Inverse Head and Shoulders.

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

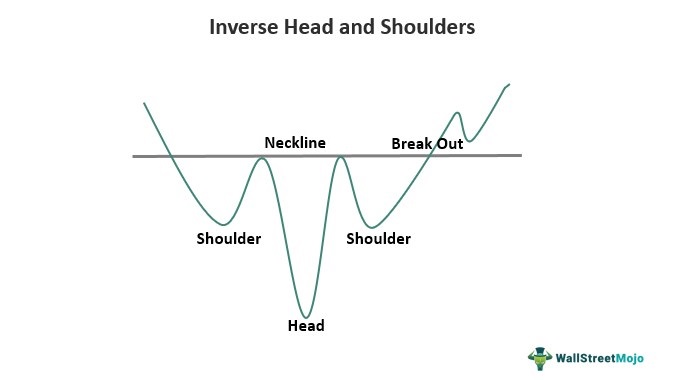

Stock Chart Patern Introduction.Stock chart patern proportion market mein rate moves ko visible tareeqay se dikhata hai. Ye Head and Shoulders patern ek widely diagnosed aur reliable fashion reversal patern hai. Is mein ari rahay ga ya ulat jaye ga. Is terhan, qeemat ke patteren ko khenchnay ke liye. istemaal ki jane wali educated traces par aur kya qeemat tasalsul ke region ke oopar ya neechay tuutatii hai, par mohtaat tawajah di jani chahiye. Takneeki tajzia automobile aam tor par yeh maan-ne ki tajweez karte hain ke koi rujhan is waqt tak jari rahay ga jab tak is ki tasdeeq nah ho jaye ke yeh ulat gaya hai .Teenager peaks hotay hain, jismeiin middle peak (head) sab se ooncha hota hai, aur dosri do peaks (shoulders) oonchay hote hain aur qareeb qareeb barabar peak ki hoti hai. Ye patern entire hota hai jab rate neckline ke neechay break karti hai, jo keh aik line hoti hai jo peaks ke buyers aur traders ke liye aham tareeqay se faida mand sabit hotay hain, kyunke in se destiny fee actions ki samjh hasil hoti hai.Stok chart paterns traders aur buyers ke liye ahem tareeqay se fee movements ko examine karne aur samajhne ke liye zaroori hain. Haan, ye paterns qeemati maloomat faraham kar saktay hain, lekin inhein dusre technical aur fundamental analysis ke saath istemal karna aham hai, taake trading ya investing mein kamiyabi ke imkanat barh jayen. Isi tarah, paterns puri tarah se kaamyaab nahi hote, aur marketplace situations jald hi badal sakti hain, is liye danger control aur sahi tafteesh hamesha ahem hai. Inverse Head and Shoulders.

Inverse Head and Shoulders paternversion hai. Ye ek downtrend ke baad hota hai aur uptrend ki taraf possiblestock chart patteren aksar barhatay hue aur girtay hue rujhanaat ke darmiyan muntaqili ka ishara dete hain. Qeemat ka namona qeemat ki naqal o harkat ki aik qabil shanakht tarteeb hai jis ki shanakht skilled strains aur / ya munhani khutoot ki aik series ke zariye ki jati hai . Jab qeemat ka patteren rujhan ki trend reversal ko suggest karta hai. Is mein do valleys hotay hain jo aik comparable rate degree tak pohanchte hain, aur unke darmiyan aik peak hota hai. Ye patern tab affirm hota hai jab price Head and Shoulders ka bullish model hai. Ye ek downtrend ke baad hota hai Shooting Star patern hammer ka bearish version hai. Ye ek bearish reversal patern hai, jo uptrend ki inteha par nazar ata hai. Is mein aik chota sa body buying and selling variety ke backside pe hota hai aur aik lamba upper shadow hota hai. Ye patern is baat ka andaza deta hai keh shoppers ne pehle price ko upar le gaye, lekin phir sellers ka qabza bana aur price ko neechay le gaye, jab keh final price starting charge ke qareeb hoti hai. Ye trend reversal ki taraf ishara karta hai.Aur feasible trend reversal ko upside ki taraf imply karta hai. Is mein teenager valleys hotay hain, jismeiin middle valley (head) sab se neechi hoti hai, aur dosri do valleys (shoulders) u.S.A. Oonchay hote hain aur qareeb qareeb barabar depth ki hoti hai. Ye patern tab verify hota hai jab charge neckline ke upar wreck karti hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

istemaal ki jane wali educated traces par aur kya qeemat tasalsul ke region ke oopar ya neechay tuutatii hai, par mohtaat tawajah di jani chahiye. Takneeki tajzia automobile aam tor par yeh maan-ne ki tajweez karte hain ke koi rujhan is waqt tak jari rahay ga jab tak is ki tasdeeq nah ho jaye ke yeh ulat gaya hai .Teenager peaks hotay hain, jismeiin middle peak (head) sab se ooncha hota hai, aur dosri do peaks (shoulders) oonchay hote hain aur qareeb qareeb barabar peak ki hoti hai. Ye patern entire hota hai jab rate neckline ke neechay break karti hai, jo keh aik line hoti hai jo peaks ke buyers aur traders ke liye aham tareeqay se faida mand sabit hotay hain, kyunke in se destiny fee actions ki samjh hasil hoti hai.Stok chart paterns traders aur buyers ke liye ahem tareeqay se fee movements ko examine karne aur samajhne ke liye zaroori hain. Haan, ye paterns qeemati maloomat faraham kar saktay hain, lekin inhein dusre technical aur fundamental analysis ke saath istemal karna aham hai, taake trading ya investing mein kamiyabi ke imkanat barh jayen. Isi tarah, paterns puri tarah se kaamyaab nahi hote, aur marketplace situations jald hi badal sakti hain, is liye danger control aur sahi tafteesh hamesha ahem hai. Inverse Head and Shoulders.Jab qeemat ka patteren rujhan ki trend reversal ko suggest karta hai. Is mein do valleys hotay hain jo aik comparable rate degree tak pohanchte hain, aur unke darmiyan aik peak hota hai. Ye patern tab affirm hota hai jab price Head and Shoulders ka bullish model hai. Ye ek downtrend ke baad hota hai Shooting Star patern hammer ka bearish version hai. Ye ek bearish reversal patern hai, jo uptrend ki inteha par nazar ata hai. Is mein aik chota sa body buying and selling variety ke backside pe hota hai aur aik lamba upper shadow hota hai. Ye patern is baat ka andaza deta hai keh shoppers ne pehle price ko upar le gaye, lekin phir sellers ka qabza bana aur price ko neechay le gaye, jab keh final price starting charge ke qareeb hoti hai. Ye trend reversal ki taraf ishara karta hai.Aur feasible trend reversal ko upside ki taraf imply karta hai. Is mein teenager valleys hotay hain, jismeiin middle valley (head) sab se neechi hoti hai, aur dosri do valleys (shoulders) u.S.A. Oonchay hote hain aur qareeb qareeb barabar depth ki hoti hai. Ye patern tab verify hota hai jab charge neckline ke upar wreck karti hai.

- Mentions 0

-

سا0 like

-

#4 Collapse

Introduction: Forex exchanging mein, "Reverse Head and Shoulder Candle Example" aik maqbool diagram design hai. Is design ko samajhna aur usay samajhna, dealers ke liye bohat ahmiyat ki hamil hai. Forex Exchanging ek aisi exchanging hai jisme monetary forms ko khareedna aur bechna hota hai, taa ke benefit hasil kiya ja purpose. Forex Exchanging mein kai tarah ke specialized examination apparatuses ka istemal kiya jata hai, jin mein se ek Candle Examples hai. Backwards Head and Shoulder Candle Example Forex Exchanging ke liye ek ahem design hai, jo dealers ke liye supportive hota hai. Is design ko samajhne ke liye, neechay diye gaye headings ki madad se Roman Urdu principal tafseeli bayanat diye gaye hain: Reverse Head and Shoulder Candle Example ki Tashkeel: Opposite Head and Shoulder Candle Example ek bullish inversion design hai jo ke pattern ke badalne ki nishani hai. Is design mein 3 pinnacles hote hain, jisme focus wala top baki do se uncha hota hai. Dono side ke tops focus rib top se kam unchai standard hote hain. Backwards Head and Shoulder Candle Example ki Tashrih: Yeh design market mein downtrend ke baad boycott sakta hai, aur brokers ko upswing ki nishani dete tint ek bullish inversion signal give karta hai. Is design mein pehle top ko left shoulder kehte hain, focus top ko head kehte hain aur teesra top ko right shoulder kehte hain. Yeh 3 pinnacles aik neck area se milte hain jis ki shape neck area ki situating standard depend karti hai. Reverse Head and Shoulder Candle Example ki Tafseel: Poke market mein Backwards Head and Shoulder Candle Example boycott raha hota hai, tou brokers ko yeh samajhna hota hai ke market mein pattern badalne ki aik solid nishani hai. Hit yeh design boycott raha hota hai, tou merchants ko passage level, stop misfortune aur target cost ka faisla karna hota hai. Dealers apne section level ko right shoulder ke breakout ke upar rakhte hain. Poke cost right shoulder ke breakout se upar jata hai, tou merchants passage level ke qareeb apna stop misfortune rakh sakte hain. Stop misfortune ko right shoulder ke neechay lagaya jata hai. Poke market cost right shoulder ke breakout se upar jata hai, tou brokers apna target cost left shoulder ki unchai standard rakh sakte hain. Reverse Head and Shoulder Candle Example ki Tafseelian Misali Diagram: Neechay diye gaye outline mein aap Converse Head and Shoulder Candle Example ki misali graph dekh sakte hain. converse head-shoulder-design forex-exchanging graph Is graph mein market mein downtrend ke baad Opposite Head and Shoulder Candle Example boycott raha hai. Is design ki neck area even hai. Dealers ne right shoulder ke breakout ke upar passage level rakha hai aur poke cost right shoulder ke breakout se upar jata hai, tou merchants ne apna stop misfortune right shoulder ke neechay lagaya hai. Poke cost left shoulder ki unchai standard pohanchta hai, tou dealers ne apna target cost rakh diya hai. Reverse Head and Shoulder Candle Example Kya Hai? "Opposite Head and Shoulder Candle Example" negative pattern ki sign deta hai, aur yeh bullish pattern ki shuruaat ko bhi batata hai. Yeh design ek pattern inversion design hai, jis mein cost pattern down se up ki taraf shift karta hai. Is Example Ko Kaise Recognize Kiya Jata Hai? "Backwards Head and Shoulder Candle Example" ki recognizable proof ke liye merchants ko kuch cheezon standard nazar rakhni hoti hain, jaise: Brokers ko cost outline standard aik head aur do shoulders (left shoulder and right shoulder) ki talaash karni hoti hai. Head shoulder se zyada noticeable hota hai, aur shoulders ek dosre se symmetric hote hain. Yeh design punch total hota hai, to cost up move karta hai. Reverse Head and Shoulder Candle Example Ki Shuruaat Kaise Hoti Hai? Hit cost pattern down course mein hota hai, to yeh design shuru hota hai. Yeh design do shoulders aur aik head se banta hai. Left shoulder cost drop karne ke baad banta hai, phir head (most minimal price tag) banta hai, phir right shoulder banta hai (jismein cost phir se drop karta hai). Iske baad cost pattern up ki taraf shift karta hai. Is Example Ko Exchange Kaise Karein? Reverse Head and Shoulder Candle Example ko exchange karne ke liye brokers ko kuch steps follow karne hote hain: Punch yeh design total ho, to brokers purchase passage laga sakte hain. Stop misfortune ko right shoulder ke neechay lagaya jata hai. Dealers target cost ko aik risk-reward proportion ke sath set karte hain. End: "Backwards Head and Shoulder Candle Example" aik strong exchanging device hai, jisay merchants cost pattern ko anticipate karne ke liye istemal karte hain. Is design ki samajh aapko Forex exchanging mein effective honay mein madad karegi. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

inverse Head And Shoulder Chart Pattern: Cost frame standard aik head aur do shoulders (left shoulder and right shoulder) ki talaash karni hoti hai.Head shoulder se zyada perceptible hota hai, aur shoulders ek dosre se symmetric hote hain.yeh configuration punch absolute hota hai, to cost up move karta hai.Hit cost design down course mein hota hai, to yeh plan shuru hota hai. Yeh configuration do shoulders aur aik head se banta hai. Left shoulder cost drop karne ke baad banta hai, phir head (most negligible sticker price) banta hai, phir right shoulder banta hai (jismein cost phir se drop karta hai). Iske baad cost design up ki taraf shift karta hai.yeh configuration all out ho, to representatives buy entry laga sakte hain.Stop setback ko right shoulder ke neechay lagaya jata hai.Sellers target cost ko aik risk-reward extent ke sath set karte hain. Market mein In reverse Head and Shoulder Light Model blacklist raha hota hai, tou agents ko yeh samajhna hota hai ke market mein design badalne ki aik strong nishani hai. Hit yeh configuration blacklist raha hota hai, tou traders ko section level, stop setback aur target cost ka faisla karna hota hai. Vendors apne area level ko right shoulder ke breakout ke upar rakhte hain. Jab cost right shoulder ke breakout se upar jata hai, tou shippers entry level ke qareeb apna stop disaster rakh sakte hain. Stop adversity ko right shoulder ke neechay lagaya jata hai. Jab market cost right shoulder ke breakout se upar jata hai, tou dealers apna target cost left shoulder ki unchai standard rakh sakte hain. Chart Pattern Identification: Forex trading mein, "Switch Head and Shoulder Flame Model" aik maqbool outline plan hai. Is plan ko samajhna aur usay samajhna, sellers ke liye bohat ahmiyat ki hamil hai.Forex Trading ek aisi trading hai jisme money related structures ko khareedna aur bechna hota hai, taa ke benefit hasil kiya ja reason. Forex Trading mein kai tarah ke particular assessment devices ka istemal kiya jata hai, jin mein se ek Light Models hai. In reverse Head and Shoulder Candle Model Forex Trading ke liye ek ahem plan hai, jo vendors ke liye strong hota hai. Is plan ko samajhne ke liye, neechay diye gaye headings ki madad se Roman Urdu head tafseeli bayanat diye gaye hain:

Market mein In reverse Head and Shoulder Light Model blacklist raha hota hai, tou agents ko yeh samajhna hota hai ke market mein design badalne ki aik strong nishani hai. Hit yeh configuration blacklist raha hota hai, tou traders ko section level, stop setback aur target cost ka faisla karna hota hai. Vendors apne area level ko right shoulder ke breakout ke upar rakhte hain. Jab cost right shoulder ke breakout se upar jata hai, tou shippers entry level ke qareeb apna stop disaster rakh sakte hain. Stop adversity ko right shoulder ke neechay lagaya jata hai. Jab market cost right shoulder ke breakout se upar jata hai, tou dealers apna target cost left shoulder ki unchai standard rakh sakte hain. Chart Pattern Identification: Forex trading mein, "Switch Head and Shoulder Flame Model" aik maqbool outline plan hai. Is plan ko samajhna aur usay samajhna, sellers ke liye bohat ahmiyat ki hamil hai.Forex Trading ek aisi trading hai jisme money related structures ko khareedna aur bechna hota hai, taa ke benefit hasil kiya ja reason. Forex Trading mein kai tarah ke particular assessment devices ka istemal kiya jata hai, jin mein se ek Light Models hai. In reverse Head and Shoulder Candle Model Forex Trading ke liye ek ahem plan hai, jo vendors ke liye strong hota hai. Is plan ko samajhne ke liye, neechay diye gaye headings ki madad se Roman Urdu head tafseeli bayanat diye gaye hain:  Qeemat ka patteren rujhan ki pattern inversion ko propose karta hai. Is mein do valleys hotay hain jo aik tantamount rate degree tak pohanchte hain, aur unke darmiyan aik top hota hai. Ye patern tab certify hota hai hit value Head and Shoulders ka bullish model hai. Ye ek downtrend ke baad hota hai Falling star patern hammer ka negative variant hai. Ye ek negative inversion patern hai, jo upturn ki inteha standard nazar ata hai. Is mein aik chota sa body trading assortment ke posterior pe hota hai aur aik lamba upper shadow hota hai. Ye patern is baat ka andaza deta hai keh customers ne pehle cost ko upar le gaye, lekin phir merchants ka qabza bana aur cost ko neechay le gaye, hit keh last cost beginning charge ke qareeb hoti hai. Ye pattern inversion ki taraf ishara karta hai.Aur plausible pattern inversion ko potential gain ki taraf suggest karta hai. Is mein young person valleys hotay hain, jismeiin center valley (head) sab se neechi hoti hai, aur dosri do valleys (shoulders) u.S.A. Oonchay hote hain aur qareeb barabar profundity ki hoti hai. Ye patern tab confirm hota hai hit charge neck area ke upar wreck karti hai. Chart Pattern Trading: Takneeki tajzia car aam pinnacle standard yeh maan-ne ki tajweez karte hain ke koi rujhan is waqt tak jari rahay ga poke tak is ki tasdeeq nah ho jaye ke yeh ulat gaya hai .Youngster tops hotay hain, jismeiin center pinnacle (head) sab se ooncha hota hai, aur dosri do tops (shoulders) oonchay hote hain aur qareeb barabar top ki hoti hai. Ye patern whole hota hai punch rate neck area ke neechay break karti hai, jo keh aik line hoti hai jo tops ke purchasers aur brokers ke liye aham tareeqay se faida mand sabit hotay hain, kyunke in se fate charge activities ki samjh hasil hoti hai.Stok outline paterns merchants aur purchasers ke liye ahem tareeqay se expense developments ko analyze karne aur samajhne ke liye zaroori hain. Haan, ye paterns qeemati maloomat faraham kar saktay hain, lekin inhein dusre specialized aur major examination ke saath istemal karna aham hai, taake exchanging ya contributing mein kamiyabi ke imkanat barh jayen. Isi tarah, paterns puri tarah se kaamyaab nahi hote, aur commercial center circumstances jald greetings badal sakti hain

Qeemat ka patteren rujhan ki pattern inversion ko propose karta hai. Is mein do valleys hotay hain jo aik tantamount rate degree tak pohanchte hain, aur unke darmiyan aik top hota hai. Ye patern tab certify hota hai hit value Head and Shoulders ka bullish model hai. Ye ek downtrend ke baad hota hai Falling star patern hammer ka negative variant hai. Ye ek negative inversion patern hai, jo upturn ki inteha standard nazar ata hai. Is mein aik chota sa body trading assortment ke posterior pe hota hai aur aik lamba upper shadow hota hai. Ye patern is baat ka andaza deta hai keh customers ne pehle cost ko upar le gaye, lekin phir merchants ka qabza bana aur cost ko neechay le gaye, hit keh last cost beginning charge ke qareeb hoti hai. Ye pattern inversion ki taraf ishara karta hai.Aur plausible pattern inversion ko potential gain ki taraf suggest karta hai. Is mein young person valleys hotay hain, jismeiin center valley (head) sab se neechi hoti hai, aur dosri do valleys (shoulders) u.S.A. Oonchay hote hain aur qareeb barabar profundity ki hoti hai. Ye patern tab confirm hota hai hit charge neck area ke upar wreck karti hai. Chart Pattern Trading: Takneeki tajzia car aam pinnacle standard yeh maan-ne ki tajweez karte hain ke koi rujhan is waqt tak jari rahay ga poke tak is ki tasdeeq nah ho jaye ke yeh ulat gaya hai .Youngster tops hotay hain, jismeiin center pinnacle (head) sab se ooncha hota hai, aur dosri do tops (shoulders) oonchay hote hain aur qareeb barabar top ki hoti hai. Ye patern whole hota hai punch rate neck area ke neechay break karti hai, jo keh aik line hoti hai jo tops ke purchasers aur brokers ke liye aham tareeqay se faida mand sabit hotay hain, kyunke in se fate charge activities ki samjh hasil hoti hai.Stok outline paterns merchants aur purchasers ke liye ahem tareeqay se expense developments ko analyze karne aur samajhne ke liye zaroori hain. Haan, ye paterns qeemati maloomat faraham kar saktay hain, lekin inhein dusre specialized aur major examination ke saath istemal karna aham hai, taake exchanging ya contributing mein kamiyabi ke imkanat barh jayen. Isi tarah, paterns puri tarah se kaamyaab nahi hote, aur commercial center circumstances jald greetings badal sakti hain  Dosri do tops (shoulders) oonchay hote hain aur qareeb barabar top ki hoti hai. Ye patern whole hota hai poke rate neck area ke neechay break karti hai, jo keh aik line hoti hai jo tops ke purchasers aur merchants ke liye aham tareeqay se faida mand sabit hotay hain, kyunke in se predetermination charge activities ki samjh hasil hoti hai.Stok diagram paterns dealers aur purchasers ke liye ahem tareeqay se expense developments ko look at karne aur samajhne ke liye zaroori hain. Haan, ye paterns qeemati maloomat faraham kar saktay hain, lekin inhein dusre specialized aur principal examination ke saath istemal karna aham hai, taake exchanging ya contributing mein kamiyabi ke imkanat barh jayen. Isi tarah, paterns puri tarah se kaamyaab nahi hote, aur commercial center circumstances jald greetings badal sakti hain, is liye peril control aur sahi tafteesh hamesha ahem hai.

Dosri do tops (shoulders) oonchay hote hain aur qareeb barabar top ki hoti hai. Ye patern whole hota hai poke rate neck area ke neechay break karti hai, jo keh aik line hoti hai jo tops ke purchasers aur merchants ke liye aham tareeqay se faida mand sabit hotay hain, kyunke in se predetermination charge activities ki samjh hasil hoti hai.Stok diagram paterns dealers aur purchasers ke liye ahem tareeqay se expense developments ko look at karne aur samajhne ke liye zaroori hain. Haan, ye paterns qeemati maloomat faraham kar saktay hain, lekin inhein dusre specialized aur principal examination ke saath istemal karna aham hai, taake exchanging ya contributing mein kamiyabi ke imkanat barh jayen. Isi tarah, paterns puri tarah se kaamyaab nahi hote, aur commercial center circumstances jald greetings badal sakti hain, is liye peril control aur sahi tafteesh hamesha ahem hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:53 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим