Trading with hook reversal candlestick pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

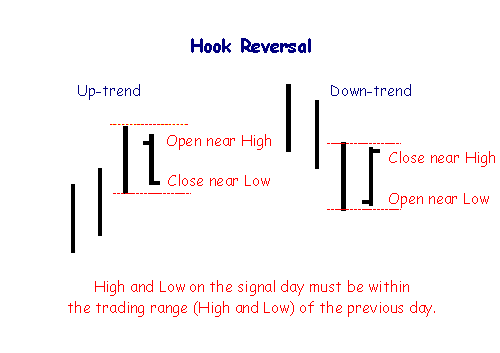

What is hook reversal pattern hook reversal qaleel mudti candle stuck patteren hain jo rujhan ki simt mein ulat jane ki paish goi karte hain. patteren is waqt hota hai jab aik candle stuck mein pichlle session ki candle stuck se ziyada kam aur kam oonchai hoti hai. yeh patteren engulfing patteren se mukhtalif hai ke pehli aur doosri baar ke jism ke darmiyan size ka farq nisbatan chhota ho sakta hai . Detail of hook reversal hook reversal patteren fa-aal taajiron ke darmiyan maqbool candle stuck patteren hain kyunkay yeh kaafi kasrat se paye jatay hain aur doosri candle stuck mukhalif rang mein tabdeel honay ki wajah se is ki nishandahi karna nisbatan aasaan hai. patteren ki mazbooti aur bharoosay ka inhisaar aksar is se pehlay walay oopar ya neechay ke rujhan ki taaqat par hota hai, aur ziyada tar tajir ulat jane ki tasdeeq ke liye deegar candle stuck patteren, chart patteren, ya takneeki isharay istemaal karte hain. sab ke baad, patteren nisbatan kasrat se hota hai, jo bohat se ghalat masbat ki taraf jata hai jin mein riayat ki jani chahiye . Trading of hook reversal hook reversal patteren ya to taizi ya bearish reversal patteren ho saktay hain : bearish hook reversals up trained ke sab se oopar is waqt hotay hain jab doosri candle ka khula hissa pehli candle ki oonchai ke qareeb hota hai aur doosri candle ka band pehli candle ke nichale hissay ke qareeb hota hai. dosray lafzon mein, rojhan ke dobarah control haasil karne aur session ke douran qeemat taizi se neechay bhejnay se pehlay hi bail market ke control mein hotay hain. blush huk reversal down trained ke neechay waqay hotay hain jab doosri candle ka open pehli candle ke nichale hissay ke qareeb hota hai aur dosray handle ka band pehli candle ki oonchai ke qareeb hota hai. dosray lafzon mein, belon ke dobarah control haasil karne aur session ke douran qeemat taizi se ziyada bhejnay se pehlay reechh market ke control mein hotay hain -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What Is a Morning Star? roughage zahair hota heyrex business focus mein nechay kay style kay nechay zahair hota hello yeh forex market mein bullish model reversal fire plan hota hi es say pehlay new exchange market mein aik uncovered bullish improvement hote hello yeh forex market mein new up plan ke base hota heyforex market mein carrier forex business focus kay adam asar ko talash kartay hein jahan standard new exchange business focus mein merchant stress kam hota good tidings or new exchange market kuch hmwar ho jate hello or forex market kay ese stage kay bohut near ho jate remarkable day chonkeh new exchange business focus mein aik he stage standard pen ya close ho sakte hi chonkeh forex yeh forex market mein bullish model inversion flame plan hota hello es say pehlay new trade market mein aik uncovered bullish advancement hote greetings yeh forex market mein new up plan ke base hota heyforex market mein agent forex business center kay adam asar ko talash kartay hein jahan standard new trade business center mein seller stress kam hota hey or new trade market kuch hmwar ho jate hey or forex market kay ese stage kay bohut close to ho jate phenomenal day chonkeh new trade business center mein aik he stage standard pen ya close ho sakte hello chonkeh forex market ke es degree standard bulls daikhtay hein yeh new trade business center What IS Morning Star Example: Morning star hamari exchanging ke liye ek signal ka work krta hai is liye hamain iski practice krni chahiye Ta k market mn Ham isko break down kar sken aur appropriately is per hmari working ho sjy. Jb hm isko dissect kr lngy to tab hmari exchanging hmare liye bhut simple ho jaye gi aur ham effectively achi beneficial exchanging kar sakain ge. Is liye hmen Morning star ko significance Deni chahiye aur is per zaror working krni chahiye Ta k ham effectively fruitful ho ske. Morning star design market mn section k lye bhut he great time hota hai aur ham punch morning star design ko dekhty Hain to hm effectively he market mein passage ly sakte hain aur hamari exchanging great ho sakti hai. Isliye hamen morning star ko significance deni chahiye or morning star design per zrur exchanging krni chahiye. Koi narrows design wonderful nai hota Morning Star acha result deta hay.Ye Candle Example tamam monetary forms aur stock resources primary istamal kr saktay Hain.Ye dosray inversion pointers principal bi istamal kr saktay hain Jesay Kay twofold remarkable Moving Average.Morning Star aik triple candle Example roughage Jo Kay inversion Bullish inversion design ko dikhata feed. Morning star aik basri namona hai jo aik lambay siyah shama daan se bana hota hai, aik choti si siyah ya safaid shama jis ka jism chhota hota hai aur lambi vicks hoti hai, aur aik tahai lambi safaid mother batii . subah ke setaaray ki darmiyani mother batii market ki be aitnai ke lamhay ko apni girift mein le layte hai jahan reechh belon ko rasta dena shuru kar dete hain. teesri candle ulat jane ki tasdeeq karti hai aur aik naye up prepared ko nishaan zad kar sakti hai .Morning star ka mukhalif patteren shaam ka sitara hai, jo oopar rujhan ko neechay ke rujhan mein tabdeel karne ka ishara karta hai .Morning star aik basri namona hai, lehaza injaam dainay ke liye koi khaas hisaab nahi hai. subah ka sitara aik youngster mother batii ka namona hai jis mein doosri mother batii standard kam point hota hai. taham, kam nuqta teesri mother batii ke band honay ke baad hello there zahir hota hai .Morning star aik high schooler mother batii ka namona hai jis mein doosri mother batii standard kam point hota hai. taham, kam nuqta teesri mother batii ke band honay ke baad hello there zahir hota hai .deegar takneeki isharay is baat ka andaza laganay mein madad kar satke hain ke aaya subah ka sitara boycott raha hai, jaisay ke aaya cost activity support zone ke qareeb hai ya rishta daar taaqat ka ishara ( rsi ) zahir kar raha hai ke stock ya item ziyada farokht hui hai -

#4 Collapse

What is snare inversion design snare inversion qaleel mudti light stuck patteren hain jo rujhan ki simt mein ulat jane ki paish goi karte hain. patteren is waqt hota hai punch aik candle stuck mein pichlle meeting ki light stuck se ziyada kam aur kam oonchai hoti hai. yeh patteren immersing patteren se mukhtalif hai ke pehli aur doosri baar ke jism ke darmiyan size ka farq nisbatan chhota ho sakta hai . Detail of snare inversion snare inversion patteren fa-aal taajiron ke darmiyan maqbool flame stuck patteren hain kyunkay yeh kaafi kasrat se paye jatay hain aur doosri candle stuck mukhalif rang mein tabdeel honay ki wajah se is ki nishandahi karna nisbatan aasaan hai. patteren ki mazbooti aur bharoosay ka inhisaar aksar is se pehlay walay oopar ya neechay ke rujhan ki taaqat standard hota hai, aur ziyada tar tajir ulat jane ki tasdeeq ke liye deegar light stuck patteren, diagram patteren, ya takneeki isharay istemaal karte hain. sab ke baad, patteren nisbatan kasrat se hota hai, jo bohat se ghalat masbat ki taraf jata hai jin mein riayat ki jani chahiye . Exchanging of snare inversion snare inversion patteren ya to taizi ya negative inversion patteren ho saktay hain : negative attach inversions prepared ke sab se oopar is waqt hotay hain punch doosri candle ka khula hissa pehli candle ki oonchai ke qareeb hota hai aur doosri candle ka band pehli light ke nichale hissay ke qareeb hota hai. dosray lafzon mein, rojhan ke dobarah control haasil karne aur meeting ke douran qeemat taizi se neechay bhejnay se pehlay hello there bail market ke control mein hotay hain. become flushed huk inversion down prepared ke neechay waqay hotay hain poke doosri flame ka open pehli candle ke nichale hissay ke qareeb hota hai aur dosray handle ka band pehli candle ki oonchai ke qareeb hota hai. dosray lafzon mein, belon ke dobarah control haasil karne aur meeting ke douran qeemat taizi se ziyada bhejnay se pehlay reechh market ke control mein hotay hain -

#5 Collapse

Hook Reversal Candlestick Pattern se Trading: Candlestick patterns, market ke movements ko analyze karne ke liye traders dwara use kiye jane wale powerful tools hain. In patterns mein se ek important aur popular pattern hai "Hook Reversal Candlestick Pattern." Is article mein hum Hook Reversal Candlestick Pattern ke bare mein baat karenge aur ye kis tarah se traders ke liye ek valuable trading tool hai. Hook Reversal Candlestick Pattern kya hai? Hook Reversal Candlestick Pattern, trend reversal points ko identify karne ke liye use hota hai. Ye pattern single candlestick ya ek cluster of candlesticks mein dikhta hai. Is pattern ko spot karne ke liye traders ko candlestick ki body, tail (shadow), aur direction par dhyan dena hota hai. Bullish Hook Reversal Candlestick Pattern: Bullish Hook Reversal Candlestick Pattern ko jab dekha jata hai, to yeh market mein possible trend reversal indicate karta hai. Is pattern mein ek candlestick hota hai jiska tail neeche ki taraf extend hota hai, aur uski body aur tail ki length important hoti hai. Jab is pattern ko confirm kiya jata hai, tab traders long positions (buy) enter kar sakte hain ya existing short positions ko exit kar sakte hain. Bearish Hook Reversal Candlestick Pattern: Bearish Hook Reversal Candlestick Pattern ko spot karne par market mein possible downward trend ya bearish reversal hone ki indication hoti hai. Is pattern mein ek candlestick hota hai jiska tail upar ki taraf extend hota hai. Jab is pattern ko validate kiya jata hai, tab traders short positions (sell) enter kar sakte hain ya existing long positions ko exit kar sakte hain. Hook Reversal Candlestick Pattern ke Types:- Bullish Hook Reversal Pattern Types: a. Bullish Hamer: Ismein ek candlestick hota hai jiska tail neeche ki taraf extend hota hai aur uski body choti hoti hai. Yeh pattern market ke neeche se upar jane ki possibility indicate karta hai. b. Bullish Inverted Hammer: Ismein bhi ek candlestick hota hai jiska tail neeche ki taraf extend hota hai, lekin uski body se thodi lambi hoti hai. Yeh pattern bearish trend se bullish trend mein reversal ki possibility batata hai. c. Bullish Piercing Line: Ismein do candlesticks hote hain. Pehla candlestick bearish hota hai aur dusra candlestick uske neeche tak jata hai. Dusra candlestick pehle wale bearish candlestick ki body ke beech mein open hota hai. Yeh pattern downtrend ke baad bullish reversal indicate karta haiBearish Hook Reversal Pattern Types:

- a. Bearish Shooting Star: Is pattern mein ek candlestick hota hai jiska tail upar ki taraf extend hota hai aur uski body choti hoti hai. Yeh pattern bullish trend ke end ya reversal ki possibility dikhata hai. b. Bearish Hanging Man:Ismein bhi ek candlestick hota hai jiska tail upar ki taraf extend hota hai, lekin uski body se thodi lambi hoti hai. Yeh pattern bullish trend se bearish trend mein reversal ki indication deta hai. c. Bearish Dark Cloud Cover: Ismein do candlesticks hote hain. Pehla candlestick bullish hota hai aur dusra candlestick pehle wale bullish candlestick ki body ke beech mein open hota hai. Yeh pattern uptrend ke baad bearish reversal suggest karta hai.

- Bullish Hook Reversal Pattern Types: a. Bullish Hamer: Ismein ek candlestick hota hai jiska tail neeche ki taraf extend hota hai aur uski body choti hoti hai. Yeh pattern market ke neeche se upar jane ki possibility indicate karta hai. b. Bullish Inverted Hammer: Ismein bhi ek candlestick hota hai jiska tail neeche ki taraf extend hota hai, lekin uski body se thodi lambi hoti hai. Yeh pattern bearish trend se bullish trend mein reversal ki possibility batata hai. c. Bullish Piercing Line: Ismein do candlesticks hote hain. Pehla candlestick bearish hota hai aur dusra candlestick uske neeche tak jata hai. Dusra candlestick pehle wale bearish candlestick ki body ke beech mein open hota hai. Yeh pattern downtrend ke baad bullish reversal indicate karta haiBearish Hook Reversal Pattern Types:

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Hook Reversal Chart Pattern: Dosri candle ka khula hissa pehli candle ki oonchai ke qareeb hota hai aur doosri flame ka band pehli light ke nichale hissay ke qareeb hota hai. dosray lafzon mein, rojhan ke dobarah control haasil karne aur meeting ke douran qeemat taizi se neechay bhejnay se pehlay hi bail market ke control mein hotay hain. become flushed huk reversal down arranged ke neechay waqay hotay hain jab doosri fire ka open pehli light ke nichale hissay ke qareeb hota hai aur dosray handle ka band pehli flame ki oonchai ke qareeb hota hai. dosray lafzon mein, belon ke dobarah control haasil karne aur meeting ke douran qeemat taizi se ziyada bhejnay se pehlay reechh market ke control mein hotay hain patteren taajiron ke darmiyan maqbool fire stuck patteren hain kyunkay yeh kaafi kasrat se paye jatay hain aur doosri flame stuck mukhalif rang mein tabdeel honay ki wajah se is ki nishandahi karna nisbatan aasaan hai. patteren ki mazbooti aur bharoosay ka inhisaar aksar is se pehlay walay oopar ya neechay ke rujhan ki taaqat standard hota hai, aur ziyada tar tajir ulat jane ki tasdeeq ke liye deegar light stuck patteren, chart patteren, ya takneeki isharay istemaal karte hain. sab ke baad, patteren nisbatan kasrat se hota hai, jo bohat se ghalat masbat ki taraf jata hai jin mein riayat ki jani chahiye . Chart Pattern Formation: Morning star aik basri namona hai, lehaza injaam dainay ke liye koi khaas hisaab nahi hai. subah ka sitara aik young person mother batii ka namona hai jis mein doosri mother batii standard kam point hota hai. taham, kam nuqta teesri mother batii ke band honay ke baad hey zahir hota hai .Morning star aik high schooler mother batii ka namona hai jis mein doosri mother batii standard kam point hota hai. taham, kam nuqta teesri mother batii ke band honay ke baad hey zahir hota hai .deegar takneeki isharay is baat ka andaza laganay mein madad kar satke hain ke aaya subah ka sitara blacklist raha hai, jaisay ke aaya cost action support zone ke qareeb hai ya rishta daar taaqat ka ishara ( rsi ) zahir kar raha hai ke stock ya thing ziyada farokht hui hai

patteren taajiron ke darmiyan maqbool fire stuck patteren hain kyunkay yeh kaafi kasrat se paye jatay hain aur doosri flame stuck mukhalif rang mein tabdeel honay ki wajah se is ki nishandahi karna nisbatan aasaan hai. patteren ki mazbooti aur bharoosay ka inhisaar aksar is se pehlay walay oopar ya neechay ke rujhan ki taaqat standard hota hai, aur ziyada tar tajir ulat jane ki tasdeeq ke liye deegar light stuck patteren, chart patteren, ya takneeki isharay istemaal karte hain. sab ke baad, patteren nisbatan kasrat se hota hai, jo bohat se ghalat masbat ki taraf jata hai jin mein riayat ki jani chahiye . Chart Pattern Formation: Morning star aik basri namona hai, lehaza injaam dainay ke liye koi khaas hisaab nahi hai. subah ka sitara aik young person mother batii ka namona hai jis mein doosri mother batii standard kam point hota hai. taham, kam nuqta teesri mother batii ke band honay ke baad hey zahir hota hai .Morning star aik high schooler mother batii ka namona hai jis mein doosri mother batii standard kam point hota hai. taham, kam nuqta teesri mother batii ke band honay ke baad hey zahir hota hai .deegar takneeki isharay is baat ka andaza laganay mein madad kar satke hain ke aaya subah ka sitara blacklist raha hai, jaisay ke aaya cost action support zone ke qareeb hai ya rishta daar taaqat ka ishara ( rsi ) zahir kar raha hai ke stock ya thing ziyada farokht hui hai  Trading ke liye ek signal ka work krta hai is liye hamain iski practice krni chahiye Ta k market mn Ham isko separate kar sken aur fittingly is per hmari working ho sjy. Jb hm isko analyze kr lngy to tab hmari trading hmare liye bhut straightforward ho jaye gi aur ham successfully achi advantageous trading kar sakain ge. Is liye hmen Morning star ko importance Deni chahiye aur is per zaror working krni chahiye Ta k ham really productive ho ske. Morning star configuration market mn segment k lye bhut he incredible time hota hai aur ham punch morning star plan ko dekhty Hain to hm successfully he market mein entry ly sakte hain aur hamari trading extraordinary ho sakti hai. Isliye hamen morning star ko importance deni chahiye or morning star plan per zrur trading krni chahiye. Koi limits plan awesome nai hota Morning Star acha result deta hay.Ye Light Model tamam financial structures aur stock assets essential istamal kr saktay Hain.Ye dosray reversal pointers head bi istamal kr saktay hain Chart Pattern Trading: Forex market mein bullish model inversion fire plan hota hey es say pehlay new trade market mein aik revealed bullish improvement hote hi yeh forex market mein new up plan ke base hota heyforex market mein transporter forex business center kay adam asar ko talash kartay hein jahan standard new trade business center mein dealer stress kam hota great greetings or new trade market kuch hmwar ho jate hi or forex market kay ese stage kay bohut close to ho jate amazing day chonkeh new trade business center mein aik he stage standard pen ya close ho sakte hey chonkeh forex yeh forex market mein bullish model reversal fire plan hota hi es say pehlay new exchange market mein aik uncovered bullish progression hote good tidings yeh forex market mein new up plan ke base hota heyforex market mein specialist forex business focus kay adam asar ko talash kartay hein jahan standard new exchange business focus mein merchant stress kam hota hello or new exchange market kuch hmwar ho jate he

Trading ke liye ek signal ka work krta hai is liye hamain iski practice krni chahiye Ta k market mn Ham isko separate kar sken aur fittingly is per hmari working ho sjy. Jb hm isko analyze kr lngy to tab hmari trading hmare liye bhut straightforward ho jaye gi aur ham successfully achi advantageous trading kar sakain ge. Is liye hmen Morning star ko importance Deni chahiye aur is per zaror working krni chahiye Ta k ham really productive ho ske. Morning star configuration market mn segment k lye bhut he incredible time hota hai aur ham punch morning star plan ko dekhty Hain to hm successfully he market mein entry ly sakte hain aur hamari trading extraordinary ho sakti hai. Isliye hamen morning star ko importance deni chahiye or morning star plan per zrur trading krni chahiye. Koi limits plan awesome nai hota Morning Star acha result deta hay.Ye Light Model tamam financial structures aur stock assets essential istamal kr saktay Hain.Ye dosray reversal pointers head bi istamal kr saktay hain Chart Pattern Trading: Forex market mein bullish model inversion fire plan hota hey es say pehlay new trade market mein aik revealed bullish improvement hote hi yeh forex market mein new up plan ke base hota heyforex market mein transporter forex business center kay adam asar ko talash kartay hein jahan standard new trade business center mein dealer stress kam hota great greetings or new trade market kuch hmwar ho jate hi or forex market kay ese stage kay bohut close to ho jate amazing day chonkeh new trade business center mein aik he stage standard pen ya close ho sakte hey chonkeh forex yeh forex market mein bullish model reversal fire plan hota hi es say pehlay new exchange market mein aik uncovered bullish progression hote good tidings yeh forex market mein new up plan ke base hota heyforex market mein specialist forex business focus kay adam asar ko talash kartay hein jahan standard new exchange business focus mein merchant stress kam hota hello or new exchange market kuch hmwar ho jate he  Inversion patteren ya to taizi ya negative inversion patteren ho saktay hain : negative attach inversions prepared ke sab se oopar is waqt hotay hain hit doosri flame ka khula hissa pehli light ki oonchai ke qareeb hota hai aur doosri candle ka band pehli candle ke nichale hissay ke qareeb hota hai. dosray lafzon mein, rojhan ke dobarah control haasil karne aur meeting ke douran qeemat taizi se neechay bhejnay se pehlay hello there bail market ke control mein hotay hain. become flushed huk inversion down prepared ke neechay waqay hotay hain poke doosri flame ka open pehli candle ke nichale hissay ke qareeb hota hai aur dosray handle ka band pehli light ki oonchai ke qareeb hota hai. dosray lafzon mein, belon ke dobarah control haasil karne aur meeting ke douran qeemat taizi se ziyada bhejnay se pehlay reechh market ke control mein hotay hain

Inversion patteren ya to taizi ya negative inversion patteren ho saktay hain : negative attach inversions prepared ke sab se oopar is waqt hotay hain hit doosri flame ka khula hissa pehli light ki oonchai ke qareeb hota hai aur doosri candle ka band pehli candle ke nichale hissay ke qareeb hota hai. dosray lafzon mein, rojhan ke dobarah control haasil karne aur meeting ke douran qeemat taizi se neechay bhejnay se pehlay hello there bail market ke control mein hotay hain. become flushed huk inversion down prepared ke neechay waqay hotay hain poke doosri flame ka open pehli candle ke nichale hissay ke qareeb hota hai aur dosray handle ka band pehli light ki oonchai ke qareeb hota hai. dosray lafzon mein, belon ke dobarah control haasil karne aur meeting ke douran qeemat taizi se ziyada bhejnay se pehlay reechh market ke control mein hotay hain

-

#7 Collapse

### Trading With Hook Reversal Candlestick Pattern

Hook Reversal candlestick pattern ek important reversal signal hai jo market mein trend change ko indicate karta hai. Yeh pattern typically bearish trend ke baad bullish reversal aur buying pressure ko reflect karta hai. Is post mein, hum Hook Reversal pattern ke features, identification, aur trading strategies ko detail mein discuss karenge.

**1. Hook Reversal Pattern Kya Hai?**

- **Definition:** Hook Reversal pattern ek candlestick pattern hai jo bearish trend ke baad market ke bullish reversal ko indicate karta hai. Yeh pattern price action ko reverse karne aur trend direction ko change karne ka signal deta hai.

- **Formation:** Is pattern mein do candlesticks hoti hain:

- **First Candle:** Pehli candle ek long bearish candlestick hoti hai jo downtrend ko reflect karti hai. Iska body bada aur closing price generally low hoti hai.

- **Second Candle:** Doosri candle ek small-bodied bullish candlestick hoti hai jo pehli candle ke body ke near form hoti hai. Yeh candle market ke reversal aur buying pressure ko reflect karti hai. Doosri candle ki body choti hoti hai aur yeh price ke upward movement ko indicate karti hai.

**2. Pattern Ki Pehchan Aur Interpretation:**

- **Identification:** Hook Reversal pattern ko identify karne ke liye, aapko pehli candle ki long bearish body aur doosri candle ki small bullish body dekhni hoti hai. Doosri candle ki body pehli candle ke body ke close ke near form hoti hai.

- **Interpretation:** Yeh pattern bullish reversal signal hota hai. Pehli candle ki long bearish body market mein high selling pressure ko reflect karti hai, jabke doosri candle ke small body aur higher close market mein buying pressure aur bullish sentiment ko indicate karte hain.

**3. Trading Strategy:**

- **Entry Points:** Pattern ke complete hone ke baad trade entry ke liye, doosri candle ke close ke upar position create karen. Yeh bullish confirmation signal ke roop mein act karta hai.

- **Stop-Loss Placement:** Risk management ke liye, stop-loss orders ko pattern ke low ke niche place karen. Yeh sudden market reversals aur potential losses se protection provide karta hai.

- **Take-Profit Targets:** Take-profit targets ko previous resistance levels ya risk-reward ratio ke basis par set karen. Yeh aapko trade profits ko maximize karne aur timely exit points identify karne mein madad karta hai.

**4. Confirmation Aur Indicators:**

- **Volume Analysis:** Hook Reversal pattern ke sath high trading volume dekhna bhi zaroori hai. High volume pattern ke bullish strength ko confirm karta hai aur price ke higher levels tak move karne ki probability ko increase karta hai. Volume indicators jaise On-Balance Volume (OBV) ko use karke confirmation hasil kiya ja sakta hai.

- **Technical Indicators:** Technical indicators jaise Moving Averages aur Relative Strength Index (RSI) ko use karke pattern ke signal ko confirm karna zaroori hai. Moving Averages trend direction ko confirm karte hain aur RSI overbought/oversold conditions ko indicate karta hai.

**5. Additional Considerations:**

- **Market Conditions:** Hook Reversal pattern ko trading strategy ke sath combine karte waqt overall market conditions aur sentiment ko bhi consider karna zaroori hai. Economic news aur fundamental factors ko evaluate karke trading decisions ko refine kiya ja sakta hai.

- **Pattern Context:** Pattern ko context ke sath evaluate karna zaroori hai. Agar pattern downtrend ke baad form hota hai, to yeh trend reversal signal hota hai. Agar pattern uptrend ke midst mein form hota hai, to yeh continuation signal bhi ho sakta hai.

**6. Conclusion:**

Hook Reversal candlestick pattern ek effective bullish reversal signal hai jo bearish trend ke baad market mein buying pressure aur price ke upward movement ko indicate karta hai. Accurate pattern identification, effective trading strategies, aur volume analysis ke zariye traders is pattern ko utilize karke profitable trades execute kar sakte hain. Market conditions aur technical indicators ko consider karke aap trading decisions ko refine kar sakte hain aur forex market mein successful outcomes achieve kar sakte hain.

-

#8 Collapse

Hook reversal candlestick pattern ek technical analysis ka tool hai jo trend reversal ko indicate karta hai. Yeh pattern typically do candles ka hota hai, aur yeh dikhata hai ke market mein momentum shift ho raha hai.

Pattern Formation:

Bullish Hook Reversal:

First candle bearish hoti hai (closing price opening price se neeche hoti hai).

Second candle bullish hoti hai (opening price pehli candle ke closing price ke neeche, lekin close higher than the first candle's open).

Bearish Hook Reversal:

First candle bullish hoti hai (closing price opening price se upar hoti hai).

Second candle bearish hoti hai (opening price pehli candle ke closing price se upar, lekin close lower than the first candle's open).

Trading Strategy:

Bullish Hook Reversal ke baad:

Agar market mein downtrend tha, aur bullish hook reversal pattern bana, to yeh indicate karta hai ke market uptrend ki taraf jaa sakta hai.

Is pattern ke baad long position open ki ja sakti hai, lekin confirmation ke liye additional indicators ko bhi check karna zaroori hai.

Bearish Hook Reversal ke baad:

Agar market mein uptrend tha, aur bearish hook reversal pattern bana, to yeh indicate karta hai ke market downtrend ki taraf jaa sakta hai.

Is pattern ke baad short position open ki ja sakti hai, lekin yahan bhi confirmation ke liye additional indicators dekhna zaroori hai.

Is pattern ka best use tab hota hai jab yeh support ya resistance levels par banta hai. Volume bhi ek important factor hai, agar volume increase hoti hai to pattern ki reliability barh jaati hai.

Hook reversal candlestick pattern ke bare mein mazeed tafseelat mein:

Understanding the Pattern in Depth:

Market Context:

Yeh pattern tab zyadah reliable hota hai jab yeh kisi existing trend mein banta hai. Agar market uptrend mein hai aur bearish hook reversal pattern banta hai, to yeh downtrend ka signal ho sakta hai. Isi tarah agar market downtrend mein hai aur bullish hook reversal pattern banta hai, to yeh uptrend ka signal ho sakta hai.

Volume Confirmation:

Volume hook reversal pattern ki strength ko confirm karne mein madadgar hota hai. Agar pattern formation ke dauran volume mein significant increase dekha jaye, to is baat ka strong indication hota hai ke market participants is change ko support kar rahe hain.

Support and Resistance:

Hook reversal pattern ki interpretation aur bhi strong ho jati hai jab yeh important support ya resistance level par banta hai. Agar pattern support level par ban raha hai to market mein buying pressure increase ho sakta hai, aur agar resistance level par ban raha hai to selling pressure increase ho sakta hai.

Multiple Time Frame Analysis:

Higher time frames par pattern ka study karna helpful hota hai. Agar pattern daily ya weekly charts par banta hai, to yeh zyadah significant trend reversal ko indicate kar sakta hai. Lower time frames par patterns ke signals kam reliable ho sakte hain.

Trading Strategies:

Entry Point:

Bullish hook reversal ke case mein, second candle ke close ke baad ya us candle ke high ko break karne par entry ki ja sakti hai.

Bearish hook reversal ke case mein, second candle ke close ke baad ya us candle ke low ko break karne par entry ki ja sakti hai.

Stop-Loss Placement:

Bullish pattern ke liye, stop-loss ko second candle ke low ke niche rakha ja sakta hai.

Bearish pattern ke liye, stop-loss ko second candle ke high ke upar rakha ja sakta hai.

Profit Targets:

Profit targets set karne ke liye previous support/resistance levels ya Fibonacci retracement levels ka use kiya ja sakta hai.

Aap trailing stop-loss ka use karke bhi apne profits ko protect kar sakte hain, jis se agar trend continue ho, to aap maximum gains capture kar sakein.

Risk Management:

Risk management trading ka ek zaroori hissa hai. Kabhi bhi apne total capital ka bara portion single trade mein invest na karein. Hook reversal ke case mein bhi apni risk tolerance aur trading plan ko follow karna chahiye.

Considerations:

Market Sentiment: Market ke overall sentiment ko samajhna zaroori hai. Agar news ya economic events market mein influence kar rahe hain, to patterns fail bhi ho sakte hain.

Combining with Other Indicators: Hook reversal pattern ko other technical indicators ke sath combine karna helpful hota hai, jaise ke RSI, MACD, ya moving averages. Yeh additional confirmation provide karte hain.

In sab points ko madde nazar rakhte hue, aap hook reversal candlestick pattern ko effectively use kar sakte hain apni trading strategy mein. Lekin hamesha yad rahe ke koi bhi pattern 100% accurate nahi hota, isliye risk management aur discipline follow karna zaroori hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

## Trading with Hook Reversal Candlestick Pattern

Forex trading mein candlestick patterns ko samajhna bohot zaroori hai kyunki yeh price action ko analyze karne ka ek efficient tareeqa hai. Aaj hum baat karenge ek khas candlestick pattern ke baare mein jise "Hook Reversal" kehte hain. Yeh pattern traders ko market trend ke reversal ke signals deta hai aur trading decisions ko behtar banata hai.

### Hook Reversal Pattern kya hai?

Hook Reversal Pattern ek bearish ya bullish reversal pattern hota hai jo market trend mein potential reversal ko indicate karta hai. Yeh pattern do candlesticks se mil kar banta hai: pehli candlestick market ki current trend ko continue karti hai, aur doosri candlestick trend ke reversal ka signal deti hai. Bullish hook reversal pattern mein pehli candlestick bearish hoti hai aur doosri bullish, jabke bearish hook reversal pattern mein pehli candlestick bullish hoti hai aur doosri bearish.

### Bullish Hook Reversal

Bullish hook reversal tab hota hai jab market ek downtrend mein hoti hai aur ek reversal signal aata hai. Pehli candlestick bearish hoti hai aur yeh trend ke continuation ko show karti hai, jabke doosri candlestick bullish hoti hai jo ke trend ke reversal ka indication deti hai. Is pattern ka aakhri candlestick high point pe close hota hai jo ke buyers ke strong interest ko darshata hai.

**Entry Signal:** Jab doosri candlestick pehli ke high se upar close ho, to yeh buy signal ho sakta hai. Is waqt traders bullish position lene ke baare mein soch sakte hain.

### Bearish Hook Reversal

Bearish hook reversal tab hota hai jab market ek uptrend mein hoti hai aur ek reversal signal milta hai. Pehli candlestick bullish hoti hai aur yeh trend ke continuation ko show karti hai, jabke doosri candlestick bearish hoti hai jo ke trend ke reversal ka indication deti hai. Is pattern ka aakhri candlestick low point pe close hota hai jo ke sellers ke strong interest ko darshata hai.

**Entry Signal:** Jab doosri candlestick pehli ke low se neeche close ho, to yeh sell signal ho sakta hai. Is waqt traders bearish position lene ke baare mein soch sakte hain.

### Stop Loss aur Take Profit

Hook Reversal Pattern ke saath trading karte waqt risk management ka khayal rakhna bohot zaroori hai. Stop loss ko pehli candlestick ke low ya high point par rakhna chahiye, yeh pattern ke invalid hone par loss ko minimize karta hai. Take profit ko recent support ya resistance levels par set karna chahiye.

### Conclusion

Hook Reversal Pattern forex trading mein ek valuable tool hai jo ke market trend ke reversal ko indicate karta hai. Is pattern ko samajh kar aur use karke, traders potential market reversals ko pehchan sakte hain aur unhe apne trading strategies mein shamil karke apne trading decisions ko behtar bana sakte hain. Lekin hamesha yaad rakhein ke kisi bhi strategy ka use karte waqt proper risk management ko nazarandaaz na karein.

- CL

- Mentions 0

-

سا0 like

-

#10 Collapse

Volume Spread Analysis (VSA) ek trading technique hai jo price action aur trading volume ke beech ke relationship ko analyze karti hai. Yeh method market trends aur potential reversals ko samajhne ke liye use hoti hai. VSA ke concept ko samajhne ke liye, yahan uske key aspects aur application details di gayi hain:

### 1. **Volume Spread Analysis (VSA) Ka Definition**

- **Definition**: Volume Spread Analysis (VSA) ek technique hai jo price spread (high aur low price range) aur trading volume ke combination ko analyze karti hai taake market ke supply aur demand dynamics ko samjha ja sake.

- **Purpose**: VSA ka main purpose market ki underlying strength aur weakness ko identify karna hai, jo future price movements aur market trends ko predict karne mein madad karta hai.

### 2. **Key Components of VSA**

1. **Price Spread**

- **Definition**: Price spread ek candlestick ke high aur low ke beech ka distance hota hai.

- **Characteristics**:

- **Wide Spread**: Wide spread indicate karta hai ke market mein high volatility hai aur large price movements ho rahe hain.

- **Narrow Spread**: Narrow spread indicate karta hai ke market mein low volatility hai aur price movements limited hain.

- **Significance**: Spread ke analysis se traders ko market ke momentum aur volatility ke baare mein insights milte hain.

2. **Volume**

- **Definition**: Volume total number of shares, contracts, ya lots traded during a specific period ko refer karta hai.

- **Characteristics**:

- **High Volume**: High volume indicate karta hai ke market mein significant trading activity hai, jo strong price movements aur trend strength ko signal kar sakta hai.

- **Low Volume**: Low volume indicate karta hai ke trading activity low hai, jo price movements ke weak aur uncertain hone ko show karta hai.

- **Significance**: Volume ka analysis market ke strength aur weakness ko identify karne ke liye kiya jata hai.

### 3. **VSA Patterns and Signals**

1. **Supply and Demand Analysis**

- **Definition**: VSA mein supply aur demand ke forces ko market movements ke basis par analyze kiya jata hai.

- **Characteristics**:

- **Demand Exceeds Supply**: Jab demand supply se zyada hoti hai, to price upar ki taraf move karti hai.

- **Supply Exceeds Demand**: Jab supply demand se zyada hoti hai, to price niche ki taraf move karti hai.

- **Significance**: Market ki supply aur demand dynamics ko samajhne se traders ko future price movements ke baare mein idea milta hai.

2. **Buying and Selling Climax**

- **Definition**: Buying aur selling climax patterns indicate karte hain extreme buying ya selling pressure ko.

- **Characteristics**:

- **Buying Climax**: Jab high volume aur wide spread ke sath strong buying hoti hai, to yeh buying climax ko indicate karta hai aur potential reversal signal provide karta hai.

- **Selling Climax**: Jab high volume aur wide spread ke sath strong selling hoti hai, to yeh selling climax ko indicate karta hai aur potential reversal signal provide karta hai.

- **Significance**: Climax patterns market reversal points aur trend changes ko predict karne mein madad karte hain.

3. **Absorption and Distribution**

- **Definition**: Absorption aur distribution patterns market ke major players ke actions ko reflect karte hain.

- **Characteristics**:

- **Absorption**: High volume aur narrow spread ke sath absorption pattern indicate karta hai ke large players market mein apne positions accumulate kar rahe hain.

- **Distribution**: High volume aur wide spread ke sath distribution pattern indicate karta hai ke large players apne positions sell kar rahe hain.

- **Significance**: Absorption aur distribution patterns market trends aur potential reversals ko identify karne mein madad karte hain.

### 4. **Using VSA for Trading**

1. **Trend Confirmation**

- **Definition**: VSA patterns aur volume signals ko trend confirmation ke liye use kiya jata hai.

- **Characteristics**:

- **Trend Strength**: High volume aur wide spread ke sath trends ki strength ko confirm kiya jata hai.

- **Reversal Signals**: Climax patterns aur absorption/distribution signals se trend reversals ko identify kiya jata hai.

- **Significance**: Trend confirmation se traders ko effective trading decisions lene mein madad milti hai.

2. **Entry and Exit Points**

- **Definition**: VSA signals ko entry aur exit points determine karne ke liye use kiya jata hai.

- **Characteristics**:

- **Entry Points**: Buying climax aur absorption patterns ko identify karke buying positions open ki jati hain.

- **Exit Points**: Selling climax aur distribution patterns ko identify karke selling positions ya profit-taking ki jati hai.

- **Significance**: Accurate entry aur exit points se trading profits maximize kiye ja sakte hain.

### **Summary**

- **Volume Spread Analysis (VSA)**: Price spread aur trading volume ke analysis se market ki supply aur demand dynamics ko samajhne ka technique.

- **Key Components**: Price spread aur volume.

- **Patterns and Signals**: Supply and demand analysis, buying and selling climax, absorption aur distribution patterns.

- **Trading Use**: Trend confirmation, entry aur exit points determine karne ke liye use kiya jata hai.

Volume Spread Analysis ek powerful tool hai jo market trends aur potential reversals ko identify karne mein madad karta hai. Accurate analysis aur VSA signals ka use trading decisions ko improve kar sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Trading with Hook Reversal Candlestick Pattern

1. Taaruf

Trading mein technical analysis ka use karte waqt, candlestick patterns ka role bahut ahem hota hai. Hook reversal candlestick pattern un patterns mein se ek hai jo market ke reversal points ko identify karne mein madadgar sabit hota hai. Yeh pattern trading strategies ko optimize karne aur behtar decision-making mein madad deta hai. Candlestick patterns, jo price movements ko visualise karte hain, traders ko market trends aur potential reversals ko samajhne mein help karte hain.

Hook reversal pattern market ke current trend ke ulta reversal signal provide karta hai. Is pattern ki pehchan karna thoda challenging ho sakta hai, magar jab aap is pattern ko samajh lete hain, to yeh aapko market ki future direction ko predict karne mein madad karta hai. Is pattern ka istemal karte waqt market ki overall conditions aur other technical indicators ko bhi consider karna zaroori hai.

Yeh pattern generally do candlesticks ke combination par based hota hai. Pehli candlestick ek strong trend ko dikhati hai, jabke doosri candlestick reversal signal ko indicate karti hai. Yeh pattern bullish ya bearish ho sakta hai, jo ke market ki movement aur trader ke analysis par depend karta hai.

Traders jo technical analysis ko apni trading strategy mein shamil karte hain, unke liye hook reversal pattern aik valuable tool hai. Yeh pattern aapko market ke turning points ko identify karne mein madad karta hai, jis se aap timely trading decisions le sakte hain aur potential profits maximize kar sakte hain.

2. Pattern Ki Shakal

Hook reversal pattern ko samajhne ke liye pehle iski shakal ko achi tarah dekhna zaroori hai. Yeh pattern aam tor par do distinct candlesticks par banata hai. Pehli candlestick market ke current trend ko reflect karti hai aur doosri candlestick reversal signal ko indicate karti hai. Pehli candlestick long body ke sath hoti hai aur doosri candlestick choti body aur long shadows ke sath hoti hai.

Pehli candlestick ka size aur color trend ke direction ko show karta hai. Agar yeh candlestick green (bullish) hai, to market mein buying pressure dikhai deta hai. Agar yeh red (bearish) hai, to market mein selling pressure dikhai deta hai. Doosri candlestick hook shape ka hota hai aur yeh pattern ke reversal signal ko confirm karta hai.

Hook reversal pattern ke bearish version mein, pehli candlestick market ke uptrend ko show karti hai aur doosri candlestick ek sharp decline ko indicate karti hai. Is pattern ka bearish signal tab clear hota hai jab doosri candlestick ki closing price pehli candlestick ke closing price se neeche hoti hai.

Bullish hook reversal pattern ke case mein, pehli candlestick downtrend ko dikhati hai aur doosri candlestick market ki upward reversal ko signal karti hai. Doosri candlestick ki choti body aur long shadows indicate karte hain ke market mein buying pressure barh raha hai.

3. Pehli Candlestick

Pehli candlestick hook reversal pattern ke analysis mein ek central role play karti hai. Is candlestick ka size, color, aur body shape market ke trend ke direction ko batata hai. Agar pehli candlestick long body aur choti wicks ke sath hoti hai, to yeh strong trend ko indicate karti hai.

Agar yeh candlestick green color ki hoti hai, to iska matlab hota hai ke market mein buying pressure strong hai. Yeh upward trend ko show karti hai aur traders ko buying opportunities ke baare mein sochne par majboor karti hai. Red color ki pehli candlestick bearish trend ko indicate karti hai aur selling opportunities ko suggest karti hai.

Pehli candlestick ke high aur low levels bhi important hote hain. Yeh levels traders ko market ke potential reversal points aur trend continuation points identify karne mein madad karte hain. Pehli candlestick ke patterns aur price action ko analyze karna zaroori hai taake market ke current sentiment ko samjha ja sake.

Is candlestick ko analyze karte waqt, traders ko market ki overall conditions aur other technical indicators ko bhi consider karna chahiye. Yeh ensure karta hai ke trading decisions well-informed aur accurate hon. Pehli candlestick ke analysis ke bina, hook reversal pattern ka full potential utilize nahi kiya ja sakta.

Pehli candlestick ki analysis trading strategy ko refine karne aur risk management ko improve karne mein bhi madad karti hai. Yeh candlestick aapko market ke sentiment aur potential reversal signals ko identify karne mein help karti hai.

4. Doosri Candlestick

Doosri candlestick hook reversal pattern ke core element hoti hai jo ke reversal signal ko indicate karti hai. Yeh candlestick generally choti body aur long shadows ke sath hoti hai, aur iski shape hook jaisi hoti hai. Doosri candlestick ki appearance market ke current trend ke reversal ki confirmation hoti hai.

Bullish hook reversal pattern mein, doosri candlestick pehli candlestick ke mukabil hoti hai. Is candlestick ki body choti hoti hai aur iske shadows lambi hoti hain. Yeh indicate karti hai ke market mein buying pressure barh raha hai aur downtrend reversal ho sakta hai. Doosri candlestick ke high aur low levels bhi important hote hain kyun ke yeh traders ko market ke potential entry points aur stop loss levels identify karne mein madad karte hain.

Bearish hook reversal pattern mein, doosri candlestick pehli candlestick ke mukabil hoti hai aur yeh strong selling pressure ko indicate karti hai. Is candlestick ki appearance market ke uptrend ke reversal ko confirm karti hai. Doosri candlestick ke size aur shape market ke bearish sentiment ko show karti hai aur traders ko selling opportunities ke baare mein sochne par majboor karti hai.

Doosri candlestick ka analysis trading decisions ko enhance karne aur risk management ko improve karne mein bhi madad karta hai. Is candlestick ki appearance ko dekh kar traders ko market ke potential reversal points aur entry points ko identify karna aasaan hota hai.

Trading strategy mein doosri candlestick ki analysis ko integrate karna zaroori hai taake aap effective trading decisions le sakein aur market ke movement ko accurately predict kar sakein.

5. Hook Reversal Ki Pehchaan

Hook reversal pattern ko identify karna thoda challenging ho sakta hai, lekin is pattern ki distinct features ko samajh kar aap accurate analysis kar sakte hain. Is pattern ki pehchaan ke liye, aapko do candlesticks ki combination ko dekhna hota hai jo ke trend ke reversal signal ko indicate karti hai.

Pehli candlestick market ke current trend ko show karti hai aur doosri candlestick hook shape ke sath hoti hai jo ke reversal signal ko confirm karti hai. Is pattern ke analysis ke liye, aapko candlestick ke size, color, aur shape ko carefully dekhna chahiye.

Bullish hook reversal pattern ko identify karne ke liye, pehli candlestick ke green color aur long body ko dekhna hota hai, aur doosri candlestick ki choti body aur long shadows ko observe karna hota hai. Bearish hook reversal pattern ke case mein, pehli candlestick red color ki hoti hai aur doosri candlestick bearish reversal signal ko show karti hai.

Is pattern ki pehchaan karne ke liye, aapko candlestick chart par market ke overall trend aur price action ko bhi dekhna chahiye. Is pattern ke analysis ko integrate karte waqt, aapko market ki volatility aur liquidity ko bhi consider karna zaroori hai.

Hook reversal pattern ki pehchaan ke liye, traders ko market ke other technical indicators aur chart patterns ko bhi consider karna chahiye taake accurate trading decisions liye ja sakein. Yeh ensure karta hai ke aap market ke potential reversals ko accurately identify kar sakein.

6. Bullish Hook Reversal

Bullish hook reversal pattern market ke downtrend ke reversal ko indicate karta hai. Is pattern ko identify karte waqt, aapko pehli candlestick ke long body aur red color ko dekhna hota hai, aur doosri candlestick ki choti body aur long shadows ko observe karna hota hai. Yeh pattern market mein buying pressure ke barhne aur downtrend ke reversal ka signal hota hai.

Bullish hook reversal pattern ke analysis ke liye, aapko candlestick chart par market ke previous highs aur lows ko dekhna chahiye. Yeh analysis aapko market ke potential reversal points aur entry points identify karne mein madad karta hai. Bullish pattern ko samajhne ke liye, aapko market ki overall conditions aur other technical indicators ko bhi consider karna chahiye.

Is pattern ke sath effective trading decisions lene ke liye, traders ko stop loss aur target setting ko bhi dhyan mein rakhna chahiye. Bullish hook reversal pattern ke case mein, entry point wo hota hai jab doosri candlestick ki closing price pehli candlestick ki closing price se upar hoti hai.

Bullish hook reversal pattern ko implement karte waqt, traders ko market ki liquidity aur volatility ko bhi consider karna chahiye. Yeh ensure karta hai ke aapki trading strategy effective ho aur market ke potential reversals ko accurately predict kiya ja sake.

Bullish hook reversal pattern ke analysis ko risk management aur trading strategy ke sath integrate karna zaroori hai. Yeh aapko market ke potential profits ko maximize karne aur losses ko minimize karne mein madad karta hai.

7. Bearish Hook Reversal

Bearish hook reversal pattern market ke uptrend ke reversal ko indicate karta hai. Is pattern ko identify karte waqt, aapko pehli candlestick ke long body aur green color ko dekhna hota hai, aur doosri candlestick ki choti body aur long shadows ko observe karna hota hai. Yeh pattern market mein selling pressure ke barhne aur uptrend ke reversal ka signal hota hai.

Bearish hook reversal pattern ke analysis ke liye, aapko candlestick chart par market ke previous highs aur lows ko dekhna chahiye. Yeh analysis aapko market ke potential reversal points aur entry points identify karne mein madad karta hai. Bearish pattern ko samajhne ke liye, aapko market ki overall conditions aur other technical indicators ko bhi consider karna chahiye.

Is pattern ke sath effective trading decisions lene ke liye, traders ko stop loss aur target setting ko bhi dhyan mein rakhna chahiye. Bearish hook reversal pattern ke case mein, entry point wo hota hai jab doosri candlestick ki closing price pehli candlestick ki closing price se neeche hoti hai.

Bearish hook reversal pattern ko implement karte waqt, traders ko market ki liquidity aur volatility ko bhi consider karna chahiye. Yeh ensure karta hai ke aapki trading strategy effective ho aur market ke potential reversals ko accurately predict kiya ja sake.

Bearish hook reversal pattern ke analysis ko risk management aur trading strategy ke sath integrate karna zaroori hai. Yeh aapko market ke potential profits ko maximize karne aur losses ko minimize karne mein madad karta hai.

8. Entry Points

Hook reversal pattern ke analysis mein entry points identify karna ek crucial step hai. Entry point ko sahi tarike se identify karna market ke potential profits ko maximize karne aur losses ko minimize karne mein madad karta hai. Entry point ko determine karte waqt, aapko pehli aur doosri candlestick ke high aur low levels ko consider karna chahiye.

Bullish hook reversal pattern ke case mein, entry point wo hota hai jab doosri candlestick ki closing price pehli candlestick ki closing price se upar hoti hai. Yeh indicate karta hai ke market mein buying pressure barh raha hai aur uptrend ka reversal ho sakta hai. Entry point ke sath stop loss ko bhi set karna zaroori hai taake agar market aapke expected direction mein nahi chalti to aapke losses minimize ho sakein.

Bearish hook reversal pattern ke case mein, entry point wo hota hai jab doosri candlestick ki closing price pehli candlestick ki closing price se neeche hoti hai. Yeh indicate karta hai ke market mein selling pressure barh raha hai aur downtrend ka reversal ho sakta hai. Entry point ke sath stop loss ko bhi set karna zaroori hai taake agar market aapke expected direction mein nahi chalti to aapke losses minimize ho sakein.

Effective entry point determination ke liye, traders ko market ke previous price action aur other technical indicators ko bhi consider karna chahiye. Yeh ensure karta hai ke aapke trading decisions well-informed aur accurate hon.

Entry points ko determine karte waqt, market ki overall conditions aur volatility ko bhi dekhna zaroori hai. Yeh aapko accurate trading decisions lene aur market ke potential reversals ko predict karne mein madad karta hai.

9. Stop Loss Ka Istemaal

Stop loss ek ahem trading tool hai jo ke aapke losses ko control mein rakhta hai. Hook reversal pattern ko use karte waqt stop loss ka sahi istemaal karna zaroori hai taake agar market aapke expected direction mein nahi chalti to aapke losses minimize ho sakein. Stop loss ko set karte waqt, aapko market ke previous highs aur lows ko consider karna chahiye.

Bullish hook reversal pattern ke case mein, stop loss ko pehli candlestick ke low ke thoda niche set karna chahiye. Yeh ensure karta hai ke agar market bearish ho jaati hai to aapke losses limited rahenge. Bearish hook reversal pattern ke case mein, stop loss ko pehli candlestick ke high ke thoda upar set karna chahiye taake agar market bullish ho jaati hai to aapke losses minimize ho sakein.

Stop loss ke sath, traders ko risk management strategies ko bhi implement karna chahiye. Yeh strategies include position sizing aur diversification jo ke aapke capital ko protect karne mein madad karti hain. Stop loss ko trading strategy ke sath integrate karna zaroori hai taake aap effective risk management kar sakein.

Stop loss ka effective istemaal trading strategy ko refine karne aur market ke unexpected movements se protect karne mein madad karta hai. Yeh aapko market ke potential reversals ko identify karne aur timely trading decisions lene mein madad karta hai.

Stop loss ke placement ko trading strategy ke sath align karna zaroori hai taake aapki trading decisions well-informed aur accurate hon. Yeh aapko market ke potential reversals aur price movements ko effectively handle karne mein madad karta hai.

10. Target Setting

Trading mein target setting ka role bhi important hota hai. Hook reversal pattern ke sath target setting karte waqt, aapko market ke previous highs aur lows ko dekhna chahiye taake realistic target set kiya ja sake. Target setting aapko trading goals ko achieve karne aur potential profits ko maximize karne mein madad karti hai.

Bullish hook reversal pattern ke case mein, target setting ko pehli candlestick ke high aur low levels ke analysis ke sath align karna chahiye. Yeh ensure karta hai ke aapke trading targets realistic aur achievable hon. Bearish hook reversal pattern ke case mein, target setting ko pehli candlestick ke low aur high levels ke analysis ke sath align karna chahiye.

Target setting ke sath, traders ko risk management strategies ko bhi implement karna chahiye. Yeh strategies include stop loss aur position sizing jo ke aapko market ke unexpected movements se protect karne mein madad karti hain. Target setting ko trading strategy ke sath integrate karna zaroori hai taake aap effective trading decisions le sakein.

Effective target setting market ke trends aur price action ko accurately predict karne mein madad karti hai. Yeh aapko trading goals ko achieve karne aur potential profits ko maximize karne mein madad karti hai. Target setting ko trading strategy ke sath align karna zaroori hai taake aapki trading decisions well-informed aur accurate hon.

Target setting ke sath, market ki overall conditions aur volatility ko bhi consider karna zaroori hai. Yeh ensure karta hai ke aapke trading targets realistic aur achievable hon.

11. Risk Management

Risk management trading strategy ka aik important element hai jo ke aapke capital ko protect karne aur losses ko minimize karne mein madad karta hai. Hook reversal pattern ko trading strategy mein shamil karte waqt effective risk management strategies ko implement karna zaroori hai. Risk management strategies include stop loss, position sizing, aur diversification jo ke aapko market ke unexpected movements se protect karne mein madad karti hain.

Stop loss ek ahem risk management tool hai jo ke aapke losses ko control mein rakhta hai. Is tool ko effectively use karte waqt, aapko stop loss levels ko market ke previous highs aur lows ke analysis ke sath align karna chahiye. Yeh ensure karta hai ke aapke trading decisions well-informed aur accurate hon.

Position sizing aur diversification bhi risk management strategies ka part hain. Position sizing ko aapke capital aur risk tolerance ke sath align karna chahiye. Diversification aapko multiple trades aur asset classes ke through risk ko spread karne mein madad karti hai.

Effective risk management trading strategy ko refine karne aur market ke unexpected movements se protect karne mein madad karti hai. Yeh aapko market ke potential reversals ko accurately identify karne aur timely trading decisions lene mein madad karti hai.

Risk management strategies ko trading strategy ke sath integrate karna zaroori hai taake aapki trading decisions well-informed aur accurate hon. Yeh aapko market ke potential reversals aur price movements ko effectively handle karne mein madad karta hai.

12. Market Conditions

Market conditions trading strategy aur technical analysis ke effectiveness ko influence karti hain. Hook reversal pattern ko implement karte waqt, market ki overall conditions aur volatility ko consider karna zaroori hai. High volatility markets mein hook reversal pattern zyada effective hota hai kyunki yeh market ke rapid price movements aur potential reversals ko accurately identify karne mein madad karta hai.

Market conditions ko analyze karte waqt, aapko economic indicators, news events, aur market sentiment ko bhi consider karna chahiye. Yeh factors market ke overall trends aur price movements ko influence karte hain aur trading decisions ko impact karte hain.

Market ki liquidity bhi hook reversal pattern ke effectiveness ko influence karti hai. High liquidity markets mein, pattern ke signals zyada reliable hote hain kyunki market mein sufficient buying aur selling pressure hota hai. Low liquidity markets mein, pattern ke signals less reliable ho sakte hain aur market ke movements unpredictable ho sakte hain.

Market conditions ko trading strategy ke sath integrate karna zaroori hai taake aap accurate trading decisions le sakein aur market ke potential reversals ko predict kar sakein. Market conditions ko regularly monitor karna aur trading strategy ko adjust karna zaroori hai taake aapki trading decisions well-informed aur accurate hon.

Effective market condition analysis trading strategy ko refine karne aur market ke unexpected movements se protect karne mein madad karti hai. Yeh aapko market ke potential reversals ko accurately identify karne aur timely trading decisions lene mein madad karti hai.

13. Technical Indicators Ka Istemaal

Technical indicators trading strategy ke effectiveness ko enhance karte hain. Hook reversal pattern ko implement karte waqt, technical indicators ko use karna zaroori hai taake aap market ke potential reversals ko accurately predict kar sakein. Technical indicators like moving averages, RSI, aur MACD aapko market ke trends aur momentum ko analyze karne mein madad karte hain.

Moving averages market ke overall trend ko identify karne mein madad karti hain. Yeh indicators aapko market ke potential reversal points aur trend continuation points identify karne mein madad karte hain. RSI (Relative Strength Index) market ke overbought aur oversold conditions ko analyze karne mein madad karta hai.

MACD (Moving Average Convergence Divergence) market ke trend aur momentum ko measure karne mein madad karta hai. Yeh indicator aapko market ke potential reversals aur trend strength ko analyze karne mein madad karta hai. Technical indicators ko hook reversal pattern ke analysis ke sath integrate karna zaroori hai taake aap accurate trading decisions le sakein.

Technical indicators ke signals ko market ke price action aur candlestick patterns ke sath align karna zaroori hai. Yeh ensure karta hai ke aapke trading decisions well-informed aur accurate hon. Technical indicators ko trading strategy ke sath integrate karna aapko market ke potential reversals aur price movements ko effectively handle karne mein madad karta hai.

Effective technical indicator analysis trading strategy ko refine karne aur market ke unexpected movements se protect karne mein madad karti hai. Yeh aapko market ke potential reversals ko accurately identify karne aur timely trading decisions lene mein madad karti hai.

14. Conclusion

Hook reversal candlestick pattern ek valuable trading tool hai jo ke market ke potential reversals ko identify karne mein madad karta hai. Is pattern ka effective istemal trading strategy ko enhance karne aur market ke unexpected movements se protect karne mein madad karta hai. Hook reversal pattern ke analysis ke liye, aapko candlestick ke size, color, aur shape ko carefully dekhna chahiye aur market ke overall conditions aur other technical indicators ko consider karna chahiye.

Effective trading strategy ke liye, risk management, stop loss, aur target setting ko hook reversal pattern ke analysis ke sath integrate karna zaroori hai. Yeh ensure karta hai ke aapke trading decisions well-informed aur accurate hon. Hook reversal pattern ke sath technical indicators ko use karna trading strategy ke effectiveness ko enhance karne mein madad karta hai.

Hook reversal pattern ke analysis ke liye, market ke previous price action aur other chart patterns ko consider karna zaroori hai taake aap market ke potential reversals ko accurately predict kar sakein. Is pattern ka effective istemal aapko market ke potential profits ko maximize karne aur losses ko minimize karne mein madad karta hai.

Trading mein hook reversal pattern ka istemal karte waqt, aapko market ki overall conditions aur volatility ko regularly monitor karna chahiye taake aapki trading decisions timely aur accurate hon. Yeh pattern aapko market ke potential reversals ko identify karne aur effective trading decisions lene mein madad karta hai.

Is pattern ka effective istemal trading strategy ko refine karne aur market ke unexpected movements se protect karne mein madad karta hai. Hook reversal candlestick pattern aapko market ke potential reversals ko accurately identify karne aur timely trading decisions lene mein madad karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:53 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим