What is the mat hold candlestick pattern?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

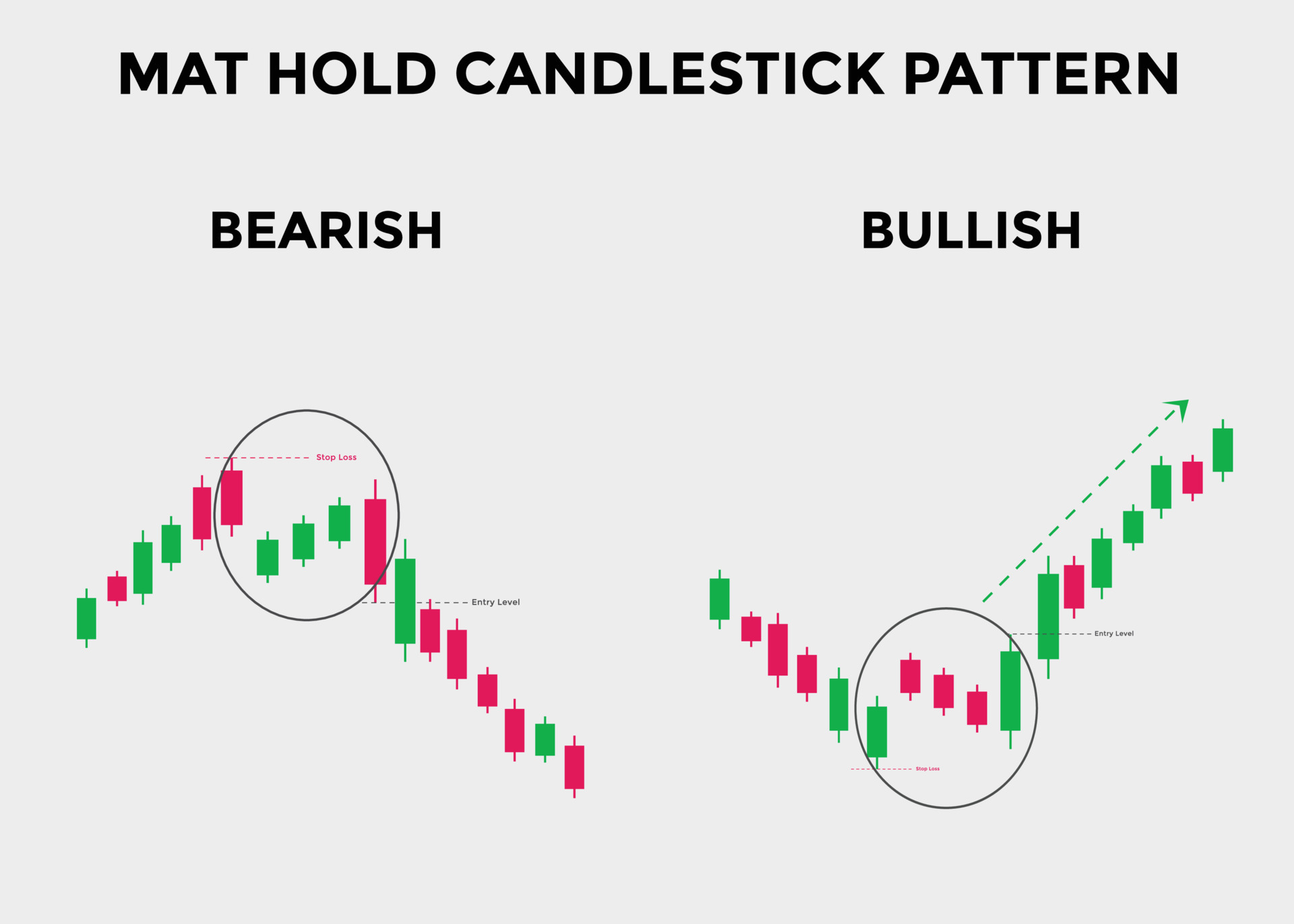

WHAT IS MAT HOLD CANDLESTICK PATTERN: Mat hold pattern five candlestick formation ha ya signals data ha continuation ka ongoing trend ka. Ya chart pattern ha or ya shows karta ha market ki corrections or take profit ka zones ko is ka trend ka continues hona sa phalay or is ma trade ka batata ha same direction ma. Jo logic ha is pattern ka pitcha wo ya ha ka koi bhi trend hota ha is ka must hota ha pullback,retracement, or price ka correction hona ka is trend ka continues ma initial direction ma move hona da pahlay. Ya jo mat hold pattern jab ya banta ha to is ma price correction hoti ha market ma or ya huma provide karti ha ideal entry level ka jab ongoing trend ho ga. Is pattern ka similar structure hota ha jasa rising or falling three method pattern hota ha , traders cosider karta ha mat hold pattern ko zada reliable jab is ma minor gap ata ha or ya banta ga first positive candle ka bad. HOW TO IDENTIFY AND USE MAT HOLD PATTERN: Is mat hold pattern ko identify karna ka liya zaruri ho ga ka ya pattern follow karay in points ko : 1: Jab bhi ya mat hold pattern banay ga to is time par koi trend chal raha ho ga ya bullish bhi ho sakta ha or bearish trend bhi. 2: Ya pattern bana hota ha five candlesticks ka sath. Is ma first bullish a bearish candle hoti ha or is ko followed karti ha three opposite candles hoti ha,or last ma same direction first candle wali candle hoti ha. 3: Last candle is pattern ki bullish ta bearish ho ge or ya close above or below ma ho ge previous fourth candle ka. EXAMPLE PF MAT HOLD PATTERN: Jasa ka abova ka chart ma mat hold ki exame ko dalh sakta ha, ya mat hold pattern bana ha jab ongoing uptrend ha. Is ma dakh saktaha ka is ma bearish ki three candles bani ha or ya middle ma validate kar rahi ha or jo is ma market participants ha forex market ma ya captured ho raha ha phir sa. Jab is ma correction completed hoi ha ,to jo bullish ki fifth candle ha ya confirm kar raha ha mat hold pattern ko ,or ya bullish trend ka continues hona ka bata raha ha. In points ko follow karna hp ga agar us mat hold pattern ko sai sa use or is ma correctly trade karna chata ha: 1: Is ma sab sa phalay identify karay ga market ka correction ko jab ongoing trend ho ga ya bullish bhi ho sakta ha or bearish bhi, is ma first candle current trend ko follow karta hua bullish ki ya bearish ki banay ge or is first candle or market ka trend ka opposite direction ma three candles ho ge. 2: Wait karay ga is ma fifth candle ka la is ma ya close above ma ya phir below ma ho is pattern ki fourth candle ka or is ma enter karay ga posituon ko jab last candle completed ho jay ge. 3: Is ma use karay ga Fibonacci retracement levels ko or set karay ga entry level,stop loss or take profit ko. 4: Use karay ga is ma risk reward ratio ko or is ma determine karay ga apna exit points ko. TRADE USING MAT HOLD CANDLESTICK PATTERN: Trading karay ga mat hold pattern ma is ka matlab ha ka is ma dakha ga or join karay ga existing trend ko. Is ma waiting karay ga market ka retrace hona ka or is ma get karay ga chance ko join karna ko bandwagon ko kisi bhi high risk ko na la kar. Ya mat hold pattern banay ga jab bullish ka trend ho ga ya bearish trend ho ga. Ya continuation chart pattern ha ,is ko zada acha use kar sakta ha is ko combine kar ka Fibonacci retracement levels sa or is ma sai sa support or resistance levels ko dakhta ha. 1: BULLISH MAT HOLD PATTERN AND FIBONACCI LEVELS: Ya bullish mat hold candlestick pattern chart ma five candlestick sa specific sequencea ma ho ga,or ya banay ga jab uptrend chal rha ho ga market ma price ka or ya signal da ga stock ki price upwards ki janab trend ko continues karta hua jay ge. Is pattern ki first candle uptrend sa bullish ki long candle banay ge or is ko follows karay gi three small bearish ki candles ,or jo last fight candle ha ya phir sa ak long bullish ki candle ho ge or ya uptrend or first candle ko follow karta hua high ma jay ge ,or ya chart ma close abpve ma ho ge fourth candle sa. Is pattern ka sath hum use karay ga Fibonacci retracement levels ko or is sa huma mila ga best stopbloss ,entry level or profit target ka. Jasa ka abova ma chart ko dakh sakta ha is ma drawing kiya ha Fibonacci retracement ho highest or lowee ma previous wala trend ka or ya huma bata raha ba support or resistance levels ka. Jab is mat hold pattern ko identifying kar lata ha upward ku movement ma to is ka bad is ma dalha ga Fibonacci level ko or is ma enter karay ga long position ko jab is pattern ki last candle close ho jay ge or ya 50.0% line ho ge, or jo is ma stop loss ha is ko placed karay ga 23.6% or 0.0% levels par or jo take profit ho ga os ko set karay ga 61.8% or 78.6% par Fibonacci levels par. 2: BEARISH MAT HOLD PATTERN AND FIBONACCI LEVELS: Bullish mat hold pattern ka opposite side par bearish mat hold pattern ho ga or is ko inverted mat hold pattern bhi kahta ha. Is bearish mat hold pattern ki first ak long bearish ki candle hoti ha jo ka bearish ongoing trend ma banti ha or is ko three small candle follow karti ha jo ka is ka opposite ma bullish ki candle hoti ha or fifth cande phir sa ak long bearish ki candle hoti ha or ya downtrend ko continues karna ka kam karti ha or ya close below ma hoti ha apbi previous three small candlestick sa. Is ma jo higher ma chart ha is ma use kiya ha Fibonacci retracement ko or is ma dakh sakta ha ya pattern jab bana ha os time par downward ka trend ha. Is ma dalh sakta ha jo 38.2% ka level ha ya ideal level ha entering karna ka short selling position ko or is ma jo target zone o ga ya following kar raha ho ga fib levels ko. Or is case ma stop loss kobabove ma place karay ga highest level la is pattern ki third bullish ki candle ka. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction. MAT Hold, yaani "Moving Average Tak" ek mumtaz candlestick pattern hai jo technical analysis mein istemal hota hai. Candlestick patterns share market ya forex trading mein price movements ko samajhne ke liye istemal kiye jate hain. MAT Hold pattern ko samajhne ke liye neeche diye gaye mukhtasar tareeqay se explain karenge: MAT Hold Pattern Kya Hai. MAT Hold, "Moving Average Tak Hold" ka short form hai. Is pattern mein do candlesticks hote hain jo Moving Average line ke qareeb close hote hain. Ek chota candlestick ek badi candlestick ke sath hota hai, aur dono mein se bada candlestick pehle hota hai. Is pattern ko "Tak Hold" kehte hain kyunke bada candlestick moving average line ko "hold" karta hai ya usay touch karta hai. MAT Hold Pattern Formation. MAT Hold pattern ka formation neeche diye gaye tareeqay se hota hai. Sabse pehle, market mein ek uptrend ya downtrend hona zaroori hai. Phir, ek bada bullish (upward) candlestick banta hai jo moving average line ke qareeb close karta hai. Uske baad, ek chota bearish (downward) candlestick banta hai jo bade candlestick ki body ke andar rehta hai aur moving average line ko touch karta hai. Bullish MAT Hold Pattern. Agar MAT Hold pattern ek uptrend mein ban raha hai, to isay "Bullish MAT Hold Pattern" kehte hain. Is pattern ko samajhne ke liye neeche diye gaye points ko follow karen. Pehla candlestick bada bullish (upward) candlestick hota hai jo moving average line ko touch karta hai. Dusra candlestick chota bearish (downward) candlestick hota hai jo pehle candlestick ki body ke andar rehta hai aur moving average line ko touch karta hai. Bearish MAT Hold Pattern. Jab MAT Hold pattern downtrend mein ban raha hota hai, to isay "Bearish MAT Hold Pattern" kehte hain. Is pattern ko samajhne ke liye neeche diye gaye points ko follow karen. Pehla candlestick bada bearish (downward) candlestick hota hai jo moving average line ko touch karta hai. Dusra candlestick chota bullish (upward) candlestick hota hai jo pehle candlestick ki body ke andar rehta hai aur moving average line ko touch karta hai. MAT Hold pattern bullish ya bearish trends mein price reversal ke indication ke taur par istemal hota hai. Is pattern ko samajhne ke liye technical analysis tools jaise Moving Averages ka istemal hota hai jo price trends ko smoothen karte hain. Jab bada candlestick moving average line ko touch karta hai, to yeh ek strong buying ya selling signal ho sakta hai. MAT Hold Pattern Ka Istemal. Traders aur investors MAT Hold pattern ka istemal karke entry aur exit points tay karte hain. Agar bullish MAT Hold pattern ban raha hai to log long positions lete hain, jabki bearish MAT Hold pattern mein short positions lete hai MAT Hold pattern ek reliable signal hai, lekin kisi bhi trading strategy mein risk hota hai. Traders ko stop-loss orders ka istemal karke apne positions ko protect karna chahiye. Technical analysis ke sath fundamental analysis aur risk management ka bhi istemal karna zaroori hai. -

#4 Collapse

Mat Hold candlestick pattern ek aisa continuation pattern hai jo forex market mein traders istemal karte hain taakey potential trends ko pehchanein. Ye pattern paanch candlesticks se mil kar bana hota hai aur trend continuation ka strong signal samjha jata hai. Traders is pattern ko khaas tawajju dete hain kyun ke ye market ki taraf ki manzil aur trading opportunities mein ahem insights faraham kar sakta hai.

Components of Mat Hold Pattern

Mat Hold pattern mein paanch ahem components hote hain: pehli candlestick bearish hoti hai, jo ke significant downward movement ko darust karti hai. Dusri candlestick ek choti bullish candlestick hoti hai jo ke peechle close se zyada open hoti hai lekin pehli candlestick ka midpoint cross kar ke close hoti hai. Teesri candlestick ek lambi bullish candlestick hoti hai jo peechle close se ooper open hoti hai aur pehli candlestick ke qareeb close hoti hai. Chouthi candlestick phir se ek choti bullish candlestick hoti hai, peechle close se ooper open hoti hai lekin teesri candlestick ka midpoint cross kar ke close hoti hai. Aakhir mein, paanchvi candlestick ek lambi bullish candlestick hoti hai jo peechle close se ooper open hoti hai aur teesri candlestick ke qareeb close hoti hai.

Formation of Mat Hold Pattern

Mat Hold pattern ka formation ek khaas sequence of candlesticks ko follow karta hai, jo ke ek strong bearish candlestick se shuru hota hai aur phir aane wali bullish candlesticks ki series ke saath badhte hue buying pressure ko dikhata hai. Ye pattern aam tor par ek strong uptrend ke andar hota hai, jo temporary pause ya consolidation ko darust karta hai pehle ke trend ke shuru hone se pehle.

Traders Mat Hold pattern ka khaas tawajju dete hain kyun ke ye suggest karta hai ke bullish trend consolidation phase ke baad jaari rahega. Ye pattern ye bhi darust karta hai ke temporary pullback ya consolidation ke bawajood, buyers ab bhi control mein hain aur future mein prices ke liye strong possibilities hain.

Trading Strategies with Mat Hold Pattern

Mat Hold pattern ko trade karte waqt, traders aksar confirmation ke liye intezaar karte hain, teesri candlestick ke close ke qareeb paanchvi bullish candlestick ko dekh kar. Ye bullish trend continuation ke strength ko confirm karta hai. Traders jab pattern confirm ho jaye, to long positions mein enter karte hain, preferably stop-loss ko pehli candlestick ke low ke neeche rakhte hue risk ko manage karte hain. Woh target levels set kar sakte hain technical analysis tools jaise ke Fibonacci retracement levels, peechle swing highs, ya trendline projections ke basis par.

Proper risk management Mat Hold pattern ko trade karte waqt ahem hai, kyun ke false signals ya market reversals ho sakte hain. Traders ko stop-loss orders aur position sizing ka istemal kar ke risk ko control karna chahiye. Is pattern ki analysis ko combine karke aur doosre technical indicators, risk management strategies, aur market context ko dhyan mein rakhte hue traders informed trading decisions le sakte hain.

Jabke Mat Hold pattern clear signals of trend continuation faraham karta hai, traders ko hamesha caution rakni chahiye aur kisi bhi single pattern ya indicator par rely karne se bachna chahiye trading decisions mein. Market conditions, volatility, aur doosre factors is pattern ke effectiveness par asar dal sakte hain, isliye traders ko comprehensive approach apnana chahiye apne trading strategies mein.

Advantages of Mat Hold Pattern

Mat Hold pattern ke faide mein clear trend continuation signal, defined entry aur exit points, aur favorable risk-reward ratios shaamil hain jab sahi risk management techniques ke saath istemal kiya jata hai. Traders ko pattern ka appreciation hota hai bullish trends ko confirm karne mein aur potential price movements par guidance dene mein.

Disadvantages of Mat Hold Pattern

Magar, Mat Hold pattern ke kuch nuqsan bhi hote hain. False signals ka samna ho sakta hai jo ke losses ka sabab ban sakte hain agar traders sirf is pattern par rely karte hain aur doosre factors ko ignore karte hain. Market volatility bhi pattern ke reliability par asar daal sakti hai, sudden price movements pattern ko invalidate kar sakti hain ya stop-loss orders ko pehle activate kar sakti hain. Iske alawa, pattern ka effectiveness market conditions par depend karta hai, jaise trending vs. ranging markets, liquidity, aur news events.

Mat Hold candlestick pattern ek valuable tool hai forex traders ke liye jo trend continuation opportunities ko pehchanna aur unse faida uthana chahte hain. Traders ko is pattern ki analysis ko doosre technical indicators, risk management strategies, aur market context ke saath combine karke informed trading decisions leni chahiye. Jabke pattern clear signals of trend continuation faraham karta hai, traders ko hamesha caution maintain karni chahiye aur kisi bhi single pattern ya indicator par rely karne se bachna chahiye trading decisions mein. Comprehensive approach trading mein, multiple factors aur strategies ko shaamil karke, trading success ko enhance karta hai aur risks ko minimize karta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

Mat Hold Candlestick Pattern (میٹ ہولڈ کینڈلسٹک پیٹرن)

1. تعارف:

Mat Hold Candlestick Pattern ek bullish continuation pattern hai jo uptrend ke doran develop hota hai.

2. پیٹرن کی خصوصیات:

Pehle din ek strong uptrend hota hai.

Dusre din ek gap down open hota hai, lekin price phir se uptrend ki direction mein move karta hai.

Dusre din ka low pehle din ke uptrend ke range mein rehta hai.

Iske baad, price phir se uptrend mein continue karta hai.

3. پیٹرن کا تصدیق:

Is pattern ko confirm karne ke liye, traders volume ki tafteesh karte hain. Agar volume dusre din bhi high hai, to yeh pattern aur bhi powerful hota hai.

4. تشخیص:

Jab ek gap down ke baad price phir se uptrend ki direction mein move karta hai aur dusre din ka low pehle din ke range mein rehta hai, to yeh Mat Hold pattern ka ek indication hota hai.

5. مواقع استعمال:

Traders is pattern ko uptrend ke doran continuation ke liye istemal karte hain.

Is pattern ke mukhtalif variations ko dekhte hue, traders apni entry aur exit points tay karte hain.

6. اہمیت:

Mat Hold pattern ek strong continuation signal provide karta hai, lekin isko confirm karne ke liye volume ki tafteesh zaroori hai.

Is pattern ko sahi taur par pehchan karne ke liye, traders ko candlestick chart analysis mein maharat honi chahiye.

7. ختم:

Mat Hold Candlestick Pattern ek bullish continuation pattern hai jo uptrend ke doran traders ko entry points provide karta hai. Is pattern ko samajhna aur sahi taur par istemal karna traders ke liye ahem hai, lekin proper risk management ke sath.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Mat Hold Candlestick pattern ek mukhtasar lekin ahem technical analysis tool hai jo stock market aur trading mein istemal hota hai. Ye pattern candlestick charts par dekha jata hai aur traders ke liye ek mukhtasar trend continuation ya reversal signal hai. Is article mein hum Mat Hold Candlestick pattern ke bare mein mukhtasar taur par baat karenge aur iske kuch ahem pehluon ko samjheinge.

1. Mat Hold Candlestick Pattern Kya Hai?

Mat Hold Candlestick pattern ek bullish continuation pattern hai jo market mein uptrend ke doran dikhai deta hai. Ye pattern bearish trend ke doran bhi dekhne ko milta hai, lekin zyadatar traders isay bullish continuation signal ke roop mein dekhte hain. Is pattern mein ek series ke kuch bullish candles hoti hain jo ek kisi bearish candle ko follow karti hain. Iske baad ek lambi bullish candle aati hai jo pehle bearish candle ke rang mein rehti hai.

2. Pattern Ki Tashkeel

Mat Hold Candlestick pattern ki tashkeel mein do ahem elements hote hain:- Ek bearish candlestick: Ye pehli candle hoti hai jo downtrend ke doran dikhai deti hai.

- Lambi bullish candlestick: Ye doosri candle hoti hai jo pehli candle ke neechay ya qareeb hoti hai aur lambi body ke sath upar jaati hai.

3. Kaise Pehchanein Mat Hold Candlestick Pattern?

Mat Hold Candlestick pattern ko pehchanne ke liye kuch zaroori points hain:- Pehli candle bearish honi chahiye aur downtrend ke doran form honi chahiye.

- Doosri candle lambi bullish candle honi chahiye.

- Doosri candle ki body pehli candle ke neechay ya qareeb honi chahiye.

- Doosri candle ki body lambi honi chahiye aur ideally pehli candle ke range mein rehni chahiye.

4. Pattern Ki Tasdeeq

Mat Hold Candlestick pattern ki tasdeeq ke liye traders ko kuch aur technical indicators ka istemal bhi karna chahiye. Ismein volume analysis aur trend indicators jaise ki moving averages ka istemal kiya ja sakta hai. Agar doosri candle mein zyada volume hai aur trend indicators bhi bullish signals de rahe hain, to pattern ki tasdeeq ho sakti hai.

5. Trading Strategies

Mat Hold Candlestick pattern ko samajhne ke baad traders iska istemal apni trading strategies mein shamil kar sakte hain. Kuch traders sirf is pattern ki base par trading karte hain jab market mein strong trend ho. Doosre traders ise confirmation ke roop mein istemal karte hain aur aur technical indicators ke sath mila kar entry aur exit points tay karte hain.

6. Mat Hold Candlestick Pattern Ki Ahmiyat

Mat Hold Candlestick pattern ki ahmiyat market trends ko samajhne mein hoti hai. Ye pattern uptrend ke continuity ka signal deta hai aur traders ko bullish momentum ka pata lagane mein madad karta hai. Iske istemal se traders ko sahi entry aur exit points ka pata lag sakta hai.

7. Conclusion

In conclusion, Mat Hold Candlestick pattern ek mukhtasar lekin ahem tool hai jo traders ko market trends ka pata lagane mein madad karta hai. Is pattern ko samajh kar aur sahi tarike se istemal karke traders apni trading strategies ko mazbooti se bana sakte hain. Zaroori hai ke traders is pattern ko samajhne ke liye practice karein aur sahi technical analysis ka istemal karen -

#7 Collapse

Candlestick charting ek powerful tool hai jo traders ko market trends aur price movements ka analysis karne mein madad karta hai. Ek aham candlestick pattern jo traders ke liye useful hai, woh hai "Mat Hold." Yeh pattern trend continuation ke liye istemal hota hai aur agar aap trading mein naye hain toh yeh aapke liye ek mufeed introduction ho sakta hai. Is article mein hum "Mat Hold" candlestick pattern ke bare mein gehraai se baat karenge.

1. Mat Hold Ki Tareef

Mat Hold ek bullish candlestick pattern hai jo trend continuation ko darust karti hai. Is pattern mein ek uptrend hoti hai aur phir ek choti si correction aati hai jise ek khaas tarah ka candlestick formation follow karta hai. Mat Hold pattern mein, pehla candle ek lamba bullish candle hota hai jo uptrend ko confirm karta hai. Phir doosre candle mein thori si downward movement hoti hai, lekin yeh candle pehle candle ke kuch hisse ko cover karta hai aur trend ko continue karne ka signal deta hai.

2. Mat Hold Ka Formation

Mat Hold pattern ka formation kuch is tarah hota hai:- Pehla candle: Lamba bullish candle jo uptrend ko confirm karta hai.

- Doosra candle: Thori si downward movement ke baad bhi pehle candle ke kuch hisse ko cover karta hai aur downtrend ki strength ko dikhata hai.

Is pattern mein doosre candle ka open pehle candle ke close ke qareeb hota hai aur iska close pehle candle ke kuch hisse ke neeche hota hai.

3. Mat Hold Ka Matlab

Mat Hold pattern ka matlab hota hai ke uptrend mein choti si correction hone ke baad bhi bullish momentum barkarar hai aur price phir se upar ki taraf jaane ki sambhavna hai. Is pattern ko dekhte hue traders trend ko follow kar sakte hain aur sahi samay par entry aur exit points decide kar sakte hain.

4. Mat Hold Ka Istemal

Mat Hold pattern ko samajhne ke baad, traders iska istemal karke apni trading strategy ko improve kar sakte hain. Agar kisi stock ya anya financial instrument par Mat Hold pattern detect hota hai, toh traders long positions enter kar sakte hain ya existing positions ko hold kar sakte hain. Is pattern ke confirmation ke liye traders ko price movement aur volume ko bhi monitor karna chahiye.

5. Mat Hold Vs. Other Patterns

Mat Hold pattern ko doosre candlestick patterns se compare karke samajhna bhi zaroori hai. Is pattern ka mukabla kiya jata hai doji, hammer, aur doosre reversal patterns ke saath. Har ek pattern apne unique characteristics aur trading implications ke saath aata hai, isliye traders ko market conditions ke hisaab se inhe distinguish karna important hai.

6. Mat Hold Ki Trading Strategies

Mat Hold pattern ko samajh kar traders apni trading strategies ko enhance kar sakte hain. Yeh pattern ek strong bullish signal deta hai, isliye traders isko dekhte hue long positions enter karte hain ya existing positions ko hold karte hain. Iske alawa, stop-loss aur target levels ko bhi set karte hue traders apni risk management ko improve kar sakte hain.

7. Conclusion

Mat Hold candlestick pattern ek powerful tool hai jo traders ko uptrend continuation ke signals provide karta hai. Is pattern ko samajh kar aur sahi tareeke se istemal karke, traders apni trading performance ko improve kar sakte hain. Lekin, jaise har ek technical analysis tool ki tarah, Mat Hold pattern ko bhi dusri confirmatory indicators ke saath istemal karna zaroori hai aur risk management ko dhyan mein rakhna chahiye. Is pattern ko samajhne ke liye practice aur experience ki zaroorat hoti hai, isliye naye traders ko dhairya aur mehnat se kaam karna chahiye. -

#8 Collapse

What is the mat hold candlestick pattern?

"Mat Hold" candlestick pattern ek bullish continuation pattern hai jo traders market analysis mein istemal karte hain. Yeh pattern ek uptrend ke beech mein dikhta hai aur bullish momentum ka continuation indicate karta hai. "Mat Hold" ka naam isliye hai kyunki ismein ek large green (bullish) candlestick ka body ek small red (bearish) candlestick ke body ko partially hold karta hai.

Yahan Mat Hold candlestick pattern ke key points hain:

Context: Mat Hold pattern existing uptrend ke dauran dikhta hai jab market mein bullish sentiment hai aur price mein upside movement ho raha hai.

First Candle (Pehla Candlestick): Pehla candlestick ek large green (bullish) candle hota hai jo uptrend ko reflect karta hai. Is candle ka body lamba hota hai aur high volume ke sath trade hota hai.

Second Candle (Dusra Candlestick): Dusra candlestick ek small red (bearish) candle hota hai jo pehle candlestick ke body ko partially hold karta hai. Is candle ka body short hota hai aur low volume ke sath trade hota hai.

Third Candle (Teesra Candlestick): Teesra candlestick ek large green (bullish) candle hota hai jo pehle candlestick ke body ko hold karta hai. Is candle ka body pehle candle ke body mein fit hota hai aur high volume ke sath trade hota hai.

Confirmation: Mat Hold pattern ko confirm karne ke liye traders volume ki bhi observation karte hain. Agar teesra candlestick ke sath sath volume bhi increase ho rahi hai, toh yeh bullish continuation ka signal ko strengthen karta hai.

Mat Hold pattern ka istemal karke traders existing bullish momentum ka continuation expect karte hain aur buying opportunities ko spot karte hain. Lekin yaad rahe ke har ek pattern ki tarah, Mat Hold pattern bhi akela indicator nahi hota aur dusre technical analysis tools aur indicators ke saath mila kar istemal kiya jata hai trading decisions mein.

Note: Technical analysis patterns aur concepts ki samajh ke liye, traders ko market ke current conditions aur trend ko bhi dekhna chahiye. False signals bhi ho sakte hain, isliye risk management ka dhyan rakhna zaroori hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Mat Hold candlestick pattern ek technical analysis tool hai jo traders ko market trends aur price movements ko samajhne mein madad deta hai. Ye pattern ek bullish continuation pattern hai, jo ke uptrend ke doran dikhai deta hai aur traders ko future price movements ke liye guide karta hai.

Mat Hold pattern ek series of candlesticks se bana hota hai, jo ke ek uptrend ke doran dikhai dete hain. Ye pattern generally 5 candlesticks se bana hota hai, jinme se pehla candlestick ek long white (bullish) candle hota hai jo ke existing uptrend ko confirm karta hai.

Doosra candlestick bhi white (bullish) hota hai aur iska close pehle candlestick ke upper part ke qareeb hota hai, indicating continuation of the uptrend. Teesra, chautha, aur paanchwa candlesticks ek range-bound pattern follow karte hain, jahan par price kuch fluctuation dikhata hai magar overall uptrend intact rehta hai.

Mat Hold pattern ka mukhya pehchanne ka tareeqa ye hai ke traders ko is pattern mein ek clear uptrend dekhna hota hai, followed by a series of candlesticks jo ke ek range-bound pattern mein hoti hain lekin overall uptrend ko confirm karti hain.

Is pattern ko samajhne ke liye, traders ko market ke overall context ko bhi dekhna zaroori hota hai. Agar market mein strong uptrend hai aur Mat Hold pattern dikhai deta hai, to ye ek bullish continuation signal ho sakta hai aur traders ko future price movements ke liye guide karta hai.

Mat Hold pattern ka istemal karke, traders apne trading strategies ko improve kar sakte hain aur better trading decisions le sakte hain. Is pattern ko dekh kar traders apne entry aur exit points ko define kar sakte hain aur market ke potential continuation ko anticipate kar sakte hain.

In conclusion, Mat Hold candlestick pattern forex trading mein ek important technical analysis tool hai jo traders ko bullish trends ko identify karne mein madad karta hai. Is pattern ko dekh kar traders future price movements ko predict kar sakte hain aur apne trading strategies ko improve kar sakte hain.

-

#10 Collapse

What is the mat hold candlestick pattern?

Mat Hold Candlestick Pattern ek bullish continuation pattern hai jo stock market mein dekha jata hai. Ye pattern trend ke continuation ko darust karta hai aur traders ko existing uptrend mein trading opportunities dhoondhne mein madad karta hai. Is pattern ko dekh kar traders ko bullish momentum ki jariyat ka andaza lag jata hai aur unhe market mein further upside movement ka expectation hota hai.

Mat Hold pattern ko samajhne ke liye, pehle toh traders ko candlesticks ki formation par dhyan dena hota hai. Ye pattern generally kuch consecutive bullish candlesticks se banta hai jo ek uptrend ke doran dikhte hain. Phir, ek bearish candlestick aata hai jo pehle bullish candlesticks ke beech mein hota hai lekin overall trend ke khilaf hota hai.

Iske baad, ek ya multiple small bullish candlesticks aate hain jo bearish candlestick ke baad dikhte hain. Ye small bullish candlesticks uptrend ke continuation ko darust karte hain aur indicate karte hain ke bullish momentum abhi bhi strong hai.

Iske baad, ek long bullish candlestick aata hai jo pehle bearish candlestick ke bottom se start hota hai aur uptrend ke continuation ko confirm karta hai. Is long bullish candlestick ko "Mat Hold" candlestick kehte hain.

Mat Hold pattern ki wazahat ke liye, pehle bearish candlestick ko "opening marubozu" ya "black marubozu" kehte hain jo market mein selling pressure ko darust karta hai. Iske baad aane wale small bullish candlesticks bullish momentum ko indicate karte hain aur ye uptrend ke continuation ko darust karte hain.

Phir, Mat Hold candlestick aata hai jo pehle bearish candlestick ke bottom se shuru hokar upward movement karta hai aur ek lambi bullish candlestick ki shakal mein hota hai. Is long bullish candlestick ke jalne se pehle wale bearish candlestick ko engulf karta hai aur bullish trend ko confirm karta hai.

Traders Mat Hold pattern ko dekh kar uptrend ke continuation ke signals ke liye istemal karte hain. Is pattern ke appearance ke baad, traders long positions le sakte hain ya phir apne existing long positions ko hold kar sakte hain.

Lekin, jaise har technical pattern mein hota hai, Mat Hold pattern ko bhi confirm karne ke liye doosre technical indicators aur price action ko bhi consider kiya jana chahiye. False signals ka khatra bhi hota hai, isliye is pattern ka istemal karne se pehle market analysis ko thik se samajhna zaroori hai.

Overall, Mat Hold Candlestick Pattern ek bullish continuation signal hai jo market ke sentiment ka change darust karta hai. Traders ko is pattern ko samajh kar sahi waqt par apne trading decisions ko adjust karna chahiye, lekin hamesha caution aur risk management ke saath kaam karna zaroori hai.

-

#11 Collapse

**Mat Hold Candlestick Pattern Kya Hai?**

**1. Pehchaan:**

- Mat Hold candlestick pattern ek bullish continuation pattern hai jo market ke uptrend ke dauran banta hai. Yeh pattern price trend ke continuation ki indication deta hai aur generally strong bullish trends ko confirm karta hai.

**2. Banawat:**

- **Initial Uptrend:** Mat Hold pattern tab banta hai jab market ek strong uptrend ke dauran hoti hai. Is initial move ko "flagpole" kehte hain.

- **Consolidation Phase:** Uptrend ke baad price ek consolidation phase se guzarti hai jahan price chhoti si range mein move karti hai. Yeh phase "mat" ke shape ka hota hai, isliye isse "Mat Hold" kaha jata hai.

- **Breakout:** Consolidation phase ke baad, price ek strong bullish move se consolidation ke upar break karti hai, jo ke trend continuation ko confirm karta hai.

**3. Characteristics:**

- **Length:** Mat Hold pattern mein consolidation phase chhoti aur tight range ki hoti hai. Yeh chhoti consolidation pattern ke liye zaroori hai.

- **Volume:** Ideal pattern mein, consolidation ke dauran trading volume decrease hota hai aur breakout ke waqt volume increase hota hai. Yeh volume increase trend continuation ko support karta hai.

**4. Trading Strategy:**

- **Entry Point:** Entry point tab hota hai jab price consolidation phase ke upper boundary ko break karti hai. Yeh breakout ek bullish signal hota hai.

- **Stop-Loss:** Stop-loss ko consolidation phase ke neeche rakha jata hai, taake agar price pattern ke against move karti hai to loss minimize ho.

- **Target:** Target price generally initial uptrend ke length ke barabar hota hai. Agar flagpole ka length 100 pips tha, to target bhi 100 pips ke aas-paas hota hai.

**5. Importance:**

- **Trend Continuation:** Yeh pattern trend continuation ko confirm karta hai. Agar market ek strong uptrend mein hai aur Mat Hold pattern banta hai, to yeh trend continue hone ke chances ko increase karta hai.

- **Confirmation Tool:** Yeh pattern trend confirmation ke liye useful hota hai aur traders ko potential bullish moves identify karne mein help karta hai.

**6. Limitations:**

- **Pattern Size:** Har consolidation phase Mat Hold pattern nahi hoti. Isliye pattern ki size aur shape ko carefully analyze karna zaroori hai.

- **Market Conditions:** Pattern ka effectiveness market conditions aur other technical indicators ke sath align karna zaroori hai. Mat Hold pattern ko kisi bhi single indicator par rely karna risky ho sakta hai.

In points ke zariye, aap Mat Hold candlestick pattern ko samajh kar apni trading strategies ko enhance kar sakte hain aur market trends ko better analyze kar sakte hain.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Mat Hold Candlestick Pattern Kya Hai?

Mat Hold candlestick pattern ek aise technical analysis pattern hai jo ke Japanese candlestick charts mein istemal hota hai. Ye pattern traders ko market ke trend ke baray mein valuable insights provide karta hai. Mat Hold pattern ki pehchaan aur iski trading strategy samajhna zaroori hai taake aap trading decisions mein behtari laa sakein.

Mat Hold Pattern Ki Pehchaan

Mat Hold pattern ka structure kuch is tarah hota hai:- Strong Uptrend: Ye pattern ek strong uptrend ke baad develop hota hai. Iska matlab hai ke pehle se hi market mein ek bullish trend chala aa raha hota hai.

- First Candlestick: Pattern ka pehla candlestick ek long white candlestick hota hai jo ke market ke strong uptrend ko represent karta hai.

- Consolidation Phase: Pehli candlestick ke baad, do ya teen chhote white candlesticks ya do pinkish candlesticks develop hoti hain. Ye consolidation phase hota hai jo ke market ko thoda pause deta hai.

- Last Candlestick: Pattern ke end par ek aur strong white candlestick hota hai jo ke consolidation phase ko break kar deta hai aur uptrend ko continue karta hai.

Mat Hold pattern ka analysis karna traders ko future price movement ke baare mein insights provide karta hai. Jab aap is pattern ko identify kar lete hain, to aapko market ke sentiment aur trend ke baare mein clear indication milta hai. Mat Hold pattern bullish market trend ko confirm karta hai aur iske develop hone ke baad, price ka further increase hone ka high probability hota hai.

Mat Hold Pattern Ki Trading Strategy- Entry Point: Mat Hold pattern ko trading strategy mein implement karne ke liye, aapko pattern ke complete hone ka intezar karna hota hai. Jab aakhri white candlestick form hoti hai aur previous consolidation phase ko break karti hai, to ye entry point hota hai.

- Stop Loss: Stop loss ko set karna bhi zaroori hai. Stop loss ko pattern ke lower consolidation range ke niche set kiya jata hai. Isse aapko unnecessary losses se bachne mein madad milti hai agar market aapke expectation ke contrary move kare.

- Profit Target: Profit target ko set karte waqt, aapko pattern ke initial strong uptrend ko consider karna chahiye. Ek common approach ye hai ke profit target ko pattern ke initial white candlestick ke length ke barabar set kiya jata hai.

Mat Hold pattern ke kuch limitations bhi hain jo aapko consider karni chahiye:- False Signals: Kabhi kabhi pattern false signals bhi generate kar sakta hai. Isliye, pattern ko confirm karne ke liye aapko additional technical indicators ka istemal karna chahiye.

- Market Conditions: Mat Hold pattern ka effectiveness market conditions par bhi depend karta hai. Agar market mein high volatility hai ya major economic events ho rahe hain, to pattern ka signal accurate nahi ho sakta.

- Time Frame: Pattern ki accuracy time frame par bhi depend karti hai. Shorter time frames par pattern less reliable ho sakta hai compared to longer time frames.

Mat Hold pattern ka use karne ke liye, aapko candlestick chart ko regularly monitor karna hoga aur pattern ko identify karna hoga. Aap is pattern ko ek part of a broader trading strategy bana sakte hain jo ke multiple technical indicators aur market analysis tools ko combine karta hai.

Conclusion

Mat Hold candlestick pattern ek valuable tool hai jo traders ko market trend ko analyze karne aur trading decisions lene mein madad karta hai. Is pattern ki pehchaan aur trading strategy ko samajhna zaroori hai taake aap market ke trends ko effectively capture kar sakein. Hamesha yaad rakhein ke kisi bhi trading pattern ko ek comprehensive strategy ke part ke taur par use karna chahiye aur market conditions ko bhi consider karna chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

**Mat Hold Candlestick Pattern: Kya Hai?**

Mat Hold candlestick pattern forex trading aur stock markets mein ek aham indicator hai jo price trends aur potential reversals ko identify karne mein madadgar hota hai. Ye pattern chaar candles par mushatamil hota hai aur iska main purpose market ke mood ko samajhna hota hai taake traders ko behtar trading decisions lene mein madad mil sake.

Mat Hold pattern ka basic structure chaar candles par base hota hai:

1. **Bullish Candle:** Pehli candle ek bullish candle hoti hai jo ek significant upward movement ko represent karti hai. Is candle ke baad, market mein ek positive trend nazar aata hai.

2. **Doji Candle:** Dusri candle ek Doji hoti hai, jo market mein uncertainty ko dikhati hai. Doji candle ke open aur close prices almost barabar hote hain, aur isse market mein confusion aur indecision ka signal milta hai.

3. **Bearish Candle:** Teesri candle ek bearish candle hoti hai jo price mein downward movement ko represent karti hai. Yeh candle Doji candle ke upar se open hoti hai aur neechi ki taraf move karti hai, market mein bearish sentiment ko dikhati hai.

4. **Bullish Candle:** Chothi aur aakhri candle phir se bullish hoti hai. Ye candle bearish candle ke niche se open hoti hai aur upar ki taraf move karti hai, ek strong buying signal dikhati hai.

Mat Hold pattern ke formation ke baad, traders ko expect hota hai ke market ek upward trend ki taraf move karega. Is pattern ki confirmation ke liye, traders ko dekhna hota hai ke chothi candle bullish hai aur uska close price teesri candle ke close price se zyada hai.

**Mat Hold Pattern ki Significance**

Mat Hold pattern ke key points ko samajhna trading decisions ke liye zaroori hai:

- **Trend Continuation:** Ye pattern generally bullish trend ki continuation ko indicate karta hai. Agar pattern market ke upar ke trend ke dauran banta hai, to isse strong buying signal samjha jata hai.

- **Reversal Signal:** Kabhi kabhi Mat Hold pattern market ke reversal point ko bhi indicate karta hai. Agar ye pattern bearish trend ke dauran banta hai, to isse market ke reversal ka signal mil sakta hai.

- **Volume Analysis:** Volume ka bhi analysis zaroori hai. Agar Mat Hold pattern ke formation ke dauran volume increase hota hai, to ye pattern ki strength ko confirm karta hai.

- **Risk Management:** Trading decisions lene se pehle risk management ko consider karna zaroori hai. Mat Hold pattern ko confirm karne ke liye aur additional indicators ka use karna behtar hota hai.

**Conclusion**

Mat Hold candlestick pattern ek powerful tool hai jo traders ko market ke direction aur trends ko identify karne mein madad karta hai. Is pattern ka correct interpretation aur confirmation trading decisions ko behtar aur informed bana sakta hai. Lekin, kisi bhi trading strategy ya pattern ka use karte waqt, risk management aur additional analysis ko zaroor shaamil karna chahiye. Ye pattern ek helpful guide hai, lekin market ki dynamics aur external factors ko bhi dhyan mein rakhna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:37 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим