Benefit of using DPO indicator in trading

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

BENEFITS OF USING DETRENDED PRICE OSCILLATOR INDICATOR (DPO)Introduction Detrended Price Oscillator (DPO) technical indicator hai jo market analysis mein istemal hota hai. Iska maqsad price trends ko identify karne mein madad karna hai aur kisi security ya asset ki actual price variation ko highlight karna hai. DPO, price ki moving average se mawazna kar ke price movement mein sahi trends ko detect karne mein madad deta hai. Yeh indicator traders ko market ki behaviour aur price patterns samajhne mein madadgar sabit ho sakta hai. Benefits Iss indicator ki kuch key benefits samjhae hain: Trend Identification: DPO ke zariye traders trend ko samajh sakte hain. Price ki fluctuations ko trend se alag kar ke actual price movements ko highlight karne se, market ki direction aur trend ke patterns ko asani se detect karne mein madad milti hai. Overbought aur Oversold Levels: DPO, security ke overbought ya oversold levels ko determine karne mein madad karta hai. Jab price moving average se ooper jata hai, toh security overbought kehlata hai, aur jab price moving average se neechay jata hai, toh security oversold kehlata hai. Yeh levels traders ke liye entry ya exit points tayyar karne mein madadgar sabit ho sakte hain. Cycles ki pehchan: DPO, price cycles ko identify karne mein bhi madad deta hai. Yeh cycles kuch dino, hafton ya mahinon ke liye ho sakte hain. In cycles ko samajhna, traders ko future price movements ko predict karne mein asani deti hai. Price Reversals ki Nishandahi: DPO price reversals ko detect karne mein bhi kaam aata hai. Jab price trend change karta hai, toh DPO indicator uss reversal ko advance mein signal karta hai. Isse traders ko pata chal jata hai ke market ka direction change hone wala hai. Price aur Indicator Divergence: DPO traders ko price aur indicator ke beech divergence ko identify karne mein madad deta hai. Yeh divergence, price movement aur indicator movement mein farq ko dikhata hai, jisse traders ko potential trend changes ka andaza lagane mein madad milti hai. Entry aur Exit Points: DPO, entry aur exit points tayyar karne mein bhi kaam aata hai. Isse traders ko samajh mein aata hai ke kis waqt security ko khareedna hai aur kis waqt bechna hai. Lamba-Term Trends: DPO, lambe arsay ke trends ko detect karne mein madad deta hai. Price ki short-term fluctuations ko filter kar ke, DPO traders ko lamba-term trends ko samajhne mein madad karta hai. Price Volatility ke Pata lagana: DPO volatility ko measure karne mein madad deta hai. Agar DPO ka value barhta hai, toh price volatility bhi barhti hai, aur agar DPO ka value kam hota hai, toh price volatility bhi kam hoti hai. Summary Detrended Price Oscillator (DPO) aik powerful technical indicator hai jo traders ko trend identification, cycles ki pehchan, price reversals, entry aur exit points tayyar karne mein madad deta hai. Yeh indicator market analysis mein zaroori tareeqon mein istemal hota hai, lekin har indicator ki tarah, DPO ko bhi dusre tools aur analysis ke saath istemal karna zaroori hai, aur iss indicator ke signals ko confirm karna mahatvapurna hai. -

#3 Collapse

What is the DPO indicator?

Salam dosto ! Detrend indicator Market kay rujhan kay muraliq ha. aik aisa tasawwur hai jo istemaal kya jata hai kyunkay cycle ka kuch phase aam tor par aglay cycle ki simt par munhasir hota hai. Jis ki wajah is market ki negative move ko phase karna hai jo qeematon ki naqal o harkat se laya jata hai. Is ka amal nisbatan aasaan hai. aap kisi asasay ki mojooda qeemat ko qeemat ki moving average oscillator se aasani se taqseem karte hain. detrended price oscillator ka hisaab zail ke formulay se kya jata hai getqeemat ( x / 2 + 1 ) jahan x istemaal shuda adwaar ki tadaad hai. jab detrended price oscillator ko chart par laago kya jata hai to yeh aam tor par aik lakeer ke tor par zahir hota hai jo oopar neechay hoti hai. yeh aam tor par -0. 05 aur + 0. 05 ke darmiyan hota hai .

Best detrended price oscillator settings:

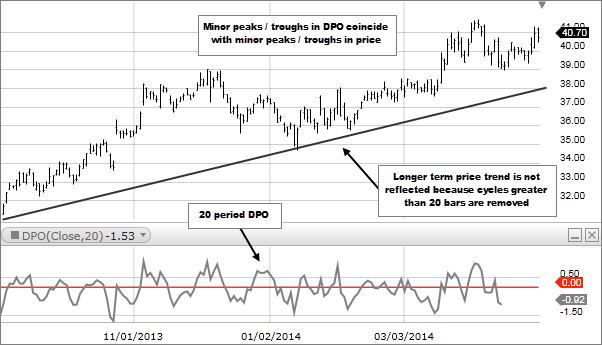

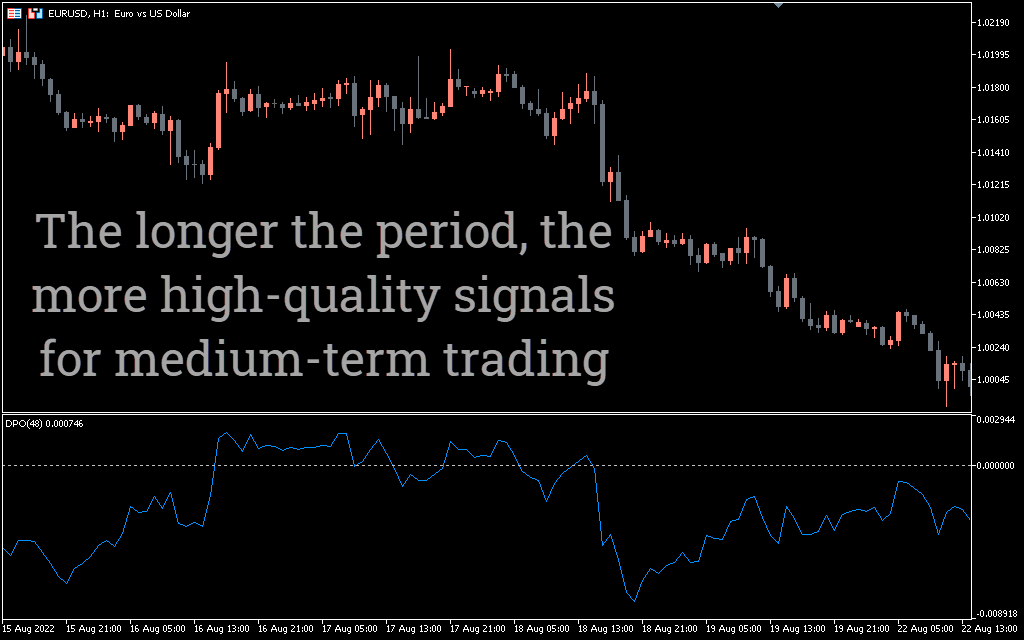

Detrended price osilator istemaal karne wala trader tabdeel kar sakta hai. sab se ahem period section ha jo ziyada tar traders plateforms mein istemaal honay wali difault muddat 21 hai. taham tamam takneeki isharay ki terhan, yeh aik aisi tarteeb hai jisay aap apni tijarti hikmat e amli se mutabqat rakhnay ke liye tabdeel kar satke hain. doosri ahem tarteeb jo aap ko dekhna chahiye woh hai isharay ka time frame. ziyada tar mamlaat mein, aap ko aik aisa isharay istemaal karna chahiye jo chart ke barabar ho. misaal ke tor par, agar aap rozana chart istemaal kar rahay hain, to aap ko isharay ko rozana chart par mabni honay dena chahiye. aap sirf aisi sorat e haal nahi chahtay hain jahan aap rozana chart aur aik ghantay ke chart ka d pi o istemaal kar rahay hon. aakhir mein, aap line ka rang tabdeel kar satke hain. pehlay se tay shuda tor par detrended isharay mein sabz aur surkh rang hota hai lekin aap dono ko tabdeel kar satke hain. zail ka chart sales force chart par laago dpo isharay ko dekhata hai .

Using the DPO Zero Line:

DPO indicator ke istemaal ke sab se muaser tareeqon mein se aik sifar line ka istemaal hai. yeh woh line hai jo darmiyan mein nazar aati hai. khayaal yeh hai ke agar Detrended price line line ke neechay se agay barh rahi hai aur barh rahi hai, to yeh kharidne ka ishara hai. aap ko tijarat ko is waqt tak rokna chahiye jab tak d pi o line zero line se oopar ho. jaisay jaisay qeemat barhay gi, d pi o isharay mein utaar charhao aaye ga lekin aap ko un utaar charhao par tawajah nahi deeni chahiye. is ke bajaye, aap ko line par tawajah markooz karni chahiye jab woh sifar line ko uboor karti hai. isi terhan, agar d pi o line neechay chalti hai aur sifar se neechay rehti hai, to usay aam tor par sale signal kaha jata hai. is ki aik achi misaal neechay dukhaay gaye Google chart par dikhayi gayi hai .

Using the Detrended Price Oscillator with Moving Averages:

is osilator ko istemaal karne ka dosra option yeh hai ke usay harkat Pazeer ost ke sath istemaal kya jaye. is nuqta nazar ka maqsad rujhan ke isharay aur rujhan ko hataane walay isharay ko yakja karna hai. hum jis nuqta nazar ko tarjeeh dete hain woh hai jahan dpo ko double exponential moving average ke sath milaya jata hai. hum ema istemaal karne ko tarjeeh dete hain kyunkay yeh sma se ziyada durust hota hai. is ki wajah yeh hai ke yeh aam tor par aakhri band honay wali qeemat par zor deta hai. zail ki misaal mein, hum ne 21 din ka dpo istemaal kya aur usay 21 din aur 10 din ke ema ke sath milaya. aisa karne ka maqsad nisbatan aasaan hai. hum double ema ka istemaal is baat ki shanakht ke liye karna chahtay hain ke aik naya rujhan kab ban'nay wala hai. yeh cross over ke naam se jana jata hai. agar yeh aik ulat ki taraf ishara karta hai, to hum rujhan ki tasdeeq ke liye d pi o ko dekhte hain. hum jari rujhan ki tasdeeq ke liye un asharion ka majmoa bhi istemaal karte hain . -

#4 Collapse

technical indicator hai jo market analysis mein istemal hota hai. Iska maqsad price trends ko identify karne mein madad karna hai aur kisi security ya asset ki actual price variation ko highlight karna hai. DPO, price ki moving average se mawazna kar ke price movement mein sahi trends ko detect karne mein madad deta hai. Yeh indicator traders ko market ki behaviour aur price patterns samajhne mein madadgar sabit ho sakta hai. Benefits Iss indicator ki kuch key benefits samjhae hain: Trend Identification: DPO ke zariye traders trend ko samajh sakte hain. Price ki fluctuations ko trend se alag kar ke actual price movements ko highlight karne se, market ki direction aur trend ke patterns ko asani se detect karne mein madad milti hai. Overbought aur Oversold Levels: DPO, security ke overbought ya oversold levels ko determine karne mein madad karta hai. Jab price moving average se ooper jata hai, toh security overbought kehlata hai, aur jab price moving average se neechay jata hai, toh security oversold kehlata hai. Yeh levels traders ke liye entry ya exit points tayyar karne mein madadgar sabit ho sakte hain.Cycles ki pehchan: DPO, price cycles ko identify karne mein bhi madad deta hai. Yeh cycles kuch dino, hafton ya mahinon ke liye ho sakte hain. In cycles ko samajhna, traders ko future price movements ko predict karne mein asani deti hai. Price Reversals ki Nishandahi: DPO price reversals ko detect karne mein bhi kaam aata hai. Jab price trend change karta hai, toh DPO indicator uss reversal ko advance mein signal karta hai. Isse traders ko pata chal jata hai ke market ka direction change hone wala hai. Price aur Indicator Divergence: DPO traders ko price aur indicator ke beech divergence ko identify karne mein madad deta hai. Yeh divergence, price movement aur indicator movement mein farq ko dikhata hai, jisse traders ko potential trend changes ka andaza lagane mein madad milti hai. istemaal shuda adwaar ki tadaad hai. jab detrended price oscillator ko chart par laago kya jata hai, to yeh aam tor par aik lakeer ke tor par zahir hota hai jo oopar neechay hoti hai. yeh aam tor par -0. 05 aur + 0. 05 ke darmiyan hota hai . Best detrended price oscillator settings

teen ahem hain jinhein Detrended price osilator istemaal karne wala tajir tabdeel kar sakta hai. sab se ahem period section hai. ziyada tar tijarti plate forms mein, istemaal honay wali difalt muddat 21 hai. taham, tamam takneeki isharay ki terhan, yeh aik aisi tarteeb hai jisay aap apni tijarti hikmat e amli se mutabqat rakhnay ke liye tabdeel kar satke hain. doosri ahem tarteeb jo aap ko dekhna chahiye woh hai isharay ka time frame. ziyada tar mamlaat mein, aap ko aik aisa isharay istemaal karna chahiye jo chart ke barabar ho. misaal ke tor par, agar aap rozana chart istemaal kar rahay hain, to aap ko isharay ko rozana chart par mabni honay dena chahiye. aap sirf aisi sorat e haal nahi chahtay hain jahan aap rozana chart aur aik ghantay ke chart ka d pi o istemaal kar rahay hon. aakhir mein, aap line ka rang tabdeel kar satke hain. pehlay se tay shuda tor par, detrended isharay mein sabz aur surkh rang hota hai lekin aap dono ko tabdeel kar satke hain. zail ka chart sales force chart par laago dpo isharay ko dekhata hai . Using the DPO’s Zero Line

DPO indicator ke istemaal ke sab se muaser tareeqon mein se aik sifar line ka istemaal hai. yeh woh line hai jo darmiyan mein nazar aati hai. khayaal yeh hai ke agar Detrended price line line ke neechay se agay barh rahi hai aur barh rahi hai, to yeh kharidne ka ishara hai. aap ko tijarat ko is waqt tak rokna chahiye jab tak d pi o line zero line se oopar ho. jaisay jaisay qeemat barhay gi, d pi o isharay mein utaar charhao aaye ga lekin aap ko un utaar charhao par tawajah nahi deeni chahiye. is ke bajaye, aap ko line par tawajah markooz karni chahiye jab woh sifar line ko uboor karti hai. isi terhan, agar d pi o line neechay chalti hai aur sifar se neechay rehti hai, to usay aam tor par sale signal kaha jata hai. is ki aik achi misaal neechay dukhaay gaye Google chart par dikhayi gayi hai . Using the Detrended Price Oscillator with Moving Averages

-

#5 Collapse

**DPO Indicator ki Explanation:** Detrended Price Oscillator (DPO) ek momentum oscillator hai jo price ke detrended version par based hota hai. Ye indicator price ko moving average se detrend karke present momentum ko analyze karta hai.DPO ek oscillating indicator hai jo zero line ke around fluctuate karta hai. Ismein price ke detrended version ka use kiya jata hai, jisse price ke short-term cycles aur price changes ka pata chalta hai. **Is ki Khasosiat:** 1. Detrended Version: DPO moving average se price ko detrend karke current market momentum ko dekhta hai, isliye short-term price cycles aur trend reversals ka pata chalta hai. 2. Cycle Identification: DPO price ke repetitive cycles ko identify karta hai, jisse traders ko trend ki direction aur reversals ka pata chalta hai. 3. Lagging Indicator: DPO ek lagging indicator hai, jisse present market conditions par based nahi hota, lekin future price movements ki indication provide karta hai. **Fawaid:** 1. Short-term Cycles: DPO short-term price cycles ko identify karke traders ko entry aur exit points provide karta hai. 2. Trend Reversals: DPO trend reversals ka pata karne mein madad karta hai, jisse traders price changes se advance information milta hai. 3. Trend Confirmation: DPO trend ki direction ko confirm karta hai, jisse traders trend-following strategies implement kar sakte hain. **Nuqsan (Drawbacks):** 1. Lagging Nature: DPO ek lagging indicator hai, isliye present price movements ke liye immediate signals provide nahi karta. 2. Choppy Markets: DPO choppy ya sideways markets mein accurate signals nahi deta, jisse false signals ka risk hota hai. 3. Whipsaw Movements: DPO ke oscillating nature ki wajah se whipsaw movements ki samasya hoti hai, jisse wrong signals ka khadsha rehta hai. **Ikhtitam (Conclusion):** DPO indicator price ke short-term cycles aur trend reversals ko analyze karne mein madad karta hai. Iski madad se traders entry aur exit points decide kar sakte hain aur trend ki direction ko confirm kar sakte hain. Lekin DPO ka lagging nature aur whipsaw movements ki wajah se false signals ka risk rehta hai. Isliye, traders ko DPO ke signals ko confirm karne ke liye dusre indicators ya price action analysis ka istemal karna chahiye. Overall, DPO ko apni trading strategy ke sath combine karke better results mil sakte hain.

- Mentions 0

-

سا0 like

-

#6 Collapse

BENEFITS OF USING DPO INDICATOR IN TRADING DEFINITION Jaisa ke indicator ke name se hi Dekha Ja sakta hai dpo ka use current price se long term Trend ke Asar ko Dur karne ke liye Kiya jata hai kabhi kabhi kisi trend Ki long evity ka andaza Lagana aur uske Kareeb reversal ki predict karna easy Hai Jab trend se linked prices ki movements ko chart se Apne Shakal Mein Kafi simillar hai donon Ke Darmiyan sabse obvious difference dpo per Ek important Trend Kami hai indicator ko correctly tarike seused karne ke liye yah samajhna zaruri hai ke oscillator detrended price Ek moving average ke use per mabani hai jismein Kai periods ko Kai taraf muntakil Kiya jata hai indicator past ki price ka moving average ke sath compare Karega kam time ke waqfon per trade Karte time indicator khas taur per useful Hota Hai long term trading mein interested na hone ki vajah se aap apne exclude se long lasting trends ko kharej karna chahte hain Aur sirf shorter fluctuation per consider kar sakte hain WHAT DOES THE DETRENDED PRICE OSCILLATOR TELL YOU agar peaks mein 1.5 months ka Faisla hota hai to Ek recent Peak ko tlash kar sakta hai aur Andaaza Laga sakta hai ke next peak 1.5 months per Aaegi is matwake peak/time frame ko price Ke Piche pahly potentially position sell karne ke opportunity ke Taur per istemal Kiya Ja sakta hai detrended oscillator price oscillator kisi trader ko price ke asset ke Chakkar ki identify karne mein help karne ki koshish karta hai yeh sma ka historical price se mowazna kerke kerta hai joke looking ki term ke oast ke kareeb hai

WHAT DOES THE DETRENDED PRICE OSCILLATOR TELL YOU agar peaks mein 1.5 months ka Faisla hota hai to Ek recent Peak ko tlash kar sakta hai aur Andaaza Laga sakta hai ke next peak 1.5 months per Aaegi is matwake peak/time frame ko price Ke Piche pahly potentially position sell karne ke opportunity ke Taur per istemal Kiya Ja sakta hai detrended oscillator price oscillator kisi trader ko price ke asset ke Chakkar ki identify karne mein help karne ki koshish karta hai yeh sma ka historical price se mowazna kerke kerta hai joke looking ki term ke oast ke kareeb hai  LIMITATION OF USING THE DPO indicator bhi trend mein ahmeyat Rakhta hai yeh trader per munhsir hai ke vah kis direction trade Karen Agar asset ki price free Girne Mein Hai To ho sakta hai yah cycle bottom per bhi kharidne ke able Na Ho Kyunki price anyway falling hai dpo Apne Taur per trade signal per provide nahin karta balke trade ke Waqt mein help karne ke liye ek izaafi tool hai

LIMITATION OF USING THE DPO indicator bhi trend mein ahmeyat Rakhta hai yeh trader per munhsir hai ke vah kis direction trade Karen Agar asset ki price free Girne Mein Hai To ho sakta hai yah cycle bottom per bhi kharidne ke able Na Ho Kyunki price anyway falling hai dpo Apne Taur per trade signal per provide nahin karta balke trade ke Waqt mein help karne ke liye ek izaafi tool hai

-

#7 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Benefit of using DPO indicator in trading ". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. DPO indicator Detrended price oscillator ziyada aasani se cyclon ki shanakht ki ijazat dainay ke liye qeemat se rujhan ko hataane ki koshish karta hai. isharay ke liye makhsoos muddat se ziyada taweel cyclon ko hata diya jata hai, jis se sirf mukhtasir muddat ke cycle reh jatay hain. dpo ko baen taraf hata diya gaya hai taakay isharay qeemat mein chotyon aur girton ke sath munsalik hon. cyclon ka andaza chotyon ya girton ke darmiyan ke waqfon ko gun kar lagaya ja sakta hai. sarfeen behtareen foot talaash karne ke liye choti aur lambi dpo accelators ke sath tajurbah kar satke hain. takneeki tajzia mein istemaal honay wala detrends price accelator qeemat ke rujhanaat ko khatam karta hai taakay qeemat ke chakron ki lambai chouti se chouti tak ya girt se girt tak ka andaza lagaya ja sakay. dosray accelators ke bar aks, jaisay ke stocks ya moving average knorjns divergence ( macd ), dpo momentum indicator nahi hai. is ke bajaye yeh qeemat mein chotyon aur girton ko numaya karta hai, jo tareekhi chakkar ke mutabiq khareed o farokht ke points ka takhmeenah laganay ke liye istemaal hotay hain. qeemat / indicator mein chotyon aur girton ke darmiyan faaslay ki pemaiesh ke liye detrended price accelators ( dpo ) istemaal kya jata hai. agar girt mein tareekhi tor par taqreeban do mah ka faasla raha hai, to is se tajir ko mustaqbil ke faislay karne mein madad mil sakti hai kyunkay woh haliya girt ko talaash kar satke hain aur yeh tay kar satke hain ke agla taqreeban do mah mein ho sakta hai. tajir mustaqbil ki mutawaqqa chotyon ko farokht ke mawaqay ke tor par istemaal kar satke hain ya mustaqbil ke takhminay ko kharidne ke mawaqay ke tor par istemaal kar satke hain. isharay ko aam tor par 20 se 30 adwaar mein peechay dekhnay ke liye set kya jata hai . Explanation and calculation Qeemat / indicator mein chotyon aur girton ke darmiyan faaslay ki pemaiesh ke liye detrended price accelator ( dpo ) istemaal kya jata hai. Agar girt mein tareekhi tor par taqreeban do mah ka faasla raha hai, to is se tajir ko mustaqbil ke faislay karne mein madad mil sakti hai kyunkay woh haliya girt ko talaash kar satke hain aur yeh tay kar satke hain ke agla taqreeban do mah mein ho sakta hai. tajir mustaqbil ki mutawaqqa chotyon ko farokht ke mawaqay ke tor par istemaal kar satke hain ya mustaqbil ke takhminay ko kharidne ke mawaqay ke tor par istemaal kar satke hain. isharay ko aam tor par 20 se 30 adwaar mein peechay dekhnay ke liye set kya jata hai. detrended price oscillator ( dpo ) ka formula yeh hai : = 2 + 1 - kahan : x = dekhnay ki muddat ke liye istemaal honay walay adwaar ki tadaad sma = saada harkat pazeeri ost dpo = qeemat se 2 x + 1 adwaar pehlay −x dorania sma kahan : x = dekhnay ki muddat ke liye istemaal honay walay adwaar ki tadaad sma = saada harkat pazeeri ost detrended price oscillator ( dpo ) ka hisaab kaisay lagayen talaash karne ki muddat ka taayun karen, jaisay 20 adwaar. x / 2 + 1 adwaar pehlay se ikhtitami qeemat talaash karen. agar 20 adwaar istemaal kar rahay hain, to yeh 11 adwaar pehlay ki qeemat hai. aakhri x periods ke liye sma ka hisaab lagayen. is soorat mein, 20. dpo value haasil karne ke liye ikhtitami qeemat x / 2 + 1 muddat pehlay ( marhala 2 ) se sma value ( marhala 3 ) ko ghatain. yeh aik sma ka tareekhi qeemat se mawazna kar ke karta hai jo ke wapsi ki muddat ke wast ke qareeb hai. isharay par tareekhi chotyon aur girton ko dekh kar, jo qeemat mein chotyon aur girton ke sath munsalik hain, tajir aam tor par amoodi lakerain khinchin ge. yeh mourr aur phir shumaar karen ke un ke darmiyan kitna waqt guzra hai. agar bottoms mein do mah ka faasla hai, to is se andaza hota hai ke agli kharidari ka mauqa kab aasakta hai. yeh isharay / qeemat mein taaza tareen girt ko allag karkay aur phir wahan se aglay do mah ke neechay paish karkay kya jata hai. agar chotyon mein aam tor par 1. 5 mah ka faasla hota hai, to aik tajir taaza tareen chouti ko talaash kar sakta hai aur phir andaza laga sakta hai ke agli chouti 1. 5 mah baad aaye gi. is mutawaqqa chouti / time frame ko qeemat ke peechay hatnay se pehlay mumkina tor par position farokht karne ke mauqa ke tor par istemaal kya ja sakta hai. tijarti waqt ke sath mazeed madad ke liye, aik girt aur chouti ke darmiyan faasla aik taweel tijarat ki lambai ka andaza laganay ke liye, ya aik mukhtasir tijarat ki lambai ka andaza laganay ke liye chouti aur girt ke darmiyan faasla istemaal kya ja sakta hai .

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

FOREX TRADING ME DPO INDICATOR KY FAWAED OR WAZAHAT BEYAAN KIJIYE ???FOREX TRADING ME DPO INDICATOR KA OVERVIEW:- Eh rujhan saazi ke istemaal ke bar aks hai. Aik aisa tasawwur hai jo istemaal kya jata hai kyunkay cycle ka kuch rawayya aam tor par aglay cycle ki simt par munhasir hota hai. Ki wajah is shore ko daur karna hai jo qeematon ki naqal o harkat se laya jata hai. Ka amal nisbatan aasaan hai : aap kisi asasay ki mojooda qeemat ko qeemat ki harkat Pazeer ost se aasani se taqseem karte hain. Detrended fee oscillator ka hisaab zail ke formulay se kya jata hai getqeemat ( x / 2 + 1 ) jahan x istemaal shuda adwaar ki tadaad hai. Jab detrended rate oscillator ko chart par laago kya jata hai, to yeh aam tor par aik lakeer ke tor par zahir hota hai jo oopar neechay hoti hai. Yeh aam tor par -zero. 05 aur + 0. 05 ke darmiyan hota ha.Technical indicator hai jo marketplace assessment mein istemal hota hai. Iska maqsad price dispositions ko grow to be privy to karne mein madad karna hai aur kisi safety ya asset ki actual fee version ko highlight karna hai. DPO, fee ki transferring commonplace se mawazna kar ke rate movement mein sahi dispositions ko come upon karne mein madad deta hai. Yeh indicator clients ko marketplace ki behaviour aur charge patterns samajhne mein madadgar sabit ho sakta ha.Detrended Price Oscillator (DPO) ek momentum oscillator hai jo price ke detrended version par based totally surely hota hai. Ye indicator rate ko moving commonplace se detrend karke present momentum ko test karta hai.DPO ek oscillating indicator hai jo 0 line ke round variety karta hai. Ismein fee ke detrended version ka use kiya jata hai, jisse price ke short-term cycles aur fee changes ka pata chalta hai. FOREX TRADING ME DPO INDICATOR AP SE SHARE KARTA HA:- agar peaks mein 1.Five months ka Faisla hota hai to Ek modern Peak ko tlash kar sakta hai aur Andaaza Laga sakta hai ke next pinnacle 1.Five months in line with Aaegi is matwake pinnacle/time body ko fee Ke Piche pahly probably characteristic promote karne ke opportunity ke Taur consistent with istemal Kiya Ja sakta hai detrended oscillator rate oscillator kisi issuer ko rate ke asset ke Chakkar ki discover karne mein help karne ki koshish karta hai yeh sma ka historic fee se mowazna kerke kerta hai comic tale looking ki time period ke oast ke kareeb hai. FOREX TRADING ME DPO INDICATOR MOVING AVERAGE KY SATH:- is osilator ko istemaal karne ka dosra opportunity yeh hai ke usay harkat Pazeer ost ke sath istemaal kya jaye. Is nuqta nazar ka maqsad rujhan ke isharay aur rujhan ko hataane walay isharay ko yakja karna hai. Hum jis nuqta nazar ko tarjeeh dete hain woh hai jahan dpo ko double exponential transferring commonplace ke sath milaya jata hai. Hum ema istemaal karne ko tarjeeh dete hain kyunkay yeh sma se ziyada durust hota hai. Is ki wajah yeh hai ke yeh aam tor par aakhri band honay wali qeemat par zor deta hai. Zail ki misaal mein, hum ne 21 din ka dpo istemaal kya aur usay 21 din aur 10 din ke ema ke sath milaya. Aisa karne ka maqsad nisbatan aasaan hai. Hum double ema ka istemaal is baat ki shanakht ke liye karna chahtay hain ke aik naya rujhan kab ban'nay wala hai. Yeh pass over ke naam se jana jata hai. Agar yeh aik ulat ki taraf ishara karta hai, to hum rujhan ki tasdeeq ke liye d pi all proper dekhte hain. Hum jari rujhan ki tasdeeq ke liye un asharion ka majmoa bhi istemaal karte hain .

FOREX TRADING ME DPO INDICATOR AP SE SHARE KARTA HA:- agar peaks mein 1.Five months ka Faisla hota hai to Ek modern Peak ko tlash kar sakta hai aur Andaaza Laga sakta hai ke next pinnacle 1.Five months in line with Aaegi is matwake pinnacle/time body ko fee Ke Piche pahly probably characteristic promote karne ke opportunity ke Taur consistent with istemal Kiya Ja sakta hai detrended oscillator rate oscillator kisi issuer ko rate ke asset ke Chakkar ki discover karne mein help karne ki koshish karta hai yeh sma ka historic fee se mowazna kerke kerta hai comic tale looking ki time period ke oast ke kareeb hai. FOREX TRADING ME DPO INDICATOR MOVING AVERAGE KY SATH:- is osilator ko istemaal karne ka dosra opportunity yeh hai ke usay harkat Pazeer ost ke sath istemaal kya jaye. Is nuqta nazar ka maqsad rujhan ke isharay aur rujhan ko hataane walay isharay ko yakja karna hai. Hum jis nuqta nazar ko tarjeeh dete hain woh hai jahan dpo ko double exponential transferring commonplace ke sath milaya jata hai. Hum ema istemaal karne ko tarjeeh dete hain kyunkay yeh sma se ziyada durust hota hai. Is ki wajah yeh hai ke yeh aam tor par aakhri band honay wali qeemat par zor deta hai. Zail ki misaal mein, hum ne 21 din ka dpo istemaal kya aur usay 21 din aur 10 din ke ema ke sath milaya. Aisa karne ka maqsad nisbatan aasaan hai. Hum double ema ka istemaal is baat ki shanakht ke liye karna chahtay hain ke aik naya rujhan kab ban'nay wala hai. Yeh pass over ke naam se jana jata hai. Agar yeh aik ulat ki taraf ishara karta hai, to hum rujhan ki tasdeeq ke liye d pi all proper dekhte hain. Hum jari rujhan ki tasdeeq ke liye un asharion ka majmoa bhi istemaal karte hain .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:40 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим