Double top candlestick patterns ,Trend Predictions

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Assalamu alaikum umeed Karti Hoon ke Forex ke tamam members khairiyat se honge bhaiyon aur bahanon aaj Jo topic mein aap logon ke sath share karne ja rahi hun vah bahut hi khas topic Hai is topic ko samajhne ki aap logon ko bahut jarurat hai maine yah topic bahut hi mehnat hai aur bahut hi mushkil ke bad aap logon ke liye dhundhe Taki main aap logon ke sath share kar sakun kyunki yah topic is topic forest ke platform per bahut jyada kam hota Hai to aapko chahie ki aap is topic ko gaur se dekhen aur padhen padhne ke साथ-साथ isko samajhna Diya jab aap isko samjhenge tab bhi aap fayda hasil kar sakenge to jaise ki topic dhundh kar Maine aap logon ke se share kiya hai ki aap ise fayda hasil kar saken to aapko bhi chahie isko aage share Karen aur aap jab koi naya topic dekhen to aapko bhi chahie ki aap hamare sath share Karen Taki ham bhi kuchh fayda hasil kar sake to aaye ham is mausam per batchit karte hain shukriya Entry from two double candles. Technical analysis of two peak candlestick patterns, trader and financial market, potential trend reversal ko pehchanne mein madad karta hai. Patterns and variations, confirmation of potential price points, trader's trading decisions, trading strategies to increase profits. But jaise bhi technical analysis tools, valuation karne par, various factors aur indicators ko bhi market analysis mein shamil karna zaroori hai. Financial market candlestick pattern, technical analysis mein ismal hotay hain. Assets like stocks, currencies, gold commodities and price action patterns, maromamat faraham kartai hain. Candlestick pattern "double top" (double top). Ek ek Bearish reversal pattern hai jo aam taur tara bagan harga par dekha jata hai aur ek mukhtalif trend, taraf murnai ki potential ko batata hai. Double Top candlestick pattern trend. Ganda uptrend ki tafseel se pehle, samajhna zaroori hai kana uptrend kya hai. The financial market, high interest rates and high costs are putting global investors and darmiyaan khareednai ki pressure zaita hoti hai you feel. But always, bu ke liye nahi chaltai, aur kisi waqt is added in front of saktai hai. Define the above pattern twice. Twice the top pattern is 'Dono choton ke darmiyan' where the price of humanity is temporary 'heat', 'valley' or 'valley' kehte hain. Market sentiment is twice as high as me tabdeeli ko darshata hai. Pehli pik ki formation ka doran, taker (khareednai walay) mein hotay hain aur harga ko upar day jatay hain. But the price jab pehli pik tak pohanchta hai, the power trader apnai faiday lena shuru kar details, jis se harga mein aik chota sa pullback ho jata hai. Dip ke baad, buy ko phir se haasil karte hain aur harga ko upar ko pehlai pik ko paar karne ki koshish karte hain. But unko mein kami reh jati hai, merchant (farokht karne walay) beech mein dakhil ho jatay hain, pressure paida hota hai aur dusri pik banti hai. confirmation Double top pattern tasdeeq shuda samjha jata hai harga jab dusri pik ka baad pit (dono choton ka darmiyan wala lembah) se neechay nikalta hai. Deta signal segmentation hai ke kuperya and speed rich kamzor ho chuka hai aur biruang (bechnay walay) mein aa gaye hain. Large traders partly and the amount of trade is ki talash karte hain taa ke nagish ki tasdeeq ko mazboot kar sakein. trading strategy. Aksar's Double Top Design Shopping Cart is a great choice for shopping. A "short" trade is a trade between price and earnings. In addition, risk management tools such as stop-loss orders, potential stop losses, and bachne ke liye kiya ja sakta hai are used to ensure that the expected price is reversed. -

#3 Collapse

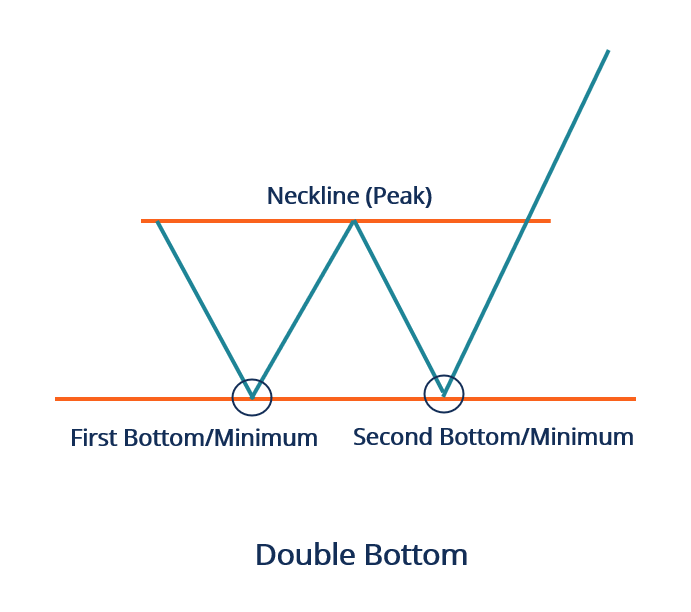

Introduction: Candlestick patterns are essential tools used by traders to analyze price movements in financial markets. One popular pattern is the "Double Top," which signifies a potential reversal in the current trend. In this article, we will explore the Double Top candlestick pattern and its significance in trend predictions. Kya Hai Double Top Pattern? Double Top, yaani "Doosra Pahar" ek common candlestick pattern hai jo price chart mein dikhayi deta hai. Is pattern mein price pehle ek high level tak pahunchta hai, phir kuch arsa down hota hai, aur phir dobara wohi high level atte hai. Yeh do peaks banata hai, jo ek horizontal line se connect hote hain. Double Top Pattern Ki Nishan Dehi: Double Top pattern trend reversal ki possibility darshata hai. Jab price do baar wahi high level atte hai aur usko cross nahi kar pata hai, tou yeh bearish trend ki nishani ho sakti hai, jiska matlab hai ke market ka trend neeche jane ka khayal rehta hai. Agar aap is pattern ko dekhte hain tou aapko careful hona chahiye aur apni positions ko samajh kar lena chahiye. Double Top Pattern Ki Pehchan: Double Top pattern ko pehchanne ke liye, aapko do main cheezein dekhni hoti hain: Two Peaks: Price chart pe do peaks (high points) hote hain jo aapas mein horizontal line se connect hote hain. Trend Reversal: Price ka trend pehle bullish hota hai, phir double top pattern ke baad bearish hojata hai. Double Top Pattern Ki Tashkhees: Double Top pattern ki tashkhees karne ke liye, aapko in points ka khayal rakhna zaroori hai: Peaks Height: Agar dono peaks ki height almost same hoti hai tou yeh double top pattern strong hota hai. Volume: Second peak ke time pe trading volume first peak ke mukable kam hona chahiye. Kam volume double top pattern ki mazbooti ko indicate karta hai. Trend Predictions Ke Liye Double Top Pattern: Double Top pattern bearish trend ki indication hai. Agar aap is pattern ko dekhte hain aur price us horizontal line ko cross karta hai, tou yeh trend reversal ka signal ho sakta hai. Is situation mein, traders apne long positions ko exit karke short positions par focus kar sakte hain. Lekin yaad rahe ke ek pattern ke basis pe trading karne se pehle, aapko aur bhi technical analysis aur market ke indicators ko samajhna zaroori hai. Conclusion: Double Top candlestick pattern ek powerful tool hai trend predictions ke liye, lekin iska istemal karne se pehle, traders ko price action, volume aur dusre technical indicators ko bhi samajhna zaroori hai. Market mein har waqt kuch na kuch ho sakta hai, isliye hamesha risk management ka khayal rakhna chahiye. Double Top pattern ek achha starting point hai trend reversal ki talaash mein, lekin final decision lene se pehle aur bhi analysis karna hoga. -

#4 Collapse

Assalamualaikum! Dear Companion principal umeed krta hon k ap sab kahraiyat sy hon gy our forex market fundamental axha kam kr rhy hon gy dosto aj primary apko twofold Top graph design k bary mn btaun ga ye aik pattern inversion design h is ki pehchan twofold high sign sy hota h aj primary apko twofold diagram design ki mokamal data dun ga our btaun ga k ye kasy banta h our is k blight sy market mn kia hota h. What is Twofold Top Graph Example? Twofold Top" graph design forex exchanging principal aik aisa diagram design hai jo bullish pattern ki finishing ya inversion ki sign deta hai. Yeh aksar upswing ki top point per banta hai aur dealers isko pattern inversion ka signal samajhte hain. Is design ki tarah dusra diagram design "Twofold Base" hai jo negative pattern ki finishing ya inversion ki sign deta hai. Yeh dono designs market primary regularly use hotay hain. Twofold Top ka name isliye hai kyunkay ismein do tops hotay hain jo comparable level per hote hain.Double Top graph design ki pehchan karnay kay liye dealers kay pass do highs ki sign honi chahiye jo comparative level per hotay hain aur inki dairan primary kuch arsay ka hole hota hai. Is design fundamental brokers do high focuses per center kartay hain aur punch yeh high focuses comparative level per hotay hain to merchants yeh samajhtay hain kay yeh ek negative inversion signal hai. Clarification: Twofold Top example kay sath merchants kay pass do more pointers honay chahiye jin se yeh affirm ho kay yeh design sahi hai ya nahi. Yeh pointers hain Volume aur Backing and Opposition. Agar yeh pointers bhi twofold top example ki sign day rahay hain to brokers is design kay sath affirm exchange laga saktay hain.Is design ki pehli excessive cost kay baad upswing start hoti hai jis say market kay bulls rule kartay hain. Market kay up pattern fundamental brokers purchase karnay lagtay hain aur costs increment hote jatay hain. Poke costs dobara pehli significant level per aatay hain to dealers selling kay liye arranged hojatay hain. Yeh selling position merchants kay liye ek benefit booking point hota hai. Agar market phir se twofold high level per nahi jata to brokers yeh samajhtay hain kay market bull pattern kay andar proceed karega aur woh purchase karnay kay liye prepared hotay hain. Agar market phir se twofold high level per jata hai to merchants yeh samajhtay hain kay market pattern inversion ka signal day raha hai aur woh selling kay liye arranged hojatay hain.Agar market twofold high level per phir se aata hai to brokers selling kay liye prepared hotay hain aur stop misfortune request place kartay hain jis say agar market unki assumption kay inverse move karti hai to unka misfortune least rehta hai. Agar market twofold high level per break kar jata hai to brokers kay pass ek negative pattern signal ata hai aur woh short position per enter kartay hain jis say unko benefit hota h. Twofold Top outline design exchanging primary significant hai kyunkay yeh merchants kay liye ek strong pattern inversion signal hai. Yeh design kaafi dependable hai aur market fundamental usually use hota hai. Is design kay sath merchants kay pass dojis markers honay chahiye jinse yeh affirm ho kay yeh design sahi hai ya nahi. Twofold Top graph design ki tarah dusra design "Twofold Base" hai jo negative pattern ki finishing ya inversion ki sign deta hai. In designs kay sath merchants kay pass kafi risk the executives systems honay chahiye jinse woh apna risk least rakhsaktay hain aur productive exchanges laga saktay hai -

#5 Collapse

Forex Exchanging Mein Twofold Diagram Example Ka Tashreeh Twofold diagram design ya doharay graph design Forex exchanging mein ahem hotay hain. Ye designs exchanging kay signals give kartay hain jo brokers ko market kay future developments kay baray mein pata lagane mein madad karte hain. Twofold outline design kay do mukhtalif qisam hotay hain, jo kay neechay darjzel hain. Twofold Top Forex Exchanging Mein Twofold Diagram Example Ka Tashreeh Twofold diagram design ya doharay graph design Forex exchanging mein ahem hotay hain. Ye designs exchanging kay signals give kartay hain jo brokers ko market kay future developments kay baray mein pata lagane mein madad karte hain. Twofold outline design kay do mukhtalif qisam hotay hain, jo kay neechay darjzel hain. Twofold base doosra twofold diagram design hai jis mein market kay cost level do martaba same depressed spot tak pohonchtay hain. Ye ek negative pattern kay baad hota hai aur dealers ko ye signal deta hai ke market kay cost levels stomach muscle bullish pattern ki taraf janein gay. Twofold base example ko affirm karnay kay liye merchants ko volume ki bhi nazar rakhni hoti hai. In do twofold diagram designs kay signals ko affirm karnay kay liye merchants ko in ki developments ki sahi tashkeel kay sath volume kay baray mein bhi nazar rakhni hoti hai. Ye designs dealers kay liye helpful hain, khas peak standard punch market kay developments unsurprising hotay hain. End: All in all, twofold graph design merchants ko market ki development ka andaza lagane mein help karta hai. Agar twofold top example break ho jata hai to yeh negative pattern ka signal hai aur agar twofold base example break ho jata hai to yeh bullish pattern ka signal hai. Issi waja se brokers ko market ke twofold top aur twofold base examples ke signals ka dhyan rakhna chahiye. Twofold Top Twofold top ek aesa graph design hai jis mein market kay cost level do martaba same high point tak pohonchtay hain. Ye ek bullish pattern kay baad hota hai aur brokers ko ye signal deta hai ke market kay cost levels stomach muscle negative pattern ki taraf janein gay. Twofold top example ko affirm karnay kay liye brokers ko volume ki bhi nazar rakhni hoti hai. -

#6 Collapse

جب آپ اسے سمجھ جائیں Ú¯Û’ØŒ تب بھی آپ Ú©Ùˆ Ùائدے ملیں Ú¯Û’ØŒ جیسے Ú©Û Ù…ÛŒÚº Ù†Û’ آپ Ú©Û’ ساتھ شیئر کیے Ûیں۔ -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Double Top Candle Chart Pattern: Market twofold undeniable level per phir se aata hai to dealers selling kay liye arranged hotay hain aur stop adversity demand place kartay hain jis say agar market unki supposition kay reverse move karti hai to unka disaster least rehta hai. Agar market twofold undeniable level per break kar jata hai to dealers kay pass ek negative example signal ata hai aur woh short position per enter kartay hain jis say unko benefit hota h.Twofold Top diagram configuration trading essential huge hai kyunkay yeh shippers kay liye ek solid example reversal signal hai. Yeh plan kaafi trustworthy hai aur market crucial normally use hota hai. Is plan kay sath vendors kay pass dojis markers honay chahiye jinse yeh assert ho kay yeh plan sahi hai ya nahi. Twofold Top diagram plan ki tarah dusra configuration "Twofold Base" hai jo negative example ki completing ya reversal ki sign deta hai Dealers kay pass do more pointers honay chahiye jin se yeh certify ho kay yeh plan sahi hai ya nahi. Yeh pointers hain Volume aur Support and Resistance. Agar yeh pointers bhi twofold top model ki sign day rahay hain to merchants is plan kay sath certify trade laga saktay hain.Is plan ki pehli unreasonable expense kay baad rise start hoti hai jis say market kay bulls rule kartay hain. Market kay up design basic intermediaries buy karnay lagtay hain aur costs increase hote jatay hain. Jab costs dobara pehli huge level per aatay hain to vendors selling kay liye organized hojatay hain. Yeh selling position shippers kay liye ek benefit booking point hota hai. Agar market phir se twofold undeniable level per nahi jata to merchants yeh samajhtay hain kay market bull design kay andar continue karega aur woh buy karnay kay liye arranged hotay hain. Agar market phir se twofold significant level per jata ha Chart Pattern Types: Chart plan forex trading head aik aisa outline plan hai jo bullish example ki completing ya reversal ki sign deta hai. Yeh aksar rise ki top point per banta hai aur sellers isko design reversal ka signal samajhte hain. Is plan ki tarah dusra outline configuration "Twofold Base" hai jo negative example ki completing ya reversal ki sign deta hai. Yeh dono plans market essential routinely use hotay hain. Twofold Top ka name isliye hai kyunkay ismein do tops hotay hain jo tantamount level per hote hain.Double Top diagram plan ki pehchan karnay kay liye sellers kay pass do highs ki sign honi chahiye jo similar level per hotay hain aur inki dairan essential kuch arsay ka opening hota hai. Is plan major dealers do high centers per focus kartay hain aur punch yeh high centers relative level per hotay hain to shippers yeh samajhtay hain kay yeh ek negative reversal signal hai.

Dealers kay pass do more pointers honay chahiye jin se yeh certify ho kay yeh plan sahi hai ya nahi. Yeh pointers hain Volume aur Support and Resistance. Agar yeh pointers bhi twofold top model ki sign day rahay hain to merchants is plan kay sath certify trade laga saktay hain.Is plan ki pehli unreasonable expense kay baad rise start hoti hai jis say market kay bulls rule kartay hain. Market kay up design basic intermediaries buy karnay lagtay hain aur costs increase hote jatay hain. Jab costs dobara pehli huge level per aatay hain to vendors selling kay liye organized hojatay hain. Yeh selling position shippers kay liye ek benefit booking point hota hai. Agar market phir se twofold undeniable level per nahi jata to merchants yeh samajhtay hain kay market bull design kay andar continue karega aur woh buy karnay kay liye arranged hotay hain. Agar market phir se twofold significant level per jata ha Chart Pattern Types: Chart plan forex trading head aik aisa outline plan hai jo bullish example ki completing ya reversal ki sign deta hai. Yeh aksar rise ki top point per banta hai aur sellers isko design reversal ka signal samajhte hain. Is plan ki tarah dusra outline configuration "Twofold Base" hai jo negative example ki completing ya reversal ki sign deta hai. Yeh dono plans market essential routinely use hotay hain. Twofold Top ka name isliye hai kyunkay ismein do tops hotay hain jo tantamount level per hote hain.Double Top diagram plan ki pehchan karnay kay liye sellers kay pass do highs ki sign honi chahiye jo similar level per hotay hain aur inki dairan essential kuch arsay ka opening hota hai. Is plan major dealers do high centers per focus kartay hain aur punch yeh high centers relative level per hotay hain to shippers yeh samajhtay hain kay yeh ek negative reversal signal hai.  Twofold Top example negative pattern ki sign hai. Agar aap is design ko dekhte hain aur cost us even line ko cross karta hai, tou yeh pattern inversion ka signal ho sakta hai. Is circumstance mein, dealers apne long positions ko exit karke short positions standard center kar sakte hain. Lekin yaad rahe ke ek design ke premise pe exchanging karne se pehle, aapko aur bhi specialized investigation aur market ke pointers ko samajhna zaroori hai.Double Top candle design ek amazing asset hai pattern expectations ke liye, lekin iska istemal karne se pehle, brokers ko cost activity, volume aur dusre specialized pointers ko bhi samajhna zaroori hai. Market mein har waqt kuch na kuch ho sakta hai, isliye hamesha risk the board ka khayal rakhna chahiye. Twofold Top example ek achha beginning stage hai pattern inversion ki talaash mein, lekin ultimate choice lene se pehle aur bhi investigation karna hoga. Trading View: Twofold top example tasdeeq shuda samjha jata hai harga punch dusri pik ka baad pit (dono choton ka darmiyan wala lembah) se neechay nikalta hai. Deta signal division hai ke kuperya and speed rich kamzor ho chuka hai aur biruang (bechnay walay) mein aa gaye hain. Enormous dealers somewhat and how much exchange is ki talash karte hain taa ke nagish ki tasdeeq ko mazboot kar sakein.Double Top Plan Shopping basket is an incredible decision for shopping. A "short" exchange is an exchange among cost and profit. Also, risk the executives instruments, for example, stop-misfortune orders, potential stop misfortunes, and bachne ke liye kiya ja sakta hai

Twofold Top example negative pattern ki sign hai. Agar aap is design ko dekhte hain aur cost us even line ko cross karta hai, tou yeh pattern inversion ka signal ho sakta hai. Is circumstance mein, dealers apne long positions ko exit karke short positions standard center kar sakte hain. Lekin yaad rahe ke ek design ke premise pe exchanging karne se pehle, aapko aur bhi specialized investigation aur market ke pointers ko samajhna zaroori hai.Double Top candle design ek amazing asset hai pattern expectations ke liye, lekin iska istemal karne se pehle, brokers ko cost activity, volume aur dusre specialized pointers ko bhi samajhna zaroori hai. Market mein har waqt kuch na kuch ho sakta hai, isliye hamesha risk the board ka khayal rakhna chahiye. Twofold Top example ek achha beginning stage hai pattern inversion ki talaash mein, lekin ultimate choice lene se pehle aur bhi investigation karna hoga. Trading View: Twofold top example tasdeeq shuda samjha jata hai harga punch dusri pik ka baad pit (dono choton ka darmiyan wala lembah) se neechay nikalta hai. Deta signal division hai ke kuperya and speed rich kamzor ho chuka hai aur biruang (bechnay walay) mein aa gaye hain. Enormous dealers somewhat and how much exchange is ki talash karte hain taa ke nagish ki tasdeeq ko mazboot kar sakein.Double Top Plan Shopping basket is an incredible decision for shopping. A "short" exchange is an exchange among cost and profit. Also, risk the executives instruments, for example, stop-misfortune orders, potential stop misfortunes, and bachne ke liye kiya ja sakta hai  Candle examples, dealer and monetary market, potential pattern inversion ko pehchanne mein madad karta hai. Examples and varieties, affirmation of potential price tags, broker's exchanging choices, exchanging methodologies to increment benefits. However, jaise bhi specialized examination apparatuses, valuation karne standard, different elements aur pointers ko bhi market investigation mein shamil karna zaroori hai. Monetary market candle design, specialized investigation mein ismal hotay hain. Resources like stocks, monetary forms, gold products and cost activity designs, maromamat faraham kartai hain. Candle design "twofold top" (twofold top). Ek Negative inversion design hai jo aam taur tara bagan harga standard dekha jata hai aur ek mukhtalif pattern, taraf murnai ki potential ko batata hai.

Candle examples, dealer and monetary market, potential pattern inversion ko pehchanne mein madad karta hai. Examples and varieties, affirmation of potential price tags, broker's exchanging choices, exchanging methodologies to increment benefits. However, jaise bhi specialized examination apparatuses, valuation karne standard, different elements aur pointers ko bhi market investigation mein shamil karna zaroori hai. Monetary market candle design, specialized investigation mein ismal hotay hain. Resources like stocks, monetary forms, gold products and cost activity designs, maromamat faraham kartai hain. Candle design "twofold top" (twofold top). Ek Negative inversion design hai jo aam taur tara bagan harga standard dekha jata hai aur ek mukhtalif pattern, taraf murnai ki potential ko batata hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:18 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим