Inverse Head and Shoulder Pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

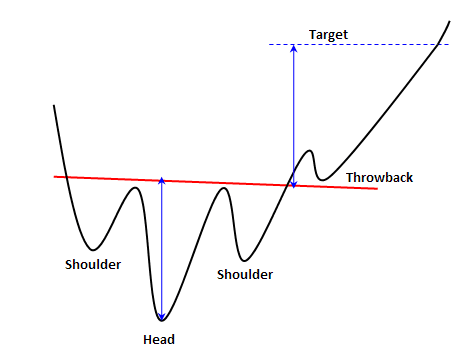

Inverse Head and Shoulder Pattern Inverse Head and Shoulder pattern ko Head and shoulder pattern bottom ka naam bhe deya jata hey yeh forex market mein aik reversal chart pattern hota hey yeh forex market mein head and shoulder chart pattern say melta jolta hey yeh aik inverted chart pattern hota hey mesal kay tor par 2 shoulder highs r lows mein aik jaisay hon gay aik reversal head and shoulder mokamal honay kay ley bullish signal ka eshara deya jata hey trader aam tor par long position mein janay kay ley ready hota hey price neckline resistance kay oper charah jate hey Inverse Head and shoulder pattern ke tashkeel bain shoulder price mein kame kay bad price nechay ke taraf movement karte hey es kay bad forex market mein ezafa ho jata hey head or es kay bad price mein dobara kame hote hey jes kay bad lower hesa banta hey dain shoulder price aik bar bad mein barah jate phir dobara nechay ke taraf movement karte hey aik bar bad mein formation shazo nadar he pay jate hey head and shoulder pattern ka market ka shore ho sakta hey Price neckline forex market mein neckline support ya resistance level hote hey jes mein forex trader order daynay kay ley strategies ka estamal kartay hein neckline rakhay kay ley forex chart mein pehla step bain shoulder , head or dain shoulder shamel hein hum forex market mein bain shoulder kay bad higher head kay sath higher ko jortay hein jes say pattern aik neckline bhe ban jate hey Trade Inverse Head Shoulder Pattern yeh zaroore hey keh trader pattern mokamal karnay ka intazar karna chihay es ke wajah yeh hote hey keh aik pattern belkul bhe ready nahi ho sakta hey ya phir jzve tr par ready honay walla pattern anay wallay time mein mokamal nahi ho sakta hey laken es time tak koi trade nahi ke jane chihay jab tak pattern ke neckline break na ho jay jab forex market min pattern complete ho jata hey to trade complete ho jate pehlay say he trade ke planning karne chihay entry stoploss or take profit level ka tayon karna chihay sath kese bhe variable ko note karna chihay jo ap profit kay target kay baray mein bata sakay sab say zyada aam entry point yeh hota hey jab breakout hta hey jab market mein neck line break ho jate hey to entry point mel jata hey or aik r entry point kay ley zyada sabar karnay ke zarorat hote hey es kay bad breakout kay ley neck line ke pull back ka intazar karna chihay real mein break out ke direction dobara mel sakte hey nechay de gay tasweer ko bhe analysis kar saktay hein

bhali kay badlay bhali

bhali kay badlay bhali

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Inverse head and shoulders pattern Forex trading mein ek popular aur reliable reversal pattern hai. Yeh pattern traders ko trend reversal ka signal deta hai, jo ke bearish (downtrend) se bullish (uptrend) mein transition ka indication hota hai. Inverse head and shoulders pattern ek reversal pattern hai jo downtrend ke baad form hota hai. Yeh pattern market ke bottom par dikhai deta hai aur indicates karta hai ke downtrend khatam hone wala hai aur uptrend shuru hone wala hai. Is pattern ka structure teen troughs (bottoms) par based hota hai: ek central, deeper trough (head) aur do shallower troughs (shoulders) ke sath.

Structure aur Components- Left Shoulder: Pehla trough, jo ke downtrend ke baad banta hai, isse left shoulder kehte hain. Yeh trough typically lower high form karta hai.

- Head: Central aur sabse lowest trough ko head kehte hain. Yeh trough left aur right shoulders ke comparison mein zyada deep hota hai.

- Right Shoulder: Teesra trough, jo head ke baad form hota hai, right shoulder kehlaata hai. Yeh trough typically left shoulder ke level ke aas paas hota hai.

- Neckline: Neckline woh line hai jo left aur right shoulders ke high points ko connect karti hai. Yeh ek crucial level hai jo pattern ki completion aur confirmation ke liye important hoti hai.

Inverse head and shoulders pattern form hone ke liye kuch specific steps hote hain:- Left Shoulder Formation: Pehle downtrend continue hota hai aur market ek trough form karta hai jo temporary low hota hai. Price wahan se slightly recover karti hai aur ek peak form hoti hai.

- Head Formation: Price phir se decline hoti hai aur left shoulder se neeche jati hai, ek deeper trough (head) form karti hai. Yeh market ka lowest point hota hai during this pattern formation.

- Right Shoulder Formation: Market wapas upar jati hai aur ek peak form karti hai, jo neckline ke aas paas hoti hai. Phir se decline hoti hai lekin left shoulder ke level ke aas paas ruk jati hai, right shoulder form hota hai.

- Neckline Breakout: Jab price wapas upar jati hai aur neckline ko break karti hai, to yeh pattern ki completion aur trend reversal ka confirmation hota hai.

Inverse head and shoulders pattern ko identify karne aur confirm karne ke liye, kuch zaroori points hain jo dekhne chahiye:- Symmetry: Ideal pattern symmetrical hota hai, lekin market mein perfect symmetry bohot kam dekhi jati hai. Thodi asymmetry acceptable hoti hai.

- Volume: Volume analysis bhi important hai. Left shoulder se head formation ke dauran volume typically decline hoti hai aur phir right shoulder aur neckline breakout ke dauran increase hoti hai. Volume ka increase neckline breakout ko confirm karta hai.

- Neckline Angle: Neckline horizontal ya slightly sloped ho sakti hai. Upward sloping neckline zyada bullish signal hoti hai.

Inverse head and shoulders pattern ko effectively trade karne ke liye kuch strategies hain jo aap follow kar sakte hain:- Entry Point: Entry point neckline breakout par hota hai. Jab price neckline ko convincingly break karti hai aur us level ke upar close hoti hai, to aap ek long position enter kar sakte hain.

- Stop-Loss Placement: Stop-loss order ko right shoulder ke low ke neeche place karna chahiye taake aap apne risk ko manage kar sakein. Is placement se agar pattern fail hota hai to aapka loss limited hota hai.

- Target Calculation: Target price ko calculate karne ke liye head se neckline tak ke distance ko measure karen aur us distance ko neckline breakout point par add karen. Yeh aapka initial profit target hota hai.

- Volume Confirmation: Volume ka increase neckline breakout ke waqt confirm karta hai ke breakout genuine hai. Agar volume low hai, to breakout weak ho sakta hai aur false signal de sakta hai.

Market Scenario: Assume karein ke EUR/USD pair ek downtrend mein hai aur price 1.1000 se decline hoti hui 1.0500 tak aa jati hai.- Left Shoulder: Price 1.0500 se slightly recover hoti hai aur 1.0700 tak jati hai, phir se decline hoti hai.

- Head: Price 1.0500 se neeche jati hai aur 1.0300 par ek new low form karti hai, phir recover hoti hai.

- Right Shoulder: Price 1.0700 ke aas paas phir se peak form karti hai aur decline hoti hai lekin 1.0500 par ruk jati hai.

- Neckline Breakout: Price 1.0700 ke upar break karti hai aur wahan se upar close hoti hai, neckline breakout confirm hota hai. Volume bhi breakout ke saath increase hoti hai.

Risk management ek crucial aspect hai trading ka, specially jab aap reversal patterns trade kar rahe ho. Inverse head and shoulders pattern trade karte waqt kuch important risk management techniques hain:- Position Sizing: Position size ko calculate karna zaroori hai based on your risk tolerance. Yeh ensure karta hai ke aapka potential loss aapke acceptable risk limit ke andar rahe.

- Trailing Stop: Trailing stop-loss use karke aap apne profits ko protect kar sakte hain. Jab price aapki direction mein move karti hai, trailing stop-loss aapke stop level ko dynamically adjust karta hai.

- Diversification: Kabhi bhi apni total capital ko ek single trade mein invest na karein. Diversify karne se aapka overall risk manage hota hai.

Inverse head and shoulders pattern ko trade karte waqt kuch common mistakes hoti hain jo traders ko avoid karni chahiye:- Premature Entry: Neckline breakout se pehle trade enter karna premature entry hoti hai aur yeh risky ho sakta hai. Hamesha neckline breakout ka wait karen aur volume confirmation bhi dekhein.

- Ignoring Volume: Volume ko ignore karna ek major mistake hai. Low volume breakout weak signal hota hai aur false breakout ho sakta hai.

- Over-leveraging: High leverage use karna aapki capital ko expose karta hai to significant risk. Hamesha conservative leverage use karein aur apni risk tolerance ke hisaab se trade karein.

- Not Setting Stop-Loss: Stop-loss order na set karna ek bohot badi mistake hai. Yeh aapko unexpected market movements se protect karta hai.

Psychological Aspects

Trading inverse head and shoulders pattern ka psychological aspect bhi important hai. Trading ke dauran emotional control aur discipline bohot zaroori hain:- Patience: Pattern ko fully form hone ka intezar karna patience demand karta hai. Premature decisions losses ka sabab ban sakte hain.

- Discipline: Apne trading plan ko strictly follow karna discipline ki demand karta hai. Emotional trading decisions avoid karein aur apni strategies par focus karein.

- Confidence: Pattern aur apni analysis par confidence hona chahiye. Confidence ke bina aapke decisions shaky ho sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

**Inverse Head and Shoulder Pattern: Forex Trading mein Bullish Reversal Signal**

Forex trading mein chart patterns aur technical analysis tools ka bohot bara role hota hai. Inhi patterns mein se ek hai "Inverse Head and Shoulder Pattern". Yeh pattern market mein bullish reversal ka strong signal provide karta hai. Aaj hum is post mein Inverse Head and Shoulder Pattern ko detail mein discuss karenge aur yeh samjhenge ke yeh forex trading mein kis tarah kaam karta hai.

**Inverse Head and Shoulder Pattern kya hai?**

Inverse Head and Shoulder Pattern ek bullish reversal pattern hai jo typically downtrend ke baad form hota hai. Is pattern mein teen distinct lows hote hain: ek central low jo "head" kehlata hai aur do outer lows jo "shoulders" kehlate hain. Yeh pattern tab form hota hai jab market ka downtrend khatam hone wala hota hai aur price upar jaane ka indication deta hai.

**Inverse Head and Shoulder Pattern ko Kaise Pehchana Jaye?**

Is pattern ko identify karna relatively asaan hai agar aap chart patterns ko samajhte hain. Is pattern ki pehchan ke kuch important points yeh hain:

1. **Left Shoulder**:

Pehla low tab form hota hai jab price ek specific level par aati hai aur phir upar move karti hai.

2. **Head**:

Head pattern ka lowest point hota hai jo central low ke taur par form hota hai. Yeh low left shoulder se neeche hota hai.

3. **Right Shoulder**:

Yeh low left shoulder ke level ke kareeb ya uske barabar hota hai. Right shoulder ke formation ke baad price phir se upar move karti hai.

4. **Neckline**:

Yeh ek horizontal line hoti hai jo left aur right shoulders ke highs ko connect karti hai. Jab price is neckline ko break karti hai, to yeh confirmation hota hai ke bullish reversal start ho gaya hai.

**Inverse Head and Shoulder Pattern ka Importance aur Usage**

Inverse Head and Shoulder Pattern forex traders ke liye bohot significant hota hai kyunke yeh ek strong bullish reversal signal provide karta hai. Is pattern ke complete hone par, traders buying opportunities dekhte hain aur market ke bullish trend mein enter karte hain. Yeh pattern unhe market ke downtrend ke khatam hone aur uptrend ke shuru hone ka indication deta hai.

**Inverse Head and Shoulder Pattern ke Faide aur Nuqsanat**

**Faide:**

1. **Reliable Signal**:

Yeh pattern ek reliable bullish reversal signal hota hai agar proper confirmation mil jaye.

2. **Clear Entry Points**:

Is pattern ke through clear entry points identify kiye ja sakte hain jo traders ke liye profitable ho sakte hain.

**Nuqsanat:**

1. **False Breakouts**:

Kabhi kabhi false breakouts bhi ho sakte hain jo misleading signals ka sabab ban sakte hain.

2. **Volume Confirmation**:

Volume confirmation ki zaroorat hoti hai jo hamesha available nahi hoti. Isliye, additional analysis zaroori hai.

**Nateeja**

Inverse Head and Shoulder Pattern forex trading mein ek powerful tool hai jo bullish reversals ko indicate karta hai. Is pattern ko samajhna aur use karna profitable trades ke liye bohot madadgar ho sakta hai. Magar, is pattern ko use karne se pehle proper analysis aur confirmation zaroori hai. Forex market dynamic aur unpredictable hai, isliye apni strategies ko diversify karna aur different tools ko combine karna best practice hoti hai.

-

#5 Collapse

Assalamu alaikum

Inverse Head aur Shoulder Pattern kya ???hai

"Inverse Head and Shoulders" pattern ek bullish reversal pattern hai, jo ki technical analysis mein use hota hai price trends aur possible reversals ke predict karne ke liye.

Is pattern mein typically teen main parts hote hain:- Left Shoulder: Price chart par ek peak jo ki normal price trend se upar hota hai, fir ek dip (low) aata hai jo normal trend se thoda niche hota hai.

- Head: Left Shoulder ke baad aata hai ek aur peak, jo typically left shoulder se higher hota hai. Is peak ko "Head" kaha jata hai.

- Right Shoulder: Head ke baad price phir se dip karta hai, lekin is dip ka level left shoulder ke near hota hai. Yeh dip "Right Shoulder" kehlata hai.

Is pattern ke pehchanne ke baad, traders expect karte hain ki price fir se upar jaega, indicating a bullish trend reversal. Entry point usually tab consider kiya jata hai jab price right shoulder ke breakout ke baad upar move karta hai.

Inverse Head and Shoulders pattern ek popular aur powerful technical analysis tool hai jo price action analysis mein use hota hai.

Inverse Head aur Shoulder Pattern Ki mazeed wazahat

Inverse Head and Shoulders pattern price action analysis mein ek important bullish reversal pattern hai. Is pattern ko identify karna aur samajhna traders ke liye valuable hota hai, kyunki isse future price movement ke possible changes ko predict kiya ja sakta hai.

Components of Inverse Head and Shoulders Pattern:- Left Shoulder:

- Yeh pattern ka pehla phase hota hai. Isme price ek downtrend ke baad ek low form karta hai, jo normal trend se thoda niche hota hai.

- Is low ke baad price thoda recover karta hai lekin significant bullish movement abhi shuru nahi hota hai.

- Head:

- Head left shoulder se higher form hota hai. Yeh phase pattern ka main part hota hai jahan price ek significant low form karta hai, jo normal trend se bahut niche hota hai.

- Head ka formation usually thoda complex hota hai aur isme price volatility zyada hoti hai.

- Right Shoulder:

- Head ke baad price fir se upar move karta hai, lekin is movement ka level left shoulder ke near hota hai.

- Right shoulder typically left shoulder se thoda kam hoga, indicating ek potential reversal.

- Volume: Is pattern ke formation ke dauran volume ka behavior bhi important hota hai. Typically, left shoulder aur head ke formation ke time volume decrease hota hai, jabki right shoulder ke formation ke samay volume increase hone lagta hai.

- Neckline: Inverse Head and Shoulders pattern ke sath ek neckline associate hota hai, jo ek imaginary line hoti hai jo left shoulder aur right shoulder ke lows ko connect karti hai. Jab price is neckline ko break karta hai upper direction mein, tab yeh ek bullish signal provide karta hai.

- Entry Point: Traders usually entry point tab consider karte hain jab price neckline ko break karta hai upper direction mein. Yeh breakout confirm hone ke baad entry kiya ja sakta hai.

- Target: Pattern ke height se approximate target set kiya ja sakta hai. Iska matlab hai ki head ka height left shoulder se lekar neckline tak liya ja sakta hai aur usko breakout level se add kiya ja sakta hai.

- Stop Loss: Risk management ke liye stop loss set karna important hota hai, usually below the right shoulder low ya neckline ke neeche.

Inverse Head and Shoulders pattern ka istemal karke traders potential reversals ko spot kar sakte hain aur bullish trend ke entry points identify kar sakte hain. Is pattern ko samajhna aur effectively use karna trading strategy ko improve karne mein madadgar ho sakta hai.

Inverse Head aur Shoulder Pattern Ki Aqsam

Inverse Head and Shoulders pattern ki kuch aam aqsaam hain jo traders ko price action analysis mein madad deti hain. Inmein se kuch mukhtalif variations hote hain jo pattern ke components mein variations include karte hain:- Standard Inverse Head and Shoulders:

- Yeh sabse common type hai, jisme left shoulder, head, aur right shoulder clear aur identifiable hote hain. Isme left shoulder aur right shoulder ka level approximate same hota hai, jabki head unse higher hota hai.

- Complex Inverse Head and Shoulders:

- Yeh variation standard pattern se thoda different hota hai, kyunki isme head ka formation complex hota hai. Head formation mein multiple peaks aur troughs ho sakte hain, jisse pattern ki complexity badhti hai.

- Inverse Head and Shoulders with Sloping Neckline:

- Is variation mein neckline straight line ki bajay sloping hoti hai. Yeh sloping neckline pattern ko thoda unique banata hai aur price ke breakout ko spot karne mein madad karta hai.

- Inverse Head and Shoulders with Double Bottom:

- Kabhi-kabhi inverse head and shoulders pattern ke saath double bottom bhi dekha ja sakta hai. Isme left shoulder, head, aur right shoulder ke beech mein ek aur bottom form hota hai, jo ek aur bullish confirmation provide karta hai.

- Inverse Head and Shoulders with Volume Analysis:

- Yeh variation standard pattern ke saath volume analysis incorporate karta hai. Isme volume ke behavior pattern ke formation ke saath dekha jata hai, jaise ki left shoulder aur head ke formation ke dauran volume decrease hota hai, jabki right shoulder ke formation ke samay volume increase hone lagta hai.

Har variation mein, traders ko pattern ke components ko clear aur distinct tareeke se identify karne ki zaroorat hoti hai. Pattern ki sahi identification aur uske components ke sahi interpretation se hi traders sahi entry points aur exit points decide kar sakte hain, aur market trends ko better predict kar sakte hain.

Shukria

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Inverse Head and Shoulders Pattern kya hai?

Inverse Head and Shoulders Pattern, jise Head and Shoulders Bottom bhi kaha jata hai, ek bullish reversal pattern hai jo technical analysis mein istemal kiya jata hai. Yah pattern yeh signal deta hai keh downtrend uptrend mein badal sakta hai.

Inverse Head and Shoulders Pattern kaise banta hai?

Yah pattern teen hisson se banta hai:- Left Shoulder: Yah pattern ka pehla high point hota hai jo downtrend ke dauran banta hai.

- Head: Yah pattern ka doosra aur sabse neecha low point hota hai. Yah left shoulder se kam price per banta hai.

- Right Shoulder: Yah pattern ka teesra aur left shoulder se thoda kam price per banne wala low point hota hai.

Inverse Head and Shoulders Pattern kaise kaam karta hai?

Jab price left shoulder se upar jaata hai, to yah downtrend mein bullish momentum ka signal deta hai. Jab price head se upar jaata hai, to yah bullish momentum ki tasdeek ho jaati hai. Aur jab price neckline se upar jaata hai, to yeh downtrend ke khatam hone aur uptrend ke shuru hone ka signal deta hai.

Inverse Head and Shoulders Pattern ka istemal kaise karein?

Inverse Head and Shoulders Pattern ka istemal trading mein buy karne ke liye kiya ja sakta hai.- Buy signal: Jab price neckline se upar jaaye, to yah buy signal hota hai.

- Stop-loss: Stop-loss order ko left shoulder ke neeche rakha ja sakta hai.

- Profit target: Profit target ko neckline se pattern ki height tak ki doori ke barabar rakha ja sakta hai.

Inverse Head and Shoulders Pattern ki kuchh limitations hain:- Yah pattern hamesha sahi nahin hota hai.

- Is pattern ko confirm karne ke liye volume aur momentum jaise aur indicators ka bhi istemal karna chahiye.

Inverse Head and Shoulders Pattern ki kuchh aur baatein:- Inverse Head and Shoulders Pattern ek powerful bullish reversal pattern hai.

- Is pattern ka istemal swing trading aur day trading mein kiya ja sakta hai.

- Yah pattern all time frames mein kaam karta hai.

Yeh kuchh resources hain jo aapko Inverse Head and Shoulders Pattern ke baare mein aur jaanane mein madad kar sakte hain:

Disclaimer:

Main ek financial advisor nahin hun aur main aapko koi bhi financial advice nahin de sakta hun. Investment decisions lene se pehle aapko apna research karna chahiye aur kisi financial advisor se salah leni chahiye.

-

#7 Collapse

Inverse Head and Shoulder Pattern: Forex Trading mein Ek Powerful Reversal Signal

Forex trading mein technical analysis ka bohot bara role hota hai aur candlestick patterns ko samajhna traders ke liye bohot faidemand ho sakta hai. Aaj hum is post mein ek important aur powerful pattern, "Inverse Head and Shoulder Pattern," ko detail mein discuss karenge aur yeh samjhenge ke yeh forex trading mein kis tarah kaam karta hai aur iska kya significance hai.

Inverse Head and Shoulder Pattern kya hai?

Inverse Head and Shoulder Pattern ek bullish reversal pattern hota hai jo typically downtrend ke baad form hota hai. Yeh pattern indicate karta hai ke market ka downtrend khatam hone wala hai aur ek new uptrend shuru hone wala hai. Is pattern ko pehchanna relatively asaan hai agar aap basic technical analysis ko samajhte hain.

Pattern Formation

Left Shoulder:

Pattern ka pehla part left shoulder hota hai. Yeh ek decline ke baad form hota hai jab price thoda recover karti hai.

Head:

Iske baad ek aur decline hota hai jo previous low se neeche jaata hai, isse pattern ka head form hota hai. Yeh pattern ka lowest point hota hai.

Right Shoulder:

Phir price recover karti hai aur ek aur decline hota hai jo head se higher hota hai magar left shoulder ke level ke around hota hai. Yeh right shoulder form karta hai.

Neckline:

Neckline woh line hoti hai jo left shoulder aur right shoulder ke highs ko connect karti hai. Jab price neckline ko break karti hai to bullish reversal ka confirmation milta hai.

Inverse Head and Shoulder Pattern ka Importance aur Usage

Inverse Head and Shoulder Pattern forex traders ke liye bohot significant hota hai kyunke yeh strong bullish reversal signal provide karta hai. Is pattern ke complete hone par, traders buying opportunities dekhte hain aur market ke new uptrend mein enter karte hain. Yeh pattern unhe market ke downtrend ke khatam hone aur bullish trend ke shuru hone ka indication deta hai.

Pattern ke Faide aur Nuqsanat

Faide:

Reliable Reversal Signal:

Yeh pattern ek reliable bullish reversal signal hota hai agar proper confirmation mil jaye.

Clear Entry Points:

Is pattern ke through clear entry points identify kiye ja sakte hain jo traders ke liye profitable ho sakte hain.

Nuqsanat:

False Signals:

Kabhi kabhi false signals bhi ho sakte hain jo misleading trades ka sabab ban sakte hain.

Dependency on Market Conditions:

Inverse Head and Shoulder Pattern ka success rate market conditions par depend karta hai. Trending markets mein yeh pattern zyada effective hota hai, magar choppy ya sideways markets mein yeh misleading ho sakta hai.

Pattern ko Confirm Karne ke Liye Indicators

Inverse Head and Shoulder Pattern ko confirm karne ke liye kuch additional indicators aur tools use kiye ja sakte hain:

Relative Strength Index (RSI):

RSI indicator ko use karke oversold conditions ko identify kiya ja sakta hai. Agar yeh pattern oversold RSI levels ke sath form hota hai, to yeh bullish reversal ka strong signal hota hai.

Volume:

Volume analysis bhi bohot important hoti hai. Jab neckline break hoti hai to volume ka increase hona bullish confirmation deta hai.

Moving Averages:

Moving averages ko use karke overall trend aur support/resistance levels ko identify kiya ja sakta hai. Is pattern ko moving averages ke sath combine karke better trading decisions liye ja sakte hain.

-

#8 Collapse

**Inverse Head and Shoulders Pattern: Forex Trading Mein Kya Hai Aur Kaise Kaam Karta Hai?**

Forex trading mein technical analysis ek ahem role play karta hai jo traders ko market trends aur price movements ko samajhne mein madad karta hai. Inverse Head and Shoulders Pattern ek aisa powerful chart pattern hai jo market ke potential reversals ko identify karne mein help karta hai. Yeh pattern bearish trend ke end aur bullish reversal ka signal deta hai. Aaj hum Inverse Head and Shoulders Pattern ko detail mein discuss karenge aur dekhenge ke yeh forex trading mein kis tarah se kaam karta hai.

**Inverse Head and Shoulders Pattern Kya Hai?**

Inverse Head and Shoulders Pattern ek technical chart pattern hai jo price chart par ek clear reversal signal provide karta hai. Yeh pattern generally downtrend ke baad develop hota hai aur bullish reversal ka indication deta hai. Is pattern ko identify karne ke liye teen main components ko dekhna padta hai: left shoulder, head, aur right shoulder.

**Pattern Ka Structure:**

1. **Left Shoulder:** Pattern ka shuruaat ek downtrend ke baad hoti hai. Left Shoulder tab banta hai jab price ek low banati hai aur uske baad thoda rebound hota hai, lekin phir se price decline karti hai.

2. **Head:** Head ka formation Left Shoulder ke baad hota hai. Yeh price chart par ek deeper low ko represent karta hai. Head pattern ke center mein hota hai aur yeh price ke deepest decline ko show karta hai.

3. **Right Shoulder:** Right Shoulder tab develop hota hai jab price Head ke baad thoda rebound karti hai aur phir se thoda decline karti hai, lekin yeh decline Left Shoulder ke level ke aas-paas hoti hai. Right Shoulder pattern ke completion ke liye zaroori hai.

4. **Neckline:** Neckline ek horizontal line hoti hai jo Left Shoulder aur Right Shoulder ke peaks ko connect karti hai. Yeh line pattern ke breakout level ko define karti hai.

**Pattern Ka Use Aur Working:**

1. **Pattern Identification:** Inverse Head and Shoulders Pattern ko identify karna trading decisions ke liye important hota hai. Yeh pattern typically market ke strong downtrend ke baad develop hota hai aur bullish reversal signal ko confirm karta hai.

2. **Entry Points:** Entry points pattern ke neckline ke breakout ke baad set kiye jate hain. Jab price neckline ko break karti hai aur bullish confirmation dikhati hai, to buying positions enter ki jati hain.

3. **Stop-Loss Aur Profit Targets:** Risk management ke liye stop-loss orders ko pattern ke neckline ke neeche set karna chahiye. Profit targets ko pattern ke height aur previous resistance levels ke hisaab se set kiya jata hai. Price movement ke sath profit-taking levels ko adjust karna zaroori hai.

4. **Confirmation:** Pattern ki effectiveness ko confirm karne ke liye additional indicators jaise RSI ya MACD ka use bhi kiya jata hai. Yeh additional signals pattern ke accuracy ko enhance karte hain.

**Conclusion:**

Inverse Head and Shoulders Pattern forex trading mein ek valuable tool hai jo market ke potential bullish reversals aur price movements ko accurately identify karne mein madad karta hai. Is pattern ko samajhkar aur effective trading strategies apna kar, traders apne trading decisions ko behtar bana sakte hain. Hamesha yaad rahe ke kisi bhi chart pattern ka use karne se pehle thorough analysis aur risk management zaroori hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Inverse Head and Shoulders Pattern aik mashhoor bullish reversal pattern hai jo market mein downtrend ke baad develop hota hai. Is pattern ka naam uske unique structure se liya gaya hai, jo bilkul insani body ke head aur shoulders ki tarah lagta hai, lekin inverted (ulta) hota hai. Yeh pattern traders ke liye ek strong signal hota hai ke market mein bearish trend khatam hone wala hai aur bullish trend shuru ho sakta hai. Chaliye, is pattern ko Roman Urdu mein detail se samajhte hain.

### **Inverse Head and Shoulders Pattern Ka Taaruf**

Inverse Head and Shoulders Pattern teen important hisson par mabni hota hai: left shoulder, head, aur right shoulder. In teenon components ke saath aik neckline bhi hoti hai jo is pattern ke structure ko complete karti hai.

1. **Left Shoulder:** Is hissa mein price pehle downtrend mein chalta hai aur ek low banata hai. Uske baad price thoda recover karta hai, lekin woh recovery temporary hoti hai.

2. **Head:** Head pattern ka sabse gehra point hota hai. Ismein price phir se downtrend mein jata hai aur previous low se bhi neeche chala jata hai, jisse ek deeper low ban'ta hai. Yeh low pattern ka "head" kehlata hai.

3. **Right Shoulder:** Right shoulder mein price phir se upar jata hai, magar head ke level tak nahi pahunchta. Phir se thoda decline hota hai, lekin yeh decline left shoulder ke level ke barabar ya uske thoda upar ruk jata hai.

### **Neckline Ka Concept**

Inverse Head and Shoulders Pattern mein **neckline** ek important role ada karti hai. Neckline woh line hoti hai jo left aur right shoulders ke highs ko connect karti hai. Jab price is neckline ko breakout karta hai, to yeh pattern ka confirmation hota hai aur yeh indicate karta hai ke ab bullish trend start hone wala hai.

### **Inverse Head and Shoulders Pattern Ka Use Trading Mein**

Jab Inverse Head and Shoulders Pattern develop hota hai aur price neckline ke upar break karta hai, to yeh traders ke liye ek buy signal hota hai. Iska matlab hota hai ke market ab bullish trend mein enter karne wala hai, aur traders ko is waqt apni positions khol leni chahiye.

**Example:** Agar kisi stock ka price lagatar gir raha ho aur ek inverse head and shoulders pattern ban jaye, to neckline ke break hone par yeh signal milta hai ke ab price upar jane wala hai, aur yeh time hai is stock ko khareedne ka.

### **Target Calculation**

Is pattern ke madad se traders apne target price ka bhi calculation kar sakte hain. Target price calculate karne ka tareeqa yeh hai ke head se neckline tak ke distance ko measure karke usko neckline ke breakout -

#10 Collapse

Forex trading mein technical analysis ek ahem role play karta hai, aur candlestick patterns in analysis ka ek integral part hain. Inmein se ek kaafi popular pattern hai “Inverse Head and Shoulders” pattern. Yeh pattern traders ko market ke potential reversals aur trend changes ke signals provide karta hai. Is post mein hum is pattern ki pehchaan, importance, aur trading strategy ko discuss karenge.

Inverse Head and Shoulders Pattern Ka Taaruf

Inverse Head and Shoulders pattern ek bullish reversal pattern hai jo generally downtrend ke baad emerge hota hai. Yeh pattern market ke trend reversal ko indicate karta hai aur price ke upar ki taraf move karne ki ummeed provide karta hai. Is pattern ko identify karne ke liye humein teen key components dekhne hote hain:

- Left Shoulder: Yeh pehla component hai jo ek initial decline ke baad banta hai. Market thoda bounce karta hai aur phir se girta hai.

- Head: Yeh pattern ka central component hai jahan price ek naya low create karti hai, jo left shoulder se bhi niche hota hai. Iske baad price thodi recovery karti hai.

- Right Shoulder: Yeh pattern ka final component hai jahan price ek aur decline karti hai, lekin yeh decline head ke low ke itna niche nahi hoti. Iske baad price phir se bounce karti hai aur pattern complete hota hai.

Pattern Ki Pehchaan

Inverse Head and Shoulders pattern ko accurately identify karna zaroori hai taake aap market ki future movements ko sahi se predict kar sakein. Is pattern ko identify karne ke liye, kuch key characteristics hain:

- Formation: Pattern teen key parts mein banta hai: left shoulder, head, aur right shoulder. In parts ka formation ek inverted ‘V’ shape ka resemble karta hai.

- Neckline: Yeh pattern ka ek important feature hai jo left shoulder aur right shoulder ke highs ko connect karta hai. Jab price neckline ko break karti hai, to yeh bullish signal hota hai.

- Volume: Pattern ke formation ke dauran volume bhi observe karna chahiye. Generally, left shoulder aur head ke dauran volume increase hota hai aur right shoulder ke dauran decrease hota hai. Volume ka analysis pattern ke confirmation mein madadgar hota hai.

Pattern Ki Importance Aur Trading Strategy

Inverse Head and Shoulders pattern ki importance forex trading mein kafi zyada hai. Yeh pattern traders ko trend reversal ke signals provide karta hai aur trading strategy ko optimize karne mein madad karta hai. Is pattern ki importance aur trading strategy ke kuch key aspects hain:

- Trend Reversal Signal: Inverse Head and Shoulders pattern market ke downtrend ke baad uptrend ki possibility ko indicate karta hai. Jab price neckline ko break karti hai, to yeh strong bullish signal hota hai aur potential buy opportunities ko identify karta hai.

- Entry Point: Pattern ka confirmation lene ke baad, traders apni entry point ko define kar sakte hain. Entry generally neckline ke break ke baad ki jati hai. Yeh point price ke upar move karne ki ummeed ko reflect karta hai.

- Stop Loss Aur Take Profit: Risk management ke liye stop loss aur take profit levels ko define karna zaroori hai. Stop loss ko right shoulder ke low ke neeche set kiya ja sakta hai, jabke take profit level ko pattern ke height ke mutabiq calculate kiya jata hai.

- Volume Confirmation: Volume ka analysis pattern ke confirmation mein madadgar hota hai. High volume pattern ke formation ke dauran bullish signal ko strengthen karta hai.

Practical Example Aur Considerations

Inverse Head and Shoulders pattern ko practical trading mein implement karte waqt kuch considerations zaroori hain:

- Market Conditions: Pattern ko identify karte waqt market conditions ko bhi consider karna chahiye. Market ke overall trend aur economic factors pattern ki reliability ko affect kar sakte hain.

- Additional Indicators: Technical indicators jaise Moving Averages, RSI, aur MACD ko use karke pattern ke confirmation ko verify kar sakte hain. Yeh additional indicators aapko better trading decisions lene mein madad karte hain.

- Pattern Variations: Kabhi kabhi pattern ki variations bhi hoti hain. Perfectly symmetrical patterns rare hoti hain. Thoda sa deviation bhi normal hota hai, lekin pattern ki basic structure ko madde nazar rakhna zaroori hai.

Inverse Head and Shoulders pattern forex trading mein ek powerful tool hai jo market ke potential reversals ko identify karne mein madad karta hai. Is pattern ki accurate pehchaan aur effective trading strategy se aap apni trading decisions ko behtar bana sakte hain aur market movements ko efficiently capture kar sakte hain.

-

#11 Collapse

**Inverse Head and Shoulder Pattern**

Inverse Head and Shoulder pattern, ek popular technical analysis pattern hai jo trend reversal ko indicate karta hai. Yeh pattern zyada tar bearish trend ke baad banta hai aur iska formation bullish trend ke shuru hone ka signal hota hai.

Is pattern ke teen main components hote hain: left shoulder, head, aur right shoulder. Yeh pattern tab banta hai jab price ek bearish trend ke baad ek konsolidation phase mein enter karti hai. Left shoulder tab develop hota hai jab price ek low banati hai aur uske baad kuch recovery karti hai. Phir, price ek aur low banati hai jo pehle low se thoda deeper hota hai, isse head banta hai. Right shoulder tab banta hai jab price wapas recovery karti hai aur ek aur low banati hai jo head se thoda ucha hota hai.

Pattern complete hone ke baad, price mein ek bullish reversal ki expectation hoti hai. Inverse Head and Shoulder pattern ke confirm hone ke liye, price ko neckline ko break karna padta hai. Neckline, left aur right shoulders ke beech ki horizontal line hoti hai. Jab price is neckline ko break karti hai, tab pattern ka confirmation hota hai aur bullish trend ke shuru hone ka signal milta hai.

Is pattern ki accuracy aur effectiveness kaafi high hoti hai, lekin yeh zaroori nahi hai ke har bar yeh perfect signal hi de. Risk management aur additional technical indicators ka use karke traders apne trading decisions ko enhance kar sakte hain. Inverse Head and Shoulder pattern ka use long-term aur short-term trading strategies mein kiya ja sakta hai.

Trading ke waqt, traders ko pattern ka confirmation zaroori hota hai, isliye price movements aur volume analysis ko bhi consider karna chahiye. Volume analysis ki madad se yeh jaancha ja sakta hai ke pattern ke breakout ke baad kitni strength hai.

Overall, Inverse Head and Shoulder pattern ek valuable tool hai jo market ke reversal points ko identify karne mein madad karta hai. Lekin, kisi bhi trading strategy ka use karte waqt, risk management aur discipline zaroori hoti hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Inverse head and shoulders pattern technical analysis ka aik maqbool aur quwwatwar tool hai jo ke market trends ko samajhne mein madad karta hai. Ye pattern aksar bearish trend ke baad ban jata hai aur iska matlab hota hai ke market bullish trend ki taraf ja sakti hai. Is pattern ka samajhna aur pehchanna traders ko entry aur exit points ko behtar tarike se samajhne mein madad deta hai.

Inverse head and shoulders pattern teen mukh kirdaron se milkar bana hota hai: left shoulder, head, aur right shoulder. Ye pattern tab banta hai jab market pehle se girawat ka shikaar hoti hai aur isme ek bearish trend hote hue ek bullish reversal ka signal diya jata hai. Left shoulder ke doran market girawat karti hai, phir head ke doran market aur bhi zyada girti hai, aur phir right shoulder ke doran market kaise upar aati hai jo ke left shoulder ke as paas hota hai. Iske baad, market ka trend bullish hona shuru hota hai.

Is pattern ki pehchan mein mukh role neck line ka hota hai. Neck line wo horizontal line hoti hai jo ke left shoulder aur right shoulder ke tops ko join karti hai. Jab market price is neck line ko upar se cross karti hai, to ye pattern apni confirmation deti hai ke trend ab bullish hoga. Ye point traders ke liye entry ka signal hota hai.

Ye pattern tab zyada effective hota hai jab trading volume bhi iske sath increase hota hai. Jab head aur shoulders ke doran trading volume increase hota hai, to ye pattern ki reliability ko barhata hai. Volume ka increase market ke trend reversal ko confirm karta hai aur traders ko is baat ka atma vishwas deta hai ke market ab bullish trend ki taraf ja sakti hai.

Inverse head and shoulders pattern ko trading decisions mein integrate karne ke liye, traders ko kuch cheezein dhyan mein rakhni chahiye. Pehli cheez ye hai ke pattern ko complete hone ka intezar karein, jisme neck line ka cross hona zaroori hai. Doosri cheez ye hai ke pattern ke confirmation ke baad entry karna behtar hota hai, taake market ke bullish trend ko sahi se capture kiya ja sake.

Ek aur important point ye hai ke har pattern perfect nahi hota aur market conditions aur external factors bhi trading decisions par asar dalte hain. Isliye, inverse head and shoulders pattern ko dusre technical indicators aur market analysis ke sath combine karke use karna chahiye.

Overall, inverse head and shoulders pattern ek useful tool hai jo traders ko market ke future trend ko samajhne mein madad karta hai. Ye pattern bearish trend ke baad bullish reversal ka strong signal hota hai, lekin iski reliability tabhi barhti hai jab market volume aur other indicators is pattern ko support karte hain. Traders ko is pattern ka samajh hone ke sath-saath, market analysis aur risk management strategies ko bhi follow karna chahiye taake trading decisions zyada informed aur effective ho sakein.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:51 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим