Explanation of Stalled pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction salam alaikum umeed hai ke y forex ke tamam mimbraan achi karkardagi ka muzahira kar rahay hain aaj hum aap ko ruke hue patteren ke baray mein tafseeli wazahat dainay ja rahay hain jo aap ko pareshan karne wala hai baraye meharbani usay ghhor se parheen . meaning The pattern remains aik candle closed pattern chart hai jo up douran hota hai but hammam ka ulat jane ki nishhandahi karta hai. usay aik pola ke naam se bhi jana jata hai. candle closed line inhen apna naam terhan se milta hai jis terhan chart mein di kayi tasverain eje btyon aur un ki vicks se millti hain. ya taajiron ka liye qaleel mudti tijarat ka zariye fori munafe kamanay ki aik mehdood salahiyat tajweez kar sakta hai. This is important Aik ruka sun-hwa pola laazmi tor par mandi ka ulat jane ki nishhandahi nahi karta hai. Taham, jab eje batii aik ruke hue patternen ka baad doosri eje batii ka asli jism ka wast se neechay chali jati hai, hammam ka ulat jane ka imkaan hota hai. tajir aksar usay baat ka isharay ke tor par dekhte hain ke inhen -apne nuqsanaat ko kam karne par ghor karna chahiye. Ulat phair bohat taizi se ho sakti hai, aksar hem ka andar, lekin pasar ka mubasireen un ulat plto ko dekhte hain jo taweel arsay mein hotay hain, jaisay hafton. takneeki tajzia car baat ka isharay ka tor par din bhar ulat patteren talaash karte hain ka inhen apni tijarti hikmat amlyon ko kis terhan tabdeel karna chahiye. This informs today ulat phair aam tor par ka elanaat ya khabron ki jaisay waqeat ki wajah se hotay hain jo sarveen ya sarmaya mobil ka aetmaad ko taizi se tabdeel kar satke hain. Understanding Aik ruka sun-hwa pattern drawing teenagers safaid eje btyon par mushtamil hota hai aur usay miyaar ka aik makhsoos set par poora utarna chahiye. sab se pehlai, har eje batii ka khula aur band pattern mein pichli eje batii se ziyada hona chahiye. doosri, teesri eje batii ka asal jism deegar do eje btyon se chhota hona chahiye. aakhir mein, teesri eje batii mein aik lamba oopri me hona chahiye, aur aik khula jo doosri eje batii ka qareeb ho. -

#3 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Stalled pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction ruka sun-hwa patteren aik candle stuck chart patteren hai jo up trained ke douran hota hai, lekin mumkina mandi ke ulat jane ki nishandahi karta hai. usay ghhor o fikar ka koi namona bhi kaha jata hai. candle stuck charts qeemat ke charts hain jo security ki khuli aur band qeematon ke sath sath aik makhsoos muddat ke liye un ki oonchai aur es sy kmyan bhi dikhata hain. inhen apna naam is terhan se koi milta hai jis terhan chart mein di gayi taswerain mom sy btyon aur un ki VICKS se millti jalti hain. aik ruka sun-hwa patteren market mein Adam faisla ki nishandahi karta hai. yeh taajiron ke liye qaleel mudti tijarat ke zariye fori to es munafe kamanay ki aik mehdood salahiyat tajweez kar sakta hai . Keysteps aik ruka sun-hwa patteren laazmi tor par mandi ke ulat jane ki nishandahi nahi karta hai. taham, jab mom batii ruke hue patteren ke baad doosri mom batii ke asli jism ke wast se neechay chali jati hai, to mandi ke ulat jane ka imkaan hota hai. tajir aksar usay is baat ke isharay ke tor par dekhte hain ke inhen –apne nuqsanaat ko kam karne par ghhor karna chahiye. ulat phair bohat taizi se ho sakti hai, aksar aik din ke andar, lekin market ke mubasireen un ulat plto ko dekhte hain jo taweel arsay mein hotay hain, jaisay hafton. takneeki tajzia car is baat ke isharay ke tor par din bhar ulat patteren talaash karte hain ke inhen apni tijarti hikmat e amli ko kis terhan tabdeel karna chahiye. intra day ulat phair aam tor par aisay waqeat ki wajah se hoti hai jaisay company ke elanaat ya khabrain jo sarfeen ya sarmaya car ke aetmaad ko taizi se tabdeel kar sakti hain. mandi, ya neechay ki taraf rujhan ki nishandahi nichli oonchaiyon aur nichli sthon ki aik series se hoti hai. aik baar mandi ka shikaar honay ke baad, market aik oopri rujhaan mein tabdeel ho sakti hai jab oonchai aur nichli satah dono oopar jana shuru kar den . Understanding aik ruka sun-hwa patteren chart teen safaid mom btyon par mushtamil hota hai aur usay miyaar ke aik makhsoos set par poora utarna chahiye. sab se pehlay, har mom batii ka khula aur band patteren mein pichli mom batii se koi ziyada hona chahiye. doosri, teesri mom batii ka asal jism deegar do mom btyon se chhota hona chahiye. aakhir mein, teesri mom batii mein aik lamba oopri saya hona chahiye, aur aik khula jo doosri mom batii ke qareeb ke qareeb ho. chart mein mom batii ka wasee hissa asli body kehlata hai. yeh aik makhsoos muddat ke douran security ki iftitahi aur ikhtitami qeemat ke darmiyan ki had ko zahir karta hai. agar asli body siyah ya surkh hai, to stock sy to khilnay se kam band sun-hwa. agar yeh safaid ya sabz hai to, stock ziyada band sun-hwa. sarmaya car aur koi es sy mubasireen mustaqbil ki mom btyon mein ulat palat bhi dekh satke hain jo ruke hue patteren ki pairwi karte hain. is terhan ke ulat phair ka aik ishara bearish engulfing hai . Pros patteren ki shanakht aasaan hai aur signal ki toseeq karne ke liye usay izafi takneeki isharay ke sath milaya ja sakta hai. patteren ko taizi aur mandi dono baazaaron mein sy istemaal kya ja sakta hai, jis se tajir dono simtao mein sy tijarat kar satke hain . Cons patteren aik qabil aetmaad isharay nahi hai. patteren aik ahem rujhan ke ulat jane ka kaafi mazboot ishara nahi ho sakta hai, aur taajiron ko mohtaat rehna chahiye ke yeh ulat earzi ho sakta hai. patteren ghalat signal ho sakta hai, is liye taajiron ko signal ki toseeq karne ke liye candle sy stick patteren ke sath sath deegar patteren ki tashkeel par bhi nazar rakhni chahiye . Conclusion aakhir mein, ruka sun-hwa candle stuck patteren aik to es zabardast ulat signal hai jo bta sakta hai ke rujhan kab sy tabdeel honay wala hai. is ka aik lamba nichala saya hai aur aik chhota sa jism hai jo ya to taizi ya mandi ka hai. taajiron ko yeh baat zehen mein rakhni chahiye ke aik hi ruki hui candle stuck patteren qabil aitbaar isharay nahi hai aur is ke bajaye usay dosray takneeki tajzia ke alaat ke sath istemaal karen. -

#4 Collapse

-

#5 Collapse

-

#6 Collapse

Stalled pattern forex trading mein aik ahem concept hai jo traders ko price action ki samajh mein madad deta hai. Yeh pattern market mein momentum ki kami ko indicate karta hai aur future price movements ke baray mein traders ko information deta hai.

Forex market mein, prices ki movement trend ya range-bound hoti hai. Agar market mein kisi specific direction mein movement hoti hai, toh usay trend kaha jata hai, jabke agar prices kisi range ke andar fluctuate karti hain, toh usay range-bound market kaha jata hai. Stalled pattern range-bound markets mein form hota hai jab market mein momentum khatam hota hai aur price movement slow ho jata hai.

- Momentum Ki Kami: Stalled pattern ka sabse ahem feature hai ke market mein momentum ki kami hoti hai. Is pattern mein price movement slow ho jata hai aur market ek specific range mein stagnant ho jata hai.

- Range-Bound Market: Stalled pattern typically range-bound markets mein form hota hai. Iska matlab hai ke prices ek specific range ke andar fluctuate kar rahi hoti hain aur kisi specific trend ki direction mein movement nahi ho rahi hoti.

- Price Action Ki Kami: Stalled pattern mein price action ki kami hoti hai. Candlesticks ki bodies chhoti hoti hain aur shadows lambi hoti hain, jo indicate karta hai ke buyers aur sellers mein koi clear dominance nahi hai.

- Indecision: Stalled pattern market mein indecision ko darust karta hai. Traders aur investors confuse hote hain ke market kis direction mein move kar raha hai aur isliye trading volume kam ho jata hai.

Stalled pattern ka formation market mein price action ko samajhne ka ek tareeqa hai. Jab yeh pattern form hota hai, traders ko samajhna chahiye ke market mein price movement slow ho gaya hai aur kisi specific direction mein movement nahi ho rahi hai. Is situation mein, traders ko cautious rehna chahiye aur further confirmation ka wait karna chahiye.

Stalled pattern ke formation ke baad, traders ko market ka behavior closely monitor karna chahiye. Agar koi clear direction nahi milta hai, to traders ko sidelines par rehna chahiye ya phir range-bound trading strategies ka istemal kar sakte hain.

Stalled pattern ka istemal karke, traders apni trading strategies ko improve kar sakte hain aur better trading decisions le sakte hain. Is pattern ko samajh kar, traders ko market ke indecision aur slow momentum ko recognize karne mein madad milti hai.

Lekin yaad rahe ke stalled pattern bhi ek indicator hai aur sirf is par rely karke trading decisions nahi leni chahiye. Traders ko hamesha market ko comprehensive taur par analyze karna chahiye aur multiple indicators ka istemal karke confirmations leni chahiye.

Stalled pattern ko samajhna traders ke liye zaroori hai, lekin unko istemal karte waqt cautious rehna bhi zaroori hai. In patterns ko samajhne ke liye practice aur experience ki zaroorat hoti hai, jise traders trading journey ke doran develop karte hain.

Stalled pattern ka istemal karke traders apne trading decisions ko improve kar sakte hain aur consistent profits earn kar sakte hain.

-

#7 Collapse

Explanation of stalled pattern

Stalled pattern ek technical analysis concept hai jo hota hai jab kisi asset ki keemat temporarily ruk jaati hai ya phir kisi khaas range ke andar chali jaati hai. Ye market mein indecision ya consolidation ke dauraan dekha jaata hai.

Yahan stalled pattern ki tafseel di gayi hai:- Price Consolidation: Stalled pattern mein, kisi asset ki keemat aam tor par ek nisbatan maqami range ke andar move karti hai, jo keemat ke chart par ek horizontal ya sideways movement ko banati hai. Ye consolidation phase trend direction mein ek temporary rukawat ka izhar karta hai.

- Volatility Ki Kami: Stalled pattern ke dauraan, volatility usually kam ho jaati hai jab keemat ki range tight hoti hai. Ye volatility ki kami darust karta hai ke market mein kisi bhi significant buying ya selling pressure ka na hona, jo keemat mein balance ka izhar karta hai.

- Equal Highs aur Lows: Stalled patterns aksar consolidation range ke andar barabar ki unchaaiyon aur nichaaiyon ko dikhaate hain. Ye yeh batata hai ke na to kharidne wale aur na hi bechne wale market par qaboo hasil kar sake hain, jo ke bulls aur bears ke darmiyaan ek mawafiq tug-of-war ko darust karta hai.

- Trading Activity Mein Kami: Jab keemat consolidate hoti hai, to trading volume aam tor par kam ho jaata hai. Traders is doran ek wait-and-see approach apnaate hain, jisse ke previous trend ke mukabley kam transaction volumes paida hoti hain.

- Indecision: Stalled pattern market ka indecision darust karta hai, jahan na to kharidne wale aur na hi bechne wale market par qaboo hasil kar sakte hain. Ye uncertainty aksar significant price movements se pehle hoti hai, jab market naye catalysts ya developments ka intizaar karta hai jo agle trend direction ko tay karein.

Traders aksar stalled pattern ke saath mukhtalif technical indicators ya chart patterns ka istemal karte hain takay wo potential breakout ya breakdown scenarios ko pehchan sakein. Isi tarah, consolidation range ke andar key levels of support aur resistance ko closely monitor kiya jaata hai, jisse ke breakout ke signs ko pesh kiya ja sake jo keemat ke pehle trend ka aghaz ya naye trend ka aghaz darust karta hai.

Stalled pattern par trade karte waqt traders ko ehtiyaat bartarafana hai, kyun ke ghalat breakouts ya whipsaws ho sakte hain, jo ke agar sahi risk management strategies istemal na ki jaayein to nuksan ka sabab ban sakte hain. Mazeed, doosre technical indicators ya fundamental analysis se tasdeeq hasil karna bhi stalled pattern par trading decisions ko qabil-e-bharosa banata hai.

-

#8 Collapse

Explanation of Stalled pattern

Stalled Pattern ek candlestick pattern hai jo market mein price action ka ek specific scenario ko darust karta hai.

Is pattern mein ek particular candlestick formation hoti hai jo ek muddat ke baad ek price range mein stuck rehti hai.

Ye pattern market ki indecision ko darust karta hai aur often ek potential reversal ya continuation ko indicate karta hai.

Stalled Pattern ki mukhtasir tafseelat roman Urdu mein di gayi hai:

Stalled Pattern - Stalled Pattern ek candlestick pattern hai jo market mein price action ka ek specific scenario ko darust karta hai.

Dharohar:

Stalled Pattern ek single candlestick ya ek series of candlesticks se banta hai.

Is pattern mein price action muddat ke liye ek specific price range mein stuck rehti hai.

Candlesticks ki bodies chhoti hoti hain aur shadows (upper aur lower) lambe hote hain, indicating indecision ya lack of strong momentum.

Tafsiliat:

Stalled Pattern market mein price action ki ek temporary pause ya indecision ko darust karta hai.

Is pattern mein buyers aur sellers ke beech mein balance hota hai aur kisi ek direction mein strong movement nahi hota.

Market mein uncertainty aur volatility ke dauran Stalled Pattern dikhai deta hai.

Tijarati Tareeqa:

Stalled Pattern ke appearance ke baad, traders cautious ho jate hain aur price action ka further confirmation wait karte hain.

Agar Stalled Pattern ek reversal ya continuation ke indication deta hai, to traders additional technical analysis aur signals ka istemal karte hain trading decisions ke liye.

Stop loss aur take profit levels ka istemal karte hue, traders apni positions ko manage karte hain.

Stalled Pattern traders ke liye important hota hai kyunki ye market mein temporary indecision ko indicate karta hai, jo ek potential reversal ya continuation ke signal ke saath juda hota hai.

Lekin, iska istemal karne se pehle mukammal analysis aur risk management ka dhyan rakha jana chahiye.

-

#9 Collapse

Forex mein rukawat ka tajzia karna aham hai, kyunki yeh traders ke liye ahem nishaan hai. Jab forex market mein rukawat ya stalled pattern hota hai, toh yeh samjhnay ke liye zaroori hai ke iska asal maqsad aur asbaab kya hain.

Stalled pattern ya rukawat ka matlab hai ke forex market mein trading activity mein rukawat aagayi hai aur prices mein kisi bhi taraf tezi ya mandgi ki kami mehsoos hoti hai. Yeh aksar ek temporary phase hoti hai, lekin iska samajhna aur pehchanana traders ke liye zaroori hai.

Iska pehla asal maqsad hai market ki uncertainty ko darust karna. Jab market mein rukawat hoti hai, toh yeh ek indication hoti hai ke traders mein uncertainty ya confusion hai. Is wajah se traders ko apni strategies ko dobara dekhnay aur market conditions ko samajhnay ka mouqa milta hai.

Iske alawa, stalled pattern traders ko market ki sentiment ka andaza dene mein madad karta hai. Agar market mein rukawat hai toh yeh indicate karta hai ke traders ka mood ya sentiment change ho sakta hai. Is tarah ke patterns ko samajh kar, traders apni positions ko adjust kar sakte hain aur market ke mutabiq apni trading strategies tayar kar sakte hain.

Stalled pattern ka hona bhi ek tarah ka signal ho sakta hai ke market mein trend change hone wala hai. Jab market mein rukawat hoti hai, toh yeh ek transition phase bhi ho sakti hai jahan ek trend khatam hota hai aur doosra shuru hota hai. Is wajah se traders ko alert rehna chahiye aur trend reversal ke signs ko dhyaan se dekhna chahiye.

Overall, forex market mein stalled pattern ka hona ek common occurrence hai jo traders ko market conditions ke bare mein ahem maloomat faraham karta hai. Traders ko is pattern ko samajh kar apni trading strategies ko refine karna chahiye aur market ke mizaaj ko samajhne ka hunar develop karna chahiye taake woh successful trading decisions le sakein.

-

#10 Collapse

Forex Trading Mein Rukaavat Ka Tafseeli Bayan

Forex trading ek bohot hi mukhtalif aur daulatmand shobah hai jahan har roz hazaron log apne maal-o-daulat ko barhane ki koshish karte hain. Lekin kabhi-kabhi, is rah mein rukaavat aati hai jo ke traders ko mushkil mein daal deti hai. Is article mein hum forex trading mein rukaavat ke patterns ki wazahat karenge.

1. Stalled Pattern Kya Hai?

Stalled pattern forex trading mein ek aham concept hai jo ke traders ke liye ahem hai. Jab ek trend ya price movement mein ek muddat tak koi tabdili na ho, aur market mein activity kam ho ya bilkul ruk jaye, to isay stalled pattern kehte hain. Yeh aksar market ki uncertainty ya consolidation ka nateeja hota hai.

2. Stalled Pattern Ki Wajohat

Stalled pattern ki wajohat bohot si hoti hain. Ek wajah ho sakti hai ke traders mein uncertainty paida ho gayi ho aur woh market mein dakhil ho kar aage ke faislay ka intezaar kar rahe hon. Doosri wajah ho sakti hai ke kisi bari si khabar ya ghatna ne market ko tham diya ho aur traders cautious ho gaye hon.

3. Stalled Pattern Ka Asar

Stalled pattern ka asar market mein taraqqi ko rok sakta hai aur traders ko pareshani mein daal sakta hai. Is waqt, traders ko dhyaan se market ka analysis karna zaroori hai taake woh future ke trends ko samajh sakein aur sahi faislay le sakein.

4. Stalled Pattern Ko Samajhna

Stalled pattern ko samajhna zaroori hai takay traders apni trading strategies ko sahi tareeqe se adjust kar sakein. Is waqt, risk management aur patience ka istemal karna zaroori hai taake nuqsaan se bacha ja sake.

5. Stalled Pattern Se Nikalne Ki Strategies

Stalled pattern se nikalne ke liye traders ko sabar aur samajhdari se kaam lena chahiye. Yeh kuch strategies hain jo traders istemal kar sakte hain:- Wait and Watch: Kabhi-kabhi behter hota hai ke traders market ki activity ko dekhte rahen aur tabdeeliyon ka intezaar karen. Is se unhe behtar understanding hoti hai ke market kis taraf ja rahi hai.

- Risk Management: Stalled pattern mein, risk management ka ahem kirdar hota hai. Traders ko apne positions ko control mein rakhna chahiye aur ziada nuqsaan se bachne ke liye apne stop-loss orders ko update karna chahiye.

- Alternate Instruments: Agar ek currency pair mein stalled pattern hai, to traders doosre currency pairs ya financial instruments ki taraf bhi tawajjo de sakte hain jahan activity zyada ho aur potential profit ho sakta hai.

- Technical Analysis: Stalled pattern ko samajhne ke liye technical analysis ka istemal karna zaroori hai. Chart patterns, indicators aur oscillators ka istemal karke traders market ke future trends ka andaza laga sakte hain.

In strategies ko istemal karke traders stalled pattern se nikal sakte hain aur apni trading ko behtar bana sakte hain.

Ikhtitami Guftagu

Forex trading mein rukaavat ka samna karna har trader ka imtehan hai. Stalled pattern ko samajhna aur sahi tareeqe se deal karna traders ke liye zaroori hai agar woh mazeed kamiyabi hasil karna chahte hain. Sabar aur tahqeeqati tajziya ke saath, traders apne maqsad ko hasil kar sakte hain aur forex market mein kamyabi ke raste par chal sakte hain. -

#11 Collapse

Forex trading ek mukhtalif aur roshan duniya hai jahan har koi karobar karna chahta hai. Is mein kuch pattar aur patterns hote hain jo traders ke liye ahem hota hai. Ek aham pattern jo traders ko samajhna zaroori hai wo "stalled pattern" hai. Stalled pattern ka matlab hota hai jab market ka movement ruk jata hai aur prices mein kisi bhi direction mein koi tabdeeli nahi hoti.

Stalled pattern ko samajhne ke liye, traders ko market ke dynamics ko dekhna zaroori hai. Ye pattern usually market ki volatility ki wajah se hota hai, jab market mein trading volume kam ho ya phir traders ki interest kam ho. Is situation mein, prices ek jagah par stuck ho jate hain aur ek trading range mein band ho jate hain.

Stalled pattern ka asal matlab hai ke market mein kisi bhi direction mein koi clear trend nahi hai. Is waqt, traders ko sabar aur tahammul ka hona zaroori hai. Ye pattern usually short-term traders ke liye challenging hota hai, kyunke unko profits kamane ki asani nahi hoti jab market mein movement nahi hoti.

Is situation mein, traders ko kuch strategies istemal karni chahiye. Sab se pehle, risk management ka khayal rakhna zaroori hai. Trading positions ko control mein rakhna aur stop-loss orders lagana zaroori hai taake nuqsaan kam ho sake. Mazeed, traders ko market ke fundamentals ko samajhna chahiye aur technical analysis ka istemal karna chahiye taake wo potential trading opportunities ko pehchan sakein.

Stalled pattern ka samajhna aur uss par amal karna traders ke liye mushkil ho sakta hai, lekin is kaam mein maharat hasil karne se traders apni trading skills ko behtar bana sakte hain. Is liye, har trader ko stalled pattern ko samajhna aur uss par tawajju dena zaroori hai taake wo market ke har situation mein kamyaab ho sakein.

- CL

- Mentions 0

-

سا2 likes

-

#12 Collapse

Forex, yaani Foreign Exchange, aik bohot ahem aur aam maamooli tareeqa hai paisay tabdeel karne ka. Yeh aam taur par mulkun ke darmiyan mukhtalif currencies ke muaamlaat ko shamil karta hai. Lekin kuch dafa hota hai ke forex market mein kaam karne wale logon ko "stalled pattern" ya "rukaavat ka tareeqa" ka samna karna parta hai. Is article mein, hum is phenomenon ko samjhein ge aur yeh samajhne ki koshish karein ge ke yeh kyun hota hai aur is se kaise nipta jaye.

Stalled pattern, yaani rukaavat ka tareeqa, woh waqt hota hai jab forex market mein trading activity ya currency pairs ki movement mein kami mehsoos hoti hai. Yeh aksar market mein ek temporary break ke roop mein zahir hota hai, jahan par traders ko asal amadni hasil karne mein mushkilat ka samna hota hai. Iska mukhtalif wajohat ho sakti hain, jin mein shamil hain:- Economic News Releases: Kabhi-kabhi, jab ahem economic news ya data release hota hai, jaise GDP numbers, employment reports, ya central bank ke monetary policy decisions, to market mein temporary rukaavat hoti hai. Traders is waqt cautious ho jate hain aur market ke movement ke samne savdhani se qareebi hote hain.

- Market Sentiment Changes: Agar market sentiment sudden taur par badal jaye, jaise geopolitical tensions ya unexpected events ke wajah se, to traders cautious ho jate hain aur trading activity mein kami aati hai. Yeh bhi ek rukaavat ka sabab ban sakta hai.

- Liquidity Issues: Kabhi-kabhi, market mein liquidity kam hone ki wajah se bhi stalled pattern dekha jata hai. Jab liquidity kam hoti hai, to traders ke liye transactions karna mushkil ho jata hai aur is se trading activity mein kami aati hai.

- Technical Factors: Technical analysis ke mutabiq, kuch waqt market mein consolidation phase hota hai, jahan par prices ek range mein ghoomte rehte hain. Is phase mein trading activity kam hoti hai aur yeh bhi rukaavat ka ek tareeqa hai.

Stalled pattern ka samna karne wale traders ko kuch strategies apnane chahiye taake is se behtar tareeqe se nipat saken:- Risk Management: Har trader ko apni positions ko monitor karna aur risk ko manage karna zaroori hai, khas tor par jab market mein rukaavat ka samna ho. Stop loss orders ka istemal karke apni positions ko protect karna ahem hai.

- News Monitoring: Economic calendar ka regular monitoring karna zaroori hai taake ahem economic events ke waqt traders apni positions ko adjust kar sakein aur market ke unexpected movements ke liye tayyar rahein.

- Patience: Stalled pattern ke doran sabar ka istemal karna zaroori hai. Kabhi-kabhi market mein temporary rukaavat hoti hai lekin yeh hamesha ke liye nahi hoti. Traders ko apni strategy par mazbooti se qaim rehna chahiye aur impulsive decisions se bachna chahiye.

- Adaptability: Market conditions ki changing nature ko samajhna aur uske mutabiq apni strategy ko adjust karna bhi zaroori hai. Agar market mein rukaavat hai, to traders ko apni approach ko adapt karna hoga.

In asoolon ka amal karke, traders stalled pattern ke doran bhi mukhtalif challenges ka samna kar sakte hain aur market mein apni positions ko mehfooz rakh sakte hain. Yeh zaroori hai ke har trader apni knowledge ko barhawa de aur market ke mukhtalif scenarios ke liye tayyar rahe.

-

#13 Collapse

Forex trading ek mukhtalif aur dilchasp duniya hai jahan traders duniya bhar ke currencies ki trading karte hain. Yeh ek dynamic market hai jahan roz naye patterns aur trends aate hain. Ek aham tajziya jise traders ke darmiyan istemal kiya jata hai, woh "stalled pattern" hai. Is article mein hum is pattern ke tafseeli bayanat denge aur samjhayenge ke yeh kis tarah kaam karta hai aur traders ke liye kyun ahem hai.

Stalled pattern ka matlab hai jab market ka movement ruk jata hai aur koi clear direction nahi milti. Yeh ek aam situation hai jab market mein uncertainty hoti hai ya phir kisi event ke intezar mein hota hai. Is pattern ko samajhne ke liye zaroori hai ke traders market ki behavior ko sahi se samjhein aur iska sahi tajziya karein.

Stalled pattern ka sab se aham pehlu hai ke yeh traders ko cautionary signal deta hai. Jab market stalled pattern mein hoti hai, toh yeh indicate karta hai ke market mein kisi badi movement ya trend ke hone ke chances kam hain. Is waqt traders ko aggressive trading se bachna chahiye aur wait-and-watch approach apnana chahiye.

Is pattern ka ek aur important aspect hai ke yeh traders ko opportunities provide karta hai. Jab market mein movement kam hoti hai, toh traders ko chances milte hain ke woh consolidation zones aur range-bound markets ko identify kar sakein. Is waqt, traders range trading strategies istemal karke profit earn kar sakte hain.

Stalled pattern ko samajhne ke liye technical analysis ka istemal karna zaroori hai. Traders ko price action, chart patterns aur indicators ka sahi istemal karna chahiye takay woh market ki behavior ko samajh sakein aur stalled patterns ko identify kar sakein.

Overall, stalled pattern forex trading mein ek ahem concept hai jo traders ko market ki behavior samajhne aur sahi tajziya karne mein madad deta hai. Is pattern ko samajhna aur sahi istemal karna traders ke liye zaroori hai takay woh apne trading strategies ko improve kar sakein aur consistent profits earn kar sakein. -

#14 Collapse

Forex trading ek bohot hi mukhtalif aur daulatmand shobah hai jahan har roz hazaron log apne maal-o-daulat ko barhane ki koshish karte hain. Lekin kabhi-kabhi, is rah mein rukaavat aati hai jo ke traders ko mushkil mein daal deti hai. Is article mein hum forex trading mein rukaavat ke patterns ki wazahat karenge.

1. Stalled Pattern Kya Hai?

Stalled pattern forex trading mein ek aham concept hai jo ke traders ke liye ahem hai. Jab ek trend ya price movement mein ek muddat tak koi tabdili na ho, aur market mein activity kam ho ya bilkul ruk jaye, to isay stalled pattern kehte hain. Yeh aksar market ki uncertainty ya consolidation ka nateeja hota hai.

2. Stalled Pattern Ki Wajohat

Stalled pattern ki wajohat bohot si hoti hain. Ek wajah ho sakti hai ke traders mein uncertainty paida ho gayi ho aur woh market mein dakhil ho kar aage ke faislay ka intezaar kar rahe hon. Doosri wajah ho sakti hai ke kisi bari si khabar ya ghatna ne market ko tham diya ho aur traders cautious ho gaye hon.

3. Stalled Pattern Ka Asar

Stalled pattern ka asar market mein taraqqi ko rok sakta hai aur traders ko pareshani mein daal sakta hai. Is waqt, traders ko dhyaan se market ka analysis karna zaroori hai taake woh future ke trends ko samajh sakein aur sahi faislay le sakein.

4. Stalled Pattern Ko Samajhna

Stalled pattern ko samajhna zaroori hai takay traders apni trading strategies ko sahi tareeqe se adjust kar sakein. Is waqt, risk management aur patience ka istemal karna zaroori hai taake nuqsaan se bacha ja sake.

5. Stalled Pattern Se Nikalne Ki Strategies

Stalled pattern se nikalne ke liye traders ko sabar aur samajhdari se kaam lena chahiye. Yeh kuch strategies hain jo traders istemal kar sakte hain:

Wait and Watch: Kabhi-kabhi behter hota hai ke traders market ki activity ko dekhte rahen aur tabdeeliyon ka intezaar karen. Is se unhe behtar understanding hoti hai ke market kis taraf ja rahi hai.

Risk Management: Stalled pattern mein, risk management ka ahem kirdar hota hai. Traders ko apne positions ko control mein rakhna chahiye aur ziada nuqsaan se bachne ke liye apne stop-loss orders ko update karna chahiye.

Alternate Instruments: Agar ek currency pair mein stalled pattern hai, to traders doosre currency pairs ya financial instruments ki taraf bhi tawajjo de sakte hain jahan activity zyada ho aur potential profit ho sakta hai.

Technical Analysis: Stalled pattern ko samajhne ke liye technical analysis ka istemal karna zaroori hai. Chart patterns, indicators aur oscillators ka istemal karke traders market ke future trends ka andaza laga sakte hain.

In strategies ko istemal karke traders stalled pattern se nikal sakte hain aur apni trading ko behtar bana sakte hain.

Ikhtitami Guftagu

Forex trading mein rukaavat ka samna karna har trader ka imtehan hai. Stalled pattern ko samajhna aur sahi tareeqe se deal karna traders ke liye zaroori hai agar woh mazeed kamiyabi hasil karna chahte hain. Sabar aur tahqeeqati tajziya ke saath, traders apne maqsad ko hasil kar sakte hain aur forex market mein kamyabi ke raste par chal sakte ha

Forex trading ek mukhtalif aur roshan duniya hai jahan har koi karobar karna chahta hai. Is mein kuch pattar aur patterns hote hain jo traders ke liye ahem hota hai. Ek aham pattern jo traders ko samajhna zaroori hai wo "stalled pattern" hai. Stalled pattern ka matlab hota hai jab market ka movement ruk jata hai aur prices mein kisi bhi direction mein koi tabdeeli nahi hoti.

Stalled pattern ko samajhne ke liye, traders ko market ke dynamics ko dekhna zaroori hai. Ye pattern usually market ki volatility ki wajah se hota hai, jab market mein trading volume kam ho ya phir traders ki interest kam ho. Is situation mein, prices ek jagah par stuck ho jate hain aur ek trading range mein band ho jate hain.

Stalled pattern ka asal matlab hai ke market mein kisi bhi direction mein koi clear trend nahi hai. Is waqt, traders ko sabar aur tahammul ka hona zaroori hai. Ye pattern usually short-term traders ke liye challenging hota hai, kyunke unko profits kamane ki asani nahi hoti jab market mein movement nahi hoti.

Is situation mein, traders ko kuch strategies istemal karni chahiye. Sab se pehle, risk management ka khayal rakhna zaroori hai. Trading positions ko control mein rakhna aur stop-loss orders lagana zaroori hai taake nuqsaan kam ho sake. Mazeed, traders ko market ke fundamentals ko samajhna chahiye aur technical analysis ka istemal karna chahiye taake wo potential trading opportunities ko pehchan sakein.

Stalled pattern ka samajhna aur uss par amal karna traders ke liye mushkil ho sakta hai, lekin is kaam mein maharat hasil karne se traders apni trading skills ko behtar bana sakte hain. Is liye, har trader ko stalled pattern ko samajhna aur uss par tawajju dena zaroori hai taake wo market ke har situation mein kamyaab ho sakein.

InstaForex is a reliable guide to the world of finance and investments.

InstaSpot: Withdraw profits to any EPS and to the bank, and earn up to 7% on the exchange of EPS and cryptocurrencies.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

**Stalled Pattern Ki Tashreeh**

Forex aur stock trading mein technical analysis ek ahem tool hai jo market trends aur potential reversals ko identify karne mein madad karta hai. Candlestick patterns in analysis ka ek aham hissa hain, aur unmein se ek hai "Stalled Pattern." Is post mein hum Stalled Pattern ke formation, characteristics aur trading implications ko detail se samjhenge.

**Stalled Pattern Kya Hai?**

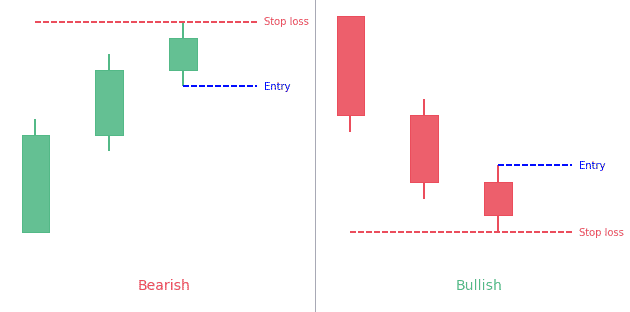

Stalled Pattern ek bearish reversal pattern hai jo market ke upward trend ke baad banta hai aur potential price reversal ya trend weakening ko signal karta hai. Yeh pattern aksar market mein buying pressure ke weak hone aur selling pressure ke barhne ko reflect karta hai. Stalled Pattern ko accurately identify karne se traders ko market ke reversal points aur potential trading opportunities ko recognize karne mein madad milti hai.

**Pattern Ki Formation Aur Characteristics:**

1. **Initial Uptrend**:

- Stalled Pattern ki formation ek strong uptrend ke baad hoti hai. Uptrend ke dauran, price regularly higher highs aur higher lows banati hai, jo bullish market sentiment ko reflect karti hai.

2. **Pattern Formation**:

- Pattern ki formation do candlesticks se hoti hai:

- **Pehli Candlestick**: Yeh ek long bullish candlestick hoti hai jo previous trend ko continue karti hai. Is candlestick ka body bada aur price movement positive hota hai.

- **Doosri Candlestick**: Yeh candlestick pehli candlestick ke closing price ke near open hoti hai, lekin iska body chhota hota hai. Yeh candlestick market ke indecision aur weak buying pressure ko indicate karti hai. Doosri candlestick ki closing price pehli candlestick ke closing price ke near hoti hai ya usse thodi si neeche hoti hai.

3. **Pattern Completion**:

- Stalled Pattern tab complete hota hai jab doosri candlestick ke baad ek strong bearish candlestick banta hai. Yeh bearish candlestick pattern ke bearish reversal ko confirm karta hai aur price ke downward movement ko signal karta hai.

**Trading Implications:**

1. **Entry Points**:

- Stalled Pattern ka trading signal tab confirm hota hai jab doosri candlestick ke baad bearish confirmation candlestick banta hai. Entry point ko pattern ke confirmation ke baad set kiya jata hai, jab market ke downward reversal ka signal clear hota hai.

2. **Stop-Loss Aur Target Setting**:

- Stop-loss ko pattern ke recent high ke thoda sa upar set kiya jata hai, taake unexpected price movements se protection mil sake. Target levels ko pattern ke size aur market conditions ke basis par define kiya jata hai. Target levels ko calculate karte waqt, pattern ke dimensions aur market trends ko consider karna zaroori hai.

3. **Risk Management**:

- Effective risk management ko Stalled Pattern ke signal ke sath integrate karna zaroori hai. Market ki volatility aur pattern ke accuracy ko dekhte hue, trading positions aur exposure ko manage karein.

**Conclusion:**

Stalled Pattern ek important bearish reversal pattern hai jo market ke upward trend ke baad downward reversal ko indicate karta hai. Is pattern ki accurate identification aur formation ki characteristics ko samajhkar, traders market ke potential reversal points aur trading opportunities ko effectively analyze kar sakte hain. Stalled Pattern ko other technical tools aur market conditions ke sath combine karke, aap apni trading strategies ko optimize kar sakte hain aur profitable trading decisions le sakte hain. Effective trading ke liye, pattern analysis ke sath proper risk management aur strategic planning bhi zaroori hai.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:09 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим