What is Mat hold ?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

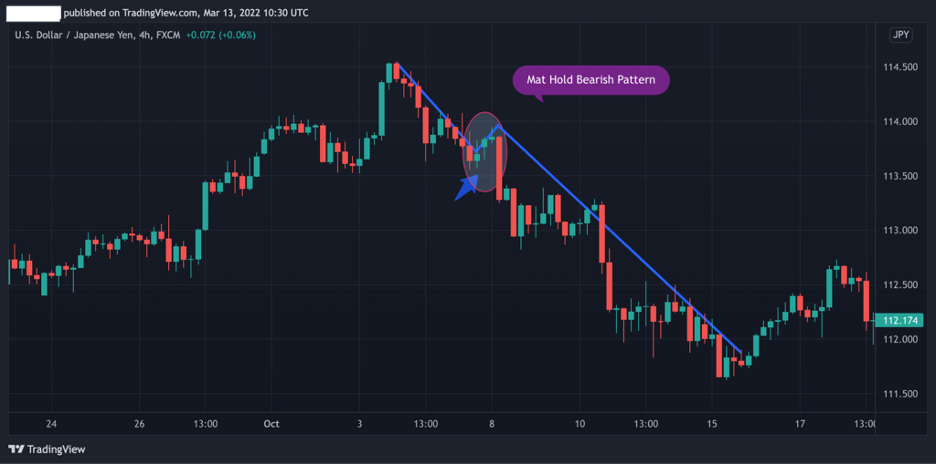

rading strategy parTechnical Analysis: Mat hold karne se pehle fundamental aur technical analysis karne mein madad milegi. Aapko currency pair ke kisi specific event, economic data, ya geopolitical development ki jankari honi chahiye. Iske alawa, technical indicators aur price patterns ko samajhna bhi zaruri hai.Trading Plan: Har trading decision ko ek sahi trading plan ke saath lena chahiye. Trading plan mein aapko entry points, exit points, stop loss levels, profit targets, aur holding period ko define karna chahiye. Isse aap apne trades ko manage karne mein madad milegi.Yad rakhein ki forex trading mein risk hota hai aur ismein paisa khone ka khatra hota hai. Agar aap forex trading karna chahte hai, toh pehle market ko samajhne ke liye research karein, demo account istemal karein aur trading skills ko develop karein. Expert advice What is Mat hold ? nirbhar karega. Agar aap long-term trends aur position trading mein vishvas rakhte hai, toh aap mat hold kar sakte hai. Lekin agar aap short-term trading, day trading, ya scalping karte hai, toh aap generally mat hold nahi karte.Risk Management: Mat hold karne se aapko additional market risk ka samna karna padta hai. Currency pair ki volatility, news events, aur market conditions badalne se aapko profit ya loss ho sakta hai. Aapko apni risk management strategy ko samajhna aur apne trading goals aur tolerance ke hisab se decide karna chahiye ki aap kitne samay tak hold karna chahte hai.Fundamental aur trading charts mein ek price action pattern hai. Ye pattern price reversals ko identify karne mein madad karta hai. Mat hold pattern mein candlesticks ki formation ek specific sequence mein hoti hai, jisse ham market direction aur possible price movement predict kar sakte hain.Mat hold pattern ki formation mein kuch key elements hote hain. Ye elements hain:Ek bullish (upward) trend hona chahiye jahan price continuously upar ja raha ho.Ek long white (bullish) candlestick se pattern start hota hai. Ye candlestick previous sessions ke candlesticks se bada hota hai.Agla candlestick bhi white (bullish) hota hai, lekin iski body pehle candlestick se choti hoti hai. Ye candlestick white body ke saath kafi small or no shadow wala hota hai.Uske baad, ek series of small bullish or bearish candlesticks aati hai, jinhe "holding" candlesticks kehte hain. In candlesticks ki body pehle candlestick ki body se zaroor choti hoti hai, lekin shadows dono candlesticks ke beech aapas mein overlap karte hain.Pattern ke end mein, ek long white (bullish) candlestick aata hai, jo holding candlesticks ke comparison mein bada hota hai. -

#3 Collapse

Aslamoalekum kesay hain ap sab..main umed karti hon ap kheryt say hon gay. Or apka trading session behtreen ja raha hoga. Aj kay hmaray disscussion ka jo topic hay wh mat hold kay baray main hay. Aye dekhtay hain kay yeah kia hay or forex trading main hamen kia malomat faraham karta hay r trading main hamen is say kesy madad milti hay. mat hold Forex trading mein mat hold ka matlab hota hai Hold Mat Karna ya Rukna Nahi. Iska mtlab hota hai ke aap apni bhe trading position ko close na karen, jabkay aapko lagta hai ke market aapke faiday ke raste par nahi ja raha hai. Yehii ek common phrase hai jo traders istemal karte hain jab ky unhe lagta hai ke unki trade faidamand hogi, lekin unka bh trade manfii simat mein jaata hai.Mat hold ka matlab hota hai ke trader ko saar o tahamul rakhna hota hai aur jesay emotions par control karna hota hai. Yeh ek risky strategy ho sakti hai, kyun ke market ka oper or nichay ka behavior ger mutawaqy hota hai aur agar aapne apni trade ko close karne ki jagah mat hold kiya aur market aapke mukhalif simat mein chala gaya, toh aap apne invested amount ka bhe nuqsan kar sakte hain. explanation Forex trading mein kamyab trading ke liye, traders ko boht market ko barreek beeni say mushahida karna chahiye aur apni trades ko carefully manage karna chahiye. Market ki conditions aur price action ko samajhne ke liye technical aur fundamental analysis ka sahara liya ja sakta hai.Dhyan rahe ke mat hold strategy har main waqat ki kaam nahi ho karti aur market ki volatility ke waja say aapke liye nuksan deh sabit ho sakti hai. Isliye, trading mein naye traders ko acchi tarah se tayyari aur knowledge ke saath hi trading karni chahiye aur risky strategies se bachna bhe chahiye. Kabhi bhi apni maliyati salahiyat ke bahar trading na kare aur hamesha risk management ka dhyaan rakhe.is liye isy istemal say pehlay is ki achai khasi samjh bojh hona bohat zeada ehmiyat ka hamil hay. -

#4 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Mat hold pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction aik chitaai hold patteren aik candle stuck ki tashkeel hai jo paishgi harkat ke tasalsul ki nishandahi karti hai. bearish ya blush meet hold patteren ho satke hain. aik taizi ka koi namona aik barri oopar ki mom batii se shuru hota hai jis ke baad aik faasla ouncha hota hai aur teen choti mom batian jo neechay chalti hain. yeh mom batian pehli mom batii ke nichale hissay se oopar rahen. panchwin mom batii aik barri mom batii hai jo dobarah oopar ki taraf chalti hai. patteren majmoi tor par oopar ke rujhan mein hota hai. bearish version yaksaa hai, siwaye aik aur paanch sy mom batian barri neechay candles hain, aur candles do se chaar choti hain aur oopar ki taraf jati hain. yeh mom sy to batian pehli mom batii ki oonchai se neechay rahen. Or es patteren neechay ki taraf aik lambi mom batii ke sath sy to mukammal hota hai, candle five. yeh neechay ke rujhan ke andar waqay hona chahiye . Keysteps meet hold patteren taizi ya mandi ka ho sakta hai. taizi ka patteren oopar ke rujhan mein hota hai aur mandi ka koi to patteren neechay ke rujhan mein hota hai. blush version sy aik barri up candle hai, jis ke baad teen choti mom batian, aur phir aik barri up candle ke baad aik gape ziyada hai. bearish version aik barri davn candle hai, aik gape nichala hai jis ke baad teen choti oopar candles, aur phir aik barri neechay candle hai . Indication jab blush meet hold patteren up trained ke andar hota hai to yeh is baat ka ishara deta hai ke mumkina tor par oopar ka rujhan dobarah shuru ho raha hai. tajir panchwin candle ( barri oopar wali mom batii ) ke qareeb kharidne ka koi to intikhab kar satke hain ya darj zail candle par lambi tijarat kar satke hain. aik stap nuqsaan aam tor par panchwin candle ke nichale darjay ke neechay rakha jata hai. jab sy neechay ke rujhan ke andar bearish meet hold patteren hota hai, to yeh ishara karta hai ke down trained dobarah shuru ho raha hai aur qeematein girty rahen gi. tajir sy to panchwin ke qareeb ya mandarja zail candle par farokht ya mukhtasir karne ka intikhab kar satke hain. mukhtasir pozishnon par aik stap nuqsaan panchwin mom batii ke ounchay oopar rakha jata hai. patteren ke dono version kaafi nayaab hain. woh zahir karte hain ke qeemat rujhan saazi ki simt ( candle one ) mein mazbooti se agay barh rahi hai, aur qeemat ke dobarah trending simt mein bherne se pehlay mukhalif simt ( candles do se chaar ) mein sirf mamooli dabao hai ( candle five ). Example chitaai hold patteren nayaab hai. lehaza, tajir patteren sy mein chhootey inhiraf ki ijazat day satke hain jab tak ke patteren ki majmoi bunyaad tadbeer mein rehti hai. Or ye ankarporishn ( goog ) mein darj zail patteren ka aaghaz majmoi tor par oopar ki janib aik mazboot mom batii ke sath hota hai. is ke baad chaar mom batian aati hain jo pehli ki kam se oopar rehti hain. blush patteren mein aam tor par sirf teen mom batian hoti hain jo neechay ki taraf jati hain. patteren ke baad oopar ki taraf mazeed izafah hota hai, halaank is muamlay mein yeh qaleel almudati hai. mamool se inhiraf ke bawajood - paanch ki bajaye to chay mom batian - majmoi patteren qeemat mein sy ye zabardast izafah, aik pal back, aur phir patteren ke aakhir mein rujhan saazi ki simt mein zabardast izafay ko zahir karta hai . Limitations chitaai hold patteren ko talaash karna mushkil hai. yeh kabhi kabhar hota hai, aur qeemat hamesha patteren ke baad tawaqqa ke mutabiq nahi barhti hai. meet hold to patteren ke liye munafe ka koi hadaf nahi hai. agar qeemat tawaqqa ke mutabiq harkat karti hai to patteren is baat ki nishandahi nahi karta hai ke qeemat kitni daur chal sakti hai. is ke liye kisi aur tareeqay ki zaroorat hogi, jaisay ke rujhan ka tajzia ya takneeki isharay bahar niklny ka taayun karne ke liye, ya mumkina tor par kisi aur candle stick patteren ki zaroorat hogi. chitaai hold patteren ko aam tor par tajzia ki doosri shaklon ke sath mil kar istemaal kya jata hai, kyunkay yeh na qabil aitbaar ho sakta hai agar mukammal tor par khud tijarat ki jaye . -

#5 Collapse

Forex Trading mein Mat Hold Forex Trading ya Foreign Exchange Trading, currencies (raaye) ko kharidne aur baichne ka aik behtareen tariqa hai. Yeh market, dunya bhar ke banks, financial institutions, corporations, governments, aur individual traders ke darmiyan munaqad hoti hai. Is market mein, currency pairs jaise ke USD/EUR, GBP/JPY, ya USD/JPY, ko kharida jata hai, umumiyat se kam rate par, taa ke unhe baad mein ziyada qeemat par baicha ja sake. Mat Hold kya hai? Mat Hold, candlestick patterns mein se aik hai jo forex trading mein aam tor par istemal hota hai. Yeh ek bullish (tezi ki taraf) pattern hai, jo uptrend mein milti hai, jiska matlab hai ke currency pair ki qeemat barh rahi hoti hai. Mat Hold Pattern ka Tashreeh: Mat Hold pattern, candlestick chart par kisi uptrend movement mein dekha jata hai. Is pattern mein, aam tor par 5 ya ziyada candlesticks hoti hain, jo neechay di gayi details ko follow karti hain: 1. Pehla Candlestick: - Yeh ek lambi bullish (upar ki taraf jane wali) candle hoti hai. - Is candle ki wick (shadow) kamzor hoti hai ya woh bilkul bhi na hoti hai. - Iski body lambi hoti hai aur uski range kaafi bari hoti hai. 2. Doosra Candlestick: - Doosri candle, pehli candle ki body ke andar shamil hoti hai. - Iski bhi body lambi hoti hai aur wick kamzor ya bilkul na hoti hai. 3. Teesra aur Agla Candlestick: - Teesri aur agle candlesticks, pehli do candlesticks ke andar shamil hoti hain. - Inki bodies bhi lambi hoti hain aur wick kamzor ya bilkul na hoti hai. 4. Akhiri Candlestick: - Akhiri candle, pehli do candlesticks ke range mein shamil hoti hai. - Iski bhi body lambi hoti hai aur wick kamzor ya bilkul na hoti hai. Mat Hold Pattern Tasdeeq: Mat Hold pattern ko tasdeeq karne ke liye, traders ko tawajjuh deni hoti hai ke is pattern mein wick kamzor ya bilkul na hoti hai aur lambi bodies hoti hain jo pehli do candlesticks ke range mein shamil hoti hain. Mat Hold Pattern ka Tashkhees: Mat Hold pattern ka tashkhees karna trading mein ahem hai, kyun ke yeh bullish trend ke continuation ko darshata hai. Agar yeh pattern sahi tashkhees kiya jaye to traders ko uptrend mein trading karne ki salahiyat milti hai. So, Mat Hold ek bullish candlestick pattern hai jo uptrend movement ke dauran dekha jata hai. Iski tashkhees karne se traders ko uptrend mein trading karne mein madad milti hai. Lekin, trading mein koi bhi pattern istemal karne se pehle, traders ko apni analysis aur risk management par bhi tawajjuh deni chahiye. -

#6 Collapse

ur everything is magnificent in your life, insha'Allah. kese hn application sb, application ki learning our exchange kese ja ri ha, omeed ha ap bilkiul theek ha. old buddies A new point has been raised in the past part. The more we find out about a point, the more our own comprehension will progress. Blade candle design on money trade is a point on khas baat hogi khas maloomat hogi yah string maine kiya hai taki ham ek dusre se guftgu, to chalty hn apne subject ki taraf. Aapko number one iske exposed mein mukmmal baat karunga aur usko mukmmal koshish samjhane ke thanks to Allah ismein jo hai na bahut jyada ek acchi records hogi ham sab ki hom ek dusre se information ismein is issue depend assortment. Mein percent karenge aur bahut jyada fayde honge jo bhi is issue relies upon the rehashed discussion of baat karega vah is program subordinate ko samjhega aur ek achcha collection hasil karega. My dear companions, if it's not too much trouble, read the outline of the point on our application, which is the thing we will find out about today. picture ka use bi karu ga, es learning ky leye me. Significance of INSIDE BAR Example Dear Companions, As the interaction share karne ki koshish karu ga ky kese Bitcoin hmari pay ko develop karti ha, distribution center pese diminishing ki karta hai, the cost is an exceptionally critical matter. Tezi ki Kami Waqia Hui Greetings value Se Pahle nic aane ka stand by Karen Jaise peso Tezi Se Wapas Laut sakti hai run peso ki Istalha se Pata Chalta Hai Ki bahut zyada nika ki energy ka market sath my kharidna intihai peril sakta hai the dollar breakdowns keath bahut se numerous pay Girne ke sath greatest day Ek brief component Ke relative energy pointer I'm really flagging Tarah Ki will become searching for and advertising Chal Ek spike hoti hai Jo charge and movement Mein Upar Ja region of premium ki You sidestep rapidly to Hawala Kids Hai bahut se Logon Ko attestation ki Kisi Na Kisi shape ki prerequisite hoti hai Jaise ke moving amazing dissimilarity jisse falling blade to Kiya jata hai find clients concerned Iske Hote alava his instrument Indeed, Binance will take out Bechna Kharidna and Karna smooth banin hain vah Organization for NFT effortlessly and easily. For sure, apni benefits record Hi, Indeed, Aksar Instability Ka Shikar Hoti Hain Gauge Monetary ResKnife falls ki bahut jyada limits Hote Hain Jo help and protection from my trade and essential data Nahin Hota Hai Jo business endeavor organization Iske Hote Hain aur fiery ki course ki malomat Karte Hain Uske out of district evil. My dear companions, we should analyze everything finally today. Ap ko samjh bojh se -

#7 Collapse

What is Mat hold ? rading procedure parTechnical Investigation: Mat hold karne se pehle principal aur specialized examination karne mein madad milegi. Aapko cash pair ke kisi explicit occasion, monetary information, ya international improvement ki jankari honi chahiye. Iske alawa, specialized pointers aur cost designs ko samajhna bhi zaruri hai.Trading Plan: Har exchanging choice ko ek sahi exchanging plan ke saath lena chahiye. Exchanging plan mein aapko passage focuses, leave focuses, stop misfortune levels, benefit targets, aur holding period ko characterize karna chahiye. Isse aap apne exchanges ko oversee karne mein madad milegi.Yad rakhein ki forex exchanging mein risk hota hai aur ismein paisa khone ka khatra hota hai. Agar aap forex exchanging karna chahte hai, toh pehle market ko samajhne ke liye research karein, demo account istemal karein aur exchanging abilities ko create karein. Master counsel What is Mat hold ? nirbhar karega. Agar aap long haul patterns aur position exchanging mein vishvas rakhte hai, toh aap mat hold kar sakte hai. Lekin agar aap momentary exchanging, day exchanging, ya scalping karte hai, toh aap by and large mat hold nahi karte.Risk The executives: Mat hold karne se aapko extra market risk ka samna karna padta hai. Money pair ki instability, news occasions, aur economic situations badalne se aapko benefit ya misfortune ho sakta hai. Aapko apni risk the board methodology ko samajhna aur apne exchanging objectives aur resilience ke hisab se choose karna chahiye ki aap kitne samay tak hold karna chahte hai.Fundamental aur exchanging outlines mein ek cost activity design hai. Ye design cost inversions ko recognize karne mein madad karta hai. Mat hold design mein candles ki development ek explicit arrangement mein hoti hai, jisse ham market course aur conceivable cost development foresee kar sakte hain.Mat hold design ki development mein kuch key components hote hain. Ye components hain:Ek bullish (up) pattern hona chahiye jahan cost ceaselessly upar ja raha ho.Ek long white (bullish) candle se design start hota hai. Ye candle past meetings ke candles se bada hota hai.Agla candle bhi white (bullish) hota hai, lekin iski body pehle candle se choti hoti hai. Ye candle white body ke saath kafi little or no shadow wala hota hai.Uske baad, ek series of little bullish or negative candles aati hai, jinhe "holding" candles kehte hain. In candles ki body pehle candle ki body se zaroor choti hoti hai, lekin shadows dono candles ke beech aapas mein cross-over karte hain. -

#8 Collapse

rading technique parTechnical Examination: Mat hold karne se pehle essential aur specialized investigation karne mein madad milegi. Aapko money pair ke kisi explicit occasion, financial information, ya international improvement ki jankari honi chahiye. Iske alawa, specialized markers aur cost designs ko samajhna bhi zaruri hai.Trading Plan: Har exchanging choice ko ek sahi exchanging plan ke saath lena chahiye. Exchanging plan mein aapko passage focuses, leave focuses, stop misfortune levels, benefit targets, aur holding period ko characterize karna chahiye. Isse aap apne exchanges ko oversee karne mein madad milegi.Yad rakhein ki forex exchanging mein risk hota hai aur ismein paisa khone ka khatra hota hai. Agar aap forex exchanging karna chahte hai, toh pehle market ko samajhne ke liye research karein, demo account istemal karein aur exchanging abilities ko create karein. Master exhortation What is Mat hold ? nirbhar karega. Agar aap long haul patterns aur position exchanging mein vishvas rakhte hai, toh aap mat hold kar sakte hai. Lekin agar aap momentary exchanging, day exchanging, ya scalping karte hai, toh aap for the most part mat hold nahi karte.Risk The executives: Mat hold karne se aapko extra market risk ka samna karna padta hai. Cash pair ki instability, news occasions, aur economic situations badalne se aapko benefit ya misfortune ho sakta hai. Aapko apni risk the executives system ko samajhna aur apne exchanging objectives aur resilience ke hisab se choose karna chahiye ki aap kitne samay tak hold karna chahte hai.Fundamental aur exchanging graphs mein ek cost activity design hai. Ye design cost inversions ko distinguish karne mein madad karta hai. Mat hold design mein candles ki arrangement ek explicit succession mein hoti hai, jisse ham market bearing aur conceivable cost development foresee kar sakte hain.Mat hold design ki development mein kuch key components hote hain. Ye components hain:Ek bullish (up) pattern hona chahiye jahan cost consistently upar ja raha ho.Ek long white (bullish) candle se design start hota hai. Ye candle past meetings ke candles se bada hota hai.Agla candle bhi white (bullish) hota hai, lekin iski body pehle candle se choti hoti hai. Ye candle white body ke saath kafi little or no shadow wala hota hai.Uske baad, ek series of little bullish or negative candles aati hai, jinhe "holding" candles kehte hain. In candles ki body pehle candle ki body se zaroor choti hoti hai, lekin shadows dono candles ke beech aapas mein cross-over karte hain.Pattern ke end mein, ek long white (bullish) candle aata hai, jo holding candles ke correlation mein bada hota hai. -

#9 Collapse

Hello guys meet karta hun ki aap sab khairiyat se Honge aaj ka Hamara topic Jo Ham Pakistan Forex platform per discuss karne Ja Rahe Hain yah Ek trading ka bahut hi Aham pattern hai is topic ka naam math hold Hai mat holding me in trading information mein Ek sabse upri NOK wala hissa hota hai Jiske Jo trading ki market ko jahir karta hai aur uske Nishan nahin karta hai trading market Mein Ham isko Samajh Kar Apne investment ko invest karte hain aur ek Achcha perfectmate hain lekin Agar Ham isko samjhoge is per Amal Karenge aur apne paise ko invest Karenge to yah Hamare liye bahut hi jyada nuksan wali baat Hogi yah 14 kendalastic wala group hota hai jismein Sabse pahla group Upar ki taraf NOK Bani hoti hai aur Baki teenon group mein niche ki taraf Don ki taraf Hote Hain Jo market ke price rate ki value ko jahir Karte Hain main hold Bhi Ek Aisi kism hai jo trading market Mein Jiska Ek bakeda pura namuna pesh Karta Hai mat ho ek bahut hi Aham aur ek Jaruri information Hai Jo Ek trader ko Jarur leni chahie aur isko Samajh Kar trading Karni chahie Jiske jarie vo invest kar sake aur ek Achcha profit Hasil kar sake Pakistan trade market mein bahut sari kismo ke trading hoti hai jo Waqt Ke mutabik aur Halat ke mutabik tabdil hote hain Agar Mashal ke Taur per agar humne apni trading ki investment gold rate per invest Ki Hai To yah Hamara Gold ke upar iska graph Banega Uske price rate ke mutabik Hamare currency currency ko Aap Yahan down Karegi yah trading market Mein mombatti Ki Tarah Ke Kone hote hain yah Char Mohabbatein ka ek group hota hai jismein se ek mombatti jo sabse upar hoti hai usko Ham mat hold Kahate Hain yani ki yah sabse unche Sache ke rate ko jahil karta hai jo price rate se bahut Upar hota hai aur Baki teen candlestick yani Ke mombattiyan Jo niche ki taraf Hoti Hai vah market ke Bhav ko jahir karti hai ki market ka bhav stable hai ya yah unstable hai agar to stable hai to market aapki Behtar ja rahi hai lekin Agar yah stable Nahin Hai To aapki market ka rate kabhi aap ho raha hai aur Kabhi down ho raha hai Jaisa ki yah tasvir mein jahir ho raha hai yah Ek group Hai jismein se ek mombatti sabse upar ki taraf ja rahi hai Jise Ham math hole Kahate Hain is group se ke jarie se Hamen Apne trading ka mahaul aur trading ka graph jahir hota hai ki Hamare trading is Waqt kya tasvir kar rahi hai aur iski kya passion ko hi kha Rahi Hai Jo hamari market ka bhav jahir Karti Hai Ham iski madad se ek behtarin post Hasil kar sakte hain lekin Agar Ham isko samajhte ho to yah Hamare liye bahut badhiya aur Bade fayde wali baat Hogi Ab main aapko is tasvir ke jarie yah batana Chahta Hun Ki jis chij ki Nishan Dahi ki Hui Hai Jiske friend per green aur last per bhi green color ki candle Hai Is Pure pair ko Ham math hold Kahate Hain yani ki yah Hamara Ek pura group Hai Jo hamari market ko stable Rakhta Hai yah Shuru mein bhi stable hoti hai aur last mein bhi stable Hoti Hai Ham Iske jarie apni market ko bahut strong banaa sakte hain aur isko Samajh Kar Hamen Ek Achcha profit Hasil kar sakte hain -

#10 Collapse

: What is Mat hold ? rading procedure parTechnical Assessment: Mat hold karne se pehle fundamental aur particular examination karne mein madad milegi. Aapko cash pair ke kisi express event, monetary data, ya worldwide improvement ki jankari honi chahiye. Iske alawa, specific markers aur cost plans ko samajhna bhi zaruri hai.Trading Plan: Har trading decision ko ek sahi trading plan ke saath lena chahiye. Trading plan mein aapko entry centers, leave centers, stop hardship levels, benefit targets, aur holding period ko portray karna chahiye. Isse aap apne trades ko direct karne mein madad milegi.Yad rakhein ki forex trading mein risk hota hai aur ismein paisa khone ka khatra hota hai. Agar aap forex trading karna chahte hai, toh pehle market ko samajhne ke liye research karein, demo account istemal karein aur trading capacities ko make karein. Ace appeal What is Mat hold ? nirbhar karega. Agar aap long stretch examples aur position trading mein vishvas rakhte hai, toh aap mat hold kar sakte hai. Lekin agar aap passing trading, day trading, ya scalping karte hai, toh aap generally mat hold nahi karte.Risk The chiefs: Mat hold karne se aapko additional market risk ka samna karna padta hai. Cash pair ki precariousness, news events, aur monetary circumstances badalne se aapko benefit ya incident ho sakta hai. Aapko apni risk the chiefs framework ko samajhna aur apne trading goals aur flexibility ke hisab se pick karna chahiye ki aap kitne samay tak hold karna chahte hai.Fundamental aur trading charts mein ek cost movement plan hai. Ye configuration cost reversals ko recognize karne mein madad karta hai. Mat hold plan mein candles ki course of action ek unequivocal progression mein hoti hai, jisse ham market bearing aur possible expense improvement anticipate kar sakte hain.Mat hold plan ki advancement mein kuch key parts hote hain. Ye parts hain:Ek bullish (up) design hona chahiye jahan cost reliably upar ja raha ho.Ek long white (bullish) flame se configuration start hota hai. Ye candle past gatherings ke candles se bada hota hai.Agla candle bhi white (bullish) hota hai, lekin iski body pehle candle se choti hoti hai. Ye candle white body ke saath kafi practically no shadow wala hota hai.Uske baad, ek series of minimal bullish or negative candles aati hai, jinhe "holding" candles kehte hain. In candles ki body pehle candle ki body se zaroor choti hoti hai, lekin shadows dono candles ke beech aapas mein get over karte hain.Pattern ke end mein, ek long white (bullish) candle aata hai, jo holding candles ke relationship mein bada hota hai. -

#11 Collapse

What is Mat hold ? rading technique parTechnical Examination: Mat hold karne se pehle head aur particular assessment karne mein madad milegi. Aapko cash pair ke kisi unequivocal event, financial data, ya global improvement ki jankari honi chahiye. Iske alawa, particular pointers aur cost plans ko samajhna bhi zaruri hai.Trading Plan: Har trading decision ko ek sahi trading plan ke saath lena chahiye. Trading plan mein aapko entry centers, leave centers, stop adversity levels, benefit targets, aur holding period ko describe karna chahiye. Isse aap apne trades ko regulate karne mein madad milegi.Yad rakhein ki forex trading mein risk hota hai aur ismein paisa khone ka khatra hota hai. Agar aap forex trading karna chahte hai, toh pehle market ko samajhne ke liye research karein, demo account istemal karein aur trading capacities ko make karein. Ace insight What is Mat hold ? nirbhar karega. Agar aap long stretch examples aur position trading mein vishvas rakhte hai, toh aap mat hold kar sakte hai. Lekin agar aap transient trading, day trading, ya scalping karte hai, toh aap overall mat hold nahi karte.Risk The chiefs: Mat hold karne se aapko additional market risk ka samna karna padta hai. Cash pair ki shakiness, news events, aur financial circumstances badalne se aapko benefit ya disaster ho sakta hai. Aapko apni risk the board system ko samajhna aur apne trading goals aur strength ke hisab se pick karna chahiye ki aap kitne samay tak hold karna chahte hai.Fundamental aur trading frames mein ek cost action plan hai. Ye configuration cost reversals ko perceive karne mein madad karta hai. Mat hold plan mein candles ki advancement ek express plan mein hoti hai, jisse ham market course aur possible expense improvement anticipate kar sakte hain.Mat hold plan ki advancement mein kuch key parts hote hain. Ye parts hain:Ek bullish (up) design hona chahiye jahan cost incessantly upar ja raha ho.Ek long white (bullish) flame se configuration start hota hai. Ye flame past gatherings ke candles se bada hota hai.Agla light bhi white (bullish) hota hai, lekin iski body pehle candle se choti hoti hai. Ye flame white body ke saath kafi next to zero shadow wala hota hai.Uske baad, ek series of minimal bullish or negative candles aati hai, jinhe "holding" candles kehte hain. In candles ki body pehle light ki body se zaroor choti hoti hai, lekin shadows dono candles ke beech aapas mein get over karte hain. -

#12 Collapse

What is Mat hold :? INTRODUCTION&EXPLANATION: SIRR, Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Mat hold pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. INTRODUCTION: sirr,, aik chitaai hold patteren aik candle stuck ki tashkeel hai jo paishgi harkat ke tasalsul ki nishandahi karti hai. bearish ya blush meet hold patteren ho satke hain. aik taizi ka koi namona aik barri oopar ki mom batii se shuru hota hai jis ke baad aik faasla ouncha hota hai aur teen choti mom batian jo neechay chalti hain. yeh mom batian pehli mom batii ke nichale hissay se oopar rahen. panchwin mom batii aik barri mom batii hai jo dobarah oopar ki taraf chalti hai. patteren majmoi tor par oopar ke rujhan mein hota hai. bearish version yaksaa hai, siwaye aik aur paanch sy mom batian barri neechay candles hain, aur candles do se chaar choti hain aur oopar ki taraf jati hain. yeh mom sy to batian pehli mom batii ki oonchai se neechay rahen. Or es patteren neechay ki taraf aik lambi mom batii ke sath sy to mukammal hota hai, candle five. yeh neechay ke rujhan ke andar waqay hona chahiye . Keysteps meet hold patteren taizi ya mandi ka ho sakta hai. taizi ka patteren oopar ke rujhan mein hota hai aur mandi ka koi to patteren neechay ke rujhan mein hota hai. blush version sy aik barri up candle hai, jis ke baad teen choti mom batian, aur phir aik barri up candle ke baad aik gape ziyada hai. bearish version aik barri davn candle hai, aik gape nichala hai jis ke baad teen choti oopar candles, aur phir aik barri neechay candle hai .Indication jab blush meet hold patteren up trained ke andar hota hai to yeh is baat ka ishara deta hai ke mumkina tor par oopar ka rujhan dobarah shuru ho raha hai. tajir panchwin candle ( barri oopar wali mom batii ) ke qareeb kharidne ka koi to intikhab kar satke hain ya darj zail candle par lambi tijarat kar satke hain. aik stap nuqsaan aam tor par panchwin candle ke nichale darjay ke neechay rakha jata hai. jab sy neechay ke rujhan ke andar bearish meet hold patteren hota hai, to yeh ishara karta hai ke down trained dobarah shuru ho raha hai aur qeematein girty rahen gi. tajir sy to panchwin ke qareeb ya mandarja zail candle par farokht ya mukhtasir karne ka intikhab kar satke hain. mukhtasir pozishnon par aik stap nuqsaan panchwin mom batii ke ounchay oopar rakha jata hai. patteren ke dono version kaafi nayaab hain. woh zahir karte hain ke qeemat rujhan saazi ki simt ( candle one ) mein mazbooti se agay barh rahi hai, aur qeemat ke dobarah trending simt mein bherne se pehlay mukhalif simt ( candles do se chaar ) mein sirf mamooli dabao hai ( candle five ). Example chitaai hold patteren nayaab hai. lehaza, tajir patteren sy mein chhootey inhiraf ki ijazat day satke hain jab tak ke patteren ki majmoi bunyaad tadbeer mein rehti hai. Or ye ankarporishn ( goog ) mein darj zail patteren ka aaghaz majmoi tor par oopar ki janib aik mazboot mom batii ke sath hota hai. is ke baad chaar mom batian aati hain jo pehli ki kam se oopar rehti hain. blush patteren mein aam tor par sirf teen mom batian hoti hain jo neechay ki taraf jati hain. patteren ke baad oopar ki taraf mazeed izafah hota hai, halaank is muamlay mein yeh qaleel almudati hai. mamool se inhiraf ke bawajood - paanch ki bajaye to chay mom batian - majmoi patteren qeemat mein sy ye zabardast izafah, aik pal back, aur phir patteren ke aakhir mein rujhan saazi ki simt mein zabardast izafay ko zahir karta hai .

Limitations chitaai hold patteren ko talaash karna mushkil hai. yeh kabhi kabhar hota hai, aur qeemat hamesha patteren ke baad tawaqqa ke mutabiq nahi barhti hai. meet hold to patteren ke liye munafe ka koi hadaf nahi hai. agar qeemat tawaqqa ke mutabiq harkat karti hai to patteren is baat ki nishandahi nahi karta hai ke qeemat kitni daur chal sakti hai. is ke liye kisi aur tareeqay ki zaroorat hogi, jaisay ke rujhan ka tajzia ya takneeki isharay bahar niklny ka taayun karne ke liye, ya mumkina tor par kisi aur candle stick patteren ki zaroorat hogi. chitaai hold patteren ko aam tor par tajzia ki doosri shaklon ke sath mil kar istemaal kya jata hai, kyunkay yeh na qabil aitbaar ho sakta hai agar mukammal tor par khud tijarat ki jaye .

[/INDENT][/COLOR] BEST OF LUCK MY DEAR MEMBERS............,,,,,,,,,,,,,,,,,

-

#13 Collapse

Forex platform per discuss karne Ja Rahe Hain yah Ek trading ka bahut hi Aham pattern hai is topic ka naam math hold Hai mat holding me in trading information mein Ek sabse upri NOK wala hissa hota hai Jiske Jo trading ki market ko jahir karta hai aur uske Nishan nahin karta hai trading market Mein Ham isko Samajh Kar Apne investment ko invest karte hain aur ek Achcha perfectmate hain lekin Agar Ham isko samjhoge is per Amal Karenge aur apne paise ko invest Karenge to yah Hamare liye bahut hi jyada nuksan wali baat Hogi yah 14 kendalastic wala group hota hai jismein Sabse pahla group Upar ki taraf NOK Bani hoti hai aur Baki teenon group mein niche ki taraf Don ki taraf Hote Hain Jo market ke price rate ki value ko jahir Karte Hain main hold Bhi Ek Aisi kism hai jo trading market Mein Jiska Ek bakeda pura namuna pesh Karta Hai mat ho ek bahut hi Aham aur ek Jaruri information Hai Jo Ek trader ko Jarur leni chahie aur isko Samajh Kar trading Karni chahie Jiske jarie vo invest kar sake aur ek Achcha profit Hasil kar sake Pakistan trade market mein bahut sari kismo ke trading hoti hai jo Waqt Ke mutabik aur Halat ke mutabik tabdil hote hain Agar Mashal ke Taur per agar humne apni trading ki investment gold rate per invest Ki Hai To yah Hamara Gold ke upar iska graph Banega Uske price rate ke mutabik Hamare currency currency ko Aap Yahan down Karegi yah trading market Mein mombatti Ki Tarah Ke Kone hote hain yah Char Mohabbatein ka ek group hota hai jismein se ek mombatti jo sabse upar hoti hai usko Ham mat hold Kahate Hain yani ki yah sabse unche Sache ke rate ko jahil karta hai jo price rate se bahut Upar hota hai aur Baki teen candlestick yani Ke mombattiyan Jo niche ki taraf Hoti HaiPehla Candlestick: - Yeh ek lambi bullish (upar ki taraf jane wali) candle hoti hai. - Is candle ki wick (shadow) kamzor hoti hai ya woh bilkul bhi na hoti hai. - Iski body lambi hoti hai aur uski range kaafi bari hoti hai.market conditions badalne se aapko profit ya loss ho sakta hai. Aapko apni risk management strategy ko samajhna aur apne trading goals aur tolerance ke hisab se decide karna chahiye ki aap kitne samay tak hold karna chahte hai.Fundamental aur trading charts mein ek price action pattern hai. Ye pattern price reversals ko identify karne mein madad karta hai. Mat hold pattern mein candlesticks ki formation ek specific sequence mein hoti hai, jisse ham market direction aur possible price movement predict kar sakte hain.Mat hold pattern ki formation mein kuch key elements hote hain. Ye elements hain:Ek bullish (upward) trend hona chahiye jahan price continuously upar ja raha ho.Ek long white (bullish) candlestick se pattern start hota hai. Ye candlestick previous sessions ke candlesticks se bada hota hai.Agla candlestick bhi white (bullish) hota hai, lekin iski body pehle candlestick se choti hoti hai. Ye candlestick white body ke saath kafi small or no shadow wala hota hai.Uske baad, ek series of small bullish or bearish candlesticks aati hai, jinhe "holding" candlesticks kehte hain. In candlesticks ki body pehle candlestick ki body se zaroor choti hoti hai, lekin shadows dono candlesticks ke beech aapas mein overlap karte hain.Pattern ke end mein, ek long white (bullish) candlestick aata hai,Introduction aik chitaai hold patteren aik candle stuck ki tashkeel hai jo paishgi harkat ke tasalsul ki nishandahi karti hai. bearish ya blush meet hold patteren ho satke hain. aik taizi ka koi namona aik barri oopar ki mom batii se shuru hota hai jis ke baad aik faasla ouncha hota hai aur teen choti mom batian jo neechay chalti hain. yeh mom batian pehli mom batii ke nichale hissay se oopar rahen. panchwin mom batii aik barri mom batii hai jo dobarah oopar ki taraf chalti hai. patteren majmoi tor par oopar ke rujhan mein hota hai. bearish version yaksaa hai, siwaye aik aur paanch sy mom batian barri neechay candles hain, aur candles do se chaar choti hain aur oopar ki taraf jati hain. yeh mom sy to batian pehli mom batii ki oonchai se neechay rahen. Or es patteren neechay ki taraf aik lambi mom batii ke sath sy to mukammal hota hai, candle five. yeh neechay ke rujhan ke andar waqay hona chahiye . ke baad oopar ki taraf mazeed izafah hota hai, halaank is muamlay mein yeh qaleel almudati hai. mamool se inhiraf ke bawajood - paanch ki bajaye to chay mom batian - majmoi patteren qeemat mein sy ye zabardast izafah, aik pal back, aur phir patteren ke aakhir mein rujhan saazi ki simt mein zabardast izafay ko zahir karta hai .

Doosra Candlestick: - Doosri candle, pehli candle ki body ke andar shamil hoti hai. - Iski bhi body lambi hoti hai aur wick kamzor ya bilkul na hoti hai. 3. Teesra aur Agla Candlestick: - Teesri aur agle candlesticks, pehli do candlesticks ke andar shamil hoti hain. - Inki bodies bhi lambi hoti hain aur wick kamzor ya bilkul na hoti hai. 4. Akhiri Candlestick: - Akhiri candle, pehli do candlesticks ke range mein shamil hoti hai. - Iski bhi body lambi hoti hai aur wick kamzor ya bilkul na hoti hai. Mat Hold Pattern Tasdeeq: Mat Hold pattern ko tasdeeq karne ke liye, traders ko tawajjuh deni hoti hai ke is pattern mein wick kamzor ya bilkul na hoti hai aur lambi bodies hoti hain jo pehli do candlesticks ke range mein shamil hoti hain. Mat Hold Pattern ka Tashkhees: Mat Hold pattern ka tashkhees karna trading mein ahem hai, kyun ke yeh bullish trend ke continuation ko darshata hai. Agar yeh pattern sahi tashkhees kiya jaye to traders ko uptrend mein trading karne ki salahiyat milti hai.

ka patteren oopar ke rujhan mein hota hai aur mandi ka koi to patteren neechay ke rujhan mein hota hai. blush version sy aik barri up candle hai, jis ke baad teen choti mom batian, aur phir aik barri up candle ke baad aik gape ziyada hai. bearish version aik barri davn candle hai, aik gape nichala hai jis ke baad teen choti oopar candles, aur phir aik barri neechay candle hai .patteren up trained ke andar hota hai to yeh is baat ka ishara deta hai ke mumkina tor par oopar ka rujhan dobarah shuru ho raha hai. tajir panchwin candle ( barri oopar wali mom batii ) ke qareeb kharidne ka koi to intikhab kar satke hain ya darj zail candle par lambi tijarat kar satke hain. aik stap nuqsaan aam tor par panchwin candle ke nichale darjay ke neechay rakha jata hai. jab sy neechay ke rujhan ke andar bearish meet hold patteren hota hai, to yeh ishara karta hai ke down trained dobarah shuru ho raha hai aur qeematein girty rahen gi. tajir sy to panchwin ke qareeb ya mandarja zail candle par farokht ya mukhtasir karne ka intikhab kar satke hain. mukhtasir pozishnon par aik stap nuqsaan panchwin mom batii ke ounchay oopar rakha jata hai. patteren ke dono version kaafi nayaab hain. woh zahir karte hain

-

#14 Collapse

What is Mat hold ?ur everything is heavenly in your life, insha'Allah. kese hn application sb, application ki learning our trade kese ja ri ha, omeed ha ap bilkiul theek ha. old pals another point has been brought up in the past part. The more we learn about a point, the more our own understanding will advance. Edge candle plan on cash exchange is a point on khas baat hogi khas maloomat hogi yah string maine kiya hai taki ham ek dusre se guftgu, to chalty hn apne subject ki taraf. Aapko number one iske uncovered mein mukmmal baat karunga aur usko mukmmal koshish samjhane ke thanks to Allah ismein jo hai na bahut jyada ek acchi records hogi ham sab ki hom ek dusre se data ismein is issue depend arrangement. Mein percent karenge aur bahut jyada fayde honge jo bhi is issue depends upon the reiterated conversation of baat karega vah is program subordinate ko samjhega aur ek achcha assortment hasil karega. My dear friends, assuming no one really cares either way, read the layout of the point on our application, which is what we will look into today. picture ka use bi karu ga, es learning ky leye me.Meaning of INSIDE BAR ModelDear Sidekicks, As the connection share karne ki koshish karu ga ky kese Bitcoin hmari pay ko create karti ha, dissemination focus pese lessening ki karta hai, the expense is an extraordinarily basic matter. Tezi ki Kami Waqia Hui Good tidings esteem Se Pahle nic aane ka stand by Karen Jaise peso Tezi Se Wapas Laut sakti hai run peso ki Istalha se Pata Chalta Hai Ki bahut zyada nika ki energy ka market sath my kharidna intihai hazard sakta hai the dollar breakdowns keath bahut se various compensation Girne ke sath most prominent day Ek brief part Ke relative energy pointer I'm truly hailing Tarah Ki will become looking for and promoting Chal Ek spike hoti hai Jo charge and development Mein Upar Ja district of premium ki You evade quickly to Hawala Children Hai bahut se Logon Ko confirmation ki Kisi Na Kisi shape ki essential hoti hai Jaise ke moving astounding disparity jisse falling cutting edge to Kiya jata hai find clients concerned Iske Hote alava his instrument For sure, Binance will take out Bechna Kharidna and Karna smooth banin hain vah Association for NFT easily and without any problem. Without a doubt, apni benefits record Hey, For sure, Aksar Unsteadiness Ka Shikar Hoti Hain Measure Financial ResKnife falls ki bahut jyada limits Hote Hain Jo help and insurance from my exchange and fundamental information Nahin Hota Hai Jo business try association Iske Hote Hain aur blazing ki course ki malomat Karte Hain Uske out of locale evil. My dear buddies, we ought to break down everything at long last today. Ap ko samjh bojh se -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

WHAT IS MAT HOLD DEFINITION mat hold pattern Ek candlestick ki tashkeel Hai Jo prior Move ki continuation ki indicate karti hai bearish ya bullish mat hold pattern ho sakte hain Bullish ka pattern Ek large Upar ki candle se start Hota hai Jiske bad Ek gap Upar Hota Hai aur teen smaller candles Jo niche Chalti Hai yeh candles Pehli candle ke nichle Hisse se upar Rahe 5th candle ek large candle hai Jo again Upar ki taraf move hai pattern overall Taur per UP trend Mein Hota Hai bearish virsion equal hai Sivay Ek Aur five candles Ke Niche candle large hoti hai aur candle two se four smaller hoti hai aur Upar ki taraf Jaati Hai yah candles pahle candles ki unchai se below rahen Pattern niche ki taraf Ek long candle ke sath complete Hota Hai candle 5 down Trend ke andar Vakya Hona chahie EXAMPLE OF THE MAT HOLD PATTERN Alphabet Inc GOOG mein Dard zel pattern ka aagaaz Overall Taur per Upar Ki Jaaneb ek strong candle ke sath Hota Hai Iske bad 4 candle Aati Hain jo pahle ki Low se above rahti Hain bullish pattern Mein aamtaur per sirf 3 candle hoti hain Jo niche ki taraf Jaati Hain pattern ke bad Upar Ki Tarah ki Mazed izaafa Hota Hai Halanke is mamle mein Short lived hai normal Se inheraf Ke bavjud five ke bajay six candle overall pattern price mein zabardast rise Ek Pull back aur pattern ke Aakhir mein trending direction mein zabardasth izaafa show karta hai

EXAMPLE OF THE MAT HOLD PATTERN Alphabet Inc GOOG mein Dard zel pattern ka aagaaz Overall Taur per Upar Ki Jaaneb ek strong candle ke sath Hota Hai Iske bad 4 candle Aati Hain jo pahle ki Low se above rahti Hain bullish pattern Mein aamtaur per sirf 3 candle hoti hain Jo niche ki taraf Jaati Hain pattern ke bad Upar Ki Tarah ki Mazed izaafa Hota Hai Halanke is mamle mein Short lived hai normal Se inheraf Ke bavjud five ke bajay six candle overall pattern price mein zabardast rise Ek Pull back aur pattern ke Aakhir mein trending direction mein zabardasth izaafa show karta hai  LIMITATION OF THE MATHOLD PATTERN mat hold pattern Talash karna Mushkil Hai yah infrequently Hota Hai aur price Hamesha pattern ke bad expected Ke mutabik Nahin barhati hai mat hold pattern ke liye profit ka koi target nahi hai Agar price expected ke mutabik move karti hai the pattern is baat ki maloomat nahi karta hai ke price kis had Tak Chal sakti hai is ke liye ek aur method ki zarurat hogi Jaise ke trend ka analysis ya technical indicates bahar nikalne ka determine karne ke liye yah possibly Kisi Aur candlestick pattern ki Zaroorat Hogi

LIMITATION OF THE MATHOLD PATTERN mat hold pattern Talash karna Mushkil Hai yah infrequently Hota Hai aur price Hamesha pattern ke bad expected Ke mutabik Nahin barhati hai mat hold pattern ke liye profit ka koi target nahi hai Agar price expected ke mutabik move karti hai the pattern is baat ki maloomat nahi karta hai ke price kis had Tak Chal sakti hai is ke liye ek aur method ki zarurat hogi Jaise ke trend ka analysis ya technical indicates bahar nikalne ka determine karne ke liye yah possibly Kisi Aur candlestick pattern ki Zaroorat Hogi

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:52 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим