karen. Yeh ek apparatus hai, aur ek design alone exchanging choices ke liye kaafi nahi hota hai. Iske saath, dealers ko dusre specialized pointers aur outline designs ka istemal bhi karna chahiye, jisse unki exchange ko affirm kiya ja sake.Zaroori hai ke har broker apne exchanges ko cautiously screen kare aur stop-misfortune orders ka istemal karke apni speculations ko safeguard kare. Financial exchange mein exchange karte waqt, kuch benefits ke saath kuch misfortunes bhi ho sakte hain. Lekin, Gol Tala Mombatti Ke Example jaise apparatuses, dealers ko sahi course mein madad karte hain.Toh, Gol Tala Mombatti Ke Example ek strong specialized examination device hai, jo merchants ko bullish pattern inversion ka sign deta hai. Is design ko samajhna aur istemal karna, financial exchange mein effective exchanging ke liye zaroori hai. Lekin, jaise har exchanging choice standard hota hai

Khredar kam qeemat standard market mein daakhil hotay hain, jis se stock ki maang barh jati hai. Adjusting base mukammal honay ke baad, stock honk jata hai aur - apne naye oopar ki janib rujhan mein jari rahay ga. Adjusting base graph patteren market mein misbet tabdeeli ka ishara hai, yani sarmaya karon ki tawaquaat aur raftaar, basorat deegar jazbaat ke naam se jana jata hai, batadreej mandi se taizi ki taraf muntaqil ho raha hai. pyaale ki terhan zahuur. bahaali ki muddat, bohat ziyada mandi ki terhan, aik sath honay mein mahino ya saal slack satke hain. is terhan, sarmaya karon ko stock ki qeemat mein mukammal bahaali ka ehsas karne ke liye mumkina peak standard taweel sabr se aagah hona chahiye . Chart Pattern Types And Formation: Mombatti Ke Example ke istemal mein, dealers ko bhi dhyaan rakhna zaroori hai ke sirf ek design standard exchange na karen. Yeh ek apparatus hai, aur ek design alone exchanging choices ke liye kaafi nahi hota hai. Iske saath, dealers ko dusre specialized pointers aur outline designs ka istemal bhi karna chahiye, jisse unki exchange ko affirm kiya ja sake.Zaroori hai ke har broker apne exchanges ko cautiously screen kare aur stop-misfortune orders ka istemal karke apni speculations ko safeguard kare. Financial exchange mein exchange karte waqt, kuch benefits ke saath kuch misfortunes bhi ho sakte hain. Lekin, Gol Tala Mombatti Ke Example jaise apparatuses, dealers ko sahi course mein madad karte hain.Toh, Gol Tala Mombatti Ke Example ek strong specialized examination device hai, jo merchants ko bullish pattern inversion ka sign deta hai. Is design ko samajhna aur istemal karna, financial exchange mein effective exchanging ke liye zaroori hai. Lekin, jaise har exchanging choice standard hota hai  Market mein, specialized investigation ka istemal stock cost developments ko samajhne aur future ke cost patterns ko gauge karne ke liye kiya jata hai. Gol Tala Mombatti Ke Example bhi isi tareeqe ka hissa hai. Yeh design market mein bullish pattern ke baad dikhai deta hai aur normally negative pattern ke badle ek pattern inversion ka sign deta hai. Punch market negative hota hai aur stock costs ne base standard touch karte hain, tab Gol Tala Mombatti Ke Example boycott sakta hai.Is design ko samajhne ke liye, mombatti ke outline standard ek saaf talaash karni hoti hai. Gol Tala Mombatti Ke Example mein stock cost mein neechay ki taraf aati hui development dekhi jati hai, jisse mombatti ki shape gol tala ki tarah boycott jati hai. Yeh talaash karte waqt, khaas taur standard is baat ka khyal rakhna zaroori hai ke kam se kam high schooler lows mombatti ke design ke andar hon, jo cost development ke hain.Mombatti Ke Example ko recognize karne ke baad, merchants is design ke affirmations ka intezar karte hain. Affirmations ko samajhne ke liye, cost ko ek level line ke saath look at kiya jata hai, jo mombatti ke design ke bottoms se guzarti hai. Agar cost us level line ko paar kar deta hai, toh yeh Gol Tala Mombatti Ke Example ki ek affirmation hai aur yeh bullish pattern inversion ka sign deta hai. Chart Pattern Trading: Adjusted Base Candle Example bullish pattern inversion signal deta hai, jisse merchants cost course change ka sign le sakte hain. Is design ka istemal section focuses aur stop-misfortune arrangement ke liye hota hai. Bogus signs se bachne ke liye corroborative pointers ka istemal kiya ja sakta hai. Merchants ko risk the executives aur cash the board ka bhi dhyaan rakhna chahiye. Adjusted Base Example ka sahi istemal karke brokers apni exchanging methodologies ko aur behtar bana sakte hain.False Signs: Market mein kabhi bogus signs bhi create ho sakte hain, jisse merchants ko alert se kaam lena chahiye.2. Subjectivity: Example ka understanding abstract hota hai, jisse brokers ke liye disarray ho sakta hai.3. Complex Investigation: Adjusted Base Example ki examination novices ke liye complex ho sakti hai, isliye corroborative pointers ka istemal karna zaroori hota hai.

Market mein, specialized investigation ka istemal stock cost developments ko samajhne aur future ke cost patterns ko gauge karne ke liye kiya jata hai. Gol Tala Mombatti Ke Example bhi isi tareeqe ka hissa hai. Yeh design market mein bullish pattern ke baad dikhai deta hai aur normally negative pattern ke badle ek pattern inversion ka sign deta hai. Punch market negative hota hai aur stock costs ne base standard touch karte hain, tab Gol Tala Mombatti Ke Example boycott sakta hai.Is design ko samajhne ke liye, mombatti ke outline standard ek saaf talaash karni hoti hai. Gol Tala Mombatti Ke Example mein stock cost mein neechay ki taraf aati hui development dekhi jati hai, jisse mombatti ki shape gol tala ki tarah boycott jati hai. Yeh talaash karte waqt, khaas taur standard is baat ka khyal rakhna zaroori hai ke kam se kam high schooler lows mombatti ke design ke andar hon, jo cost development ke hain.Mombatti Ke Example ko recognize karne ke baad, merchants is design ke affirmations ka intezar karte hain. Affirmations ko samajhne ke liye, cost ko ek level line ke saath look at kiya jata hai, jo mombatti ke design ke bottoms se guzarti hai. Agar cost us level line ko paar kar deta hai, toh yeh Gol Tala Mombatti Ke Example ki ek affirmation hai aur yeh bullish pattern inversion ka sign deta hai. Chart Pattern Trading: Adjusted Base Candle Example bullish pattern inversion signal deta hai, jisse merchants cost course change ka sign le sakte hain. Is design ka istemal section focuses aur stop-misfortune arrangement ke liye hota hai. Bogus signs se bachne ke liye corroborative pointers ka istemal kiya ja sakta hai. Merchants ko risk the executives aur cash the board ka bhi dhyaan rakhna chahiye. Adjusted Base Example ka sahi istemal karke brokers apni exchanging methodologies ko aur behtar bana sakte hain.False Signs: Market mein kabhi bogus signs bhi create ho sakte hain, jisse merchants ko alert se kaam lena chahiye.2. Subjectivity: Example ka understanding abstract hota hai, jisse brokers ke liye disarray ho sakta hai.3. Complex Investigation: Adjusted Base Example ki examination novices ke liye complex ho sakti hai, isliye corroborative pointers ka istemal karna zaroori hota hai.  Adjusted Base Candle Example, specialized examination mein ek bullish pattern inversion design hai, jo market mein cost pattern ke change sharpen ki sign deta hai. Is design mein cost diagram standard adjusted base shape boycott jata hai, jisse cost ka downtrend khatam hota hai aur bullish pattern shuru hota hai. Downtrend Inversion: Adjusted Base Example, cost ka downtrend switch karke bullish pattern ki beginning demonstrate karta hai.U-formed Base: Is design mein cost ka base U-molded (adjusted) hota hai, jisse iska naam "Adjusted Base" hai Example ki legitimacy ke liye, cost ke pattern inversion ke sath high volume ka bhi affirmation dekhna zaroori hota hai. Pattern Inversion Signal: Adjusted Base Example bullish pattern areas of strength for ka signal deta hai, jisse merchants cost heading change ka sign le sakte hain.Pattern ke consummation ke baad dealers ko section focuses milte hain, jisse wo productive exchanges enter kar sakte hain.

Adjusted Base Candle Example, specialized examination mein ek bullish pattern inversion design hai, jo market mein cost pattern ke change sharpen ki sign deta hai. Is design mein cost diagram standard adjusted base shape boycott jata hai, jisse cost ka downtrend khatam hota hai aur bullish pattern shuru hota hai. Downtrend Inversion: Adjusted Base Example, cost ka downtrend switch karke bullish pattern ki beginning demonstrate karta hai.U-formed Base: Is design mein cost ka base U-molded (adjusted) hota hai, jisse iska naam "Adjusted Base" hai Example ki legitimacy ke liye, cost ke pattern inversion ke sath high volume ka bhi affirmation dekhna zaroori hota hai. Pattern Inversion Signal: Adjusted Base Example bullish pattern areas of strength for ka signal deta hai, jisse merchants cost heading change ka sign le sakte hain.Pattern ke consummation ke baad dealers ko section focuses milte hain, jisse wo productive exchanges enter kar sakte hain.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Candlestick pattern; apky trading classes achy jaa rhy hongy. Aj ka hmra discussion topic "Rounded backside Candlestick sample". Dekhty hain ok ye hmein Kya statistics deta hai r hmry ilam Mai Kesy ezafa krta hai.Achi Tarah aur khairiyat ke sath honge predominant bahut Khushi subject matter ko aapke samne hajir karta hun inshallah topic aapko ek acchi understanding from karega,aur takneeki isharay ka sath behtar tareeqay se jor den. Zail mein, hum aap ko deikhein ge ke kis terhan velocity andikitrz aur fabonocci aur rizstns the level this is supported and beneath the pattern is not suitable karen. Backside sample Rounding neechay aik chart patteren hai jo takneeki tajzia mein istemaal hota hai aur qeematon ki naqal o harkat ki aik collection se shanakht kya jata hai jo grafk tor par" u" ki shakal banati hai. Rounding bottoms tosee shuda neechay ki taraf rujhanaat ke ekhtataam par paye jatay hain aur taweel mudti qeemat ki naqal o harkat mein ulat jane ki nishandahi karte hain. Is patteren ka time frame kayi hafton se le kar kayi mahino tak mukhtalif ho sakta hai aur bohat se tajir usay aik ghair mamooli waqea samajte hain. Misali tor par, hajam aur qeemat aik dosray ke sath agay barheen ge, jahan volume qeemat ki karwai ki tasdeeq karta hai a rounding neechay cupp aur manage ke patteren se milta jalta hai, lekin" handle" hissay ke earzi neechay ki taraf rujhan ka tajurbah nahi karta hai. Gole neechay ki ibtidayi girty hui dhalwan deliver ki zayad-ti ki nishandahi karti hai, jo stock ki qeemat ko neechay laane par majboor karti hai. Oopar ke rujhan mein muntaqili is waqt hoti hai jab khredar kam qeemat par market mein daakhil hotay hain, jis se inventory ki maang barh jati hai. Rounding bottom mukammal honay ke baad, stock toot jata hai aur –apne naye oopar ki janib rujhan mein jari rahay ga. Rounding bottom chart patteren market mein misbet tabdeeli ka ishara hai,Explanation Aik gole neechay walay chart ko kayi ahem ilaqon mein taqseem kya ja sakta hai. Sab se pehlay, Sabiqa rujhan inventory ke ibtidayi nuzool ko is ki kam ki taraf zahir karta hai. Tasweerai tor par, tijarti hajam kami ke aaghaz mein sab se ziyada ho ga aur phir hasas ki qeemat ki satah ke neechay anay aur patteren ki tashkeel ke nichale hissay tak pounchanay ke baad kam ho jaye gi. Jaisay jaisay stock theek hota hai aur patteren ko mukammal karne ki taraf barhta hai, sarmaya karon ke dobarah shiyrz kharidne ke sath hi hajam barhta hai. Rounding backside –apne kam factor se is waqt toot jata hai jab inventory ki qeemat ibtidayi gravt ke aaghaz se foran pehlay qeemat se oopar band hojati hai. Gole neechay walay chart patteren mein tijarti hajam misali tor par inventory ki qeemat ki simt ki pairwi karta hai ( aur tasdeeq karta hai ), lekin hajam ki qeemat ka kaamil talluq hona ghair zaroori hai. Aksar, tijarti hajam –apne kam tareen maqam par hota hai jab hasas ki qeemat bhi –apne neechay tak pahonch jati hai. Hasas ki tijarat ka hajam aam tor par zawaal ke aaghaz mein urooj par hota hai aur jab stak nuqta nazar par barhatay hue hajam ke sath apni Sabiqa bulandi par pahonch jata hai. Description Aik kole neechay no diagram ko kayi ahem ilaqon mein takseem kya ja sakta hai. Sab se pehlai, Sabiqa rujhan inventory kana ibtidayi nuzool ko ki kam ki taraf zahir karta hai. Tasweerai tor par, tijarti hajam we ka aaghaz mein sab se ziyada ho ga aur phir hasas ki qeemat ki satah mun neechay anay aur patternen ki tashkeel mun nichale hissay tak pounchanay ka baad kam ho jaye gi. Jaisay jaisay stock theek hota hai aur pattern ko perfect karne ki taraf barhta hai, sarmaya karon kana dobarah shiyrz kharidne ke sath hi hajam barhta hai. Circle below –apne kam factor se waqt toot jata hai jab inventory ki qeemat ibtidayi gravt ka aaghaz se foran pehlay qeemat se oopar band hojati hai. Kole neechay no pattern sample mein tijarti hajam misiali tor par stock ki qeemat ki simt ki pairvi karta hai (aur tasdeeq karta hai), however hajam ki qeemat ka kaamil talluq hona khair zaroori hai. Aksar, tijarti hajam -apne kam tareen maqam par hota hai.

-

#10 Collapse

Forex Main Rounded Bottom Candlestick Pattern

Rounded bottom candlestick pattern forex trading mein ek ahem hawala hai. Ye pattern chart analysis ka aham hissa hai jo traders ko market trends aur price movements samajhne mein madad karta hai.

Taaruf

Rounded bottom candlestick pattern ek bullish reversal pattern hai jo market ke downtrend ko indicate karta hai. Is pattern mein candlesticks ki ek series hoti hai jo ek curve ki tarah neeche se ooper ki taraf badhti hai.

Pehchan

Is pattern ki pehchan karne ke liye traders ko chart par candlesticks ki series par nazar rakhni hoti hai. Yeh series neeche ki taraf chalti hai aur phir dhire dhire ooper ki taraf mudi hui hoti hai, jisse ek 'rounded bottom' banta hai.

Shuruat

Rounded bottom pattern ki shuruat mein market mein ek strong downtrend hota hai. Prices continuously neeche jaate hain aur phir ek point par stabilise ho jaate hain, jise rounded bottom kehte hain.

Toseef

Jab rounded bottom ban jaata hai, toh yeh indicate karta hai ke sellers ki power khatam ho rahi hai aur buyers market mein dakhil ho rahe hain. Yeh ek bullish signal hai ke market trend badalne wala hai.

Mawafiqat

Is pattern ko confirm karne ke liye, traders ko doosri technical indicators aur tools ka istemal karna hota hai jaise ki volume analysis aur trend lines. Agar doosri indicators bhi bullish signals show karte hain, toh rounded bottom ki mawafiqat aur bhi mazboot hoti hai.

Taaqat

Rounded bottom candlestick pattern ki taaqat us waqt zahir hoti hai jab ek strong support level ke qareeb yeh pattern ban raha ho. Support level se price bounce hone ka chance zyada hota hai, jo traders ke liye faida mand hota hai.

Inteshaar

Jab rounded bottom pattern confirm ho jaata hai aur price ne support level ko paar kar leti hai, toh yeh ek bullish reversal ka inteshaar indicate karta hai. Traders is time par long positions enter karte hain expecting ke price ab upar jaayega.

Nigha

Traders ko rounded bottom pattern ki nigha se market ke price action ko samajhna hota hai. Agar pattern sahi taur par identify kiya gaya hai aur confirmatory signals bhi hain, toh yeh ek mukhtasar arsay mein achhi munafa dene wala pattern hai.

Khataara

Hamesha yaad rahe ke har pattern ki tarah, rounded bottom pattern bhi 100% kaamyaab nahi hota. Market mein har waqt risk hota hai aur isliye traders ko apne risk management ko hamesha madde nazar rakhna chahiye.

Niyat

Rounded bottom pattern ko samajh kar trading ke liye niyat aur tawajjuh ki zaroorat hoti hai. Traders ko patience aur discipline ke saath is pattern ka istemal karna chahiye taake woh sahi waqt par entry aur exit points ko identify kar sakein.

Mukhtasir Mashwara

Rounded bottom pattern sirf ek piece of puzzle hai market analysis ka. Traders ko doosre technical aur fundamental factors ko bhi madde nazar rakhte hue trading decisions leni chahiye.

Khaas Tawajjuh

Rounded bottom pattern ko sahi taur par samajh kar istemal karne ke liye traders ko market ki trends aur price movements ko ghaur se dekhna hota hai. Iske saath saath, doosre technical indicators ka bhi istemal zaroori hai pattern ko confirm karne ke liye.

-

#11 Collapse

Forex Main Rounded Bottom Candlestick Pattern

Taaruf Rounded bottom candlestick pattern ek bullish reversal pattern hai jo market ke downtrend ko indicate karta hai. Is pattern mein candlesticks ki ek series hoti hai jo ek curve ki tarah neeche se ooper ki taraf badhti hai.

Pehchan

Is pattern ki pehchan karne ke liye traders ko chart par candlesticks ki series par nazar rakhni hoti hai. Yeh series neeche ki taraf chalti hai aur phir dhire dhire ooper ki taraf mudi hui hoti hai, jisse ek 'rounded bottom' banta hai.

Shuruat

Rounded bottom pattern ki shuruat mein market mein ek strong downtrend hota hai. Prices continuously neeche jaate hain aur phir ek point par stabilise ho jaate hain, jise rounded bottom kehte hain.

Toseef

Jab rounded bottom ban jaata hai, toh yeh indicate karta hai ke sellers ki power khatam ho rahi hai aur buyers market mein dakhil ho rahe hain. Yeh ek bullish signal hai ke market trend badalne wala hai.

Mawafiqat

Is pattern ko confirm karne ke liye, traders ko doosri technical indicators aur tools ka istemal karna hota hai jaise ki volume analysis aur trend lines. Agar doosri indicators bhi bullish signals show karte hain, toh rounded bottom ki mawafiqat aur bhi mazboot hoti hai.

Taaqat

Rounded bottom candlestick pattern ki taaqat us waqt zahir hoti hai jab ek strong support level ke qareeb yeh pattern ban raha ho. Support level se price bounce hone ka chance zyada hota hai, jo traders ke liye faida mand hota hai.

Inteshaar

Jab rounded bottom pattern confirm ho jaata hai aur price ne support level ko paar kar leti hai, toh yeh ek bullish reversal ka inteshaar indicate karta hai. Traders is time par long positions enter karte hain expecting ke price ab upar jaayega.

Nigha

Traders ko rounded bottom pattern ki nigha se market ke price action ko samajhna hota hai. Agar pattern sahi taur par identify kiya gaya hai aur confirmatory signals bhi hain, toh yeh ek mukhtasar arsay mein achhi munafa dene wala pattern hai.

Khataara

Hamesha yaad rahe ke har pattern ki tarah, rounded bottom pattern bhi 100% kaamyaab nahi hota. Market mein har waqt risk hota hai aur isliye traders ko apne risk management ko hamesha madde nazar rakhna chahiye.

Niyat

Rounded bottom pattern ko samajh kar trading ke liye niyat aur tawajjuh ki zaroorat hoti hai. Traders ko patience aur discipline ke saath is pattern ka istemal karna chahiye taake woh sahi waqt par entry aur exit points ko identify kar sakein.

Mukhtasir Mashwara

Rounded bottom pattern sirf ek piece of puzzle hai market analysis ka. Traders ko doosre technical aur fundamental factors ko bhi madde nazar rakhte hue trading decisions leni chahiye.

Khaas Tawajjuh

Rounded bottom pattern ko sahi taur par samajh kar istemal karne ke liye traders ko market ki trends aur price movements ko ghaur se dekhna hota hai. Iske saath saath, doosre technical indicators ka bhi istemal zaroori hai pattern ko confirm karne ke liye.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Main Rounded Bottom Candlestick Pattern

Rounded Bottom Candlestick Pattern ek market analysis technique hai jo ke trend reversal ke signals provide karta hai. Ye pattern typically downtrend ke baad ek potential trend reversal ko indicate karta hai.

Rounded Bottom Candlestick Pattern ka appearance kuch is tarah hota hai:

Downtrend ke baad: Agar market mein ek prolonged downtrend ke baad Rounded Bottom Candlestick Pattern dikhta hai, to ye bullish reversal ka indication ho sakta hai.

Gradual Recovery: Is pattern mein price gradually apne previous lows se recover karta hai aur ek rounded shape banata hai, jise rounded bottom kehte hain. Is phase mein, price mein stability dikhti hai aur sellers ki dominance kam hoti hai.

Volume Analysis: Is pattern ke sath typically volume analysis bhi kiya jata hai. Agar pattern ke sath increasing volume dikhta hai, to ye pattern ka validity aur strength ko enhance karta hai.

Rounded Bottom Candlestick Pattern ke mukhya feature ye hai ke ismein price gradual recovery aur stability dikhta hai, jo bearish trend ko indicate karta hai. Jab ye pattern form hota hai, to ye bullish reversal ke possibility ko darust karta hai.

Rounded Bottom Candlestick Pattern ka importances aur benefits kuch is tarah hain:

Trend Reversal Indication: Rounded Bottom Candlestick Pattern ek potential trend reversal ko indicate karta hai. Agar ek strong downtrend ke baad ye pattern form hota hai, to ye bullish reversal ke signals provide karta hai.

Entry Points Identification: Is pattern ke appearance ke baad, traders entry points identify kar sakte hain jahan se wo bullish trend ke liye trade enter kar sakte hain.

Confirmation with Other Indicators: Rounded Bottom Candlestick Pattern ko dusre technical indicators aur price action signals ke saath combine karke confirm kiya ja sakta hai. Is pattern ko confirm karne ke liye, traders ko volume analysis aur doosre reversal indicators ka bhi istemal karna chahiye.

Overall, Rounded Bottom Candlestick Pattern ek useful market analysis technique hai jo trend reversal ko spot karne mein madad karta hai. Lekin, is pattern ko samajhne aur istemal karne ke liye, traders ko practice aur experience ki zarurat hoti hai.

-

#13 Collapse

Forex Main Rounded Bottom Candlestick Pattern

unded Bottom Candlestick Pattern, jo ke forex trading mein dekha jata hai, ek price action pattern hai jo typically downtrend ke baad ek reversal signal provide karta hai. Is pattern mein, candlestick charts par price movements ko dekhte hue ek round shape ki bottom formation observed hoti hai, jo ke market ke price mein ek potential reversal ko darust karta hai.

Yeh pattern traders ko market ki direction ka change samajhne mein madad karta hai. Jab market ek downtrend mein hota hai aur phir price bottom par aake stable ho jata hai, jisse ki bottom formation ban jati hai, to yeh ek indication hoti hai ke sellers ki control weaken ho rahi hai aur buyers ka dominance barh raha hai. Is tarah ka pattern dekh kar traders uptrend ki shuruwat ka expectation rakhte hain.

Rounded Bottom Candlestick Pattern ki pehchan karne ke liye traders candlestick charts par price action ko closely observe karte hain. Is pattern mein typically kuch candlesticks ki formation dekhi jati hai jo ke downtrend ke baad price ki stabilization ko represent karte hain. Jab price ek round shape ki bottom formation complete karta hai, jismein price gradual tarz par upar jaane lagta hai aur phir stability ke baad strong uptrend shuru hota hai, tab traders ko is pattern ki confirmation milti hai.

Yeh pattern ko confirm karne ke liye traders dusre technical indicators aur tools ka bhi istemal karte hain jese ke volume analysis, moving averages, aur trend lines. In sab factors ko mila kar dekhte hue traders apni trading decisions banate hain.

Rounded Bottom Candlestick Pattern ek powerful reversal signal ho sakta hai lekin yeh bhi yaad rakhna zaroori hai ke kisi bhi single pattern par pura bharosa na rakha jaye. Iske saath, proper risk management aur confirmation ke liye dusre technical factors ka bhi dhyan rakha jana chahiye.

- CL

- Mentions 0

-

سا0 like

-

#14 Collapse

Rounded Bottom Candlestick Pattern

Rounded Bottom" candlestick pattern, jise "saaf" taur par "round bottom" pattern bhi kaha jata hai, ek bullish reversal signal hai jo chart analysis mein istemal hota hai. Yeh pattern typically downtrend ke baad aata hai aur ek trend reversal ya price recovery ko darust karta hai.

Is pattern ka appearance is tarah hota hai:- Price Downtrend: Pehle, asset ya security ka price ek sustained downtrend mein hota hai.

- Bottom Formation: Downtrend ke baad, price gradually apni downward movement ko slow karta hai aur ek "rounded" ya "saaf" shape banata hai. Iska matlab hai ke price ka movement gradually flat ya sideways ho raha hai.

- Uptrend Initiation: Downtrend ke baad, price ka movement phir se upward direction mein shift hota hai aur uptrend shuru hota hai.Rounded Bottom pattern ka interpretation hota hai ke downtrend ke baad market sentiment mein change aya hai aur buyers market mein control regain kar rahe hain. Yeh ek bullish reversal signal provide karta hai, indicating a potential trend reversal from bearish to bullish.

Treading Analysis

Traders is pattern ko confirm karne ke liye doosre technical indicators aur tools ka bhi istemal karte hain. Yeh pattern effective ho sakta hai jab woh significant support levels ke near ya downtrend ke baad dikhai jaaye. Trading decisions ko lene se pehle market ke overall context, trend, aur doosre relevant factors ko bhi madde nazar rakha jana chahiye.Rounded Bottom pattern ek important bullish reversal signal hai lekin yeh zaroori nahi hai ki har bar yeh reversal hoga. Isliye, prudent trading ke liye aur bhi confirmation aur risk management tools ka istemal kiya jata hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

rounded bottom candlestick pattern

Rounded Bottom Candlestick Pattern:

Rounded Bottom Candlestick Pattern Kya Hai?

Rounded Bottom Candlestick Pattern ek bullish reversal pattern hai jo market mein trend change ko indicate karta hai. Is pattern mein price initially downtrend mein hoti hai, phir gradual sa rounded bottom banati hai, aur phir upward trend shuru hota hai.

Rounded Bottom Candlestick Pattern Ki Tafseel:- Structure (Banawat): Rounded Bottom pattern typically do se teen candlesticks ya phir ek extended period ko cover karta hai.

- Is pattern mein pehli candlestick mein downtrend ka indication hota hai.

- Doosri aur teesri candlesticks mein gradual sa rounded bottom formation hoti hai jismein lower lows aur higher lows dikhai dete hain.

- Price ka gradual rise is pattern ke completion ko indicate karta hai.

- Characteristics (Khasiyat):

- Downtrend ke baad gradual sa price stabilization aur bottoming out process hoti hai.

- Candlesticks ki bodies lambi hoti hain aur shadows (ya wicks) minimal ya negligible hote hain.

- Volume ke bhadane ki possibility hoti hai, indicating buying interest.

Rounded Bottom Candlestick Pattern Ka Istemal:- Bullish Reversal Signal (Bullish Ulat Jhukav Ka Signal): Rounded Bottom pattern ek bullish reversal signal provide karta hai. Yeh pattern downtrend ke baad dikhai deta hai aur bullish trend ka shuru hone ka indication deta hai.

- Confirmation Ke Liye: (Tasdeeq Ke Liye): Rounded Bottom pattern ko confirm karne ke liye, traders ko doosre technical indicators aur price action ke saath combine karke confirmation hasil karna chahiye. Agar rounded bottom ke baad confirmatory signals milti hain, toh yeh bullish reversal ka strong indication ho sakta hai.

- Entry Aur Exit Points (Daakhil Aur Nikalne Ke Points): Rounded Bottom pattern ke hone par traders bullish positions mein enter kar sakte hain ya existing short positions ko exit kar sakte hain. Agar rounded bottom ke baad confirmatory signals milte hain, toh traders apne trading strategies ke mutabiq entry aur exit points decide kar sakte hain.

Nateeja:

Rounded Bottom Candlestick Pattern ek bullish reversal pattern hai jo market trend ke reversal ki possibility ko indicate karta hai. Traders ko is pattern ke formations ko samajhna aur uske saath dusre technical indicators ko combine karke trading decisions lene mein madad milti hai. Magar hamesha yaad rahe ke kisi bhi trading decision se pehle thorough analysis aur risk management ki zaroorat hoti hai.

- Structure (Banawat): Rounded Bottom pattern typically do se teen candlesticks ya phir ek extended period ko cover karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:22 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим