What is the triple top pattern?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

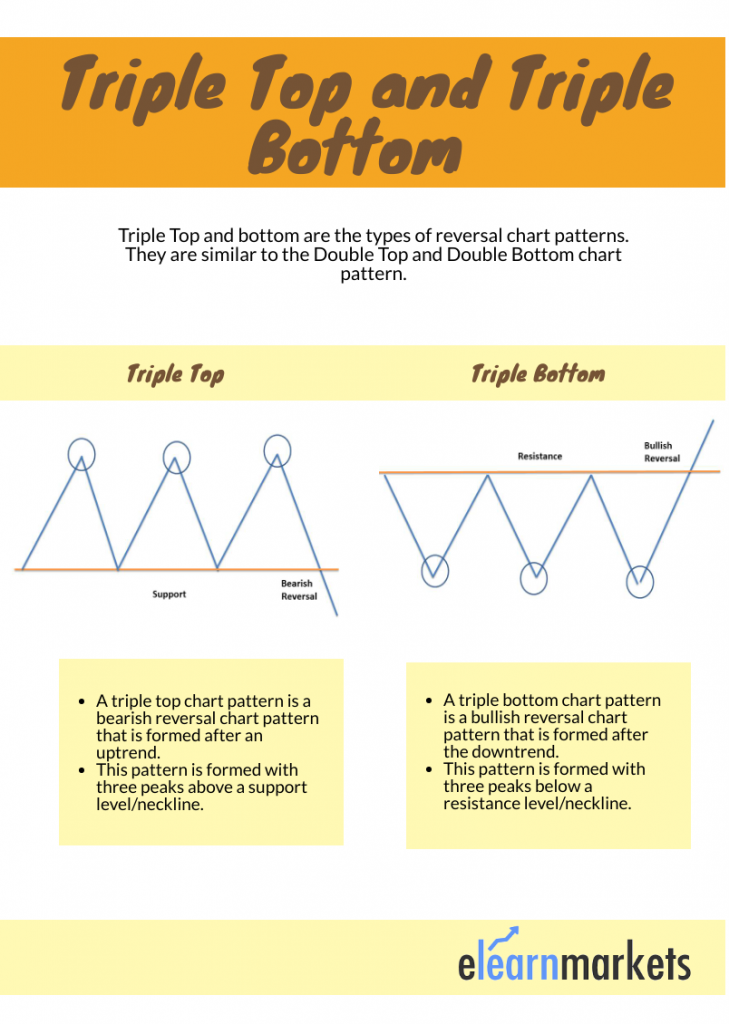

WHAT IS TRIPLE TOP PATTERN : Triple top pattern ak bearish technical analysis chart pattern ha ya tab banta ha jab uptrend hota ha or is ma tests karti ha highest ma price three times is ma bearish downward ki movement ka start hona sa phalay. Jab is ma price hits karay gi third peak ko or falls karay ge below ma neckline sa, to assets price is ma expected ho ge continue falling hona ko or is ma trend reversal banay ga. Jasa ka or chart patterns ki trha sa, ya triple top pattern bhi used ho ga predict karna ka end ko previous trend ka or ya madad karay ga traders ki find karna ka liya ak acha entry levels ko. Ya jo triple top pattern ka structure hota ha is ma ya banata ha first, second or third peaks ko jo ka same level ma ho ge or ya neckline ho ga jo ka serves karay ga support level ko. Ya pattern similar ho ga double top or head and shoulders pattern ki trha sa. Ya ak bearish reversal pattern ha jo ka end ma uptrend ka banta ha or ya three consecutive tops ko banay ga same resistance level ma. HOW TO IDENTIFY AND USE TRIPLE TOP PATTERN : Ya triple top pattern banay ga jab jo asset ho ga ya reaches karay hi resistance level ko or ya move ni kar pay gi above ma is level sa. Jab ya pattern twice banta ha to, is chart pattern ko double top pattern kahta ha, magar jab price tests karti ha highest level ko or three consecutive times ma, to is pattern ko kaha ga tripl top pattern or ya provides karay ga stronger trend ka reversal indicator ko double top pattern sa. Above ma jo ya nzd/usd ka 30 min ka chart ha is ma price stops hoi ha resistance level ma three times or phir falls below ma ay ha neckline level par. Is chart ma dakh sakta ha ka ya triple top pattern kasa kam karay ga. Ya fairly simple chart pattern ha, jab is pattern ko compared kiya jata ha or advanced patterns ka sath. Identify karna ha is triple top chart pattern ko to follow karna ho ga in 5 steps ko: 1: Is triple top pattern ma sab sa phalay identify karna ho ga three tops ko jo ka resistance line ma ho ga or ya tab banay jab bullish ka trend ho ga. 2: Second step ma is ma draw karay ga support line ko jo ka around ma lows ma ho gi sari price ka swings ka. 3: Is ma wait karay ya jab tak ka jo price ha ya breaks ni kar lati below ma support neckline ko. 4: Draw karay ga Fibonacci retracement levels ko or add karay ga MACD indicator ko. 5: In four steps ka bad is ma enter karay ga selling position ko or is ka sath spot loss ko place karay ga above ma neckline ka. HOW TO TRADE USING TRIPLE TOP PATTERN : Using karna is triple top pattern ko straightforward or easy ho ga. Jab is ma find karay ga chart pattern ma three tops ka sath to ya jab break below karay ga neckline sa to is ma short sell ki trade ko enter karay ga. Is ma increase karna ka liya chances ka success ko. To isa important ho ga confirm karna is pattern ko or is ko confirm or technical indicators sa karay ga or is ma develop karay ga effective trading strategy ko. 1: MOVING AVERAGE CONVERGENCE DIVERGENCE AND TRIPLE TOP PATTERN : MACD ak technical analysis indecator ha jis ko primarily use kiya jata ha or identify karta ha trend ka reversals ko. Is ko zada tar sara hi trading platform include karta ha, jis ki madad sa easily is indecator ko add kar sakta ha or is sa conformation kar sakta ha momentum ka change hona ko. Jab hum is pattern ka sath add karay ga MACD indicator to ya ak tool ho ga jo ka confirm karay ga breakout ka belowa neckline sa or ya false breakout ni da ga. Is ma jo MACD crossover ho ga ya same issi point sa banay ga jis ma us pattern ma breakout ho ga neckline ka. Ya madad karay ga confirm ka liya trend ka reversal ko. 2: FIBONACCI RETRACEMENT LEVEL AND TRIPLE TOP PATTERN : Ak or best way ha confirm karna ka liya trend ka reversal ko jab using kar raha ho triple top pattern ko to is ma draw karay ga Fibonacci retracement levels ko. Jasa ka ya jo chart below ma ha is ma dakh sakta Ha jo 50% ka Fibonacci retracement level ha is ko used karta hua ak or confirmation hoi ha enter karna ki trade ko jab breakout hua ha. Is case ma traders stop loss order ko place karay ga Fibonacci level ka above ma neckline ma or ya huma ensure karay ga stop loss ni ho ga triggered early ho ga. Jasa ka jo entry level ha ya 50% Fibonacci level sa good ha or jo stop loss ha ya 61.8% par ho ga Fibonacci level ka. Jab price breaks karay ge neckline ko or falls ho ge phir sa retest karta hua 61.8% Fibonacci level, ko to start ho ga bearish ka trend or ya confirm karay ga price ka target ko or is ya set ho ga kisi Fibonacci level ma. ADVANTAGES /DISADVANTAGES OF TRIPLE TOP PATTERN : Ya jo triple top pattern ho ga is ko identify karna bahot hi easy ho ga or is pattern ki advantage ya bhi ha ka ya bahot hi accurate or reliable trend reversal pattern ho ga or ya bahot hi great method ho ga trend reversals ko identify karna ka. Is pattern ma disadvantage ya ho ge ka ya pattern ni banay ga bahot hi often or is ki disadvantage ya bhi ho ge ka is pattern ma jo stop loss ho ga ya triggered ho ga jab price pullback ho ge or is ka solve karna ka liya hum Fibonacci level ko use karay ga. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Up-side tasuki candle design kam ho. flame ki do sab se aam kasmain dark empty candle hain, jo ke aik mazboot oopri rujhan ki nishandahi karti hain, aur surkh bhari hui mother batian, jo aik mazboot neechay ke rujhan ki nishandahi karti hain. surkh khokhli aur siyah bhari hui shammen kam aam hain kyunkay un ke liye qeemat mein farq ki zaroorat hoti hai. takneeki tajzia vehicle outline ke kisi bhi pehlu ko dekhnay se pehlay light stuck ke rang se bohat saari maloomat jke sath mil kar candle graph istemaal karte hain. misaal ke pinnacle standard, woh flame stuck graphs ka istemaal karte tone market ke jazbaat ka andaza laga satke hain aur phir kharabi ya break out ke mumkina ilaqon ki nishandahi karne ke liye diagram patteren ka istemaal kar satke hain. takneeki isharay market ke jazbaat ki tasdeeq ke pinnacle standard bhi kaar amad saabit ho satke hain. misaal ke pinnacle standard, rishta daar taaqat record ( rsi ) ko flame stuck graphs ke sath mil kar yeh zahir karne ke liye istemaal kya ja sakta hai ke aik makhsoos simt mein rujhan kitna mazboot hai . Red empty candle occu mi qeemat will be qeemat se kam hai jis standard yeh khuli aur pehlay band hui thi. aik candaldi se akhatta kar satke hain. misaal ke peak standard, kaali bhari hui candle stuck tajweez kar sakti hai ke qeemat bohat ziyada ho rahi hai, poke ke surkh rang se bhari candle stuck wazeh aur mazboot neechay ke rujhan ki numaindagi karti hai. tajir market ke jazbaat ka andaza laganay ke liye un baseerat ka istemaal kar satke hain. ziyada tar tajir takneeki tajzia ki doosri shaklon le stuck bhi surkh rang ki ho sakti hai agar band pehlay ke band se neechay ho, lekin khulay ke oopar — aisi soorat mein yeh aam pinnacle standard khokhli dikhayi day gi. candle muddat ke ounchay aur nichale hissay standard mushtamil hoti hai, jis ki numaindagi saaye se hoti hai, aur khuli aur qareeb hoti hai, jis ki numaindagi mother batii ke asli jism ya motay hissay se hSurkh bhari mother batii aam hai aur is waqt hoti hai punch band khulay aur pehlay ke qareeb se neechay ho. aik khokhli surkh mother batii is waqt hoti hai punch band pehlay ke band se neechay ho, lekin khulay se oopar ho. plate structure is mein mukhtalif ho satke hain ke woh mother batian kaisay khenchte hain. kuch log paishgi band honay wali surkh mother batii ko fori peak standard yeh batatay hain ke qeemat is muddat ke douran kam ho gayi hai, sath hey khuli, onche, kam aur qareeb bhi. mother batii jitni lambi hogi, is doraniye mein qeemat ki harkat itni greetings ziyada hogi Up-Side Tasuki Example ek candle design hai jo forex market mein istemal hota hai. Is design mein bullish pattern ko affirm karne ke liye 3 candles ka istemal hota hai. Is design ki pehchan, kisi upturn ke dauran do back to back bullish candles ke beech mein ek negative candle hona hai. Pehli Candle (Bullish): Pehli candle ek bullish candle hoti hai jo upswing ko darshaati hai. Dusri Candle (Bullish): Dusri candle bhi ek bullish candle hoti hai aur pehli candle ki upar wali taraf open hoti hai.Teesri Candle (Negative): Teesri candle negative candle hoti hai aur dusri candle ki specialty wali taraf open hoti hai. Yeh candle pehli aur dusri candle ke beech mein ati hai. -

#4 Collapse

What is Cart man candle design? Cart man lambi tangon wali dogi flame stuck ki aik qisam hai jahan jism mother batii ke beech mein ya is ke bilkul qareeb paaya ja sakta hai . Key Focal points Cart wala marketplace mein ghair faisla family honay ka ishara karta hai. cart walay ke oopri aur nichale saaye lambay hotay hain, jis mein mother batii ke markaz ke qareeb aik chhota sa asli jism hota hai. cart walay ko dosray takneeki isharay, qeemat ke amal ke tajzia, ya diagram ke sath mil kar istemaal kya jana chahiye. mumkina rujhan ki tabdeeli ya tasalsul ka ishara dainay ke liye patteren . Understanding Aik candle aala, kam, khuli aur band qeematon ko dekhata hai. cart mean flame ka khula aur band aik hello there qeemat ki satah standard ya bohat qareeb hai, jo dogi banata hai. onche aur neech bohat daur hain, shama daan standard lambay saaye peda karte hain. yeh marketplace mein shurka ki janib se Adam faisla ko zahir karta hai. cart mean flame is waqt hoti hai poke bail aur reechh aik hello muddat ke douran mukhtalif auqaat mein security ki qeemat ko control karte hain. yeh tafawut muddat ke liye aik wasee tijarti range banata hai, is terhan mother batii standard taweel saaye peda hotay hain. cart walay ki taraf se zahir kardah numaya utaar charhao ke bawajood, yeh wazeh simt ki naqal o harkat ki taraf ishara nahi karta, aur qeemat is ki ibtidayi qeemat ke bilkul qareeb band ho jati hai. cart walay ki taraf se ishara kardah harkiyaat market mein Adam faisla ki nishandahi karti hai, lekin yeh taajiron ko aik ishara bhaij sakti hai. sayaq o Sabaq ki bunyaad standard. kuch sooraton mein, patteren istehkaam ki muddat ki numaindagi kar sakta hai, jo pichlle rujhanaat ke tasalsul ka mahswara day sakta hai. doosri sooraton mein, patteren taizi se run up ke ekhtataam standard Adam faisla ki nishandahi kar sakta hai, jo market ke ulat jane ka mahswara day sakta hai. kaafi sayaq o Sabaq ke haamil tajir tasalsul ya ulat jane standard shart lagana chahtay hain, lekin bohat se mamlaat mein, tajir kisi bhi position ko is waqt tak rokna chahain ge punch tak ke koi wazeh diagram patteren ya qeemat ka rujhan samnay nah aajay . What is the riskshaw candle design Cart candle design ki baat karen to ismein lambi tangon wali flame banti hai jiski Shadow bahut hello there kam hoti hai lekin land bahut jyada hoti hai isase agar aap kamyabi Lena chahte Hain to showcase ki shadow ko dekhna hota hai market ki Shadow jis taraf jyada Hogi market ki move bhi use taraf se jyada Hogi is tarike se Ham bahut greetings aasani se kamyabi le sakte hain aur aasani se kamyab bhi ho sakte hain koi bhi work hai to hamen kamyabi milegi poke Ham market mein without information aur without experience ke kam karte hain to utilize time hamen kamyabi Nahin milati hai hamare Liye specialized work market mein significant hota hai achcha work karenge to hamen kamyabi bhi milegi yah significant work hai hamare Liye. -

#5 Collapse

What is Volume Spread Investigation Dear forex vendor ko pata hota hai k market supply or solicitation ki extent sy chalti hai. Jb market mom buyer zayada ho jaty hain to us pair ya product ki cost barh jati hai or resultly market up design mom move kar jati hai. Ese tarha market mother jb merchant ki extent barh jati hai to arrange ya product ki demand kam ho jati hai or wo market ko bear mom move karwany mom kamyab ho jaty hain. So hamy es sy ye pata chala k market mother rise us waqat hota hai jb market mom buyer ki extent seller ki extent sy zayada hoti hai. Upswing k lae buy k solicitation ka zayada hona zaruri hai stiff-necked seller k orders ka kam hona zaruri hai. Visa Indecater VSA hamy sekhata hai k market ki power negative flame sy show hoti hai or bullish light sy b yet market ki weaknes hamesa bullish candle ki sorat mom show hoti hai. Ek sorat disaster sy bachny ki ye b hai k hamesa us taraf trade open karni chahe jis side standard kam dealer hon. VSA supply or solicitation k qualification ko measure karny k lae use hota hai. Forex trading mother supply or solicitation k differentiation ko find karny k lae VSA 3 vairable ka forex outline standard correspondence contemplate karta hai. 1. Cost bar k uper volume ki sum ketni hai. 2. Ye cost assortment yani market ka high or discouraged spot ko b es reason k lae use karta hai. 3. Third factor jo vsa measure karta hai wo ha closing expense. Volume Spread Assessment mom ham market mom kisi pair ki supply or solicitation ko notice karty hain. Rates high ho jaty hain jb market mother demand barh jati hai or ese tarha rate kam ho jaty hain jb market mom supply barh jati hai. Supply or solicitation k qualification ko measure karny k lae vsa bhot sary factors ko use karta hai. Pehle step mother ya dekha jata hai k light mom volume ki extent ketni hai. Second step mother eski high or low arrive at ko measure kiya jata hai or last mom closing expense ko regard ko judgr kiya jata hai. Es rule k bena standard jb market mother buyinf selling sy zayada hoti hai to promote up chali jati hai or jb market mom selling buying sy zayada hoti hai to feature fall kar jati hai. Kuch cases mom dealer ko larger part sy dor rehna chahe. Kiu k aksar ye b dakhny mom aya hai k market us side standard ni jati jis taraf bigger piece of vendor hoty hain. So seller ko hamesa apna experince sarh use kar k he decision making karni chahe. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Triple Top Chart Pattern: Market ki power negative fire sy show hoti hai or bullish light sy b yet market ki weaknes hamesa bullish candle ki sorat mother show hoti hai. Ek sorat catastrophe sy bachny ki ye b hai k hamesa us taraf exchange open karni chahe jis side standard kam vendor hon. VSA supply or sales k capability ko measure karny k lae use hota hai. Forex exchanging mother supply or sales k separation ko find karny k lae VSA 3 vairable ka forex frame standard correspondence ponder karta hai. 1. Cost bar k uper volume ki aggregate ketni hai. 2. Ye cost variety yani market ka high or deterred spot ko b es reason k lae use karta hai. 3. Third variable jo vsa measure karta hai item ki request kam ho jati hai or wo market ko bear mother move karwany mother kamyab ho jaty hain. So hamy es sy ye pata chala k market mother rise us waqat hota hai jb market mother purchaser ki degree merchant ki degree sy zayada hoti hai. Rise k lae purchase k sales ka zayada hona zaruri hai willful dealer k orders ka kam hona zaruri hai. Outline candle plan ki baat karen to ismein lambi tangon wali fire banti hai jiski Shadow bahut hey kam hoti hai lekin land bahut jyada hoti hai isase agar aap kamyabi Lena chahte Hain to exhibit ki shadow ko dekhna hota hai market ki Shadow jis taraf jyada Hogi market ki move bhi use taraf se jyada Hogi is tarike se Ham bahut good tidings aasani se kamyabi le sakte hain aur aasani se kamyab bhi ho sakte hain koi bhi work hai to hamen kamyabi milegi jab Ham market mein without data aur without experience ke kam karte hain to use time hamen kamyabi Nahin milati hai hamare Liye specific work market mein huge hota hai achcha work karenge to hamen kamyabi bhi milegi Chart Pattern Types: Chart Pattern main fire ka khula aur band aik hi qeemat ki satah standard ya bohat qareeb hai, jo dogi banata hai. onche aur neech bohat daur hain, shama daan standard lambay saaye peda karte hain. yeh commercial center mein shurka ki janib se Adam faisla ko zahir karta hai. truck mean fire is waqt hoti hai jab bail aur reechh aik hi muddat ke douran mukhtalif auqaat mein security ki qeemat ko control karte hain. yeh tafawut muddat ke liye aik wasee tijarti range banata hai, is terhan mother batii standard taweel saaye peda hotay hain. truck walay ki taraf se zahir kardah numaya utaar charhao ke bawajood, yeh wazeh simt ki naqal o harkat ki taraf ishara nahi karta, aur qeemat is ki ibtidayi qeemat ke bilkul qareeb band ho jati hai. truck walay ki taraf se ishara kardah harkiyaat market mein Adam faisla ki nishandahi karti hai, lekin yeh taajiron ko aik ishara bhaij sakti hai. sayaq o Sabaq ki bunyaad standard. kuch sooraton mein, patteren istehkaam ki muddat ki numaindagi kar sakta hai, jo pichlle rujhanaat ke tasalsul ka mahswara day sakta ha

Outline candle plan ki baat karen to ismein lambi tangon wali fire banti hai jiski Shadow bahut hey kam hoti hai lekin land bahut jyada hoti hai isase agar aap kamyabi Lena chahte Hain to exhibit ki shadow ko dekhna hota hai market ki Shadow jis taraf jyada Hogi market ki move bhi use taraf se jyada Hogi is tarike se Ham bahut good tidings aasani se kamyabi le sakte hain aur aasani se kamyab bhi ho sakte hain koi bhi work hai to hamen kamyabi milegi jab Ham market mein without data aur without experience ke kam karte hain to use time hamen kamyabi Nahin milati hai hamare Liye specific work market mein huge hota hai achcha work karenge to hamen kamyabi bhi milegi Chart Pattern Types: Chart Pattern main fire ka khula aur band aik hi qeemat ki satah standard ya bohat qareeb hai, jo dogi banata hai. onche aur neech bohat daur hain, shama daan standard lambay saaye peda karte hain. yeh commercial center mein shurka ki janib se Adam faisla ko zahir karta hai. truck mean fire is waqt hoti hai jab bail aur reechh aik hi muddat ke douran mukhtalif auqaat mein security ki qeemat ko control karte hain. yeh tafawut muddat ke liye aik wasee tijarti range banata hai, is terhan mother batii standard taweel saaye peda hotay hain. truck walay ki taraf se zahir kardah numaya utaar charhao ke bawajood, yeh wazeh simt ki naqal o harkat ki taraf ishara nahi karta, aur qeemat is ki ibtidayi qeemat ke bilkul qareeb band ho jati hai. truck walay ki taraf se ishara kardah harkiyaat market mein Adam faisla ki nishandahi karti hai, lekin yeh taajiron ko aik ishara bhaij sakti hai. sayaq o Sabaq ki bunyaad standard. kuch sooraton mein, patteren istehkaam ki muddat ki numaindagi kar sakta hai, jo pichlle rujhanaat ke tasalsul ka mahswara day sakta ha  Plan mein bullish example ko assert karne ke liye 3 candles ka istemal hota hai. Is plan ki pehchan, kisi upswing ke dauran do consecutive bullish candles ke beech mein ek negative light hona hai. Pehli Light (Bullish): Pehli flame ek bullish candle hoti hai jo rise ko darshaati hai. Dusri Light (Bullish): Dusri flame bhi ek bullish candle hoti hai aur pehli candle ki upar wali taraf open hoti hai.Teesri Candle (Negative): Teesri candle negative candle hoti hai aur dusri candle ki specialty wali taraf open hoti hai. Yeh candle pehli aur dusri flame ke beech mein ati hai.candle stuck tajweez kar sakti hai ke qeemat bohat ziyada ho rahi hai, jab ke surkh rang se bhari candle stuck wazeh aur mazboot neechay ke rujhan ki numaindagi karti hai. tajir market ke jazbaat ka andaza laganay ke liye un baseerat ka istemaal kar satke hain. ziyada tar tajir takneeki tajzia ki doosri shaklon le stuck bhi surkh rang ki ho sakti hai agar band pehlay ke band se neechay ho, lekin khulay ke oopar — aisi soorat mein yeh aam zenith standard khokhli dikhayi day gi. light muddat ke ounchay aur nichale hissay standard mushtamil hoti hai, jis ki numaindagi saaye se hoti hai Chart Pattern Trading View: Pattern ka inversion ko hit utilizing kar raha ho triple top example ko to is mama draw karay ga Fibonacci retracement levels ko. Jasa ka ya jo diagram beneath mama ha is mama dakh sakta Ha jo half ka Fibonacci retracement level ha is ko utilized karta hua ak or affirmation hoi ha enter karna ki exchange ko punch breakout hua ha. Is case mama merchants stop misfortune request ko place karay ga Fibonacci level ka above mama neck area mama or ya huma guarantee karay ga stop misfortune ni ho ga set off early ho ga. Jasa ka jo passage level ha ya half Fibonacci level sa great ha or jo stop misfortune ha ya 61.8% standard ho ga Fibonacci level ka. Hit cost breaks karay ge neck area ko or falls ho ge phir sa retest karta hua 61.8% Fibonacci level, ko to begin ho ga negative ka pattern or ya affirm karay ga cost ka target ko or is ya set ho ga kisi Fibonacci level primary ha

Plan mein bullish example ko assert karne ke liye 3 candles ka istemal hota hai. Is plan ki pehchan, kisi upswing ke dauran do consecutive bullish candles ke beech mein ek negative light hona hai. Pehli Light (Bullish): Pehli flame ek bullish candle hoti hai jo rise ko darshaati hai. Dusri Light (Bullish): Dusri flame bhi ek bullish candle hoti hai aur pehli candle ki upar wali taraf open hoti hai.Teesri Candle (Negative): Teesri candle negative candle hoti hai aur dusri candle ki specialty wali taraf open hoti hai. Yeh candle pehli aur dusri flame ke beech mein ati hai.candle stuck tajweez kar sakti hai ke qeemat bohat ziyada ho rahi hai, jab ke surkh rang se bhari candle stuck wazeh aur mazboot neechay ke rujhan ki numaindagi karti hai. tajir market ke jazbaat ka andaza laganay ke liye un baseerat ka istemaal kar satke hain. ziyada tar tajir takneeki tajzia ki doosri shaklon le stuck bhi surkh rang ki ho sakti hai agar band pehlay ke band se neechay ho, lekin khulay ke oopar — aisi soorat mein yeh aam zenith standard khokhli dikhayi day gi. light muddat ke ounchay aur nichale hissay standard mushtamil hoti hai, jis ki numaindagi saaye se hoti hai Chart Pattern Trading View: Pattern ka inversion ko hit utilizing kar raha ho triple top example ko to is mama draw karay ga Fibonacci retracement levels ko. Jasa ka ya jo diagram beneath mama ha is mama dakh sakta Ha jo half ka Fibonacci retracement level ha is ko utilized karta hua ak or affirmation hoi ha enter karna ki exchange ko punch breakout hua ha. Is case mama merchants stop misfortune request ko place karay ga Fibonacci level ka above mama neck area mama or ya huma guarantee karay ga stop misfortune ni ho ga set off early ho ga. Jasa ka jo passage level ha ya half Fibonacci level sa great ha or jo stop misfortune ha ya 61.8% standard ho ga Fibonacci level ka. Hit cost breaks karay ge neck area ko or falls ho ge phir sa retest karta hua 61.8% Fibonacci level, ko to begin ho ga negative ka pattern or ya affirm karay ga cost ka target ko or is ya set ho ga kisi Fibonacci level primary ha  MACD ak specialized examination indecator ha jis ko principally use kiya jata ha or recognize karta ha pattern ka inversions ko. Is ko zada tar sara greetings exchanging stage incorporate karta ha, jis ki madad sa effectively is indecator ko add kar sakta ha or is sa compliance kar sakta ha energy ka change hona ko. Punch murmur is design ka sath add karay ga MACD marker to ya ak instrument ho ga jo ka affirm karay ga breakout ka belowa neck area sa or ya bogus breakout ni da ga. Is mama jo MACD hybrid ho ga ya same issi point sa banay ga jis mama us design mama breakout ho ga neck area ka. Ya madad karay ga iple top example ko straight forward or simple ho ga. Hit is mama find karay ga diagram design mama three tops ka sath to ya hit break beneath karay ga neck area sa to is mama short sell ki exchange ko enter karay ga. Is mama increment karna ka liya chances ka achievement ko. To isa significant ho ga affirm karna is design ko or is ko affirm or specialized pointers sa karay ga or is mama create karay ga compelling exchanging methodology ko.

MACD ak specialized examination indecator ha jis ko principally use kiya jata ha or recognize karta ha pattern ka inversions ko. Is ko zada tar sara greetings exchanging stage incorporate karta ha, jis ki madad sa effectively is indecator ko add kar sakta ha or is sa compliance kar sakta ha energy ka change hona ko. Punch murmur is design ka sath add karay ga MACD marker to ya ak instrument ho ga jo ka affirm karay ga breakout ka belowa neck area sa or ya bogus breakout ni da ga. Is mama jo MACD hybrid ho ga ya same issi point sa banay ga jis mama us design mama breakout ho ga neck area ka. Ya madad karay ga iple top example ko straight forward or simple ho ga. Hit is mama find karay ga diagram design mama three tops ka sath to ya hit break beneath karay ga neck area sa to is mama short sell ki exchange ko enter karay ga. Is mama increment karna ka liya chances ka achievement ko. To isa significant ho ga affirm karna is design ko or is ko affirm or specialized pointers sa karay ga or is mama create karay ga compelling exchanging methodology ko.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

The most effective method to see wicks and type wicks in market The most effective method to SEE WICKS AND TYPE WICKS IN MARKET DEFINITION Shadow ya wick candle Outline mein light per Paye jaane wali Ek line hai Jo is baat ki maloomat karne ke liye use ki Jaati Hai yah opening an end Sharpen Wali costs ke Muqable Mein stock ki cost mein Primary Kahan unpredictability Aaya Hai buniyadi Taur per Yah shadow subse zyada aur sabse com costs ki ukasi karte hain Jin per security Ne ek specifice time ke dauran exchanged ki hai Ek Shadow ya to opening cost yah shutting cost Ke Specialty wakya Hote Hain Hit flame ke nichle Hisse per long Shadow hota hai Jaise hammer Ki Tarah to purchasing level mein expanded to design ke lihaze se mumkna Taur per specialty Ki idea hoti hai exchanging Mein examination ki two Aham shapes Hain basic and specialized investigation stock ki future ki bearing ke exposed mein piece of information and bits of knowledge give Karen Exchange In a hurry .Anyplace Whenever Correlation ke lihaze se specialized examination value Mein Sharpen Wali developments tavajjo Dete Hain vah cost ki activity mein design ki recognize karne ki Koshish Karte Hain aur phir future Mein cost ki bearing ka andaza Lagane ke liye UN design ka use karte hain central investigation investigators ko yah select karne mein help karna chahie ki kaun se stock ko exchange karna chahie Poke Ke specialized examination inhen batate Hain Inki exchange kab Karni chahie candle outline specialized examination ke bahut se instruments mein se ek hai her candles ki tashkeel open high low and close hote hai open high low aur close stock ki costs ka havala dete hain yah voh values hain jo candle design banate hain candle ke box ka segment jo ya to empty ya filled hai body Kehlata Hai candle different measure mein use hote hain jise waqt aur ticks aur different edges Jaise brief 2 moment hazaar ticks ya 2000 ticks is Baat Se Koi Fark Nahin parta hai Keh measure ya outline kya hai arrangement aur rules ek hello there work Karte Hain body ke donon siron per maujud lines Ko wick ya Shadow kahan jata hai

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:15 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим