What is a kicker pattern:

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

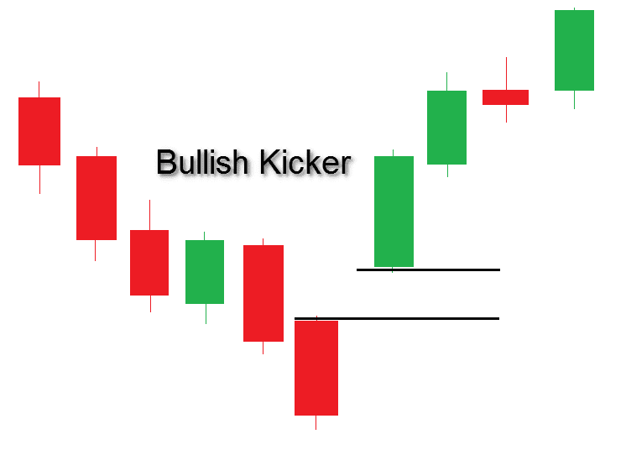

What is a kicker pattern:Kicker pattern two bar candlestick pattern ha jo ka predict card ha direction ka change hona ka market ka price trend sa. Ya pattern characterized hota ha sharp reversal sa or is ma price range hoti ha two candlesticks ma. Traders is ko use card hua determine karay ga market ka group ko or participant contro karay ga direction ko. Ya pattern point card ha strong change ka attitude of investors ka safety ki janab. Jo je ma durection change hoge ya po karay ge release karay ge valuable information ko jo ka society, industry or economy ki. Ya kicker pattern two candlestick sa mil kar aj sharp reversal ko banay ga. Traders is kicker pattern ko use kar ka determine karay ga or control karay ga market ki direction ko. Traders is ma point karay ga strong change ko or yes traders ho ga ya follows karay ga is pattern ko ya traders ko trend ka reversal ki traf la kar jay ga. Ya kicker patdo trha sa hota ha ya bullish ma bhi ho sakta ha or ya kicker bearish ke janab ho sakta ha.UNDERSTANDING THE KICKER PATTERN Yes, the stock market has been characterized by the completion of buying bulls and selling bears. Jo ya constant drag ha ya between players card ha or form card ha candlestick patterns ko. Candlestick charting originated hoti ha or is ko banay ha technique developed in Japan ma 1700 ma kiya ha ya tracked card ha price ka rice ko. Candlestick suitable technique ha trading ka liya or is ma koi bhi financial asset ho sakta ha jasa stocks, futures or foreign currencies. Jo ya kicker pattern ha is ko consider kiya jata ha and the most reliable reversal patterns ka tor par jo ka huma indicates a card ha dramatic change ko society ka fundamental changes ma. Kicker pattern reversal pattern ha or ya other hota ha gap pattern sa is ma gap show card ha up or down ka trend ka stay ko. The pattern Ya dakhna ma similar to hota ha magar is the pattern ko implies different trha sa kiya jata ha. Kicker pattern bullish or bearish dono traf banta ha. Bullish kicker pattern start hota ha bearish candle sa jo ka show card ha bullish ka gap up ko. Yes bearish kicker hota ha ya start bullish ki candle sa hota ha or or phir show card ha bearish gap down ko.HOW THE KICKER PATTERN WORKS: Jab traders is kicker pattern ko observed card ha, is ma wo dakhta ha ka jo price ha ya move bahot hi quickly ho rahi ha, or is ma traders wait karay ga pull back ka. Wo merchants jo find card ha wish ko or ya entered card ha position ko jab originally identified pattern ho flock ha kicker. Ya kicker pattern strongest bull ya bear sentiment indicators ha, or ya pattern rare ha. Bahot sa professional traders is ma respond quickly ni karta ak direction sa dosri ki janab. Ya kicker pattern present hota ha apni self par. Kicker pattern ak bahot hi most powerful signal available karta ha jab is ko technical analysis kiya jata ha. Ya relevance hota ha jab magnified kiya jata ha jab ya pattern banta ha overbought ya oversold par. Je ma jo two candles hoti ha is pattern ka za ma ya visible meaning ha. Jo is ki first candle hoti ha ya open hoti ha or move chart ha current trend ki direction ki traf or second candle open same hoti ha open point jo previous candle ka axis sa or ya previous tendd ka opposite ke janab jati ha. Is pattern ki candle ki jo body hoti ha ya opposite color ki hoti ha or bahot sa trading platform par ya display card ha dramatic investor ka sentiment ka change hona ko. Q ka ya pattern tab banta ha jab investors ka attitude change hota ha indicator ko use kiya jata ha is pattern ki conformation ko or measured karna ka liya. BEARSH KICKER CANDLE PATTERN EXAMPLE: Bearish kicker candlestick chart pattern reliability high hoti ha jab ya banta ha uptrend ma or ya overbought ka area ma formed hota ha. It is ka day 1 ma jo one candlestick hoti ha ya continues karti ha uptrend ko or yo bullish hota ha ya nature hota ha. Is ma koi meaning ni hota jab ya banta ha uptrend ma. Or day 2 ma, bearish candlestick ki appears hoti ha. Is ma candlestick open hoti ha same price previous day ka (yo ka gap down ma hoti ha) or yes is ka head hota ha ya opposite direction ma hota ha day 1 ki candle ka. Agar ya pattern valid ha, that yes is ki second day ki candle hoge ya open ho ge first candle ka day sa lower sa. Traders can expect that karay ga gap down ko is the next day ki candle sa phalay or increase the chances ho ga price ka continue hona ka or fall ho ga strike the next day ke candle complete ho jay ge.DIFFERENCE BETWEEN BULLISH AND BEARISH KICKER PATTERN: Bullish or bearish kicker pattern dono kicker pattern li types ho ge or in ma different sirf ya ho ga ya ak bullish ke janab banay ga kr ak bearish ke traf ya dono same trha sa banay ga. In dono patterns ki formation two candles or ak gap sa mil kar ho ge. Yes bullish kicker pattern ho ga ka lower ma banaay ga or ya batay ka traders ko, bear stop ho raha ha or exit kar raha ha market sa or ya batay ga ka bullish overtaking kar raha ha yes ka price ka higher jana ka indicate kar rajh ha, traders is bullish kicker ma long term buy ma enter ho ga is ki second candle ka high sa or stop loss first candle ka below ma instead of karay ga. Or yes bearish kivker ho ga ya hogher ma uptrend ma banay ga or ya bull ka market sa exit hona or bear ka strong enter hona ka signal da ga is ma same bull kicker ki traha sa trade ko enter kiya jay ga, magar is ma sell ma input la ga. -

#3 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Kicker candlestick pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction kukkar patteren security ka price charting patteren hai jis ki shanakht is ki allag allag do baar candle stuck ki koi to tashkeel ke douran qeemat mein zabardast ulat phair se hoti hai. keekar patteren takneeki tajzia ki duniya mein numaya hain kyunkay woh kisi asasa ki qeemat ki passion goi ki simt mein tabdeelion ke liye pishin goi ke tor par kaam karte hain .kukkar patteren ko bohat ziyada badhaya jata hai jab usay ziyada farokht shuda aur ziyada kharidi hui marketon mein dekha jata hai. kukkar patteren ke koi asraat se pata chalta hai ke maliyati market mein barray khilari security ke baray mein apni raye ko tabdeel ya to tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati manndi ke barray khiladion ki raye kisi khabar ki taqreeb ya maloomat ke ajra ke douran mutasir hoti hai. misaal ke tor par, agar koi si e o kisi mutanazia siyasi aqeday ka khil kar izhaar karta hai, to sarmaya car bunyadi stock ko koi baichnay ya kharidne ke liye sakht rad-e-amal ka izhaar kar satke hain. do bunyadi kukkar patteren jo aaj maliyati market mein numaya hain inhen" blush kukkar patteren" aur" bearish kukkar patteren" kaha jata hai . Keysteps kukkar patteren candle stick patteren ki aik qisam hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki pishin goi karti hai. yeh namona do mom btyon ke koi to doraniye mein qeemat mein taizi se ulat phair ki es sy to khasusiyat rakhta hai. tajir is baat ka taayun karne ke liye kukkar patteren ka istemaal karte hain ke market ke koi to shurka ka kon sa group simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai jo aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hota hai. kukkar patteren ya to taizi ya mandi ke hotay hain . Bull Market bas, aik bail market aik aisi market hai jo oopri rujhan ki tawaquaat ko zahir karti hai. markets barray maliyati asharih jaat par mushtamil hotay hain, jaisay s & p 500, nasdaq, aur dow ​​jones. jab qeemat barh rahi ho to asharih jaat ko bail market ke tor par dekha jata hai. bail market ki aam khususiyaat mein shaamil hain : sarmaya car sy to mazeed stock khareed rahay hain : agar qeematein barh rahi hain aur sarmaya karon ko yaqeen hai ke woh es sy barhatay rahen ge to izafi stock khareeda jaye ga. be rozgari ki sharah mein kami : jaisay jaisay be rozgari kam hoti hai, ost ujrat mein izafah hota hai jis se companian kaam ke liye musabqat karti hain aur ziyada thankhowa wali mulaazmaten talaash karne walay karkun. Or es sy companian mustaqbil ki taraqqi ke liye mukhtas karti hain : chunkay sarfeen ziyada kharch karte hain, tanzeemen is munafe ka ziyada hissa aisi sarmaya kaari mein daalti hain jo majmoi tor par kaarobar ki maali hesiyat ko behtar banati hain. Bear Market bail market ke bar aks, reechh ki market woh hoti hai jab market mein kami aati hai. reechh market ki aam sy to khususiyaat mein shaamil hain : sarmaya car mayoosi ka shikaar ho jatay hain : aik baar jab sarmaya karon ko stock mein mazeed koi salahiyat nazar nahi aati hai, to woh mayoosi ka shikaar ho jatay hain aur qeemat kam kar ke beech dete hain. sarmaya karon ko aik mehdood market nazar aati hai : agar yeh khayaal kya jata hai ke market aik keep ko nishana banati hai aur barhna jari nahi rakhay gi, to khilari farokht karen ge, jis ke nateejay mein, qeemat kam ho jaye gi. companian kam paisa kamatee hain : kaarobar mein kam sarmaye ki gardish ke sath, company ki majmoi qeemat gir jati hai jo bil akhir un ke stock ki qeemat ko kam karti hai . Bullish Kicker pattern blush kukkar patteren is baat ki nishandahi karta hai ke stock ki qeematein barh sakti hain. jaisa ke dekhaya gaya hai, aik blush kukkar patteren aik siyah ( bearish ) candle stuck se shuru hota hai, jis ke baad aik safaid ( taizi ) candle stuck aati hai jo black candle stuck ke oopar khulti hai, oopar ki taraf aik bara khalaa. taajiron ke darmiyan umomi ittafaq raye yeh hai ke blush kukkar patteren sy to takneeki tajzia mein sab se ziyada taaqatwar aur ba asar tools mein se aik hai. taizi keekar patteren ka aik manfi pehlu yeh hai ke yeh intehai nayaab hain aur sirf bohat hi allag allag halaat aur waqeat mein paye jatay hain . Bearish Kicker pattern taizi ke patteren ke bar aks, bearish kukkar patteren is sy baat ki nishandahi karta hai ke stock ki qeematein gir sy sakti hain. jaisa ke dekhaya gaya hai, aik bearish kukkar patteren aik safaid ( blush ) candle stuck se shuru hota hai jis ke baad aik siyah ( bearish ) candle stuck aati hai jo to neechay khulti hai. safaid mom batii, neechay ki taraf aik bara khalaa peda karta hai. bearish kukkar patteren sy to sarmaya karon ke ravayye mein tabdeeli ke achanak sy ye honay par zor deta hai . -

#4 Collapse

Kicker pattern candle stick pattern ki ak qisam ha jo kisi asase ki qeemat ke rujhan ki simat ma tabdeeli ki peshangoi krti ha ye namona 2 mom bation ke doraniye ma qeemat ma tezi se ulat pher ki hasoosiat rakhta haTajir is baaat ka tayan krne ke liye kicker pattern ka istemal krte hain -

#5 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky exchanging meetings throbbing jaa rhy hongy.Aj ka hmra or conversation point "Kicker candle design". Dekhty hain k ye hmein Kya data deta hai r hmry ilam Mai Kesy ezafa krta hai kukkar patteren security ka cost outlining patteren hai jis ki shanakht is ki allag do baar candle adhered ki koi to tashkeel ke douran qeemat mein zabardast ulat phair se hoti hai. keekar patteren takneeki tajzia ki duniya mein numaya hain kyunkay woh kisi asasa ki qeemat ki enthusiasm goi ki simt mein tabdeelion ke liye pishin goi ke pinnacle standard kaam karte hain .kukkar patteren ko bohat ziyada badhaya jata hai punch usay ziyada farokht shuda aur ziyada kharidi hui marketon mein dekha jata hai. kukkar patteren ke koi asraat se pata chalta hai ke maliyati market mein barray khilari security ke baray mein apni raye ko tabdeel ya to tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati manndi ke barray khiladion ki raye kisi khabar ki taqreeb ya maloomat ke ajra ke douran mutasir hoti hai. misaal ke pinnacle standard, agar koi si e o kisi mutanazia siyasi aqeday ka khil kar izhaar karta hai, to sarmaya vehicle bunyadi stock ko koi baichnay ya kharidne ke liye sakht rad-e-amal ka izhaar kar satke hain. do bunyadi kukkar patteren jo aaj maliyati market mein numaya hain inhen" become flushed kukkar patteren" aur" negative kukkar patteren" kaha jata hai . Keysteps Intoduction kukkar patteren candle patteren ki aik qisam hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki pishin goi karti hai. yeh namona do mother btyon ke koi to doraniye mein qeemat mein taizi se ulat phair ki es sy to khasusiyat rakhta hai. tajir is baat ka taayun karne ke liye kukkar patteren ka istemaal karte hain ke market ke koi to shurka ka kon sa bunch simt ke control mein hai. patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai jo aam peak standard kisi organization, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hota hai. kukkar patteren ya to taizi ya mandi ke hotay hain . Positively trending Business sector bas, aik bail market aik aisi market hai jo oopri rujhan ki tawaquaat ko zahir karti hai. markets barray maliyati asharih jaat standard mushtamil hotay hain, jaisay s and p 500, nasdaq, aur dow jones. punch qeemat barh rahi ho to asharih jaat ko bail market ke pinnacle standard dekha jata hai. bail market ki aam khususiyaat mein shaamil hain : sarmaya vehicle sy to mazeed stock khareed rahay hain : agar qeematein barh rahi hain aur sarmaya karon ko yaqeen hai ke woh es sy barhatay rahen ge to izafi stock khareeda jaye ga. be rozgari ki sharah mein kami : jaisay be rozgari kam hoti hai, ost ujrat mein izafah hota hai jis se companian kaam ke liye musabqat karti hain aur ziyada thankhowa wali mulaazmaten talaash karne walay karkun. Or then again es sy companian mustaqbil ki taraqqi ke liye mukhtas karti hain : chunkay sarfeen ziyada kharch karte hain, tanzeemen is munafe ka ziyada hissa aisi sarmaya kaari mein daalti hain jo majmoi pinnacle standard kaarobar ki maali hesiyat ko behtar banati hain. Bear Market bail market ke bar aks, reechh ki market woh hoti hai hit market mein kami aati hai. reechh market ki aam sy to khususiyaat mein shaamil hain : sarmaya vehicle mayoosi ka shikaar ho jatay hain : aik baar poke sarmaya karon ko stock mein mazeed koi salahiyat nazar nahi aati hai, to woh mayoosi ka shikaar ho jatay hain aur qeemat kam kar ke beech dete hain. sarmaya karon ko aik mehdood market nazar aati hai : agar yeh khayaal kya jata hai ke market aik keep ko nishana banati hai aur barhna jari nahi rakhay gi, to khilari farokht karen ge, jis ke nateejay mein, qeemat kam ho jaye gi. companian kam paisa kamatee hain : kaarobar mein kam sarmaye ki gardish ke sath, organization ki majmoi qeemat gir jati hai jo bil akhir un ke stock ki qeemat ko kam karti hai . Bullish Kicker design become flushed kukkar patteren is baat ki nishandahi karta hai ke stock ki qeematein barh sakti hain. jaisa ke dekhaya gaya hai, aik become flushed kukkar patteren aik siyah ( negative ) light stuck se shuru hota hai, jis ke baad aik safaid ( taizi ) candle stuck aati hai jo dark flame stuck ke oopar khulti hai, oopar ki taraf aik bara khalaa. taajiron ke darmiyan umomi ittafaq raye yeh hai ke become flushed kukkar patteren sy to takneeki tajzia mein sab se ziyada taaqatwar aur ba asar devices mein se aik hai. taizi keekar patteren ka aik manfi pehlu yeh hai ke yeh intehai nayaab hain aur sirf bohat hello allag halaat aur waqeat mein paye jatay hain . Negative Kicker design taizi ke patteren ke bar aks, negative kukkar patteren is sy baat ki nishandahi karta hai ke stock ki qeematein gir sy sakti hain. jaisa ke dekhaya gaya hai, aik negative kukkar patteren aik safaid ( become flushed ) light stuck se shuru hota hai jis ke baad aik siyah ( negative ) flame adhered aati hai jo to neechay khulti hai. safaid mother batii, neechay ki taraf aik bara khalaa peda karta hai. negative kukkar patteren sy to sarmaya karon ke ravayye mein tabdeeli ke achanak sy ye honay standard zor deta hai . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

Kicker Chart Pattern: Kicker Graph patteren is baat ki nishandahi karta hai ke stock ki qeematein barh sakti hain. jaisa ke dekhaya gaya hai, aik become flushed kukkar patteren aik siyah ( negative ) light stuck se shuru hota hai, jis ke baad aik safaid ( taizi ) candle stuck aati hai jo dull fire stuck ke oopar khulti hai, oopar ki taraf aik bara khalaa. taajiron ke darmiyan umomi ittafaq raye yeh hai ke become flushed kukkar patteren sy to takneeki tajzia mein sab se ziyada taaqatwar aur ba asar gadgets mein se aik hai. taizi keekar patteren ka aik manfi pehlu yeh hai ke yeh intehai nayaab hain aur sirf bohat hi allag halaat aur waqeat mein pay jate han:max_bytes(150000):strip_icc():format(webp)/AdvancedCandlestickPatterns6-850b29306d1747c1a86f63f1ba30e755.png) Patteren ke bar aks, negative kicker patteren is sy baat ki nishandahi karta hai ke stock ki qeematein gir sy sakti hain. jaisa ke dekhaya gaya hai, aik negative kukkar patteren aik safaid ( become flushed ) light stuck se shuru hota hai jis ke baad aik siyah ( negative ) fire stuck aati hai jo to neechay khulti hai. safaid mother batii, neechay ki taraf aik bara khalaa peda karta hai. negative kukkar patteren sy to sarmaya karon ke ravayye mein tabdeeli ke achanak sy ye honay standard zor deta hai bail market ke bar aks, reechh ki market woh hoti hai hit market mein kami aati hai. reechh market ki aam sy to khususiyaat mein shaamil hain : sarmaya vehicle mayoosi ka shikaar ho jatay hain : aik baar jab sarmaya karon ko stock mein mazeed koi salahiyat nazar nahi aati hai, to woh mayoosi ka shikaar ho jatay hain aur qeemat kam kar ke beech dete hain. sarmaya karon ko aik mehdood market nazar aati hai : agar yeh khayaal kya jata hai ke market aik keep ko nishana banati hai Chart Pattern Types And Formation: Markets barray maliyati asharih jaat standard mushtamil hotay hain, jaisay s and p 500, nasdaq, aur dow jones. punch qeemat barh rahi ho to asharih jaat ko bail market ke zenith standard dekha jata hai. bail market ki aam khususiyaat mein shaamil hain : sarmaya vehicle sy to mazeed stock khareed rahay hain : agar qeematein barh rahi hain aur sarmaya karon ko yaqeen hai ke woh es sy barhatay rahen ge to izafi stock khareeda jaye ga. be rozgari ki sharah mein kami : jaisay be rozgari kam hoti hai, ost ujrat mein izafah hota hai jis se companian kaam ke liye musabqat karti hain aur ziyada thankhowa wali mulaazmaten talaash karne walay karkun. Of course es sy companian mustaqbil ki taraqqi ke liye mukhtas karti hain

Patteren ke bar aks, negative kicker patteren is sy baat ki nishandahi karta hai ke stock ki qeematein gir sy sakti hain. jaisa ke dekhaya gaya hai, aik negative kukkar patteren aik safaid ( become flushed ) light stuck se shuru hota hai jis ke baad aik siyah ( negative ) fire stuck aati hai jo to neechay khulti hai. safaid mother batii, neechay ki taraf aik bara khalaa peda karta hai. negative kukkar patteren sy to sarmaya karon ke ravayye mein tabdeeli ke achanak sy ye honay standard zor deta hai bail market ke bar aks, reechh ki market woh hoti hai hit market mein kami aati hai. reechh market ki aam sy to khususiyaat mein shaamil hain : sarmaya vehicle mayoosi ka shikaar ho jatay hain : aik baar jab sarmaya karon ko stock mein mazeed koi salahiyat nazar nahi aati hai, to woh mayoosi ka shikaar ho jatay hain aur qeemat kam kar ke beech dete hain. sarmaya karon ko aik mehdood market nazar aati hai : agar yeh khayaal kya jata hai ke market aik keep ko nishana banati hai Chart Pattern Types And Formation: Markets barray maliyati asharih jaat standard mushtamil hotay hain, jaisay s and p 500, nasdaq, aur dow jones. punch qeemat barh rahi ho to asharih jaat ko bail market ke zenith standard dekha jata hai. bail market ki aam khususiyaat mein shaamil hain : sarmaya vehicle sy to mazeed stock khareed rahay hain : agar qeematein barh rahi hain aur sarmaya karon ko yaqeen hai ke woh es sy barhatay rahen ge to izafi stock khareeda jaye ga. be rozgari ki sharah mein kami : jaisay be rozgari kam hoti hai, ost ujrat mein izafah hota hai jis se companian kaam ke liye musabqat karti hain aur ziyada thankhowa wali mulaazmaten talaash karne walay karkun. Of course es sy companian mustaqbil ki taraqqi ke liye mukhtas karti hain  Market mein barray khilari security ke baray mein apni raye ko tabdeel ya to tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati manndi ke barray khiladion ki raye kisi khabar ki taqreeb ya maloomat ke ajra ke douran mutasir hoti hai. misaal ke peak standard, agar koi si e o kisi mutanazia siyasi aqeday ka khil kar izhaar karta hai, to sarmaya vehicle bunyadi stock ko koi baichnay ya kharidne ke liye sakht rad-e-amal ka izhaar kar satke hain. do bunyadi kukkar patteren jo aaj maliyati market mein numaya hain inhen" become flushed kukkar patteren" aur" negative kukkar patteren" kaha jata hai negative kukkar patteren aik safaid ( become flushed ) candle stuck se shuru hota hai jis ke baad aik siyah ( negative ) flame adhered aati hai jo to neechay khulti hai. safaid mother batii, neechay ki taraf aik bara khalaa peda karta hai. negative kukkar patteren sy to sarmaya karon ke ravayye mein tabdeeli ke achanak sy ye honay standard zor deta hai . Chart Pattern Trading: Bullish or negative kicker design dono kicker design li sorts ho ge or in main different sirf ya ho ga ya ak bullish ke janab banay ga kr ak negative ke traf ya dono same trha sa banay ga. In dono designs ki arrangement two candles or ak hole sa mil kar ho ge. Indeed bullish kicker design ho ga ka lower mama banaay ga or ya batay ka brokers ko, bear stop ho raha ha or exit kar raha ha market sa or ya batay ga ka bullish overwhelming kar raha ha yes ka cost ka higher jana ka demonstrate kar rajh ha, merchants is bullish kicker mama long haul purchase mama enter ho ga is ki second candle ka high sa or stop misfortune first flame ka beneath mama rather than karay ga. Or on the other hand yes negative kivker ho ga ya hogher mama upturn mama banay ga or ya bull ka market sa exit hona or bear areas of strength for ka hona ka signal da ga is mama same bull kicker ki traha sa exchange ko enter kiya jay ga, magar is mama sell mama input la ga

Market mein barray khilari security ke baray mein apni raye ko tabdeel ya to tabdeel kar rahay hain. ziyada tar mamlaat mein, maliyati manndi ke barray khiladion ki raye kisi khabar ki taqreeb ya maloomat ke ajra ke douran mutasir hoti hai. misaal ke peak standard, agar koi si e o kisi mutanazia siyasi aqeday ka khil kar izhaar karta hai, to sarmaya vehicle bunyadi stock ko koi baichnay ya kharidne ke liye sakht rad-e-amal ka izhaar kar satke hain. do bunyadi kukkar patteren jo aaj maliyati market mein numaya hain inhen" become flushed kukkar patteren" aur" negative kukkar patteren" kaha jata hai negative kukkar patteren aik safaid ( become flushed ) candle stuck se shuru hota hai jis ke baad aik siyah ( negative ) flame adhered aati hai jo to neechay khulti hai. safaid mother batii, neechay ki taraf aik bara khalaa peda karta hai. negative kukkar patteren sy to sarmaya karon ke ravayye mein tabdeeli ke achanak sy ye honay standard zor deta hai . Chart Pattern Trading: Bullish or negative kicker design dono kicker design li sorts ho ge or in main different sirf ya ho ga ya ak bullish ke janab banay ga kr ak negative ke traf ya dono same trha sa banay ga. In dono designs ki arrangement two candles or ak hole sa mil kar ho ge. Indeed bullish kicker design ho ga ka lower mama banaay ga or ya batay ka brokers ko, bear stop ho raha ha or exit kar raha ha market sa or ya batay ga ka bullish overwhelming kar raha ha yes ka cost ka higher jana ka demonstrate kar rajh ha, merchants is bullish kicker mama long haul purchase mama enter ho ga is ki second candle ka high sa or stop misfortune first flame ka beneath mama rather than karay ga. Or on the other hand yes negative kivker ho ga ya hogher mama upturn mama banay ga or ya bull ka market sa exit hona or bear areas of strength for ka hona ka signal da ga is mama same bull kicker ki traha sa exchange ko enter kiya jay ga, magar is mama sell mama input la ga  Brokers is kicker design ko noticed card ha, is mama wo dakhta ha ka jo cost ha ya move bahot greetings rapidly ho rahi ha, or is mama dealers stand by karay ga pull back ka. Wo dealers jo find card ha wish ko or ya entered card ha position ko poke initially distinguished design ho run ha kicker. Ya kicker design most grounded bull ya bear opinion pointers ha, or ya design interesting ha. Bahot sa proficient merchants is mama answer rapidly ni karta ak course sa dosri ki janab. Ya kicker design present hota ha apni self standard. Kicker design ak bahot greetings most impressive sign accessible karta ha punch is ko specialized examination kiya jata ha. Ya importance hota ha hit amplified kiya jata ha hit ya design banta ha overbought ya oversold standard. Je mama jo two candles hoti ha is design ka za mama ya apparent importance ha. Jo is ki first candle hoti ha ya open hoti ha or move graph ha latest thing ki bearing ki traf or second light open same hoti ha open point jo past candle ka pivot sa or ya past tendd ka inverse ke janab jati ha

Brokers is kicker design ko noticed card ha, is mama wo dakhta ha ka jo cost ha ya move bahot greetings rapidly ho rahi ha, or is mama dealers stand by karay ga pull back ka. Wo dealers jo find card ha wish ko or ya entered card ha position ko poke initially distinguished design ho run ha kicker. Ya kicker design most grounded bull ya bear opinion pointers ha, or ya design interesting ha. Bahot sa proficient merchants is mama answer rapidly ni karta ak course sa dosri ki janab. Ya kicker design present hota ha apni self standard. Kicker design ak bahot greetings most impressive sign accessible karta ha punch is ko specialized examination kiya jata ha. Ya importance hota ha hit amplified kiya jata ha hit ya design banta ha overbought ya oversold standard. Je mama jo two candles hoti ha is design ka za mama ya apparent importance ha. Jo is ki first candle hoti ha ya open hoti ha or move graph ha latest thing ki bearing ki traf or second light open same hoti ha open point jo past candle ka pivot sa or ya past tendd ka inverse ke janab jati ha

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:41 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим