What is naked trading strategy:

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

WHAT IS NAKED TRADING STRATEGY:Naked buying and selling ko fee motion tradingvbhi kahta ha ,is ma ya refer karta ha buying and selling ka fashion ko identification ka koi bhi trading signs use ni hota. Jasa ka is ma name ha jab nake yradevkarta ha ,to is ma Naked trading begin karna ha to sab sa phaly is ma open karna ho ga demonstration account ko. Ya bahot hi smooth tareka hota ha locate karna or easily trading karna is naked ma. Is ma apni jo demo buying and selling ha os ko use karna ha critical buying and selling ki trha or is ma putting karay ga amount ko deposit karay ga or setting karay ga sensible profit goal ko. Jab recognize karay ga de dakhta ha clean nalef rate ka chart ko jis ma koi bhi drawings,trend strains, or technical analysis indicators ni use hota. Is ko surely positioned larta ha strategy ko is ma koi bhi indicators ko encompass ni karta or na hello is ma records, or complicated math ko. Wo investors jo evaluation karta ha market ko is bare buying and selling method ko useing karta hua ya uses karta ha real time ma charge motion ko. Ya only ,purest or oldest buying and selling ki strategy ha. Is ma evaluation karta ha markets ka beyond performance ko or adding karat ha indicators,is ma necked traders relybkarta ha buying and selling instincts ko or experience karay ga or banay ga trading selections ko. Ya jo charge motion trading strategy ha ya not unusual ka every kind ka buying and selling fashion ka liya or ya zada tar long term method ha or is ma swing or position trading hoti ha. DOES THE NAKED TRADING STRATEGY WORK?

Jab use karta ha naked approach ko or buying and selling karta ha to is ma sucvess relies upon kar raha hota ha apni capacity ma ka kasa examine lar raha ha matkets ko or is ma l. A. Ga a success tradinga jo professional investors ho ga or ya specialize ho ga bare trading ma to ya use karay ga level 2 market statistics ko or locate karay ga is ma trading opportunities ko. Jo ya degree r technique ha jis ko use karay ga naked tradecma ya order glide analysis approach ha. Ya order waft kuch similar hota ha stage 2 market facts ka. Ya order glide evaluation displayed directly ho jata ha price chart ma . Is tool sa bahot hi less difficult hota habnaked investors ka liya ka wo without difficulty apprehend kar la market ka imbalances or sc2 marketplace information ha ya bahot hi detaima ha order growth ma ya permit karta ha consumers or sellers ki list ko marketplace ma dakhna ko ,ya along with hota ha market maker every order ka. Jab use karay ga the use of karay ga degree 2 order ko ,to bare traders banay ga trading ka decision ko bagar kisi additional trading indicators ka. Bahot sa traders entirely the use of karay ga is stage 2 market information ka. Jab is ma dakha ga kisi particular marketplace ka trend okay ka decisions ko. Ya jo charge action selections ha ya banta ha tradersvka intuition na ka evaluation sa. Is ko use karna ka liya zaruri hota ha ka acquainted ho candlestick patterns ,guide and resistance degrees ,key monetary activities or bhia sa bahot si matters ka. Agar instinct ha or sainsa sense ha expect karna ka market ka subsequent motion ko to naked trading method ak great ho gi ap ka liya firex ma kam karna ka liya.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Trading Without Indicators

Trading ke duniya mein, indicators ko porane zamane se market trends ka tanqeedi jaiza laine, entry aur exit points ka pata lagane aur maqool trading decisions lene ke liye essentiyal tools samjha gaya hai. Traders aksar indicators jese ke moving averages, oscillators, aur trend lines par bharosa karte hain taake woh qeemat ki harkat aur trading ke mouqaat mein dakhil batain. Lekin, aik alternative taur par, jo ke conventional indicators par bharosa ko challenge karta hai, yeh hai: indicators ke baghair trading.

Indicators ke baghair trading traditional technical analysis tools ka istemaal na karne ki approach hai, balkay raw price action aur market dynamics ko parhne aur samajhne par tawajju dene ka nateeja hai. Is approach mein supply aur demand, market sentiment, aur chart patterns ko trading decisions ke bunyadi drivers ke tor par tasleem kia jata hai. Jabke yeh ghair riwayati lag sakta hai, lekin indicators ke baghair trading ne un traders mein pasandidgi hasil ki hai jo asaan, lachakdar, aur markets ke liye aik mazeed samajhdar approach chahte hain.

Indicators ke Baghair Trading Kya Hai?

Indicators ke baghair trading aik aisa approach hai jo trading decisions ko sirf raw price action aur market dynamics par mabni banata hai, traditional technical indicators par bharosa kiye bina. Is mein moving averages, oscillators, ya trend lines ki bajaye, traders jo is approach ko ikhtiyar karte hain, woh price movement khud ko tawajju se parhne aur samajhne par tawajju dete hain, sath hi sath supply aur demand, market sentiment, aur chart patterns jese factors par bhi. Inn market ke bunyadi pehluon ko dekhte hue aur samajhte hue, traders ko asaan aur tawajju se trading decisions, patterns, trends, aur potential trading opportunities ka pata lagane mein madad mil sakta hai. Indicators ke baghair trading mein tawajju ka hona, market dynamics ka gehra ilm, aur price action signals ko effectively interpret aur amal karne ki salahiyat ko shamil karta hai.

Log Indicators ke Baghair Kyun Trade Karte Hain?

Indicators ke baghair trading ne traders mein kai wajohat ki bina par pasandidgi hasil ki hai. Yahan kuch key motivations hain:- Asaanai:

Indicators ke baghair trading ek asaan trading approach pesh karta hai. Charts par mukhtalif indicators ki bhari bharkam se peecha chhurane se, traders qeemat ki harkat aur market dynamics ki bunyad par tawajju de sakte hain. Yeh streamline approach traders ko asaan aur tawajju se decisions lene mein madad kar sakta hai. - Flexibility:

Indicators specific mathematical formulas aur parameters par mabni hote hain, jo ke har market situation ke nuances ko hamesha capture nahi kar sakte. Indicators ke baghair trading se traders apne strategies ko asani se changing market conditions ke mutabiq adapt kar sakte hain. Yeh unhein rigid indicator rules se mehroom bina kisi rukawat ke real-time market dynamics ka jawab dene ki ijaazat deta hai. - Price Action Par Tawajju:

Indicators ke baghair trading mein price action ko seedha samajhne aur interpret karne par zor diya jata hai. Traders ko patterns, trends, support aur resistance levels, aur doosre asooli price-related factors ko analyze karne ki salahiyat milti hai. Price dynamics ki yeh gehri samajh market sentiment aur potential future price movements ke liye qeemati idaray faraham kar sakti hai. - Lag Mein Kami:

Indicators historical price data par mabni hote hain, jo ke unke generate kardah signals mein aik khas had tak lag ka sabab ban sakta hai. Indicators ke baghair trading karke, traders lag ko kam kar sakte hain aur mojooda market conditions ke bare mein zyada foran aur durust malumat hasil kar sakte hain. - Shakhsiyat Ki Ijaazat:

Her trader ka apne trading pasandeedgiyon, risk bardasht, aur trading styles mein apne khaas munfarid hai. Indicators ke baghair trading traders ko apni strategies ko personalize karne aur apne market ki individul samajh ke mutabiq apne apne rules aur criteria banane ki ijaazat deta hai. - Zehni Faida:

Kuch traders ke liye, sirf indicators par bharosa karna unhein over-reliance ya confusion mein mubtila kar sakta hai jab kai indicators conflicting signals generate karte hain. Indicators ke baghair trading zehni faiday pesh kar sakta hai jaise ke decision-making process ko asaan karna, noise ko kam karna, aur zyada tawajju aur pur sukoon trading mindset ko barhna.

Jabke indicators ke baghair trading apne faiday pesh karta hai, yeh zaroori hai ke yeh tajurbat, maharat, aur market dynamics ka gehra ilm talab karta hai. Jo traders is approach ko ikhtiyar karte hain, unko price action patterns ko parhne, market behaviour ka gehra ehsas karna, aur apne positions ko effectively nigranayi karne ke liye disciplined risk management techniques par amal karne ke liye waqt dena chahiye.

Indicators Ke Baghair Trading Ke Faiday Aur Mumkin Risks

- Faiday:

- Price Action Par Focus:

Indicators ke baghair trading se traders ko price action aur is ke mooli dynamics ki gehri samajh hasil karne ka mauka milta hai. Sirf price movements par tawajju dene se traders ko market sentiment, trends, aur potential reversals ke liye qeemati idaray miltay hain. - Increased Adaptability:

Fixed indicator rules par bharosa na karne ke baghair, traders apne strategies ko mukhtalif market conditions ke mutabiq asaan se tabdeel kar sakte hain. Woh apne trading approach ko haqeeqi waqt ke price action ke mutabiq adjust kar sakte hain. - Streamline Decision-Making:

Mukhtalif indicators ki istemal kiye bina decision-making process ko asaan bana dene se traders saaf price patterns aur support aur resistance ke key levels par tawajju de kar tezi se faislay le sakte hain. - Lag Mein Kami:

Indicators aksar historical price data par mabni hote hain, jo ke unke generate kardah signals mein aik khas had tak lag ka sabab banata hai. Indicators ke baghair trading karke, traders lag ko kam kar sakte hain aur mojooda market conditions ke bare mein zyada foran aur durust malumat hasil kar sakte hain. - Greater Personalization:

Indicators ke baghair trading traders ko apni trading strategies ko apni observations aur market ki samajh ke mutabiq personalize karne ki ijaazat deta hai. Yeh customisation ek zyada numaya aur tailored trading approach ki taraf le ja sakti hai.

- Price Action Par Focus:

- Mumkina Risks:

- Subjectivity:

Indicators ke baghair trading par bharosa karna kisi trader ke price action ki tawajju par hai. Yeh shakhsiyat ko ziada level ka personal bias introduce karta hai aur inconsistent ya ghair reliable trading decisions ka bhi sabab ban sakta hai. - Increase Complexiti:

Raw price action ko analyze karna chart patterns, candlestick formations, aur market dynamics ka gehra ehsas talab karta hai. Is ko effectively trading ke liye istemaal karne ke liye zaroorat hai aur isko develop karne mein waqt aur tajurbati zaroorat ho sakti hai. - Confirmation Mein Kami:

Indicators aksar yeh confirmation signals provide karte hain jab multiple indicators align hote hain. Indicators ke baghair trading karte waqt, traders additional confirmation par qarar dene mein kamyabi se mehroom ho sakte hain aur sirf price action par hi bharosa karna, jo false signals ka khatra barha sakta hai. - Risk Management Ke Liye Mamooli Instruments:

Indicators aksar risk management ke liye khaas aalaat provide karte hain, jese ke stop-loss levels ya trailing stops. Jab indicators ke baghair trading ki jati hai, traders ko apne positions ko effectively nigranayi karne ke liye alternative risk management techniques develop karna parta hai.

- Subjectivity:

Indicators k Bagher Trading k Tips

Indicators ke baghair trading, traditional indicator-based trading ke muqablay mein aik mukhtalif taur aur soch talab karta hai. Yahan kuch insights aur tips hain jo aapki madad karenge ke aap indicators ke baghair trading karte waqt markets ko effectively navigate karen:- Price Action Analysis Par Maharat Hasil Karen:

Price action analysis aapki trading strategy ka bunyadi kon bun jata hai. Mukhtalif chart patterns, candlestick formations, aur ahem support aur resistance levels ko mutala karen. Tareekh, reversals, aur important price levels ko pehchanne ki salahiyat hasil karen jo aapki trading decisions ko rehnumai kar sakti hain. - Multiple Time Frames Ka Istemaal Karen:

Price action ko multiple time frames par mutala karna market trends aur potential trading opportunities par mazeed nazar hasil kar sakta hai. Higher time frames ko trend identification ke liye aur lower time frames ko dakhil aur nikhal ke waqt ke liye istemaal karen. - Support aur Resistance Ko Shamil Karen:

Apne charts par ahem support aur resistance levels ko pehchanen. Ye levels price movement ke liye rukawat ka kaam karte hain aur potential reversal points ya trade entries ke liye dilchasp malumat faraham kar sakte hain. - Market Structure Ko Nazar Mein Rakhen:

Puraani market structure aur price patterns par tawajju den. Trend continuation ya potential trend reversal ke nishan dhoonden. Market structure ko samajhna aapki trades ko mojooda market sentiment ke sath milana mein madadgar sabit ho sakta hai. - Price Patterns Ko Istemaal Karen:

Price patterns, jese ke triangles, wedges, aur head and shoulders formations, potential breakouts ya trend reversals ke liye qeemati signals faraham kar sakte hain. In patterns ko pehchanne aur inke implications ko samajhne mein maharat hasil karen. - Sabr aur Nizaamatiyat Ka Amal Karen:

Indicators ke baghair trading mein sabr aur nizaamatiyat ka amal zaroori hai. Clear aur strong price signals ka intezaar karen trading mein dakhil hone se pehle. Overtrading se bachen aur apne trade setups mein intikhabiyat se amal karen. - Munasib Risk Management Ka Istemaal Karen:

Apne paisay ko mehfooz karne ke liye effective risk management techniques ko amal karen. Key support aur resistance levels ya price action ki structure ke mutabiq munasib stop-loss orders set karen. Apne trades ko faida aur nuksan ke ratios ko madde nazar rakhte hue position sizing aur risk-to-reward ratios ka tawajju den. - Fundamental Analysis Ko Shamil Karen:

Jabke indicators ke baghair trading mainly price action par tawajju deta hai, to market ki mazeed samajh hasil karne ke liye fundamental analysis ko shamil karna bhi soch sakte hain. News events aur economic data releases price movements ko asar andaz hone mein madadgar sabit ho sakte hain aur aapke trades ke liye mazeed context faraham kar sakte hain. - A Trading Journal Banayein:

Apne trades ka tafseeli record banayein, jise aapki raaye, dakhil aur nikhal points, aur observations shamil hon. Apne trading journal ko baar-baar mutala karna aapko patterns, strengths, aur aapki trading approach mein behtari ki areas ko pehchanne mein madad karsakta hai. - Musalsal Learning aur Experience Hasil Karen:

Indicators ke baghair trading musalsal seekhne aur behtar hone ko talab karta hai. Market news se mutaliq rahen, mukhtalif price action techniques ko research karen, aur musalsal amal mein mubtala ho. Webinars mein hissa lein, kitabein parhen, aur experienced traders ko follow karen jo indicators ke baghair trading karte hain takay aap mazeed insights hasil karen aur apne skills ko durust karen.

Yaad rakhen, indicators ke baghair trading har kisi ke liye munasib nahi hai, aur is mein maharat aur amal ki zarurat hoti hai. Is approach mein gradual taur par enter karen, chhoti position sizes se shuruat karen aur waqt ke sath apne confidence ko barhain. Jaise ke kisi bhi trading method mein, tayyarahi, nizaamatiyat, aur risk management ka khasoosi tor par khayal rakhna ahem hai.

Conclusion:– Kya Indicators ke Baghair Trading Karni Chahiye?

Yeh faisla karna ke indicators ke baghair trading karna chahiye ya nahi, yeh aapki trading style, pasandeedgiyan, aur maharat ke level par mabni hota hai. Jabke indicators ke baghair trading kuch faiday pesh karta hai, lekin yeh har kisi ke liye munasib nahi hota. Yahan kuch factors hain jo iss approach ko ikhtiyar karte waqt ghor karne chahiye:- Trading Style:

Indicators ke baghair trading price action aur chart patterns par tawajju dene ko talab karta hai. Agar aap raw price data ko mutala karna, trends ko pehchanne, aur intuitional trading decisions lene mein lutf uthate hain, to yeh approach aapki trading style ke sath achhi tarah se mawafiq ho sakta hai. - Experience aur Skill Level:

Indicators ke baghair trading price action aur market dynamics ka gehra ilm talab karta hai. Yeh aksar traders ke liye mustahiq hai jo technical analysis mein mazbut bunyad aur chart patterns ka mukammal ilm rakhte hain. Agar aap trading mein naya hain, to indicators ke baghair trading se pehle indicator-based strategies ko samajhna faydakar ho sakta hai. - Patience and Discipline:

Indicators ke baghair trading sabr aur nizaamatiyat ka amal karta hai. Aapko clear price signals ka intezaar karna hoga aur apne trading plan ko indicators ke generate kiye gaye buy ya sell signals par bharosa na karte hue follow karna hoga. Agar aapke paas yeh khasoosiyaat hai aur aap price action analysis par tawajju de sakte hain, to yeh approach aapke liye munasib ho sakta hai. - Risk Management:

Jaise ke kisi bhi trading strategy mein, risk management ka ahem kirdar hai. Indicators ke baghair, aapko alternative risk management techniques develop karna hoga, jese ke key price levels par munasib stop-loss orders set karna ya trailing stops ka istemaal karna. Apni risk tolerance ko tajwez karen aur yakeeniyat rakhen ke aapke paas ek mustahkam risk management plan hai. - Personal Bias (Tasur):

Indicators ke baghair trading aapko shakhsiyat ke asar mein daal sakta hai kyun ke aap sirf price action ki tawajju par munhasir hain. Yeh zaroori hai ke aap is potential bias ko pehchanen aur apne tafseeli trades ko regular taur par mutala karen taa ke personal bias ka asar kam ho sake.

Ultimately, indicators ke baghair trading ka faisla aapki shakhsiyat aur pasandeedgiyon par mabni hai. Kuch traders indicators ke baghair behtareen taur par kaam karte hain, jinko is approach ki asaan aur mutanazza nizamat pasand aati hai. Kuch log traditional technical indicators ke dwara diye jane wale tawajju aur rehnumai ko pasand karte hain.

Agar aap indicators ke baghair trading explore karne ka faisla karte hain, to musalsal seekhne, amal karne, aur behtar hone ka ahd karen. Price action patterns ko mutala karen, market dynamics ka gehra ehsas karen, aur apne skills ko amli istemal ke zariye taraqqi karen.

Yeh yaad rakhen ke trading mein ek size sab par nahi beth'ti. Sab se zyada ahem cheez yeh hai ke aap apne trading maqasid ke mutabiq aik strategy daryaft karen, jisse ke aap risk ko effectively nigranayi kar sakein aur aapko maloom ho ke aap inform trading decisions le sakte hain. Apne strengths, pasandeedgiyon, aur risk tolerance ko madde nazar rakhen aur yeh tajwez karen ke indicators ke baghair trading aapke liye sahi raaste ka intikhab hai."**

- Asaanai:

-

#4 Collapse

WHAT IS NAKED TRADING STRATEGY:

Naked trading strategy, ya jo bhi price action trading technique hai, woh traders ko market mein bina kisi indicator ya oscillators ke rely kiye trading karne ka tareeqa deta hai. Is strategy ka maqsad hota hai ke trader directly price charts ko analyze karke market trends aur reversals ko identify kare, rather than relying on lagging indicators.

Naked trading strategy ka naam is liye hai kyunki ismein koi bhi "clothing" yaani ke indicators ka istemal nahi hota. Ismein trader ko sirf market ke historical price data pe amal karna hota hai. Ye strategy purane waqt se aaj tak popular hai, kyun ke ismein ek simplification aur clarity hoti hai.

Is strategy mein trader ko price patterns, support aur resistance levels, trend lines, aur candlestick patterns par zyada tawajjuh deni parti hai. Trader ko yeh samajhna hota hai ke market mein kya ho raha hai aur future mein kya hone wala hai, sirf price action ki madad se.

Naked trading strategy ke kuch mukhtalif tareeqay hote hain, jinmein se kuchh yeh hote hain:

Support aur Resistance Levels:

Trader price chart par support aur resistance levels ko identify karte hain, jinse woh potential entry aur exit points tay karte hain.

Trend Lines:

Price charts par trend lines draw ki jati hain, jo market trend ko represent karte hain. Trader in lines ki madad se trend ki direction ko samajhte hain.

Candlestick Patterns:

Trader candlestick patterns ka istemal karte hain, jaise ke dojis, engulfing patterns, aur hammer, market ki future movement ko predict karne ke liye.

Naked trading strategy ka istemal karne wale traders ka kehna hota hai ke isse unko market ki asliyat ka behtar andaza hota hai, aur woh market movements ko samajhne mein asani hoti hai. Lekin, is strategy mein risk bhi hota hai, aur ye beginners ke liye challenging ho sakta hai, kyun ke ismein precise entry aur exit points ka tajaweez karna mushkil hota hai. Is liye, har ek trader ko apne risk tolerance aur trading style ke mutabiq is strategy ka istemal karna chahiye. -

#5 Collapse

Naked trading strategy ek aise trading approach hai jo indicators ka istimaal nahi karti. Ye strategy primarily price action analysis par mabni hoti hai. Naked trading mein, trader sirf chart patterns, candlestick formations, aur support aur resistance levels par focus karta hai. Is strategy ka maqsad market ke natural movements ko samajhna aur unhein trade karna hai bina kisi technical indicators ke interference ke.

Naked Trading Strategy ke Key Components

1. Price Action

Price action naked trading ka sabse important component hai. Ismein trader sirf price movements ko observe karta hai aur unki basis par trading decisions leta hai. Price action analysis mein candlestick patterns, trend lines, aur chart formations jese ke head and shoulders, double tops and bottoms, aur triangles shamil hain.

2. Support and Resistance

Support aur resistance levels naked trading mein bohot aham hote hain. Support level wo price level hai jahan demand strong hoti hai aur price niche girne se ruk jati hai. Resistance level wo price level hai jahan supply strong hoti hai aur price upar jane se ruk jati hai. In levels ko identify karke trader buy aur sell positions ke liye better entry aur exit points dhund sakta hai.

3. Candlestick Patterns

Candlestick patterns naked trading ka ek aur aham hissa hain. In patterns ko samajh kar trader market sentiment ko pehchan sakta hai. Kuch common candlestick patterns jo naked traders use karte hain wo hain:- Doji: Ye pattern indicate karta hai ke market mein indecision hai.

- Hammer: Ye pattern bullish reversal signal hai jab price downtrend ke baad is pattern ko banati hai.

- Engulfing: Bullish ya bearish engulfing patterns trend reversal ko indicate karte hain.

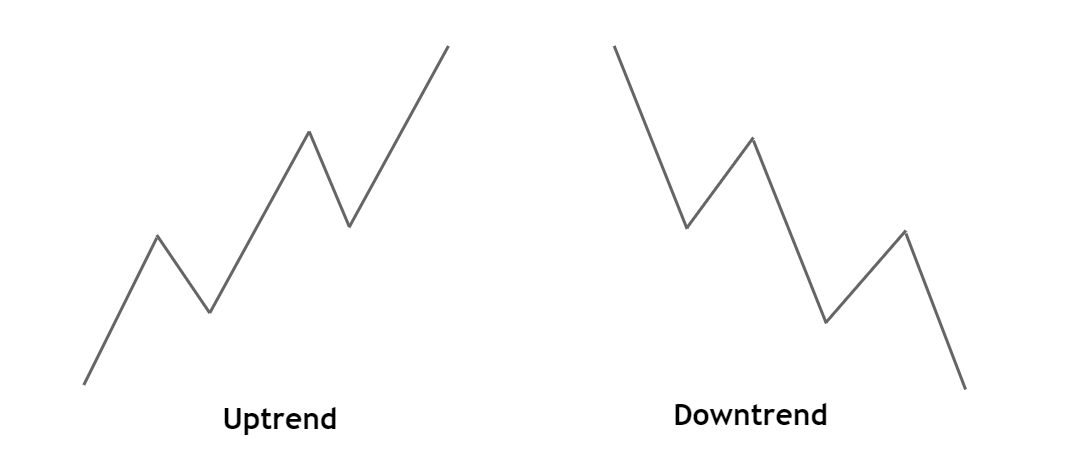

Trend identification naked trading mein zaroori hai. Market trends ko samajhne se trader ko pata chalta hai ke overall market direction kya hai. Uptrend, downtrend, aur sideways trends ko identify karke trader better trading decisions le sakta hai.

Naked Trading Strategy ka Implementation

Naked trading ko successfully implement karne ke liye kuch basic steps hain jo trader follow kar sakta hai:- Chart Analysis: Pehle, trader ko charts ko analyze karna hota hai bina kisi indicators ke. Sirf price action aur candlestick patterns par focus karna hota hai.

- Support and Resistance Levels Draw: Price chart par significant support aur resistance levels ko draw karna hota hai. Ye levels future price movements ke liye key areas ko indicate karte hain.

- Trend Lines Draw: Trend lines draw karke market trends ko identify karna hota hai. Trend lines uptrend aur downtrend ko highlight karti hain.

- Price Patterns Observe: Candlestick patterns aur chart formations ko observe karke potential trading setups identify karna hota hai.

- Trade Entry and Exit: Identified patterns aur levels ke basis par trade entries aur exits define karna hota hai. Entry ke liye confirmation signals jese ke breakouts ka intezar karna hota hai aur exit points ko predefined levels par set karna hota hai.

Advantages

1. Simplicity

Naked trading strategy simple hoti hai kyun ke ismein indicators ka istimaal nahi hota. Sirf price chart aur price action ko observe karna hota hai.

2. Real-time Analysis

Indicators ka lag nahi hota, isliye price action ke zariye real-time analysis aur quick decision making possible hoti hai.

3. Market Understanding

Naked trading se trader ko market ke natural movements aur behaviors ko samajhne ka mauka milta hai, jo long-term trading success ke liye beneficial hota hai.

Disadvantages

1. Subjectivity

Price action aur chart patterns ko interpret karna subjective ho sakta hai. Different traders same chart ko different tarike se interpret kar sakte hain.

2. Experience Requirement

Naked trading successful hone ke liye trader ko experience aur practice chahiye hoti hai. Beginners ke liye ye approach initially challenging ho sakti hai.

3. Emotional Control

Indicators na hone ki wajah se naked trading emotional control aur discipline demand karti hai. Trader ko impulsive decisions se bachna hota hai aur price action par trust karna hota hai.

Naked trading strategy ek effective trading approach ho sakti hai agar trader price action, candlestick patterns, aur support aur resistance levels ko accurately interpret kar sake. Ye strategy indicators par depend nahi karti aur market ke natural movements par focus karti hai. Naked trading ka main advantage simplicity aur real-time analysis hai, lekin ismein subjectivity aur experience requirement bhi shamil hai. Beginners ko pehle price action analysis seekhna chahiye aur gradually naked trading ko implement karna chahiye. Overall, naked trading disciplined traders ke liye profitable ho sakti hai jo market movements ko achi tarah samajhte hain aur emotional control maintain kar sakte hain. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Nanga Trading Strategy: Ek Jaiza

Muqaddama

Nanga trading strategy ek approach hai jo traders ke liye simple aur effective trading decision lene mein madad deti hai. Is strategy mein traders market ke raw price data ko analyze karte hain bina kisi indicators ke istemal kiye. Is article mein hum nanga trading strategy ko detail mein samjhenge aur iske benefits, limitations, aur implementation ka tareeqa discuss karenge.

Nanga Trading Strategy Kya Hai?

Nanga trading strategy ka matlab hai ke traders sirf price action ko dekh kar trading decisions lete hain, bina kisi indicators ke. Is approach mein traders market ke natural fluctuations aur patterns ko identify karne ki koshish karte hain, jisse wo market trends aur reversals ko samajh sake.

Nanga Trading Strategy Ka Istemaal Kaise Hota Hai?- Price Action Analysis: Nanga trading strategy mein sabse zaroori hai ke traders price action ko analyze karein. Iske liye wo candlestick charts, bar charts, ya line charts ka istemal karte hain. Price action analysis se traders market ke current state aur potential future movements ko samajhte hain.

- Support aur Resistance Levels: Traders nanga trading strategy mein major support aur resistance levels ko identify karte hain. Support levels price ka area hota hai jahan se price ko expect kiya jata hai ke woh upar ja sakta hai. Resistance levels price ka area hota hai jahan se price ko expect kiya jata hai ke woh neeche ja sakta hai.

- Candlestick Patterns: Candlestick patterns ki study bhi nanga trading strategy ka important hissa hai. Traders specific candlestick patterns jaise ki dojis, engulfing patterns, aur pin bars ko dekhte hain jo potential reversals ya trend continuations ka indication dete hain.

- Trend Lines aur Channels: Trend lines aur channels bhi price movements ko analyze karne mein madad dete hain. Traders trend lines draw karte hain jo price ke major movements aur trend directions ko define karte hain.

Nanga Trading Strategy Ke Benefits- Simplicity: Nanga trading strategy ki sabse bari faida hai uski simplicity. Is approach mein traders ko complex indicators ki zaroorat nahi hoti, sirf price action aur basic charting techniques par focus hota hai.

- Real-Time Decision Making: Nanga trading strategy mein traders market ke real-time price changes ko analyze karte hain, jisse unhein prompt trading decisions lene mein madad milti hai.

- Versatility: Is strategy ki versatility bhi ek bari faida hai. Har market condition mein yeh apply kiya ja sakta hai, chahe trending market ho ya range-bound.

Nanga Trading Strategy Ki Limitations- False Signals: Jaise ki har trading strategy ki tarah, nanga trading strategy mein bhi false signals ka risk hota hai. Market ke volatile periods ya choppy conditions mein ye strategy less effective ho sakti hai.

- Experience ki Zaroorat: Nanga trading strategy ko effectively implement karne ke liye traders ko experience aur technical analysis ki acchi understanding honi chahiye. Beginners ke liye ye initially challenging ho sakta hai.

- Risk Management: Kyun ke is strategy mein koi indicators nahi hote, isliye risk management ko effective tareeqe se handle karna zaroori hota hai. Stop loss aur take profit levels ko set karke risk ko manage karna critical hota hai.

Nanga Trading Strategy Ka Implemention- Educational Resources: Traders ko nanga trading strategy ko samajhne ke liye educational resources aur courses ka istemal karna chahiye jo price action analysis aur chart patterns ko samjhane mein madad karte hain.

- Practice: Is strategy ko samajhne aur master karne ke liye practice zaroori hai. Demo trading accounts ka istemal karke traders apne skills ko improve kar sakte hain bina real money risk kiye.

- Combine with Risk Management: Nanga trading strategy ko use karte waqt effective risk management strategies ka istemal karna zaroori hai. Har trade ke liye stop loss aur take profit levels ko define karna critical hota hai.

Conclusion

Nanga trading strategy ek simple aur effective approach hai jo traders ko market ke price movements aur patterns ko samajhne mein madad deti hai. Is strategy ko sahi tareeqe se implement karke traders apne trading decisions ki accuracy ko improve kar sakte hain aur consistent profitability achieve kar sakte hain. Har trader ke liye zaroori hai ke wo nanga trading strategy ko samajhe aur usko apni trading style ke hisab se customize karke istemal kare, taki wo market ke dynamics ko better grasp kar sake aur successful trading kar sake.

3.5 -

#7 Collapse

NAKED TRADING STRATEGYWhat is Naked trading strategy?

As salam o alaikum mere pyare aziz dosto, Naked trading strategy, known as be-naqab tijarat in Roman Urdu, is a trading approach where traders maky decisions solely based on price action charts without using any additional indicators. This method emphasizes the raw price movement of a security or asset, aiming to identify trends, support, resistance, and potential entry and exit points.trading ka ik simple or direct approach hy jahan trader technical indicators or complex tools ky baghyr sirf price action par focus karta hy. Yeh strategy traders ko price movement ko samajhne or market trends or patterns ko identify karne main madad deti hy.Naked Trading Strategy, jisay 'price action trading' bhi kaha jata hy, ik aisa tariqa hy jismain tajir baghyr kisi indicators ya technical tools ky sirf price action ko dikh kar tijarat karte hain. Ismain charts par mukhtalif patterns, trends, or price movements ko dikh kar kharid-o-farokht ky faislay kiye jate hain.Naked trading" refers to a trading strategy where a trader makys decisions based solely on price charts and technical analysis, without relying on indicators or other supplementary tools. The term "naked" implies trading without any additional layers or coverings, such as indicators, oscillators, or other technical tools.

Important points of Naked trading strategy:

1. Naked Trading:

Hello dear traders, Naked trading strategy ka matlab hota hy ky traders sirf price charts ka istemal karte hain or kisi bhi technical indicators ya tools ky bina trade enter ya exit karte hain. Yeh strategy purani trading methods par mabni hy jahan traders ko price action ki samajh or observation par zyada bharosa hota tha. Is section ko or expand karky, naked trading ki history or evolution ky bare main or detail se bataya ja sakta hy. Pehle traders jaise Jesse Livermore or Richard Wyckoff ky techniques or unky contributions ky bare main bhi discuss kiya ja sakta hy.

2. Price Action ki Ahmiyat

Dear forex members, Is section main price action ki ahmiyat ko mazid explain kiya ja sakta hy. Price action kya hy, or kaise traders isko samajhte hain? Different types of price action patterns jaise ki trend lines, support or resistance levels, candlestick patterns, or chart formations ky examples diye ja sakte hain. Isky alawa, price action ki alag-alag strategies or unka impact trading decisions par kaise hota hy, isko bhi explore kiya ja sakta hy.

3. Kya Hy Naked Charts?

Mere pyare aziz dosto, Naked charts wo hote hain jo kisi bhi indicators ya oscillators ky bina hote hain. Yeh charts usually candlesticks ya bar charts hote hain jahan sirf price movement or volume dikhaya jata hy. Is section main naked charts ky alag-alag types, unki advantages or disadvantages, or kaise traders inko effectively interpret karte hain, isko or detail main expand kiya ja sakta hy.

-

#8 Collapse

### Naked Trading Strategy: Kya Hai Aur Kaise Kaam Karta Hai?

Naked trading strategy forex aur stocks trading mein ek approach hai jahan traders sirf price charts aur price action analysis par focus karte hain, bina kisi technical indicators ke. Yeh strategy traders ko market ke natural movement aur trends ko samajhne mein madad deta hai, aur unhe clear trading signals provide karta hai.

**Naked Trading Kaam Kaise Karta Hai?**

1. **Price Action Analysis:**

- Naked trading mein traders price action ko study karte hain, jaise ki candlestick patterns, chart patterns, aur support/resistance levels.

- Isse unhe market trends aur reversal points ka clear insight milta hai.

2. **Key Support/Resistance Levels:**

- Traders naked trading mein price charts par key support aur resistance levels identify karte hain. Yeh levels previous price history aur market psychology ko reflect karte hain.

3. **Candlestick Patterns:**

- Candlestick patterns jaise ki pin bars, engulfing patterns, aur inside bars naked traders ke liye important hote hain. Yeh patterns price reversals aur continuations ko indicate karte hain.

4. **No Lagging Indicators:**

- Naked trading mein koi bhi lagging indicators ka use nahi hota hai, jaise ki moving averages ya oscillators. Isse traders immediate market conditions par focus kar sakte hain.

**Naked Trading Strategy Ke Benefits:**

1. **Simplicity:**

- Yeh strategy simple aur straightforward hoti hai, jo beginners aur experienced traders dono ke liye effective ho sakti hai.

2. **Clear Signals:**

- Price action analysis aur chart patterns se milne wale signals clear hote hain, jo traders ko entry aur exit points determine karne mein help karte hain.

3. **Adaptability:**

- Naked trading traders ko market conditions ke hisaab se apni strategy adjust karne mein madad deta hai, kyunki wo direct price movements par focus karte hain.

**Challenges of Naked Trading:**

1. **Subjectivity:**

- Naked trading mein interpretation subjective ho sakta hai, jahan traders ke different perspectives aur experience levels ke hisaab se analysis vary kar sakta hai.

2. **Market Noise:**

- Kuch situations mein market noise aur false signals bhi ho sakte hain jo naked trading mein traders ko confuse kar sakte hain.

**Conclusion:**

Naked trading strategy ek powerful approach hai jo traders ko price action aur market dynamics ko samajhne mein help karta hai. Ismein technical indicators ke absence mein traders ke analytical skills aur experience ka zyada use hota hai. Lekin hamesha yaad rahe ke har trading strategy apne risk aur rewards ke sath aati hai, isliye proper risk management aur thorough market analysis ke sath iska use karna zaroori hai. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Naked Trading Strategy: Kya Hai Aur Kaise Kaam Karta Hai?**

Naked trading strategy forex aur stock markets mein ek popular approach hai jo primarily price action analysis par focus karta hai. Is strategy mein traders indicators aur oscillators ka use minimize karte hain aur sirf raw price data aur candlestick patterns par rely karte hain.

**Kaise Kaam Karta Hai Naked Trading Strategy?**

1. **Price Action Analysis**: Naked trading strategy mein traders price movements aur candlestick patterns ko study karte hain. Isme koi bhi additional indicators ya oscillators use nahi kiye jate, bas raw price data analyze kiya jata hai.

2. **Candlestick Patterns**: Traders specific candlestick patterns jaise ke pin bars, engulfing patterns, aur inside bars ko identify karte hain. Yeh patterns market sentiment aur trend reversals ko indicate karte hain.

3. **Support aur Resistance**: Naked trading strategy mein support aur resistance levels ko bhi importance di jati hai. Traders in levels ko identify karte hain jahan price action ke significant movements ya reversals ho sakte hain.

**Naked Trading Strategy Ke Benefits**

1. **Simplicity**: Is strategy ki simplicity traders ke liye beneficial hai kyunki wo price action ko directly interpret kar sakte hain bina complex indicators ke.

2. **Clear Signals**: Candlestick patterns aur price action analysis se traders ko clear entry aur exit signals milte hain jisse wo trading decisions easily make kar sakte hain.

3. **Flexibility**: Naked trading strategy flexible hai aur different timeframes par apply ki ja sakti hai. Isse traders short-term aur long-term trading opportunities explore kar sakte hain.

**Challenges of Naked Trading Strategy**

1. **Subjectivity**: Price action analysis aur candlestick patterns interpret karne mein subjective element hota hai jisse different traders alag-alag signals interpret kar sakte hain.

2. **Market Volatility**: High volatility situations mein naked trading strategy ke signals unreliable ho sakte hain kyunki price action unpredictability badh jati hai.

**Conclusion**

Naked trading strategy ek effective approach hai jo traders ko price action ke through market movements ko samajhne aur trading decisions lene mein madad deta hai. Is strategy ko samajhna aur effectively use karna traders ke liye zaroori hai jo technical indicators ke bina trading karna pasand karte hain. Har ek trader ko apni risk tolerance aur trading style ke according strategies choose karna chahiye taki wo consistent aur profitable trading kar sakein.

-

#10 Collapse

**Naked Trading Strategy:**

Naked trading strategy forex aur stock market mein ek popular approach hai jo ke price action analysis par mabni hota hai aur indicators ya oscillators ka istemal nahi karta. Is strategy mein traders sirf price charts ko dekhte hain aur un par base kar ke trading decisions lete hain, bina kisi additional technical indicators ke.

Naked trading ka concept yeh hai ke price action hi market ki sabse important information provide karta hai. Is tarah se, traders price patterns, support aur resistance levels, aur trend lines ko identify kar ke trading signals generate karte hain. Is strategy mein ek mukhtalif approach hota hai jahan traders apne decision making process ko simplify karte hain aur market ke natural movements par focus karte hain.

Is strategy ke istemal se traders ko market ke sentiment aur trend ko samajhne mein madad milti hai. Price action analysis ke zariye, traders market mein chhipe hue patterns aur trends ko detect kar sakte hain jo ke traditional indicators se dikhai nahi dete. Is tarah se, naked trading strategy ek holistic view provide karta hai aur traders ko market ki actual dynamics ko samajhne mein madad deta hai.

Naked trading strategy ke kuch mukhtalif components hote hain jo ke traders istemal karte hain:

1. **Candlestick Patterns:** Candlestick patterns jaise ke pin bars, engulfing patterns, aur dojis ko identify kar ke traders apne entry aur exit points tayyar karte hain.

2. **Support aur Resistance Levels:** Price action analysis ke zariye traders support aur resistance levels ko identify karte hain jo ke market mein important hai.

3. **Trend Lines:** Trend lines ko draw kar ke traders current trend ko identify karte hain aur trend reversal signals ko bhi samajhte hain.

Naked trading strategy ka istemal karne se pehle, traders ko strong understanding honi chahiye market dynamics aur price action ke bare mein. Is strategy ke mukhtalif aspects ko samajhne ke liye, traders ko practice aur experience ki zaroorat hoti hai taake wo effective trading decisions le sakein.

Is strategy ka ek faida yeh hai ke is mein reliance kam hota hai lagbhag onay indicators aur oscillators par, jo ke kabhi kabar conflicting signals provide kar sakte hain. Lekin is ke saath saath, naked trading strategy ke use mein risk bhi hota hai keh market ke sudden changes aur volatility ki wajah se trading decisions galat ho sakte hain.

Aakhir mein, naked trading strategy ek personal preference hai jo ke har trader ke liye suit nahi karti. Har ek trader ko apni risk tolerance aur trading style ke according apne trading strategies choose karna chahiye taake wo market mein consistent aur successful ho sakein.

-

#11 Collapse

**Naked Trading Strategy:**

Naked trading strategy forex market mein ek popular approach hai jisme traders sirf price charts aur historical price movements pe focus karte hain. Is strategy mein traders indicators ya oscillators ka use nahi karte aur sirf naked charts (without any additional indicators) ka analysis karte hain.

**Key Elements of Naked Trading Strategy:**

1. **Candlestick Patterns:**

Naked trading strategy mein candlestick patterns ki importance bohat zyada hoti hai. Traders candlesticks ki formations study karte hain jaise ki pin bars, engulfing patterns, aur doji patterns. In patterns ke through price action interpret kiya jata hai aur potential entry aur exit points determine kiye jate hain.

2. **Support and Resistance Levels:**

Support aur resistance levels naked trading strategy mein critical hote hain. Traders price charts pe identify karte hain jahan par price previously bounce kiya hai ya consolidate hua hai. Ye levels traders ko market direction aur potential reversals ke liye guide karte hain.

3. **Trend Analysis:**

Trend analysis naked trading strategy ka integral part hai. Traders current trend ko identify karte hain using price action techniques. Trend ke sath trading karne se traders ko higher probability trades milte hain aur risk management improve hoti hai.

4. **Price Action Signals:**

Price action signals naked trading strategy mein key role play karte hain. Traders look for specific price action signals jaise ki rejection candles, inside bars, aur breakout patterns. In signals ke through traders entry aur exit points define karte hain without relying on lagging indicators.

**Advantages of Naked Trading Strategy:**

1. **Simplicity:**

Naked trading strategy ki simplicity traders ko clear direction provide karta hai market analysis mein. Bina complex indicators ke, traders focus maintain kar sakte hain price movements pe.

2. **Clarity:**

Price action analysis naked trading strategy mein clarity create karta hai. Traders ko clear signals milte hain entry aur exit points ke liye jo decision-making process ko simplify karta hai.

3. **Versatility:**

Naked trading strategy versatile hai aur different timeframes aur market conditions ke liye applicable hai. Isse traders adaptive ho sakte hain changing market dynamics ke according.

**Challenges of Naked Trading Strategy:**

1. **Subjectivity:**

Price action analysis subjective hota hai aur interpret karne mein traders ki discretion involve hoti hai. Isse consistency maintain karna difficult ho sakta hai.

2. **Experience Required:**

Naked trading strategy ko effectively apply karne ke liye experience aur practice zaroori hai. New traders ko initial learning curve face karna padta hai.

3. **Market Noise:**

Market noise naked trading strategy ke effectiveness ko affect kar sakta hai. Choppy market conditions mein clear price signals difficult ho sakte hain.

**Conclusion:**

Naked trading strategy ek powerful tool hai forex market mein jo traders ko price action based decisions lene mein help karta hai. Is strategy ka use karke traders apne analysis skills improve kar sakte hain aur confident trading decisions le sakte hain. However, is strategy ko master karne ke liye patience, discipline, aur continuous learning zaroori hai. Agar aap price action analysis mein interested hain ya forex trading ko simplify karna chahte hain, to naked trading strategy ko explore karna ek beneficial step ho sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Naked Trading Strategy**

Naked trading strategy, jise price action trading bhi kaha jata hai, ek simple aur effective approach hai jo indicators aur technical tools ke bajaye market ke price movements par focus karti hai. Yeh strategy traders ko price charts par banne wale patterns, trends, aur key levels ko analyze karne mein madad karti hai. Naked trading strategy mein, traders sirf price action aur candlestick patterns par rely karte hain.

**Naked Trading Strategy Ki Key Elements:**

1. **Price Action Analysis:** Naked trading ka core price action analysis hai. Traders historical price movements ko dekhte hain aur patterns, trends, aur key support/resistance levels ko identify karte hain.

2. **Candlestick Patterns:** Candlestick patterns naked trading strategy ka important part hain. Traders different patterns jaise pin bars, engulfing candles, dojis, aur inside bars ko use karke market sentiment aur potential reversals ko predict karte hain.

3. **Support and Resistance Levels:** Support aur resistance levels ko identify karna naked trading mein critical hai. Yeh levels price ke previous highs aur lows hote hain jahan price reversal ya breakout hone ke chances hote hain.

4. **Trend Analysis:** Trend ko identify karna aur uske direction mein trade karna naked trading ka basic principle hai. Uptrend mein buy aur downtrend mein sell karna recommended hota hai.

5. **Risk Management:** Risk management naked trading mein bhi bohot zaroori hai. Stop-loss aur take-profit levels ko define karna har trade ke liye essential hai taake potential losses ko limit kiya ja sake aur profits ko secure kiya ja sake.

**Advantages of Naked Trading Strategy:**

- **Simplicity:** Indicators aur technical tools ka use na karte hue, yeh strategy simple aur easy to understand hoti hai.

- **Clear Signals:** Price action aur candlestick patterns clear aur direct trading signals provide karte hain.

- **Flexibility:** Yeh strategy different market conditions aur timeframes mein effective hoti hai.

**Disadvantages of Naked Trading Strategy:**

- **Experience Required:** Naked trading ke liye market ke price action aur candlestick patterns ko samajhne ki zaroorat hoti hai, jo beginners ke liye challenging ho sakta hai.

- **No Objective Confirmation:** Indicators ke bina, sirf price action par rely karna subjective ho sakta hai aur false signals ka risk ho sakta hai.

**Conclusion:**

Naked trading strategy ek powerful approach hai jo traders ko market ke price movements ko samajhne aur profitable trading opportunities ko identify karne mein madad deti hai. Yeh strategy indicators aur technical tools ke bajaye price action aur candlestick patterns par focus karti hai, jo isse simple aur effective banata hai. Proper risk management aur experience ke sath, naked trading strategy ko successfully implement kiya ja sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:21 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим